Analysts’ Viewpoint

Surge in demand for smart and connected technologies such as sensor-based detection systems and infrared sensors is a key factor expected to propel the intelligent transportation system market size during the forecast period. Key participants in the market are focusing on offering a diverse product portfolio that is innovative, offers cutting-edge technology, and is cost effective. Most companies are spending significantly on comprehensive research & development activities, primarily to develop highly advanced products.

The surge in demand for military light utility vehicles, armored utility vehicles, sports utility vehicles (SUV), multi utility vehicles (MUV), and utility task vehicles is driving market progress. Furthermore, the rise in buying power of individuals and development of artificial intelligence across the globe are likely to offer lucrative opportunities for market expansion.

An intelligent transportation system (ITS) is an advanced technology which aims to provide innovative services relating to different modes of transport & traffic management, and enable users to be appropriately informed and make safer, more coordinated, and 'smarter' use of transport networks. In other words, Intelligent Transport System (ITS) is a system which allows communication & data transfer between road infrastructure, vehicles, travelers, and drivers. ITS uses computers, sensors, and electronics to improve safety and efficiency of the transport system.

ITS is used in car parking areas, toll booths, traffic lights, and bridges. It enables real time information and actively manages the traffic in public and private transportation sectors. ITS is a technology upgrade to the traditional transport system to improve traffic flow, safety, and achieve lower emission values.

The global intelligent transportation system market is projected to expand at a decent growth rate during the forecast period, owing to surge in adoption of personal and commercial vehicles, off-road vehicles, construction equipment, and industrial vehicles.

The world is undergoing the largest wave of urban growth in history. More than half of the world’s population now lives in towns and cities, and by 2030 this number is likely to touch 5 billion. If properly managed, urbanization may support sustainable growth by boosting productivity and encouraging the emergence of new concepts and innovations.

Advanced transportation management systems (ATMS) are being used on vehicles to control the traffic on the road and allow drivers to move hassle free. Intelligent transportation systems (ITS) are anticipated to eliminate the problem of traffic congestion, and reduce the road accidents ratio. ITS is made up of a number of subsystems, including Pedestrian Information and Communication Systems (PICS), Advanced Mobile Information Systems (AMIS), Driving Safety Support Systems (DSSS), Traffic Signal Prediction Systems (TSPS), and Public Transportation Priority Systems (PTPS).

IoT is the networking of physical items using embedded sensors, actuators, and other devices that may gather and communicate data about in-progress network activities. Transportation authorities can examine the data obtained from these devices to enhance the travelling experience, increase safety, decrease traffic and energy consumption, and enhance operational efficiency.

The intelligent transportation system market growth is likely to influence the optimization of the movement of people & goods, and improve public safety, economics, and the environment. The next generation of intelligent transportation systems are anticipated to work on automation of roadways, railways, and airways to transform passenger experiences, and reshape the way merchandise and cargo are tracked and delivered, creating substantial business opportunities for system integrators, independent software vendors (ISVs), service providers, and other solution providers. All these factors are likely to augment the intelligent transportation system industry value globally.

Additionally, new technologies are expected to drive intelligent transportation system market development due to increase in focus on enhancing the on-road driving experience as well as strengthening the transportation sector by integrating advanced technologies.

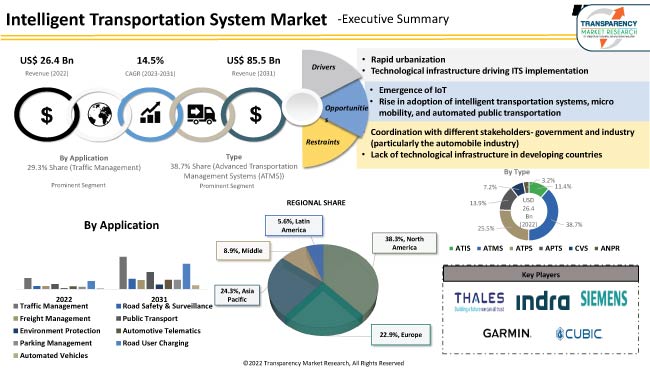

In 2022, based on type, the advanced transportation management system (ATMS) segment held major share in the intelligent transportation system market segmentation. ATMS has been rapidly adopted across transport corridors to detect traffic congestions, and accidents.

A more robust traffic signal communication needs to be implemented since the existing traffic control system is at the maturity phase of its lifecycle and needs replacement. ATMS maximizes the available capacity of the roadway network, minimizes the impact of roadway incidents, proactively manages traffic, assists in the provision of emergency services, and maintains public confidence in traffic management.

According to the intelligent transportation system market analysis, based on application, the traffic management segment held dominant share in 2022 and is expected to maintain its dominance during the forecast period.

Rise in traffic congestion is inevitable in large and growing metropolitan areas across the world. Peak-hour traffic congestion is an intrinsic result of the way modern societies operate. Emergence of autonomous vehicles require a smooth and advanced traffic management system, which is achievable with the help of intelligent transportation systems.

As per the latest intelligent transportation system market forecast, in terms of value, North America dominated the global landscape in 2022. The highly advanced road infrastructure and adoption of tech-enabled vehicles is driving the market dynamics in the region.

Asia Pacific and Europe also account for significant intelligent transportation system industry share. Advanced transportation management system (ATMS) is the leading segment in these regions.

Middle East & Africa is a large market for intelligent transportation systems as compared to Latin America; however, the market in Latin America is anticipated to expand at a higher growth rate owing to growth in the pre-owned vehicles market as well as presence of prominent players of the automotive industry in the region.

The global intelligent transportation system market is fairly consolidated with the largest players controlling a majority of the share. Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by major players.

Thales Group, Aeon Software, CUBIC CORPORATION, EFKON GMBH, eTrans Solutions, Garmin International Inc., GPS Allied, Iteris, Inc., KAPSCH TRAFFICCOM, Nuance Communications Incorporation, Sixth Sensor Technology, Telenav, Inc., Tom-Tom NV, Vbron Technologies, and WS Atkins PLC are the prominent entities operating in the market.

Key players have been profiled in the intelligent transportation system market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | USD 26.4 Bn |

| Market Forecast Value in 2031 | USD 85.5 Bn |

| Growth Rate (CAGR) | 14.5% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Billion for Value |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, industry trend analysis, etc. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 26.4 Bn in 2022

The CAGR is projected to be 14.5% from 2023 to 2031

It is expected to reach US$ 85.5 Bn by the end of 2031

Thales Group, Aeon Software, CUBIC CORPORATION, EFKON GMBH, eTrans Solutions, Garmin International Inc., GPS Allied, Iteris, Inc., KAPSCH TRAFFICCOM, Nuance Communications Incorporation, Sixth Sensor Technology, Telenav, Inc., Tom-Tom NV, Vbron Technologies, and WS Atkins PLC.

The U.S. is a prominent market for intelligent transportation systems

In terms of application, the traffic management segment accounts for largest share

North America is the most lucrative region and holds dominant market

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2023-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding the Buying Process of Customers

1.2.4. Preferred Sales & Marketing Strategy

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Definition / Scope / Limitations

2.2. Macroeconomic Factors

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. Impact Factors: Intelligent Transportation System

3.1. Emergence of Electric Vehicles

4. Global Intelligent Transportation System Market, By Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Type

4.2.1. Advanced Traveler Information System (ATIS)

4.2.2. Advanced Transportation Management System (ATMS)

4.2.3. Advanced Transportation Pricing System (ATPS)

4.2.4. Advanced Public Transportation System (APTS)

4.2.5. Cooperative Vehicle System (CVS)

4.2.6. Automatic Number Plate Recognition System (ANPR)

5. Global Intelligent Transportation System Market, By Application

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Application

5.2.1. Traffic Management

5.2.2. Road Safety & Surveillance

5.2.3. Freight Management

5.2.4. Public Transport

5.2.5. Environment Protection

5.2.6. Automotive Telematics

5.2.7. Parking Management

5.2.8. Road User Charging

5.2.9. Automated Vehicles

5.3. Global Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East & Africa

5.3.5. Latin America

6. North America Intelligent Transportation System Market

6.1. Market Snapshot

6.2. North America Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Type

6.2.1. Advanced Traveler Information System (ATIS)

6.2.2. Advanced Transportation Management System(ATMS)

6.2.3. Advanced Transportation Pricing System (ATPS)

6.2.4. Advanced Public Transportation System (APTS)

6.2.5. Cooperative Vehicle System (CVS)

6.2.6. Automatic Number Plate Recognition System (ANPR)

6.3. North America Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Application

6.3.1. Traffic Management

6.3.2. Road Safety & Surveillance

6.3.3. Freight Management

6.3.4. Public Transport

6.3.5. Environment Protection

6.3.6. Automotive Telematics

6.3.7. Parking Management

6.3.8. Road User Charging

6.3.9. Automated Vehicles

6.4. Key Country Analysis – North America Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031

6.4.1. U.S.

6.4.2. Canada

6.4.3. Mexico

7. Europe Intelligent Transportation System Market

7.1. Market Snapshot

7.2. Europe Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Type

7.2.1. Advanced Traveler Information System (ATIS)

7.2.2. Advanced Transportation Management System(ATMS)

7.2.3. Advanced Transportation Pricing System (ATPS)

7.2.4. Advanced Public Transportation System (APTS)

7.2.5. Cooperative Vehicle System (CVS)

7.2.6. Automatic Number Plate Recognition System (ANPR)

7.3. Europe Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Application

7.3.1. Traffic Management

7.3.2. Road Safety & Surveillance

7.3.3. Freight Management

7.3.4. Public Transport

7.3.5. Environment Protection

7.3.6. Automotive Telematics

7.3.7. Parking Management

7.3.8. Road User Charging

7.3.9. Automated Vehicles

7.4. Key Country Analysis – Europe Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031

7.4.1. Germany

7.4.2. U. K.

7.4.3. France

7.4.4. Italy

7.4.5. Spain

7.4.6. Nordic Countries

7.4.7. Russia & CIS

7.4.8. Rest of Europe

8. Asia Pacific Intelligent Transportation System Market

8.1. Market Snapshot

8.2. Asia Pacific Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Type

8.2.1. Advanced Traveler Information System (ATIS)

8.2.2. Advanced Transportation Management System(ATMS)

8.2.3. Advanced Transportation Pricing System (ATPS)

8.2.4. Advanced Public Transportation System (APTS)

8.2.5. Cooperative Vehicle System (CVS)

8.2.6. Automatic Number Plate Recognition System (ANPR)

8.3. Asia Pacific Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Application

8.3.1. Traffic Management

8.3.2. Road Safety & Surveillance

8.3.3. Freight Management

8.3.4. Public Transport

8.3.5. Environment Protection

8.3.6. Automotive Telematics

8.3.7. Parking Management

8.3.8. Road User Charging

8.3.9. Automated Vehicles

8.4. Key Country Analysis – Asia Pacific Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031

8.4.1. China

8.4.2. India

8.4.3. Japan

8.4.4. ASEAN Countries

8.4.5. South Korea

8.4.6. ANZ

8.4.7. Rest of Asia Pacific

9. Middle East & Africa Intelligent Transportation System Market

9.1. Market Snapshot

9.2. Middle East & Africa Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Type

9.2.1. Advanced Traveler Information System (ATIS)

9.2.2. Advanced Transportation Management System(ATMS)

9.2.3. Advanced Transportation Pricing System (ATPS)

9.2.4. Advanced Public Transportation System (APTS)

9.2.5. Cooperative Vehicle System (CVS)

9.2.6. Automatic Number Plate Recognition System (ANPR)

9.3. Middle East & Africa Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Application

9.3.1. Traffic Management

9.3.2. Road Safety & Surveillance

9.3.3. Freight Management

9.3.4. Public Transport

9.3.5. Environment Protection

9.3.6. Automotive Telematics

9.3.7. Parking Management

9.3.8. Road User Charging

9.3.9. Automated Vehicles

9.4. Key Country Analysis – Middle East & Africa Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031

9.4.1. GCC

9.4.2. South Africa

9.4.3. Turkey

9.4.4. Rest of Middle East & Africa

10. Latin America Intelligent Transportation System Market

10.1. Market Snapshot

10.2. Latin America Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Type

10.2.1. Advanced Traveler Information System (ATIS)

10.2.2. Advanced Transportation Management System(ATMS)

10.2.3. Advanced Transportation Pricing System (ATPS)

10.2.4. Advanced Public Transportation System (APTS)

10.2.5. Cooperative Vehicle System (CVS)

10.2.6. Automatic Number Plate Recognition System (ANPR)

10.3. Latin America Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031, By Application

10.3.1. Traffic Management

10.3.2. Road Safety & Surveillance

10.3.3. Freight Management

10.3.4. Public Transport

10.3.5. Environment Protection

10.3.6. Automotive Telematics

10.3.7. Parking Management

10.3.8. Road User Charging

10.3.9. Automated Vehicles

10.4. Key Country Analysis – Latin America Intelligent Transportation System Market Size Analysis & Forecast, 2023-2031

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of Latin America

11. Competitive Landscape

11.1. Company Share Analysis/ Brand Share Analysis, 2022

11.2. Company Analysis for each player

12. Company Profile/ Key Players

12.1. Aarya ITES

12.1.1. Company Overview

12.1.2. Company Footprints

12.1.3. Product Portfolio

12.1.4. Competitors & Customers

12.1.5. Subsidiaries & Parent Organization

12.1.6. Recent Developments

12.1.7. Financial Analysis

12.2. Aeon Software

12.2.1. Company Overview

12.2.2. Company Footprints

12.2.3. Product Portfolio

12.2.4. Competitors & Customers

12.2.5. Subsidiaries & Parent Organization

12.2.6. Recent Developments

12.2.7. Financial Analysis

12.3. AGMA Technologies

12.3.1. Company Overview

12.3.2. Company Footprints

12.3.3. Product Portfolio

12.3.4. Competitors & Customers

12.3.5. Subsidiaries & Parent Organization

12.3.6. Recent Developments

12.3.7. Financial Analysis

12.4. AllGoVision Technologies

12.4.1. Company Overview

12.4.2. Company Footprints

12.4.3. Product Portfolio

12.4.4. Competitors & Customers

12.4.5. Subsidiaries & Parent Organization

12.4.6. Recent Developments

12.4.7. Financial Analysis

12.5. ATT Group

12.5.1. Company Overview

12.5.2. Company Footprints

12.5.3. Product Portfolio

12.5.4. Competitors & Customers

12.5.5. Subsidiaries & Parent Organization

12.5.6. Recent Developments

12.5.7. Financial Analysis

12.6. AUM Infotech

12.6.1. Company Overview

12.6.2. Company Footprints

12.6.3. Product Portfolio

12.6.4. Competitors & Customers

12.6.5. Subsidiaries & Parent Organization

12.6.6. Recent Developments

12.6.7. Financial Analysis

12.7. CELLINT

12.7.1. Company Overview

12.7.2. Company Footprints

12.7.3. Product Portfolio

12.7.4. Competitors & Customers

12.7.5. Subsidiaries & Parent Organization

12.7.6. Recent Developments

12.7.7. Financial Analysis

12.8. CUBIC CORPORATION

12.8.1. Company Overview

12.8.2. Company Footprints

12.8.3. Product Portfolio

12.8.4. Competitors & Customers

12.8.5. Subsidiaries & Parent Organization

12.8.6. Recent Developments

12.8.7. Financial Analysis

12.9. Cyrrup

12.9.1. Company Overview

12.9.2. Company Footprints

12.9.3. Product Portfolio

12.9.4. Competitors & Customers

12.9.5. Subsidiaries & Parent Organization

12.9.6. Recent Developments

12.9.7. Financial Analysis

12.10. EFKON GMBH

12.10.1. Company Overview

12.10.2. Company Footprints

12.10.3. Product Portfolio

12.10.4. Competitors & Customers

12.10.5. Subsidiaries & Parent Organization

12.10.6. Recent Developments

12.10.7. Financial Analysis

12.11. eTrans Solutions

12.11.1. Company Overview

12.11.2. Company Footprints

12.11.3. Product Portfolio

12.11.4. Competitors & Customers

12.11.5. Subsidiaries & Parent Organization

12.11.6. Recent Developments

12.11.7. Financial Analysis

12.12. Garmin International Inc.

12.12.1. Company Overview

12.12.2. Company Footprints

12.12.3. Product Portfolio

12.12.4. Competitors & Customers

12.12.5. Subsidiaries & Parent Organization

12.12.6. Recent Developments

12.12.7. Financial Analysis

12.13. GPS Allied

12.13.1. Company Overview

12.13.2. Company Footprints

12.13.3. Product Portfolio

12.13.4. Competitors & Customers

12.13.5. Subsidiaries & Parent Organization

12.13.6. Recent Developments

12.13.7. Financial Analysis

12.14. INDRA SISTEMAS, S.A.

12.14.1. Company Overview

12.14.2. Company Footprints

12.14.3. Product Portfolio

12.14.4. Competitors & Customers

12.14.5. Subsidiaries & Parent Organization

12.14.6. Recent Developments

12.14.7. Financial Analysis

12.15. Iteris, Inc.

12.15.1. Company Overview

12.15.2. Company Footprints

12.15.3. Product Portfolio

12.15.4. Competitors & Customers

12.15.5. Subsidiaries & Parent Organization

12.15.6. Recent Developments

12.15.7. Financial Analysis

12.16. KAPSCH TRAFFICCOM

12.16.1. Company Overview

12.16.2. Company Footprints

12.16.3. Product Portfolio

12.16.4. Competitors & Customers

12.16.5. Subsidiaries & Parent Organization

12.16.6. Recent Developments

12.16.7. Financial Analysis

12.17. LANNER ELECTRONICS

12.17.1. Company Overview

12.17.2. Company Footprints

12.17.3. Product Portfolio

12.17.4. Competitors & Customers

12.17.5. Subsidiaries & Parent Organization

12.17.6. Recent Developments

12.17.7. Financial Analysis

12.18. Nuance Communications Incorporation

12.18.1. Company Overview

12.18.2. Company Footprints

12.18.3. Product Portfolio

12.18.4. Competitors & Customers

12.18.5. Subsidiaries & Parent Organization

12.18.6. Recent Developments

12.18.7. Financial Analysis

12.19. RICARDO

12.19.1. Company Overview

12.19.2. Company Footprints

12.19.3. Product Portfolio

12.19.4. Competitors & Customers

12.19.5. Subsidiaries & Parent Organization

12.19.6. Recent Developments

12.19.7. Financial Analysis

12.20. Sixth Sensor Technology

12.20.1. Company Overview

12.20.2. Company Footprints

12.20.3. Product Portfolio

12.20.4. Competitors & Customers

12.20.5. Subsidiaries & Parent Organization

12.20.6. Recent Developments

12.20.7. Financial Analysis

12.21. TELEGRA

12.21.1. Company Overview

12.21.2. Company Footprints

12.21.3. Product Portfolio

12.21.4. Competitors & Customers

12.21.5. Subsidiaries & Parent Organization

12.21.6. Recent Developments

12.21.7. Financial Analysis

12.22. Telenav, Inc.

12.22.1. Company Overview

12.22.2. Company Footprints

12.22.3. Product Portfolio

12.22.4. Competitors & Customers

12.22.5. Subsidiaries & Parent Organization

12.22.6. Recent Developments

12.22.7. Financial Analysis

12.23. Thales Group

12.23.1. Company Overview

12.23.2. Company Footprints

12.23.3. Product Portfolio

12.23.4. Competitors & Customers

12.23.5. Subsidiaries & Parent Organization

12.23.6. Recent Developments

12.23.7. Financial Analysis

12.24. TomTom NV

12.24.1. Company Overview

12.24.2. Company Footprints

12.24.3. Product Portfolio

12.24.4. Competitors & Customers

12.24.5. Subsidiaries & Parent Organization

12.24.6. Recent Developments

12.24.7. Financial Analysis

12.25. Vbron Technologies

12.25.1. Company Overview

12.25.2. Company Footprints

12.25.3. Product Portfolio

12.25.4. Competitors & Customers

12.25.5. Subsidiaries & Parent Organization

12.25.6. Recent Developments

12.25.7. Financial Analysis

12.26. WS Atkins PLC

12.26.1. Company Overview

12.26.2. Company Footprints

12.26.3. Product Portfolio

12.26.4. Competitors & Customers

12.26.5. Subsidiaries & Parent Organization

12.26.6. Recent Developments

12.26.7. Financial Analysis

12.27. Other Key Players

12.27.1. Company Overview

12.27.2. Company Footprints

12.27.3. Product Portfolio

12.27.4. Competitors & Customers

12.27.5. Subsidiaries & Parent Organization

12.27.6. Recent Developments

12.27.7. Financial Analysis

List of Tables

Table 01: Global Intelligent Transportation System Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 02: Global Intelligent Transportation System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 03: Global Intelligent Transportation System Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 04: North America Intelligent Transportation System Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 05: North America Intelligent Transportation System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 06: North America Intelligent Transportation System Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 07: Europe Intelligent Transportation System Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 08: Europe Intelligent Transportation System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 09: Europe Intelligent Transportation System Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 10: Asia Pacific Intelligent Transportation System Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 11: Asia Pacific Intelligent Transportation System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 12: Asia Pacific Intelligent Transportation System Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 13: Middle East & Africa Intelligent Transportation System Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 14: Middle East & Africa Intelligent Transportation System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 15: Middle East & Africa Intelligent Transportation System Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 16: Latin America Intelligent Transportation System Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 17: Latin America Intelligent Transportation System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 18: Latin America Intelligent Transportation System Market Value (US$ Bn) Forecast, by Region, 2023-2031

List of Figures

Figure 01: Global Intelligent Transportation System Market Value (US$ Bn) Forecast, by Type, 2023-2031

Figure 02: Global Intelligent Transportation System Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023‒2031

Figure 03: Global Intelligent Transportation System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Figure 04: Global Intelligent Transportation System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023‒2031

Figure 05: Global Intelligent Transportation System Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 06: Global Intelligent Transportation System Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023‒2031

Figure 07: North America Intelligent Transportation System Market Value (US$ Bn) Forecast, by Type, 2023-2031

Figure 08: North America Intelligent Transportation System Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023‒2031

Figure 09: North America Intelligent Transportation System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Figure 10: North America Intelligent Transportation System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023‒2031

Figure 11: North America Intelligent Transportation System Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 12: North America Intelligent Transportation System Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023‒2031

Figure 13: Europe Intelligent Transportation System Market Value (US$ Bn) Forecast, by Type, 2023-2031

Figure 14: Europe Intelligent Transportation System Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023‒2031

Figure 15: Europe Intelligent Transportation System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Figure 16: Europe Intelligent Transportation System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023‒2031

Figure 17: Europe Intelligent Transportation System Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 18: Europe Intelligent Transportation System Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023‒2031

Figure 19: Asia Pacific Intelligent Transportation System Market Value (US$ Bn) Forecast, by Type, 2023-2031

Figure 20: Asia Pacific Intelligent Transportation System Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023‒2031

Figure 21: Asia Pacific Intelligent Transportation System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Figure 22: Asia Pacific Intelligent Transportation System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023‒2031

Figure 23: Asia Pacific Intelligent Transportation System Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 24: Asia Pacific Intelligent Transportation System Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023‒2031

Figure 25: Middle East & Africa Intelligent Transportation System Market Value (US$ Bn) Forecast, by Type, 2023-2031

Figure 26: Middle East & Africa Intelligent Transportation System Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023‒2031

Figure 27: Middle East & Africa Intelligent Transportation System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Figure 28: Middle East & Africa Intelligent Transportation System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023‒2031

Figure 29: Middle East & Africa Intelligent Transportation System Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 30: Middle East & Africa Intelligent Transportation System Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023‒2031

Figure 31: Latin America Intelligent Transportation System Market Value (US$ Bn) Forecast, by Type, 2023-2031

Figure 32: Latin America Intelligent Transportation System Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023‒2031

Figure 33: Latin America Intelligent Transportation System Market Value (US$ Bn) Forecast, by Application, 2023-2031

Figure 34: Latin America Intelligent Transportation System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023‒2031

Figure 35: Latin America Intelligent Transportation System Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 36: Latin America Intelligent Transportation System Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023‒2031