Reports

Reports

Healthcare IT outsourcing is one of the normal practices to reduce down the functional expenses of the market. IT for the most part acquires help from a few government initiatives and guidelines to underline the necessity for great healthcare administrations and how its expense proficiency will benefit the majority. One of the bigger and promising patterns in the worldwide healthcare industry is to be the outsider IT outsourcing. In addition to this, the interest for outsourcing healthcare IT is relied upon to become much more due to the developing need of chopping down the in-house healthcare IT costs. Besides, as of late, there has been significant development as far as financing and speculations to create and fortify the healthcare framework. This also is helping the improvement of the worldwide healthcare IT outsourcing market. Different factors, for example, the expanding prerequisite for customer or patient fulfillment and upgraded productivity and simple availability of administrations at lower costs are additionally expected to drive the development of the worldwide healthcare IT outsourcing market.

Healthcare changes keep on pushing for better cooperation among hospitals and patients. As indicated by the Centers for Medicare and Medicaid Services, hospitals and wellbeing revolve around the nation are ordered to run after joining technology and patient consideration for more intuitive and productive tasks. Healthcare facilities are ordered to pursue e-entries which would make it more straightforward to acquire, view, and communicate with online data. Additionally, they are likewise expected to advance the electronic trade of information for more precise data. In conclusion, the precision of information is relied upon to positively affect wellbeing results. Subsequently, the recently passed commands, cost-viability of outsourcing, and positive wellbeing results are relied upon to drive the development of the healthcare IT outsourcing market.

New correspondence channels empowering communication among specialists and patients are relied upon to make new wellsprings of income in the healthcare IT outsourcing market. Before the digital interruptions, concerns in regards to sexual wellbeing regularly went neglected. Notwithstanding, today it is a billion-dollar industry by its own doing, on account of new businesses that are connecting with patients secretly and changing the traditional arrangement. Numerous patients feel undeniably more open to examining issues viewing their sexual wellbeing on the web when contrasted with face to face, despite steady endeavors to prepare specialists for better relational communications. This is relied upon to be a significant help for the healthcare IT outsourcing market as new income streams guarantee a worthwhile future for hospitals.

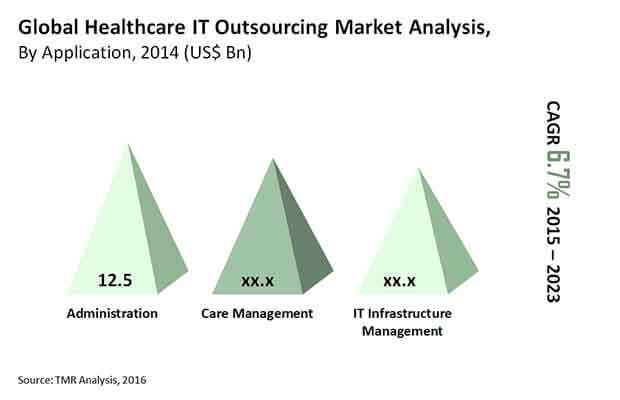

The global healthcare IT outsourcing market is classified on the basis of application, end use, and regions. In terms of application, the market is grouped into IT infrastructure management, administration, and care management. Of these, the administration segment represented around 37% of the general piece of the pie in the year 2014 and it is projected to keep on overwhelming throughout the span of the given gauge time frame. There are different variables that are answerable for driving the development of the organization fragment of the worldwide healthcare IT outsourcing market. A portion of the key driving elements is expanding the patient pool and developing interests in the healthcare area. This has brought about expanding the quantity of the managerial cycles in the healthcare area and accordingly driving the development of the section. On the basis of end use, the market is bifurcated into healthcare providers and healthcare payers.

Regionwise, the global healthcare IT outsourcing market is dominated by North America. This territorial fragment represented around 40% of the general piece of the pie. The territorial market was esteemed at US$13.4 bn in the year 2014 and will build it upto US$21.2 bn by 2023. The local portion is relied upon to exhibit a promising CAGR of 5.10% throughout the given estimate time frame. Some of the key players of the global healthcare IT outsourcing market include IBM Corp, Tata Consultancy Services Ltd., Cognizant Technology, Accenture Plc., Wipro Ltd., and others.

1. Preface

1.1. Research Scope

1.2. Market Segmentation

1.3. Research Methodology

2. Executive Summary

2.1. Global Healthcare IT Outsourcing Market Snapshot

2.2. Global Healthcare IT Outsourcing Market Revenue, 2013 – 2023 (US$ Mn) and Year-on-Year Growth (%)

3. Global Healthcare IT Outsourcing Market Analysis, 2013 – 2023 (US$ Mn)

3.1. Key Trends Analysis

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.3. Global Healthcare IT Outsourcing Market Analysis, By Application, 2013 – 2023 (US$ Mn)

3.3.1. Care Management

3.3.2. Administration

3.3.3. IT Infrastructure Management

3.4. Global Healthcare IT Outsourcing Market Analysis, By End-use, 2013 – 2023 (US$ Mn)

3.4.1. Healthcare Providers

3.4.2. Healthcare Payers

3.5. Competitive Landscape

3.5.1. Market Positioning of Key Players, 2014

3.5.2. Competitive Strategies Adopted by Leading Players

4. North America Healthcare IT Outsourcing Market Analysis, 2013 – 2023 (US$ Mn)

4.1. Key Trends Analysis

4.2. North America Healthcare IT Outsourcing Market Analysis, By Application, 2013 – 2023 (US$ Mn)

4.2.1. Care Management

4.2.2. Administration

4.2.3. IT Infrastructure Management

4.3. North America Healthcare IT Outsourcing Market Analysis, By End-use, 2013 – 2023 (US$ Mn)

4.3.1. Healthcare Providers

4.3.2. Healthcare Payers

4.4. North America Healthcare IT Outsourcing Market Analysis, By Country, 2013 – 2023 (US$ Mn)

4.4.1. U.S.

4.4.2. Rest of North America

5. Europe Healthcare IT Outsourcing Market Analysis, 2013 – 2023 (US$ Mn)

5.1. Key Trends Analysis

5.2. Europe Healthcare IT Outsourcing Market Analysis, By Application, 2013 – 2023 (US$ Mn)

5.2.1. Care Management

5.2.2. Administration

5.2.3. IT Infrastructure Management

5.3. Europe Healthcare IT Outsourcing Market Analysis, By End-use, 2013 – 2023 (US$ Mn)

5.3.1. Healthcare Providers

5.3.2. Healthcare Payers

5.4. Europe Healthcare IT Outsourcing Market Analysis, By Region, 2013 – 2023 (US$ Mn)

5.4.1. EU7 (UK, Italy, Spain, France, Germany, Belgium, and Netherlands)

5.4.2. CIS

5.4.3. Rest of Europe

6. Asia Pacific Healthcare IT Outsourcing Market Analysis, 2013 – 2023 (US$ Mn)

6.1. Key Trends Analysis

6.2. Asia Pacific Healthcare IT Outsourcing Market Analysis, By Application, 2013 – 2023 (US$ Mn)

6.2.1. Care Management

6.2.2. Administration

6.2.3. IT Infrastructure Management

6.3. Asia Pacific Healthcare IT Outsourcing Market Analysis, By End-use, 2013 – 2023 (US$ Mn)

6.3.1. Healthcare Providers

6.3.2. Healthcare Payers

6.4. Asia Pacific Healthcare IT Outsourcing Market Analysis, By Region, 2013 – 2023 (US$ Mn)

6.4.1. Japan

6.4.2. China

6.4.3. South Asia (India, Pakistan, Bangladesh, & Sri Lanka)

6.4.4. Australasia (Australia, NZ & Guinea)

6.4.5. Rest of Asia Pacific

7. Middle East and Africa (MEA) Healthcare IT Outsourcing Market Analysis, 2013 – 2023 (US$ Mn)

7.1. Key Trends Analysis

7.2. MEA Healthcare IT Outsourcing Market Analysis, By Application, 2013 – 2023 (US$ Mn)

7.2.1. Care Management

7.2.2. Administration

7.2.3. IT Infrastructure Management

7.3. MEA Healthcare IT Outsourcing Market Analysis, By End-use, 2013 – 2023 (US$ Mn)

7.3.1. Healthcare Providers

7.3.2. Healthcare Payers

7.4. MEA Healthcare IT Outsourcing Market Analysis, By Region, 2013 – 2023 (US$ Mn)

7.4.1. GCC Countries

7.4.2. South Africa

7.4.3. Rest of MEA

8. Latin America Healthcare IT Outsourcing Market Analysis, 2013 – 2023 (US$ Mn)

8.1. Key Trends Analysis

8.2. Latin America Healthcare IT Outsourcing Market Analysis, By Application, 2013 – 2023 (US$ Mn)

8.2.1. Care Management

8.2.2. Administration

8.2.3. IT Infrastructure Management

8.3. Latin America Healthcare IT Outsourcing Market Analysis, By End-use, 2013 – 2023 (US$ Mn)

8.3.1. Healthcare Providers

8.3.2. Healthcare Payers

8.4. Latin America Healthcare IT Outsourcing Market Analysis, By Region, 2013 – 2023(US$ Bn)

8.4.1. Brazil

8.4.2. Rest of Latin America

9. Company Profiles

9.1. Accenture Plc.

9.2. IBM Corporation

9.3. Cognizant Technology Solutions

9.4. Tata Consultancy Services Ltd

9.5. Infosys Limited

9.6. L&T Infotech

9.7. Allscripts Healthcare Solutions, Inc.

9.8. McKesson Corporation

9.9. HCL Technologies Ltd

9.10. Wipro Limited