Reports

Reports

Analysts’ Viewpoint on Biofuel Market Scenario

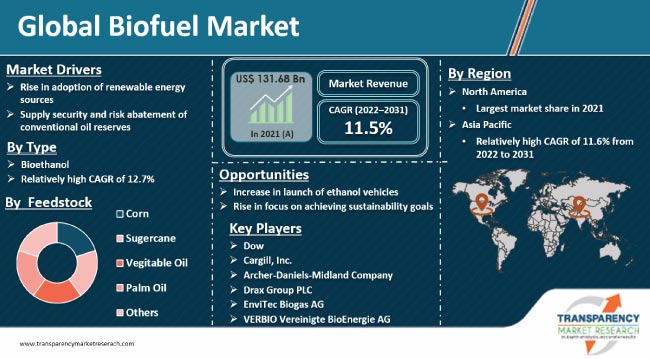

Increase in adoption of renewable energy and the implementation of government regulations to reduce carbon emissions are driving the global biofuel market. Rapid industrialization and urbanization have led to surge in the consumption of electricity worldwide. Thus, several governments are investing in clean energy to cater to the rise in demand for electricity and achieve their sustainability goals simultaneously. Surge in the construction of new biofuel projects is expected to augment the market during the forecast period. Companies in the automotive sector are launching ethanol-powered vehicles. Market players are comprehensively investing in R&D activities to identify potential sources of biofuels to enhance their revenue streams.

Biofuel is derived from organic matter such as plants, algae, and animal waste. It plays an important role in reducing carbon dioxide emissions. Biofuels are renewable alternatives to conventional fuels such as gasoline, diesel, and kerosene. They can be used in passenger vehicles, trucks, ships, and airplanes. Currently, ethanol and biodiesel are the two common types of liquid biofuels. Ethanol is produced from corn and cellulosic feedstock such as crop residues and wood. Algae biofuels are an alternative to commonly known biofuel sources, such as corn and sugarcane. Vegetable oils, yellow grease, used cooking oils, or animal fats are used in the production of renewable diesel.

Biofuels can be used to limit greenhouse gas (GHG) and CO2 emissions. Fossil fuels are the main source of global warming. Adoption of biofuels can lead to lower GHG emissions, depending on the source and its circumstances. Thus, liquid biofuels help improve local air quality, reduce bio-waste, and protect ecosystems. Regulatory policies such as the Renewable Fuel Standard, a federal program that requires transportation fuel sold in the U.S. to contain a minimum volume of renewable fuels, encourage the adoption of biofuels. The EU Renewable Energy Directive (RED) stipulates that biofuels should have at least 50% lower emissions than their fossil fuel alternatives for installations in operation before October 2015, and 60% for installations starting after this date, rising to 65% lower for biofuel plants commencing operation after 1 January 2021.

Increase in the R&D of biofuels is expected to augment the global market during the forecast period. In October 2022, a study ‘Efficient process for xylitol production from nitric acid pretreated rice straw derived pentosans by Candida tropicalis GS18’, published in the Biomass and Bioenergy Journal identified a potential Candida tropicalis strain for efficient xylitol production. Xylitol is a natural sugar alcohol. Rye straw can be converted into fuel and xylitol.

Crude oil reserves are mostly concentrated in Middle East & Africa, the Americas, and Asia Pacific. However, reserves in these regions are witnessing high pressure due to rise in demand for fuel worldwide. This could be a basis for future conflicts between oil-producing nations aiming to secure remaining reserves for themselves. Thus, diversification of energy sources is a robust solution for risk abatement in this situation. South America, Russia, and Sub-Saharan Africa are some of the largest producers of biomass. Of these regions, only Russia has major fossil fuel deposits. Crude oil prices are volatile as natural and manmade events can potentially disrupt the supply of oil & gas. These include geopolitical risks, sanctions, crude inventory draws, and speculative positioning by oil producers. Therefore, other regions and countries are significantly investing in renewable energy to reduce their dependency on oil reserves.

In terms of type, the global biofuel market has been segregated into biodiesel, bioethanol, bio-heavy oil, and others. According to recent trends in the biofuel market, the bioethanol segment held major share of 67.3% in 2021. It is estimated to dominate the market during the forecast period. Bioethanol is a renewable fuel produced from various plant materials. It is used as a blending agent with gasoline to increase octane and cut down carbon monoxide and other smog-causing emissions. E10 is the most common blend of ethanol and is approved for use in most conventional gasoline-powered vehicles. Bioethanol is made from plant starches and sugars, particularly corn starch.

Based on feedstock, the global biofuel market has been classified into corn, sugarcane, vegetable oil, palm oil, and others. The vegetable oil segment dominated the global biofuel market and accounted for 28.34% share in 2021. Biodiesel can be produced from vegetable oils such as sunflower, soybean, rapeseed, and castor oil. Biodiesel production from vegetable oils is eco-friendly, as it recycles waste cooking oil and provides renewable energy with lower pollution.

North America accounted for prominent share of 39.1% of the global market in 2021. Implementation of stringent regulations is expected to boost adoption of biofuels in the region in the next few years. Under the Energy Independence and Security Act of 2007 of the U.S., the Renewable Fuel Standard mandates that 36 billion gallons per year (bg/y) of biofuels need to be produced by 2023.

Future of the biofuel market in Asia Pacific and Europe is promising with the rise in production of liquid biofuels in Southeast Asia and increase in launch of ethanol-powered vehicles. These regions held 26.3% and 8.5 % share of the global market, respectively, in 2021. Middle East & Africa and Latin America are relatively minor markets for biofuel compared to other regions.

The global biofuel market comprises several small and large-scale service providers that control majority of the market share. Key players are investing significantly in the R&D of new products to enhance their market share. Expansion of product portfolios and mergers & acquisitions are prominent strategies adopted by market players. Dow, Cargill, Inc., Archer-Daniels-Midland Company, BTG International Ltd., Renewable Energy Group, Inc., Enerkem, Drax Group, EnviTec Biogas AG, Green Plains, AR Energy Group, Abengoa Bioenergy SA, and VERBIO Vereinigte BioEnergie AG are key vendors in the biofuel market.

Key players have been profiled in the biofuel market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 131.68 Bn |

|

Market Forecast Value in 2031 |

US$ 331.81 Bn |

|

Growth Rate (CAGR) |

11.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value and Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The biofuel market stood at US$ 131.68 Bn in 2021.

The biofuel market is expected to advance at a CAGR of 11.5% from 2022 to 2031.

Rise in adoption of renewable energy and supply security and risk abatement of conventional oil.

Bioethanol was the largest type segment that held 67.3% share of the market in 2021.

North America was the most lucrative region of the biofuel market in 2021.

Dow, Cargill, Inc., Archer-Daniels-Midland Company, BTG International Ltd., Renewable Energy Group, Inc., Enerkem, Drax Group, EnviTec Biogas AG, Green Plains, AR Energy Group, Abengoa Bioenergy SA, and VERBIO Vereinigte BioEnergie AG.

1. Executive Summary

1.1. Biofuel Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Manufacturers

2.6.2. List of Dealers and Distributors

2.6.3. List of Potential Customers

2.7. Production Process

2.8. Cost Structure Analysis

3. COVID-19 Impact Analysis

4. Impact of Current Geopolitical Scenario

5. Production Output Analysis

6. Price Trend Analysis

7. Global Biofuel Market Analysis and Forecast, by Type, 2022-2031

7.1. Introduction and Definitions

7.2. Global Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

7.2.1.1. Biodiesel

7.2.1.2. Bioethanol

7.2.1.3. Bio-heavy Oil

7.2.1.4. Others

7.3. Global Biofuel Market Attractiveness, by Type

8. Global Biofuel Market Analysis and Forecast, by Feedstock, 2022-2031

8.1. Introduction and Definitions

8.2. Global Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

8.2.1. Corn

8.2.2. Sugarcane

8.2.3. Vegetable Oil

8.2.4. Palm Oil

8.2.5. Others

9. Global Biofuel Market Attractiveness, by Feedstock

10. Global Biofuel Market Analysis and Forecast, by End-use, 2022-2031

10.1. Introduction and Definitions

10.2. Global Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

10.2.1. Transport

10.2.2. Heat

10.2.3. Electricity

10.3. Global Biofuel Market Attractiveness, by End-use

11. Global Biofuel Market Analysis and Forecast, by Region, 2022-2031

11.1. Key Findings

11.2. Global Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Region, 2022-2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. Latin America

11.3. Global Biofuel Market Attractiveness, by Region

12. North America Biofuel Market Analysis and Forecast, 2022-2031

12.1. Key Findings

12.2. North America Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

12.3. North America Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

12.4. North America Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

12.5. North America Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Country, 2022-2031

12.5.1. U.S. Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

12.5.2. U.S. Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

12.5.3. U.S. Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

12.5.4. Canada Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

12.5.5. Canada Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

12.5.6. Canada Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

12.6. North America Biofuel Market Attractiveness Analysis

13. Europe Biofuel Market Analysis and Forecast, 2022-2031

13.1. Key Findings

13.2. Europe Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

13.3. Europe Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

13.4. Europe Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

13.5. Europe Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

13.5.1. Germany Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

13.5.2. Germany Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

13.5.3. Germany Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

13.5.4. France Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

13.5.5. France Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

13.5.6. France Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

13.5.7. U.K. Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

13.5.8. U.K. Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

13.5.9. U.K. Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

13.5.10. Spain Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

13.5.11. Spain Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

13.5.12. Spain Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

13.5.13. Italy Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

13.5.14. Italy Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

13.5.15. Italy Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

13.5.16. Russia & CIS Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

13.5.17. Russia & CIS Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

13.5.18. Russia & CIS Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

13.5.19. Rest of Europe Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

13.5.20. Rest of Europe Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

13.5.21. Rest of Europe Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

13.6. Europe Biofuel Market Attractiveness Analysis

14. Asia Pacific Biofuel Market Analysis and Forecast, 2022-2031

14.1. Key Findings

14.2. Asia Pacific Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type

14.3. Asia Pacific Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

14.4. Asia Pacific Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

14.5. Asia Pacific Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

14.5.1. China Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

14.5.2. China Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

14.5.3. China Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

14.5.4. Japan Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

14.5.5. Japan Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

14.5.6. Japan Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

14.5.7. India Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

14.5.8. India Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

14.5.9. India Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

14.5.10. ASEAN Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

14.5.11. ASEAN Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

14.5.12. ASEAN Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

14.5.13. Rest of Asia Pacific Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

14.5.14. Rest of Asia Pacific Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

14.5.15. Rest of Asia Pacific Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

14.6. Asia Pacific Biofuel Market Attractiveness Analysis

15. Latin America Biofuel Market Analysis and Forecast, 2022-2031

15.1. Key Findings

15.2. Latin America Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

15.3. Latin America Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

15.4. Latin America Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

15.5. Latin America Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

15.5.1. Brazil Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

15.5.2. Brazil Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

15.5.3. Brazil Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

15.5.4. Mexico Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

15.5.5. Mexico Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

15.5.6. Mexico Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

15.5.7. Rest of Latin America Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

15.5.8. Rest of Latin America Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

15.5.9. Rest of Latin America Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

15.6. Latin America Biofuel Market Attractiveness Analysis

16. Middle East & Africa Biofuel Market Analysis and Forecast, 2022-2031

16.1. Key Findings

16.2. Middle East & Africa Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

16.3. Middle East & Africa Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

16.4. Middle East & Africa Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

16.5. Middle East & Africa Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

16.5.1. GCC Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

16.5.2. GCC Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

16.5.3. GCC Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

16.5.4. South Africa Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

16.5.5. South Africa Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

16.5.6. South Africa Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

16.5.7. Rest of Middle East & Africa Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2022-2031

16.5.8. Rest of Middle East & Africa Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by Feedstock, 2022-2031

16.5.9. Rest of Middle East & Africa Biofuel Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

16.6. Middle East & Africa Biofuel Market Attractiveness Analysis

17. Competition Landscape

17.1. Global Biofuel Company Market Share Analysis, 2020

17.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

17.2.1. Dow

17.2.1.1. Company Description

17.2.1.2. Business Overview

17.2.1.3. Financial Overview

17.2.1.4. Strategic Overview

17.2.2. Cargill, Inc.

17.2.2.1. Company Description

17.2.2.2. Business Overview

17.2.2.3. Financial Overview

17.2.2.4. Strategic Overview

17.2.3. Archer-Daniels-Midland Company

17.2.3.1. Company Description

17.2.3.2. Business Overview

17.2.3.3. Financial Overview

17.2.3.4. Strategic Overview

17.2.4. BTG International Ltd.

17.2.4.1. Company Description

17.2.4.2. Business Overview

17.2.4.3. Financial Overview

17.2.4.4. Strategic Overview

17.2.5. Renewable Energy Group, Inc.

17.2.5.1. Company Description

17.2.5.2. Business Overview

17.2.5.3. Financial Overview

17.2.5.4. Strategic Overview

17.2.6. Enerkem

17.2.6.1. Company Description

17.2.6.2. Business Overview

17.2.6.3. Financial Overview

17.2.6.4. Strategic Overview

17.2.7. Drex Group

17.2.7.1. Company Description

17.2.7.2. Business Overview

17.2.7.3. Financial Overview

17.2.7.4. Strategic Overview

17.2.8. EnviTech Biogas AG

17.2.8.1. Company Description

17.2.8.2. Business Overview

17.2.8.3. Financial Overview

17.2.8.4. Strategic Overview

17.2.9. Green Plains

17.2.9.1. Company Description

17.2.9.2. Business Overview

17.2.9.3. Financial Overview

17.2.9.4. Strategic Overview

17.2.10. AR Energy Group

17.2.10.1. Company Description

17.2.10.2. Business Overview

17.2.10.3. Strategic Overview

17.2.11. Abengoa Bioenergy SA

17.2.11.1. Company Description

17.2.11.2. Business Overview

17.2.11.3. Strategic Overview

17.2.12. VERBIO Vereinigte BioEnergie AG

17.2.12.1. Company Description

17.2.12.2. Business Overview

17.2.12.3. Strategic Overview

18. Primary Research: Key Insights

19. Appendix

List of Tables

Table 1: Global Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 2: Global Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 3: Global Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 4: Global Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 5: Global Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 6: Global Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 7: Global Biofuel Market Volume (Tons) Forecast, by Region, 2022-2031

Table 8: Global Biofuel Market Value (US$ Bn) Forecast, by Region, 2022-2031

Table 9: North America Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 10: North America Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 11: North America Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 12: North America Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 13: North America Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 14: North America Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 15: North America Biofuel Market Volume (Tons) Forecast, by Country, 2022-2031

Table 16: North America Biofuel Market Value (US$ Bn) Forecast, by Country, 2022-2031

Table 17: U.S. Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 18: U.S. Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 19: U.S. Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 20: U.S. Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 21: U.S. Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 22: U.S. Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 23: Canada Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 24: Canada Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 25: Canada Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 26: Canada Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 27: Canada Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 28: Canada Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 29: Europe Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 30: Europe Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 31: Europe Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 32: Europe Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 33: Europe Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 34: Europe Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 35: Europe Biofuel Market Volume (Tons) Forecast, by Country and Sub-region, 2022-2031

Table 36: Europe Biofuel Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

Table 37: Germany Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 38: Germany Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 39: Germany Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 40: Germany Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 41: Germany Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 42: Germany Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 43: France Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 44: France Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 45: France Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 46: France Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 47: France Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 48: France Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 49: U.K. Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 50: U.K. Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 51: U.K. Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 52: U.K. Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 53: U.K. Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 54: U.K. Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 55: Italy Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 56: Italy Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 57: Italy Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 58: Italy Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 59: Italy Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 60: Italy Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 61: Spain Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 62: Spain Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 63: Spain Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 64: Spain Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 65: Spain Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 66: Spain Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 67: Russia & CIS Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 68: Russia & CIS Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 69: Russia & CIS Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 70: Russia & CIS Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 71: Russia & CIS Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 72: Russia & CIS Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 73: Rest of Europe Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 74: Rest of Europe Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 75: Rest of Europe Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 76: Rest of Europe Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 77: Rest of Europe Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 78: Rest of Europe Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 79: Asia Pacific Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 80: Asia Pacific Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 81: Asia Pacific Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 82: Asia Pacific Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 83: Asia Pacific Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 84: Asia Pacific Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 85: Asia Pacific Biofuel Market Volume (Tons) Forecast, by Country and Sub-region, 2022-2031

Table 86: Asia Pacific Biofuel Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

Table 87: China Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 88: China Biofuel Market Value (US$ Bn) Forecast, by Type 2022-2031

Table 89: China Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 90: China Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 91: China Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 92: China Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 93: Japan Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 94: Japan Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 95: Japan Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 96: Japan Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 97: Japan Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 98: Japan Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 99: India Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 100: India Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 101: India Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 102: India Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 103: India Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 104: India Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 105: India Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 106: India Biofuel Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 107: ASEAN Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 108: ASEAN Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 109: ASEAN Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 110: ASEAN Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 111: ASEAN Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 112: ASEAN Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 113: Rest of Asia Pacific Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 114: Rest of Asia Pacific Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 115: Rest of Asia Pacific Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 116: Rest of Asia Pacific Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 117: Rest of Asia Pacific Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 118: Rest of Asia Pacific Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 119: Latin America Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 120: Latin America Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 121: Latin America Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 122: Latin America Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 123: Latin America Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 124: Latin America Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 125: Latin America Biofuel Market Volume (Tons) Forecast, by Country and Sub-region, 2022-2031

Table 126: Latin America Biofuel Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

Table 127: Brazil Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 128: Brazil Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 129: Brazil Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 130: Brazil Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 131: Brazil Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 132: Brazil Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 133: Mexico Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 134: Mexico Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 135: Mexico Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 136: Mexico Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 137: Mexico Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 138: Mexico Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 139: Rest of Latin America Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 140: Rest of Latin America Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 141: Rest of Latin America Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 142: Rest of Latin America Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 143: Rest of Latin America Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 144: Rest of Latin America Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 145: Middle East & Africa Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 146: Middle East & Africa Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 147: Middle East & Africa Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 148: Middle East & Africa Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 149: Middle East & Africa Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 150: Middle East & Africa Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 151: Middle East & Africa Biofuel Market Volume (Tons) Forecast, by Country and Sub-region, 2022-2031

Table 152: Middle East & Africa Biofuel Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

Table 153: GCC Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 154: GCC Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 155: GCC Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 156: GCC Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 157: GCC Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 158: GCC Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 159: South Africa Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 160: South Africa Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 161: South Africa Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 162: South Africa Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 163: South Africa Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 164: South Africa Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 165: Rest of Middle East & Africa Biofuel Market Volume (Tons) Forecast, by Type, 2022-2031

Table 166: Rest of Middle East & Africa Biofuel Market Value (US$ Bn) Forecast, by Type, 2022-2031

Table 167: Rest of Middle East & Africa Biofuel Market Volume (Tons) Forecast, by Feedstock, 2022-2031

Table 168: Rest of Middle East & Africa Biofuel Market Value (US$ Bn) Forecast, by Feedstock, 2022-2031

Table 169: Rest of Middle East & Africa Biofuel Market Volume (Tons) Forecast, by End-use, 2022-2031

Table 170: Rest of Middle East & Africa Biofuel Market Value (US$ Bn) Forecast, by End-use, 2022-2031

List of Figures

Figure 1: Global Biofuel Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 2: Global Biofuel Market Attractiveness, by Type

Figure 3: Global Biofuel Market Volume Share Analysis, by Feedstock, 2021, 2025, and 2031

Figure 4: Global Biofuel Market Attractiveness, by Feedstock

Figure 5: Global Biofuel Market Volume Share Analysis, by End-use, 2021, 2025, and 2031

Figure 6: Global Biofuel Market Attractiveness, by End-use

Figure 7: Global Biofuel Market Volume Share Analysis, by Region, 2021, 2025, and 2031

Figure 8: Global Biofuel Market Attractiveness, by Region

Figure 9: North America Biofuel Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 10: North America Biofuel Market Attractiveness, by Type

Figure 11: North America Biofuel Market Attractiveness, by Type

Figure 12: North America Biofuel Market Volume Share Analysis, by Feedstock, 2021, 2025, and 2031

Figure 13: North America Biofuel Market Attractiveness, by Feedstock

Figure 14: North America Biofuel Market Volume Share Analysis, by End-use, 2021, 2025, and 2031

Figure 15: North America Biofuel Market Attractiveness, by End-use

Figure 16: North America Biofuel Market Attractiveness, by Country

Figure 17: Europe Biofuel Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 18: Europe Biofuel Market Attractiveness, by Type

Figure 19: Europe Biofuel Market Volume Share Analysis, by Feedstock, 2021, 2025, and 2031

Figure 20: Europe Biofuel Market Attractiveness, by Feedstock

Figure 21: Europe Biofuel Market Volume Share Analysis, by End-use, 2021, 2025, and 2031

Figure 22: Europe Biofuel Market Attractiveness, by End-use

Figure 23: Europe Biofuel Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 24: Europe Biofuel Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Biofuel Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 26: Asia Pacific Biofuel Market Attractiveness, by Type

Figure 27: Asia Pacific Biofuel Market Volume Share Analysis, by Feedstock, 2021, 2025, and 2031

Figure 28: Asia Pacific Biofuel Market Attractiveness, by Feedstock

Figure 29: Asia Pacific Biofuel Market Volume Share Analysis, by End-use, 2021, 2025, and 2031

Figure 30: Asia Pacific Biofuel Market Attractiveness, by End-use

Figure 31: Asia Pacific Biofuel Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 32: Asia Pacific Biofuel Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Biofuel Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 34: Latin America Biofuel Market Attractiveness, by Type

Figure 35: Latin America Biofuel Market Volume Share Analysis, by Feedstock, 2021, 2025, and 2031

Figure 36: Latin America Biofuel Market Attractiveness, by Feedstock

Figure 37: Latin America Biofuel Market Volume Share Analysis, by End-use, 2021, 2025, and 2031

Figure 38: Latin America Biofuel Market Attractiveness, by End-use

Figure 39: Latin America Biofuel Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 40: Latin America Biofuel Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Biofuel Market Volume Share Analysis, by Type, 2021, 2025, and 2031

Figure 42: Middle East & Africa Biofuel Market Attractiveness, by Type

Figure 43: Middle East & Africa Biofuel Market Volume Share Analysis, by Feedstock, 2021, 2025, and 2031

Figure 44: Middle East & Africa Biofuel Market Attractiveness, by Feedstock

Figure 45: Middle East & Africa Biofuel Market Volume Share Analysis, by End-use, 2021, 2025, and 2031

Figure 46: Middle East & Africa Biofuel Market Attractiveness, by End-use

Figure 47: Middle East & Africa Biofuel Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 48: Middle East & Africa Biofuel Market Attractiveness, by Country and Sub-region