Reports

Reports

Manganese Carbonate Market: Snapshot

Manganese carbonate is a water-insoluble compound of manganese that can be changed over into other manganese mixes, for example, manganese oxide by calcination. Manganese carbonate usually occur mineral rhodochrosite. It is accessible in various colors, for example, red, pink, yellow, gray, and brown. Also, manganese carbonate can be utilized in value-added applications, for example, glaze colorants. It can likewise be utilized as a substance middle of the road for union of other chemicals. Besides, manganese carbonate can be utilized as a hematinic as supplement a business.

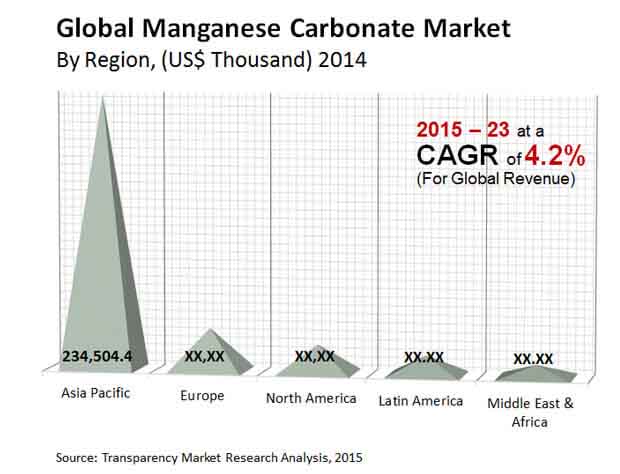

According to Transparency Market Reassert TMR's, the global manganese carbonate market, which was evaluated in 2016 to be around US$322.2 mn, is anticipated to reach nearby worth of US$464.1 mn before the finish of 2023. The market will display a CAGR of 4.2% during the forecast period from 2015 and 2023.

By the by, the potential uses of manganese carbonate for the purpose of concrete staining is expected to support its deals in future. concrete staining is gradually developing as prominent strategy to make durable, decorate, and simple to keep up home surfaces. The rising utilization of manganese carbonate to recolor solid surfaces will reinforce its scope in the future years.

Increased Usage of Manganese Carbonate as Micronutrient to Help Global Demand

The rising utilization of manganese carbonate as an important farming micronutrient will extensively fuel their deals. This chemical is regularly added to plant composts as a treatment for crops with manganese-insufficiency. Farming part still holds strength over a few rising economies in Latin America and Asia Pacific. Thus, these regions are anticipated to give lucrative chances to manganese carbonate makers, as they project rising demand regarding micronutrient manures.

Since, manganese carbonate is utilized as a colorant in pottery and porcelain items, their expanding use in the homeware sector will fuel request from the manganese carbonate market. The homeware market observes lucrative open doors in the Middle East and Africa and Asia Pacific. Demand for porcelain and pottery is consequently high over these areas, which converts into expanded scope for manganese carbonate deals.

Advancement in Farming Techniques to Support Dominance of Asia Pacific

Geographically, in 2014, Asia Pacific represented the maximum demand for manganese carbonate. The region held more than 75.5% share of the global manganese carbonate market, as per volume. Demand for manganese carbonate remained at 264,677.6 tons in 2014. India and China were among the most elevated supporters of the Asia Pacific manganese carbonate market. The fast development in the area's farming sector is required to seal Asia Pacific's strength in the global manganese carbonate market.

Other than this, Latin America likewise offers growing scope for manganese carbonate makers. Even here, the development of the farming sector helps demand for manganese carbonate. In the Middle East surge for coat colorant in agrochemical applications will reinforce future scope for the manganese carbonate market. However, in developed regions, for example, Europe and North America the market is estimated to observe just small development.

Some of the key players leading in the global manganese carbonate market are All-Chemie, Ltd., Alfa Aesar, American Elements, Mil-Spec Industries Corporation, Airedale Chemical Company Limited, Zncus Chemical Co., Ltd., and Sunrise Enterprise.

Chapter 1 Preface

1.1 Report Description

1.2 Market Segmentation

1.3 Research Scope & Assumptions

1.4 Research Methodology

Chapter 2 Executive Summary

2.1 Global Manganese Carbonate Market, 2014 - 2023, (Tons) (US$ Thousand)

2.2 Manganese Carbonate Market: Market Snapshot, 2014 & 2023

Chapter 3 Manganese Carbonate Market – Industry Analysis

3.1 Introduction

3.2 Value Chain Analysis

3.3 Market Drivers

3.3.1 Expansion of Agricultural Micronutrients Industry is Expected to Boost Demand for Manganese Carbonate

3.3.2 Increasing Demand from Ceramics and Porcelain Home Ware Industry Set to Drive Manganese Carbonate Market

3.4 Restraints

3.4.1 Unfavorable Supply Scenario due to Region-specific Concentration of Reserves Could Affect Manganese Carbonate Market Growth

3.5 Opportunity

3.5.1 Potential Applications in Concrete Staining

3.6 Porter’s Five Forces Analysis

3.6.1 Bargaining Power of Suppliers

3.6.2 Bargaining Power of Buyers

3.6.3 Threat of New Entrants

3.6.4 Threat of Substitutes

3.6.5 Degree of Competition

3.7 Manganese Carbonate: Market Attractiveness Analysis

Chapter 4 Raw Material and Price Trend Analysis

4.1 Global Manganese Carbonate Price Trend Analysis, 2014–2023 (US$/Ton)

Chapter 5 Manganese Carbonate Market – Application Analysis

5.1 Global Manganese Carbonate Market Volume Share by Application

5.2 Manganese Carbonate Market by Application

5.2.1 Manganese Carbonate Market for Agrochemicals, 2014 – 2023 (Tons) (US$ Thousand)

5.2.2 Manganese Carbonate Market for Glaze Colorant, 2014 – 2023 (Tons) (US$ Thousand)

5.2.3 Manganese Carbonate Market for Chemical Intermediates, 2014 – 2023 (Tons) (US$ Thousand)

5.2.4 Manganese Carbonate Market for Others, 2014 – 2023 (Tons) (US$ Thousand)

Chapter 6 Global Manganese Carbonate Market - Regional Analysis

6.1 Global Manganese Carbonate Market Volume Share by Region

6.2 North America

6.2.1 North America Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.2.2 North America Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.2.3 U.S.

6.2.3.1 U.S. Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.2.3.2 U.S. Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.2.4 Rest of North America

6.2.4.1 Rest of North America Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.2.4.2 Rest of North America Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.3 Europe

6.3.1 Europe Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.3.2 Europe Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.3.3 Spain

6.3.3.1 Spain Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.3.3.2 Spain Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.3.4 Italy

6.3.4.1 Italy Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.3.4.2 Italy Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.3.5 Germany

6.3.5.1 Germany Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.3.5.2 Germany Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.3.6 U.K.

6.3.6.1 U.K. Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.3.6.2 U.K. Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.3.7 France

6.3.7.1 France Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.3.7.2 France Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.3.8 Rest of Europe

6.3.8.1 Rest of Europe Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.3.8.2 Rest of Europe Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.4 Asia Pacific

6.4.1 Asia Pacific Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.4.2 Asia Pacific Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.4.3 China

6.4.3.1 China Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.4.3.2 China Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.4.4 India

6.4.4.1 India Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.4.4.2 India Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.4.5 ASEAN

6.4.5.1 ASEAN Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.4.5.2 ASEAN Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.4.6 Rest of Asia Pacific

6.4.6.1 Rest of Asia Pacific Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.4.6.2 Rest of Asia Pacific Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.5 Latin America

6.5.1 Latin America Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.5.2 Latin America Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.5.3 Brazil

6.5.3.1 Brazil Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.5.3.2 Brazil Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.5.4 Rest of Latin America

6.5.4.1 Rest of Latin America Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.5.4.2 Rest of Latin America Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.6 Middle East & Africa (MEA)

6.6.1 Middle East & Africa Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.6.2 Middle East & Africa Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.6.3 GCC

6.6.3.1 GCC Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.6.3.2 GCC Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.6.4 South Africa

6.6.4.1 South Africa Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.6.4.2 South Africa Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

6.6.5 Rest of MEA

6.6.5.1 Rest of MEA Manganese Carbonate Market Volume, by Application, 2014 – 2023 (Tons)

6.6.5.2 Rest of MEA Manganese Carbonate Market Revenue, by Application, 2014 – 2023 (US$ Thousand)

Chapter 7 Company Profiles

7.1 All-Chemie Ltd

7.2 Airedale Chemical Company Ltd

7.3 American Elements

7.4 Alfa Aesar

7.5 Akshar Chemicals

7.6 Sunrise Enterprise

7.7 Chemalloy

7.8 GFS Chemicals, Inc.

7.9 Mil-Spec Industries Corporation

7.10 Zncus Chemical Co., Ltd

Chapter 8 Primary Research – Key Findings