Reports

Reports

The global industrial gear market is witnessing steadiness, driven by the twin forces of industrial modernization and the technological upgrades spanning end-use industries. The sustained opportunities being generated for gear manufacturers due to the adoption of automation in manufacturing, investments in renewable energy, and equipment for energy efficiency are increasing in number.

The focus of manufacturers is shifting toward high-performance gears that feature lower noise, improved torque density, and longer life cycles. At the same time, the gears are becoming smarter, with sensor-equipped smart gearboxes subject to predictive maintenance becoming more common. This shift is indicative of a greater movement of industries toward improving reliability, reducing downtime, and efficient asset management at lesser costs.

Simultaneously, there are both - opportunities and risks shaping the market structure. Custom-engineered and premium efficiency gears continue to sustain their margin growth, and alterations and service operations continue to be stable even as the economy slows down. Still, variations in the cost of steel and energy, coupled with substitution risks from direct-drive systems in certain use-cases, warrant attention.

Regional conditions matter as well: Europe focuses on use driven by efficiency, India and North America enjoy benefits tied to policy-driven incentives for manufacturing, and Asia-Pacific continues to be the center for mass manufacturing. The automotive sector serves as an important demand driver, with the global motor vehicle production touching 93.5 million units in 2023, which is a 10% rise as compared to 2022 (International Organization of Motor Vehicle Manufacturers, OICA).

The global manufacturing and heavy engineering industry depends on the industrial gear market for the manufacturing of critical parts for motion, power transmission, and mechanical efficiency. Precision torque control and durability under challenging conditions is a feature of industrial gears that makes them indispensable in the automotive, energy, mining, construction, marine, and robotics sectors.

Newer gear systems try to conserve energy, reduce noise, and have a longer life span, which are all dependent on new materials, new ways, and digital supervision of modern machining. The expiry of old working contracts increases the chance of new working contract formation, thus accelerating the procurement of smart gearboxes with integrated sensors, which is an important feature of modern working contracts.

In addition, energetic gears and efficient devices associated with advanced and eco-friendly manufacturing, which are associated with governmental policies and support, are changing the manufacturing policies of gearboxes, making the industrial gears market play a key role in the industrial growth that is eco-friendly and advanced in technology.

| Attribute | Detail |

|---|---|

| Industrial Gear Market Drivers |

|

These days the process of manufacturing incorporates new technologies such as artificial intelligence controls and advanced robotics. These not only create an opportunity to create value but use the Internet of Things as a new system. These new systems improve productivity and packet processing time. As a result, such systems demand the creation of gears that are created with greater precision.

Such new gears must provide torque control that is accurate, having enhanced durability, and able to integrate with smart diagnostics. Increased efforts to realize “smart factories” have created an urgent need for more advanced gears that can support automated functions in the automotive, electronics, and even heavy engineering industries.

The International Federation of Robotics (IFR) is a perfect example of how these changes of focus have already begun to take shape as IFR reported that the world operational stock of industrial robots grew by 9.7% to a total of 4,281,585 units in 2023. The emergence of gear systems underscores the automation dependency and garners the need for top-notch industrial gears designed to propel robotic arms, conveyors, and other precision automation machinery.

With increase in automation worldwide, gear system providers are evolving their advanced automation gearboxes to include precision-ground gearboxes, high-torque assemblies, and smart gear systems that can plug into predictive maintenance systems. The perfect match between the increase in automation and technology upgrades puts automation and modernization at the core of the industrial gear industry.

Renewable energy and electrified transportation gears, especially complex gearboxes for wind turbines and e-axles, have face accelerated demand. Countries aiming to cut down on carbon and widen their energy sources provide gear makers with orders for hefty, efficient gears designed especially for electric and renewable energy applications.

The U.S. Department of Energy offers a strong piece of evidence about the United States' increasing interest in renewable energies. In 2024 Wind Market Report, the DOE reports that at the close of 2023, the United States had installed 150,492 MW of onshore wind with an addition of 6,474 MW in that year alone.

As the renewable sector and electric vehicles witness rapid adoption fueled by both - policy frame works and consumer demand, there is an increased need for innovation from the gear manufacturers. As advanced materials become a norm, they must deliver lightweight high-torque gearboxes. Their units must also be compatible with condition-based maintenance and smarter systems. As energy infrastructure shifts to cleaner and smarter models, this driver further confirms the shift to the technology-rich gear solutions for sustainable industry transformation.

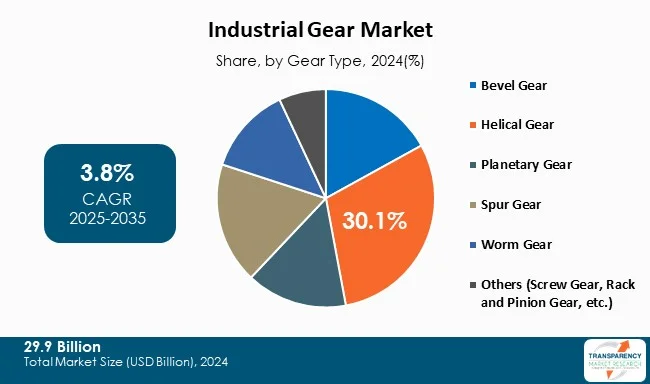

The industrial gear market is categorized into planetary gears, spur gears, helical gears, worm gears, rack and pinion gears, bevel gears, and others, which include screw miter, and specialized gears. Different end-use industries require various features such as precision, torque handling, and efficiency, which each segment individually fulfills.

Out of all gear types, helical gears hold the largest share on the account of their use in automotive gearboxes, industrial equipment, and even heavy construction machinery. They are the preferred choice in wide-ranging fields of industry due to the ease with which they can take higher loads and the lower noise levels they produce in comparison with spur gears.

Spur gears continue to matter due to their low costs and ease of use, while planetary gears are attracting attention in the fields of robotics, aerospace, and renewable energy, due to their small size and high torque density. Rack and pinion gears see use in the automotive sector, especially in steering systems, as well as in motion control, while worm gears are employed in high torque reduction sectors in compact machinery. Bevel gears are used in systems that require angular motion transfer. The category of “others”, which contains screw and miter gears, serves specific industrial sectors. The outlook for the segment indicates consistent growth in demand for all gear types, with helical gears sustaining their dominance in the market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The region of Asia-Pacific leads global industrial gears’ demand with its impressive manufacturing share driving the growth. As previously mentioned, in 2022, the region gained 55% of the global manufacturing value added (GMVA), a testament to its importance in global industrial production. This importance cuts across the high-tech sectors of machinery and equipment, chemicals, and even electronics and optical products industry sectors that are highly dependent on gearing systems.

Europe and North America maintain their important functions using advanced technology and modernizing old systems to keep gearing systems in demand. Also, neither Europe nor North America come close to Asia and Oceania’s manufacturing output or the pace of their industrial growth. This unique combination of high manufacturing density and advanced automation in Asia and Oceania makes them the undisputed leaders in the industries gears market and the other associated markets such as global demand, technology trends, and supply chain strategies.

ABB Ltd, Aero Gear Incorporated, Bharat Gears Ltd., Elecon Engineering Company Limited, Hota Industrial Manufacturing Co., Ltd., Kohara Gear Industry Co., Ltd., Martin Sprocket & Gear, Inc., OKUBO GEAR Co., Ltd., Shanthi Gears Limited, Siemens AG, Gleason Corporation, Klingelnberg, DBSantasalo, Emerson Electric Co., Bonfiglioli Group are some of the leading manufacturers operating in the global industrial gear market.

Each of these companies has been profiled in the industrial gear market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

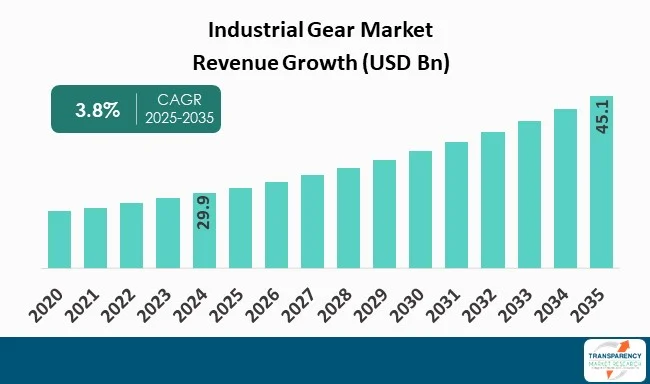

| Market Size Value in 2024 (Base Year) | US$ 29.9 Bn |

| Market Forecast Value in 2035 | US$ 45.1 Bn |

| Growth Rate (CAGR 2025 to 2035) | 3.8% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Gear Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global industrial gear market was valued at US$ 29.9 Bn in 2024

The global industrial gear industry is projected to reach at US$ 45.1 Bn by the end of 2035

Rising automation & industrial modernization and growth in renewable energy & electric mobility, are some of the driving factors for this market

The CAGR is anticipated to be 3.8% from 2025 to 2035

ABB Ltd, Aero Gear Incorporated, Bharat Gears Ltd., Elecon Engineering Company Limited, Hota Industrial Manufacturing Co., Ltd., Kohara Gear Industry Co., Ltd., Martin Sprocket & Gear, Inc., OKUBO GEAR Co., Ltd., Shanthi Gears Limited, Siemens AG, Gleason Corporation, Klingelnberg, DBSantasalo, Emerson Electric Co., and Bonfiglioli Group

Table 1: Global Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 2: Global Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 3: Global Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 4: Global Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 5: Global Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 6: Global Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 7: Global Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 8: Global Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 9: Global Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 10: Global Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 11: Global Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Region

Table 12: Global Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Region

Table 13: North America Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 14: North America Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 15: North America Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 16: North America Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 17: North America Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 18: North America Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 19: North America Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 20: North America Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 21: North America Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 22: North America Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 23: North America Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 24: North America Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 25: U.S. Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 26: U.S. Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 27: U.S. Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 28: U.S. Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 29: U.S. Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 30: U.S. Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 31: U.S. Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 32: U.S. Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 33: U.S. Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 34: U.S. Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 35: Canada Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 36: Canada Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 37: Canada Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 38: Canada Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 39: Canada Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 40: Canada Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 41: Canada Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 42: Canada Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 43: Canada Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 44: Canada Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 45: Europe Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 46: Europe Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 47: Europe Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 48: Europe Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 49: Europe Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 50: Europe Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 51: Europe Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 52: Europe Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 53: Europe Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 54: Europe Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 55: Europe Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 56: Europe Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 57: U.K. Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 58: U.K. Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 59: U.K. Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 60: U.K. Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 61: U.K. Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 62: U.K. Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 63: U.K. Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 64: U.K. Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 65: U.K. Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 66: U.K. Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 67: Germany Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 68: Germany Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 69: Germany Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 70: Germany Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 71: Germany Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 72: Germany Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 73: Germany Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 74: Germany Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 75: Germany Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 76: Germany Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 77: France Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 78: France Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 79: France Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 80: France Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 81: France Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 82: France Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 83: France Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 84: France Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 85: France Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 86: France Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 87: Italy Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 88: Italy Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 89: Italy Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 90: Italy Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 91: Italy Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 92: Italy Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 93: Italy Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 94: Italy Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 95: Italy Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 96: Italy Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 97: Spain Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 98: Spain Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 99: Spain Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 100: Spain Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 101: Spain Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 102: Spain Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 103: Spain Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 104: Spain Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 105: Spain Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 106: Spain Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 107: The Netherlands Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 108: The Netherlands Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 109: The Netherlands Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 110: The Netherlands Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 111: The Netherlands Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 112: The Netherlands Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 113: The Netherlands Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 114: The Netherlands Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 115: The Netherlands Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 116: The Netherlands Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 117: Asia Pacific Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 118: Asia Pacific Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 119: Asia Pacific Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 120: Asia Pacific Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 121: Asia Pacific Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 122: Asia Pacific Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 123: Asia Pacific Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 124: Asia Pacific Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 125: Asia Pacific Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 126: Asia Pacific Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 127: Asia Pacific Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 128: Asia Pacific Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 129: China Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 130: China Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 131: China Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 132: China Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 133: China Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 134: China Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 135: China Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 136: China Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 137: China Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 138: China Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 139: India Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 140: India Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 141: India Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 142: India Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 143: India Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 144: India Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 145: India Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 146: India Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 147: India Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 148: India Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 149: Japan Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 150: Japan Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 151: Japan Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 152: Japan Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 153: Japan Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 154: Japan Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 155: Japan Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 156: Japan Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 157: Japan Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 158: Japan Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 159: Australia Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 160: Australia Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 161: Australia Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 162: Australia Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 163: Australia Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 164: Australia Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 165: Australia Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 166: Australia Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 167: Australia Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 168: Australia Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 169: South Korea Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 170: South Korea Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 171: South Korea Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 172: South Korea Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 173: South Korea Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 174: South Korea Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 175: South Korea Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 176: South Korea Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 177: South Korea Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 178: South Korea Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 179: ASEAN Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 180: ASEAN Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 181: ASEAN Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 182: ASEAN Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 183: ASEAN Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 184: ASEAN Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 185: ASEAN Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 186: ASEAN Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 187: ASEAN Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 188: ASEAN Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 189: Middle East & Africa Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 190: Middle East & Africa Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 191: Middle East & Africa Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 192: Middle East & Africa Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 193: Middle East & Africa Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 194: Middle East & Africa Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 195: Middle East & Africa Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 196: Middle East & Africa Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 197: Middle East & Africa Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 198: Middle East & Africa Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 199: Middle East & Africa Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 200: Middle East & Africa Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 201: GCC Countries Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 202: GCC Countries Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 203: GCC Countries Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 204: GCC Countries Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 205: GCC Countries Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 206: GCC Countries Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 207: GCC Countries Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 208: GCC Countries Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 209: GCC Countries Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 210: GCC Countries Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 211: South Africa Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 212: South Africa Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 213: South Africa Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 214: South Africa Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 215: South Africa Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 216: South Africa Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 217: South Africa Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 218: South Africa Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 219: South Africa Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 220: South Africa Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 221: Latin America Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 222: Latin America Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 223: Latin America Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 224: Latin America Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 225: Latin America Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 226: Latin America Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 227: Latin America Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 228: Latin America Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 229: Latin America Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 230: Latin America Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 231: Latin America Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 232: Latin America Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 233: Brazil Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 234: Brazil Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 235: Brazil Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 236: Brazil Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 237: Brazil Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 238: Brazil Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 239: Brazil Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 240: Brazil Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 241: Brazil Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 242: Brazil Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 243: Argentina Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 244: Argentina Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 245: Argentina Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 246: Argentina Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 247: Argentina Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 248: Argentina Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 249: Argentina Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 250: Argentina Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 251: Argentina Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 252: Argentina Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 253: Mexico Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Gear Type

Table 254: Mexico Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Gear Type

Table 255: Mexico Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Teeth Count

Table 256: Mexico Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Teeth Count

Table 257: Mexico Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Material

Table 258: Mexico Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 259: Mexico Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 260: Mexico Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 261: Mexico Industrial Gear Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 262: Mexico Industrial Gear Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Figure 1: Global Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 2: Global Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 3: Global Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 4: Global Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 5: Global Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 6: Global Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 7: Global Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 8: Global Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 9: Global Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 10: Global Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 11: Global Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 12: Global Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 13: Global Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 14: Global Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 15: Global Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 16: Global Industrial Gear Market Value (US$ Mn) Projection, By Region 2020 to 2035

Figure 17: Global Industrial Gear Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 18: Global Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Region 2025 to 2035

Figure 19: North America Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 20: North America Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 21: North America Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 22: North America Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 23: North America Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 24: North America Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 25: North America Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 26: North America Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 27: North America Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 28: North America Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 29: North America Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 30: North America Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 31: North America Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 32: North America Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 33: North America Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 34: North America Industrial Gear Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 35: North America Industrial Gear Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 36: North America Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 37: U.S. Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 38: U.S. Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 39: U.S. Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 40: U.S. Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 41: U.S. Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 42: U.S. Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 43: U.S. Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 44: U.S. Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 45: U.S. Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 46: U.S. Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 47: U.S. Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 48: U.S. Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 49: U.S. Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 50: U.S. Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 51: U.S. Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 52: Canada Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 53: Canada Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 54: Canada Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 55: Canada Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 56: Canada Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 57: Canada Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 58: Canada Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 59: Canada Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 60: Canada Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 61: Canada Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 62: Canada Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 63: Canada Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 64: Canada Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Canada Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 66: Canada Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 68: Europe Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 69: Europe Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 70: Europe Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 71: Europe Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 72: Europe Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 73: Europe Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 74: Europe Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 75: Europe Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 76: Europe Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 77: Europe Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 78: Europe Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 79: Europe Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 80: Europe Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 81: Europe Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 82: Europe Industrial Gear Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 83: Europe Industrial Gear Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 84: Europe Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 85: U.K. Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 86: U.K. Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 87: U.K. Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 88: U.K. Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 89: U.K. Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 90: U.K. Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 91: U.K. Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 92: U.K. Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 93: U.K. Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 94: U.K. Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 95: U.K. Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 96: U.K. Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 97: U.K. Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 98: U.K. Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 99: U.K. Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 100: Germany Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 101: Germany Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 102: Germany Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 103: Germany Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 104: Germany Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 105: Germany Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 106: Germany Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 107: Germany Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 108: Germany Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 109: Germany Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 110: Germany Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 111: Germany Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 112: Germany Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 113: Germany Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 114: Germany Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 115: France Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 116: France Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 117: France Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 118: France Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 119: France Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 120: France Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 121: France Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 122: France Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 123: France Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 124: France Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 125: France Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 126: France Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 127: France Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 128: France Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 129: France Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 130: Italy Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 131: Italy Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 132: Italy Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 133: Italy Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 134: Italy Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 135: Italy Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 136: Italy Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 137: Italy Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 138: Italy Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 139: Italy Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 140: Italy Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 141: Italy Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 142: Italy Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 143: Italy Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 144: Italy Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 145: Spain Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 146: Spain Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 147: Spain Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 148: Spain Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 149: Spain Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 150: Spain Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 151: Spain Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 152: Spain Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 153: Spain Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 154: Spain Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 155: Spain Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 156: Spain Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 157: Spain Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 158: Spain Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 159: Spain Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 160: The Netherlands Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 161: The Netherlands Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 162: The Netherlands Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 163: The Netherlands Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 164: The Netherlands Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 165: The Netherlands Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 166: The Netherlands Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 167: The Netherlands Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 168: The Netherlands Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 169: The Netherlands Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 170: The Netherlands Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 171: The Netherlands Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 172: The Netherlands Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 173: The Netherlands Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 174: The Netherlands Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 175: Asia Pacific Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 176: Asia Pacific Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 177: Asia Pacific Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 178: Asia Pacific Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 179: Asia Pacific Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 180: Asia Pacific Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 181: Asia Pacific Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 182: Asia Pacific Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 183: Asia Pacific Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 184: Asia Pacific Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 185: Asia Pacific Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 186: Asia Pacific Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 187: Asia Pacific Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 188: Asia Pacific Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 189: Asia Pacific Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 190: Asia Pacific Industrial Gear Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 191: Asia Pacific Industrial Gear Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 192: Asia Pacific Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 193: China Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 194: China Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 195: China Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 196: China Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 197: China Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 198: China Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 199: China Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 200: China Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 201: China Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 202: China Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 203: China Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 204: China Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 205: China Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 206: China Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 207: China Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 208: India Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 209: India Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 210: India Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 211: India Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 212: India Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 213: India Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 214: India Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 215: India Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 216: India Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 217: India Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 218: India Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 219: India Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 220: India Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 221: India Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 222: India Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 223: Japan Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 224: Japan Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 225: Japan Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 226: Japan Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 227: Japan Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 228: Japan Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 229: Japan Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 230: Japan Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 231: Japan Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 232: Japan Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 233: Japan Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 234: Japan Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 235: Japan Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 236: Japan Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 237: Japan Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 238: Australia Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 239: Australia Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 240: Australia Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 241: Australia Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 242: Australia Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 243: Australia Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 244: Australia Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 245: Australia Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 246: Australia Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 247: Australia Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 248: Australia Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 249: Australia Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 250: Australia Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 251: Australia Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 252: Australia Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 253: South Korea Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 254: South Korea Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 255: South Korea Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 256: South Korea Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 257: South Korea Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 258: South Korea Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 259: South Korea Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 260: South Korea Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 261: South Korea Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 262: South Korea Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 263: South Korea Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 264: South Korea Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 265: South Korea Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Korea Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Korea Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 268: ASEAN Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 269: ASEAN Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 270: ASEAN Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 271: ASEAN Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 272: ASEAN Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 273: ASEAN Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 274: ASEAN Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 275: ASEAN Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 276: ASEAN Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 277: ASEAN Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 278: ASEAN Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 279: ASEAN Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 280: ASEAN Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 281: ASEAN Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 282: ASEAN Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 283: Middle East & Africa Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 284: Middle East & Africa Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 285: Middle East & Africa Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 286: Middle East & Africa Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 287: Middle East & Africa Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 288: Middle East & Africa Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 289: Middle East & Africa Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 290: Middle East & Africa Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 291: Middle East & Africa Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 292: Middle East & Africa Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 293: Middle East & Africa Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 294: Middle East & Africa Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 295: Middle East & Africa Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 296: Middle East & Africa Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 297: Middle East & Africa Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 298: Middle East & Africa Industrial Gear Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 299: Middle East & Africa Industrial Gear Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 300: Middle East & Africa Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 301: GCC Countries Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 302: GCC Countries Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 303: GCC Countries Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 304: GCC Countries Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 305: GCC Countries Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 306: GCC Countries Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 307: GCC Countries Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 308: GCC Countries Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 309: GCC Countries Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 310: GCC Countries Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 311: GCC Countries Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 312: GCC Countries Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 313: GCC Countries Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 314: GCC Countries Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 315: GCC Countries Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 316: South Africa Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 317: South Africa Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 318: South Africa Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 319: South Africa Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 320: South Africa Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 321: South Africa Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 322: South Africa Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 323: South Africa Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 324: South Africa Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 325: South Africa Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 326: South Africa Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 327: South Africa Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 328: South Africa Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 329: South Africa Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 330: South Africa Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 331: Latin America Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035

Figure 332: Latin America Industrial Gear Market Volume (Thousand Units) Projection, By Gear Type 2020 to 2035

Figure 333: Latin America Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Gear Type 2025 to 2035

Figure 334: Latin America Industrial Gear Market Value (US$ Mn) Projection, By Teeth Count 2020 to 2035

Figure 335: Latin America Industrial Gear Market Volume (Thousand Units) Projection, By Teeth Count 2020 to 2035

Figure 336: Latin America Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Teeth Count 2025 to 2035

Figure 337: Latin America Industrial Gear Market Value (US$ Mn) Projection, By Material 2020 to 2035

Figure 338: Latin America Industrial Gear Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 339: Latin America Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Material 2025 to 2035

Figure 340: Latin America Industrial Gear Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 341: Latin America Industrial Gear Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 342: Latin America Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 343: Latin America Industrial Gear Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 344: Latin America Industrial Gear Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 345: Latin America Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 346: Latin America Industrial Gear Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 347: Latin America Industrial Gear Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 348: Latin America Industrial Gear Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 349: Brazil Industrial Gear Market Value (US$ Mn) Projection, By Gear Type 2020 to 2035