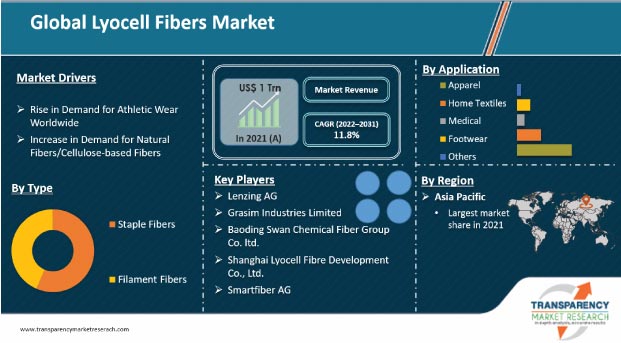

The global lyocell fibers market was valued at US$ 1.0 Trn in 2021

It is estimated to grow at a CAGR of 11.8% from 2022 to 2031

The global lyocell fibers market is expected to cross US$ 2.7 Trn by the end of 2031

Analysts’ Viewpoint on Global Lyocell Fibers Market Scenario

Companies operating in the global lyocell fibers market are focusing on key applications, such as apparel, which includes sportswear, denims, and footwear, to keep their business growing. The lyocell fibers market is highly consolidated, as leading players make the landscape less competitive. Furthermore, high capital investments required for setting up the business, especially when the cost of new technologies is high, could create a barrier for entry of new market players. The lyocell fibers market is characterized by a low degree of backward integration, as textile manufacturers tend to manufacture fibers on their own. Manufacturers are collaborating with well-established transportation and logistics companies to deliver products in a stipulated time period in order to remain competitive and grow in the market. Manufacturers are enhancing the properties of lyocell fibers by combining them with textiles such as silk, wool, acrylic, polyester, and cotton, which is likely to widen the existing scope of the market, as consumers tend to prefer breathable and smooth fabrics. Moreover, manufacturers are investing in the enhancement of product quality to consolidate their position in the market.

Lyocell fibers are extensively used in applications such as apparel, home textiles, medical, and footwear. These fibers are made of cellulose, which is found in wood pulp. Lyocell fibers can be recycled and easily disposed through processes such as sewage deposition, incineration, and landfilling. This is projected to prompt manufacturers of fibers such as rayon, cotton, and synthetic fibers to shift toward the production of lyocell fibers in the near future. Lyocell fibers provide strength similar to that of polyester. These fibers are stronger than cotton and all other manmade staple cellulosic fibers. Lyocell fibers also possess very high dry and wet modulus for cellulosic fibers in both dry and wet states. Therefore, lyocell fiber is an efficient material for dyeing and finishing of clothing.

Lyocell fibers are also highly crystalline in structure. Therefore, these fibers offer high wet strength and excellent dry strength. Thus, lyocell fibers are water washable. Furthermore, these fibers shrink less when wetted by water and dried as compared to other cellulose fibers such as cotton and viscose rayon.

Lyocell fibers can be classified as cotton lyocell; lyocell polyester; lyocell rayon; lyocell silk; and lyocell warm. Cotton lyocell is a mix of silky-smooth lyocell and soft cotton to create a durable fabric with excellent drapability and softness for shirts. Lyocell rayon fabrics exhibit better fabric feel and drape as compared to viscose rayon, owing to the fiber shape and appearance of lyocell.

Lyocell warm is one of the best fabrics for staying warm on a cold day. This is due to the fabric's ability to self-regulate temperature. The global lyocell fibers market is estimated to grow at a CAGR of 11.8% during the forecast period, owing to favorable properties of lyocell fibers, specifically for various applications such as apparel, home textiles, and medical.

Request a sample to get extensive insights into the Lyocell Fibers Market

Growing awareness about health and fitness among consumers across the globe coupled with increasing per capita income of consumers is likely to drive the demand for sportswear over the next few years. Additionally, increase in adoption of healthier lifestyles and rise in participation in sports & fitness activities in developed as well as developing nations are projected to fuel the demand for sportswear in the near future. A large number of people in the U.S. and Europe are focusing on their physical well-being. Rising middle class population in developing nations is opting for gym memberships and participating in sports.

Additionally, numerous manufacturers of athletic wear are entering into partnerships with online retailers, such as Myntra and Amazon, in order to grow their presence across the globe. Leading vendors such as Under Armour, Inc., Nike, Inc., and Adidas AG are increasingly targeting younger population across geographies and offering athletic wear at lower prices. Thus, advancements in pricing strategies among several manufacturers are projected to boost the demand for athletic wear in the near future.

Moreover, rise in preference for athletic wear is also being spurred by product innovations, which include usage of advanced materials for decreasing the overall weight of sports shoes and activity-specific shoes for running, tennis, and hiking. Increasing regulations on the production of synthetic fibers led by emission issues is likely to compel manufacturers of synthetic fibers to produce eco-friendly fibers. Characteristics of lyocell fibers such as high absorptivity, enhanced softness, and eco-friendliness are other key factors boosting the adoption of lyocell fibers across various end-use industries. Thus, considering the all factors mentioned above, the lyocell fibers market is projected to grow during the forecast period.

The rise in apparel trade can be attributed to growing urbanization combined with increasing consumer disposable income, which has resulted in a rise in the living standard of people in developing countries across Asia, the Middle East, and Africa. Furthermore, growth of the middle-class population and rapid rise in consumption are expected to drive the demand for cellulose fibers over the next few years.

Increasing awareness about environment-related issues are prompting several technology developers to work toward improvement in technology in order to reduce environmental damage created by the textile industry and reduce the consumption of energy, water, and chemicals. Attributes of cellulose fibers such as eco-friendliness, hydrophobicity, and high moisture absorbency make them a material of choice for the production of summer wear, towels, diapers, etc. This, in turn, is projected to drive the demand for cellulose fibers over the next few years.

Additionally, fast fashion brands, such as H&M, Conscious, and Zara, are making their presence in sustainable fashion by using fabrics such as cotton, organic cotton, and lyocell in the production of denim wears.

Request a custom report on Lyocell Fibers Market

In terms of type, the global lyocell fibers market has been classified into staple fibers and filament fiber. The staple fibers segment dominated the global lyocell fibers market and held more than 50% share in 2021. Staple fibers are prominently used in the production of heavy-use objects such as blankets, coats, rugs, and wrap threads. The rising demand for housing products is anticipated to fuel the demand for blankets, rugs, and carpets over the next few years. This, in turn, is projected to drive the staple fibers segment of the market in the next few years. The segment is estimated to expand at a notable CAGR of 11.7% during the forecast period.

In terms of volume, Asia Pacific leads the global lyocell fibers market. Asia Pacific accounted for more than 70% share of the global lyocell fibers market in 2021. The growth of the lyocell fibers market in Asia Pacific can be ascribed to an increase in population and rise in urbanization in developing countries such as China and India. China is estimated to be a major customer of lyocell fibers in the region. Additionally, rise in disposable income is driving the spending power of the people in these countries. This, in turn, is expected to boost the lyocell fibers market.

North America and Europe are also key markets for lyocell fibers, in terms of volume. These regions accounted for 6.9% and 8.5% share, respectively, of the global market in 2021.

Latin America is the larger market for lyocell fibers than Middle East & Africa; however, the market in Middle East & Africa is likely to grow at a higher rate during the forecast period.

The global lyocell fibers market is highly consolidated, with a small number of large-scale vendors controlling majority of the share. Most companies are investing considerably in comprehensive research and development activities, primarily to create environment-friendly products. Diversification of product portfolios and mergers & acquisitions are key strategies adopted by prominent players. Lenzing AG, Grasim Industries Limited, Baoding Swan Chemical Fiber Group Co. ltd., Shanghai Lyocell Fibre Development Co., Ltd., and Smartfiber AG are the prominent entities operating in the market.

Each of these players has been profiled in the lyocell fibers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

On October 19, 2021, Lenzing AG announced that it is expanding its sustainable offering for the denim industry with the introduction of matte TENCEL branded lyocell fibers. The new fiber type is specially designed to scatter light and permanently diminish sheen in denim applications, further enabling versatility of indigo-dyed denim fabrics.

On March 5, 2019, Grasim Industries Limited announced the acquisition of Soktas India Private Limited. Soktas India Private Limited is currently a subsidiary of SÖKTAS Tekstil Sanayi ve Ticaret A.S., which is a global manufacturer and marketer of fabrics, with its manufacturing base in Soke, Turkey.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.0 Trn |

|

Market Forecast Value in 2031 |

US$ 2.7 Trn |

|

Growth Rate (CAGR) |

11.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Trn for Value and Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The lyocell fibers market stood at US$ 1 Trn in 2021.

The lyocell fibers market is expected to grow at a CAGR of 11.8% from 2022 to 2031.

Rise in demand for athletic wear globally and increase in demand for natural fibers/cellulose-based fibers are key drivers of the lyocell fibers market.

Staple fibers was the largest type segment that held more than 50% value share in 2021.

Asia Pacific was the most lucrative region of the lyocell fibers market in 2021.

Lenzing AG, Grasim Industries Limited, Baoding Swan Chemical Fiber Group Co. ltd., Shanghai Lyocell Fibre Development Co., Ltd., and Smartfiber AG

1. Executive Summary

1.1. Lyocell Fibers Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Materials Providers

2.6.2. List of Lyocell Fibers Manufacturers

2.6.3. List of Dealers/Distributors

2.6.4. List of Potential Customer

3. COVID-19 Impact Analysis

4. Lyocell Fibers Market Analysis and Forecast, by Type, 2022–2031

4.1. Introduction and Definitions

4.2. Global Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

4.2.1. Staple Fibers

4.2.2. Filament Fibers

4.3. Global Lyocell Fibers Market Attractiveness, by Type

5. Global Lyocell Fibers Market Analysis and Forecast, Application, 2022–2031

5.1. Introduction and Definitions

5.2. Global Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

5.2.1. Apparel

5.2.1.1. Sportswear

5.2.1.2. Denims

5.2.1.3. Others

5.2.2. Home Textiles

5.2.2.1. Curtains

5.2.2.2. Carpets & Upholstery

5.2.2.3. Beddings

5.2.2.4. Towels

5.2.2.5. Others

5.2.3. Medical

5.2.4. Footwear

5.2.5. Others

5.3. Global Lyocell Fibers Market Attractiveness, by Application

6. Global Lyocell Fibers Market Analysis and Forecast, by Region, 2022–2031

6.1. Key Findings

6.2. Global Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Region, 2022–2031

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Latin America

6.2.5. Middle East & Africa

6.3. Global Lyocell Fibers Market Attractiveness, by Region

7. North America Lyocell Fibers Market Analysis and Forecast, 2022–2031

7.1. Key Findings

7.2. North America Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

7.3. North America Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

7.4. North America Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Country, 2022–2031

7.4.1. U.S. Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

7.4.2. U.S. Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

7.4.3. Canada Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

7.4.4. Canada Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

7.5. North America Lyocell Fibers Market Attractiveness Analysis

8. Europe Lyocell Fibers Market Analysis and Forecast, 2022–2031

8.1. Key Findings

8.2. Europe Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.3. Europe Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

8.4. Europe Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

8.4.1. Germany Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.4.2. Germany. Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

8.4.3. France Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.4.4. France. Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

8.4.5. U.K. Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.4.6. U.K. Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

8.4.7. Italy Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.4.8. Italy Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

8.4.9. Russia & CIS Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.4.10. Russia & CIS Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

8.4.11. Rest of Europe Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

8.4.12. Rest of Europe Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

8.5. Europe Lyocell Fibers Market Attractiveness Analysis

9. Asia Pacific Lyocell Fibers Market Analysis and Forecast, 2022–2031

9.1. Key Findings

9.2. Asia Pacific Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type

9.3. Asia Pacific Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

9.4. Asia Pacific Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

9.4.1. China Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

9.4.2. China Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

9.4.3. Japan Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

9.4.4. Japan Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

9.4.5. India Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

9.4.6. India Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

9.4.7. ASEAN Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

9.4.8. ASEAN Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

9.4.9. Rest of Asia Pacific Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

9.4.10. Rest of Asia Pacific Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

9.5. Asia Pacific Lyocell Fibers Market Attractiveness Analysis

10. Latin America Lyocell Fibers Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. Latin America Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

10.3. Latin America Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

10.4. Latin America Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

10.4.1. Brazil Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

10.4.2. Brazil Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

10.4.3. Mexico Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

10.4.4. Mexico Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

10.4.5. Rest of Latin America Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

10.4.6. Rest of Latin America Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

10.5. Latin America Lyocell Fibers Market Attractiveness Analysis

11. Middle East & Africa Lyocell Fibers Market Analysis and Forecast, 2022–2031

11.1. Key Findings

11.2. Middle East & Africa Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

11.3. Middle East & Africa Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

11.4. Middle East & Africa Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

11.4.1. GCC Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

11.4.2. GCC Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

11.4.3. South Africa Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

11.4.4. South Africa Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

11.4.5. Rest of Middle East & Africa Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022–2031

11.4.6. Rest of Middle East & Africa Lyocell Fibers Market Volume (Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

11.5. Middle East & Africa Lyocell Fibers Market Attractiveness Analysis

12. Competition Landscape

12.1. Global Lyocell Fibers Company Market Share Analysis, 2021

12.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

12.2.1. Grasim Industries Limited

12.2.1.1. Company Description

12.2.1.2. Business Overview

12.2.1.3. Financial Overview

12.2.1.4. Strategic Overview

12.2.2. Lenzing AG

12.2.2.1. Company Description

12.2.2.2. Business Overview

12.2.2.3. Financial Overview

12.2.2.4. Strategic Overview

12.2.3. Baoding Swan Chemical Fiber Group Co. ltd.

12.2.3.1. Company Description

12.2.3.2. Business Overview

12.2.3.3. Financial Overview

12.2.3.4. Strategic Overview

12.2.4. SI Group, Inc.

12.2.4.1. Company Description

12.2.4.2. Business Overview

12.2.4.3. Financial Overview

12.2.4.4. Strategic Overview

12.2.5. Smartfiber AG

12.2.5.1. Company Description

12.2.5.2. Business Overview

12.2.5.3. Financial Overview

12.2.5.4. Strategic Overview

12.2.6. Shanghai Lyocell Fibre Development Co., Ltd.

12.2.6.1. Company Description

12.2.6.2. Business Overview

12.2.6.3. Financial Overview

12.2.6.4. Strategic Overview

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 1: Global Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 2: Global Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 3: Global Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 4: Global Lyocell Fibers Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 5: Global Lyocell Fibers Market Volume (Tons) Forecast, by Region, 2022–2031

Table 6: Global Lyocell Fibers Market Value (US$ Bn) Forecast, by Region, 2022–2031

Table 7: North America Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 8: North America Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 9: North America Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 10: North America Lyocell Fibers Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 11: North America Lyocell Fibers Market Volume (Tons) Forecast, by Country, 2022–2031

Table 12: North America Lyocell Fibers Market Value (US$ Bn) Forecast, by Country, 2022–2031

Table 13: U.S. Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 14: U.S. Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 15: U.S. Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 16: U.S. Lyocell Fibers Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 17: Canada Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 18: Canada Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 19: Canada Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 20: Canada Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 21: Europe Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 22: Europe Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 23: Europe Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 24: Europe Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 25: Europe Lyocell Fibers Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 26: Europe Lyocell Fibers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 27: Germany Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 28: Germany Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 29: Germany Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 30: Germany Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 31: France Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 32: France Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 33: France Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 34: France Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 35: U.K. Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 36: U.K. Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 37: U.K. Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 38: U.K. Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 39: Italy Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 40: Italy Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 41: Italy Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 42: Italy Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 43: Spain Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 44: Spain Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 45: Spain Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 46: Spain Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 47: Russia & CIS Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 48: Russia & CIS Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 49: Russia & CIS Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 50: Russia & CIS Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 51: Rest of Europe Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 52: Rest of Europe Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 53: Rest of Europe Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 54: Rest of Europe Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 55: Asia Pacific Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 56: Asia Pacific Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 57: Asia Pacific Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 58: Asia Pacific Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 59: Asia Pacific Lyocell Fibers Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 60: Asia Pacific Lyocell Fibers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 61: China Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 62: China Lyocell Fibers Market Value (US$ Bn) Forecast, by Type 2022–2031

Table 63: China Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 64: China Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 65: Japan Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 66: Japan Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 67: Japan Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 68: Japan Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 69: India Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 70: India Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 71: India Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 72: India Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 73: ASEAN Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 74: ASEAN Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 75: ASEAN Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 76: ASEAN Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 77: Rest of Asia Pacific Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 78: Rest of Asia Pacific Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 79: Rest of Asia Pacific Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 80: Rest of Asia Pacific Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 81: Latin America Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 82: Latin America Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 83: Latin America Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 84: Latin America Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 85: Latin America Lyocell Fibers Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 86: Latin America Lyocell Fibers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 87: Brazil Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 88: Brazil Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 89: Brazil Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 90: Brazil Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 91: Mexico Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 92: Mexico Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 93: Mexico Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 94: Mexico Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 95: Rest of Latin America Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 96: Rest of Latin America Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 97: Rest of Latin America Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 98: Rest of Latin America Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 99: Middle East & Africa Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 100: Middle East & Africa Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 101: Middle East & Africa Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 102: Middle East & Africa Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 103: Middle East & Africa Lyocell Fibers Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 104: Middle East & Africa Lyocell Fibers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 105: GCC Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 106: GCC Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 107: GCC Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 108: GCC Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 109: South Africa Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 110: South Africa Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 111: South Africa Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 112: South Africa Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 113: Rest of Middle East & Africa Lyocell Fibers Market Volume (Tons) Forecast, by Type, 2022–2031

Table 114: Rest of Middle East & Africa Lyocell Fibers Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 115: Rest of Middle East & Africa Lyocell Fibers Market Volume (Tons) Forecast, by Application, 2022–2031

Table 116: Rest of Middle East & Africa Lyocell Fibers Market Value (US$ Bn) Forecast, by Application 2022–2031

List of Figures

Figure 1: Global Lyocell Fibers Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 2: Global Lyocell Fibers Market Attractiveness, by Type

Figure 3: Global Lyocell Fibers Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 4: Global Lyocell Fibers Market Attractiveness, by Application

Figure 5: Global Lyocell Fibers Market Volume Share Analysis, by Region, 2021, 2025, and 2031

Figure 6: Global Lyocell Fibers Market Attractiveness, by Region

Figure 7: North America Lyocell Fibers Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 8: North America Lyocell Fibers Market Attractiveness, by Type

Figure 9: North America Lyocell Fibers Market Attractiveness, by Type

Figure 10: North America Lyocell Fibers Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 11: North America Lyocell Fibers Market Attractiveness, by Application

Figure 12: North America Lyocell Fibers Market Attractiveness, by Country and Sub-region

Figure 13: Europe Lyocell Fibers Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 14: Europe Lyocell Fibers Market Attractiveness, by Type

Figure 15: Europe Lyocell Fibers Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 16: Europe Lyocell Fibers Market Attractiveness, by Application

Figure 17: Europe Lyocell Fibers Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 18: Europe Lyocell Fibers Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Lyocell Fibers Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 20: Asia Pacific Lyocell Fibers Market Attractiveness, by Type

Figure 21: Asia Pacific Lyocell Fibers Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 22: Asia Pacific Lyocell Fibers Market Attractiveness, by Application

Figure 23: Asia Pacific Lyocell Fibers Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 24: Asia Pacific Lyocell Fibers Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Lyocell Fibers Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 26: Latin America Lyocell Fibers Market Attractiveness, by Type

Figure 27: Latin America Lyocell Fibers Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 28: Latin America Lyocell Fibers Market Attractiveness, by Application

Figure 29: Latin America Lyocell Fibers Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 30: Latin America Lyocell Fibers Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Lyocell Fibers Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 32: Middle East & Africa Lyocell Fibers Market Attractiveness, by Type

Figure 33: Middle East & Africa Lyocell Fibers Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 34: Middle East & Africa Lyocell Fibers Market Attractiveness, by Application

Figure 35: Middle East & Africa Lyocell Fibers Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 36: Middle East & Africa Lyocell Fibers Market Attractiveness, by Country and Sub-region