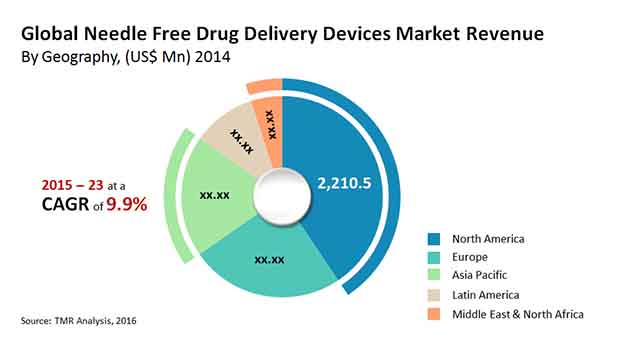

The global market for needle-free drug delivery devices has been registering a remarkable rise over the last few years, thanks to the growing demand for painless delivery of medications across the world. Analysts estimate this market to remain expanding steadily at a CAGR of 9.90% from 2015 to 2023 and increase its opportunity from US$5.4 bn in 2014 to US$13 bn by the end of 2023.

The rising need for preventive measures for needle-stick injuries is projected to stimulate the adoption of these devices significantly in the coming years. Apart from this, the growing incidence of dengue, hepatitis, and various chronic diseases, in which regular administration of medicines is required, is also expected to fuel the demand for these devices substantially over the next few years.

North America to Maintain Dominance but with Diminished Market Share

North America, Asia Pacific, Latin America, Europe, and the Middle East and Africa are the main regional markets for needle-free drug delivery devices across the world. North America and Europe dominated the overall market in 2014. While the market in North America was driven by a large pool of participants, the huge base of the geriatric population, demanding convenient and painless drug delivery led the Europe market for needle-free drug delivery devices.

Analysts predict North America to retain its dominance in the near future albeit with a diminished market share. Asia Pacific, on the flip side, is projected to emerge as the fastest rising regional market for needle-free drug delivery devices in the coming years.

The growing prevalence of chronic cardiovascular and neurological diseases, the infrastructural development in the medical and healthcare industry, and the increasing focus of leading players in this region due to unmet medical need are expected to boost the adoption of these devices in Asia Pacific considerably in the near future. These devices are also anticipated to experience a healthy rise in their demand in Latin America and the Middle East and Africa on account of the betterment of the healthcare scenario in these regions over the next few years.

Needle-free Drug Delivery Devices Find Highest Demand in Insulin Delivery

Needle-free drug delivery devices are mostly applied in insulin delivery, vaccine delivery, pediatric injections, and pain management. In 2014, the demand for these devices was the highest from the insulin delivery segment, which is likely to remain the same over the next few years. Other segments are also projected to register a steady rise in the demand for these devices in the nearing future.

The competitive landscape in the worldwide needle-free drug devices market demonstrate a consolidated structure. Leading players are increasingly entering into mergers, acquisitions, and strategic partnerships to expand their reach in this market. They are also focusing aggressively on the introduction of innovative as well as advanced devices in this market to strengthen their position. Some of the leading manufacturers of these devices across the world are Injex Pharma AG, Antares Pharma Inc., Zogenix Inc., Pharmajet Inc., Glide Pharmaceutical Technologies Ltd., and 3M.

Needle Free Drug Delivery Devices Market to Generate Notable Revenues Owing to Increasing Prevalence of Chronic Diseases

The increasing demand for easy delivery of medicines worldwide is likely to boost growth of the global needle free drug delivery devices market. The rising requirement for preventive measures for needle-stick wounds is projected to invigorate the reception of these gadgets altogether in the coming years. Aside from this, the developing rate of dengue, hepatitis, and different ongoing sicknesses, in which customary organization of prescriptions is required, is likewise expected to fuel the interest for these gadgets significantly over the course of the following not many years.

The developing predominance of persistent cardiovascular and neurological illnesses, the infrastructural improvement in the clinical and medical care industry, and the expanding focal point of driving parts in this district due to neglected clinical need are required to support the reception of these devices in Asia Pacific impressively soon. These devices are additionally expected to encounter a sound ascent in their interest in Latin America and the Middle East and Africa by virtue of the improvement of the medical care situation in these areas throughout the following not many years.

The needle free drug delivery devices market report involves an intricate leader rundown, which incorporates a market preview that gives data about different sections of the market. It additionally gives data and information investigation of the worldwide market concerning the fragments dependent on application and topography. A point by point subjective investigation of drivers and limitations of the market and openings has been given in the market outline segment. Also, the part contains Porters Five Forces Analysis to comprehend the serious scene on the lookout. This part of the report additionally gives market appeal investigation, by topography and piece of the pie examination by central members, subsequently introducing a careful investigation of the by and large serious situation in the worldwide needle free drug delivery devices market.

Table of Content

1. Preface

1.1. Report Description

1.2. Market Segmentation

1.3. Research Methodology

2. Executive Summary

2.1. Global Needle Free Drug Delivery Devices Market Share, by Geography, 2014–2023 (US$ Mn)

2.2. Global Needle Free Drug Delivery Devices Market, by Technology and Application, 2014 (US$ Mn)

2.3. Needle Free Drug Delivery Devices: Market Snapshot

3. Needle Free Drug Delivery Devices Market - Industry Analysis

3.1. Introduction

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.3. Porter’s Five Forces Analysis

3.4. Market Attractiveness Analysis - Needle Free Drug Delivery Devices Market, by Geography (2014) (%)

3.5. Competitive Landscape - Needle Free Drug Delivery Devices Market, by Key Players, 2014 (%)

4. Market Segmentation - By Technology

4.1. Introduction

4.2. Global Needle Free Drug Delivery Devices Market Revenue, by Technology, 2013–2023 (US$ Mn)

4.3. Global Jet Injectors Market Revenue, 2013–2023 (US$ Mn)

4.4. Global Competing Needle Free Technology Market Revenue, 2013–2023 (US$ Mn)

4.4.1. Global Novel Needle Technology Market Revenue, 2013–2023 (US$ Mn)

4.4.2. Global Inhaler Technology Market Revenue, 2013–2023 (US$ Mn)

4.4.3. Global Transdermal Patch Technology Market Revenue, 2013–2023 (US$ Mn)

5. Market Segmentation - By Application

5.1. Introduction

5.2. Global Needle Free Drug Delivery Devices Market Revenue, by Application, 2013–2023 (US$ Mn)

5.3. Global Vaccine Delivery Market Revenue, 2013–2023 (US$ Mn)

5.4. Global Pain Management Market Revenue, 2013–2023 (US$ Mn)

5.5. Global Insulin Delivery for Diabetes Market Revenue, 2013–2023 (US$ Mn)

5.6. Global Pediatric Injections Market Revenue, 2013–2023 (US$ Mn)

5.7. Global Other Applications Market Revenue, 2013–2023 (US$ Mn)

6. Market Segmentation - By Geography

6.1. Introduction

6.2. Global Needle Free Drug Delivery Devices Market Revenue, by Geography, 2013–2023 (US$ Mn)

6.3. North America Needle Free Drug Delivery Devices Market Revenue, 2013–2023 (US$ Mn)

6.4. Europe Needle Free Drug Delivery Devices Market Revenue, 2013–2023 (US$ Mn)

6.5. Asia Pacific Needle Free Drug Delivery Devices Market Revenue, 2013–2023 (US$ Mn)

6.6. Latin America Needle Free Drug Delivery Devices Market Revenue, 2013–2023 (US$ Mn)

6.7. Middle East & Africa Needle Free Drug Delivery Devices Market Revenue, 2013–2023 (US$ Mn)

7. Recommendations

8. Company Profiles

8.1. 3M

8.2. Antares Pharma, Inc.

8.3. Glide Pharmaceutical Technologies Ltd.

8.4. Injex Pharma AG

8.5. Pharmajet, Inc.

8.6. Zogenix, Inc.

List of Tables

TABLE 1: Needle-free Drug Delivery Devices: Market Snapshot

TABLE 2: Global Needle-Free Drug Delivery Devices Market Revenue, by Technology, 2013–2023, (US$ Mn)

TABLE 3: Global Competing Needle Free Technology Market Revenue, by Type, 2013–2023, (US$ Mn)

TABLE 4: Global Needle Free Drug Delivery Devices Market Revenue, by Application, 2013–2023, (US$ Mn)

TABLE 5: Global Needle-Free Drug Delivery Devices Market Revenue, by Geography, 2013–2023 (US$ Mn)

TABLE 6: North America Needle Free Drug Delivery Devices Market Revenue, by Technology, 2013–2023 (US$ Mn)

TABLE 7: North America Needle Free Drug Delivery Devices Market Revenue, by Country, 2013–2023 (US$ Mn)

TABLE 8: Europe Needle Free Drug Delivery Devices Market Revenue, by Technology, 2013–2023 (US$ Mn)

TABLE 9: Europe Needle Free Drug Delivery Devices Market Revenue, by Country, 2013–2023 (US$ Mn)

TABLE 10: Asia Pacific Needle Free Drug Delivery Devices Market Revenue, by Technology, 2013–2023 (US$ Mn)

TABLE 11: Asia Pacific Needle Free Drug Delivery Devices Market Revenue, by Country, 2013–2023 (US$ Mn)

TABLE 12: Latin America Needle Free Drug Delivery Devices Market Revenue, by Technology, 2013–2023 (US$ Mn)

TABLE 13: Latin America Needle Free Drug Delivery Devices Market Revenue, by Country, 2013–2023 (US$ Mn)

TABLE 14: Middle East and Africa Needle Free Drug Delivery Devices Market Revenue, by Technology, 2013–2023 (US$ Mn)

TABLE 15: Middle East & Africa Needle Free Drug Delivery Devices Market Revenue, by Country, 2013–2023 (US$ Mn)

List of Figures

FIG. 1 Needle Free Drug Delivery: Market Segmentation

FIG. 2 Global Needle-free Drug Delivery Devices Market Share, by Geography, 2014

FIG. 3 Global Needle-free Drug Delivery Devices Market Share, by Geography, 2023

FIG. 4 Global Needle-free Drug Delivery Devices Market, by Geography, 2014, Value (%)

FIG. 5 Global Needle-free Drug Delivery Devices Market, by Key Players, 2014 (%)

FIG. 6 Global Jet Injectors Market Revenue, 2013–2023, (US$ Mn)

FIG. 7 Global Novel Needle Technology Market Revenue, 2013–2023, (US$ Mn)

FIG. 8 Global Inhaler Technology Market Revenue, 2013–2023, (US$ Mn)

FIG. 9 Global Transdermal Patch Technology Market Revenue, 2013–2023, (US$ Mn)

FIG. 10 Global Vaccine Delivery Market Revenue, 2013–2023, (US$ Mn)

FIG. 11 Global Pain Management Market Revenue, 2013–2023, (US$ Mn)

FIG. 12 Global Insulin Delivery for Diabetes Market Revenue, 2013–2023, (US$ Mn)

FIG. 13 Global Pediatric Injections Market Revenue, 2013–2023, (US$ Mn)

FIG. 14 Global Other Applications Market Revenue, 2013–2023, (US$ Mn)

FIG. 15 3 M Health Care: Financial Overview: 2012–2014 (US$ Mn)

FIG. 16 Antares Pharma, Inc.: Financial Overview: 2012–2014 (US$ Mn)

FIG. 17 Zogenix, Inc.: Financial Overview: 2012–2014 (US$ Mn)