Analysts’ Viewpoint on Glycolic Acid Market Scenario

A limited number of global players operate in the glycolic acid market. Glycolic acid exhibits high cleaning efficacy and low corrosiveness. It is easily soluble in a wide range of solvents and surfactants. Furthermore, it is easy to handle and therefore, it is widely used for washing and cleaning in industrial applications. Uses of glycolic acid primarily include removal of hard salts, hard water scale deposits, and cleaning and finishing of metals in various industries such as concrete, dairy, food & beverage, and chemical. Additionally, glycolic acid has low levels of toxicity. Therefore, it can be employed in cleaning equipment that is used in the food & beverage industry. Glycolic acid is added to certain polymers, which are used as implants. Increase in number of accidents and surgical operations and rise in awareness about hygiene are anticipated to boost the demand for glycolic acid. Glycolic acid is primarily used in skin care products, as it protects the skin from pollution, chemicals, bacteria, and UV rays. Glycolic acid products help improve elasticity, firmness, and texture of the skin. Consumers in Asia Pacific, Europe, and the North America are becoming increasingly important for key players in the global cosmetics industry players owing to the high disposable incomes and high living standards of consumers in the region, which in turn leads to growth of glycolic acid market.

Glycolic acid is the smallest alpha hydroxy acid (AHA). It is colorless, odorless, and hygroscopic crystalline solid that is highly soluble in water. Glycolic acid, also known as hydroxyacetic acid, plays an important role as an intermediate for organic synthesis in a range of reactions including oxidation-reduction, esterification, and long chain polymerization. It is used as a monomer in the preparation of polyglycolic acid (PGA) and other biocompatible copolymers. Popular uses of glycolic acid include as a dyeing and tanning agent in the textile industry and a flavoring agent and preservative in the food processing industry. Furthermore, it is employed as a skin care agent and is widely used in face washes, cleansers, and various other skin care products.

Request a sample to get extensive insights into the Glycolic Acid Market

The global cosmetics market has grown rapidly in the last few years due to the rising awareness among the global population. Rise in geriatric population and its increasing demand to maintain a youthful appearance has also had a major role in the expansion of the cosmetics market.

The global cosmetics industry is becoming competitive, as key players from the U.S., France, and China have established new businesses in India and Mexico. Companies in Europe have expanded their product portfolio, which has led to an increase in market share held by these companies in the global market. Glycolic acid is one of the main ingredients in the formulation of cosmetics product, thus the global glycolic acid market is growing in line with the cosmetic industry.

Glycolic acid is extensively used as an exfoliating and moisturizing agent in skin care and hair care formulations. Rise in demand for skin care and hair care products is anticipated to be a major factor driving the glycolic acid market. Glycolic acid is also utilized in various new applications such as manufacture of polyglycolic acid (PGA).

Glycolic acid is widely used in various industrial cleaning operations such as water treatment plants, concrete truck and tool cleaning, dairy cleaning, and metal cleaning & finishing owing to its excellent cleaning capability, low toxicity, volatility, and corrosiveness. It is also non-flammable, highly soluble in water, and biodegradable. Glycolic acid also possesses chemical stability and chloride- and phosphate-free nature.

Glycolic acid is extensively employed in applications that require low levels of metallic impurities. It is used for cleaning copper substrates in electronics. Glycolic acid offers good complexing of metal ions, low corrosion rates, efficient pH adjustment profile, and good environmental, safety, and handling properties. These factors are projected to boost the glycolic acid market during the forecast period

Request a custom report on Glycolic Acid Market

Polyglycolic acid (PGA) is a biodegradable specialty plastic that is employed in the manufacture of absorbable surgical sutures. Improvement in medical facilities is likely to boost the demand for absorbable surgical sutures. This, in turn, is expected to augment the demand for polyglycolic acid and consequently, propel the demand for glycolic acid.

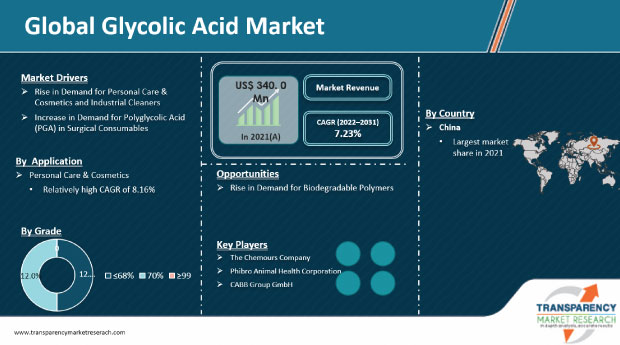

Based on grade, glycolic acid can be bifurcated into ≤68%, 70%, and ≥99%. The 70% grade segment help a major share of the global glycolic acid market in 2021. Glycolic acid 70% grade is primarily used as a cleaning agent in various industrial and household applications such as air conditioners, boilers, electric plant pipes, and oil pipeline. High concentration of glycolic acid is widely used as an ingredient in skin care and hair care products owing to its exfoliating properties.

Based on application, glycolic acid can be classified into personal care & cosmetics, plant growth stimulation, food flavoring & preservation, PGA manufacturing, cleaning agent, oil & gas, electronics, leather dyeing & tanning and others.

The personal care & cosmetics segment accounted for a major share of 43.2% of the global market in 2021. The segment is estimated to grow at an above average growth rate of 8.1% during the forecast period. The personal care & cosmetics segment includes skin care and hair care products. The segment is estimated to grow rapidly owing to the improvement in lifestyle of consumers and increase in disposable income of consumers in emerging economies of India, China, Brazil, and Russia.

In terms of value, Asia Pacific held 32.6% share of the glycolic acid market in 2021. Asia Pacific is expected to be a highly attractive market during the forecast period. Demand for glycolic acid is projected to rise considerably due to an increase in disposable income of the people in the region an increase in consumer preference for glycolic acid creams, glycolic acid face washes, glycolic acid toners, glycolic acid cleansers.

In terms of value, Europe and North America are also prominent markets for glycolic acid, and the regions held 26.0% and 30.1% share of the global market, respectively, in 2021. The market in Europe and North America is anticipated to rise at CAGR of 6.82% and 6.34%, respectively, during the forecast period.

The global glycolic acid market comprises several small and large-scale manufacturers and suppliers who control a majority of the market share. A majority of the firms are adopting strategies with comprehensive research and development and process optimization. Expansion of product portfolios and mergers and acquisitions are prominent strategies adopted by key players. The Chemours Company, Phibro Animal Health Corporation, CABB Group GmbH and China Petroleum & Chemical Corporation (SINOPEC) are the prominent entities operating in the market.

Each of these players has been profiled in the glycolic acid market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 340.0 Mn |

|

Market Forecast Value in 2031 |

US$ 683.5 Mn |

|

Growth Rate (CAGR) |

7.23% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Mn for Value and Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at Europe as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The glycolic acid market stood at US$ 340.0 Mn in 2021

The glycolic acid market is expected to rise at a CAGR of 7.23% from 2022 to 2031

Personal care & cosmetics and industrial cleaners boosts glycolic acid market and increase in demand for polyglycolic acid (PGA) in surgical consumables

70% was the largest grade segment that held 46.9% share of the market in 2021

Asia Pacific was the most lucrative region of the glycolic acid market in 2021

The Chemours Company, Phibro Animal Health Corporation, CABB Group GmbH, and China Petroleum & Chemical Corporation (SINOPEC)

1. Executive Summary

1.1. Glycolic Acid Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Service Providers

2.6.2. List of Potential Customers

3. COVID-19 Impact Analysis

4. Global Glycolic Acid Market Analysis and Forecast, by Grade, 2020–2031

4.1. Introduction and Definitions

4.2. Global Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

4.2.1. ≤68%

4.2.2. 70%

4.2.3. ≥99

4.3. Global Glycolic Acid Market Attractiveness, by Grade

5. Global Glycolic Acid Market Analysis and Forecast, by Application, 2020–2031

5.1. Introduction and Definitions

5.2. Global Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

5.2.1. Personal Care & Cosmetics

5.2.1.1. Hair Care

5.2.1.2. Skin Care

5.2.1.3. Others (Including Nail Care, Dental Care)

5.2.2. Plant Growth Stimulation

5.2.3. Food Flavoring & preservation

5.2.4. PGA Manufacturing

5.2.5. Cleaning Agents

5.2.5.1. Household

5.2.5.2. Industrial

5.2.5.3. Institutional

5.2.6. Electronics

5.2.7. Oil & Gas;

5.2.8. Leather Dyeing & Tanning

5.2.9. Others (including Biomedical & Drug Delivery and Gas Barrier Packaging)

5.3. Global Glycolic Acid Market Attractiveness, by Application

6. Global Glycolic Acid Market Analysis and Forecast, by Region, 2020–2031

6.1. Key Findings

6.2. Global Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Latin America

6.2.5. Middle East & Africa

6.3. Global Glycolic Acid Market Attractiveness, by Region

7. North America Glycolic Acid Market Analysis and Forecast, 2020–2031

7.1. Key Findings

7.2. North America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

7.3. North America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.4. North America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

7.4.1. U.S. Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

7.4.2. U.S. Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.4.3. Canada Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

7.4.4. Canada Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.5. North America Glycolic Acid Market Attractiveness Analysis

8. Europe Glycolic Acid Market Analysis and Forecast, 2020–2031

8.1. Key Findings

8.2. Europe Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.3. Europe Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4. Europe Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

8.4.1. Germany Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.2. Germany Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4.3. France Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.4. France Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4.5. U.K. Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.6. U.K. Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4.7. Italy Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.8. Italy Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4.9. Russia & CIS Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.10. Russia & CIS Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4.11. Rest of Europe Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

8.4.12. Rest of Europe Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.5. Europe Glycolic Acid Market Attractiveness Analysis

9. Asia Pacific Glycolic Acid Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. Asia Pacific Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020-2031

9.3. Asia Pacific Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4. Asia Pacific Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

9.4.1. China Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.2. China Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.3. Japan Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.4. Japan Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.5. India Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.6. India Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.7. ASEAN Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.8. ASEAN Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.9. Rest of Asia Pacific Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.10. Rest of Asia Pacific Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5. Asia Pacific Glycolic Acid Market Attractiveness Analysis

10. Latin America Glycolic Acid Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Latin America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.3. Latin America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. Latin America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

10.4.1. Brazil Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.2. Brazil Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.3. Mexico Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.4. Mexico Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.5. Rest of Latin America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.6. Rest of Latin America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5. Latin America Glycolic Acid Market Attractiveness Analysis

11. Middle East & Africa Glycolic Acid Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Middle East & Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.3. Middle East & Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4. Middle East & Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

11.4.1. GCC Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.2. GCC Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.3. South Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.4. South Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.5. Rest of Middle East & Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.6. Rest of Middle East & Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5. Middle East & Africa Glycolic Acid Market Attractiveness Analysis

12. Global Glycolic Acid Company Market Share Analysis, 2021

12.1. Competition Matrix

12.2. Market Footprint Analysis

12.2.1. By Grade

12.2.2. By Application

12.3. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

12.3.1. The Chemours Company

12.3.1.1. Company Description

12.3.1.2. Business Overview

12.3.1.3. Financial Details

12.3.1.4. Strategic Overview

12.3.2. Phibro Animal Health Corporation

12.3.2.1. Company Description

12.3.2.2. Business Overview

12.3.2.3. Financial Details

12.3.2.4. Strategic Overview

12.3.3. CABB Group GmbH

12.3.3.1. Company Description

12.3.3.2. Business Overview

12.3.3.3. Financial Details

12.3.3.4. Strategic Overview

12.3.4. China Petroleum & Chemical Corporation (SINOPEC)

12.3.4.1. Company Description

12.3.4.2. Business Overview

12.3.4.3. Financial Details

12.3.4.4. Strategic Overview

12.3.5. Shandong Xinhua Pharmaceutical Co.Ltd.

12.3.5.1. Company Description

12.3.5.2. Business Overview

12.3.5.3. Financial Details

12.3.5.4. Strategic Overview

12.3.6. CrossChem LP

12.3.6.1. Company Description

12.3.6.2. Business Overview

12.3.6.3. Financial Details

12.3.6.4. Strategic Overview

12.3.7. Avid Organics

12.3.7.1. Company Description

12.3.7.2. Business Overview

12.3.7.3. Financial Details

12.3.7.4. Strategic Overview

12.3.8. Zhonglan Industry Co., Ltd.

12.3.8.1. Company Description

12.3.8.2. Business Overview

12.3.8.3. Financial Details

12.3.8.4. Strategic Overview

12.3.9. Water Chemical Co., Ltd

12.3.9.1. Company Description

12.3.9.2. Business Overview

12.3.9.3. Financial Details

12.3.9.4. Strategic Overview

12.3.10. Hebei Chengxin Co., Ltd

12.3.10.1. Company Description

12.3.10.2. Business Overview

12.3.10.3. Financial Details

12.3.10.4. Strategic Overview

12.3.11. Hefei TNJ Chemical Industry Co.Ltd.

12.3.11.1. Company Description

12.3.11.2. Business Overview

12.3.11.3. Financial Details

12.3.11.4. Strategic Overview

12.3.12. Saanvi Corp

12.3.12.1. Company Description

12.3.12.2. Business Overview

12.3.12.3. Financial Details

12.3.12.4. Strategic Overview

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 1: Global Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 2: Global Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 3: Global Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

Table 4: North America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 5: North America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 6: North America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

Table 7: U.S. Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 8: U.S. Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 9: Canada Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 10: Canada Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 11: Europe Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 12: Europe Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 13: Europe Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 14: Germany Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 15: Germany Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 16: France Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 17: France Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 18: U.K. Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 19: U.K. Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 20: Italy Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 21: Italy Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 22: Spain Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 23: Spain Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 24: Russia & CIS Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 25: Russia & CIS Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 26: Rest of Europe Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 27: Rest of Europe Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 28: Asia Pacific Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 29: Asia Pacific Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 30: Asia Pacific Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 31: China Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade 2020–2031

Table 32: China Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 33: Japan Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 34: Japan Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 35: India Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 36: India Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 37: ASEAN Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 38: ASEAN Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 39: Rest of Asia Pacific Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 40: Rest of Asia Pacific Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 41: Latin America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 42: Latin America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: Latin America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 44: Brazil Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 45: Brazil Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 46: Mexico Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 47: Mexico Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 48: Rest of Latin America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 49: Rest of Latin America Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 50: Middle East & Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 51: Middle East & Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 52: Middle East & Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 53: GCC Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 54: GCC Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 55: South Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 56: South Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 57: Rest of Middle East & Africa Glycolic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

List of figures

Figure 1: Global Glycolic Acid Market Attractiveness, by Grade

Figure 2: Global Glycolic Acid Market Attractiveness, by Application

Figure 3: Global Glycolic Acid Market Attractiveness, by Region

Figure 4: North America Glycolic Acid Market Attractiveness, by Grade

Figure 5: North America Glycolic Acid Market Attractiveness, by Country

Figure 6: Europe Glycolic Acid Market Attractiveness, by Grade

Figure 7: Europe Glycolic Acid Market Attractiveness, by Application

Figure 8: Europe Glycolic Acid Market Attractiveness, by Country and Sub-region

Figure 9: Asia Pacific Glycolic Acid Market Attractiveness, by Grade

Figure 10: Asia Pacific Glycolic Acid Market Attractiveness, by Application

Figure 11: Asia Pacific Glycolic Acid Market Attractiveness, by Country and Sub-region

Figure 12: Latin America Glycolic Acid Market Attractiveness, by Grade

Figure 13: Latin America Glycolic Acid Market Attractiveness, by Application

Figure 14: Latin America Glycolic Acid Market Attractiveness, by Country and Sub-region

Figure 15: Middle East & Africa Glycolic Acid Market Attractiveness, by Grade

Figure 16: Middle East & Africa Glycolic Acid Market Attractiveness, by Application

Figure 17: Middle East & Africa Glycolic Acid Market Attractiveness, by Country and Sub-region