H2O2 (Hydrogen Peroxide) Measurement Market: Snapshot

Hydrogen peroxide is a basic type of peroxide, which is used as a strong bleaching and oxidizing agent. It is made by several manufacturing processes. However, the most widely used method is anthraquinone autoxidation. Hydrogen peroxide is utilized in several end-use sector for example, chemical, paper & pulp, wastewater treatment, mining, and electronics owing to its environment-friendly applications. Hydrogen peroxide, when inhaled, can cause irritation in the throat, nose, and respiratory tract. It can also lead to accumulation of fluid in the person’s lungs in extreme cases.

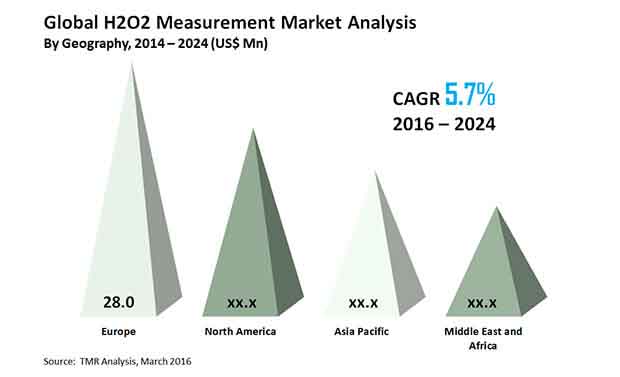

The enduring development in various end-use segments is relied upon to result in prominent extent of development in the global hydrogen peroxide market within the span of 2016 to 2024. In 2015, the opportunities in global hydrogen peroxide measurement remained at US$81.4 mn. Increasing at a CAGR of 5.70% during the period from 2016 and 2024, it is evaluated to worth US$133.3 mn by the end 2024.

Increased Usage in Healthcare Industry to Electrify MArket Development

With the rising utilization of hydrogen peroxide (H2O2) in its vaporized structure for purification, explicitly in the healthcare segment, the demand for hydrogen peroxide measurement gadgets has been showing a striking flood since the most recent couple of years. As the remnants remains from hydrogen peroxide are simply oxygen and water, the popularity of these gadgets is seeing high development in medical clinics, pharmacies, and research centers, intensive care units (ICU).

Experts at TMR foresee that the popularity rate of hydrogen peroxide measurement gadgets will stay expanding over the coming years, impacting the market's development significantly. The developing accentuation on employees in healthcare industry and the rising awareness with respect to the significance of improved indoor air quality will likewise boost the demand for these gadgets in the span of forthcoming years.

Hydrogen peroxide measurement discovers the greater part of its application in food and beverages, chemicals, laboratories, pharmaceuticals, healthcare, HAC systems, freeze dryer, and animal farming among which the healthcare segment has developed as the main end-use industry.

The competition is expected to highly intensify in the market over time. This is mainly due the fact that several players are expected to make their entry into the sector in the next few years. These players are also expected to pour huge investments in the market.

Usage of Hydrogen Peroxide in Making of Propylene Oxide to Fuel Market Demand

Rising adoption of the hydrogen peroxide in the making of propylene oxide is foreseen to help the demand regarding hydrogen peroxide in the chemical business in the coming years. Different employments of hydrogen peroxide are found crosswise over businesses, for example, in electronics, food processing, and textile. Hydrogen peroxide is utilized in the gadgets business for pickling metal surfaces. It is likewise used to dye chemical and natural fibers in the textile business.

Europe, Asia Pacific, Latin America, North America, and the Middle East and Africa are the primary regions markets for hydrogen peroxide measurement gadgets. Europe drove the global market in 2015 with an offer of almost 34%. An entrenched and propelled medical framework helped the mentioned region to obtain the main position.

Furthermore, the emergence of a huge pool of market players is probably going to help the region in keeping up its initiative over the prospective years. The expanding selection of HPV purification in drug stores, healthcare, and labs is likewise expected to support the closeout of these gadgets in Europe soon.

Table of Contents

1. Preface

1.1. Research Scope

1.2. Market Segmentation

1.3. Research Methodology

2. Executive Summary

2.1. Global H2O2 Measurement Market Snapshot

2.2. Global H2O2 Measurement Market Revenue and Volume, 2014 – 2024 (US$ Mn and Thousand Units) and Year-on-Year Growth (%)

3. Global H2O2 Measurement Market Analysis, 2014 – 2024 (US$ Mn and Thousand Units)

3.1. Overview

3.2. Key Trends Analysis

3.3. Market Dynamics

3.3.1. Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.4. Regional Price Trends Analysis

3.5. Market Share of Key Players

3.6. Technical Analysis: H2O2 Measurement Market

3.6.1. Technological overview - System requirement

3.6.2. Role of Intrinsically Safe Devices

3.6.3. Need of Data Logging

3.7. Global H2O2 Measurement Market Revenue and Volume, By Product Type, 2014 – 2024 (US$ Mn and Thousand Units)

3.7.1. Overview

3.7.2. H2O2 Sensors

3.7.3. H2O2 Detectors

3.7.4. Transmitters

3.8. Global H2O2 Measurement Market Revenue and Volume, By Application, 2014 – 2024 (US$ Mn and Thousand Units)

3.8.1. Overview

3.8.2. Pharmaceutical

3.8.3. Chemical

3.8.4. Healthcare

3.8.5. Food and Beverage

3.8.6. Laboratories

3.8.7. Animal Farming

3.8.8. HVAC Systems

3.8.9. Freeze Dryers

3.9. Global H2O2 Measurement Market Revenue, By Area of Operation, 2014 – 2024 (US$)

3.9.1. For Gaseous Application

3.9.1.1. Process Measurement (By Decontamination Technology)

3.9.1.1.1. Plasma Decontamination

3.9.1.1.2. H2O2 Fogging

3.9.1.1.3. Vaporized Hydrogen Peroxide (HPV) Decontamination

3.9.1.1.4. Vacuum

3.9.1.2. Safety Measurement (Plant and Personnel Safety)

3.9.2. For Aqueous Application

3.10. Global H2O2 Measurement Market Analysis, By Area of Operation in Application, 2014 – 2024 (US$ Mn)

3.10.1. Pharmaceutical

3.10.1.1. For Gaseous Application

3.10.1.1.1. Process Measurement

3.10.1.1.2. Safety Measurement

3.10.1.2. For Aqueous Application

3.10.2. Chemical

3.10.2.1. For Gaseous Application

3.10.2.1.1. Process Measurement

3.10.2.1.2. Safety Measurement

3.10.2.2. For Aqueous Application

3.10.3. Healthcare

3.10.3.1. For Gaseous Application

3.10.3.1.1. Process Measurement

3.10.3.1.2. Safety Measurement

3.10.3.2. For Aqueous Application

3.10.4. Food and Beverage

3.10.4.1. For Gaseous Application

3.10.4.1.1. Process Measurement

3.10.4.1.2. Safety Measurement

3.10.4.2. For Aqueous Application

3.10.5. Laboratories

3.10.5.1. For Gaseous Application

3.10.5.1.1. Process Measurement

3.10.5.1.2. Safety Measurement

3.10.5.2. For Aqueous Application

3.10.6. Animal Farming

3.10.6.1. For Gaseous Application

3.10.6.1.1. Process Measurement

3.10.6.1.2. Safety Measurement

3.10.6.2. For Aqueous Application

3.10.7. HVAC Systems

3.10.7.1. For Gaseous Application

3.10.7.1.1. Process Measurement

3.10.7.1.2. Safety Measurement

3.10.7.2. For Aqueous Application

3.10.8. Freeze Dryers

3.10.8.1. For Gaseous Application

3.10.8.1.1. Process Measurement

3.10.8.1.2. Safety Measurement

3.10.8.2. For Aqueous Application

3.11. Competitive Landscape

3.11.1. Market Positioning of Key Players, 2015

3.11.2. Competitive Strategies Adopted by Leading Players

4. North America H2O2 Measurement Market Analysis, 2014 – 2024 (US$ Mn and Thousand Units)

4.1. Key Trends Analysis

4.2. North America H2O2 Measurement Market Revenue and Volume, By Product Type, 2014 – 2024 (US$ Mn and Thousand Units)

4.2.1. Overview

4.2.2. H2O2 Sensors

4.2.3. H2O2 Detectors

4.2.4. Transmitters

4.3. North America H2O2 Measurement Market Revenue and Volume, By Application, 2014 – 2024 (US$ Mn and Thousand Units)

4.3.1. Overview

4.3.2. Pharmaceutical

4.3.3. Chemical

4.3.4. Healthcare

4.3.5. Food and Beverage

4.3.6. Laboratories

4.3.7. Animal Farming

4.3.8. HVAC Systems

4.3.9. Freeze Dryers

4.4. North America H2O2 Measurement Market Revenue, By Area of Operation, 2014 – 2024

4.4.1. For Gaseous Application

4.4.1.1. Process Measurement (By Decontamination Technology)

4.4.1.1.1. Plasma Decontamination

4.4.1.1.2. H2O2 Fogging

4.4.1.1.3. Vaporized Hydrogen Peroxide (HPV) Decontamination

4.4.1.1.4. Vacuum

4.4.1.2. Safety Measurement (Plant and Personnel Safety)

4.4.2. For Aqueous Application

4.5. North America H2O2 Measurement Market Analysis, By Geography, 2014 – 2024 (US$ Mn and Thousand Units)

4.5.1. Overview

4.5.2. U.S.

4.5.3. Rest of North America

5. Europe H2O2 Measurement Market Analysis, 2014 – 2024 (US$ Mn and Thousand Units)

5.1. Key Trends Analysis

5.2. Europe H2O2 Measurement Market Revenue and Volume, By Product Type, 2014 – 2024 (US$ Mn and Thousand Units)

5.2.1. Overview

5.2.2. H2O2 Sensors

5.2.3. H2O2 Detectors

5.2.4. Transmitters

5.3. Europe H2O2 Measurement Market Revenue and Volume, By Application, 2014 – 2024 (US$ Mn and Thousand Units)

5.3.1. Overview

5.3.2. Pharmaceutical

5.3.3. Chemical

5.3.4. Healthcare

5.3.5. Food and Beverage

5.3.6. Laboratories

5.3.7. Animal Farming

5.3.8. HVAC Systems

5.3.9. Freeze Dryers

5.4. Europe H2O2 Measurement Market Revenue, By Area of Operation, 2014 – 2024

5.4.1. For Gaseous Application

5.4.1.1. Process Measurement (By Decontamination Technology)

5.4.1.1.1. Plasma Decontamination

5.4.1.1.2. H2O2 Fogging

5.4.1.1.3. Vaporized Hydrogen Peroxide (HPV) Decontamination

5.4.1.1.4. Vacuum

5.4.1.2. Safety Measurement (Plant and Personnel Safety)

5.4.2. For Aqueous Application

5.5. Europe H2O2 Measurement Market Analysis, By Geography, 2014 – 2024 (US$ Mn and Thousand Units)

5.5.1. Overview

5.5.2. EU7

5.5.3. CIS

5.5.4. Rest of Europe

6. Asia Pacific H2O2 Measurement Market Analysis, 2014 – 2024 (US$ Mn and Thousand Units)

6.1. Key Trends Analysis

6.2. Asia Pacific H2O2 Measurement Market Revenue and Volume, By Product Type, 2014 – 2024 (US$ Mn and Thousand Units)

6.2.1. Overview

6.2.2. H2O2 Sensors

6.2.3. H2O2 Detectors

6.2.4. Transmitters

6.3. Asia Pacific H2O2 Measurement Market Revenue and Volume, By Application, 2014 – 2024 (US$ Mn and Thousand Units)

6.3.1. Overview

6.3.2. Pharmaceutical

6.3.3. Chemical

6.3.4. Healthcare

6.3.5. Food and Beverage

6.3.6. Laboratories

6.3.7. Animal Farming

6.3.8. HVAC Systems

6.3.9. Freeze Dryers

6.4. Asia Pacific H2O2 Measurement Market Revenue, By Area of Operation, 2014 – 2024

6.4.1. For Gaseous Application

6.4.1.1. Process Measurement (By Decontamination Technology)

6.4.1.1.1. Plasma Decontamination

6.4.1.1.2. H2O2 Fogging

6.4.1.1.3. Vaporized Hydrogen Peroxide (HPV) Decontamination

6.4.1.1.4. Vacuum

6.4.1.2. Safety Measurement (Plant and Personnel Safety)

6.4.2. For Aqueous Application

6.5. Asia Pacific H2O2 Measurement Market Analysis, By Geography, 2014 – 2024 (US$ Mn and Thousand Units)

6.5.1. Overview

6.5.2. Japan

6.5.3. China

6.5.4. South Asia

6.5.5. Australasia

6.5.6. Rest of APAC

7. Middle-East and Africa (MEA) H2O2 Measurement Market Analysis, 2014 – 2024 (US$ Mn and Thousand Units)

7.1. Key Trends Analysis

7.2. MEA H2O2 Measurement Market Revenue and Volume, By Product Type, 2014 – 2024 (US$ Mn and Thousand Units)

7.2.1. Overview

7.2.2. H2O2 Sensors

7.2.3. H2O2 Detectors

7.2.4. Transmitters

7.3. MEA H2O2 Measurement Market Revenue and Volume, By Application, 2014 – 2024 (US$ Mn and Thousand Units)

7.3.1. Overview

7.3.2. Pharmaceutical

7.3.3. Chemical

7.3.4. Healthcare

7.3.5. Food and Beverage

7.3.6. Laboratories

7.3.7. Animal Farming

7.3.8. HVAC Systems

7.3.9. Freeze Dryers

7.4. Middle East and Africa H2O2 Measurement Market Revenue, By Area of Operation, 2014 – 2024

7.4.1. For Gaseous Application

7.4.1.1. Process Measurement (By Decontamination Technology)

7.4.1.1.1. Plasma Decontamination

7.4.1.1.2. H2O2 Fogging

7.4.1.1.3. Vaporized Hydrogen Peroxide (HPV) Decontamination

7.4.1.1.4. Vacuum

7.4.1.2. Safety Measurement (Plant and Personnel Safety)

7.4.2. Aqueous Application

7.5. MEA H2O2 Measurement Market Analysis, By Geography, 2014 – 2024 (US$ Mn and Thousand Units)

7.5.1. Overview

7.5.2. GCC

7.5.3. South Africa

7.5.4. Rest of MEA

8. Latin America H2O2 Measurement Market Analysis, 2014 – 2024 (US$ Mn and Thousand Units)

8.1. Key Trends Analysis

8.2. Latin America H2O2 Measurement Market Revenue and Volume, By Product Type, 2014 – 2024 (US$ Mn and Thousand Units)

8.2.1. Overview

8.2.2. H2O2 Sensors

8.2.3. H2O2 Detectors

8.2.4. Transmitters

8.3. Latin America H2O2 Measurement Market Revenue and Volume, By Application, 2014 – 2024 (US$ Mn and Thousand Units)

8.3.1. Overview

8.3.2. Pharmaceutical

8.3.3. Chemical

8.3.4. Healthcare

8.3.5. Food and Beverage

8.3.6. Laboratories

8.3.7. Animal Farming

8.3.8. HVAC Systems

8.3.9. Freeze Dryers

8.4. Latin America H2O2 Measurement Market Revenue, By Area of Operation, 2014 – 2024

8.4.1. For Gaseous Application

8.4.1.1. Process Measurement (By Decontamination Technology)

8.4.1.1.1. Plasma Decontamination

8.4.1.1.2. H2O2 Fogging

8.4.1.1.3. Vaporized Hydrogen Peroxide (HPV) Decontamination

8.4.1.1.4. Vacuum

8.4.1.2. Safety Measurement (Plant and Personnel Safety)

8.4.2. For Aqueous Application

8.5. Latin America H2O2 Measurement Market Analysis, By Geography, 2014 – 2024 (US$ Mn and Thousand Units)

8.5.1. Overview

8.5.2. Brazil

8.5.3. Rest of Latin America

9. Company Profiles

9.1. Drägerwerk AG & Co.

9.2. Analytical Technology, Inc. (ATI)

9.3. Interscan Corporation

9.4. Picarro Inc.

9.5. The Gwent Group