Reports

Reports

Increasing Need for Renewable Energy Sources for Industrial-Scale Heating Drives Industrial Biomass Boiler Market

Industrial biomass boilers produce energy from biomass, which includes agricultural and forest residues, industrial waste, and urban waste. An industrial biomass boiler warms the biomass residue to generate energy at a low cost. Industrial biomass boilers are widely used since energy generated from industrial biomass has the least negative impact on the environment when compared to energy generated from fossil fuels. The growing emphasis of governments throughout the world on reducing reliance on fossil fuels and associated emissions has driven utilities and industrial businesses to replace fossil fuels with alternative fuels.

The industrial biomass boiler market is observing growth and is predicted to continue to witness growth during the forecast period (2016-2025). The rapid rate of industrialization in various regions, particularly in developing countries, and the rising need for renewable energy sources for industrial-scale heating are the factors providing a stable platform for the expansion of the industrial biomass boiler market.

The growing emphasis of governments in both developing and developed countries on encouraging the use of renewable energy has boosted the industrial biomass boiler market. Various tax breaks and feed-in tariffs provided by governments to a wide range of businesses have increased the usage of industrial biomass boilers. Furthermore, the implementation of strict boiler regulations has had a favorable influence on market growth. The growing importance of eco-friendly fuels and sustainable technology in different industrial heating applications is likely to boost the industrial biomass boiler market in the years ahead.

Europe stood as the leading region in the industrial biomass boiler market in 2015, and it is likely to present handsome growth prospects for players in the industrial biomass boiler market. The success of initiatives such as the Renewable Heat Incentive (RHI) had a significant impact on the adoption of biomass boilers for industrial applications. Furthermore, the European Commission's commitment to reduce greenhouse gas emissions by 80% below 1990 levels has led to the continuous initiatives by numerous companies in the region targeted at reducing carbon emissions. This is expected to boost demand for industrial biomass boilers throughout Europe.

The industrial biomass boiler market is gaining considerable momentum and is expected to perform well in the forecast period 2016 - 2025. Soaring demand for the use of renewable sources of energy in various industries may boost the industrial biomass boiler market. The staggering use of harmful chemicals and gases across many industries is resulting in massive carbon emissions, thus damaging the environment. Hence, biomass boilers are finding a place in every industry for reducing carbon emissions.

Biomass boilers are similar to gas boilers but the difference is just that instead of using gas to produce heat, the biomass boiler effectively uses wood pellets that are sustainably sourced. Biomass boilers are automatic appliances that smartly limit the fuel amount according to the heating requirements. These appliances offer a range of economical and environmental benefits.

A biomass boiler can be categorized as Combined Heat and Power Systems, Fully Automated Biomass Boiler, and Semi-Automated Biomass Boiler. The end-users of the biomass boiler market are commercial, industrial, and residential. The industrial segment is the largest consumer of biomass boilers.

Global Industrial Biomass Boiler Market: Snapshot

The swift pace of industrialization in various regions, especially across developed regions, and the soaring demand for renewable sources of energy for industrial scale heating are the factors offering robust background to the evolution of the industrial biomass boiler market. The rising focus of governments on several developing and developed nations to encourage the adoption of renewable energy has propelled the market. Various fiscal incentives and feed-in tariff offered by governments to a large number of businesses have bolstered the use of industrial biomass boilers. Initiatives taken by government players to boost the consumption of heat from renewable sources have pulled substantial investment in biomass boiler technology. In addition, enforcement of stringent boiler standards has positively impacted the growth of the market. The increasing prominence of eco-friendly fuels and sustainable technologies in various industrial heating applications is expected to boost the market in the coming years.

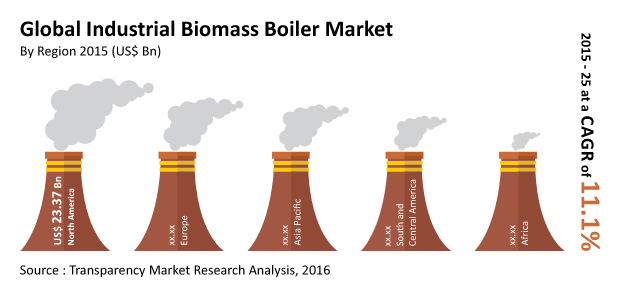

The global industrial biomass boiler market stood at US$68.2 bn in 2015. Rising at a steady CAGR of 11.1% during 2016–2025 the market is expected reach a valuation of US$193.1 bn by 2025.

Europe to Provide Most Lucrative Market Avenues

Based on geography, the global market is segmented into Europe, Asia Pacific, Africa, South and Central America (SCA), and North America. Europe was the leading regional segment in 2015 and is expected to provide ample growth opportunities for players in industrial biomass boiler. The success of schemes such as Renewable Heat Incentive (RHI) has a marked effect on the uptake of biomass boilers for industrial applications. In addition, commitment of the European Commission to cut down its greenhouse gas emissions to 80% below the 1990 levels has led to sustained initiatives by various industries in the region aimed at curbing the carbon emission. This is anticipated to spur the demand for biomass boilers in the Europe. The regional market is expected to rise at a CAGR of 12% during 2015–2023, measured in terms of installed capacity.

On the other hand, North America and Asia Pacific markets for industrial biomass boilers are expected to witness moderate growth through the forecast period. The use of conventional sources such as coal and oil in boilers is expected to provide stiff competition to the demand for biomass boilers in these regional markets. The market for industrial biomass boilers in these regions are driven by mounting concerns on the use non-renewables sources of energy and the implementation of stringent emission regulations in various countries.

Biomass Cogeneration System Emerging as Prominent Application

Based on type of feedstock used, the industrial biomass boilers is segmented into wood deliverable, agricultural residues, and landfill residues. The major application segments are pulp & paper industry, sawmill industry, brewery industry, combined heat and power (CHP) production, and power generation. Among these, combined heat and power or cogeneration system is the leading segment. CHP systems are capable of transforming a variety of waste products into heat, electricity and biofuels. This, coupled with advancement in conversion technology has bolstered its adoption. The prominence of CHP over other conventional systems is due to the high energy efficiency levels of about 80% of producing heat and power. The market is expected to register an impressive CAGR of 11.1% from 2016 to 2023.

Some of the leading players operating in the industrial biomass boiler market are Babcock & Wilcox Enterprises, Thermax, Alstom SA, Baxi Heating UK Ltd., Clyde Bergemann Power Group, Inc., ANDRITZ AG, Aalborg Energie Technik a/s, and Bayview Engineering and Construction.

Table of Content

Section 1 Preface

Section 2 Executive Summary

Section 3 Industry Analysis

Section 4 Global Industrial Biomass Boilers Market – Capacity, by Volume and Capex, 2014 – 2025 (MW) (US$ Bn)

Section 5 Global Industrial Biomass Boilers Market – Application, by Volume and Capex, 2014 – 2025 (MW) (US$ Bn)

Section 6 Global Industrial Biomass Boilers Market - Feedstock, by Volume and Capex, 2014 - 2025 (MW) (US$ Bn)

Section 7 Global Industrial Biomass Boilers Market – Regional Analysis by Volume and Capex, 2014 - 2025 (MW) (US$ Bn)

Section 8 Company Profiles

List of Figures

Figure 1. Global Industrial Biomass Boilers Market, Estimates and Forecast, by Capex, 2014–2025 (US$ Bn)

Figure 2. Global Industrial Biomass Boilers Market, Global Market Share

Figure 3. Global Industrial Biomass Boilers Market, Company Market Share (%) (2015)

Figure 4. Market Attractiveness, Industrial Biomass Boilers Market

Figure 5. Global Industrial Biomass Boilers, Market Share by Capacity Segment, 2015

Figure 6. Global Industrial Biomass Boilers, Market Share by Capacity Segment, 2025

Figure 7. Global Industrial Biomass Boilers Market, Capacity Segment, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 8. Global Industrial Biomass Boilers Market, ~2-10 MW, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 9. Global Industrial Biomass Boilers Market, ~10-25 MW, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 10. Global Industrial Biomass Boilers Market, ~25-50 MW, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 11. Global Industrial Biomass Boilers Market, Application Segment, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 12. Global Industrial Biomass Boilers Market, Pulp & Paper Industry, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 13. Global Industrial Biomass Boilers Market, Brewery Industry, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 14. Global Industrial Biomass Boilers Market, Sawmill Industry, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 15. Global Industrial Biomass Boilers Market, CHP Production, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 16. Global Industrial Biomass Boilers Market, Power Generation, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 17. Global Industrial Biomass Boilers Market, Others, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 18. Global Industrial Biomass Boilers Market, Feedstock Segment, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 19. Global Industrial Biomass Boilers Market, Wood Deliverable, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 20. Global Industrial Biomass Boilers Market, Landfill Residues, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 21. Global Industrial Biomass Boilers Market, Agricultural Residues, By Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 22. Global Industrial Biomass Boilers Market, By Region, 2014 and 2025

Figure 23. North America Industrial Biomass Boilers Market Share, by Country, 2015 and 2025

Figure 24. North America Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 25. U.S. Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 26. U.S. Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 27. U.S. Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 28. U.S. Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 29. Canada Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 30. Canada Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 31. Canada Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 32. Canada Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 33. Mexico Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 34. Mexico Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 35. Mexico Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 36. Mexico Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 37. Europe Industrial Biomass Boilers Market, By Country, 2014 and 2025

Figure 38. Europe Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 39. U.K. Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 40. U.K. Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 41. U.K. Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 42. U.K. Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 43. France Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 44. France. Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 45. France Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 46. France Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 47. Germany Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 48. Germany Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 49. Germany Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 50. Germany Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 51. Sweden Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 52. Sweden Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 53. Sweden Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 54. Sweden Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 55. Finland Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 56. Finland Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 57. Finland Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 58. Finland Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 59. Rest of Europe Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 60. Rest of Europe Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 61. Rest of Europe Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 62. Rest of Europe Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 63. Asia Pacific Industrial Biomass Boilers Market, By Country, 2014 and 2025

Figure 64. Asia Pacific Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 65. Japan Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 66. Japan Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 67. Japan Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 68. Japan Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 69. India Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 70. India Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 71. India Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 72. India Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 73. China Industrial Biomass Boilers Market, by Volume and Capex, 2013–2025 (MW) (US$ Bn)

Figure 74. China Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 75. China Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 76. China Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 77. Rest of Asia Pacific Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 78. Rest of Asia Pacific Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 79. Rest of Asia Pacific Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 80. Rest of Asia Pacific Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 81. Africa Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 82. Africa Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 83. Ivory Coast Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 84. Ivory Coast Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 85. Ivory Coast Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 86. Ivory Coast Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 87. Cameroon Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 88. Cameroon Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 89. Cameroon Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 90. Cameroon Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 91. Rest of Africa Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 92. Rest of Africa Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 93. Rest of Africa Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 94. Rest of Africa Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 95. South and Central America Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 96. South and Central America Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 97. Brazil Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 98. Brazil Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 99. Brazil Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 100. Brazil Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)

Figure 101. Rest of SCA Industrial Biomass Boilers Market, by Volume and Capex, 2014–2025 (MW) (US$ Bn)

Figure 102. Rest of SCA Industrial Biomass Boilers Market, by Capacity, 2014–2025 (MW) (US$ Bn)

Figure 103. Rest of SCA Industrial Biomass Boilers Market, by Application, 2014–2025 (MW) (US$ Bn)

Figure 104. Rest of SCA Industrial Biomass Boilers Market, by Feedstock, 2014–2025 (MW) (US$ Bn)