Chapter 1 Preface

1.1 Report Description

1.2 Market Segmentation

1.3 Research Scope and Assumptions

1.4 Research Methodology

Chapter 2 Executive Summary

2.1 Global Itaconic Acid Market, 2014 – 2023 (Tons) (US$ Mn)

2.1.1 Global Itaconic Acid Market Snapshot, 2014 & 2023

Chapter 3 Itaconic Acid – Industry Analysis

3.1 Introduction

3.2 Value Chain Analysis

3.3 Market Drivers

3.3.1 Increasing application of superabsorbent polymers (SAP) in several end-user industries to drive the itaconic acid market

3.3.1.1 Global Superabsorbent Polymer (SAP) Market, 2014 – 2023 (Kilo Tons)(US$ Mn)

3.3.2 Increasing demand for unsaturated polyester resins (UPR) to boost market growth

3.3.2.1 Global Maleic Anhydride Demand Share by Applications, 2014

3.3.3 Rising usage of itaconic acid in production of bio-based methyl methacrylate (MMA) to bolster market

3.3.3.1 Global Poly Methyl Methacrylate Demand Share by End-users, 2014

3.4 Market Restraints

3.4.1 Limited exploration of technology leads to high cost of production, thus impeding market growth

3.4.2 Narrow potential of itaconic acid as drop-in replacement in application industries hampers market growth

3.4.2.1 Potential Application of Itaconic Acid and their Derivatives

3.5 Market Opportunities

3.5.1 High growth opportunities for itaconic acid manufacturers in coatings and adhesives application

3.5.1.1 Global Adhesives Market, 2014 – 2023 (US$ Mn)

3.6 Porter’s Five Forces Analysis

3.6.1 Bargaining power of suppliers

3.6.2 Bargaining power of buyers

3.6.3 Threat of new entrants

3.6.4 Threat of substitutes

3.6.5 Degree of competition

3.7 Itaconic Acid: Market Attractiveness Analysis, by Applications

3.7.1 Itaconic Acid: Market Attractiveness Analysis, by Applications

3.8 Itaconic Acid Market: Company Market Share Analysis, 2014

Chapter 4 Manufacturing Process and Price Trend Analysis

4.1 Manufacturing Process

4.2 Price Trend Analysis

4.2.1 Price Trend Analysis, 2014 – 2023

4.2.1.1 Itaconic Acid Price Trend Analysis, 2014 – 2023 (US$/Tons)

Chapter 5 Itaconic Acid Market – Application Segment Analysis

5.1 Global Itaconic Acid Market: Application Segment Overview

5.1.1 Global Itaconic Acid Market Volume Share, by Application Segment, 2014 and 2023

5.2 Synthetic Latex

5.2.1.1 Global Itaconic Acid Market for Synthetic latex, 2014 – 2023 (Tons) (US$ Mn)

5.3 Unsaturated Polyester Resin (UPR)

5.3.1.1 Global Itaconic Acid Market for Unsaturated Polyster Resin, 2014 – 2023 (Tons) (US$ Mn)

5.4 Detergents

5.4.1.1 Global Itaconic Acid Market for Detergents, 2014 – 2023 (Tons) (US$ Mn)

5.5 Superabsorbent Polymers (SAP)

5.5.1.1 Global Itaconic Acid Market for Superabsorbent Polymers (SAP), 2014 – 2023 (Tons) (US$ Mn)

5.6 Others

5.6.1.1 Global Itaconic Acid Market for Others, 2014 – 2023 (Tons) (US$ Mn)

Chapter 6 Itaconic Acid Market – Regional Segment Analysis

6.1 Global Itaconic Acid Market: Regional Segment Overview

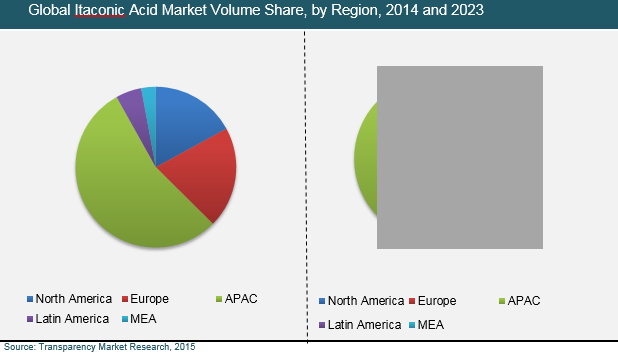

6.1.1 Global Itaconic Acid Market Volume Share By Region, 2014 And 2023

6.2 North America

6.2.1 North America Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.2.2 North America Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.2.3 U.S.

6.2.3.1 U.S. Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.2.3.2 U.S. Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.2.4 Rest of North America

6.2.4.1 Rest of North America Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.2.4.2 Rest of North America Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.3 Europe

6.3.1 Europe Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.3.2 Europe Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.3.3 France

6.3.3.1 France Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.3.3.2 France Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.3.4 U.K.

6.3.4.1 U.K. Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.3.4.2 U.K. Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.3.5 Spain

6.3.5.1 Spain Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.3.5.2 Spain Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.3.6 Germany

6.3.6.1 Germany Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.3.6.2 Germany Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.3.7 Italy

6.3.7.1 Italy Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.3.7.2 Italy Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.3.8 Rest of Europe

6.3.8.1 Rest of Europe Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.3.8.2 Rest of Europe Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.4 Asia Pacific

6.4.1 Asia Pacific Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.4.2 Asia Pacific Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.4.3 China

6.4.3.1 China Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.4.3.2 China Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.4.4 Japan

6.4.4.1 Japan Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.4.4.2 Japan Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.4.5 ASEAN

6.4.5.1 ASEAN Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.4.5.2 ASEAN Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.4.6 Rest of Asia Pacific

6.4.6.1 Rest of Asia Pacific Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.4.6.2 Rest of Asia Pacific Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.5 Latin America

6.5.1 Latin America Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.5.2 Latin America Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.5.3 Brazil

6.5.3.1 Brazil Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.5.3.2 Brazil Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.5.4 Rest of Latin America

6.5.4.1 Rest of Latin America Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.5.4.2 Rest of Latin America Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.6 Middle East and Africa

6.6.1 Middle East and Africa Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.6.2 Middle East and Africa Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.6.3 GCC

6.6.3.1 GCC Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.6.3.2 GCC Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.6.4 South Africa

6.6.4.1 South Africa Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.6.4.2 South Africa Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

6.6.5 Rest of Middle East and Africa

6.6.5.1 Rest of Middle East and Africa Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

6.6.5.2 Rest of Middle East and Africa Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

Chapter 7 Company Profiles

7.1 Itaconix Corporation

7.2 Chengdu Jinkai Biology Engineering Co., Ltd.

7.3 Shandong Qingdao Langyatai (Group) Co., Ltd.

7.4 Nanjing Huajin Biologicals Co., Ltd.

7.5 Ronas Chemicals Ind. Co., Ltd.

7.6 Shandong Kaison Biochemical Co., Ltd.

7.7 Spectrum Chemical Manufacturing Corp.

7.8 Zhejiang Guoguang Biochemistry Co., Ltd.

7.9 Alpha Chemika

Chapter 8 Primary Research – Key Findings

List of Tables

TABLE 1 Global Itaconic Acid Market Snapshot, 2014 & 2023

TABLE 2 Drivers for Itaconic Acid Market - Impact Analysis

TABLE 3 Restraints for Itaconic Acid Market - Impact Analysis

TABLE 4 Potential Application of Itaconic Acid and their Derivatives

TABLE 5 Itaconic Acid Price Trend Analysis, 2014 – 2023 (US$/Tons)

TABLE 1 North America Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 2 North America Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 3 U.S. Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 4 U.S. Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 5 Rest of North America Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 6 Rest of North America Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 7 Europe Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 8 Europe Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 9 France Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 10 France Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 11 U.K. Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 12 U.K. Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 13 Spain Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 14 Spain Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 15 Germany Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 16 Germany Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 17 Italy Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 18 Italy Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 19 Rest of Europe Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 20 Rest of Europe Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 21 Asia Pacific Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 22 Asia Pacific Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 23 China Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 24 China Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 25 Japan Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 26 Japan Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 27 ASEAN Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 28 ASEAN Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 29 Rest of Asia Pacific Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 30 Rest of Asia Pacific Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 31 Latin America Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 32 Latin America Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 33 Brazil Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 34 Brazil Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 35 Rest of Latin America Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 36 Rest of Latin America Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 37 Middle East and Africa Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 38 Middle East and Africa Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 39 GCC Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 40 GCC Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 41 South Africa Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 42 South Africa Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

TABLE 43 Rest of Middle East and Africa Itaconic Acid Market Volume, by Application Segment, 2014 - 2023 (Tons)

TABLE 44 Rest of Middle East and Africa Itaconic Acid Market Revenue, by Application Segment, 2014 - 2023 (US$ Mn)

List of Figures

FIG. 1 Global Itaconic Acid Market Segmentation, by Application and Geography

FIG. 2 Global Itaconic Acid Market, 2014 – 2023 (Tons) (US$ Mn)

FIG. 3 Value Chain Analysis: Itaconic Acid Market

FIG. 4 Global Superabsorbent Polymer (SAP) Market, 2014 – 2023 (Kilo Tons) (US$ Mn)

FIG. 5 Global Maleic Anhydride Demand Share by Applications, 2014

FIG. 6 Global Poly Methyl Methacrylate Demand Share by End-users, 2014

FIG. 7 Global Adhesives Market, 2014 – 2023 (US$ Mn)

FIG. 8 Porter’s Five Forces Analysis: Itaconic Acid Market

FIG. 9 Itaconic Acid: Market Attractiveness Analysis, by Applications

FIG. 10 Itaconic Acid Market: Company Market Share Analysis, 2014

FIG. 11 Global Itaconic Acid Market Volume Share, by Application Segment, 2014 and 2023

FIG. 12 Global Itaconic Acid Market for Synthetic latex, 2014 – 2023 (Tons) (US$ Mn)

FIG. 13 Global Itaconic Acid Market for Unsaturated Polyster Resin, 2014 – 2023 (Tons) (US$ Mn)

FIG. 14 Global Itaconic Acid Market for Detergents, 2014 – 2023 (Tons) (US$ Mn)

FIG. 15 Global Itaconic Acid Market for Superabsorbent Polymers (SAP), 2014 – 2023 (Tons) (US$ Mn)

FIG. 16 Global Itaconic Acid Market for Others, 2014 – 2023 (Tons) (US$ Mn)

FIG. 17 Global Itaconic Acid Volume Share, by Region, 2014 and 2023