Global Auto-injectors Market: Snapshot

The global auto-injectors market is growing at a healthy pace and is predicted to witness a promising growth in the next few years. The emerging economies, across the globe, are likely to offer lucrative growth opportunities for the market players in the next few years. The rising use of biologics and the increasing incidence of chronic ailments are predicted to enhance the growth of the global auto-injectors market in the next few years.

According to the market research study by Transparency Market Research, in 2013, the global market for auto-injectors was worth US$665.0 mn and is projected to reach a value of US$2.5 bn by the end of 2020. Furthermore, the market is estimated to register a strong 18.60% CAGR between 2014 and 2020.

Advancements and Innovations to Encourage Market Growth in Coming Years

The increasing incidence of rheumatoid arthritis and the rising food allergies are the key factors that are estimated to encourage the growth of the global auto-injectors market in the next few years. The rising research and development activities and the advancements in the medical sector are further projected to accelerate the growth of the market in the near future. On the flip side, the high price of auto-injectors is projected to restrict the growth of the global market in the coming few years. Nevertheless, the rising disposable income of consumers in developing nations is expected to support the growth of the overall market in the coming years.

The global auto-injectors market has been categorized on the basis of product type into fillable auto-injectors and prefilled auto-injectors. Among these, the prefilled auto-injectors segment is expected to account for a large share of the market in the next few years. The rising awareness among patients and the ease of use are the key factors that are estimated to accelerate the growth of this segment in the next few years. Furthermore, on the basis of manufacturing design, the global auto-injectors market has been divided into customized auto-injectors and standardized auto-injectors. The standardized auto-injectors segment is predicted to lead the market in the next few years; however, the customized auto-injectors segment is predicted to register a strong growth in the coming years.

North America to Remain Dominant in Global Auto-injectors Market

The global market for auto-injectors has been categorized on the basis of geography into Asia Pacific, Latin America, North America, Europe, and the Middle East and Africa. In the last few years, North America led the global auto-injectors market and is expected to remain in the similar position in the coming few years. The favorable government reimbursement policies and the presence of several key players are the major factors that are estimated to enhance the growth of the auto-injectors market across North America in the next few years. On the flip side, Asia Pacific is projected to witness a strong growth in the next few years, thanks to the rising awareness among consumers regarding the advanced treatment methods that are available in the market.

The global market for auto-injectors is consolidated in nature with a few players holding a major share of the market. The key players in the market are focusing on the development of new product and innovations in order to maintain their dominance across the globe. In addition to this, the rising research and development activities is projected to accelerate the growth of the overall market in the next few years. Some of the leading players operating in the auto-injectors market across the globe are Antares Pharma, Inc., Pfizer, Inc., Becton, Dickinson and Company, Unilife Corporation, Mylan, Inc., Ypsomed Holdings AG., Novartis International AG, Biogen Idec, Inc., and Sanofi.

List of Figures

FIG. 1 Auto-injectors Market Segmentation

FIG. 2 Global Auto-injectors Market, by Product Type and by Manufacturing Design, 2013 (USD Million)

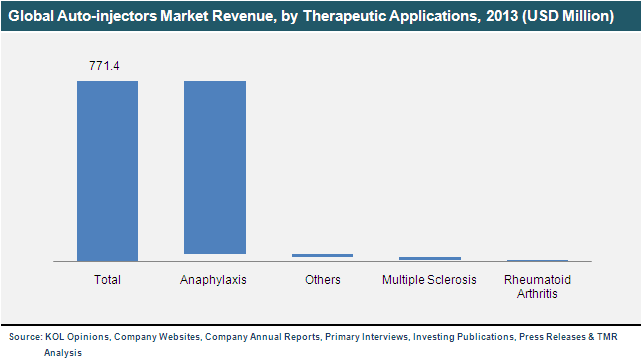

FIG. 3 Global Auto-injectors Market, by Therapeutic Applications, 2013 (USD Million)

FIG. 4 Comparative Analysis: Global Auto-injectors Market, by Geography, 2013 & 2020 (Value %)

FIG. 5 Value Chain Analysis: Global Auto-injectors Market

FIG. 6 Porter’s Five Forces Analysis: Global Auto-injectors Market

FIG. 7 Market Attractiveness Analysis: Global Auto-injectors Market, by Geography

FIG. 8 Market Share Analysis: Global Standardized Auto-injectors Market, by Key Players, 2013 (Value %)

FIG. 9 Global Prefilled Auto-injectors Market Revenue, 2012 – 2020 (USD Million)

FIG. 10 Global Fillable Auto-injectors Market Revenue, 2012 – 2020 (USD Million)

FIG. 11 Global Standardized Auto-injectors Market Revenue, 2012 – 2020 (USD Million)

FIG. 12 Global Customized Auto-injectors Market Revenue, 2012 – 2020 (USD Million)

FIG. 13 Global Anaphylaxis Auto-injectors Market Revenue, 2012 – 2020 (USD Million)

FIG. 14 Global Multiple Sclerosis Auto-injectors Market Revenue, 2012 – 2020 (USD Million)

FIG. 15 Global Rheumatoid Arthritis Auto-injectors Market Revenue, 2012 – 2020 (USD Million)

FIG. 16 Global Others Auto-injectors Market Revenue, 2012 – 2020 (USD Million)

FIG. 17 North America Auto-injectors Market Revenue, 2012 – 2020 (USD Million)

FIG. 18 Europe Auto-injectors Market Revenue, 2012 – 2020 (USD Million)

FIG. 19 Asia Pacific Auto-injectors Market Revenue, 2012 – 2020 (USD Million)

FIG. 20 Rest of the World Auto-injectors Market Revenue, 2012 – 2020 (USD Million)

FIG. 21 Antares Pharma, Inc.: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 22 Becton, Dickinson & Company: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 23 Biogen Idec: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 24 Mylan, Inc.: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 25 Novartis International AG: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 26 Pfizer, Inc.: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 27 Sanofi: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 28 Unilife Corporation: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 29 Ypsomed Holding AG: Annual Revenue, 2011 – 2013 (USD Million)