Reports

Reports

Industrial packaging refers to the process of storing, shipping, and protecting a wide range of goods. Industrial packaging is utilized in the site of production, just straight after the production process. However, this packaging solution can be utilized at any point of time along the supply chain. The growth of the global industrial packaging market is estimated to be driven by its extensive use in the packaging of sensitive products or bulky or hazardous products.

Several end use industries such as machinery manufacturers, technology industry, automotive industry, and manufacturers of highly sensitive equipment manufactures often utilize this type of packaging. Such wide use is estimated to bolster growth of the global industrial packaging market in the years to come. This type of packaging is used in providing protection of products from vibrations to moisture.

This type of packaging makes abundant use of plastics. Different types of plastic that are used in industrial packaging are mentioned as below

Increased demand of this type of packaging in food and beverage, oil and gas, chemical and pharmaceutical, agriculture, and electronics industry is estimated to amplify growth of the global industrial packaging market in the years to come.

Industrial packaging is packaging for the manufacturers, for the big producers in businesses. Sometimes, standard packaging isn’t enough for the product, and need more protection to makes sure product stays safe, lasts longer, and makes it to the customer in the right condition.

Standard wraps and papers can’t protect from the harsh conditions, long shelf times, and environmental damage that industry products face, so having the right protection for the products is essential to maintaining quality and consistency. There are many different types of industrial packaging wraps, papers, fluids, and sprays.

Rising globalization and international trade are supporting the industry growth. Growing commercial industries such as chemical, pharmaceutical, construction, and electronics sector further propels the demand. The developed economies are the highest producers and consumers of these products. Whereas increasing demand in emerging economies will further drive the industry growth.

The market for industrial packaging is growing due to increasing trends in end-use industries. The market growth due to increasing trend in the chemical industry output combined with the increasing healthcare needs of drugs and medicines for the aging U.S. population, coupled with continuing innovations in drug development. The global industrial packaging market had reached to reach US$53.03 bn by the end of 2016.

The industrial packaging market segments the product into drums, intermediate bulk container (IBC), crates, sacks, pails, tubes, and bulk boxes. IBCs are the leading packaging type in terms of popularity. Plastic sacks are replacing paper & jute sacks owing to its benefits such as low cost, lightweight, durability etc.

The industry segments the material into metal, plastic, paper and wood, and fiber. The plastic material segment is the most preferred type by the manufacturers owing to its various properties such as cost effective than other materials, can be molded in to specific shape and size, and durability.

By type, the industry segments as rigid and flexible packing. Flexible segment includes paper & plastic whereas rigid sub-segment includes wooden, metal, and plastic. Increased use of polyethylene terephthalate (PET) in place of heavy metal cans will influence positively on the market. The flexible segment, plastic has a higher growth rate owing to technological advancements.

By end use or application, industrial packaging market cater to various industries such as agriculture & horticulture, building & construction, automotive, chemicals & pharmaceuticals, food & beverage, engineering, metal products, plastic & rubber, electronics, and furniture. Of these, flexible packaging is expected to gain tremendous popularity over the coming years, due to the improvements in flexible packaging in terms of toughness and spatial minimization.

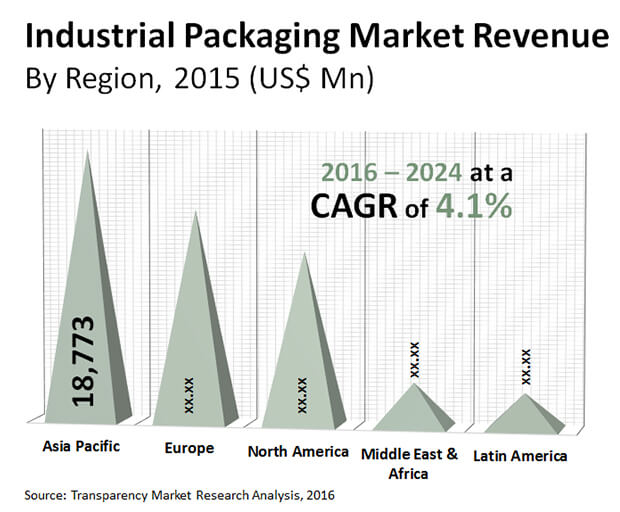

Geographically, the global industrial packaging market is classified as North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa. The rise in the demand for the industrial packaging from the industry is the main factors that are boosting the global market in Asia Pacific region. Use of advanced technology in the production of the industrial packaging has boosted the global market in North America. Europe, Latin America, and Middle East and Africa are likely to witness a slow growth in the global market.

Some of the key players in the global market for industrial packaging are Smurfit Kappa Group, Sonoco, Nefab Group, International Paper, Grief Inc., and Sealed Air Corporation, AmeriGlobe, Tekni Films Inc., and B.A.G. Corp among others

1. Executive Summary

2. Research Methodology

3. Assumptions & Acronyms Used

4. Taxonomy

5. Market Overview

5.1. Industrial Packaging Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Winning Imperative

5.1.4. Opportunities

5.2. Value and Supply Chain Analysis

5.3. Product - Cost Structure Analysis

5.3.1. Direct Cost

5.3.2. Indirect Cost

5.3.3. Regional Cost Structure Benchmarking

5.4. Location Analysis

5.4.1. Top Producing Countries

5.4.2. Top Consuming Countries

5.4.3. Shift of Supply Locations in Near Term

5.5. Industrial Packaging Market Forecast, 2016-2024

5.5.1. Industrial Packaging Market Size (Value) Forecast

5.5.1.1. Global Value and Volume

5.5.1.2. Absolute $ Opportunity

5.6. Industrial Packaging Market Analysis By Region

5.7. Industrial Packaging Market Share Snapshot (2016)

5.7.1. Market Share By Material Type

5.7.2. Market Share By Product Type

5.7.3. Market Share By Packaging Type

5.7.4. Market Share By End Use

5.7.5. Market Share By Region

6. Industrial Packaging Market Analysis, By Material Type

6.1. Introduction

6.1.1. Y-o-Y Growth Comparison, By Material Type

6.1.2. Basis Point Share (BPS) Analysis, By Material Type

6.1.3. Comparative Analysis, By Material Type

6.2. Industrial Packaging Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

6.2.1. Metal

6.2.2. Plastic

6.2.3. Paper & Wood

6.2.4. Fiber

6.3. Industrial Packaging Market Attractiveness Analysis, By Material Type

6.4. Prominent Trends

7. Industrial Packaging Market Analysis, Product Type

7.1. Introduction

7.1.1. Y-o-Y Growth Comparison, Product Type

7.1.2. Basis Point Share (BPS) Analysis, Product Type

7.1.3. Comparative Analysis, Product Type

7.2. Industrial Packaging Market Size (US$ Mn) and Volume (Units) Forecast Product Type

7.2.1. Drums

7.2.2. IBCs

7.2.3. Sacks

7.2.4. Pails

7.2.5. Crates

7.2.6. Bulk Boxes

7.2.7. Other

7.3. Industrial Packaging Market Attractiveness Analysis, Product Type

7.4. Prominent Trends

8. Industrial Packaging Market Analysis, By Packaging Type

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison, By Packaging Type

8.1.2. Market Share and BPS Analysis, By Packaging Type

8.1.3. Comparative Analysis, By Packaging Type

8.2. Industrial Packaging Market Size (US$ Mn) and Volume (Units) Forecast By Packaging Type

8.2.1. Rigid

8.2.2. Flexible

8.3. Industrial Packaging Market Attractiveness Analysis, By Packaging Type

8.4. Prominent Trends

9. Industrial Packaging Market Analysis, By End Use

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison, By End Use

9.1.2. Market Share and BPS Analysis, By End Use

9.1.3. Comparative Analysis, By End Use

9.2. Industrial Packaging Market Size (US$ Mn) and Volume (Units) Forecast By End Use

9.2.1. Agriculture And Horticulture

9.2.2. Automotive

9.2.3. Building & Construction

9.2.4. Chemicals And Pharmaceuticals

9.2.5. Engineering

9.2.6. Food & Beverages

9.2.7. Metal Products

9.2.8. Oil & Lubricants

9.2.9. Plastics And Rubber

9.2.10. Electronics

9.2.11. Tobacco

9.2.12. Other

9.3. Industrial Packaging Market Attractiveness Analysis, By End Use

9.4. Prominent Trends

10. Industrial Packaging Market Analysis, By Region

10.1. Introduction

10.1.1. Y-o-Y Growth Projections, By Region

10.1.2. Basis Point Share (BPS) Analysis, By Region

10.2. Industrial Packaging Market Forecast By Region

10.2.1. North America Market Value Forecast

10.2.2. Latin America Market Value Forecast

10.2.3. Asia Pacific excluding Japan Market Value Forecast

10.2.4. Europe Market Value Forecast

10.2.5. Middle East & Africa Market Value Forecast

10.3. Regional Attractiveness Analysis

10.4. Prominent Trend

10.5. Drivers and Restraints: Impact Analysis

11. North America Industrial Packaging Market Analysis

11.1. Introduction

11.1.1. Y-o-Y Growth Projections, By Country

11.1.2. Basis Point Share (BPS) Analysis, By Country

11.1.3. Key Trends

11.2. North America Industrial Packaging Market Size (US$ Mn) and Volume (Units) Forecast

11.2.1. Market Size and Volume Forecast By Country

11.2.1.1. U.S. Absolute $ Opportunity

11.2.1.2. Canada Absolute $ Opportunity

11.2.2. Market Size and Volume Forecast By Material Type

11.2.2.1. Metal

11.2.2.2. Plastic

11.2.2.3. Paper & Wood

11.2.2.4. Fiber

11.2.3. Market Size and Volume Forecast Product Type

11.2.3.1. Drums

11.2.3.2. IBCs

11.2.3.3. Sacks

11.2.3.4. Pails

11.2.3.5. Crates

11.2.3.6. Bulk Boxes

11.2.3.7. Other

11.2.4. Market Size and Volume Forecast By Packaging Type

11.2.4.1. Rigid

11.2.4.2. Flexible

11.2.5. Market Size and Volume Forecast By End Use

11.2.5.1. Agriculture And Horticulture

11.2.5.2. Automotive

11.2.5.3. Building & Construction

11.2.5.4. Chemicals And Pharmaceuticals

11.2.5.5. Engineering

11.2.5.6. Food & Beverages

11.2.5.7. Metal Products

11.2.5.8. Oil & Lubricants

11.2.5.9. Plastics And Rubber

11.2.5.10. Electronics

11.2.5.11. Tobacco

11.2.5.12. Other

11.2.6. Industrial Packaging Market Attractiveness Analysis

11.2.6.1. By Material Type

11.2.6.2. By Product Type

11.2.6.3. By Packaging Type

11.2.6.4. By End Use

11.2.6.5. By Country

11.2.7. Drivers & Restraints: Impact Analysis

12. Latin America Industrial Packaging Market Analysis

12.1. Introduction

12.1.1 Y-o-Y Growth Projections, By Country

12.1.2 Basis Point Share (BPS) Analysis, By Country

12.1.3 Key Trends

12.2 Latin America Industrial Packaging Market Size (US$ Mn) and Volume (Units) Forecast

12.2.1 Market Size and Volume Forecast By Country

12.2.1.1 Mexico Absolute $ Opportunity

12.2.1.2 Brazil Absolute $ Opportunity

12.2.1.3 Argentina Absolute $ Opportunity

12.2.1.4 Rest of LATAM Absolute $ Opportunity

12.2.2 Market Size and Volume Forecast By Material Type

12.2.2.1 Metal

12.2.2.2 Plastic

12.2.2.3 Paper & Wood

12.2.2.4 Fiber

12.2.3 Market Size and Volume Forecast Product Type

12.2.3.1 Drums

12.2.3.2 IBCs

12.2.3.3 Sacks

12.2.3.4 Pails

12.2.3.5 Crates

12.2.3.6 Bulk Boxes

12.2.3.7 Other

12.2.4 Market Size and Volume Forecast By Packaging Type

12.2.4.1 Rigid

12.2.4.2 Flexible

12.2.5 Market Size and Volume Forecast By End Use

12.2.5.1 Agriculture And Horticulture

12.2.5.2 Automotive

12.2.5.3 Building & Construction

12.2.5.4 Chemicals And Pharmaceuticals

12.2.5.5 Engineering

12.2.5.6 Food & Beverages

12.2.5.7 Metal Products

12.2.5.8 Oil & Lubricants

12.2.5.9 Plastics And Rubber

12.2.5.10 Electronics

12.2.5.11 Tobacco

12.2.5.12 Other

11.2.6 Industrial Packaging Market Attractiveness Analysis

11.2.6.1 By Material Type

11.2.6.2 By Product Type

11.2.6.3 By Packaging Type

11.2.6.4 By End Use

11.2.6.5 By Country

11.2.7 Drivers & Restraints: Impact Analysis

13 APAC excluding Japan (APEJ) Industrial Packaging Market Analysis

13.1 Introduction

13.1.1 Y-o-Y Growth Projections, By Country

13.1.2 Basis Point Share (BPS) Analysis, By Country

13.1.3 Key Trends

13.2 APEJ Industrial Packaging Market Size (US$ Mn) and Volume (Units) Forecast

13.2.1 Market Size and Volume Forecast By Country/Region

13.2.1.1 China Absolute $ Opportunity

13.2.1.2 India Absolute $ Opportunity

13.2.1.3 ASEAN Absolute $ Opportunity

13.2.1.4 ANZ Absolute $ Opportunity

13.2.1.5 Rest of Asia Pacific Absolute $ Opportunity

13.2.2 Market Size and Volume Forecast By Material Type

13.2.2.1 Metal

13.2.2.2 Plastic

13.2.2.3 Paper & Wood

13.2.2.4 Fiber

13.2.3 Market Size and Volume Forecast Product Type

13.2.3.1 Drums

13.2.3.2 IBCs

13.2.3.3 Sacks

13.2.3.4 Pails

13.2.3.5 Crates

13.2.3.6 Bulk Boxes

13.2.3.7 Other

13.2.4 Market Size and Volume Forecast By Packaging Type

13.2.4.1 Rigid

13.2.4.2 Flexible

13.2.5 Market Size and Volume Forecast By End Use

13.2.5.1 Agriculture And Horticulture

13.2.5.2 Automotive

13.2.5.3 Building & Construction

13.2.5.4 Chemicals And Pharmaceuticals

13.2.5.5 Engineering

13.2.5.6 Food & Beverages

13.2.5.7 Metal Products

13.2.5.8 Oil & Lubricants

13.2.5.9 Plastics And Rubber

13.2.5.10 Electronics

13.2.5.11 Tobacco

13.2.5.12 Other

13.2.6 Industrial Packaging Market Attractiveness Analysis

13.2.6.1 By Material Type

13.2.6.2 By Product Type

13.2.6.3 By Packaging Type

13.2.6.4 By End Use

13.2.6.5 By Country

13.2.7 Drivers & Restraints: Impact Analysis

14 Europe Industrial Packaging Market Analysis

14.1 Introduction

14.1.1 Y-o-Y Growth Projections, By Country

14.1.2 Basis Point Share (BPS) Analysis, By Country

14.1.3 Key Trends

14.2 Europe Industrial Packaging Market Size (US$ Mn) and Volume (Units) Forecast

14.2.1 Market Size and Volume Forecast By Country/Region

14.2.1.1 Germany Absolute $ Opportunity

14.2.1.2 Spain Absolute $ Opportunity

14.2.1.3 Italy Absolute $ Opportunity

14.2.1.4 France Absolute $ Opportunity

14.2.1.5 U.K Absolute $ Opportunity

14.2.1.6 BENELUX Absolute $ Opportunity

14.2.1.7 Nordic Countries Absolute $ Opportunity

14.2.1.8 Russia Absolute $ Opportunity

14.2.1.9 Rest of Europe Absolute $ Opportunity

14.2.2 Market Size and Volume Forecast By Material Type

14.2.2.1 Metal

14.2.2.2 Plastic

14.2.2.3 Paper & Wood

14.2.2.4 Fiber

14.2.3 Market Size and Volume Forecast Product Type

14.2.3.1 Drums

14.2.3.2 IBCs

14.2.3.3 Sacks

14.2.3.4 Pails

14.2.3.5 Crates

14.2.3.6 Bulk Boxes

14.2.3.7 Other

14.2.4 Market Size and Volume Forecast By Packaging Type

14.2.4.1 Rigid

14.2.4.2 Flexible

14.2.5 Market Size and Volume Forecast By End Use

14.2.5.1 Agriculture And Horticulture

14.2.5.2 Automotive

14.2.5.3 Building & Construction

14.2.5.4 Chemicals And Pharmaceuticals

14.2.5.5 Engineering

14.2.5.6 Food & Beverages

14.2.5.7 Metal Products

14.2.5.8 Oil & Lubricants

14.2.5.9 Plastics And Rubber

14.2.5.10 Electronics

14.2.5.11 Tobacco

14.2.5.12 Other

14.2.6 Industrial Packaging Market Attractiveness Analysis

14.2.6.1 By Material Type

14.2.6.2 By Product Type

14.2.6.3 By Packaging Type

14.2.6.4 By End Use

14.2.6.5 By Country

14.2.7 Drivers & Restraints: Impact Analysis

15 Middle East & Africa Industrial Packaging Market Analysis

15.1 Introduction

15.1.1 Y-o-Y Growth Projections, By Country

15.1.2 Basis Point Share (BPS) Analysis, By Country

15.1.3 Key Trends

15.2 MEA Industrial Packaging Market Size (US$ Mn) and Volume (Units) Forecast

15.2.1 Market Size and Volume Forecast By Country/Region

15.2.1.1 GCC Absolute $ Opportunity

15.2.1.2 N. Africa Absolute $ Opportunity

15.2.1.3 S. Africa Absolute $ Opportunity

15.2.1.4 Rest of MEA Absolute $ Opportunity

15.2.2 Market Size and Volume Forecast By Material Type

15.2.2.1 Metal

15.2.2.2 Plastic

15.2.2.3 Paper & Wood

15.2.2.4 Fiber

15.2.3 Market Size and Volume Forecast Product Type

15.2.3.1 Drums

15.2.3.2 IBCs

15.2.3.3 Sacks

15.2.3.4 Pails

15.2.3.5 Crates

15.2.3.6 Bulk Boxes

15.2.3.7 Other

15.2.4 Market Size and Volume Forecast By Packaging Type

15.2.4.1 Rigid

15.2.4.2 Flexible

15.2.5 Market Size and Volume Forecast By End Use

15.2.5.1 Agriculture And Horticulture

15.2.5.2 Automotive

15.2.5.3 Building & Construction

15.2.5.4 Chemicals And Pharmaceuticals

15.2.5.5 Engineering

15.2.5.6 Food & Beverages

15.2.5.7 Metal Products

15.2.5.8 Oil & Lubricants

15.2.5.9 Plastics And Rubber

15.2.5.10 Electronics

15.2.5.11 Tobacco

15.2.5.12 Other

15.2.6 Industrial Packaging Market Attractiveness Analysis

15.2.6.1 By Material Type

15.2.6.2 By Product Type

15.2.6.3 By Packaging Type

15.2.6.4 By End Use

15.2.6.5 By Country

15.2.7 Drivers & Restraints: Impact Analysis

16 Competition Landscape

16.1 Competition Dashboard

16.2 Market Structure

16.3 Company Profiles (Overview, Financials, SWOT Analysis, Strategy Overview)

16.3.1 Smurfit Kappa Group Plc.

16.3.1.1 Company Overview

16.3.1.2 Segment Outlook

16.3.1.3 Key Financials

16.3.1.4 SWOT Analysis

16.3.1.5 Strategy Focus

16.3.2 Grief Inc.

16.3.2.1 Company Overview

16.3.2.2 Segment Outlook

16.3.2.3 Key Financials

16.3.2.4 SWOT Analysis

16.3.2.5 Strategy Focus

16.3.3 International Paper Company

16.3.3.1 Company Overview

16.3.3.2 Segment Outlook

16.3.3.3 Key Financials

16.3.3.4 SWOT Analysis

16.3.3.5 Strategy Focus

16.3.4 Nefab AB

16.3.4.1 Company Overview

16.3.4.2 Segment Outlook

16.3.4.3 Key Financials

16.3.4.4 SWOT Analysis

16.3.4.5 Strategy Focus

16.3.5 SCHÜTZ GmbH & Co. KGaA

16.3.5.1 Company Overview

16.3.5.2 Segment Outlook

16.3.5.3 Key Financials

16.3.5.4 SWOT Analysis

16.3.5.5 Strategy Focus

16.3.6 AmeriGlobe LLC

16.3.6.1 Company Overview

16.3.6.2 Segment Outlook

16.3.6.3 Key Financials

16.3.6.4 SWOT Analysis

16.3.6.5 Strategy Focus

16.3.7 B.A.G. Corp

16.3.7.1 Company Overview

16.3.7.2 Segment Outlook

16.3.7.3 Key Financials

16.3.7.4 SWOT Analysis

16.3.7.5 Strategy Focus

16.3.8 Sonoco Product Company

16.3.8.1 Company Overview

16.3.8.2 Segment Outlook

16.3.8.3 Key Financials

16.3.8.4 SWOT Analysis

16.3.8.5 Strategy Focus

16.3.9 Cascades Inc.

16.3.9.1 Company Overview

16.3.9.2 Segment Outlook

16.3.9.3 Key Financials

16.3.9.4 SWOT Analysis

16.3.9.5 Strategy Focus

16.3.10 Mauser Group B.V.

16.3.10.1 Company Overview

16.3.10.2 Segment Outlook

16.3.10.3 Key Financials

16.3.10.4 SWOT Analysis

16.3.10.5 Strategy Focus

List of Tables

Table 01: Global Industrial Packaging Market Size (US$ Mn) and Volume (Mn Units) By Material Type, 2015–2024

Table 02: Global industrial Packaging Market Size (US$ Mn) and Volume (Mn Units) By Product Type, 2015–2024

Table 03: Global industrial Packaging Market Size (US$ Mn) and Volume (Mn Units) By Product Type, 2015–2024

Table 04: Global industrial Packaging Market Size (US$ Mn) and Volume(Mn Units) By Application, 2015–2024

Table 05: Global industrial Packaging Market Size (US$ Mn) and Volume (Mn Units) By Region, 2015–2024

List of Figures

Figure 01: Global Industrial Packaging Market Value (US$ Mn) and Volume (Mn Units), 2015–2024

Figure 02: Global Industrial Packaging Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 03: Global Industrial Packaging Market Y-o-Y Growth by Region, 2015 & 2024

Figure 04 : Global Industrial Packaging Market Value Share, By Product Type, 2016

Figure 05 : Global Industrial Packaging Market Value Share, By Material Type, 2016

Figure 06 : Global Industrial Packaging Market Value Share, By Packaging Type, 2016

Figure 07 : Global Industrial Packaging Market Value Share, By End Use, 2016

Figure 08 : Global Industrial Packaging Market Value Share, By Region, 2016

Figure 09: Global Industrial Packaging Market Share & BPS Analysis by Material Type, 2016 & 2024

Figure 10: Global Industrial Packaging Market Revenue Y-o-Y Growth by Material Type, 2015–2024

Figure 11: Global Industrial Packaging Market Value (US$ Mn) by Material Type, 2014–2024

Figure 12: Global Industrial Packaging Market Volume (Mn Units) by Material Type, 2014–2024

Figure 13: Global Industrial Packaging Market Attractiveness by Material Type, 2016–2024

Figure 14: Global Industrial Packaging Market Share & BPS Analysis by Product Type, 2016 & 2024

Figure 15: Global Industrial Packaging Market Revenue Y-o-Y Growth by Product Type, 2015–2024

Figure 16: Global Industrial Packaging Market Value (US$ Mn) by Product Type, 2014–2024

Figure 17: Global Industrial Packaging Market Volume (Mn Units) by Product Type, 2014–2024

Figure 18: Global Industrial Packaging Market Attractiveness by Product Type, 2016–2024

Figure 19: Global Industrial Packaging Market Share & BPS Analysis by Packaging Type, 2016 & 2024

Figure 20: Global Industrial Packaging Market Revenue Y-o-Y Growth by Packaging Type, 2015–2024

Figure 20: Global Industrial Packaging Market Value (US$ Mn) by Packaging Type, 2014–2024

Figure 21: Global Industrial Packaging Market Volume (Mn Units) by Packaging Type, 2014–2024

Figure 22: Global Industrial Packaging Market Attractiveness by Packaging Type, 2016–2024

Figure 23: Global Industrial Packaging Market Share & BPS Analysis by End Use, 2016 & 2024

Figure 24: Global Industrial Packaging Market Value (US$ Mn) by End Use, 2015–2024

Figure 26: Global Industrial Packaging Market Attractiveness by End Use, 2015–2024

Figure 27: Global industrial Packaging Market Share & BPS Analysis by Region, 2016 & 2024

Figure 28: Global industrial Packaging Market Revenue Y-o-Y Growth by Region, 2015–2024

Figure 29: Global industrial Packaging Market Attractiveness by Region, 2016–2024

Figure 30: North America Industrial Packaging Market Value (US$ Mn) and Volume (Mn Units), 2015–2024

Figure 31: North America Industrial Packaging Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 32 : North America Industrial Packaging Market Value Share, By Country, 2016 & 2024

Figure 33: North America Industrial Packaging Market Y-o-Y Growth Comparison, By Country, 2016 & 2024

Figure 34 : North America Industrial Packaging Market Value Share, By Product Type, 2016 & 2024

Figure 35 : North America Industrial Packaging Market Value Share, By Material Type, 2016 & 2024

Figure 36: North America Industrial Packaging Market Value Share, By Packaging Type, 2016 & 2024

Figure 37 : North America Industrial Packaging Market Value Share, By End Use, 2016 & 2024

Figure 38: North America Industrial Packaging Market Attractiveness Analysis, By Product Type, 2016 - 2024

Figure 39: North America Industrial Packaging Market Attractiveness Analysis, By Material, 2016 - 2024

Figure 40 : North America Industrial Packaging Market Attractiveness Analysis, By Packaging Type, 2016 – 2024

Figure 41 : North America Industrial Packaging Market Attractiveness Analysis, By Product Type 2016 - 2024

Figure 42: Latin America industrial Packaging Market Value (US$ Mn) and Volume(Mn Units), 2015–2024

Figure 43: Latin America industrial Packaging Market Absolute $ Opportunity (US$ Mn), 2016?2024

Figure 44: Latin America Industrial Packaging Market Value Share, By Country, 2016 & 2024

Figure 45: Latin America Industrial Packaging Market Y-o-Y Growth Comparison, By Country, 2015 & 2024

Figure 46: Latin America Industrial Packaging Market Value Share, By Product Type, 2016 & 2024

Figure 47: Latin America Industrial Packaging Market Value Share, By Material Type, 2016 & 2024

Figure 48 : Latin America Industrial Packaging Market Value Share, By Packaging Type, 2016 & 2024

Figure 49: Latin America Industrial Packaging Market Value Share, By End Use, 2016 & 2024

Figure 50: Latin America Industrial Packaging Market Attractiveness Analysis, By Product Type, 2016 - 2024

Figure 51: Latin America Industrial Packaging Market Attractiveness Analysis, By Material, 2016 - 2024

Figure 52: Latin America Industrial Packaging Market Attractiveness Analysis, By Packaging Type, 2016 - 2024

Figure 53: Latin America Industrial Packaging Market Attractiveness Analysis, By End Use 2016 - 2024

Figure 54: Europe Industrial Packaging Market Value (US$ Mn) and Volume (Mn Units), 2015–2024

Figure 55: Europe Industrial Packaging Market Absolute $ Opportunity (US$ Mn), 2016?2024

Figure 56: Europe Industrial Packaging Market Value Share & BPS Analysis, By Country, 2016 & 2024

Figure 57: Europe Industrial Packaging Market Y-o-Y Growth Comparison, By Country, 2015–2024

Figure 58: Europe Industrial Packaging Market Value Share, By Product Type, 2016 & 2024

Figure 59: Europe Industrial Packaging Market Value Share, By Material Type, 2016 & 2024

Figure 60: Europe Industrial Packaging Market Value Share, By Packaging Type, 2016 & 2024

Figure 61: Europe Industrial Packaging Market Value Share, By End Use, 2016 & 2024

Figure 62: Europe Industrial Packaging Market Attractiveness Analysis, By Product Type, 2016 - 2024

Figure 63: Europe Industrial Packaging Market Attractiveness Analysis, By Material, 2016 - 2024

Figure 64: Europe Industrial Packaging Market Attractiveness Analysis, By Packaging Type, 2016 - 2024

Figure 65: Europe Industrial Packaging Market Attractiveness Analysis, By Product Type 2016 - 2024

Figure 66: APAC industrial Packaging Market Value (US$ Mn) and Volume (Mn units), 2015–2024

Figure 67: APAC industrial Packaging Market Absolute $ Opportunity (US$ Mn), 2016?2024

Figure 68: APAC Industrial Packaging Market Value Share, By Country, 2016 & 2024

Figure 69: APAC Industrial Packaging Market Y-o-Y Growth Comparison, By Country, 20152–2024

Figure 70: APAC Industrial Packaging Market Value Share, By Product Type, 2016 & 2024

Figure 71: APAC Industrial Packaging Market Value Share, By Material Type, 2016 & 2024

Figure 72: APAC Industrial Packaging Market Value Share, By Packaging Type, 2016 & 2024

Figure 73: APAC Industrial Packaging Market Value Share, By End Use, 2016 & 2024

Figure 74: APAC Industrial Packaging Market Attractiveness Analysis, By Product Type, 2016 - 2024

Figure 75: APAC Industrial Packaging Market Attractiveness Analysis, By Material, 2016 - 2024

Figure 76: APAC Industrial Packaging Market Attractiveness Analysis, By Packaging Type, 2016 - 2024

Figure 77: APAC Industrial Packaging Market Attractiveness Analysis, By Product Type 2016 - 2024

Figure 78: MEA industrial Packaging Market Value (US$ Mn) and Volume(Mn Units), 2015–2024

Figure 79: MEA industrial Packaging Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 80: MEA Industrial Packaging Market Value Share, By Country, 2016 & 2024

Figure 81: MEA Industrial Packaging Market Y-o-Y Growth Comparison, By Country, 2016 & 2024

Figure 82: MEA Industrial Packaging Market Value Share, By Product Type, 2016 & 2024

Figure 83: MEA Industrial Packaging Market Value Share, By Material Type, 2016 & 2024

Figure 84: MEA Industrial Packaging Market Value Share, By Packaging Type, 2016 & 2024

Figure 85: MEA Industrial Packaging Market Value Share, By End Use, 2016 & 2024

Figure 86: MEA Industrial Packaging Market Attractiveness Analysis, By Product Type, 2016 - 2024

Figure 87: MEA Industrial Packaging Market Attractiveness Analysis, By Material, 2016 - 2024

Figure 88: MEA Industrial Packaging Market Attractiveness Analysis, By Packaging Type, 2016 - 2024

Figure 89: MEA Industrial Packaging Market Attractiveness Analysis, By End Use 2016 – 2024