Reports

Reports

A laser a light-emitting device that consists of a laser diode, circuit board, case, and optics. Electric components on the circuit board and laser diode are usually made up of semiconductor materials, metals, and ceramics. Semiconductor materials include compounds/alloys of aluminum, gallium, arsenic, phosphorous, indium, and similar elements. These semiconductor materials also contain metals such as gold, aluminum, and tantalum. The circuit board used in a laser is typically composed of synthetic resin, usually epoxy, with glass fibers to strengthen it. The circuit board is connected to the various components using lines of metals such as aluminum and copper. Semiconductor parts used in a laser are encapsulated in plastic with metal leads that are connected to metal pads on the circuit board with a solder. Solder is a metal alloy made up of tin and lead; however, in recent years, lead has been replaced by other metals. Non-semiconductor parts in a laser are composed of materials such as metal, plastic, glass, and ceramic. Optics used in a laser can be prepared with glass; however, they are usually made from acrylic plastic, which is more economical than glass. The casings used in a laser are usually made up of materials such as metal, plastic, or wood. It may also have metal contacts with batteries, usually prepared from brass. Usage of these materials varies as per requirement of end-user applications and also depends upon the laser device manufacturer.

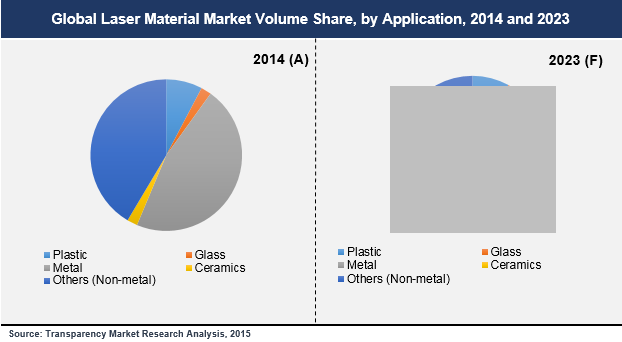

Major raw materials used in laser manufacturing include glass, plastic, metal, ceramic, and others along with the processing medium, which is the source of optical gain within a laser. In terms of demand, metals dominated the laser material market in 2014 and accounted for over 45% of the demand share in the same year. Metals are primarily consumed in the production of electric components of laser, laser diodes, semiconductor, and casing of laser. Glass is the fastest-growing product segments of the laser material market. Ceramic is also one of the fastest-growing product segment of the laser material market. Ceramics are principally consumed in semiconductor parts, non-semiconductor parts, and in the manufacture of circuit boards.

In terms of demand, the communication industry was the largest application segment of the laser material market and accounted for more than 30% of the global market share in 2014. Laser technology plays a vital role in communication. Rising demand for Internet services, e-commerce, digitalization of information, and economic cycles are key factors driving growth of laser devices. This, in turn, is boosting the communication application segment of the laser material market. R&D and military would be the fastest-growing segment of the market for laser materials. Increasing demand for laser devices in anti-tank missiles, radars, underwater equipment in military services, and advanced R&D application is expected to significantly drive the laser material market during the forecast period. Other application segments such as material processing, medical & aesthetic, instrumentation & sensors, lithography, optical storage, and others are likely to exhibit higher demand for laser materials in the near future.

Asia Pacific accounted for the highest share of the global laser material market in 2014. In terms of volume, the region accounted for more than one-third share of the global laser material market in 2014 and is expected to be the fastest-growing market in the near future. North America accounted for the second-largest market share of the laser material market in 2014. Growth of the laser material market in this region is expected to remain steady in the next few years. The market in North America is anticipated to depict stable growth as the region is technologically advanced and has established markets.

Key market players include BHP Billiton, Aurubis AG, Anglo American plc, Norilsk Nickel Group, ArcelorMittal, Sinopec Shanghai Petrochemical Group Co., Ltd., Mitsubishi Chemical Corporation, The Dow Chemical Company, Evonik Industries AG, Exxon Mobil Corporation, BASF SE, Taishan Fiberglass Inc., Murata Manufacturing Co., Ltd., Corning Incorporated, Saint Gobain, Mason Graphite Inc., GrafTech International, Kyocera Corp., Asahi Glass Co., Ltd., CreamTec GmbH, Morgan Advanced Materials plc, Triton Minerals Ltd., Deveron Resources Ltd., Schott AG, and Rio Tinto Alcan.

Chapter 1 Preface

1.1 Report Description

1.2 Research Scope

1.3 Assumptions

1.4 Market Segmentation

1.5 Research Methodology

Chapter 2 Executive Summary

2.1 Global Laser Material Market, Volume and Revenue, (Kilo Tons) (US$ Mn), 2014–2023

2.2 Global laser Material Market: Market Snapshot

Chapter 3 Industry Analysis

3.1 Introduction

3.2 Value Chain Analysis

3.3 Market Drivers

3.3.1 Driver 1- Rapid Growth in Global Pharmaceuticals Industry to Boost Laser Material Market

3.3.2 Driver 2- Demand from Aerospace & Defense Industry to Propel Laser Material Market

3.3.3 Driver 3- Growing Demand from Telecommunication Industry to Drive Laser Material Market

3.4.1 Restraint 1 - Volatility in Crude Oil Prices

3.4.2 Restraint 2 - Volatility in Natural Gas Prices

3.4.3 Restraint 3 - Volatility in Metal Prices to Act as Restraint for Global Laser Material Market

3.5.1 Opportunity 1 – Growing Demand for Laser Products in Asia Pacific Expected to Act as Opportunity for Laser Material Suppliers

3.6 Porter’s Five Forces Analysis

3.7 Market Attractiveness Analysis – Laser Material Market

Chapter 4 Raw Material Price Trend Analysis

Chapter 5 Laser Material Market – Product Analysis

5.1 Laser Material Market: Product Segment Overview

5.2 Laser Material Market: By Product Segment

5.2.1 Global Laser Material Market for Plastics, 2014 – 2023 (kilo tons) (US$ Mn)

5.2.2 Global Laser Material Market for Glass, 2014 – 2023 (kilo tons) (US$ Mn)

5.2.3 Global Laser Material Market for Metal, 2014 – 2023 (kilo tons) (US$ Mn)

5.2.4 Global Laser Material Market for Ceramics, 2014 – 2023 (kilo tons) (US$ Mn)

5.2.5 Global Laser Material Market for Others (Non-Metals), 2014 – 2023 (kilo tons) (US$ Mn)

Chapter 6 Laser Material Market – Application Analysis

6.1 Laser Material Market: Application Overview

6.2 Laser Material Market: By Application

6.2.1 Global Laser Material Market for Communication, 2014 – 2023 (kilo tons) (US$ Mn)

6.2.2 Global Laser Material Market for Material Processing, 2014 – 2023 (kilo tons) (US$ Mn)

6.2.3 Global Laser Market for Medical & aesthetics 2014 – 2023 (kilo tons) (US$ Mn)

6.2.4 Global Laser Market for Instrumentation & sensors, 2014 – 2023 (kilo tons) (US$ Mn)

6.2.5 Global Laser Market for Lithography, 2014 – 2023 (kilo tons) (US$ Mn)

6.2.6 Global Laser Market for Optical Storage, 2014 – 2023 (kilo tons) (US$ Mn)

6.2.7 Global Laser Market for R&D and military, 2014 – 2023 (kilo tons) (US$ Mn)

6.2.8 Global Laser Market for Other (displays, printing, etc.) 2014 – 2023 (kilo tons) (US$ Mn)

Chapter 7 Global Laser Material Market - Regional Analysis

7.1 Laser Material Market: Regional Overview

7.2 North America Laser Material Market – By Regional Sub-segment

7.2.1 North America Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.2.2 North America Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.2.3 North America Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.2.4 North America Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.2.5 US Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.2.6 US Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.2.7 US Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.2.8 US Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.2.9 Rest of North America Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.2.10 Rest of North America Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.2.11 Rest of North America Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.2.12 Rest of North America Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.3 Europe Laser Material Market – By Regional Sub-segment

7.3.1 Europe Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.3.2 Europe Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.3.3 Europe Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.3.4 Europe Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.3.5 UK Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.3.6 UK Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.3.7 UK Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.3.8 UK Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.3.9 Germany Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.3.10 Germany Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.3.11 Germany Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.3.12 Germany Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.3.13 France Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.3.14 France Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.3.15 France Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.3.16 France Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.3.17 Spain Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.3.18 Spain Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.3.19 Spain Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.3.20 Spain Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.3.21 Italy Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.3.22 Italy Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.3.23 Italy Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.3.24 Italy Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.3.25 Rest of Europe Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.3.26 Rest of Europe Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.3.27 Rest of Europe Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.3.28 Rest of Europe Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.4 Asia Pacific Laser Material Market – By Regional Sub-segment

7.4.1 Asia Pacific Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.4.2 Asia Pacific Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.4.3 Asia Pacific Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.4.4 Asia Pacific Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.4.5 China Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.4.6 China Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.4.7 China Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.4.8 China Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.4.9 Japan Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.4.10 Japan Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.4.11 Japan Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.4.12 Japan Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.4.13 ASEAN Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.4.14 ASEAN Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.4.15 ASEAN Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.4.16 ASEAN Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.4.17 REST of Asia Pacific Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.4.18 REST of Asia Pacific Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.4.19 REST of Asia Pacific Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.4.20 REST of Asia Pacific Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.5 Latin America Laser Material Market – By Regional Sub-segment

7.5.1 Latin America Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.5.2 Latin America Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.5.3 Latin America Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.5.4 Latin America Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.5.5 Brazil Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.5.6 Brazil Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.5.7 Brazil Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.5.8 Brazil Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.5.9 Rest of Latin America Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.5.10 Rest of Latin America Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.5.11 Rest of Latin America Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.5.12 Rest of Latin America Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.6 Middle East & Africa (MEA) Laser Material Market – By Regional Sub-segment

7.6.1 Middle East & Africa Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.6.2 Middle East & Africa Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.6.3 Middle East & Africa Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.6.4 Middle East & Africa Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.6.5 GCC Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.6.6 GCC Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.6.7 GCC Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.6.8 GCC Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.6.9 South Africa Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.6.10 South Africa Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.6.11 South Africa Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.6.12 South Africa Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

7.6.13 Rest of Middle East & Africa Laser Material Market, by Product Segment, 2014 – 2023 (kilo tons)

7.6.14 Rest of Middle East & Africa Laser Material Market, by Product Segment, 2014 – 2023 (US$ Mn)

7.6.15 Rest of Middle East & Africa Laser Material Market, by Application Segment, 2014 – 2023 (kilo tons)

7.6.16 Rest of Middle East & Africa Laser Material Market, by Application Segment, 2014 – 2023 (US$ Mn)

Chapter 8 Company Profiles

8.1 BHP Billiton

8.2 Aurubis AG

8.3 Anglo American plc

8.4 Norilsk Nickel Group

8.5 ArcelorMittal

8.6 Sinopec Petrochemical Group Co., Ltd.

8.7 Mitsubishi Chemical Corporation

8.8 The Dow Chemical Company

8.9 Evonik Industries AG

8.10 Exxon Mobil Corporation

8.11 BASF SE

8.12 Taishan Fiberglass Inc.

8.13 Murata Manufacturing Co., Ltd.

8.14 Corning Inc.

8.15 Saint Gobain

8.16 Mason Graphite Inc.

8.17 GrafTech International

8.18 Kyocera Corp.

8.19 Asahi Glass Co. Ltd

8.2 CeramTec GmbH

8.21 Morgan Advanced Materials plc.

8.22 ArcelorMittal

8.23 Triton Minerals Ltd

8.24 Deveron Resources Ltd

8.25 Schott AG

8.26 Rio Tinto Alcan

Chapter 9 Primary Research- Key Findings