Analysts’ Viewpoint

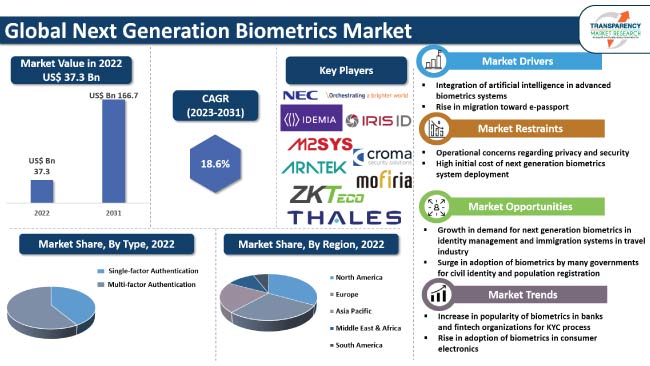

Integration of artificial intelligence in advanced biometrics systems and rise in migration toward e-passport are the major factors augmenting global next generation biometrics market growth. Increase in use of face recognition technology by the police department, immigration control agencies, and banking organizations for fighting crime, enhancing public safety, preventing fraud, and improving customer experience is augmenting market expansion.

Applications of next generation biometrics are increasing in end-use industries such as BFSI, consumer electronics, aerospace & defense, healthcare, retail, and automotive & transportation. Key players are engaged in integrating advanced technologies into biometrics solutions such as artificial neural networks, deep neural networks, support vector machine, and genetic algorithms (GA) to tap the lucrative next generation biometrics market opportunities.

Biometrics offers a highly trustworthy and instant method of identifying and verifying individuals based on distinctive biological traits. It finds applications in identity management, surveillance, access control, social welfare management, and automatic border control. Single-factor authentication and multi-factor authentication are the major types of next generation biometrics.

Latest advancements in biometrics technologies aim to extract even more sophisticated biological markers from the human body, adding extra layers of security for authentication. Such cutting-edge technologies encompass odor recognition, heartbeat pattern recognition, hand geometry, and DNA signature reading, making it increasingly challenging to counterfeit these unique identifiers.

Rise in public acceptance, substantial improvements in accuracy, and decline in costs of biometrics sensors, IP cameras, and software have made the installation of biometrics systems accessible.

Next generation biometrics technology, such as face recognition, is being rapidly adopted by the police department, immigration control agencies, and banking organizations for fighting crime, securing public safety, preventing fraud, and improving customer experience.

Iris recognition is the most emerging and advanced technology that offers high accuracy, top-class precision, and fast recognition among other technologies. Thus, it is widely used in national security systems such as government immigration control and crime investigation.

Biometrics has become an integral component of contemporary security due to its seamless implementation, widespread acceptance, and high level of security. Advancements in scanning devices, software, and artificial intelligence have facilitated the proliferation of various biometrics modalities, encompassing fingerprints, iris recognition, facial recognition, voice recognition, and more.

Manufacturers are increasingly embracing deep learning and machine learning techniques for face analysis, leading to enhanced ease and precision in identification processes. Moreover, AI plays a pivotal role in providing innovative solutions for addressing unique challenges in fingerprint identification.

Utilization of AI-assisted iris recognition offers significant advantages in citizen ID programs, physical access control, law enforcement, and border control. Leading players in the market are capitalizing on advanced biometrics solutions to enhance public safety and address various commercial applications.

In September 2021, NEC Corporation announced that its iris recognition technology achieved the top rank globally in the IREX 10 (*1) benchmark test conducted by the U.S. National Institute of Standards and Technology (NIST). NEC significantly improved the performance of its iris recognition technology by leveraging artificial intelligence (AI), particularly when dealing with images of lower quality, which are common in real-world scenarios.

The electronic passport, also known as a biometrics passport, second-generation electronic passport, or e-passport, features a contactless microprocessor. This microprocessor stores a digital copy of the ID photo and all the essential ID data from the first page of the paper passport. Digital fingerprints are also stored in e-passports.

Airports and airlines frequently aim to offer their customers a distinctive and enjoyable travel experience. Biometrics offers the simplest way for travelers to go through the authentication process. Biometrics authentication involves comparing the face or fingerprints captured at the border with the corresponding data stored in the passport microcontroller. When both sets of biometrics data match, authentication is successfully confirmed.

Several countries have developed biometrics infrastructure to manage migration flows to and from their territories. Fingerprint scanners and cameras capture data at border posts that aid in the more precise and accurate identification of travelers entering the country.

In 2022, the Indian Ministry of External Affairs (MEA) processed approximately 13.3 million passports and miscellaneous services, representing a remarkable 63.0% surge compared to 2021. Moreover, in June 2023, the Central Government of India launched the Passport Seva Programme (PSP-Version 2.0), which offered new and upgraded e-passports. These developments reflect a growth in preference for e-passports and rise in government initiatives, which have further boosted demand for next-generation biometrics.

In terms of type, the global market has been bifurcated into single-factor authentication and multi-factor authentication. According to the latest research report on next generation biometrics market, the multi-factor authentication segment is expected to dominate the global industry during the forecast period.

Multi-factor authentication (MFA) involves users presenting two or more pieces of evidence or factors for authentication. The primary objective of MFA is to enhance security by incorporating multiple authentication factors.

Multi-factor authentication is particularly valuable in the financial industry, where robust security systems are essential to safeguard users' sensitive data and financial assets. Banks and other financial institutions employ multi-factor authentication measures to ensure that access to online financial accounts is granted only to authenticated users. Fingerprint scans, retina scans, voice recognition, facial recognition, and behavioral biometrics, such as keystroke dynamics, are the key inherence factors used for multi-stage authentication.

Based on technology, the global market has been classified into contact-based, contactless, and hybrid. According to the next generation biometrics market analysis, the contactless technology segment is anticipated to account for major share of the global industry in the near future.

Contactless biometrics authentication provides a combination of high speed, enhanced security, and improved hygiene. Demand for contactless biometrics systems has surged across various industries and commercial spaces during the COVID-19 pandemic. Contactless biometrics reduce the risk of virus transmission between individuals by minimizing physical contact, and also facilitate the storage of health check information. Major players in the market are actively innovating contactless biometrics systems.

North America accounted for the largest share of 33.2% of the global market in 2022. According to the next generation biometrics market forecast, the region is anticipated to lead the global industry in the next few years.

Rise in adoption of next-generation biometrics by the government for border control, law enforcement, and national security applications, such as e-passports, visa processing, and criminal identification, is fueling next generation biometrics industry growth in the region.

Increase in adoption of biometrics for patient identification, medical record management, and access control to restricted areas within healthcare facilities is further contributing to market progress in the region.

The next generation biometrics market size in Asia Pacific is projected to rise during the forecast period. This is ascribed to growing deployment of advanced biometrics solutions in the financial sector for secure access to accounts, mobile banking, and transactions across various countries in the region.

Biometrics verification has played a crucial role in facilitating secure and convenient mobile transactions in China. Increase in usage of technologies, such as fingerprint scanning and facial recognition for payment authentication in China, is also augmenting the growth of the market in Asia Pacific.

The global landscape is fragmented, with the presence of a large number of vendors controlling majority of next generation biometrics market share. As per the latest next generation biometrics market research analysis, several firms are investing significantly in comprehensive R&D to gain incremental opportunities.

Aratek, CMITech Company, Ltd., Croma Security Solution Group, Fujitsu Limited, IDEMIA, Iris ID, Inc., Iritech, Inc., M2SYS Technology, mofiria Corporation, NEC Corporation, SHIELD AI Technologies Pte. Ltd., Suprema, Inc., Thales Group, and ZKTECO CO., LTD. are some of the prominent companies in global next generation biometrics market. These players are following the next generation biometrics market trends to avail lucrative revenue opportunities.

Each of these players has been profiled in the next generation biometrics market report based on parameters such as business strategies, financial overview, latest developments, product portfolio, business segments, and company overview.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 37.3 Bn |

|

Forecast (Value) in 2031 |

US$ 166.7 Bn |

|

Growth Rate (CAGR) |

18.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 37.3 Bn in 2022

It is projected to advance at a CAGR of 18.6% by 2031

It is expected to reach US$ 166.7 Bn in 2031

Aratek, CMITech Company, Ltd., Croma Security Solution Group, Fujitsu Limited, IDEMIA, Iris ID, Inc., Iritech, Inc., M2SYS Technology, mofiria Corporation, NEC Corporation, SHIELD AI Technologies Pte. Ltd., Suprema, Inc., Thales Group, and ZKTECO CO., LTD.

Demand is anticipated to be high in the country in the near future

The multi-factor authentication type segment held major share of around 58.7% in 2022

Integration of artificial intelligence in advanced biometrics systems and rise in migration toward e-passport.

North America accounted for major share in 2022.

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Next Generation Biometrics Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Digital Recognition and Security Industry Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

5. Global Next Generation Biometrics Market Analysis, by Type

5.1. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Type, 2017-2031

5.1.1. Single-factor Authentication

5.1.2. Multi-factor Authentication

5.2. Market Attractiveness Analysis, by Type

6. Global Next Generation Biometrics Market Analysis, by Technology

6.1. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017-2031

6.1.1. Contact-based

6.1.2. Contactless

6.1.3. Hybrid

6.2. Market Attractiveness Analysis, by Technology

7. Global Next Generation Biometrics Market Analysis, by Mobility

7.1. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Mobility, 2017-2031

7.1.1. Portable

7.1.2. Fixed

7.2. Market Attractiveness Analysis, by Mobility

8. Global Next Generation Biometrics Market Analysis, by Solution

8.1. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Solution, 2017-2031

8.1.1. Face Recognition

8.1.2. Fingerprint Recognition

8.1.3. Iris Recognition

8.1.4. Vein Pattern Recognition

8.1.5. Biometric Smart Cards

8.1.6. Voice Recognition

8.1.7. Others

8.2. Market Attractiveness Analysis, by Solution

9. Global Next Generation Biometrics Market Analysis, by Industry Vertical

9.1. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Industry Vertical, 2017-2031

9.1.1. Aerospace and Defense

9.1.2. Automotive and Transportation

9.1.3. BFSI

9.1.4. Retail

9.1.5. Government

9.1.6. Consumer Electronics

9.1.7. Commercial Spaces

9.1.8. Industrial

9.1.9. Others

9.2. Market Attractiveness Analysis, by Industry Vertical

10. Global Next Generation Biometrics Market Analysis and Forecast, by Region

10.1. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Region, 2017-2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, by Region

11. North America Next Generation Biometrics Market Analysis and Forecast

11.1. Market Snapshot

11.2. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Type, 2017-2031

11.2.1. Single-factor Authentication

11.2.2. Multi-factor Authentication

11.3. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017-2031

11.3.1. Contact-based

11.3.2. Contactless

11.3.3. Hybrid

11.4. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Mobility, 2017-2031

11.4.1. Portable

11.4.2. Fixed

11.5. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Solution, 2017-2031

11.5.1. Face Recognition

11.5.2. Fingerprint Recognition

11.5.3. Iris Recognition

11.5.4. Vein Pattern Recognition

11.5.5. Biometric Smart Cards

11.5.6. Voice Recognition

11.5.7. Others

11.6. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Industry Vertical, 2017-2031

11.6.1. Aerospace and Defense

11.6.2. Automotive and Transportation

11.6.3. BFSI

11.6.4. Retail

11.6.5. Government

11.6.6. Consumer Electronics

11.6.7. Commercial Spaces

11.6.8. Industrial

11.6.9. Others

11.7. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

11.7.1. U.S.

11.7.2. Canada

11.7.3. Rest of North America

11.8. Market Attractiveness Analysis

11.8.1. By Type

11.8.2. By Technology

11.8.3. By Mobility

11.8.4. By Solution

11.8.5. By Industry Vertical

11.8.6. By Country/Sub-region

12. Europe Next Generation Biometrics Market Analysis and Forecast

12.1. Market Snapshot

12.2. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Type, 2017-2031

12.2.1. Single-factor Authentication

12.2.2. Multi-factor Authentication

12.3. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017-2031

12.3.1. Contact-based

12.3.2. Contactless

12.3.3. Hybrid

12.4. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Mobility, 2017-2031

12.4.1. Portable

12.4.2. Fixed

12.5. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Solution, 2017-2031

12.5.1. Face Recognition

12.5.2. Fingerprint Recognition

12.5.3. Iris Recognition

12.5.4. Vein Pattern Recognition

12.5.5. Biometric Smart Cards

12.5.6. Voice Recognition

12.5.7. Others

12.6. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Industry Vertical, 2017-2031

12.6.1. Aerospace and Defense

12.6.2. Automotive and Transportation

12.6.3. BFSI

12.6.4. Retail

12.6.5. Government

12.6.6. Consumer Electronics

12.6.7. Commercial Spaces

12.6.8. Industrial

12.6.9. Others

12.7. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

12.7.1. U.K.

12.7.2. Germany

12.7.3. France

12.7.4. Rest of Europe

12.8. Market Attractiveness Analysis

12.8.1. By Type

12.8.2. By Technology

12.8.3. By Mobility

12.8.4. By Solution

12.8.5. By Industry Vertical

12.8.6. By Country/Sub-region

13. Asia Pacific Next Generation Biometrics Market Analysis and Forecast

13.1. Market Snapshot

13.2. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Type, 2017-2031

13.2.1. Single-factor Authentication

13.2.2. Multi-factor Authentication

13.3. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017-2031

13.3.1. Contact-based

13.3.2. Contactless

13.3.3. Hybrid

13.4. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Mobility, 2017-2031

13.4.1. Portable

13.4.2. Fixed

13.5. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Solution, 2017-2031

13.5.1. Face Recognition

13.5.2. Fingerprint Recognition

13.5.3. Iris Recognition

13.5.4. Vein Pattern Recognition

13.5.5. Biometric Smart Cards

13.5.6. Voice Recognition

13.5.7. Others

13.6. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Industry Vertical, 2017-2031

13.6.1. Aerospace and Defense

13.6.2. Automotive and Transportation

13.6.3. BFSI

13.6.4. Retail

13.6.5. Government

13.6.6. Consumer Electronics

13.6.7. Commercial Spaces

13.6.8. Industrial

13.6.9. Others

13.7. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

13.7.1. China

13.7.2. India

13.7.3. Japan

13.7.4. South Korea

13.7.5. ASEAN

13.7.6. Rest of Asia Pacific

13.8. Market Attractiveness Analysis

13.8.1. By Type

13.8.2. By Technology

13.8.3. By Mobility

13.8.4. By Solution

13.8.5. By Industry Vertical

13.8.6. By Country/Sub-region

14. Middle East & Africa Next Generation Biometrics Market Analysis and Forecast

14.1. Market Snapshot

14.2. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Type, 2017-2031

14.2.1. Single-factor Authentication

14.2.2. Multi-factor Authentication

14.3. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017-2031

14.3.1. Contact-based

14.3.2. Contactless

14.3.3. Hybrid

14.4. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Mobility, 2017-2031

14.4.1. Portable

14.4.2. Fixed

14.5. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Solution, 2017-2031

14.5.1. Face Recognition

14.5.2. Fingerprint Recognition

14.5.3. Iris Recognition

14.5.4. Vein Pattern Recognition

14.5.5. Biometric Smart Cards

14.5.6. Voice Recognition

14.5.7. Others

14.6. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Industry Vertical, 2017-2031

14.6.1. Aerospace and Defense

14.6.2. Automotive and Transportation

14.6.3. BFSI

14.6.4. Retail

14.6.5. Government

14.6.6. Consumer Electronics

14.6.7. Commercial Spaces

14.6.8. Industrial

14.6.9. Others

14.7. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

14.7.1. GCC

14.7.2. South Africa

14.7.3. Rest of Middle East & Africa

14.8. Market Attractiveness Analysis

14.8.1. By Type

14.8.2. By Technology

14.8.3. By Mobility

14.8.4. By Solution

14.8.5. By Industry Vertical

14.8.6. By Country/Sub-region

15. South America Next Generation Biometrics Market Analysis and Forecast

15.1. Market Snapshot

15.2. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Type, 2017-2031

15.2.1. Single-factor Authentication

15.2.2. Multi-factor Authentication

15.3. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017-2031

15.3.1. Contact-based

15.3.2. Contactless

15.3.3. Hybrid

15.4. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Mobility, 2017-2031

15.4.1. Portable

15.4.2. Fixed

15.5. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Solution, 2017-2031

15.5.1. Face Recognition

15.5.2. Fingerprint Recognition

15.5.3. Iris Recognition

15.5.4. Vein Pattern Recognition

15.5.5. Biometric Smart Cards

15.5.6. Voice Recognition

15.5.7. Others

15.6. Next Generation Biometrics Market Size (US$ Bn) Analysis & Forecast, by Industry Vertical, 2017-2031

15.6.1. Aerospace and Defense

15.6.2. Automotive and Transportation

15.6.3. BFSI

15.6.4. Retail

15.6.5. Government

15.6.6. Consumer Electronics

15.6.7. Commercial Spaces

15.6.8. Industrial

15.6.9. Others

15.7. Next Generation Biometrics Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

15.7.1. Brazil

15.7.2. Rest of South America

15.8. Market Attractiveness Analysis

15.8.1. By Type

15.8.2. By Technology

15.8.3. By Mobility

15.8.4. By Solution

15.8.5. By Industry Vertical

15.8.6. By Country/Sub-region

16. Competition Assessment

16.1. Global Next Generation Biometrics Market Competition Matrix - a Dashboard View

16.1.1. Global Next Generation Biometrics Market Company Share Analysis, by Value (2022)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. Aratek

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. CMITech Company, Ltd.

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. Croma Security Solution Group

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. Fujitsu Limited

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. IDEMIA

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. Iris ID, Inc.

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. Iritech, Inc.

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. M2SYS Technology

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. mofiria Corporation

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. NEC Corporation

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. SHIELD AI Technologies Pte. Ltd.

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

17.12. Suprema Inc.

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Key Financials

17.13. Thales Group

17.13.1. Overview

17.13.2. Product Portfolio

17.13.3. Sales Footprint

17.13.4. Key Subsidiaries or Distributors

17.13.5. Strategy and Recent Developments

17.13.6. Key Financials

17.14. ZKTECO CO., LTD.

17.14.1. Overview

17.14.2. Product Portfolio

17.14.3. Sales Footprint

17.14.4. Key Subsidiaries or Distributors

17.14.5. Strategy and Recent Developments

17.14.6. Key Financials

18. Go to Market Strategy

18.1. Identification of Potential Market Spaces

18.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Next Generation Biometrics Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 2: Global Next Generation Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 3: Global Next Generation Biometrics Market Size & Forecast, by Technology, Volume (Million Units), 2017-2031

Table 4: Global Next Generation Biometrics Market Size & Forecast, by Mobility, Value (US$ Bn), 2017-2031

Table 5: Global Next Generation Biometrics Market Size & Forecast, by Mobility, Volume (Million Units), 2017-2031

Table 6: Global Next Generation Biometrics Market Size & Forecast, by Solution, Value (US$ Bn), 2017-2031

Table 7: Global Next Generation Biometrics Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017-2031

Table 8: Global Next Generation Biometrics Market Size & Forecast, by Region, Value (US$ Bn), 2017-2031

Table 9: Global Next Generation Biometrics Market Size & Forecast, by Region, Volume (Million Units), 2017-2031

Table 10: North America Next Generation Biometrics Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 11: North America Next Generation Biometrics Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 12: North America Next Generation Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 13: North America Next Generation Biometrics Market Size & Forecast, by Technology, Volume (Million Units), 2017-2031

Table 14: North America Next Generation Biometrics Market Size & Forecast, by Mobility, Value (US$ Bn), 2017-2031

Table 15: North America Next Generation Biometrics Market Size & Forecast, by Mobility, Volume (Million Units), 2017-2031

Table 16: North America Next Generation Biometrics Market Size & Forecast, by Solution, Value (US$ Bn), 2017-2031

Table 17: North America Next Generation Biometrics Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017-2031

Table 18: North America Next Generation Biometrics Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017-2031

Table 19: North America Next Generation Biometrics Market Size & Forecast, by Country and Sub-region, Volume (Million Units), 2017-2031

Table 20: Europe Next Generation Biometrics Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 21: Europe Next Generation Biometrics Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 22: Europe Next Generation Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 23: Europe Next Generation Biometrics Market Size & Forecast, by Technology, Volume (Million Units), 2017-2031

Table 24: Europe Next Generation Biometrics Market Size & Forecast, by Mobility, Value (US$ Bn), 2017-2031

Table 25: Europe Next Generation Biometrics Market Size & Forecast, by Mobility, Volume (Million Units), 2017-2031

Table 26: Europe Next Generation Biometrics Market Size & Forecast, by Solution, Value (US$ Bn), 2017-2031

Table 27: Europe Next Generation Biometrics Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017-2031

Table 28: Europe Next Generation Biometrics Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017-2031

Table 29: Europe Next Generation Biometrics Market Size & Forecast, by Country and Sub-region, Volume (Million Units), 2017-2031

Table 30: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 31: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 32: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 33: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Technology, Volume (Million Units), 2017-2031

Table 34: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Mobility, Value (US$ Bn), 2017-2031

Table 35: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Mobility, Volume (Million Units), 2017-2031

Table 36: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Solution, Value (US$ Bn), 2017-2031

Table 37: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017-2031

Table 38: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017-2031

Table 39: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Country and Sub-region, Volume (Million Units), 2017-2031

Table 40: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 41: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 42: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 43: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Technology, Volume (Million Units), 2017-2031

Table 44: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Mobility, Value (US$ Bn), 2017-2031

Table 45: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Mobility, Volume (Million Units), 2017-2031

Table 46: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Solution, Value (US$ Bn), 2017-2031

Table 47: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017-2031

Table 48: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017-2031

Table 49: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Country and Sub-region, Volume (Million Units), 2017-2031

Table 50: South America Next Generation Biometrics Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 51: South America Next Generation Biometrics Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 52: South America Next Generation Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 53: South America Next Generation Biometrics Market Size & Forecast, by Technology, Volume (Million Units), 2017-2031

Table 54: South America Next Generation Biometrics Market Size & Forecast, by Mobility, Value (US$ Bn), 2017-2031

Table 55: South America Next Generation Biometrics Market Size & Forecast, by Mobility, Volume (Million Units), 2017-2031

Table 56: South America Next Generation Biometrics Market Size & Forecast, by Solution, Value (US$ Bn), 2017-2031

Table 57: South America Next Generation Biometrics Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017-2031

Table 58: South America Next Generation Biometrics Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017-2031

Table 59: South America Next Generation Biometrics Market Size & Forecast, by Country and Sub-region, Volume (Million Units), 2017-2031

List of Figures

Figure 1: Global Next Generation Biometrics Market Share Analysis, by Region

Figure 2: Global Next Generation Biometrics Price Trend Analysis (Average Price, US$)

Figure 3: Global Next Generation Biometrics Market, Value (US$ Bn), 2017-2031

Figure 4: Global Next Generation Biometrics Market, Volume (Million Units), 2017-2031

Figure 5: Global Next Generation Biometrics Market Size & Forecast, by Type, Revenue (US$ Bn), 2017-2031

Figure 6: Global Next Generation Biometrics Market Share Analysis, by Type, 2023 and 2031

Figure 7: Global Next Generation Biometrics Market Attractiveness, by Type, Value (US$ Bn), 2023-2031

Figure 8: Global Next Generation Biometrics Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 9: Global Next Generation Biometrics Market Share Analysis, by Technology, 2023 and 2031

Figure 10: Global Next Generation Biometrics Market Attractiveness, by Technology, Value (US$ Bn), 2023-2031

Figure 11: Global Next Generation Biometrics Market Size & Forecast, by Mobility, Revenue (US$ Bn), 2017-2031

Figure 12: Global Next Generation Biometrics Market Share Analysis, by Mobility, 2023 and 2031

Figure 13: Global Next Generation Biometrics Market Attractiveness, by Mobility, Value (US$ Bn), 2023-2031

Figure 14: Global Next Generation Biometrics Market Size & Forecast, by Solution, Revenue (US$ Bn), 2017-2031

Figure 15: Global Next Generation Biometrics Market Share Analysis, by Solution, 2023 and 2031

Figure 16: Global Next Generation Biometrics Market Attractiveness, by Solution, Value (US$ Bn), 2023-2031

Figure 17: Global Next Generation Biometrics Market Size & Forecast, by Industry Vertical, Revenue (US$ Bn), 2017-2031

Figure 18: Global Next Generation Biometrics Market Share Analysis, by Industry Vertical, 2023 and 2031

Figure 19: Global Next Generation Biometrics Market Attractiveness, by Industry Vertical, Value (US$ Bn), 2023-2031

Figure 20: Global Next Generation Biometrics Market Size & Forecast, by Region, Revenue (US$ Bn), 2017-2031

Figure 21: Global Next Generation Biometrics Market Share Analysis, by Region, 2023 and 2031

Figure 22: Global Next Generation Biometrics Market Attractiveness, by Region, Value (US$ Bn), 2023-2031

Figure 23: North America Next Generation Biometrics Market Size & Forecast, by Type, Revenue (US$ Bn), 2017-2031

Figure 24: North America Next Generation Biometrics Market Share Analysis, by Type, 2023 and 2031

Figure 25: North America Next Generation Biometrics Market Attractiveness, by Type, Value (US$ Bn), 2023-2031

Figure 26: North America Next Generation Biometrics Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 27: North America Next Generation Biometrics Market Share Analysis, by Technology, 2023 and 2031

Figure 28: North America Next Generation Biometrics Market Attractiveness, by Technology, Value (US$ Bn), 2023-2031

Figure 29: North America Next Generation Biometrics Market Size & Forecast, by Mobility, Revenue (US$ Bn), 2017-2031

Figure 30: North America Next Generation Biometrics Market Share Analysis, by Mobility, 2023 and 2031

Figure 31: North America Next Generation Biometrics Market Attractiveness, by Mobility, Value (US$ Bn), 2023-2031

Figure 32: North America Next Generation Biometrics Market Size & Forecast, by Solution, Revenue (US$ Bn), 2017-2031

Figure 33: North America Next Generation Biometrics Market Share Analysis, by Solution, 2023 and 2031

Figure 34: North America Next Generation Biometrics Market Attractiveness, by Solution, Value (US$ Bn), 2023-2031

Figure 35: North America Next Generation Biometrics Market Size & Forecast, by Industry Vertical, Revenue (US$ Bn), 2017-2031

Figure 36: North America Next Generation Biometrics Market Share Analysis, by Industry Vertical, 2023 and 2031

Figure 37: North America Next Generation Biometrics Market Attractiveness, by Industry Vertical, Value (US$ Bn), 2023-2031

Figure 38: North America Next Generation Biometrics Market Size & Forecast, by Country and Sub-region Revenue (US$ Bn), 2017-2031

Figure 39: North America Next Generation Biometrics Market Share Analysis, by Country and Sub-region and Sub-region 2023 and 2031

Figure 40: North America Next Generation Biometrics Market Attractiveness, by Country and Sub-region Value (US$ Bn), 2023-2031

Figure 41: Europe Next Generation Biometrics Market Size & Forecast, by Type, Revenue (US$ Bn), 2017-2031

Figure 42: Europe Next Generation Biometrics Market Share Analysis, by Type, 2023 and 2031

Figure 43: Europe Next Generation Biometrics Market Attractiveness, by Type, Value (US$ Bn), 2023-2031

Figure 44: Europe Next Generation Biometrics Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 45: Europe Next Generation Biometrics Market Share Analysis, by Technology, 2023 and 2031

Figure 46: Europe Next Generation Biometrics Market Attractiveness, by Technology, Value (US$ Bn), 2023-2031

Figure 47: Europe Next Generation Biometrics Market Size & Forecast, by Mobility, Revenue (US$ Bn), 2017-2031

Figure 48: Europe Next Generation Biometrics Market Share Analysis, by Mobility, 2023 and 2031

Figure 49: Europe Next Generation Biometrics Market Attractiveness, by Mobility, Value (US$ Bn), 2023-2031

Figure 50: Europe Next Generation Biometrics Market Size & Forecast, by Solution, Revenue (US$ Bn), 2017-2031

Figure 51: Europe Next Generation Biometrics Market Share Analysis, by Solution, 2023 and 2031

Figure 52: Europe Next Generation Biometrics Market Attractiveness, by Solution, Value (US$ Bn), 2023-2031

Figure 53: Europe Next Generation Biometrics Market Size & Forecast, by Industry Vertical, Revenue (US$ Bn), 2017-2031

Figure 54: Europe Next Generation Biometrics Market Share Analysis, by Industry Vertical, 2023 and 2031

Figure 55: Europe Next Generation Biometrics Market Attractiveness, by Industry Vertical, Value (US$ Bn), 2023-2031

Figure 56: Europe Next Generation Biometrics Market Size & Forecast, by Country and Sub-region Revenue (US$ Bn), 2017-2031

Figure 57: Europe Next Generation Biometrics Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 58: Europe Next Generation Biometrics Market Attractiveness, by Country and Sub-region Value (US$ Bn), 2023-2031

Figure 59: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Type, Revenue (US$ Bn), 2017-2031

Figure 60: Asia Pacific Next Generation Biometrics Market Share Analysis, by Type, 2023 and 2031

Figure 61: Asia Pacific Next Generation Biometrics Market Attractiveness, by Type, Value (US$ Bn), 2023-2031

Figure 62: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 63: Asia Pacific Next Generation Biometrics Market Share Analysis, by Technology, 2023 and 2031

Figure 64: Asia Pacific Next Generation Biometrics Market Attractiveness, by Technology, Value (US$ Bn), 2023-2031

Figure 65: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Mobility, Revenue (US$ Bn), 2017-2031

Figure 66: Asia Pacific Next Generation Biometrics Market Share Analysis, by Mobility, 2023 and 2031

Figure 67: Asia Pacific Next Generation Biometrics Market Attractiveness, by Mobility, Value (US$ Bn), 2023-2031

Figure 68: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Solution, Revenue (US$ Bn), 2017-2031

Figure 69: Asia Pacific Next Generation Biometrics Market Share Analysis, by Solution, 2023 and 2031

Figure 70: Asia Pacific Next Generation Biometrics Market Attractiveness, by Solution, Value (US$ Bn), 2023-2031

Figure 71: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Industry Vertical, Revenue (US$ Bn), 2017-2031

Figure 72: Asia Pacific Next Generation Biometrics Market Share Analysis, by Industry Vertical, 2023 and 2031

Figure 73: Asia Pacific Next Generation Biometrics Market Attractiveness, by Industry Vertical, Value (US$ Bn), 2023-2031

Figure 74: Asia Pacific Next Generation Biometrics Market Size & Forecast, by Country and Sub-region Revenue (US$ Bn), 2017-2031

Figure 75: Asia Pacific Next Generation Biometrics Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 76: Asia Pacific Next Generation Biometrics Market Attractiveness, by Country and Sub-region Value (US$ Bn), 2023-2031

Figure 77: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Type, Revenue (US$ Bn), 2017-2031

Figure 78: Middle East & Africa Next Generation Biometrics Market Share Analysis, by Type, 2023 and 2031

Figure 79: Middle East & Africa Next Generation Biometrics Market Attractiveness, by Type, Value (US$ Bn), 2023-2031

Figure 80: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 81: Middle East & Africa Next Generation Biometrics Market Share Analysis, by Technology, 2023 and 2031

Figure 82: Middle East & Africa Next Generation Biometrics Market Attractiveness, by Technology, Value (US$ Bn), 2023-2031

Figure 83: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Mobility, Revenue (US$ Bn), 2017-2031

Figure 84: Middle East & Africa Next Generation Biometrics Market Share Analysis, by Mobility, 2023 and 2031

Figure 85: Middle East & Africa Next Generation Biometrics Market Attractiveness, by Mobility, Value (US$ Bn), 2023-2031

Figure 86: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Solution, Revenue (US$ Bn), 2017-2031

Figure 87: Middle East & Africa Next Generation Biometrics Market Share Analysis, by Solution, 2023 and 2031

Figure 88: Middle East & Africa Next Generation Biometrics Market Attractiveness, by Solution, Value (US$ Bn), 2023-2031

Figure 89: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Industry Vertical, Revenue (US$ Bn), 2017-2031

Figure 90: Middle East & Africa Next Generation Biometrics Market Share Analysis, by Industry Vertical, 2023 and 2031

Figure 91: Middle East & Africa Next Generation Biometrics Market Attractiveness, by Industry Vertical, Value (US$ Bn), 2023-2031

Figure 92: Middle East & Africa Next Generation Biometrics Market Size & Forecast, by Country and Sub-region Revenue (US$ Bn), 2017-2031

Figure 93: Middle East & Africa Next Generation Biometrics Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 94: Middle East & Africa Next Generation Biometrics Market Attractiveness, by Country and Sub-region Value (US$ Bn), 2023-2031

Figure 95: South America Next Generation Biometrics Market Size & Forecast, by Type, Revenue (US$ Bn), 2017-2031

Figure 96: South America Next Generation Biometrics Market Share Analysis, by Type, 2023 and 2031

Figure 97: South America Next Generation Biometrics Market Attractiveness, by Type, Value (US$ Bn), 2023-2031

Figure 98: South America Next Generation Biometrics Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 99: South America Next Generation Biometrics Market Share Analysis, by Technology, 2023 and 2031

Figure 100: South America Next Generation Biometrics Market Attractiveness, by Technology, Value (US$ Bn), 2023-2031

Figure 101: South America Next Generation Biometrics Market Size & Forecast, by Mobility, Revenue (US$ Bn), 2017-2031

Figure 102: South America Next Generation Biometrics Market Share Analysis, by Mobility, 2023 and 2031

Figure 103: South America Next Generation Biometrics Market Attractiveness, by Mobility, Value (US$ Bn), 2023-2031

Figure 104: South America Next Generation Biometrics Market Size & Forecast, by Solution, Revenue (US$ Bn), 2017-2031

Figure 105: South America Next Generation Biometrics Market Share Analysis, by Solution, 2023 and 2031

Figure 106: South America Next Generation Biometrics Market Attractiveness, by Solution, Value (US$ Bn), 2023-2031

Figure 107: South America Next Generation Biometrics Market Size & Forecast, by Industry Vertical, Revenue (US$ Bn), 2017-2031

Figure 108: South America Next Generation Biometrics Market Share Analysis, by Industry Vertical, 2023 and 2031

Figure 109: South America Next Generation Biometrics Market Attractiveness, by Industry Vertical, Value (US$ Bn), 2023-2031

Figure 110: South America Next Generation Biometrics Market Size & Forecast, by Country and Sub-region Revenue (US$ Bn), 2017-2031

Figure 111: South America Next Generation Biometrics Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 112: South America Next Generation Biometrics Market Attractiveness, by Country and Sub-region Value (US$ Bn), 2023-2031