Reports

Reports

Analysts’ Viewpoint on Market Scenario

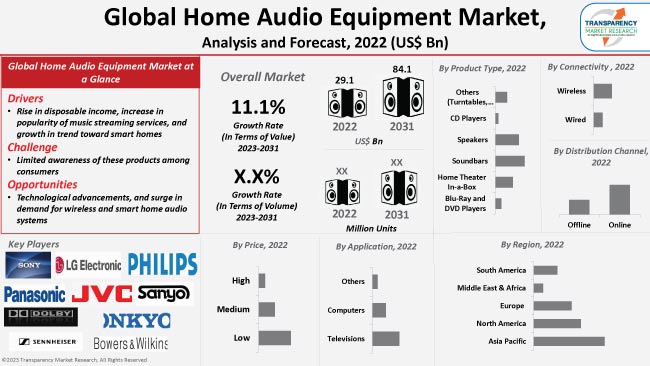

The global home audio equipment market size is expected to grow at a significant pace in the near future due to technological advancement in products with features such as wireless connectivity, and voice assistance. Rapid urbanization, changes in lifestyle, and rise in popularity of smart homes in developing countries are the key factors increasing the home audio equipment market share.

The rise of streaming services such as Spotify, Apple Music, and Tidal offers lucrative opportunities for market expansion, as consumers seek to improve their listening experience. Increase in adoption of quality home audio equipment is also boosting market development. Leading manufacturers are devising competitive marketing strategies and promotions to reach more customers and boost their product sales.

Home audio equipment refers to electronic devices and components which are used to produce, amplify, and play back sound in a home setting. It enables users to enjoy high-quality sound within the comfort of their own homes.

The home audio equipment industry is continuously growing and includes products such as speakers, amplifiers, headphones, soundbars, and receivers. Consumers are becoming more conscious of the quality of sound and are looking for products that can offer them a superior listening experience. One of the significant home audio equipment market trends is the usage of compact and portable audio devices, such as Bluetooth speakers and wireless headphones.

High end stereo systems for home offer superior sound quality and are often designed to be visually appealing as well. They can be a significant investment, but many audiophiles believe that the improved sound quality is well worth the cost.

Consumer demand for modern technology is fueling market progress. This is evident in the rapid development of new and inventive audio equipment such as wireless speakers, soundbars, Bluetooth connectivity, voice assistants, and smart speakers.

Growth in popularity of smart homes has led to a rise in demand for audio equipment that is connected with home automation systems and can be managed by voice assistants such as Amazon Alexa and Google Assistant. The development of smart speakers and other voice-controlled audio equipment is likely to increase home audio equipment market demand.

Spatial Studio, which significantly enhances the sound quality when numerous people are conversing at once, is one of the most significant innovations in the industry. Furthermore, Pioneer home audio speakers have become an increasingly popular choice among music listeners and manufacturers owing to the rapid digitalization of musical instruments.

Home audio equipment is being adopted extensively across the globe, especially in emerging economies, due to the speed of technological improvements in the industry and the decline in production costs.

The popularity of online entertainment and high-speed data streaming, rapid urbanization, and altering consumer preferences, are the primary drivers responsible for home audio equipment industry growth, especially in developing economies.

The popularity of home entertainment encourages more consumers to create home theaters and media rooms. This has led to an increase in demand for high end home audio systems that can provide immersive sound and enhance the overall entertainment experience.

Furthermore, as disposable incomes increase, consumers are willing to spend more on high-quality audio equipment to enhance their entertainment experience at home, bolstering the demand for premium home theater equipment that offer superior sound quality.

Development of new audio products that are compatible with streaming services is thus expected to enhance the home audio equipment market value.

Based on product type, the market is segmented into Blu-ray and DVD players, home theater in-a-box, soundbars, speakers, CD players, and others (turntables, etc). Soundbars are likely to lead the global market during the forecast period as these are compact speakers that are designed to enhance the sound quality of a television and other home sound systems. With the extensive consumption of immersive media content, sound details are more accurate and clearer with soundbars.

Based on connectivity, the global home audio equipment market has been classified into wired and wireless. The wireless segment is estimated to lead the global market in the next few years. These gadgets are easy to connect to other devices and can be controlled both manually and remotely. They are convenient and simple to set up, in contrast to wired systems, which require complex installation and wiring.

Additionally, a wide range of devices, such as smartphones, tablets, and laptops that can stream music from anywhere can be used with wireless audio systems. Many of the wireless home audio systems are built using cutting-edge audio technology that produce high-quality sound even in big rooms or outside spaces.

According to the home audio equipment market analysis, Asia Pacific is likely to dominate the global market during the forecast period. Surge in population of youngsters, rise in standard of living, modern lifestyles, and growth in disposable income in emerging economies such as India and China is driving the purchase of quality home audio equipment.

Moreover, people in Asia Pacific choose integrated media devices that can be operated remotely and connected automatically to their devices. Also, large number of consumers opting for smart homes in APAC, is driving home audio equipment market growth in the region.

The home audio equipment market is highly competitive, as manufacturers are offering a wide range of products at varying price points. They are focusing on product development and introducing more efficient home audio equipment at reasonable price.

Furthermore, key manufacturers are focusing on home audio equipment market opportunities, industry research, and striving to meet the demands of customers as per latest trends to stay ahead of the competitive curve.

The global home audio equipment industry is highly fragmented due to presence of many local, regional and global players. Sony Corporation, Panasonic Corporation, LG Electronics, Dolby Laboratories Inc, JVC KENWOOD Holdings Inc., Koninklijke Philips Electronics NV, Onkyo Corporation, Sanyo Electric Co. Ltd., Sennheiser Electronic GmbH. Co.KG, and Bowers & Wilkins Group Ltd. are key entities operating in this industry.

Each of these players has been profiled in the home audio equipment market report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 29.1 Bn |

| Market Forecast Value in 2031 | US$ 84.1 Bn |

| Growth Rate (CAGR) | 11.1% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and brand analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 29.1 Bn in 2022

It is expected to reach US$ 84.1 Bn by the end of 2031

It is anticipated to advance at a CAGR of 11.1% from 2023 to 2031

Rapid advancement in technology, rise in disposable income of consumers, and increase in popularity of music streaming services

Soundbars product type segment holds major share

Asia Pacific is a more attractive region for vendors

Sony Corporation, Panasonic Corporation, LG Electronics, Dolby Laboratories Inc, JVC KENWOOD Holdings Inc., Koninklijke Philips Electronics NV, Onkyo Corporation, Sanyo Electric Co. Ltd., Sennheiser Electronic GmbH. Co.KG, and Bowers & Wilkins Group Ltd

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Technology Overview

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Home Audio Equipment Market Analysis and Forecast, 2017-2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Million Units)

6. Global Home Audio Equipment Market Analysis and Forecast, By Product Type

6.1. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017-2031

6.1.1. Blu-Ray and DVD Players

6.1.2. Home Theater In-a-Box

6.1.3. Soundbars

6.1.4. Speakers

6.1.5. CD Players

6.1.6. Others

6.2. Incremental Opportunity, By Product Type

7. Global Home Audio Equipment Market Analysis and Forecast, By Connectivity

7.1. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Connectivity, 2017-2031

7.1.1. Wired

7.1.2. Wireless

7.2. Incremental Opportunity, By Connectivity

8. Global Home Audio Equipment Market Analysis and Forecast, By Price

8.1. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Price, 2017-2031

8.1.1. Low

8.1.2. Medium

8.1.3. High

8.2. Incremental Opportunity, By Price

9. Global Home Audio Equipment Market Analysis and Forecast, By Application

9.1. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Application, 2017-2031

9.1.1. Televisions

9.1.2. Computers

9.1.3. Others

9.2. Incremental Opportunity, By Application

10. Global Home Audio Equipment Market Analysis and Forecast, By Distribution Channel

10.1. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017-2031

10.1.1. Online

10.1.1.1. E-commerce Websites

10.1.1.2. Company Owned Websites

10.1.2. Offline

10.1.2.1. Specialty Stores

10.1.2.2. Supermarkets/Hypermarkets

10.1.2.3. Departmental Stores

10.1.2.4. Convenience Stores

10.2. Incremental Opportunity, By Distribution Channel

11. Global Home Audio Equipment Market Analysis and Forecast, By Region

11.1. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Region, 2017-2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Home Audio Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Price

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Brand Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017-2031

12.6.1. Blu-Ray and DVD Players

12.6.2. Home Theater In-a-Box

12.6.3. Soundbars

12.6.4. Speakers

12.6.5. CD Players

12.6.6. Others

12.7. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Connectivity, 2017-2031

12.7.1. Wired

12.7.2. Wireless

12.8. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Price, 2017-2031

12.8.1. Low

12.8.2. Medium

12.8.3. High

12.9. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Application, 2017-2031

12.9.1. Televisions

12.9.2. Computers

12.9.3. Others

12.10. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017-2031

12.10.1. Online

12.10.1.1. E-commerce Websites

12.10.1.2. Company Owned Websites

12.10.2. Offline

12.10.2.1. Specialty Stores

12.10.2.2. Supermarkets/Hypermarkets

12.10.2.3. Departmental Stores

12.10.2.4. Convenience Stores

12.11. Home Audio Equipment Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2027

12.11.1. U.S.

12.11.2. Canada

12.11.3. Rest of North America

12.12. Incremental Opportunity Analysis

13. Europe Home Audio Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Price

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017-2031

13.6.1. Blu-Ray and DVD Players

13.6.2. Home Theater In-a-Box

13.6.3. Soundbars

13.6.4. Speakers

13.6.5. CD Players

13.6.6. Others

13.7. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Connectivity, 2017-2031

13.7.1. Wired

13.7.2. Wireless

13.8. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Price, 2017-2031

13.8.1. Low

13.8.2. Medium

13.8.3. High

13.9. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Application, 2017-2031

13.9.1. Televisions

13.9.2. Computers

13.9.3. Others

13.10. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017-2031

13.10.1. Online

13.10.1.1. E-commerce Websites

13.10.1.2. Company Owned Websites

13.10.2. Offline

13.10.2.1. Specialty Stores

13.10.2.2. Supermarkets/Hypermarkets

13.10.2.3. Departmental Stores

13.10.2.4. Convenience Stores

13.11. Home Audio Equipment Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017-2031

13.11.1. U.K.

13.11.2. Germany

13.11.3. France

13.11.4. Rest of Europe

13.12. Incremental Opportunity Analysis

14. Asia Pacific Home Audio Equipment Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Price

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017-2031

14.6.1. Blu-Ray and DVD Players

14.6.2. Home Theater In-a-Box

14.6.3. Soundbars

14.6.4. Speakers

14.6.5. CD Players

14.6.6. Others

14.7. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Connectivity, 2017-2031

14.7.1. Wired

14.7.2. Wireless

14.8. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Price, 2017-2031

14.8.1. Low

14.8.2. Medium

14.8.3. High

14.9. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Application, 2017-2031

14.9.1. Televisions

14.9.2. Computers

14.9.3. Others

14.10. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017-2031

14.10.1. Online

14.10.1.1. E-commerce Websites

14.10.1.2. Company Owned Websites

14.10.2. Offline

14.10.2.1. Specialty Stores

14.10.2.2. Supermarkets/Hypermarkets

14.10.2.3. Departmental Stores

14.10.2.4. Convenience Stores

14.11. Home Audio Equipment Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017-2031

14.11.1. China

14.11.2. India

14.11.3. Japan

14.11.4. Rest of Asia Pacific

14.12. Incremental Opportunity Analysis

15. Middle East & Africa Home Audio Equipment Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Price

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017-2031

15.6.1. Blu-Ray and DVD Players

15.6.2. Home Theater In-a-Box

15.6.3. Soundbars

15.6.4. Speakers

15.6.5. CD Players

15.6.6. Others

15.7. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Connectivity, 2017-2031

15.7.1. Wired

15.7.2. Wireless

15.8. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Price, 2017-2031

15.8.1. Low

15.8.2. Medium

15.8.3. High

15.9. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Application, 2017-2031

15.9.1. Televisions

15.9.2. Computers

15.9.3. Others

15.10. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017-2031

15.10.1. Online

15.10.1.1. E-commerce Websites

15.10.1.2. Company Owned Websites

15.10.2. Offline

15.10.2.1. Specialty Stores

15.10.2.2. Supermarkets/Hypermarkets

15.10.2.3. Departmental Stores

15.10.2.4. Convenience Stores

15.11. Home Audio Equipment Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017-2031

15.11.1. GCC

15.11.2. South Africa

15.11.3. Rest of Middle East & Africa

15.12. Incremental Opportunity Analysis

16. South America Home Audio Equipment Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Price

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Brand Analysis

16.5. Consumer Buying Behavior Analysis

16.6. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017-2031

16.6.1. Blu-Ray and DVD Players

16.6.2. Home Theater In-a-Box

16.6.3. Soundbars

16.6.4. Speakers

16.6.5. CD Players

16.6.6. Others

16.7. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Connectivity, 2017-2031

16.7.1. Wired

16.7.2. Wireless

16.8. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Price, 2017-2031

16.8.1. Low

16.8.2. Medium

16.8.3. High

16.9. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Application, 2017-2031

16.9.1. Televisions

16.9.2. Computers

16.9.3. Others

16.10. Home Audio Equipment Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017-2031

16.10.1. Online

16.10.1.1. E-commerce Websites

16.10.1.2. Company Owned Websites

16.10.2. Offline

16.10.2.1. Specialty Stores

16.10.2.2. Supermarkets/Hypermarkets

16.10.2.3. Departmental Stores

16.10.2.4. Convenience Stores

16.11. Home Audio Equipment Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017-2031

16.11.1. Brazil

16.11.2. Rest of South America

16.12. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player - Competition Dashboard

17.2. Market Share Analysis - 2022 (%)

17.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

17.3.1. Sony Corporation

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Revenue

17.3.1.4. Strategy & Business Overview

17.3.2. Panasonic Corporation

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Revenue

17.3.2.4. Strategy & Business Overview

17.3.3. LG Electronics

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Revenue

17.3.3.4. Strategy & Business Overview

17.3.4. Dolby Laboratories Inc.

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Revenue

17.3.4.4. Strategy & Business Overview

17.3.5. JVC KENWOOD Holdings Inc.

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Revenue

17.3.5.4. Strategy & Business Overview

17.3.6. Koninklijke Philips Electronics NV

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Revenue

17.3.6.4. Strategy & Business Overview

17.3.7. Onkyo Corporation

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Revenue

17.3.7.4. Strategy & Business Overview

17.3.8. Sanyo Electric Co. Ltd.

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Revenue

17.3.8.4. Strategy & Business Overview

17.3.9. Sennheiser Electronic GmbH. Co.KG

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Revenue

17.3.9.4. Strategy & Business Overview

17.3.10. Bowers & Wilkins Group Ltd

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Revenue

17.3.10.4. Strategy & Business Overview

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.1.1. Product Type

18.1.2. Connectivity

18.1.3. Price

18.1.4. Application

18.1.5. Distribution channel

18.1.6. Region

18.2. Understanding the Procurement Process of End-users

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Home Audio Equipment Market by Product Type, Million Units 2017-2031

Table 2: Global Home Audio Equipment Market by Product Type, US$ Bn 2017-2031

Table 3: Global Home Audio Equipment Market by Connectivity, Million Units 2017-2031

Table 4: Global Home Audio Equipment Market by Connectivity, US$ Bn 2017-2031

Table 5: Global Home Audio Equipment Market by Price, Million Units 2017-2031

Table 6: Global Home Audio Equipment Market by Price, US$ Bn 2017-2031

Table 7: Global Home Audio Equipment Market by Application, Million Units, 2017-2031

Table 8: Global Home Audio Equipment Market by Application, US$ Bn 2017-2031

Table 9: Global Home Audio Equipment Market by Distribution Channel, Million Units, 2017-2031

Table 10: Global Home Audio Equipment Market by Distribution Channel, US$ Bn 2017-2031

Table 11: Global Home Audio Equipment Market by Region, Million Units, 2017-2031

Table 12: Global Home Audio Equipment Market by Region, US$ Bn 2017-2031

Table 13: North America Home Audio Equipment Market by Product Type, Million Units 2017-2031

Table 14: North America Home Audio Equipment Market by Product Type, US$ Bn 2017-2031

Table 15: North America Home Audio Equipment Market by Connectivity, Million Units 2017-2031

Table 16: North America Home Audio Equipment Market by Connectivity, US$ Bn 2017-2031

Table 17: North America Home Audio Equipment Market by Price, Million Units 2017-2031

Table 18: North America Home Audio Equipment Market by Price, US$ Bn 2017-2031

Table 19: North America Home Audio Equipment Market by Application, Million Units, 2017-2031

Table 20: North America Home Audio Equipment Market by Application, US$ Bn 2017-2031

Table 21: North America Home Audio Equipment Market by Distribution Channel, Million Units, 2017-2031

Table 22: North America Home Audio Equipment Market by Distribution Channel, US$ Bn 2017-2031

Table 23: Europe Home Audio Equipment Market by Product Type, Million Units 2017-2031

Table 24: Europe Home Audio Equipment Market by Product Type, US$ Bn 2017-2031

Table 25: Europe Home Audio Equipment Market by Connectivity, Million Units 2017-2031

Table 26: Europe Home Audio Equipment Market by Connectivity, US$ Bn 2017-2031

Table 27: Europe Home Audio Equipment Market by Price, Million Units 2017-2031

Table 28: Europe Home Audio Equipment Market by Price, US$ Bn 2017-2031

Table 29: Europe Home Audio Equipment Market by Application, Million Units, 2017-2031

Table 30: Europe Home Audio Equipment Market by Application, US$ Bn 2017-2031

Table 31: Europe Home Audio Equipment Market by Distribution Channel, Million Units, 2017-2031

Table 32: Europe Home Audio Equipment Market by Distribution Channel, US$ Bn 2017-2031

Table 33: Asia Pacific Home Audio Equipment Market by Product Type, Million Units 2017-2031

Table 34: Asia Pacific Home Audio Equipment Market by Product Type, US$ Bn 2017-2031

Table 35: Asia Pacific Home Audio Equipment Market by Connectivity, Million Units 2017-2031

Table 36: Asia Pacific Home Audio Equipment Market by Connectivity, US$ Bn 2017-2031

Table 37: Asia Pacific Home Audio Equipment Market by Price, Million Units 2017-2031

Table 38: Asia Pacific Home Audio Equipment Market by Price, US$ Bn 2017-2031

Table 39: Asia Pacific Home Audio Equipment Market by Application, Million Units, 2017-2031

Table 40: Asia Pacific Home Audio Equipment Market by Application, US$ Bn 2017-2031

Table 41: Asia Pacific Home Audio Equipment Market by Distribution Channel, Million Units, 2017-2031

Table 42: Asia Pacific Home Audio Equipment Market by Distribution Channel, US$ Bn 2017-2031

Table 43: Middle East & Africa Home Audio Equipment Market by Product Type, Million Units 2017-2031

Table 44: Middle East & Africa Home Audio Equipment Market by Product Type, US$ Bn 2017-2031

Table 45: Middle East & Africa Home Audio Equipment Market by Connectivity, Million Units 2017-2031

Table 46: Middle East & Africa Home Audio Equipment Market by Connectivity, US$ Bn 2017-2031

Table 47: Middle East & Africa Home Audio Equipment Market by Price, Million Units 2017-2031

Table 48: Middle East & Africa Home Audio Equipment Market by Price, US$ Bn 2017-2031

Table 49: Middle East & Africa Home Audio Equipment Market by Application, Million Units, 2017-2031

Table 50: Middle East & Africa Home Audio Equipment Market by Application, US$ Bn 2017-2031

Table 51: Middle East & Africa Home Audio Equipment Market by Distribution Channel, Million Units, 2017-2031

Table 52: Middle East & Africa Home Audio Equipment Market by Distribution Channel, US$ Bn 2017-2031

Table 53: South America Home Audio Equipment Market by Product Type, Million Units 2017-2031

Table 54: South America Home Audio Equipment Market by Product Type, US$ Bn 2017-2031

Table 55: South America Home Audio Equipment Market by Connectivity, Million Units 2017-2031

Table 56: South America Home Audio Equipment Market by Connectivity, US$ Bn 2017-2031

Table 57: South America Home Audio Equipment Market by Price, Million Units 2017-2031

Table 58: South America Home Audio Equipment Market by Price, US$ Bn 2017-2031

Table 59: South America Home Audio Equipment Market by Application, Million Units, 2017-2031

Table 60: South America Home Audio Equipment Market by Application, US$ Bn 2017-2031

Table 61: South America Home Audio Equipment Market by Distribution Channel, Million Units, 2017-2031

Table 62: South America Home Audio Equipment Market by Distribution Channel, US$ Bn 2017-2031

List of Figures

Figure 1: Global Home Audio Equipment Market Projections, by Product Type, Million Units, 2017-2031

Figure 2: Global Home Audio Equipment Market Projections, by Product Type, US$ Bn 2017-2031

Figure 3: Global Home Audio Equipment Market, Incremental Opportunity, by Product Type, US$ Bn 2023-2031

Figure 4: Global Home Audio Equipment Market Projections, by Connectivity, Million Units, 2017-2031

Figure 5: Global Home Audio Equipment Market Projections, by Connectivity, US$ Bn 2017-2031

Figure 6: Global Home Audio Equipment Market, Incremental Opportunity, by Connectivity, US$ Bn 2023-2031

Figure 7: Global Home Audio Equipment Market Projections, by Price, Million Units, 2017-2031

Figure 8: Global Home Audio Equipment Market Projections, by Price, US$ Bn 2017-2031

Figure 9: Global Home Audio Equipment Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 10: Global Home Audio Equipment Market Projections, by Application, Million Units, 2017-2031

Figure 11: Global Home Audio Equipment Market Projections, by Application, US$ Bn 2017-2031

Figure 12: Global Home Audio Equipment Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 13: Global Home Audio Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 14: Global Home Audio Equipment Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 15: Global Home Audio Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 16: Global Home Audio Equipment Market Projections, by Region, Million Units, 2017-2031

Figure 17: Global Home Audio Equipment Market Projections, by Region, US$ Bn 2017-2031

Figure 18: Global Home Audio Equipment Market, Incremental Opportunity, by Region, US$ Bn 2023-2031

Figure 19: North America Home Audio Equipment Market Projections, by Product Type, Million Units, 2017-2031

Figure 20: North America Home Audio Equipment Market Projections, by Product Type, US$ Bn 2017-2031

Figure 21: North America Home Audio Equipment Market, Incremental Opportunity, by Product Type, US$ Bn 2023-2031

Figure 22: North America Home Audio Equipment Market Projections, by Connectivity, Million Units, 2017-2031

Figure 23: North America Home Audio Equipment Market Projections, by Connectivity, US$ Bn 2017-2031

Figure 24: North America Home Audio Equipment Market, Incremental Opportunity, by Connectivity, US$ Bn 2023-2031

Figure 25: North America Home Audio Equipment Market Projections, by Price, Million Units, 2017-2031

Figure 26: North America Home Audio Equipment Market Projections, by Price, US$ Bn 2017-2031

Figure 27: North America Home Audio Equipment Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 28: North America Home Audio Equipment Market Projections, by Application, Million Units, 2017-2031

Figure 29: North America Home Audio Equipment Market Projections, by Application, US$ Bn 2017-2031

Figure 30: North America Home Audio Equipment Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 31: North America Home Audio Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 32: North America Home Audio Equipment Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 33: North America Home Audio Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 34: Europe Home Audio Equipment Market Projections, by Product Type, Million Units, 2017-2031

Figure 35: Europe Home Audio Equipment Market Projections, by Product Type, US$ Bn 2017-2031

Figure 36: Europe Home Audio Equipment Market, Incremental Opportunity, by Product Type, US$ Bn 2023-2031

Figure 37: Europe Home Audio Equipment Market Projections, by Connectivity, Million Units, 2017-2031

Figure 38: Europe Home Audio Equipment Market Projections, by Connectivity, US$ Bn 2017-2031

Figure 39: Europe Home Audio Equipment Market, Incremental Opportunity, by Connectivity, US$ Bn 2023-2031

Figure 40: Europe Home Audio Equipment Market Projections, by Price, Million Units, 2017-2031

Figure 41: Europe Home Audio Equipment Market Projections, by Price, US$ Bn 2017-2031

Figure 42: Europe Home Audio Equipment Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 43: Europe Home Audio Equipment Market Projections, by Application, Million Units, 2017-2031

Figure 44: Europe Home Audio Equipment Market Projections, by Application, US$ Bn 2017-2031

Figure 45: Europe Home Audio Equipment Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 46: Europe Home Audio Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 47: Europe Home Audio Equipment Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 48: Europe Home Audio Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 49: Asia Pacific Home Audio Equipment Market Projections, by Product Type, Million Units, 2017-2031

Figure 50: Asia Pacific Home Audio Equipment Market Projections, by Product Type, US$ Bn 2017-2031

Figure 51: Asia Pacific Home Audio Equipment Market, Incremental Opportunity, by Product Type, US$ Bn 2023-2031

Figure 52: Asia Pacific Home Audio Equipment Market Projections, by Connectivity, Million Units, 2017-2031

Figure 53: Asia Pacific Home Audio Equipment Market Projections, by Connectivity, US$ Bn 2017-2031

Figure 54: Asia Pacific Home Audio Equipment Market, Incremental Opportunity, by Connectivity, US$ Bn 2023-2031

Figure 55: Asia Pacific Home Audio Equipment Market Projections, by Price, Million Units, 2017-2031

Figure 56: Asia Pacific Home Audio Equipment Market Projections, by Price, US$ Bn 2017-2031

Figure 57: Asia Pacific Home Audio Equipment Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 58: Asia Pacific Home Audio Equipment Market Projections, by Application, Million Units, 2017-2031

Figure 59: Asia Pacific Home Audio Equipment Market Projections, by Application, US$ Bn 2017-2031

Figure 60: Asia Pacific Home Audio Equipment Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 61: Asia Pacific Home Audio Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 62: Asia Pacific Home Audio Equipment Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 63: Asia Pacific Home Audio Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 64: Middle East & Africa Home Audio Equipment Market Projections, by Product Type, Million Units, 2017-2031

Figure 65: Middle East & Africa Home Audio Equipment Market Projections, by Product Type, US$ Bn 2017-2031

Figure 66: Middle East & Africa Home Audio Equipment Market, Incremental Opportunity, by Product Type, US$ Bn 2023-2031

Figure 67: Middle East & Africa Home Audio Equipment Market Projections, by Connectivity, Million Units, 2017-2031

Figure 68: Middle East & Africa Home Audio Equipment Market Projections, by Connectivity, US$ Bn 2017-2031

Figure 69: Middle East & Africa Home Audio Equipment Market, Incremental Opportunity, by Connectivity, US$ Bn 2023-2031

Figure 70: Middle East & Africa Home Audio Equipment Market Projections, by Price, Million Units, 2017-2031

Figure 71: Middle East & Africa Home Audio Equipment Market Projections, by Price, US$ Bn 2017-2031

Figure 72: Middle East & Africa Home Audio Equipment Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 73: Middle East & Africa Home Audio Equipment Market Projections, by Application, Million Units, 2017-2031

Figure 74: Middle East & Africa Home Audio Equipment Market Projections, by Application, US$ Bn 2017-2031

Figure 75: Middle East & Africa Home Audio Equipment Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 76: Middle East & Africa Home Audio Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 77: Middle East & Africa Home Audio Equipment Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 78: Middle East & Africa Home Audio Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 79: South America Home Audio Equipment Market Projections, by Product Type, Million Units, 2017-2031

Figure 80: South America Home Audio Equipment Market Projections, by Product Type, US$ Bn 2017-2031

Figure 81: South America Home Audio Equipment Market, Incremental Opportunity, by Product Type, US$ Bn 2023-2031

Figure 82: South America Home Audio Equipment Market Projections, by Connectivity, Million Units, 2017-2031

Figure 83: South America Home Audio Equipment Market Projections, by Connectivity, US$ Bn 2017-2031

Figure 84: South America Home Audio Equipment Market, Incremental Opportunity, by Connectivity, US$ Bn 2023-2031

Figure 85: South America Home Audio Equipment Market Projections, by Price, Million Units, 2017-2031

Figure 86: South America Home Audio Equipment Market Projections, by Price, US$ Bn 2017-2031

Figure 87: South America Home Audio Equipment Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 88: South America Home Audio Equipment Market Projections, by Application, Million Units, 2017-2031

Figure 89: South America Home Audio Equipment Market Projections, by Application, US$ Bn 2017-2031

Figure 90: South America Home Audio Equipment Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 91: South America Home Audio Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 92: South America Home Audio Equipment Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 93: South America Home Audio Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031