Reports

Reports

The global halal products market has expanded at a promising pace in the past few years and is expected to embark upon a path of exponential growth in the next few years as well. Rising global population of the Muslim community and rising disposable incomes across some of the world’s prominent Islamic countries are expected to be the key drivers of the market. However, the market is expected to bear the brunt of the lack of transparency with respect to the use of ingredients for the pharmaceutical and personal care products and the absence of a globally uniform halal standard.

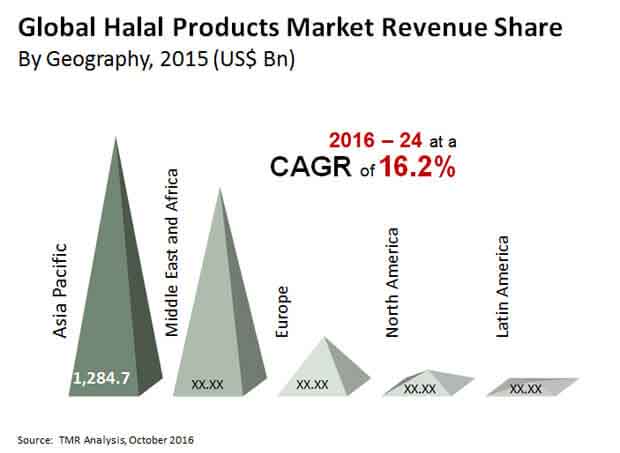

Transparency Market Research estimates that the global halal products market, which was valued at US$2.70 trillion in 2015, will rise to US$10.51 trillion by 2024, exhibiting a CAGR of 16.2% from 2016 to 2024.

Primarily, food and beverages are considered to be the key varieties of halal products. However, pharmaceutical, personal care products, and other products such as nutraceuticals, bakery, and food supplements also account for significant share of the halal products market. For this study, the halal products market has been examined for product types such as primary meat, processed food and beverages, pharmaceuticals, and cosmetics and personal care.

Of these, the segments of primary meat and processed food and beverages cumulatively accounted for nearly 50% of the market demand in 2015. The segment of processed food and beverages accounted for the dominant share in the global halal products market in 2015. Owing to the rising global demand for processed food, the halal processed food and beverages segment is expected to maintain its steady growth rate during the forecast period as well.

Despite the high growth rate of the processed food and beverages segment, independent halal butchers have an upper hand against their retail counterparts when it comes to customer services and customer trust in the absence of proliferation of modern retail outlets. Owing to this, the primary meat segment is also projected to witness exponential growth, especially in developing and under-developed economies in the next few years.

From a geographic perspective, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East and Africa. Owing to the presence of a large number of certified manufacturers and large Muslim population, the halal products market in Asia Pacific is projected to have a significant positive impact on the overall development of the global halal products market in the near future. From a country-wise outlook, Brazil, the U.S., and India are some of the most significant exporters of halal products.

The market for halal products in Asia Pacific and Middle East and Africa regions cumulatively accounted for more than 80% of the global market in 2015. Asia Pacific constitutes of four of the top ten countries with the highest Muslim population, namely Indonesia, India, Pakistan and Bangladesh. Asia Pacific alone accounted for 47.74% of the global halal products market in 2015 and is also expected to witness the expansion of the halal products market at the most significant pace over the period between 2016 and 2024.

The halal products market is also expected to witness strong growth in Europe during the forecast period, primarily driven by the growing Muslim population the Western European nations such as Germany, France and U.K. The halal market demand is also anticipated to be augmented by the large Muslim population in Russia and CIS countries.

The key players operating in the halal products market can be distinguished by the end use industry they are catering to. The leading player in the halal products market for the food and beverage segment is Nestle S.A. For halal products for cosmetic and personal care application Unilever is the major player, besides several other notable players. Reckitt Benckiser Group plc is the major player catering halal products to the chemical and materials industry.

Halal Products Market to Witness Significant Growth Rate Owing to Rising Demand from the Food and Beverage Sector

The worldwide halal items market has expanded at a promising speed in the previous few years and is required to leave upon a way of remarkable development in the following not many years too. Rising worldwide populace of the Muslim people group and rising expendable livelihoods across a portion of the world's unmistakable Islamic nations are relied upon to be the vital drivers of the market. Be that as it may, the market is relied upon to endure the worst part of the absence of straightforwardness as for the utilization of elements for the drug and individual consideration items and the shortfall of an around the world uniform halal standard.

Essentially, food and drinks are viewed as the vital assortments of halal products. Notwithstanding, drug, individual consideration products, and different products, for example, nutraceuticals, bread kitchen, and food supplements additionally represent critical portion of the halal products market. For this examination, the halal products market has been analyzed for item types like essential meat, handled food and drinks, drugs, and beautifying agents and individual consideration.

The quick advancement of Islamic nations in the Middle East and Southeast Asia attributable to the expanding optional income could fill in as an extra factor accelerating the improvement of the worldwide halal products market. The interest for halal products could be additionally pushed across the globe due their consideration in assortments of food products. Aside from food and refreshments, halal products have been imagined to discover applications in different areas like drugs, nutraceuticals, food supplements, individual consideration products, and pastry kitchen.

The rising populace in Muslim countries has been visualized to be a standout factor significantly reinforcing the demand for halal items. Muslims have consistently been a primary customers bunch for halal items. The creating people of Muslims overall is assessed to be a promising variable for the headway of the market in the years to come.

Chapter 1: Preface

1.1. Research scope and market segmentation

1.2. Research highlights

1.3. Research assumptions and acronyms used

1.4. Key questions answered

Chapter 2: Executive Summary

2.1. Global halal products market snapshot

2.2. Global halal products market key trends

2.3. Market opportunity map

Chapter 3: Market Dynamics

3.1. Key findings

3.2. Drivers and restraints snapshot analysis

3.3. Global halal products market driver 1

3.3. Global halal products market driver 2

3.3. Global halal products market driver 3

3.4. Global halal products market restraint 1

3.4. Global halal products market restraint 2

3.5. Global halal products market opportunity 1

3.6. Global halal products market attractiveness analysis, by products, 2015

3.7. Halal standards

3.8. Halal certification

Chapter 4: Global Halal Products Market Analysis, by Product Type

4.1. Overview

4.2. Global Halal Products Market, Value Share Analysis, By Product Type

4.3. Global Halal Products Market Size (USD Mn), Forecast, By Product Type, 2015-2024

4.4. Global Halal Primary Meat Market Size (USD Mn), Forecast, 2015-2024

4.5. Global Halal Processed Food & Beverages Market Size (USD Mn), Forecast, 2015-2024

4.6. Global Halal Pharmaceuticals Market Size (USD Mn), Forecast, 2015-2024

4.7. Global Halal Cosmetic & Personal Care Products Market Size (USD Mn), Forecast, 2015-2024

4.8. Global Other Halal Products Market Size (USD Mn), Forecast, 2015-2024

Chapter 5: Global Halal Products Market Analysis, by Region

5.1. Geographic Scenario

5.2. Global Halal Products Market, Value Share Analysis, By Region

5.3. Global Halal Products Market Size (USD Mn), Forecast, By Region, 2015-2024

5.4. North America Halal Products Market Size (USD Mn), Forecast, 2015-2024

5.5. Europe Halal Products Market Size (USD Mn), Forecast, 2015-2024

5.6. Asia Pacific Halal Products Market Size (USD Mn), Forecast, 2015-2024

5.7. Middle East & Africa Halal Products Market Size (USD Mn), Forecast, 2015-2024

5.8. Latin America Halal Products Market Size (USD Mn), Forecast, 2015-2024

Chapter 6: North America Halal Products Market Analysis, by Products

6.1. North America Halal Primary Meat Market Size (USD Mn), Forecast, 2015-2024

6.2. North America Halal Processed Food & Beverages Market Size (USD Mn), Forecast, 2015-2024

6.3. North America Halal Pharmaceuticals Market Size (USD Mn), Forecast, 2015-2024

6.4. North America Halal Cosmetic & Personal Care Products Market Size (USD Mn), Forecast, 2015-2024

6.5. North America Other Halal Products Market Size (USD Mn), Forecast, 2015-2024

Chapter 7: Europe Halal Products Market Analysis, by Products

7.1. Europe Halal Primary Meat Market Size (USD Mn), Forecast, 2015-2024

7.2. Europe Halal Processed Food & Beverages Market Size (USD Mn), Forecast, 2015-2024

7.3. Europe Halal Pharmaceuticals Market Size (USD Mn), Forecast, 2015-2024

7.4. Europe Halal Cosmetic & Personal Care Products Market Size (USD Mn), Forecast, 2015-2024

7.5. Europe Other Halal Products Market Size (USD Mn), Forecast, 2015-2024

Chapter 8: Asia Pacific Halal Products Market Analysis, by Products

8.1. Asia Pacific Halal Primary Meat Market Size (USD Mn), Forecast, 2015-2024

8.2. Asia Pacific Halal Processed Food & Beverages Market Size (USD Mn), Forecast, 2015-2024

8.3. Asia Pacific Halal Pharmaceuticals Market Size (USD Mn), Forecast, 2015-2024

8.4. Asia Pacific Halal Cosmetic & Personal Care Products Market Size (USD Mn), Forecast, 2015-2024

8.5. Asia Pacific Other Halal Products Market Size (USD Mn), Forecast, 2015-2024

Chapter 9: Middle East & Africa Halal Products Market Analysis, by Products

9.1. Middle East & Africa Halal Primary Meat Market Size (USD Mn), Forecast, 2015-2024

9.2. Middle East & Africa Halal Processed Food & Beverages Market Size (USD Mn), Forecast, 2015-2024

9.3. Middle East & Africa Halal Pharmaceuticals Market Size (USD Mn), Forecast, 2015-2024

9.4. Middle East & Africa Halal Cosmetic & Personal Care Products Market Size (USD Mn), Forecast, 2015-2024

9.5. Middle East & Africa Other Halal Products Market Size (USD Mn), Forecast, 2015-2024

Chapter 10: Latin America Halal Products Market Analysis, by Products

10.1. Latin America Halal Primary Meat Market Size (USD Mn), Forecast, 2015-2024

10.2. Latin America Halal Processed Food & Beverages Market Size (USD Mn), Forecast, 2015-2024

10.3. Latin America Halal Pharmaceuticals Market Size (USD Mn), Forecast, 2015-2024

10.4. Latin America Halal Cosmetic & Personal Care Products Market Size (USD Mn), Forecast, 2015-2024

10.5. Latin America Other Halal Products Market Size (USD Mn), Forecast, 2015-2024

Chapter 11: Halal Products Market: Major Players

11.1. Leading player in the Halal Food and Beverages segment

11.2. Leading player in the Cosmetic & Personal Care segment

11.3. Leading player in the Halal Chemicals and Materials segment

List of Tables

Table 1. Global Halal Products Market Size (US$ Bn), by Product Types, 2015-2024

Table 2. Global Halal Products Market Size (US$ Bn), by Region, 2015-2024

Table 3. North America Halal Products Market Forecast (US$ Bn), by Country, 2015-2024

Table 4. Europe Halal Products Market Forecast (US$ Bn), by Country, 2015-2024

Table 5. Asia Pacific Halal Products Market Forecast (US$ Bn), by Country, 2015-2024

Table 6. MEA Halal Products Market Forecast (US$ Bn), by Country, 2015-2024

Table 7. Latin America Halal Products Market Forecast (US$ Bn), by Country, 2015-2024

List of Figures

Figure 1. Halal Products Market, Revenue Share, 2015

Figure 2. Global Halal Products Market Attractiveness Analysis, by Product Types, 2015

Figure 3 Global Halal Products Market, Value Share Analysis, by Product Types, 2015 and 2024

Figure 4 Global Halal Primary Meat Market Revenue, (US$ Bn), 2015-2024

Figure 5 Global Halal Processed Food & Beverages Market Revenue, (US$ Bn), 2015-2024

Figure 6 Global Halal Pharmaceuticals Market Revenue, (US$ Bn), 2015-2024

Figure 7 Global Halal Cosmetics & Personal Care Products Market Revenue, (US$ Bn), 2015-2024

Figure 8 Global Others Halal Products Market Revenue, (US$ Bn), 2015-2024

Figure 9 Global Halal Products Market, Value Share Analysis, by Region, 2015 and 2024

Figure 10 North America Halal Products Market Revenue (US$ Bn), 2015-2024

Figure 11 Europe Halal Products Market Revenue (US$ Bn), 2015-2024

Figure 12 Asia Pacific Halal Products Market Revenue (US$ Bn), 2015-2024

Figure 13 MEA Halal Products Market Revenue (US$ Bn), 2015-2024

Figure 14 Latin America Halal Products Market Revenue (US$ Bn), 2015-2024

Figure 15 North America Halal Primary Meat Market Revenue (US$ Bn), 2015–2024

Figure 16 North America Halal Processed Food & Beverages Market Revenue (US$ Bn), 2015–2024

Figure 17 North America Halal Processed Food & Beverages Market Revenue (US$ Bn), 2015–2024

Figure 18 North America Halal Cosmetics & Personal Care Market Revenue (US$ Bn), 2015–2024

Figure 19 North America Other Halal Products Market Revenue (US$ Bn), 2015–2024

Figure 20 Europe Halal Primary Meat Market Revenue (US$ Bn), 2015–2024

Figure 21 Europe Halal Processed Food & Beverages Market Revenue (US$ Bn), 2015–2024

Figure 22 Europe Halal Processed Food & Beverages Market Revenue (US$ Bn), 2015–2024

Figure 23 Europe Halal Cosmetics & Personal Care Market Revenue (US$ Bn), 2015–2024

Figure 24 Europe Other Halal Products Market Revenue (US$ Bn), 2015–2024

Figure 25 Asia Pacific Halal Primary Meat Market Revenue (US$ Bn), 2015–2024

Figure 26 Asia Pacific Halal Processed Food & Beverages Market Revenue (US$ Bn), 2015–2024

Figure 27 Asia Pacific Halal Pharmaceuticals Market Revenue (US$ Bn), 2015–2024

Figure 28 Asia Pacific Halal Cosmetics & Personal Care Market Revenue (US$ Bn), 2015–2024

Figure 29 Asia Pacific Other Halal Products Market Revenue (US$ Bn), 2015–2024

Figure 30 MEA Halal Primary Meat Market Revenue (US$ Bn), 2015–2024

Figure 31 MEA Halal Processed Food & Beverages Market Revenue (US$ Bn), 2015–2024

Figure 32 MEA Halal Processed Food & Beverages Market Revenue (US$ Bn), 2015–2024

Figure 33 MEA Halal Cosmetics & Personal Care Market Revenue (US$ Bn), 2015–2024

Figure 34 MEA Other Halal Products Market Revenue (US$ Bn), 2015–2024

Figure 35 Latin America Halal Primary Meat Market Revenue (US$ Bn), 2015–2024

Figure 36 Latin America Halal Processed Food & Beverages Market Revenue (US$ Bn), 2015–2024

Figure 37 Latin America Halal Pharmaceuticals Market Revenue (US$ Bn), 2015–2024

Figure 38 Latin America Halal Cosmetics & Personal Care Market Revenue (US$ Bn), 2015–2024

Figure 39 Latin America Other Halal Products Market Revenue (US$ Bn), 2015–2024