GCC, short for Gulf Cooperation Council, represents the alliance of some of the world’s leading producers of petrochemicals – the key raw materials required for the production of synthetic polymers. These six countries are the major exporters of raw polymer to the entire globe and are second only to India when it comes to the growth rate of the polymer market. Thus, GCC countries play a major role in the overall development of the global plastics industry and are a key determinant of growth of the molded plastics market.

With high fragmentation in terms of number of suppliers and a level of extreme consolidation when it comes to geographic placement of major vendors, the GCC molded plastic market features a splendid mix of intense competition and plenty of untapped growth opportunities. Transparency Market Research states that companies in the market will focus more on expansion strategies in the next few years; strengthening product portfolios by including new product verities and ventures in foreign markets will be amongst the most preferred growth strategies.

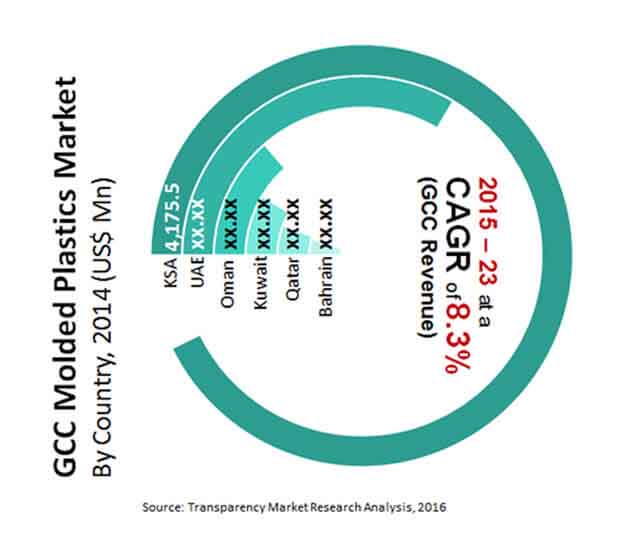

The overall market will expand at a healthy CAGR of 8.3% over the period between 2015 and 2023, and rise from a valuation of US$7.19 bn in 2014 to US$14.22 bn by 2023. In terms of volume, the GCC molded plastics market stood at 2.82 mn tons in 2014.

Market to Gain Traction across Packaging Sector

In 2014, the GCC molded plastic market attributed a dominant share of nearly 52% to its applications in the packaging industry. The sector will continue to be the dominant application for molded plastic in the GCC market and will account for nearly 56% in the overall market by 2023.

The packaging industry in the region is flourishing owing to the constant rise in trade activities and the substantial rise in the market for industrial and consumer goods in response to the vast rise in the region’s population. This has created manifold growth opportunities for molded plastics in the packaging sector in the past few years and will continue to drive the region’s molded plastic market in the years to come.

The building and construction industry is another highly attractive application area for the GCC molded plastic market as it accounts for a major share in the overall consumption of molded plastics in the region. Stimulated by the rising population in the region, increased government spending on developing residential building projects as well as public and private infrastructure projects will also prove to be beneficial for the GCC molded plastics market in the next few years.

Saudi Arabia, Qatar, and Oman to Present Attractive Growth Opportunities

The GCC molded plastics market will gain the most attractive returns from operations across Saudi Arabia, Qatar, and Oman in the next few years. Saudi Arabia being home to nearly 60% plastic converters in the overall GCC molded plastics market, will continue to be the leading supplier of molded plastic in the market. The market for molded plastics in these countries will also benefit from the flourishing construction industry.

The UAE and Kuwait have been rated as moderately attractive countries for the GCC molded plastics market. The market in these countries has suffered a huge blow from the steep drop in crude oil prices observed recently. However, the construction industry has allowed for average growth of the molded plastics market in these countries.

Some of the leading companies operating in the highly fragmented GCC market for molded plastics, which accommodates over 1,000 plastic converters, are Harwal Group, Al Barshaa Plastic Product Company LLC., Genoa Plastic Industries, Takween Advanced Industries, and Obeikan Investment Group.

Increasing Popularity of Private Building Projects will Bolster Growth of Molded Plastics Market

The bundling business in the area is prospering inferable from the consistent ascent in exchange exercises and the significant ascent the market for modern and buyer products because of the huge ascent in the district's populace. This has set out complex development open doors for molded plastics in the bundling area in the previous few years and will keep on driving the locale's molded plastic market in the years to come.

The structure and development industry is another exceptionally appealing application region for the GCC molded plastic market as it represents a significant offer in the general utilization of molded plastics around there. Invigorated by the rising populace around there, expanded government spending on creating private structure projects just as open and private foundation activities will likewise end up being helpful for the GCC molded plastics market in the following not many years.

Increasing development of the bundling business in the Middle East and the thriving of the development business are two unmistakable drivers of the GCC molded plastics market, which then again, is confronting challenge from the flighty interest examples of monetary and political solidness. Improved item portfolio to oblige different areas and innovative work are two key techniques received by the main merchants to make progress over their rivals. The ubiquity of lightweight materials and developing application in the clinical business is normal open new roads for the GCC molded plastic market.

The items bundled with molded plastics go through a few advancement stages to consent to administrative rules and the necessity of the end clients. Upgraded execution against mileage, expanded time span of usability of food items, improved toughness are a portion of the prerequisites that plastics need to meet for bundling applications. The number of inhabitants in this district has heightened rapidly in the previous decade, which has helped in setting out complex development open doors for molded plastic bundling market.

Chapter 1 - Preface

1.1 Report Description

1.2 Market Segmentation

1.3 Research Scope and Assumptions

1.4 Research Methodology

1.5 Research Models

Chapter 2- Executive Summary

2.1 GCC Molded Plastics Market, Volume and Revenue (Kilo Tons) (US$ Mn), 2014–2023

2.2 Market Snapshot

Chapter 3 - Industry Analysis

3.1 Introduction

3.2 Value Chain Analysis

3.3 Market Dynamics

3.3.1 Driver 1- Rapid Growth in Packaging Industry in the Middle East

3.3.2 Driver 2- Strong Growth in the Construction Industry

3.3.3 Restraint 1 – Unpredictable Demand Patterns in Europe and the Middle East Owing to Economic and Political Instability

3.3.4 Opportunity – Investments in R&D Activities and Product Portfolio Expansion

3.4 Porter’s Five Forces Analysis

3.5 Company Market Share – Molded Plastics Market (%) (2014)

3.6 Market Attractiveness Analysis – Molded Plastics Market (by Application)

3.7 Market Attractiveness Analysis – Molded Plastics Market (by Countries)

3.8 In-house Molding Vs Outsourced Molding Activity

Chapter 4 - Molded Plastics Market - Price Trend Analysis

Chapter 5 – Market Segmentation (By Raw Material)

5.1 GCC Molded Plastics Market – Raw Material Analysis

5.2 GCC Polyethylene Market for Molded Plastics, 2014–2023 (Kilo Tons) (US$ Mn)

5.3 GCC Polypropylene Market for Molded Plastics, 2014–2023 (Kilo Tons) (US$ Mn)

5.4 GCC Polyvinyl Chloride Market for Molded Plastics, 2014–2023 (Kilo Tons) (US$ Mn)

5.5 GCC Polystyrene Market for Molded Plastics, 2014–2023 (Kilo Tons) (US$ Mn)

5.6 GCC Polyethylene Terephthalate Market for Molded Plastics, 2014–2023 (Kilo Tons) (US$ Mn)

5.7 GCC Other Raw Materials Market for Molded Plastics, 2014–2023 (Kilo Tons) (US$ Mn)

Chapter 6 - Market Segmentation (By Technology)

6.1 GCC Molded Plastics Market – Technology Overview

6.2 GCC Injection Molding Market for Molded Plastics, 2014–2023 (Kilo Tons) (US$ Mn)

6.3 GCC Blow Molding Market for Molded Plastics, 2014–2023 (Kilo Tons) (US$ Mn)

6.4 GCC Thermoforming Market for Molded Plastics, 2014–2023 (Kilo Tons) (US$ Mn)

6.5 GCC Other Technologies Market for Molded Plastics, 2014–2023 (Kilo Tons) (US$ Mn)

Chapter 7 – Market Segmentation (By Product Segment)

7.1 GCC Molded Plastics Market – Product Segment Analysis

7.2 GCC Molded Plastics Market for Pipes & Conduits, 2014–2023 (Kilo Tons) (US$ Mn)

7.3 GCC Molded Plastics Market for Bottles & Containers, 2014–2023 (Kilo Tons) (US$ Mn)

7.4 GCC Molded Plastics Market for Wires & Cables, 2014–2023 (Kilo Tons) (US$ Mn)

7.5 GCC Molded Plastics Market for Other Products, 2014–2023 (Kilo Tons) (US$ Mn)

Chapter 8 - Market Segmentation (By Application)

8.1 GCC Molded Plastics Market – Application Overview

8.2 GCC Molded Plastics Market for Packaging, 2014–2023 (Kilo Tons) (US$ Mn)

8.3 GCC Molded Plastics Market for Consumable & Electronics, 2014–2023 (Kilo Tons) (US$ Mn)

8.4 GCC Molded Plastics Market for Automotive & Transportation, 2014–2023 (Kilo Tons) (US$ Mn)

8.5 GCC Molded Plastics Market for Building & Construction, 2014–2023 (Kilo Tons) (US$ Mn)

8.6 GCC Molded Plastics Market for Others, 2014–2023 (Kilo Tons) (US$ Mn)

Chapter 9- Market Segmentation (By Region)

9.1 GCC Molded Plastics Market: Country Overview

9.2 GCC Molded Plastics Market Overview

9.3 Saudi Arabia Molded Plastics Market Volume, by Raw Material, 2014–2023 (Kilo Tons)

9.4 Saudi Arabia Molded Plastics Market Revenue, by Raw Material, 2014–2023 (US$ Mn)

9.5 Saudi Arabia Molded Plastics Market Volume, by Technology, 2014–2023 (Kilo Tons)

9.6 Saudi Arabia Molded Plastics Market Revenue, by Technology, 2014–2023 (US$ Mn)

9.7 Saudi Arabia Molded Plastics Market Volume, by Product Segment, 2014–2023 (Kilo Tons)

9.8 Saudi Arabia Molded Plastics Market Revenue, by Product Segment, 2014–2023 (US$ Mn)

9.9 Saudi Arabia Molded Plastics Market Volume, by Application, 2014–2023 (Kilo Tons)

9.10 Saudi Arabia Molded Plastics Market Revenue, by Application, 2014–2023 (US$ Mn)

9.11 UAE Molded Plastics Market Volume, by Raw Material, 2014–2023 (Kilo Tons)

9.12 UAE Molded Plastics Market Revenue, by Raw Material, 2014–2023 (US$ Mn)

9.13 UAE Molded Plastics Market Volume, by Technology, 2014–2023 (Kilo Tons)

9.14 UAE Molded Plastics Market Revenue, by Technology, 2014–2023 (US$ Mn)

9.15 UAE Molded Plastics Market Volume, by Product Segment, 2014–2023 (Kilo Tons)

9.16 UAE Molded Plastics Market Revenue, by Product Segment, 2014–2023 (US$ Mn)

9.17 UAE Molded Plastics Market Volume, by Application, 2014–2023 (Kilo Tons)

9.18 UAE Molded Plastics Market Revenue, by Application, 2014–2023 (US$ Mn)

9.19 Qatar Molded Plastics Market Volume, by Raw Material, 2014–2023 (Kilo Tons)

9.20 Qatar Molded Plastics Market Revenue, by Raw Material, 2014–2023 (US$ Mn)

9.21 Qatar Molded Plastics Market Volume, by Technology, 2014–2023 (Kilo Tons)

9.22 Qatar Molded Plastics Market Revenue, by Technology, 2014–2023 (US$ Mn)

9.23 Qatar Molded Plastics Market Volume, by Product Segment, 2014–2023 (Kilo Tons)

9.24 Qatar Molded Plastics Market Revenue, by Product Segment, 2014–2023 (US$ Mn)

9.25 Qatar Molded Plastics Market Volume, by Application, 2014–2023 (Kilo Tons)

9.26 Qatar Molded Plastics Market Revenue, by Application, 2014–2023 (US$ Mn)

9.27 Oman Molded Plastics Market Volume, by Raw Material, 2014–2023 (Kilo Tons)

9.28 Oman Molded Plastics Market Revenue, by Raw Material, 2014–2023 (US$ Mn)

9.29 Oman Molded Plastics Market Volume, by Technology, 2014–2023 (Kilo Tons)

9.30 Oman Molded Plastics Market Revenue, by Technology, 2014–2023 (US$ Mn)

9.31 Oman Molded Plastics Market Volume, by Product Segment, 2014–2023 (Kilo Tons)

9.32 Oman Molded Plastics Market Revenue, by Product Segment, 2014–2023 (US$ Mn)

9.33 Oman Molded Plastics Market Volume, by Application, 2014–2023 (Kilo Tons)

9.34 Oman Molded Plastics Market Revenue, by Application, 2014–2023 (US$ Mn)

9.35 Bahrain Molded Plastics Market Volume, by Raw Material, 2014–2023 (Kilo Tons)

9.36 Bahrain Molded Plastics Market Revenue, by Raw Material, 2014–2023 (US$ Mn)

9.37 Bahrain Molded Plastics Market Volume, by Technology, 2014–2023 (Kilo Tons)

9.38 Bahrain Molded Plastics Market Revenue, by Technology, 2014–2023 (US$ Mn)

9.39 Bahrain Molded Plastics Market Volume, by Product Segment, 2014–2023 (Kilo Tons)

9.40 Bahrain Molded Plastics Market Revenue, by Product Segment, 2014–2023 (US$ Mn)

9.41 Bahrain Molded Plastics Market Volume, by Application, 2014–2023 (Kilo Tons)

9.42 Bahrain Molded Plastics Market Revenue, by Application, 2014–2023 (US$ Mn)

9.43 Kuwait Molded Plastics Market Volume, by Raw Material, 2014–2023 (Kilo Tons)

9.44 Kuwait Molded Plastics Market Revenue, by Raw Material, 2014–2023 (US$ Mn)

9.45 Kuwait Molded Plastics Market Volume, by Technology, 2014–2023 (Kilo Tons)

9.46 Kuwait Molded Plastics Market Revenue, by Technology, 2014–2023 (US$ Mn)

9.47 Kuwait Molded Plastics Market Volume, by Product Segment, 2014–2023 (Kilo Tons)

9.48 Kuwait Molded Plastics Market Revenue, by Product Segment, 2014–2023 (US$ Mn)

9.49 Kuwait Molded Plastics Market Volume, by Application, 2014–2023 (Kilo Tons)

9.50 Kuwait Molded Plastics Market Revenue, by Application, 2014–2023 (US$ Mn)

Chapter 10 - Company Profiles

10.1 Harwal Group

10.2 Al Barshaa Plastic Product Company LLC

10.3 Zamil Plastic Industries Ltd.

10.4 Genoa Plastic Industries

10.5 Arabian Gulf Manufacturers Ltd

10.6 Rowad Plastic Group

10.7 Takween Advanced Industries

10.8 Al Watania Plastics

10.9 Obeikan Investment Group

Chapter 11 – List of Key Customers

Chapter 12 – Primary Research - Key findings