Reports

Reports

Owing to the increase in the number of mergers and acquisition strategies, the global market for laminated labels is expected to generate great revenues in the years to come. The competitive landscape of the laminated labels market is anticipated to be highly intensive in the coming years because of the rise in the number of players. The increase in competition level amongst players may be attributed to the technological advancements and the development caused due to them are factors that can augment the global market for laminated labels.

The increasing demand for pharmaceutical supplies and packages beverages and food is among the key factors anticipated to encourage the upliftment of the global laminated labels market in the years to come. There is also a rise in awareness related to the advantages that laminated labels provide when used as well as increase in demand from consumer durables and this significantly adds to the augmentation of the market worldwide.

The need for customer engaging, highly resistive, durable and attractive packaging has caused the need for laminated labels in the industry. Laminated labels plays a significant role in marketing products and its impact in the overall industry is noteworthy. Numerous brand manufacturers and owners of end-user or consumer goods are likely to adopt laminated labels because these labels provide high level of receptivity that attracts more end-users towards this market.

On the other hand, there has been a noticeable rise in the cost of raw materials required for laminated labels, thus restricting growth. The printing done on the package itself is expensive and this may add to the hindrance of the overall market. However, the emergence of e-commerce industry is anticipated to open up new opportunities for the growth and development of the laminated labels market in the long run.

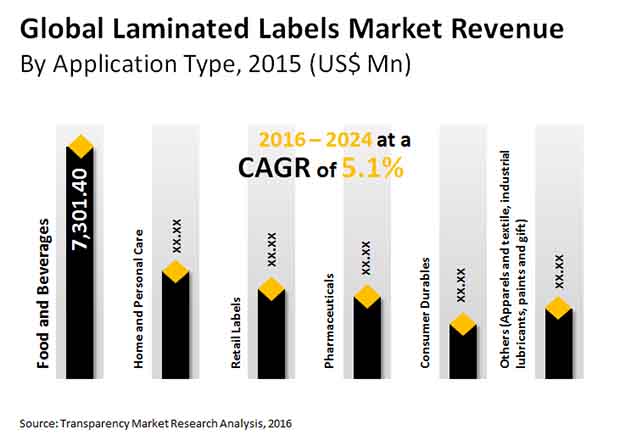

The global laminated labels market is estimated to be worth US$30.97 bn by 2024 with a CAGR of 5.1 %. The forecast period is set to 2016 to 2024 and is anticipated to be increasing by 1.5 times more than the 2015 records which was valued at US$20.02 bn.

The global laminated labels market is segmented on the basis of material type, where the key classifications are polypropylene, polycarbonate, vinyl, and polyester.On the basis of printing technology, the market is categorized into lithography, flexographic, and digital. Based on the classification of printing ink, the global market for laminated labels is segmented into UV curable, hot melt based, solvent based, and water based.

End use industry wise, laminated labels market may be categorized into Retail Labels, Consumer Durables, Home and Personal Care, Pharmaceuticals, and Food & Beverages industry. As per the TMR reports, the food and beverage industry, followed closely by home and personal care, is presumed to be attracting more end users as compared to the other end users.

The global laminated labels market is studied on the basis of key geographies Latin America, Europe, North America, Asia Pacific, Middle East and Africa. Among these regions, the market in Asia Pacific is foreseen to be among the most favorable ones with regard to generating higher revenues from the incremental opportunities that the laminated labels may provide in the coming years. Europe and North America are also seen to be closely following Asia Pacific showing an overall healthy CAGR graph over the forecast period.

Some of the key players in the lamination labels market are Langley Labels, Avery Dennison Corporation, Cenveo, CCL industries Inc, and Hub Labels.

Diverse Advantages of Laminated Labels Drive Promising Sales Avenues For Manufacturers

Laminated labels are gaining traction across various industrial sectors owing to their ability to withstand in various critical environmental conditions including hot and cold. Apart from this, they can withstand fading and abrasion, grease, water, and outdoor atmosphere. Many companies engaged in diverse industrial sectors are growing inclination toward the use of laminated labels. Key reason for this scenario is the ability of laminated labels to maintain proper readability and offer improved survival abilities than that of non-laminated labels. On the grounds of all these factors, the vendors working in the global laminated labels market are experiencing promising demand opportunities from a wide range of end-user industries across the globe.

Laminated labels are used by companies engaged in the manufacturing of many products including pharmaceuticals, food and beverages, home and personal care, consumer durables, apparels and textile, retail labels, paints and gift, and industrial lubricants. The enterprises from all these sectors are growing use of laminated labels to offer attractive packaging to their products. Thus, increased demand for all these products is foreseen to generate prodigious sales avenues for vendors working in the global laminated labels market in the forthcoming years.

Owing to the recent COVID-19 pandemic, the worldwide economy is experiencing sluggish growth. Many companies from a wide range of manufacturing sectors are experiencing numerous challenges related to production as well as sales. This scenario has impacted adversely on the revenues of the laminated labels market as well. Moving forward, major enterprises engaged in the laminated labels market are focused on resolving problems associated with the production activities. They are strategizing business moves and regaining their regular operational activities while following all guidelines enforced by regional government bodies. On the back of these efforts, the global laminated labels market is expected to bounce back in short period.

1. Executive Summary

2. Assumptions and Acronyms Used

3. Research Methodology

4. Laminated Labels Market Overview

4.1. Laminated Labels Market Outlook

4.2. Laminated Labels Market Taxonomy

4.3. Global Laminated Label Market: Definition and Scope of Research

4.4. Laminated Labels Supply Chain

5. Market Dynamics

5.1. Macro-economic Factors

5.2. Drivers

5.3. Restraints

5.4. Opportunity

6. Laminated Labels Market Analysis Scenario

6.1. Global Laminated Labels Market – Value & Volume and Absolute $ Opportunity

6.2. Global Market Snapshot, By Segments

7. Global Laminated Labels Market Analysis and Forecast, By Material Type

7.1. Introduction

7.1.1. Basis Point Share (BPS) Analysis By Material Type

7.1.2. Y-o-Y Growth Projections By Material Type

7.2. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Material Type

7.2.1. Polyester

7.2.2. Vinyl

7.2.3. Polycarbonate

7.2.4. Polypropylene

7.2.5. Others

7.3. Market Attractiveness Analysis By Material Type

8. Global Laminated Labels Market Analysis and Forecast, By Printing Technology

8.1. Introduction

8.1.1. Basis Point Share (BPS) Analysis By Printing Technology

8.1.2. Y-o-Y Growth Projections By Printing Technology

8.2. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Printing Technology

8.2.1. Digital

8.2.2. Flexographic

8.2.3. Lithography

8.2.4. Others (Letterpress, Gravure, Offset, Screen Printing)

8.3. Market Attractiveness Analysis By Printing Technology

9. Global Laminated Labels Market Analysis and Forecast, By Printing Ink

9.1. Introduction

9.1.1. Basis Point Share (BPS) Analysis By Printing Ink

9.1.2. Y-o-Y Growth Projections By Printing Ink

9.2. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Printing Ink

9.2.1. Water based

9.2.2. Solvent based

9.2.3. Hot melt based

9.2.4. UV curable

9.3. Others Market Attractiveness Analysis By Printing Ink

10. Global Laminated Labels Market Analysis and Forecast, By End use industry

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis By End use industry

10.1.2. Y-o-Y Growth Projections By End use industry

10.2. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By End use industry

10.2.1. Food & Beverages

10.2.2. Pharmaceuticals

10.2.3. Home and Personal Care

10.2.4. Consumer Durables

10.2.5. Retail Labels

10.2.6. Others (Apparels and textile, industrial lubricants, paints and gift)

10.3. Others Market Attractiveness Analysis By End use industry

11. Global Laminated Labels Market Analysis and Forecast, By Region

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis By Region

11.1.2. Y-o-Y Growth Projections By Region

11.2. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Region

11.2.1. North America

11.2.2. Latin America

11.2.3. Europe

11.2.4. Asia Pacific

11.2.5. Middle East and Africa (MEA)

11.3. Market Attractiveness Analysis By Region

12. North America Laminated Labels Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.2. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Country

12.2.1. U.S.

12.2.2. Canada

12.3. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Material Type

12.3.1. Polyester

12.3.2. Vinyl

12.3.3. Polycarbonate

12.3.4. Polypropylene

12.3.5. Others

12.4. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Printing Technology

12.4.1. Digital

12.4.2. Flexographic

12.4.3. Lithography

12.4.4. Others (Letterpress, Gravure, Offset, Screen Printing)

12.5. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Printing Ink

12.5.1. Water based

12.5.2. Solvent based

12.5.3. Hot melt based

12.5.4. UV curable

12.6. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By End Use Industry

12.6.1. Food & Beverages

12.6.2. Pharmaceuticals

12.6.3. Home and Personal Care

12.6.4. Consumer Durables

12.6.5. Retail Labels

12.6.6. Others (Apparels and textile, industrial lubricants, paints and gift)

12.7. Market Attractiveness Analysis

12.7.1. By Country

12.7.2. By Material Type

12.7.3. By Printing Technology Type

12.7.4. By Printing Ink

12.7.5. By End Use Industry

12.8. Prominent Trends

13. Latin America Laminated Labels Market Analysis and Forecast

13.1. Introduction

13.1.1. Point Share (BPS) Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.1.3. Key Regulations

13.2. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Country

13.2.1. Brazil

13.2.2. Mexico

13.2.3. Rest of Latin America

13.3. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Material Type

13.3.1. Polyester

13.3.2. Vinyl

13.3.3. Polycarbonate

13.3.4. Polypropylene

13.3.5. Others

13.4. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Printing Technology

13.4.1. Digital

13.4.2. Flexographic

13.4.3. Lithography

13.4.4. Others (Letterpress, Gravure, Offset, Screen Printing)

13.5. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Printing Ink

13.5.1. Water based

13.5.2. Solvent based

13.5.3. Hot melt based

13.5.4. UV curable

13.6. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By End Use Industry

13.6.1. Food & Beverages

13.6.2. Pharmaceuticals

13.6.3. Home and Personal Care

13.6.4. Consumer Durables

13.6.5. Retail Labels

13.6.6. Others (Apparels and textile, industrial lubricants, paints and gift)

13.7. Market Attractiveness Analysis

13.7.1. By Country

13.7.2. By Material Type

13.7.3. By Printing Technology Type

13.7.4. By Composition

13.7.5. By Printing Ink

13.7.6. By End Use Industry

13.8. Prominent Trends

14. Europe Laminated Labels Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.1.3. Key Regulations

14.2. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Country

14.2.1. Germany

14.2.2. Spain

14.2.3. Italy

14.2.4. France

14.2.5. U.K.

14.2.6. BENELUX

14.2.7. Russia

14.2.8. Rest of Europe

14.3. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Material Type

14.3.1. Polyester

14.3.2. Vinyl

14.3.3. Polycarbonate

14.3.4. Polypropylene

14.3.5. Others

14.4. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Printing Technology

14.4.1. Digital

14.4.2. Flexographic

14.4.3. Lithography

14.4.4. Others (Letterpress, Gravure, Offset, Screen Printing)

14.5. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Printing Ink

14.5.1. Water based

14.5.2. Solvent based

14.5.3. Hot melt based

14.5.4. UV curable

14.6. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By End Use Industry

14.6.1. Food & Beverages

14.6.2. Pharmaceuticals

14.6.3. Home and Personal Care

14.6.4. Consumer Durables

14.6.5. Retail Labels

14.6.6. Others (Apparels and textile, industrial lubricants, paints and gift)

14.7. Market Attractiveness Analysis

14.7.1. By Country

14.7.2. By Material Type

14.7.3. By Printing Technology Type

14.7.4. By Composition

14.7.5. By Printing Ink

14.7.6. By End Use Industry

14.8. Prominent Trends

15. Asia Pacific Laminated Labels Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.2. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Country

15.2.1. China

15.2.2. India

15.2.3. Japan

15.2.4. ASEAN

15.2.5. Australia and New Zealand

15.2.6. Rest of APAC

15.3. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Material Type

15.3.1. Polyester

15.3.2. Vinyl

15.3.3. Polycarbonate

15.3.4. Polypropylene

15.3.5. Others

15.4. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Printing Technology

15.4.1. Digital

15.4.2. Flexographic

15.4.3. Lithography

15.4.4. Others (Letterpress, Gravure, Offset, Screen Printing)

15.5. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Printing Ink

15.5.1. Water based

15.5.2. Solvent based

15.5.3. Hot melt based

15.5.4. UV curable

15.6. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By End Use Industry

15.6.1. Food & Beverages

15.6.2. Pharmaceuticals

15.6.3. Home and Personal Care

15.6.4. Consumer Durables

15.6.5. Retail Labels

15.6.6. Others (Apparels and textile, industrial lubricants, paints and gift)

15.7. Market Attractiveness Analysis

15.7.1. By Country

15.7.2. By Material Type

15.7.3. By Printing Technology Type

15.7.4. By Composition

15.7.5. By Printing Ink

15.7.6. By End Use Industry

15.8. Prominent Trends

16. Middle East & Africa Laminated Labels Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis By Country

16.1.2. Y-o-Y Growth Projections By Country

16.1.3. Key Regulations

16.2. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Country

16.2.1. North Africa

16.2.2. South Africa

16.2.3. GCC countries

16.2.4. Rest of MEA

16.3. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Material Type

16.3.1. Polyester

16.3.2. Vinyl

16.3.3. Polycarbonate

16.3.4. Polypropylene

16.3.5. Others

16.4. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Printing Technology

16.4.1. Digital

16.4.2. Flexographic

16.4.3. Lithography

16.4.4. Others (Letterpress, Gravure, Offset, Screen Printing)

16.5. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By Printing Ink

16.5.1. Water based

16.5.2. Solvent based

16.5.3. Hot melt based

16.5.4. UV curable

16.6. Market Size (US$ Mn) and Volume (Million Sq. m) Forecast By End Use Industry

16.6.1. Food & Beverages

16.6.2. Pharmaceuticals

16.6.3. Home and Personal Care

16.6.4. Consumer Durables

16.6.5. Retail Labels

16.6.6. Others (Apparels and textile, industrial lubricants, paints and gift)

16.7. Market Attractiveness Analysis

16.7.1. By Country

16.7.2. By Material Type

16.7.3. By Printing Technology Type

16.7.4. By Composition

16.7.5. By Printing Ink

16.7.6. By End Use Industry

16.8. Prominent Trends

17. Competitive Landscape

17.1. Market Share Analysis

17.2. Competitive Dashboard

17.3. Company Profiles (Details – Overview, Strategy, Recent Developments, SWOT analysis)

17.3.1. Avery Dennison Corporation

17.3.1.1. Company overview

17.3.1.2. Key developments

17.3.1.3. SWOT analysis

17.3.1.4. Strategy overview

17.3.2. Coveris Holdings S.A.

17.3.2.1. Company overview

17.3.2.2. Key developments

17.3.2.3. SWOT analysis

17.3.2.4. Strategy overview

17.3.3. CCL Label, Inc.

17.3.3.1. Company overview

17.3.3.2. Key developments

17.3.3.3. SWOT analysis

17.3.3.4. Strategy overview

17.3.4. Constantia Flexibles Group GmbH

17.3.4.1. Company overview

17.3.4.2. Key developments

17.3.4.3. SWOT analysis

17.3.4.4. Strategy overview

17.3.5. Cenveo Corporation

17.3.5.1. Company overview

17.3.5.2. Key developments

17.3.5.3. SWOT analysis

17.3.5.4. Strategy overview

17.3.6. Hub Labels, Inc.

17.3.6.1. Company overview

17.3.6.2. Key developments

17.3.6.3. SWOT analysis

17.3.6.4. Strategy overview

17.3.7. ImageTek Labels

17.3.7.1. Company overview

17.3.7.2. Key developments

17.3.7.3. SWOT analysis

17.3.7.4. Strategy overview

17.3.8. SheetLabels.com

17.3.8.1. Company overview

17.3.8.2. Key developments

17.3.8.3. SWOT analysis

17.3.8.4. Strategy overview

17.3.9. Langley Labels

17.3.9.1. Company overview

17.3.9.2. SWOT analysis

17.3.9.3. Strategy overview

17.3.10. Reflex Labels

17.3.10.1. Company overview

17.3.10.2. SWOT analysis

17.3.10.3. Strategy overview

List of Table

Table 01: Global Laminated Labels Market Analysis by Material Type, 2015–2024

Table 02: Global Laminated Labels Market Analysis by Material Type, 2015–2024

Table 03: Global Laminated Labels Market Analysis by Printing Technology, 2015–2024

Table 03: Global Laminated Labels Market Analysis by Printing Technology, 2015–2024

Table 04: Global Laminated Labels Market Analysis by Printing Ink 2015–2024

Table 05: Global Laminated Labels Market Analysis by Printing Ink, 2015–2024

Table 06: Global Laminated Labels Market Analysis by End Use Industry, 2015–2024

Table 07: Global Laminated Labels Market Analysis by End Use Industry, 2015–2024

Table 08: Global Laminated Labels Market Analysis by End Use Industry, 2015–2024

Table 09: Global Laminated Labels Market Analysis by Region, 2015–2024

Table 10: Global Laminated Labels Market Analysis by Region, 2015–2024

Table 11: North America Laminated Labels Market Analysis by Country, 2015–2024

Table 12: North America Laminated Labels Market Analysis by Material Type, 2015–2024

Table 13: North America Laminated Labels Market Analysis by Material Type, 2015–2024

Table 14: North America Laminated Labels Market Analysis by End Use Industry, 2015–2024

Table 15: North America Laminated Labels Market Analysis by End Use Industry, 2015–2024

Table 16: North America Laminated Labels Market Analysis by End Use Industry, 2015–2024

Table 17: North America Laminated Labels Market Analysis by Printing Ink, 2015–2024

Table 18: North America Laminated Labels Market Analysis by Printing Ink, 2015–2024

Table 19: North America Laminated Labels Market Analysis by Printing Technology, 2015–2024

Table 20: North America Laminated Labels Market Analysis by Printing Technology, 2015–2024

Table 21: Latin America Laminated Labels Market Analysis, by Country, 2015–2024

Table 22: Latin America Laminated Labels Market Analysis, by Country, 2015–2024

Table 23: Latin America Laminated Labels Market Analysis, by Material Type, 2015–2024

Table 24: Latin America Laminated Labels Market Analysis, by Material Type, 2015–2024

Table 25: Latin America Laminated Labels Market Analysis, by End-use Industry, 2015–2024

Table 26: Latin America Laminated Labels Market Analysis, by End-use Industry, 2015–2024

Table 27: Latin America Laminated Labels Market Analysis, by End-use Industry, 2015–2024

Table 28: Latin America Laminated Labels Market Analysis, by Printing Ink, 2015–2024

Table 29: Latin America Laminated Labels Market Analysis, by Printing Ink, 2015–2024

Table 30: Latin America Laminated Labels Market Analysis, by Printing Technology, 2015–2024

Table 31: Latin America Laminated Labels Market Analysis, by Printing Technology, 2015–2024

Table 32: Europe Laminated Labels Market Analysis, by Country, 2015–2024

Table 33: Europe Laminated Labels Market Analysis, by Country, 2015–2024

Table 34: Europe Laminated Labels Market Analysis, by Country, 2015–2024

Table 35: Europe Laminated Labels Market Analysis, by Material Type, 2015–2024

Table 36: Europe Laminated Labels Market Analysis, by Material Type, 2015–2024

Table 37: Europe Laminated Labels Market Analysis, by End-use Industry, 2015–2024

Table 38: Europe Laminated Labels Market Analysis, by End-use Industry, 2015–2024

Table 39: Europe Laminated Labels Market Analysis, by End-use Industry, 2015–2024

Table 40: Europe Laminated Labels Market Analysis, by Printing Ink, 2015–2024

Table 41: Europe Laminated Labels Market Analysis, by Printing Ink, 2015–2024

Table 42: Europe Laminated Labels Market Analysis, by Printing Technology, 2015–2024

Table 43: Europe Laminated Labels Market Analysis, by Printing Technology, 2015–2024

Table 44: Asia Pacific Laminated Labels Market Analysis, by Country, 2015–2024

Table 45: Asia Pacific Laminated Labels Market Analysis, by Country, 2015–2024

Table 46: Asia Pacific Laminated Labels Market Analysis, by Country, 2015–2024

Table 47: Asia Pacific Laminated Labels Market Analysis, by Material Type, 2015–2024

Table 48: Asia Pacific Laminated Labels Market Analysis, by Material Type, 2015–2024

Table 49: Asia Pacific Laminated Labels Market Analysis, by End-Use Industry, 2015–2024

Table 50: Asia Pacific Laminated Labels Market Analysis, by End-Use Industry, 2015–2024

Table 51: Asia Pacific Laminated Labels Market Analysis, by End-Use Industry, 2015–2024

Table 52: Asia Pacific Laminated Labels Market Analysis, by Printing Ink, 2015–2024

Table 53: Asia Pacific Laminated Labels Market Analysis, by Printing Ink, 2015–2024

Table 54: Asia Pacific Laminated Labels Market Analysis, by Printing Technology, 2015–2024

Table 55: Asia Pacific Laminated Labels Market Analysis, by Printing Technology, 2015–2024

Table 56: MEA Laminated Labels Market Analysis, by Country, 2015–2024

Table 57: MEA Laminated Labels Market Analysis, by Country, 2015–2024

Table 58: MEA Laminated Labels Market Analysis, by Material Type, 2015–2024

Table 59: MEA Laminated Labels Market Analysis, by Material Type, 2015–2024

Table 60: MEA Laminated Labels Market Analysis, by End-Use Industry, 2015–2024

Table 61: MEA Laminated Labels Market Analysis, by End-Use Industry, 2015–2024

Table 62: MEA Laminated Labels Market Analysis, by End-Use Industry, 2015–2024

Table 63: MEA Laminated Labels Market Analysis, by Printing Ink, 2015–2024

Table 64: MEA Laminated Labels Market Analysis, by Printing Ink, 2015–2024

Table 65: MEA Laminated Labels Market Analysis, by Printing Technology, 2015–2024

Table 66: MEA Laminated Labels Market Analysis, by Printing Technology, 2015–2024

List of Figures

Figure 01: Global Laminated Labels Market Size Forecast, 2015-2024 (US$ Mn)

Figure 02: Global Laminated Labels Market Incremental $ Opportunity (US$ Mn) 2016 & 2024

Figure 03: Global Laminated Labels Market Value (US$ Mn) and Volume (million square meters), 2015–2024

Figure 04: Global Laminated Labels Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 05: Global Laminated Labels Market Value BPS Analysis by Material Type, 2016 & 2024

Figure 06: Global Laminated Labels Market Value Y-o-Y Growth (%) by Material Type, 2015–2024

Figure 07: Global Laminated labels Market Absolute $ Opportunity by Polyester segment, 2016–2024

Figure 08: Global Laminated Labels Market Absolute $ Opportunity by Vinyl segment, 2016–2024

Figure 09: Global Laminated labels Market Absolute $ Opportunity by Polycarbonate segment, 2016–2024

Figure 10: Global Laminated Labels Market Absolute $ Opportunity by Polypropylene segment, 2016–2024

Figure 11: Global Laminated Labels Market Absolute $ Opportunity by Others segment, 2016–2024

Figure 12: Global Laminated Labels Market Attractiveness by Material Type, 2024

Figure 13: Global Laminated Labels Market Value BPS Analysis by Printing Technology, 2016 & 2024

Figure 14: Global Laminated Labels Market Value Y-o-Y Growth (%) by Printing Technology, 2015–2024

Figure 15: Global Lainated labels Market Absolute $ Opportunity by Digital segment, 2016–2024

Figure 16: Global Laminated Labels Market Absolute $ Opportunity by Flexography segment, 2016–2024

Figure 17: Global Laminated labels Market Absolute $ Opportunity by Lithography segment, 2016–2024

Figure 18: Global Laminated Labels Market Absolute $ Opportunity by other printing technology segment, 2016–2024

Figure 19: Global Laminated Labels Market Attractiveness by Printing Technology, 2024

Figure 20: Global Laminated Labels Market Value BPS Analysis by Printing Ink, 2016 & 2024

Figure 21: Global Laminated Labels Market Value Y-o-Y Growth (%) by Printing Ink, 2015–2024

Figure 22: Global Laminated labels Market Absolute $ Opportunity by water based segment, 2016–2024

Figure 23: Global Laminated Labels Market Absolute $ Opportunity by Solvent Based segment, 2016–2024

Figure 24: Global Laminated labels Market Absolute $ Opportunity by Hot Melt Based segment, 2016–2024

Figure 25: Global Laminated Labels Market Absolute $ Opportunity by UV Curable segment, 2016–2024

Figure 26: Global Laminated Labels Market Attractiveness by Printing Ink, 2024

Figure 27: Global Laminated Labels Market Value BPS Analysis by End use industry, 2016 & 2024

Figure 28: Global Laminated Labels Market Value Y-o-Y Growth (%) by End use industry, 2015–2024

Figure 29: Global Laminated labels Market Absolute $ Opportunity by Food and Beverages segment, 2016–2024

Figure 30: Global Laminated Labels Market Absolute $ Opportunity by Pharmaceuticals segment, 2016–2024

Figure 31: Global Laminated labels Market Absolute $ Opportunity by Home and Personal segment, 2016–2024

Figure 32: Global Laminated Labels Market Absolute $ Opportunity by Consumer Durables segment, 2016–2024

Figure 33: Global Laminated labels Market Absolute $ Opportunity by Retail Labels segment, 2016–2024

Figure 34: Global Laminated Labels Market Absolute $ Opportunity by Other end user industries segment, 2016–2024

Figure 35: Global Laminated Labels Market Attractiveness by End use industry, 2024

Figure 36: Global Laminated Labels Market Value BPS Analysis by Region, 2016 & 2024

Figure 37: Global Laminated Labels Market Value Y-o-Y Growth (%), by Region, 2016–2024

Figure 38: Global Laminated labels Market Absolute $ Opportunity by North America Region, 2016–2024

Figure 39: Global Laminated Labels Market Absolute $ Opportunity by Latin America Region, 2016–2024

Figure 40: Global Laminated labels Market Absolute $ Opportunity by Europe Region, 2016–2024

Figure 41: Global Laminated Labels Market Absolute $ Opportunity by Asia Pacific Region, 2016–2024

Figure 42: Global Laminated Labels Market Absolute $ Opportunity by MEA Region, 2016–2024

Figure 43: Global Laminated Labels Market Attractiveness, by Region, 2024

Figure 44: North America Laminated Labels Market Value (US$ Mn) and Volume Forecast, 2015–2024

Figure 45: North America Laminated Labels Market Absolute $ Opportunity, 2016–2024 (US$ Mn)

Figure 46: North America Laminated Labels Market Value BPS Analysis by Country, 2016 & 2024

Figure 47: North America Laminated Labels Market Value Y-o-Y Growth (%), by Country, 2016–2024

Figure 48: North America Laminated Labels Market Attractiveness Index, by Country, 2024

Figure 49: U.S. Laminated Labels Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 50: Canada Laminated Labels Market Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 51: North America Laminated Labels Market Value (US$ Mn) by Material Type, 2014–2024

Figure 52: North America Laminated Labels Market Volume (Mn Sq m) by Material Type, 2015–2024

Figure 53: North America Laminated Labels Market Share & BPS Analysis, by Material Type, 2016 & 2024

Figure 54: North America Laminated Labels Market Y-o-Y Growth Rate, by Material Type, 2015–2024

Figure 55: North America Laminated Labels Market Attractiveness Analysis by Material Type, 2016–2024

Figure 56: North America Laminated Labels Market Value (US$ Mn) by End Use Industry, 2014–2024

Figure 57: North America Laminated Labels Market Volume(million square meters) by End Use Industry, 2015–2024

Figure 58: North America Laminated Labels Market Share & BPS Analysis, by End Use Industry, 2016 & 2024

Figure 59: North America Laminated Labels Market Y-o-Y Growth Rate, by End Use Industry, 2015–2024

Figure 60: North America Laminated Labels Market Attractiveness Analysis by End Use Industry, 2016–2024

Figure 61: North America Laminated Labels Market Value (US$ Mn) by Printing Ink, 2014–2024

Figure 62: North America Laminated Labels Market Volume (million square meters) by Printing Ink, 2015–2024

Figure 63: North America Laminated Labels Market Share & BPS Analysis, by Printing Ink, 2016 & 2024

Figure 64: North America Laminated Labels Market Y-o-Y Growth Rate, by Printing Ink, 2015–2024

Figure 65: North America Laminated Labels Market Attractiveness Analysis, by Printing Ink, 2016–2024

Figure 66: North America Laminated Labels Market Value (US$ Mn) by Printing Technology, 2014–2024

Figure 67: North America Laminated Labels Market Volume (million square meters) by Printing Technology, 2015–2024

Figure 68: North America Laminated Labels Market Share & BPS Analysis, by Printing Technology, 2016 & 2024

Figure 69: North America Laminated Labels Market Y-o-Y Growth Rate, by Printing Technology, 2015–2024

Figure 70: North America Laminated Labels Market Attractiveness Analysis, by Printing Technology, 2016–2024

Figure 71: Latin America Laminated Labels Market Value Share, by Country, 2016 & 2024

Figure 72: Latin America Laminated Labels Market Value Share, by Material Type, 2016 & 2024

Figure 73: Latin America Laminated Labels Market Value Share, by Type of Ink, 2016 & 2024

Figure 74: Latin America Laminated Labels Market Value Share, by End-use Industry, 2016 & 2024

Figure 75: Latin America Laminated Labels Market Value Share, by Printing Technology, 2016 & 2024

Figure 76: Latin America Laminated Labels Market Value (US$ Mn) and Volume (Mn Sq m) Forecast, 2015–2024

Figure 77: Latin America Laminated Labels Market, Absolute $ Opportunity, 2016–2024 (US$ Mn)

Figure 78: Latin America Laminated Labels Market Value BPS Analysis, by Country, 2016 & 2024

Figure 79: Latin America Laminated Labels Market Value Y-o-Y Growth (%), by Country, 2016–2024

Figure 80: Latin America Laminated Labels Market Attractiveness Analysis, by Country, 2024

Figure 81: Brazil Laminated Labels Market, Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 82: Mexico Laminated Labels Market, Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 83: Rest of Latin America Laminated Labels Market, Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 84: Total Latin America Laminated Labels Market, Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 85: Latin America Laminated Labels Market Value (US$ Mn), by Material Type, 2014–2024

Figure 86: Latin America Laminated Labels Market Volume (Mn Sq m), by Material Type, 2014–2024

Figure 87: Latin America Laminated Labels Market Share and BPS Analysis, by Material Type, 2016 & 2024

Figure 88: Latin America Laminated Labels Market, Y-o-Y Growth (%), by Material Type, 2015–2024

Figure 89: Latin America Laminated Labels Market Attractiveness Analysis, by Material Type, 2016–2024

Figure 90: Latin America Laminated Labels Market Value (US$ Mn), by End-use Industry, 2014–2024

Figure 91: Latin America Laminated Labels Market Volume (million square meters), by End-use Industry, 2014–2024

Figure 92: Latin America Laminated Labels Market Share and BPS Analysis, by End-use Industry, 2016 & 2024

Figure 93: Latin America Laminated Labels Market, Y-o-Y Growth (%), by End-use Industry, 2015–2024

Figure 94: Latin America Laminated Labels Market Attractiveness Analysis, by End-use Industry, 2016–2024

Figure 95: Latin America Laminated Labels Market Value (US$ Mn), by Printing Ink, 2014–2024

Figure 96: Latin America Laminated Labels Market Volume (million square meters), by Printing Ink, 2015–2024

Figure 97: Latin America Laminated Labels Market Share and BPS Analysis, by Printing Ink, 2016 & 2024

Figure 98: Latin America Laminated Labels Market, Y-o-Y Growth (%), by Printing Ink, 2015–2024

Figure 99: Latin America Laminated Labels Market Attractiveness Analysis, by Printing Ink, 2016–2024

Figure 100: Latin America Laminated Labels Market Value (US$ Mn), by Printing Technology, 2014–2024

Figure 101: Latin America Laminated Labels Market Volume (million square meters), by Printing Technology, 2014–2024

Figure 102: Latin America Laminated Labels Market Share and BPS Analysis, by Printing Technology, 2016 & 2024

Figure 103: Latin America Laminated Labels Market, Y-o-Y Growth (%), by Printing Technology, 2015–2024

Figure 104: Latin America Laminated Labels Market Attractiveness Analysis, by Printing Technology, 2016–2024

Figure 105: Europe Laminated Labels Market Value Share, by Country, 2016 & 2024

Figure 106: Europe Laminated Labels Market Value Share, by Material Type, 2016 & 2024

Figure 107: Europe Laminated Labels Market Value Share, by Printing Ink, 2016 & 2024

Figure 108: Europe Laminated Labels Market Value Share, by End-use Industry, 2016 & 2024

Figure 109: Europe Laminated Labels Market Value Share, by Printing Technology, 2016 & 2024

Figure 110: Europe Laminated Labels Market Value (US$ Mn) and Volume (million square meters) Forecast, 2015–2024

Figure 111: Europe Laminated Labels Market, Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 112: Europe Laminated Labels Market Value and BPS Analysis, by Country, 2016 & 2024

Figure 113: Europe Laminated Labels Market Value, Y-o-Y Growth (%), by Country, 2016–2024

Figure 114: Europe Laminated Labels Market Attractiveness Analysis, by Country, 2024

Figure 115: Germany Laminated Labels Market, Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 116: Spain Laminated Labels Market, Absolute $ Opportunity (US$ Mn), 2015–2024

Figure 117: Italy Laminated Labels Market, Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 118: France Laminated Labels Market, Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 119: The U.K. Laminated Labels Market, Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 120: BENELUX Laminated Labels Market, Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 121: Russia Laminated Labels Market, Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 122: Rest of Europe Laminated Labels Market, Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 123: Total Europe Laminated Labels Market, Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 124: Europe Laminated Labels Market Value (US$ Mn), by Material Type, 2014–2024

Figure 125: Europe Laminated Labels Market Volume (Mn Sq m), by Material Type, 2015–2024

Figure 126: Europe Laminated Labels Market Share and BPS Analysis, by Material Type, 2016 & 2024

Figure 127: Europe Laminated Labels Market, Y-o-Y Growth (%), by Material Type, 2015–2024

Figure 128: Europe Laminated Labels Market Attractiveness Analysis, by Material Type, 2016–2024

Figure 129: Europe Laminated Labels Market Value (US$ Mn), by End-use Industry, 2014–2024

Figure 130: Europe Laminated Labels Market Volume (million square meters), by End-use Industry, 2015–2024

Figure 131: Europe Laminated Labels Market Share and BPS Analysis, by End-use Industry, 2016 & 2024

Figure 132: Europe Laminated Labels Market, Y-o-Y Growth (%), by End-use Industry, 2015–2024

Figure 133: Europe Laminated Labels Market Attractiveness Analysis, by End-use Industry, 2016–2024

Figure 134: Europe Laminated Labels Market Value (US$ Mn), by Printing Ink, 2014–2024

Figure 135: Europe Laminated Labels Market Volume (million square meters), by Printing Ink, 2015–2024

Figure 136: Europe Laminated Labels Market Share and BPS Analysis, by Printing Ink, 2016 & 2024

Figure 137: Europe Laminated Labels Market, Y-o-Y Growth (%), by Printing Ink, 2015–2024

Figure 138: Europe Laminated Labels Market Attractiveness Analysis, by Printing Ink, 2016–2024

Figure 139: Europe Laminated Labels Market Value (US$ Mn), by Printing Technology, 2014–2024

Figure 140: Europe Laminated Labels Market Volume (million square meters), by printing Technology, 2014–2024

Figure 141: Europe Laminated Labels Market Share and BPS Analysis, by Printing Technology, 2016 & 2024

Figure 142: Europe Laminated Labels Market, Y-o-Y Growth (%), by Printing Technology, 2015–2024

Figure 143: Europe Laminated Labels Market Attractiveness Analysis, by Printing Technology, 2016–2024

Figure 144: Asia Pacific Laminated Labels Market Value Share, by Country, 2016 & 2024

Figure 145: Asia Pacific Laminated Labels Market Value Share, by Material Type, 2016 & 2024

Figure 146: Asia Pacific Laminated Labels Market Value Share, by Type of Ink, 2016 & 2024

Figure 147: Asia Pacific Laminated Labels Market Value Share, by

Figure 148: Asia Pacific Laminated Labels Market Value Share, by Printing Technology, 2016 & 2024

Figure 149: Asia Pacific Laminated Labels Market Value (US$ Mn) and Volume (Million Sq. m) Forecast, 2015–2024

Figure 150: Asia Pacific Laminated Labels Market Absolute $ Opportunity, 2016–2024 (US$ Mn)

Figure 151: Asia Pacific Laminated Labels Market Value BPS Analysis, by Country, 2016 & 2024

Figure 152: Asia Pacific Laminated Labels Market Value Y-o-Y Growth (%), by Country, 2016–2024

Figure 153: Asia Pacific Laminated Labels Market Attractiveness Index, by Country, 2016–2024

Figure 154: China Laminated Labels Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 155: India Laminated Labels Market Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 156: Japan Laminated Labels Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 157: ASEAN Laminated Labels Market Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 158: Australia and New Zealand Laminated Labels Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 159: Rest of APAC Laminated Labels Market Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 160: Total Asia Pacific Laminated Labels Market Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 161: Asia Pacific Laminated Labels Market Value (US$ Mn), by Material Type, 2014–2024

Figure 162: Asia Pacific Laminated Labels Market Volume

Figure 163: Asia Pacific Laminated Labels Market Share & BPS Analysis, by Material Type, 2016 & 2024

Figure 164: Asia Pacific Laminated Labels Market Y-o-Y Growth Rate, by Material Type, 2015–2024

Figure 165: Asia Pacific Laminated Labels Market Attractiveness Analysis, by Material Type, 2016–2024

Figure 166: Asia Pacific Laminated Labels Market Value (US$ Mn), by End-Use Industry, 2014–2024

Figure 167 Asia Pacific Laminated Labels Market Volume

Figure 168: Asia Pacific Laminated Labels Market Share & BPS Analysis, by End-Use Industry, 2016 & 2024

Figure 169: Asia Pacific Laminated Labels Market Y-o-Y Growth Rate, by End-Use Industry, 2015–2024

Figure 170: Asia Pacific Laminated Labels Market Attractiveness Analysis, by End-Use Industry, 2016–2024

Figure 171: Asia Pacific Laminated Labels Market Value (US$ Mn), by Printing Ink, 2014–2024

Figure 172: Asia Pacific Laminated Labels Market Volume

Figure 173: Asia Pacific Laminated Labels Market Share & BPS Analysis, by Printing Ink, 2016 & 2024

Figure 174: Asia Pacific Laminated Labels Market Y-o-Y Growth Rate, by Printing Ink, 2015–2024

Figure 175: Asia Pacific Laminated Labels Market Attractiveness Analysis, by Printing Ink, 2016–2024

Figure 176: Asia Pacific Laminated Labels Market Value (US$ Mn), by Printing Technology, 2014–2024

Figure 177: Asia Pacific Laminated Labels Market Volume

Figure 178: Asia Pacific Laminated Labels Market Share & BPS Analysis, by Printing Technology, 2016 & 2024

Figure 179: Asia Pacific Laminated Labels Market Y-o-Y Growth Rate, by Printing Technology, 2015–2024

Figure 180: Asia Pacific Laminated Labels Market Attractiveness Analysis, by Printing Technology, 2016–2024

Figure 181: MEA Laminated Labels Market Value Share, by Country, 2016 & 2024

Figure 182: MEA Laminated Labels Market Value Share, by Material Type, 2016 & 2024

Figure 183: MEA Laminated Labels Market Value Share, by Type of Ink, 2016 & 2024

Figure 184: MEA Laminated Labels Market Value Share, by End-Use Industry, 2016 & 2024

Figure 185: MEA Laminated Labels Market Value Share, by Printing Technology, 2016 & 2024

Figure 186: MEA Laminated Labels Market Value (US$ Mn) and Volume (million square meter) Forecast, 2015–2024

Figure 187: MEA Laminated Labels Market Absolute $ Opportunity, 2016–2024 (US$ Mn)

Figure 188: MEA Laminated Labels Market Value BPS Analysis, by Country, 2016 & 2024

Figure 189: MEA Laminated Labels Market Value Y-o-Y Growth (%), by Country, 2016–2024

Figure 190: MEA Laminated Labels Market Attractiveness Index, by Country, 2016–2024

Figure 191: North Africa Laminated Labels Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 192: South Africa Laminated Labels Market Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 193: GCC countries Laminated Labels Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 194: Rest of MEA Laminated Labels Market Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 195: Total Laminated Labels Market Absolute $ Opportunity, 2015–2024 (US$ Mn)

Figure 196: MEA Laminated Labels Market Value (US$ Mn), by Material Type, 2014–2024

Figure 197: MEA Laminated Labels Market Volume (million square meter), by Material Type, 2015–2024

Figure 198: MEA Laminated Labels Market Share & BPS Analysis, by Material Type, 2016 & 2024

Figure 199: MEA Laminated Labels Market

Figure 200: MEA Laminated Labels Market Attractiveness Analysis, by Material Type, 2016–2024

Figure 201: MEA Laminated Labels Market Value (US$ Mn), by End-Use Industry, 2014–2024

Figure 202: MEA Laminated Labels Market Volume (million square meter), by End-Use Industry, 2015–2024

Figure 203: MEA Laminated Labels Market Share & BPS Analysis, by End-Use Industry, 2016 & 2024

Figure 204: MEA Laminated Labels Market

Figure 205: MEA Laminated Labels Market Attractiveness Analysis, by End-Use Industry, 2016–2024

Figure 206: MEA Laminated Labels Market Value (US$ Mn), by Printing Ink, 2014–2024

Figure 207: MEA Laminated Labels Market Volume (million square meter), by Printing Ink, 2015–2024

Figure 208: MEA Laminated Labels Market Share & BPS Analysis, by Printing Ink, 2016 & 2024

Figure 209: MEA Laminated Labels Market

Figure 210: MEA Laminated Labels Market Attractiveness Analysis, by Printing Ink, 2016–2024

Figure 211: MEA Laminated Labels Market Value (US$ Mn), by Printing Technology, 2014–2024

Figure 212: MEA Laminated Labels Market Volume (million square meter), by Printing Technology, 2015–2024

Figure 213: MEA Laminated Labels Market Share & BPS Analysis, by Printing Technology, 2016 & 2024

Figure 214: MEA Laminated Labels Market

Figure 215: MEA Laminated Labels Market Attractiveness Analysis, by Printing Technology, 2016–2024