Reports

Reports

Analysts’ Viewpoint

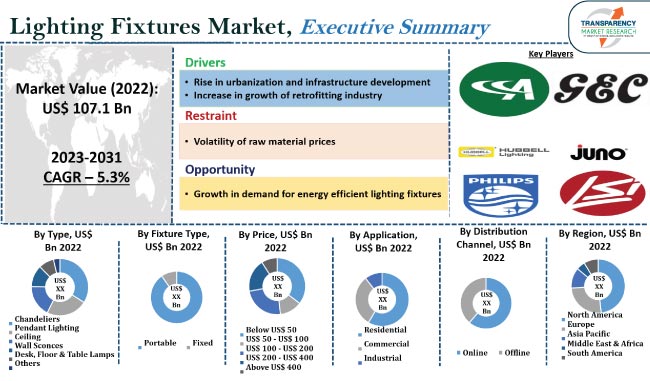

Increase in inclination toward beautification of homes, restaurants, and hotels, is leading to a rise in demand for visually appealing smart lighting fixtures. The use of lighting fixtures in different areas can drastically improve the look and feel of the place. Additionally, the inclusion of Internet of Things, wireless technology, and built-in lights, into lighting fixtures is further propelling the lighting fixtures industry growth.

Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by industry players. Rise in investments in R&D by leading manufacturers for the development of aesthetic and innovative lighting fixtures is estimated to boost the lighting fixtures market share. Similarly, the increase in demand for energy efficient lighting fixtures is expected to create lucrative lighting fixtures market opportunities during the forecast period.

A lighting fixture is often referred to as light fitting or luminaire, which is an electrical appliance that contains an electric lamp for illumination. Apart from illumination, lighting fixtures can also be used as a decorative element in houses, hotels, and offices. Every light fixture has a fixture body and one or more lights.

Fixtures require an electrical connection to a power source, normally AC mains electricity, but some, such as camping or emergency lights, run on battery power. Permanent lighting fixtures are hooked directly, while a plug and cord connects movable lighting to a wall outlet.

Lighting fixture types can either be portable/free-standing or fixed. Portable light fixtures are known as lamps. They are further classified into table lamp and floor lamp, while fixed lighting fixtures are further divided into ceiling dome, recessed light, and surface-mounted light.

Rapid urbanization and infrastructure development in countries worldwide have led to an increase in lighting fixtures market demand. With the rise in urbanization, there is a growing need for reliable lighting solutions, which can enhance the look of residential, commercial, and industrial spaces. Thus, the growth in urbanization and infrastructural development is expected to elevate the lighting fixtures market value.

The expansion and modernization of cities creates demand for efficient and aesthetic-looking lighting fixtures for cafes, hotels, offices, and other places. Likewise, growth in infrastructural construction and enhancement projects, such as airports, stadiums, and bridges, also significantly impacts the global lighting fixtures industry.

The need to replace outdated and inefficient lighting systems in a large number of residential, commercial, and other places is anticipated to contribute to lighting fixtures market development. Rise in investments to keep up with the latest looks and designs of interiors as well as exteriors of a building significantly drives market expansion.

Old, inefficient, and high energy-consuming lighting systems are increasingly being replaced with efficient and sustainable lighting systems. Moreover, large number of organizations and even households are switching to cost-efficient and energy efficient lighting systems such as LED lighting fixtures. Thus, the retrofitting trend is projected to support in driving the lighting fixtures market size.

On the basis of type, the lighting fixtures market segmentation includes chandeliers; pendant lighting; ceiling; wall sconces; desk, floor & table lamps; and others. As per the lighting fixtures market forecast, pendant lighting is anticipated to hold major industry share in the next few years. Aesthetic designs and availability in various shapes, sizes, and forms drives the demand for pendant lights.

Pendant lights are less bulky and often more affordable than chandeliers, which fuels the segment growth.

As per the lighting fixtures market analysis, Asia Pacific holds major share of the global industry. Economic progress of various countries of Asia Pacific, such as India, China, and Japan, is boosting investments in modernization and beautification of residential as well as commercial places. These activities are likely to fuel market progress in Asia Pacific.

The market in North America and Europe is anticipated to grow at a steady pace in the near future owing to willingness of consumers to spend heavily on building decorations.

Detailed profiles of companies in the lighting fixtures market report are provided to evaluate their financials, key product offerings, recent developments, and strategies. Majority of firms are spending significantly on comprehensive R&D activities, primarily to develop innovative products.

Prominent lighting fixtures manufacturers in the world are Acuity Brands, Inc., Cooper Lighting, LLC, General Electric Company, Hubbell Lighting, Inc., Juno Lighting Group, Koninklijke Philips N.V., LSI Industries Inc., OSRAM Licht AG, Panasonic Corporation Eco Solutions Company, and Zumtobel Lighting GmbH.

Each of these players has been profiled in the lighting fixtures industry research report based on parameters, such as company overview, financial overview, business strategies, product portfolio, business segments, market development, and competitive landscape.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 107.1 Bn |

|

Market Forecast Value in 2031 |

US$ 167.4 Bn |

|

Growth Rate (CAGR) |

5.3% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for value and Thousand Units for volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 107.1 Bn in 2022

It is estimated to reach US$ 167.4 Bn by 2031

Rise in urbanization and infrastructure development, and growth of the retrofitting industry

Pendant lighting is a major type segment

Asia Pacific is a highly lucrative region for vendors

Acuity Brands, Inc., Cooper Lighting, LLC, General Electric Company, Hubbell Lighting, Inc., Juno Lighting Group, Koninklijke Philips N.V., LSI Industries Inc., OSRAM Licht AG, Panasonic Eco Solutions Engineering Company, and Zumtobel Lighting GmbH

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Global Lighting Fixtures Market Analysis and Forecast, 2017-2031

5.8.1. Market Value Projections (US$ Mn)

5.8.2. Market Volume Projections (Thousand Units)

6. Global Lighting Fixtures Market Analysis and Forecast, by Type

6.1. Global Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Type, 2017-2031

6.1.1. Chandeliers

6.1.2. Pendant lighting

6.1.3. Ceiling

6.1.4. Wall Sconces

6.1.5. Desk, Floor & Table Lamps

6.1.6. Others

6.2. Incremental Opportunity, by Type

7. Global Lighting Fixtures Market Analysis and Forecast, by Fixture Type

7.1. Global Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Fixture Type, 2017-2031

7.1.1. Portable

7.1.2. Fixed

7.2. Incremental Opportunity, by Fixture Type

8. Global Lighting Fixtures Market Analysis and Forecast, by Price

8.1. Global Lighting Fixtures Market Size (US$ Mn) (Thousand Units), Price, 2017-2031

8.1.1. Below US$ 50

8.1.2. US$ 50-US$ 100

8.1.3. US$ 100-US$ 200

8.1.4. US$ 200-US$ 400

8.1.5. Above US$ 400

8.2. Incremental Opportunity, by Price

9. Global Lighting Fixtures Market Analysis and Forecast, by Application

9.1. Global Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Application, 2017-2031

9.1.1. Residential

9.1.2. Commercial

9.1.3. Industrial

9.2. Incremental Opportunity, by Application

10. Global Lighting Fixtures Market Analysis and Forecast, by Distribution Channel

10.1. Global Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

10.1.1. Online

10.1.1.1. E-commerce Websites

10.1.1.2. Company-owned Website

10.1.2. Offline

10.1.2.1. Hypermarkets/Supermarkets

10.1.2.2. Specialty Stores

10.1.2.3. Other Retail Stores

10.2. Incremental Opportunity, by Distribution Channel

11. Global Lighting Fixtures Market Analysis and Forecast, by Region

11.1. Global Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Region, 2017-2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, by Region

12. North America Lighting Fixtures Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Type, 2017-2031

12.5.1. Chandeliers

12.5.2. Pendant lighting

12.5.3. Ceiling

12.5.4. Wall Sconces

12.5.5. Desk, Floor & Table Lamps

12.5.6. Others

12.6. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Fixture Type, 2017-2031

12.6.1. Portable

12.6.2. Fixed

12.7. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Price, 2017-2031

12.7.1. Below US$ 50

12.7.2. US$ 50-US$ 100

12.7.3. US$ 100-US$ 200

12.7.4. US$ 200-US$ 400

12.7.5. Above US$ 400

12.8. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Application, 2017-2031

12.8.1. Residential

12.8.2. Commercial

12.8.3. Industrial

12.9. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

12.9.1. Online

12.9.1.1. E-commerce Websites

12.9.1.2. Company-owned Website

12.9.2. Offline

12.9.2.1. Hypermarkets/Supermarkets

12.9.2.2. Specialty Stores

12.9.2.3. Other Retail Stores

12.10. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017-2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe Lighting Fixtures Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Type, 2017-2031

13.5.1. Chandeliers

13.5.2. Pendant lighting

13.5.3. Ceiling

13.5.4. Wall Sconces

13.5.5. Desk, Floor & Table Lamps

13.5.6. Others

13.6. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Fixture Type, 2017-2031

13.6.1. Portable

13.6.2. Fixed

13.7. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Price, 2017-2031

13.7.1. Below US$ 50

13.7.2. US$ 50-US$ 100

13.7.3. US$ 100-US$ 200

13.7.4. US$ 200-US$ 400

13.7.5. Above US$ 400

13.8. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Application, 2017-2031

13.8.1. Residential

13.8.2. Commercial

13.8.3. Industrial

13.9. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

13.9.1. Online

13.9.1.1. E-commerce Websites

13.9.1.2. Company-owned Website

13.9.2. Offline

13.9.2.1. Hypermarkets/Supermarkets

13.9.2.2. Specialty Stores

13.9.2.3. Other Retail Stores

13.10. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017-2031

13.10.1. U.K.

13.10.2. Germany

13.10.3. France

13.10.4. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Asia Pacific Lighting Fixtures Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Type, 2017-2031

14.5.1. Chandeliers

14.5.2. Pendant lighting

14.5.3. Ceiling

14.5.4. Wall Sconces

14.5.5. Desk, Floor & Table Lamps

14.5.6. Others

14.6. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Fixture Type, 2017-2031

14.6.1. Portable

14.6.2. Fixed

14.7. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Price, 2017-2031

14.7.1. Below US$ 50

14.7.2. US$ 50-US$ 100

14.7.3. US$ 100-US$ 200

14.7.4. US$ 200-US$ 400

14.7.5. Above US$ 400

14.8. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Application, 2017-2031

14.8.1. Residential

14.8.2. Commercial

14.8.3. Industrial

14.9. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

14.9.1. Online

14.9.1.1. E-commerce Websites

14.9.1.2. Company-owned Website

14.9.2. Offline

14.9.2.1. Hypermarkets/Supermarkets

14.9.2.2. Specialty Stores

14.9.2.3. Other Retail Stores

14.10. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017-2031

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. Rest of Asia Pacific

14.11. Incremental Opportunity Analysis

15. Middle East & Africa Lighting Fixtures Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Supply side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Type, 2017-2031

15.5.1. Chandeliers

15.5.2. Pendant lighting

15.5.3. Ceiling

15.5.4. Wall Sconces

15.5.5. Desk, Floor & Table Lamps

15.5.6. Others

15.6. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Fixture Type, 2017-2031

15.6.1. Portable

15.6.2. Fixed

15.7. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Price, 2017-2031

15.7.1. Below US$ 50

15.7.2. US$ 50-US$ 100

15.7.3. US$ 100-US$ 200

15.7.4. US$ 200-US$ 400

15.7.5. Above US$ 400

15.8. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Application, 2017-2031

15.8.1. Residential

15.8.2. Commercial

15.8.3. Industrial

15.9. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

15.9.1. Online

15.9.1.1. E-commerce Websites

15.9.1.2. Company-owned Website

15.9.2. Offline

15.9.2.1. Hypermarkets/Supermarkets

15.9.2.2. Specialty Stores

15.9.2.3. Other Retail Stores

15.10. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017-2031

15.10.1. GCC

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Incremental Opportunity Analysis

16. South America Lighting Fixtures Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Key Trends Analysis

16.3.1. Supply side

16.3.2. Demand Side

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Type, 2017-2031

16.5.1. Chandeliers

16.5.2. Pendant lighting

16.5.3. Ceiling

16.5.4. Wall Sconces

16.5.5. Desk, Floor & Table Lamps

16.5.6. Others

16.6. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Fixture Type, 2017-2031

16.6.1. Portable

16.6.2. Fixed

16.7. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Price, 2017-2031

16.7.1. Below US$ 50

16.7.2. US$ 50-US$ 100

16.7.3. US$ 100-US$ 200

16.7.4. US$ 200-US$ 400

16.7.5. Above US$ 400

16.8. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Application, 2017-2031

16.8.1. Residential

16.8.2. Commercial

16.8.3. Industrial

16.9. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

16.9.1. Online

16.9.1.1. E-commerce Websites

16.9.1.2. Company-owned Website

16.9.2. Offline

16.9.2.1. Hypermarkets/Supermarkets

16.9.2.2. Specialty Stores

16.9.2.3. Other Retail Stores

16.10. Lighting Fixtures Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017-2031

16.10.1. Brazil

16.10.2. Rest of South America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Competition Dashboard

17.2. Market Share Analysis % (2022)

17.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

17.3.1. Acuity Brands, Inc.

17.3.1.1. Company Overview

17.3.1.2. Product Portfolio

17.3.1.3. Financial Information, (Subject to Data Availability)

17.3.1.4. Business Strategies / Recent Developments

17.3.2. Cooper Lighting, LLC

17.3.2.1. Company Overview

17.3.2.2. Product Portfolio

17.3.2.3. Financial Information, (Subject to Data Availability)

17.3.2.4. Business Strategies / Recent Developments

17.3.3. General Electric Company

17.3.3.1. Company Overview

17.3.3.2. Product Portfolio

17.3.3.3. Financial Information, (Subject to Data Availability)

17.3.3.4. Business Strategies / Recent Developments

17.3.4. Hubbell Lighting, Inc.

17.3.4.1. Company Overview

17.3.4.2. Product Portfolio

17.3.4.3. Financial Information, (Subject to Data Availability)

17.3.4.4. Business Strategies / Recent Developments

17.3.5. Juno Lighting Group

17.3.5.1. Company Overview

17.3.5.2. Product Portfolio

17.3.5.3. Financial Information, (Subject to Data Availability)

17.3.5.4. Business Strategies / Recent Developments

17.3.6. Koninklijke Philips N.V.

17.3.6.1. Company Overview

17.3.6.2. Product Portfolio

17.3.6.3. Financial Information, (Subject to Data Availability)

17.3.6.4. Business Strategies / Recent Developments

17.3.7. LSI Industries Inc.

17.3.7.1. Company Overview

17.3.7.2. Product Portfolio

17.3.7.3. Financial Information, (Subject to Data Availability)

17.3.7.4. Business Strategies / Recent Developments

17.3.8. OSRAM Licht AG

17.3.8.1. Company Overview

17.3.8.2. Product Portfolio

17.3.8.3. Financial Information, (Subject to Data Availability)

17.3.8.4. Business Strategies / Recent Developments

17.3.9. Panasonic Corporation Eco Solutions Company

17.3.9.1. Company Overview

17.3.9.2. Product Portfolio

17.3.9.3. Financial Information, (Subject to Data Availability)

17.3.9.4. Business Strategies / Recent Developments

17.3.10. Zumtobel Lighting GmbH

17.3.10.1. Company Overview

17.3.10.2. Product Portfolio

17.3.10.3. Financial Information, (Subject to Data Availability)

17.3.10.4. Business Strategies / Recent Developments

18. Go to Strategy

18.1. Identification of Potential Market Spaces

18.2. Understanding the Procurement Process of End-users

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Table 2: Global Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Table 3: Global Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Table 4: Global Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Table 5: Global Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Table 6: Global Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Table 7: Global Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Table 8: Global Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Table 9: Global Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Table 10: Global Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Table 11: Global Lighting Fixtures Market, By Region Thousand Units, 2017-2031

Table 12: Global Lighting Fixtures Market, By Region US$ Mn, 2017-2031

Table 13: North America Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Table 14: North America Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Table 15: North America Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Table 16: North America Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Table 17: North America Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Table 18: North America Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Table 19: North America Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Table 20: North America Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Table 21: North America Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Table 22: North America Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Table 23: North America Lighting Fixtures Market, By Country Thousand Units, 2017-2031

Table 24: North America Lighting Fixtures Market, By Country US$ Mn, 2017-2031

Table 25: Europe Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Table 26: Europe Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Table 27: Europe Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Table 28: Europe Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Table 29: Europe Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Table 30: Europe Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Table 31: Europe Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Table 32: Europe Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Table 33: Europe Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Table 34: Europe Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Table 35: Europe Lighting Fixtures Market, By Country Thousand Units, 2017-2031

Table 36: Europe Lighting Fixtures Market, By Country US$ Mn, 2017-2031

Table 37: Asia Pacific Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Table 38: Asia Pacific Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Table 39: Asia Pacific Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Table 40: Asia Pacific Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Table 41: Asia Pacific Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Table 42: Asia Pacific Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Table 43: Asia Pacific Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Table 44: Asia Pacific Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Table 45: Asia Pacific Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Table 46: Asia Pacific Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Table 47: Asia Pacific Lighting Fixtures Market, By Country Thousand Units, 2017-2031

Table 48: Asia Pacific Lighting Fixtures Market, By Country US$ Mn, 2017-2031

Table 49: Middle East & Africa Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Table 50: Middle East & Africa Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Table 51: Middle East & Africa Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Table 52: Middle East & Africa Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Table 53: Middle East & Africa Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Table 54: Middle East & Africa Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Table 55: Middle East & Africa Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Table 56: Middle East & Africa Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Table 57: Middle East & Africa Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Table 58: Middle East & Africa Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Table 59: Middle East & Africa Lighting Fixtures Market, By Country Thousand Units, 2017-2031

Table 60: Middle East & Africa Lighting Fixtures Market, By Country US$ Mn, 2017-2031

Table 61: South America Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Table 62: South America Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Table 63: South America Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Table 64: South America Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Table 65: South America Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Table 66: South America Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Table 67: South America Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Table 68: South America Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Table 69: South America Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Table 70: South America Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Table 71: South America Lighting Fixtures Market, By Country Thousand Units, 2017-2031

Table 72: South America Lighting Fixtures Market, By Country US$ Mn, 2017-2031

List of Figures

Figure 1: Global Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Figure 2: Global Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Figure 3: Global Lighting Fixtures Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 4: Global Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Figure 5: Global Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Figure 6: Global Lighting Fixtures Market Incremental Opportunity, By Fixture Type, US$ Mn, 2017-2031

Figure 7: Global Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Figure 8: Global Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Figure 9: Global Lighting Fixtures Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 10: Global Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Figure 11: Global Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Figure 12: Global Lighting Fixtures Market Incremental Opportunity, By Application, US$ Mn, 2017-2031

Figure 13: Global Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 14: Global Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 15: Global Lighting Fixtures Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 16: Global Lighting Fixtures Market, By Region Thousand Units, 2017-2031

Figure 17: Global Lighting Fixtures Market, By Region US$ Mn, 2017-2031

Figure 18: Global Lighting Fixtures Market Incremental Opportunity, By Region US$ Mn, 2017-2031

Figure 19: North America Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Figure 20: North America Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Figure 21: North America Lighting Fixtures Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 22: North America Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Figure 23: North America Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Figure 24: North America Lighting Fixtures Market Incremental Opportunity, By Fixture Type, US$ Mn, 2017-2031

Figure 25: North America Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Figure 26: North America Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Figure 27: North America Lighting Fixtures Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 28: North America Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Figure 29: North America Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Figure 30: North America Lighting Fixtures Market Incremental Opportunity, By Application, US$ Mn, 2017-2031

Figure 31: North America Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 32: North America Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 33: North America Lighting Fixtures Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 34: North America Lighting Fixtures Market, By Country Thousand Units, 2017-2031

Figure 35: North America Lighting Fixtures Market, By Country US$ Mn, 2017-2031

Figure 36: North America Lighting Fixtures Market Incremental Opportunity, By Country US$ Mn, 2017-2031

Figure 37: Europe Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Figure 38: Europe Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Figure 39: Europe Lighting Fixtures Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 40: Europe Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Figure 41: Europe Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Figure 42: Europe Lighting Fixtures Market Incremental Opportunity, By Fixture Type, US$ Mn, 2017-2031

Figure 43: Europe Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Figure 44: Europe Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Figure 45: Europe Lighting Fixtures Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 46: Europe Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Figure 47: Europe Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Figure 48: Europe Lighting Fixtures Market Incremental Opportunity, By Application, US$ Mn, 2017-2031

Figure 49: Europe Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 50: Europe Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 51: Europe Lighting Fixtures Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 52: Europe Lighting Fixtures Market, By Country Thousand Units, 2017-2031

Figure 53: Europe Lighting Fixtures Market, By Country US$ Mn, 2017-2031

Figure 54: Europe Lighting Fixtures Market Incremental Opportunity, By Country US$ Mn, 2017-2031

Figure 55: Asia Pacific Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Figure 56: Asia Pacific Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Figure 57: Asia Pacific Lighting Fixtures Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 58: Asia Pacific Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Figure 59: Asia Pacific Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Figure 60: Asia Pacific Lighting Fixtures Market Incremental Opportunity, By Fixture Type, US$ Mn, 2017-2031

Figure 61: Asia Pacific Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Figure 62: Asia Pacific Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Figure 63: Asia Pacific Lighting Fixtures Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 64: Asia Pacific Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Figure 65: Asia Pacific Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Figure 66: Asia Pacific Lighting Fixtures Market Incremental Opportunity, By Application, US$ Mn, 2017-2031

Figure 67: Asia Pacific Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 68: Asia Pacific Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 69: Asia Pacific Lighting Fixtures Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 70: Asia Pacific Lighting Fixtures Market, By Country Thousand Units, 2017-2031

Figure 71: Asia Pacific Lighting Fixtures Market, By Country US$ Mn, 2017-2031

Figure 72: Asia Pacific Lighting Fixtures Market Incremental Opportunity, By Country US$ Mn, 2017-2031

Figure 73: Middle East & Africa Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Figure 74: Middle East & Africa Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Figure 75: Middle East & Africa Lighting Fixtures Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 76: Middle East & Africa Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Figure 77: Middle East & Africa Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Figure 78: Middle East & Africa Lighting Fixtures Market Incremental Opportunity, By Fixture Type, US$ Mn, 2017-2031

Figure 79: Middle East & Africa Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Figure 80: Middle East & Africa Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Figure 81: Middle East & Africa Lighting Fixtures Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 82: Middle East & Africa Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Figure 83: Middle East & Africa Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Figure 84: Middle East & Africa Lighting Fixtures Market Incremental Opportunity, By Application, US$ Mn, 2017-2031

Figure 85: Middle East & Africa Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 86: Middle East & Africa Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 87: Middle East & Africa Lighting Fixtures Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 88: Middle East & Africa Lighting Fixtures Market, By Country Thousand Units, 2017-2031

Figure 89: Middle East & Africa Lighting Fixtures Market, By Country US$ Mn, 2017-2031

Figure 90: Middle East & Africa Lighting Fixtures Market Incremental Opportunity, By Country US$ Mn, 2017-2031

Figure 91: South America Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Figure 92: South America Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Figure 93: South America Lighting Fixtures Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 94: South America Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Figure 95: South America Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Figure 96: South America Lighting Fixtures Market Incremental Opportunity, By Fixture Type, US$ Mn, 2017-2031

Figure 97: South America Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Figure 98: South America Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Figure 99: South America Lighting Fixtures Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 100: South America Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Figure 101: South America Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Figure 102: South America Lighting Fixtures Market Incremental Opportunity, By Application, US$ Mn, 2017-2031

Figure 103: South America Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 104: South America Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 105: South America Lighting Fixtures Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 106: South America Lighting Fixtures Market, By Country Thousand Units, 2017-2031

Figure 107: South America Lighting Fixtures Market, By Country US$ Mn, 2017-2031

Figure 108: South America Lighting Fixtures Market Incremental Opportunity, By Country US$ Mn, 2017-2031

Figure 109: South America Lighting Fixtures Market, By Type, Thousand Units, 2017-2031

Figure 110: South America Lighting Fixtures Market, By Type, US$ Mn, 2017-2031

Figure 111: South America Lighting Fixtures Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 112: South America Lighting Fixtures Market, By Fixture Type, Thousand Units, 2017-2031

Figure 113: South America Lighting Fixtures Market, By Fixture Type, US$ Mn, 2017-2031

Figure 114: South America Lighting Fixtures Market Incremental Opportunity, By Fixture Type, US$ Mn, 2017-2031

Figure 115: South America Lighting Fixtures Market, By Price, Thousand Units, 2017-2031

Figure 116: South America Lighting Fixtures Market, By Price, US$ Mn, 2017-2031

Figure 117: South America Lighting Fixtures Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 118: South America Lighting Fixtures Market, By Application, Thousand Units, 2017-2031

Figure 119: South America Lighting Fixtures Market, By Application, US$ Mn, 2017-2031

Figure 120: South America Lighting Fixtures Market Incremental Opportunity, By Application, US$ Mn, 2017-2031

Figure 121: South America Lighting Fixtures Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 122: South America Lighting Fixtures Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 123: South America Lighting Fixtures Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 124: South America Lighting Fixtures Market, By Country Thousand Units, 2017-2031

Figure 125: South America Lighting Fixtures Market, By Country US$ Mn, 2017-2031

Figure 126: South America Lighting Fixtures Market Incremental Opportunity, By Country US$ Mn, 2017-2031