Lubricants Market: Snapshot

Interest for nourishment grade modern lubricants in the sustenance preparing industry is evaluated to rise essentially amid the conjecture time frame. This can be fundamentally attributed to the move sought after toward programmed grease frameworks and robotized plants.

A few financial components, for example, overproduction of unrefined petroleum, changing vitality standards of nations, and monetary emergency crosswise over Europe and North America have prompted a precarious decrease in oil costs. These elements have made unpredictability sought after at lubricants and their costs. In this manner, oil organizations need to embrace adaptable methodologies in the consistently changing market conditions in the midst of serious challenge.

Nonetheless, the benefits such as lower volatility, better thermal, higher viscosity index, and oxidative stability are anticipated to enhance this demand for automotive oils in the coming years. Furthermore, demand for hydraulic oils is estimated to gain momentum in the forecast period.

Ascend in family salaries, urbanization, and outside direct interests in different end-client businesses, for example, car and sustenance and drinks, is driving the interest for lubricants in Asia Pacific.

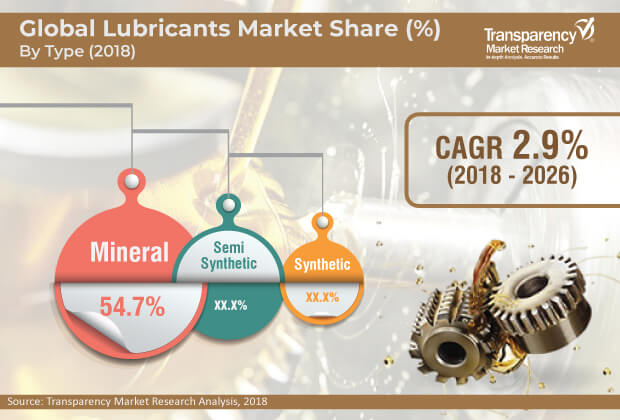

The global lubricants market collected revenue of US$125.66 bn in 2017 and is expected to attain a value of US$163.37 bn by 2026-end. The market is swelling is expected to expand at a CAGR of 2.9% over the forecast period from 2018 to 2026.

Automotive Oils Segment Accounted for the Leading Share in the Global Lubricants Market

Based on the product, the lubricants market is segmented into automotive oils, metalworking fluids, industrial oils, hydraulic oils, marine oils, process oils, and grease & others. Among these, automotive oils segment accounted for the leading share in the global lubricants market in 2017. Substantially growing demand for engine oils for preventing metal-to-metal contact coupled with reduced friction of an engine and by providing wear protection.

In terms of product, the market is segmented into synthetic, mineral, and semi-synthetic. Of these, mineral held leading share in the market in 2017 owing to its availability at lower cost. Synthetic and semi-synthetic lubricants are especially available at low cost.

Based on the application, the global lubricants market is segregated into industrial, automotive, and marine. Of these, industrial sectors dominated the overall market in 2017. This is ascribed to the rapid industrialization globally and especially across developing countries. Additionally, expansion of industries including automotive, industrial machinery, and energy in developing economies such as India, China, Brazil, and South Africa are driving growth of the market in these regions.

Asia Pacific to be Leading Region in Lubricants Market

On the geographical front, the lubricants market are segmented into North America, Latin America, Europe, Asia Pacific, And the Middle East & Africa. Of these, Asia Pacific held the dominant share of the global lubricants market in 2017. This growth of the market is attributable to the booming and expanding automotive industry coupled with rising usage of lubricants in the industries. Thanks to these factors, the region is estimated to be dominant over the forecast period. China and India are offering tremendous growth opportunities to the key players in the lubricants market in Asia Pacific. However, the lubricants market across Europe and North America is predictable to expand at a moderate pace during the forecast period being the mature markets for the lubricants.

Some of the key players operating in the global lubricants market include Royal Dutch Shell Plc., PetroChina Company Limited, Calumet Specialty Products Partners, L.P, Total Group, and China Petrochemical Corporation (Sinopec Group).

|

Type |

|

|

Product |

|

|

Application |

|

|

Region |

|

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary: Global Lubricants Market

3.1. Market Value, Indicative (US$ Mn)

3.2. Top Three Trends

4. Market Overview

4.1. Product Overview

4.2. Key Market Developments

4.3. Market Indicators

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Threat of Substitutes

5.2.2. Bargaining Power of Buyers

5.2.3. Bargaining Power of Suppliers

5.2.4. Threat of New Entrants

5.2.5. Degree of Competition

5.3. Value Chain Analysis

5.4. Global Lubricants Market: SWOT Analysis

6. Global Lubricants Market: Price Trend Analysis, 2017

6.1. Average Price Range of Lubricants (US$/Ton), by Product, 2017

6.2. Average Price Range of Lubricants (US$/Ton), by Region, 2017

7. Import/Export Trade Analysis

8. Lubricants Market – Production Output

9. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by Type

9.1. Key Findings and Introduction

9.2. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

9.2.1. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mineral, 2017–2026

9.2.2. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Synthetic, 2017–2026

9.2.3. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Semi-synthetic, 2017–2026

9.3. Global Lubricants Market Attractiveness Analysis, by Type

10. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by Product

10.1. Key Findings and Introduction

10.2. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

10.2.1. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Automotive Oils, 2017–2026

10.2.1.1. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Engine Oils, 2017–2026

10.2.1.2. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Transmission Oils, 2017–2026

10.2.2. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Industrial Oils, 2017–2026

10.2.3. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Metalworking Fluids, 2017–2026

10.2.4. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Hydraulic Oils, 2017–2026

10.2.5. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Process Oils, 2017–2026

10.2.6. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Marine Oils, 2017–2026

10.2.7. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Greases & Others, 2017–2026

10.3. Global Lubricants Market Attractiveness Analysis, by Product

11. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by Application

11.1. Key Findings and Introduction

11.2. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

11.2.1. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Automotive, 2017–2026

11.2.1.1. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Passenger Cars, 2017–2026

11.2.1.2. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Light Commercial Vehicles, 2017–2026

11.2.1.3. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Heavy Commercial Vehicles, 2017–2026

11.2.2. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Industrial, 2017–2026

11.2.3. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Marine, 2017–2026

11.3. Global Lubricants Market Attractiveness Analysis, by Application

12. Global Lubricants Market Analysis, by Region

12.1. Global Regulatory Scenario

12.2. Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Latin America

12.2.5. Middle East & Africa

12.3. Global Lubricants Market Attractiveness Analysis, by Region

13. North America Lubricants Market Overview

13.1. North America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

13.2. North America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

13.3. North America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

13.4. North America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country

13.4.1. U.S. Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

13.4.2. U.S. Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

13.4.3. U.S. Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

13.4.4. U.S. Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type 2017–2026

13.4.5. Canada Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

13.4.6. Canada Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

13.5. North America Lubricants Market Attractiveness Analysis, by Type

13.6. North America Lubricants Market Attractiveness Analysis, by Product

13.7. North America Lubricants Market Attractiveness Analysis, by Application

13.8. North America Lubricants Market Trends

14. Europe Lubricants Market Overview

14.1. Europe Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

14.2. Europe Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

14.3. Europe Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

14.4. Europe Lubricants Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, by Country and Sub-region

14.4.1. Germany Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

14.4.2. Germany Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

14.4.3. Germany Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

14.4.4. France Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

14.4.5. France Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

14.4.6. France Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

14.4.7. U.K. Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

14.4.8. U.K. Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

14.4.9. U.K. Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

14.4.10. Italy Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

14.4.11. Italy Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

14.4.12. Italy Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

14.4.13. Spain Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

14.4.14. Spain Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

14.4.15. Spain Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

14.4.16. Russia Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

14.4.17. Russia Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

14.4.18. Russia Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

14.4.19. Turkey Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

14.4.20. Turkey Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

14.4.21. Turkey Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

14.4.22. Rest of Europe Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

14.4.23. Rest of Europe Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

14.4.24. Rest of Europe Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

14.5. Europe Lubricants Market Attractiveness Analysis, by Type

14.6. Europe Lubricants Market Attractiveness Analysis, by Product

14.7. Europe Lubricants Market Attractiveness Analysis, by Application

14.8. Europe Lubricants Market Trends

15. Asia Pacific Lubricants Market Overview

15.1. Asia Pacific Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

15.2. Asia Pacific Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

15.3. Asia Pacific Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

15.4. Asia Pacific Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region

15.4.1. China Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

15.4.2. China Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

15.4.3. China Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

15.4.4. India Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

15.4.5. India Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

15.4.6. India Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

15.4.7. Japan Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

15.4.8. Japan Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

15.4.9. Japan Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

15.4.10. South Korea Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

15.4.11. South Korea Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

15.4.12. South Korea Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

15.4.13. Indonesia Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

15.4.14. Indonesia Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

15.4.15. Indonesia Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

15.4.16. Thailand Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

15.4.17. Thailand Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

15.4.18. Thailand Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

15.4.19. Rest of ASEAN (excluding Indonesia and Thailand) Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

15.4.20. Rest of ASEAN (excluding Indonesia and Thailand) Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

15.4.21. Rest of ASEAN (excluding Indonesia and Thailand) Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

15.4.22. Rest of Asia Pacific Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

15.4.23. Rest of Asia Pacific Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

15.4.24. Rest of Asia Pacific Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

15.5. Asia Pacific Lubricants Market Attractiveness Analysis, by Type

15.6. Asia Pacific Lubricants Market Attractiveness Analysis, by Product

15.7. Asia Pacific Lubricants Market Attractiveness Analysis, by Application

15.8. Asia Pacific Lubricants Market Trends

16. Latin America Lubricants Market Overview

16.1. Latin America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

16.2. Latin America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

16.3. Latin America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

16.4. Latin America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region

16.4.1. Brazil Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

16.4.2. Brazil Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

16.4.3. Brazil Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

16.4.4. Mexico Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

16.4.5. Mexico Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

16.4.6. Mexico Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

16.4.7. Rest of Latin America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

16.4.8. Rest of Latin America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

16.4.9. Rest of Latin America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

16.5. Latin America Lubricants Market Attractiveness Analysis, by Type

16.6. Latin America Lubricants Market Attractiveness Analysis, by Product

16.7. Latin America Lubricants Market Attractiveness Analysis, by Application

16.8. Latin America Lubricants Market Trends

17. Middle East & Africa Lubricants Market Overview

17.1. Middle East & Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

17.2. Middle East & Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

17.3. Middle East & Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

17.4. Middle East & Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region

17.4.1. GCC Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

17.4.2. GCC Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

17.4.3. GCC Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

17.4.4. South Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

17.4.5. South Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

17.4.6. South Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

17.4.7. Iran Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

17.4.8. Iran Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

17.4.9. Iran Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

17.4.10. Rest of Middle East & Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

17.4.11. Rest of Middle East & Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2017–2026

17.4.12. Rest of Middle East & Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017–2026

17.5. Middle East & Africa Lubricants Market Attractiveness Analysis, by Type

17.6. Middle East & Africa Lubricants Market Attractiveness Analysis, by Product

17.7. Middle East & Africa Lubricants Market Attractiveness Analysis, by Application

17.8. Middle East & Africa Lubricants Market Trends

18. Competition Landscape

18.1. Global Lubricants Market Share Analysis, by Company (2017)

18.2. Competition Matrix

18.2.1. Royal Dutch Shell Plc.

18.2.2. ExxonMobil Corporation

18.2.3. BP plc.

18.2.4. Chevron Corporation

18.3. Company Profiles

18.3.1. Calumet Specialty Products Partners, L.P

18.3.1.1. Company Description

18.3.1.2. Business Overview

18.3.1.3. Financial Details

18.3.1.4. Business Strategy

18.3.1.5. Key Developments

18.3.2. Royal Dutch Shell Plc. (Shell)

18.3.2.1. Company Description

18.3.2.2. Business Overview

18.3.2.3. Financial Details

18.3.2.4. Business Strategy

18.3.2.5. Key Developments

18.3.3. PetroChina Company Limited

18.3.3.1. Company Description

18.3.3.2. Business Overview

18.3.3.3. Financial Details

18.3.3.4. Business Strategy

18.3.4. Total Group

18.3.4.1. Company Description

18.3.4.2. Business Overview

18.3.4.3. Financial Details

18.3.4.4. Business Strategy

18.3.5. China Petrochemical Corporation (Sinopec Group)

18.3.5.1. Company Description

18.3.5.2. Business Overview

18.3.5.3. Financial Details

18.3.5.4. Business Strategy

18.3.5.5. Key Developments

18.3.6. JXTG Nippon Oil & Energy Corporation

18.3.6.1. Company Description

18.3.6.2. Business Overview

18.3.6.3. Financial Details

18.3.6.4. Business Strategy

18.3.6.5. Key Developments

18.3.7. Idemitsu Kosan Co., Ltd.

18.3.7.1. Company Description

18.3.7.2. Business Overview

18.3.7.3. Financial Details

18.3.7.4. Business Strategy

18.3.7.5. Key Developments

18.3.8. FUCHS

18.3.8.1. Company Description

18.3.8.2. Business Overview

18.3.8.3. Key Developments

18.3.9. Gulf Oil Marine Ltd

18.3.9.1. Company Description

18.3.9.2. Business Overview

18.3.9.3. Key Developments

18.3.10. BP plc.

18.3.10.1. Company Description

18.3.10.2. Business Overview

18.3.10.3. Financial Details

18.3.10.4. Product Portfolio

18.3.10.5. Key Developments

18.3.11. Petroliam Nasional Berhad (PETRONAS)

18.3.11.1. Company Description

18.3.11.2. Business Overview

18.3.11.3. Financial Details

18.3.11.4. Key Developments

18.3.12. Chevron Corporation

18.3.12.1. Company Description

18.3.12.2. Business Overview

18.3.13. ExxonMobil Corporation

18.3.13.1. Company Description

18.3.13.2. Business Overview

19. Primary Research: Key Insights

Table 01: Average Price Range of Lubricants (US$/Ton), by Product, 2017

Table 02: Average Price Range of Lubricants (US$/Ton), by Product and Region, 2017

Table 03: Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 04: Global Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 05: Global Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 06: Global Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 07: Global Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 08: Global Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2017–2026

Table 09: North America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 10: North America Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 11: North America Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 12: North America Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 13: North America Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 14: North America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2017–2026

Table 15: U.S. Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 16: U.S. Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 17: U.S. Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 18: U.S. Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 19: U.S. Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 20: Canada Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 21: Canada Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 22: Canada Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 23: Canada Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 24: Canada Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 28: Europe Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 29: Europe Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 30: Europe Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 31: Europe Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 32: Europe Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 33 (a): Europe Lubricant Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2017–2026

Table 34 (b): Europe Lubricant Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2026

Table 35: Germany Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 36: Germany Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 37: Germany Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 38: Germany Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 39: Germany Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 40: France Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 41: France Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 42: France Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 43: France Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 44: France Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 45: U.K. Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 46: U.K. Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 47: U.K. Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 48: U.K. Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 49: U.K. Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 50: Italy Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 51: Italy Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 52: Italy Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 53: Italy Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 54: Italy Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 55: Spain Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 56: Spain Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 57: Spain Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 58: Spain Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 59: Spain Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 60: Russia Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 61: Russia Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 62: Russia Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 63: Russia Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 64: Russia Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 65: Turkey Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 66: Turkey Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 67: Turkey Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 68: Turkey Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 69: Turkey Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 70: Rest of Europe Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 71: Rest of Europe Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 72: Rest of Europe Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 73: Rest of Europe Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 74: Rest of Europe Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 75: Asia Pacific Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 76: Asia Pacific Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 77: Asia Pacific Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 78: Asia Pacific Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 79: Asia Pacific Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 80 (a): Asia Pacific Lubricants Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2017–2026

Table 81 (b): Asia Pacific Lubricants Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2026

Table 82: China Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 83: China Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 84: China Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 85: China Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 86: China Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 87: Japan Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 88: Japan Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 89: Japan Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 90: Japan Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 91: Japan Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 92: India Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 93: India Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 94: India Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 95: India Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 96: India Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 97: Indonesia Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 98: Indonesia Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 99: Indonesia Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 100: Indonesia Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 101: Indonesia Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 102: Thailand Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 103: Thailand Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 104: Thailand Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 105: Thailand Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 106: Thailand Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 107: ASEAN (excluding Indonesia & Thailand) Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 108: ASEAN (excluding Indonesia & Thailand) Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 109: ASEAN (excluding Indonesia & Thailand) Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 110: ASEAN (excluding Indonesia & Thailand) Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 111: ASEAN (excluding Indonesia & Thailand) Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 112: South Korea Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 113: South Korea Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 114: South Korea Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 115: South Korea Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 116: South Korea Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 117: Rest of Asia Pacific Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 118: Rest of Asia Pacific Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 119: Rest of Asia Pacific Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 120: Rest of Asia Pacific Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 121: Rest of Asia Pacific Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 122: Latin America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 123: Latin America Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 124: Latin America Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 125: Latin America Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 126: Latin America Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 127: Latin America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2026

Table 128: Brazil Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 129: Brazil Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 130: Brazil Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 131: Brazil Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 132: Brazil Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 133: Mexico Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 134: Mexico Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 135: Mexico Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 136: Mexico Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 137: Latin America Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 138: Rest of Latin America Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 139: Rest of Latin America Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 140: Rest of Latin America Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 141: Rest of Latin America Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 142: Rest of Latin America Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 143: Middle East & Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 144: Middle East & Africa Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 145: Middle East & Africa Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 146: Middle East & Africa Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 147: Middle East & Africa Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 148: Middle East & Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2026

Table 149: GCC Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 150: GCC Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 151: GCC Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 152: GCC Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 153: GCC Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 154: Iran Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 155: Iran Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 156: Iran Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 157: Iran Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 158: Iran Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 159: South Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 160: South Africa Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 161: South Africa Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 162: South Africa Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 163: South Africa Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 164: Rest of Middle East & Africa Lubricants Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017–2026

Table 165: Rest of Middle East & Africa Lubricants Market Volume (Kilo Tons) Forecast, by Product, 2017–2026

Table 166: Rest of Middle East & Africa Lubricants Market Value (US$ Mn) Forecast, by Product, 2017–2026

Table 167: Rest of Middle East & Africa Lubricants Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 168: Rest of Middle East & Africa Lubricants Market Value (US$ Mn) Forecast, by Application, 2017–2026

Figure 01: Global Lubricants Market (US$ Mn) Volume (Kilo Tons) Forecast, 2017–2026

Figure 02: Global Lubricants Market Volume Share, by Type, 2017 and 2026

Figure 03: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Mineral, 2017–2026

Figure 04: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Semi-synthetic, 2017–2026

Figure 05: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Synthetic, 2017–2026

Figure 06: Global Lubricants Market Attractiveness, by Type, 2017

Figure 07: Global Lubricants Market Volume Share Analysis, by Product, 2017 and 2026

Figure 08: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Automotive Oils, 2017–2026

Figure 09: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Industrial Oils, 2017–2026

Figure 10: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Metalworking Fluids, 2017–2026

Figure 11: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Hydraulic Oils, 2017–2026

Figure 12: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Process Oils, 2017–2026

Figure 13: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Marine Oils, 2017–2026

Figure 14: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Greases & Others, 2017–2026

Figure 15: Global Lubricants Market Attractiveness, by Product, 2017

Figure 16: Global Lubricants Market Volume Share Analysis, by Application, 2017 and 2026

Figure 17: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Automotive, 2017–2026

Figure 18: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Industrial, 2017–2026

Figure 19: Global Lubricants Market Value (US$ Mn) and Volume (Kilo Tons), by Marine, 2017–2026

Figure 20: Global Lubricants Market Attractiveness, by Application, 2017

Figure 21: Global Lubricants Market Volume Share, by Region, 2017 and 2026

Figure 22: Global Lubricants Market Attractiveness, by Region, 2017

Figure 23: North America Lubricants Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2017–2026

Figure 24: North America Lubricants Market Attractiveness Analysis, by Country

Figure 25: North America Lubricants Market Volume Share Analysis, by Type, 2017 and 2026

Figure 26: North America Lubricants Market Volume Share Analysis, by Product, 2017 and 2026

Figure 27: North America Lubricants Market Volume Share Analysis, by Application, 2017 and 2026

Figure 28: North America Lubricants Market Volume Share Analysis, by Country, 2017 and 2026

Figure 29: U.S. Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 30: U.S. Lubricants Market Value(US$ Mn) Forecast, 2017–2026

Figure 31: Canada Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 32: Canada Lubricants Market Value(US$ Mn) Forecast, 2017–2026

Figure 33: North America Lubricants Market Attractiveness Analysis, by Type, 2017

Figure 34: North America Lubricants Market Attractiveness Analysis, by Application, 2017

Figure 35: North America Lubricants Market Attractiveness Analysis, by Application, 2017

Figure 36: Europe Lubricant Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2017–2026

Figure 37: Europe Lubricant Market Attractiveness Analysis, by Country and Sub-region

Figure 38: Europe Lubricants Market Volume Share Analysis, by Type, 2017 and 2026

Figure 39: Europe Lubricants Market Volume Share Analysis, by Product, 2017 and 2026

Figure 40: Europe Lubricants Market Volume Share Analysis, by Application, 2017 and 2026

Figure 41: Europe Lubricant Market Volume Share Analysis, by Country and Sub-region, 2017 and 2026

Figure 42: Germany Lubricant Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 43: Germany Lubricant Market Value (US$ Mn) Forecast, 2017–2026

Figure 44: France Lubricant Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 45: France Lubricant Market Value (US$ Mn) Forecast, 2017–2026

Figure 46: U.K. Lubricant Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 47: U.K. Lubricant Market Value (US$ Mn) Forecast, 2017–2026

Figure 48: Italy Lubricant Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 49: Italy Lubricant Market Value (US$ Mn) Forecast, 2017–2026

Figure 50: Spain Lubricant Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 51: Spain Lubricant Market Value (US$ Mn) Forecast, 2017–2026

Figure 52: Russia Lubricant Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 53: Russia Lubricant Market Value (US$ Mn) Forecast, 2017–2026

Figure 54: Turkey Lubricant Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 55: Turkey Lubricant Market Value (US$ Mn) Forecast, 2017–2026

Figure 56: Rest of Europe Lubricant Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 57: Rest of Europe Lubricant Market Value (US$ Mn) Forecast, 2017–2026

Figure 58: Europe Lubricants Market Attractiveness Analysis, by Type, 2017

Figure 59: Europe Lubricants Market Attractiveness Analysis, by Product, 2017

Figure 60: Europe Lubricants Market Attractiveness Analysis, by Application, 2017

Figure 61: Asia Pacific Lubricants Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2017–2026

Figure 62: Asia Pacific Lubricants Market Attractiveness Analysis, by Country and Sub-region

Figure 63: Asia Pacific Lubricants Market Volume Share Analysis, by Type, 2017 and 2026

Figure 64: Asia Pacific Lubricants Market Volume Share Analysis, by Product, 2017 and 2026

Figure 65: Asia Pacific Lubricants Market Volume Share Analysis, by Application, 2017 and 2026

Figure 66: Asia Pacific Lubricants Market Volume Share Analysis, by Country and Sub-region, 2017 and 2026

Figure 67: China Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 68: China Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 69: Japan Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 70: Japan Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 71: India Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 72: India Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 73: Indonesia Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 74: Indonesia Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 75: Thailand Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 76: Thailand Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 77: ASEAN (excluding Indonesia & Thailand) Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 78: ASEAN (excluding Indonesia & Thailand) Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 79: South Korea Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 80: South Korea Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 81: Rest of Asia Pacific Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 82: Rest of Asia Pacific Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 83: Asia Pacific Lubricants Market Attractiveness Analysis, by Type, 2017

Figure 84: Asia Pacific Lubricants Market Attractiveness Analysis, by Product, 2017

Figure 85: Asia Pacific Lubricants Market Attractiveness Analysis, by Application, 2017

Figure 86: Latin America Lubricants Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2017–2026

Figure 87: Latin America Lubricants Market Attractiveness, by Country and Sub-region

Figure 88: Latin America Lubricants Market Volume Share, by Type, 2017 and 2026

Figure 89: Latin America Lubricants Market Volume Share Analysis, by Product, 2017 and 2026

Figure 90: Latin America Lubricants Market Volume Share Analysis, by Application, 2017 and 2026

Figure 91: Latin America Lubricants Market Volume Share, by Country and Sub-region, 2017 and 2026

Figure 92: Brazil Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 93: Brazil Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 94: Mexico Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 95: Mexico Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 96: Rest of Latin America Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 97: Rest of Latin America Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 98: Latin America Lubricants Market Attractiveness Analysis, by Type, 2017

Figure 99: Latin America Lubricants Market Attractiveness Analysis, by Product, 2017

Figure 100: Latin America Lubricants Market Attractiveness Analysis, by Application, 2017

Figure 101: Middle East & Africa Lubricants Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2017–2026

Figure 102: Middle East & Africa Lubricants Market Attractiveness, by Country and Sub-region

Figure 103: Middle East & Africa Lubricants Market Volume Share, by Type, 2017 and 2026

Figure 104: Middle East & Africa Lubricants Market Volume Share Analysis, by Product, 2017 and 2026

Figure 105: Middle East & Africa Lubricants Market Volume Share Analysis, by Application, 2017 and 2026

Figure 106: Middle East & Africa Lubricants Market Volume Share, by Country and Sub-region, 2017 and 2026

Figure 107: GCC Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 108: GCC Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 109: Iran Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 110: Iran Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 111: South Africa Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 112: South Africa Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 113: Rest of Middle East & Africa Lubricants Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 114: Rest of Middle East & Africa Lubricants Market Value (US$ Mn) Forecast, 2017–2026

Figure 115: Middle East & Africa Lubricants Market Attractiveness Analysis, by Type, 2017

Figure 116: Middle East & Africa Lubricants Market Attractiveness Analysis, by Product, 2017

Figure 117: Middle East & Africa Lubricants Market Attractiveness Analysis, by Application, 2017

Figure 118: Global Lubricants Market Share, by Company, 2017