Reports

Reports

Fragment-based drug discovery (FBDD) is picking up speed as biopharma is under tremendous pressure to resupply pipelines against increasing incidences of oncology, immunology, and CNS diseases. Patent cliffs and cost headwinds compel firms to seek avenues that reveal novel chemical starting points and allow differentiation regarding challenging targets like protein-protein interactions and allosteric pockets.

Regulatory incentives for breakthrough and orphan drugs, along with venture capital investment to provide access to first-in-class mechanisms, are pushing projects to mechanism-driven design. These drivers aggregate to shift discovery strategy toward FBDD programs with access to new biology and enable sustainable rebuilding of the portfolio.

Adoption of FBDD is driven by universal availability of high-field NMR, synchrotron X-Ray crystallography, and steadily more mainstream cryo-EM, enabling faster structural turnaround and hit confirmation on difficult targets. Well-established outsourcing specialist CROs in biophysics, structure determination, and medicinal chemistry miniaturizes hurdles for small firms, while big organizations are standardizing FBDD playbooks by disease classes.

Data lakes in the enterprise integrate SAR (Structure-Activity Relationship), structural, and biophysics data, enhancing decision quality and shortening design-make-test cycles to deliver tractable ADME (Absorption, Distribution, Metabolism, and Excretion) profiles. Simultaneously, more effective translational biomarker approaches and earlier-stage pharmacology models de-risk target choice, rendering FBDD an optimum approach for first-in-class and best-in-class programs.

Recent developments include rising usage of covalent and electrophile-tuned fragments, growth in physically enumerated fragment expansion, and physics-informed scoring that applies water thermodynamics and free-energy perturbation. Cryo-EM is growing beyond large complexes to show ligand ability on challenging membrane proteins, and microcrystal X-Ray and serial crystallography are improving throughput for structure-guided elaboration.

Native mass spectrometry, SPR (Surface Plasmon Resonance), and MST (MicroScale Thermophoresis) are increasingly being combined for triaging weak binders and mapping cooperativity. Researchers are exploring challenging beyond-rule-of-five space, macrocycles, and allosteric binders, as well as extending fragment-based drug discovery toward RNA targets, molecular glues, and degrader starting points by discovering selective E3 ligase and neo substrate binders.

The competition is defined by the creation of platforms and the stacking of capabilities, rather than by individual assets. For instance, companies are setting up comprehensive FBDD studios that combine automated biophysical screening, rapid parallel synthesis, and real-time structural feedback. Investments are being made in cryo-EM and high-field NMR, microfluidics for crystallization, and cloud-native ELNs (Electronic Laboratory Notebooks) with FAIR (Findable, Accessible, Interoperable, and Reusable) data-standards to optimize design cycles.

Partnerships are also evolving to include risk-sharing discovery collaborations, option-to-license deals, and data-room partnerships based on validated targets. Screening modalities and covalent warhead chemistries are being patented, regional expansion is being pursued through specialized CRO networks, and teams are being upskilled with cross-training in structural biology, computational chemistry, and medicinal design.

Fragment-based drug discovery (FBDD) is a novel drug design strategy that discovers and develops small molecular weight chemical fragments as the leads for new drugs. In contrast to the high-throughput screening that screens large molecules from vast libraries, FBDD employs significantly shorter fragments capable of binding efficiently to target protein areas even when the binding affinity is poor. Applying structural biology and medicinal chemistry to construct more active and selective drug candidates, thereby rendering the process highly efficient in discovering new therapeutic agents, subsequently optimize these fragments.

The basis of FBDD is the fact that it can search chemical space more effectively as compared to conventional approaches. As fragments are much smaller than usual drug-like molecules, they have a better binding efficiency per atom and can be mixed or changed more often for increased affinity and specificity. This is especially useful for challenging-to-treat drug targets that have larger molecules, like protein-protein interactions or new binding sites.

Nuclear magnetic resonance (NMR), X-Ray crystallography, and cryo-electron microscopy are techniques that are crucial to FBDD. Such structural techniques can detect weak fragment binding and allow visualization of its binding to the protein target. Once structural information is obtained from a fragment, medicinal chemists have access to structures that they can then elaborate on by growing or linking the fragment into a more complex molecule with improved pharmacological properties. Computational methods and biophysical screening often aid fragment research in selecting and optimizing fragments and can also facilitate the discovery process.

FBDD has aided the expansion of a number of approved drugs and many clinical candidates. FBDD allows to discover new molecules with novel mechanisms of action, frequently against targets previously viewed as undruggable. FBDD is a key modern drug discovery approach involving the combination of fragment screening, structural biology, and rational design.

| Attribute | Detail |

|---|---|

| Fragment-based Drug Discovery Market Drivers |

|

The high efficiency of fragment-based drug discovery (FBDD) an impetus for the expansion of fragment-based drug discovery industry. Compared to the conventional high-throughput screening method of large molecules, FBDD employs smaller fragment libraries that are manageable but with high efficiency.

The fragments are screened more efficiently in chemical space, and scientists can identify insightful starting points for drug discovery with less labor. This saves time, cost, and complexity in early drug discovery, and hence FBDD is a preferred option for pharmaceutical and biotech firms.

Flexibility is another key strength of FBDD that has facilitated its popularity in the marketplace. Fragments screened during target identification, are visibly flexible and can be played around with, added to, or elongated to more advanced, larger molecules that are more potent and selective.

Fragment-based drug discovery influences a range of analytical techniques, including NMR spectroscopy, X-Ray crystallography, cryo-electron microscopy, computational modeling. Each of them has a rapid way to confirm fragment binding and thorough structure analysis that allows for a better understanding of three-dimensional structural insights. By combining biophysical and computational techniques simultaneously, FBDD blends the advantages of either technology to be valuable for both - established and emerging targets and thus, increasing the potential for drug discovery.

In addition to improve efficiencies and flexibility influencing development outcomes, drug discovery companies that depend on small molecule discoveries are increasingly adopting FBDD platforms to diversify their pipelines. FBDD decreases the discovery timetable while increasing the opportunity to identify first-in-class drug candidates. This makes FBDD worth the investment for comparative differentiation devices in an innovation-driven industry.

One of the main drivers to the fragment-based drug discovery (FBDD) market is the development of fragment library. Fragment libraries are low-molecular-weight chemical entities that are small in size and represent the starting point of drug discovery. Initially, fragment libraries were less diverse in nature, but efforts have been made to develop more chemically and structurally diverse, drug-likeness-optimized libraries. These improvements increase the likelihood of picking high-quality fragment hits, which accelerates the process of drug discovery and renders it more effective.

The design of modern fragment libraries is focused more on increased chemical diversity and rise in coverage of the chemical space. Through incorporation of new scaffolds, three-dimensional shapes, and improved physicochemical attributes, such libraries enable scientists to pick fragments that possess binding capacity against new or difficult targets. This broader applicability enables FBDD to be exploited for undruggable proteins.

Another noteworthy development is the emergence of specialized fragment libraries, including, but not limited to, covalent fragments, fragment libraries for RNA targets, and libraries populated with natural product-like fragments. These libraries increase the likelihood of successfully identifying selective and potent leads for difficult biological targets. A new type of library being created includes computationally designed libraries that use artificial intelligence and machine learning to anticipate fragment performance, which we expect to increase screening outcomes and decrease time to lead.

Through the ongoing development of these new libraries of fragments, fragment screening is poised to become more reliable, resulting in high-value hit generating candidates in a more consistent manner. Consequently, both - early-stage attrition is reduced and the probability of getting candidates into clinical development is increased. These new libraries and their successful application reinforce FBDD as an elite drug discovery strategy, ensuring that stakeholders increase their investments and partnerships in FBDD. As such, new types of fragments libraries form a prominent driver of growth and success of the global fragment-based drug discovery market.

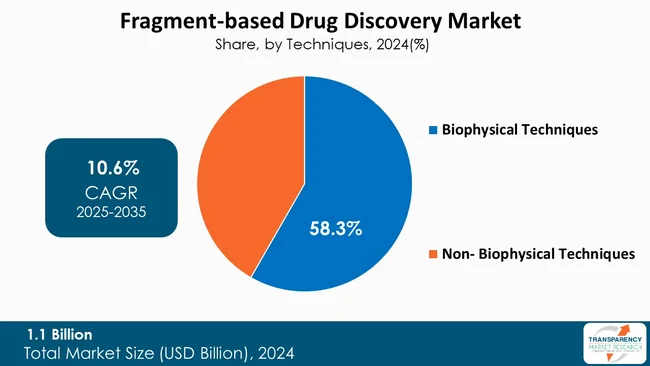

Biophysical techniques control the fragment-based drug discovery (FBDD) market due to the high sensitivity and accuracy of these methods in identifying weak fragment binding with target proteins. Methods like nuclear magnetic resonance (NMR), surface plasmon resonance (SPR), isothermal titration calorimetry (ITC), and X-Ray crystallography make it possible to identify and validate hit fragments accurately, a requirement for early drug discovery.

These methods provide detailed structural information as well as binding information and allows quick optimization of fragments into potent lead compounds. Biophysical approaches are the technology of choice for FBDD operations since they are simple to handle, rugged, reproducible, and enable measuring complex biological targets.

| Attribute | Detail |

|---|---|

| Leading Region |

|

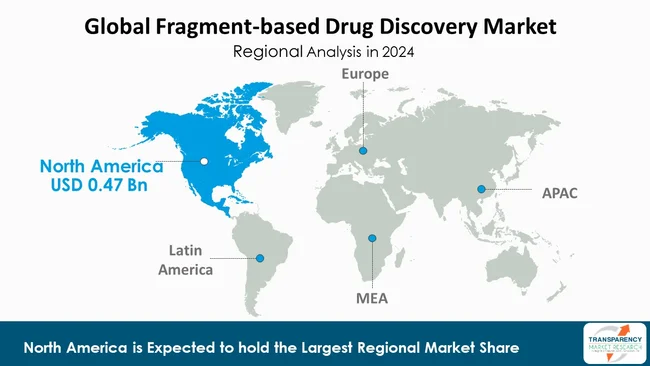

As per the latest Fragment-based drug discovery market analysis, North America dominated in 2024. This is due to the presence of well-capitalized research institutions, presence of a larger number of biotech and pharmaceutical firms, and increased funding into the technologies used during drug discovery. The region does enjoy supportive funding from public and private institutions, facilitating continuous innovation and incorporation of new screening technologies, structural biology tools, and fragment libraries

Furthermore, North America boasts a high concentration of skilled researchers, academic institutions, and contract research organizations (CROs) that support FBDD programs. Regulatory support and a robust focus on precision medicine are poised to bolster adoption to further strengthen North America’s position as a global leader in the FBDD industry.

The fragment-based drug discovery market players are adopting tactics like investing in premium fragment libraries, combining biophysical and computational platforms, building partnership relationships, and building CRO partnerships. They also focus on early-stage risk-sharing models, development of IP over screening techniques, and building end-to-end FBDD platforms for speeding up drug pipelines.

Thermo Fisher Scientific Inc., Astex Pharmaceuticals, Domainex, Beactica Therapeutics AB, Charles River Laboratories, Evotec International GmbH, Sprint Bioscience, Structure Based Design, Inc., Sygnature Discovery Limited, Malvern Panalytical Ltd., Vernalis (R&D) Limited (HitGen Inc.), SARomics Biostructures, WuXi AppTec, Schrödinger, Inc., and ZOBIO BV are some of the leading players operating in the global fragment-based drug discovery industry.

Each of these players has been profiled in the fragment-based drug discovery market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

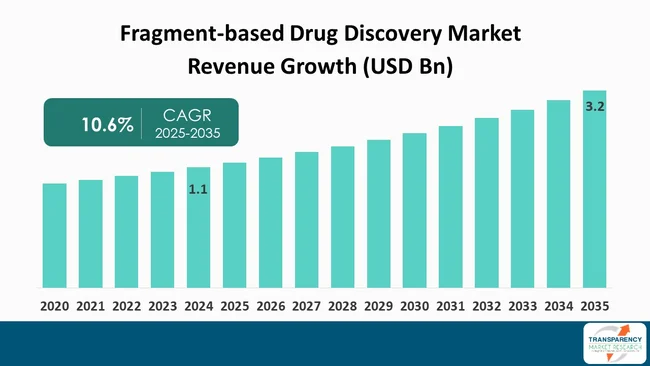

| Size in 2024 | US$ 1.1 Bn |

| Forecast Value in 2035 | US$ 3.2 Bn |

| CAGR | 10.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Biotechnology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global fragment-based drug discovery market was valued at US$ 1.1 Bn in 2024

The global fragment-based drug discovery industry is projected to cross US$ 3.2 Bn by the end of 2035

Increased pharmaceutical R&D investment, the efficiency and versatility of FBDD over traditional methods, advancements in fragment library design, screening techniques (like X-Ray crystallography, NMR, and cryo-EM) and the growing demand for novel therapies, are some of the factors driving the expansion of fragment based drug discovery market.

The CAGR is anticipated to be 10.6% from 2025 to 2035

Thermo Fisher Scientific Inc., Astex Pharmaceuticals, Domainex, Beactica Therapeutics AB, Charles River Laboratories, Evotec International GmbH, Sprint Bioscience, Structure Based Design, Inc., Sygnature Discovery Limited, Malvern Panalytical Ltd, Vernalis (R&D) Limited (HitGen Inc.), SARomics Biostructures, WuXi AppTec, Schrödinger, Inc., and ZOBIO BV

Table 01: Global Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Techniques, 2020 to 2035

Table 03: Global Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Biophysical Techniques, 2020 to 2035

Table 04: Global Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 05: Global Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 06: Global Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 08: North America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 09: North America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Techniques, 2020 to 2035

Table 10: North America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Biophysical Techniques, 2020 to 2035

Table 11: North America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: North America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Europe Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 14: Europe Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 15: Europe Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Techniques, 2020 to 2035

Table 16: Europe Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Biophysical Techniques, 2020 to 2035

Table 17: Europe Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 18: Europe Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Asia Pacific Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 20: Asia Pacific Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 21: Asia Pacific Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Techniques, 2020 to 2035

Table 22: Asia Pacific Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Bead-based Assay, 2020 to 2035

Table 23: Asia Pacific Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Asia Pacific Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Latin America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 26: Latin America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 27: Latin America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Techniques, 2020 to 2035

Table 28: Latin America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Biophysical Techniques, 2020 to 2035

Table 29: Latin America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Latin America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 31: Middle East & Africa Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 32: Middle East & Africa Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 33: Middle East & Africa Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Techniques, 2020 to 2035

Table 34: Middle East & Africa Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Biophysical Techniques, 2020 to 2035

Table 35: Middle East & Africa Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 36: Middle East & Africa Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Fragment Based Drug Discovery Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Fragment Based Drug Discovery Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Fragment Libraries, 2020 to 2035

Figure 04: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Screening Technologies, 2020 to 2035

Figure 05: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Software Tools, 2020 to 2035

Figure 06: Global Fragment Based Drug Discovery Market Value Share Analysis, By Techniques, 2024 and 2035

Figure 07: Global Fragment Based Drug Discovery Market Attractiveness Analysis, By Techniques, 2025 to 2035

Figure 08: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Biophysical Techniques, 2020 to 2035

Figure 09: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Non- Biophysical Techniques, 2020 to 2035

Figure 10: Global Fragment Based Drug Discovery Market Value Share Analysis, By Application, 2024 and 2035

Figure 11: Global Fragment Based Drug Discovery Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 12: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Oncology, 2020 to 2035

Figure 13: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Central Nervous System (CNS) Disorders, 2020 to 2035

Figure 14: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Infectious Diseases, 2020 to 2035

Figure 15: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Cardiovascular Diseases, 2020 to 2035

Figure 16: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Metabolic Disorders, 2020 to 2035

Figure 17: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global Fragment Based Drug Discovery Market Value Share Analysis, By End-user, 2024 and 2035

Figure 19: Global Fragment Based Drug Discovery Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 20: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Contract Research Organizations (CROs), 2020 to 2035

Figure 21: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Pharmaceutical and Biotechnology Companies, 2020 to 2035

Figure 22: Global Fragment Based Drug Discovery Market Revenue (US$ Bn), by Academic and Research Institutions, 2020 to 2035

Figure 23: Global Fragment Based Drug Discovery Market Value Share Analysis, By Region, 2024 and 2035

Figure 24: Global Fragment Based Drug Discovery Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 25: North America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 26: North America Fragment Based Drug Discovery Market Value Share Analysis, by Country, 2024 and 2035

Figure 27: North America Fragment Based Drug Discovery Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 28: North America Fragment Based Drug Discovery Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 29: North America Fragment Based Drug Discovery Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 30: North America Fragment Based Drug Discovery Market Value Share Analysis, By Techniques, 2024 and 2035

Figure 31: North America Fragment Based Drug Discovery Market Attractiveness Analysis, By Techniques, 2025 to 2035

Figure 31: North America Fragment Based Drug Discovery Market Value Share Analysis, By Application, 2024 and 2035

Figure 33: North America Fragment Based Drug Discovery Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 34: North America Fragment Based Drug Discovery Market Value Share Analysis, By End-user, 2024 and 2035

Figure 35: North America Fragment Based Drug Discovery Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 36: Europe Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: Europe Fragment Based Drug Discovery Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 38: Europe Fragment Based Drug Discovery Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 39: Europe Fragment Based Drug Discovery Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 40: Europe Fragment Based Drug Discovery Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 41: Europe Fragment Based Drug Discovery Market Value Share Analysis, By Techniques, 2024 and 2035

Figure 42: Europe Fragment Based Drug Discovery Market Attractiveness Analysis, By Techniques, 2025 to 2035

Figure 43: Europe Fragment Based Drug Discovery Market Value Share Analysis, By Application, 2024 and 2035

Figure 44: Europe Fragment Based Drug Discovery Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 45: Europe Fragment Based Drug Discovery Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: Europe Fragment Based Drug Discovery Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 47: Asia Pacific Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Asia Pacific Fragment Based Drug Discovery Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 49: Asia Pacific Fragment Based Drug Discovery Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 50: Asia Pacific Fragment Based Drug Discovery Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 51: Asia Pacific Fragment Based Drug Discovery Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 52: Asia Pacific Fragment Based Drug Discovery Market Value Share Analysis, By Techniques, 2024 and 2035

Figure 53: Asia Pacific Fragment Based Drug Discovery Market Attractiveness Analysis, By Techniques, 2025 to 2035

Figure 54: Asia Pacific Fragment Based Drug Discovery Market Value Share Analysis, By Application, 2024 and 2035

Figure 55: Asia Pacific Fragment Based Drug Discovery Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 56: Asia Pacific Fragment Based Drug Discovery Market Value Share Analysis, By End-user, 2024 and 2035

Figure 57: Asia Pacific Fragment Based Drug Discovery Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 58: Latin America Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Latin America Fragment Based Drug Discovery Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 60: Latin America Fragment Based Drug Discovery Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 61: Latin America Fragment Based Drug Discovery Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 62: Latin America Fragment Based Drug Discovery Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 63: Latin America Fragment Based Drug Discovery Market Value Share Analysis, By Techniques, 2024 and 2035

Figure 64: Latin America Fragment Based Drug Discovery Market Attractiveness Analysis, By Techniques, 2025 to 2035

Figure 65: Latin America Fragment Based Drug Discovery Market Value Share Analysis, By Application, 2024 and 2035

Figure 66: Latin America Fragment Based Drug Discovery Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 67: Latin America Fragment Based Drug Discovery Market Value Share Analysis, By End-user, 2024 and 2035

Figure 67: Latin America Fragment Based Drug Discovery Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 69: Middle East & Africa Fragment Based Drug Discovery Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 70: Middle East & Africa Fragment Based Drug Discovery Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 71: Middle East & Africa Fragment Based Drug Discovery Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 72: Middle East & Africa Fragment Based Drug Discovery Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 73: Middle East & Africa Fragment Based Drug Discovery Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 74: Middle East & Africa Fragment Based Drug Discovery Market Value Share Analysis, By Techniques, 2024 and 2035

Figure 75: Middle East & Africa Fragment Based Drug Discovery Market Attractiveness Analysis, By Techniques, 2025 to 2035

Figure 76: Middle East & Africa Fragment Based Drug Discovery Market Value Share Analysis, By Application, 2024 and 2035

Figure 77: Middle East & Africa Fragment Based Drug Discovery Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 78: Middle East & Africa Fragment Based Drug Discovery Market Value Share Analysis, By End-user, 2024 and 2035

Figure 79: Middle East & Africa Fragment Based Drug Discovery Market Attractiveness Analysis, By End-user, 2025 to 2035