Reports

Reports

Analysts’ Viewpoint

Application of fiber optic sensors has increased in various fields due to their inherent advantages such as cost-effectiveness, light weight, miniaturized size, and immunity to electromagnetic interference. Increasing complexity in industrial applications of fiber optic sensors has fueled the demand for more sophisticated sensing devices in smaller packages. This is estimated to offer significant growth opportunities for the fiber optic sensors industry in the near future.

Key fiber optic sensor manufacturers are focusing on various growth strategies, such as collaborations with key players, mergers & acquisitions, product launches, and developing worldwide distribution network, to increase their market share. Asia Pacific dominated the global market due to deployment of fiber optic sensors in automotive, oil & gas, and chemical industries to measure temperature. Furthermore, expansion of the automotive sector in Japan, China, South Korea, and India is boosting the fiber optic sensors market dynamics in the region.

Fiber optic sensors have wide range of applications in various branches of science and engineering due to their ability to optically detect properties, which include vibration, temperature, accelerometer calibration, stress, chemical analysis, liquid level, pH, light intensity, pressure, density, concentration, and refractive index of the liquid.

Requirements for fiber optic solutions can be highly demanding especially for applications with extreme temperatures and exposure to harsh chemicals, which require highest precision in combination with limited mounting space, or for applications requiring the reliable detection of various objects with different shapes, materials, and colors.

Fiber optic sensors play an important role in the development of communication systems to sense and measure the change in phase, wavelength, noise, uneven environmental conditions, data transmission rate, intensity, extreme heat, high vibration, etc. Analysis of the latest global fiber optic sensors market trends reveal that expanding application base of fiber optic sensors is likely to propel the fiber optic sensor market revenue during the forecast period.

Fiber optic sensing technologies are expected to be applied to various electronic control systems in the automotive industry, due to their highly desirable features such as high heat resistance, high noise immunity, and flexible light transmission, which can be used to measure the movement and direction of vehicles.

Temperature management is an important component in the development, testing, and design of electric and hybrid vehicles. The performance and aging of all important electric vehicle components is highly dependent on the temperature distribution and the development of internal hot spots. Therefore, faster and more accurate temperature measurement is required at every stage of electric vehicle product development. Therefore, the demand of fiber optic sensors is increasing in the automotive industry.

Fiber Optic sensor technology, or fiber optic temperature sensors, are rapidly gaining traction in electric / hybrid vehicles testing due to their electromagnetic field immunity, faster response, ruggedness, small size, high accuracy, and safe operation. According to India Brand Equity Foundation (IBEF), the electric vehicle market in India is estimated to reach US$ 7.09 billion by 2025. Furthermore, the automotive industry in India is focusing on increasing export of vehicles by five times between 2016 and 2026. This is estimated to positively impact the fiber optic sensors market forecast in the next few years.

Currently, thermal monitoring has become one of the major applications of fiber optic sensors in the oil & gas industry. Fiber optic sensors possess significant advantages over electrical sensors, as they can operate at higher temperatures, have small size, have less risk of failure when exposed to water (or other conductive liquids), and do not require electrical power for the sensor head.

The environments in which fiber optic oil & gas sensors need to operate require specially designed sensors to ensure long life and performance. Prominent manufacturers are engaged in the development of various types of fiber optic sensors for oil & gas monitoring. For instance, in October 2021, Luna Innovations developed oil & gas monitoring services based on fiber optic sensor products. Oil & gas solutions improve accuracy in determining oil production for individual clusters within unconventional wells and can be deployed with temporary or permanent deployment options.

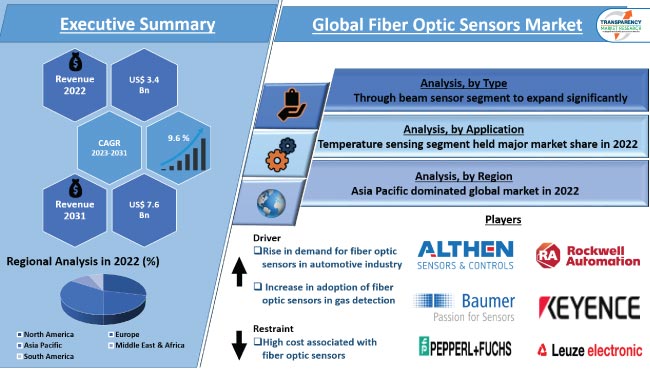

In terms of type, the global fiber optic sensors market segmentation comprises diffused sensor, through beam sensor, and retroreflective sensors. The through beam sensor segment held 42.34% of fiber optic sensors market share in 2022. It is likely to maintain the status quo and expand at a growth rate of 10.2% during the forecast period.

Through-beam sensors can operate at long range to detect objects. This is because the light only has to travel in one direction to travel from the emitter to the receiver. This is a key factor contributing to the fiber optic sensors market growth.

In terms of application, the temperature sensing segment held 34.23% share of the global business in 2022. It is likely to maintain the status quo and expand at a growth rate of 10.9% during the forecast period. Fiber optic sensors are extensively utilized for temperature sensing in pipeline and process monitoring in the oil & gas sector and in power cable monitoring in the energy & utility sector.

Fiber optic temperature sensor is an important component of monitoring systems as it helps enhance the situation awareness of industrial and manufacturing processes, which leads to improved manufacturing efficiency and reduced maintenance cost and downtime.

Asia Pacific held a prominent share of 34.23% of the global fiber optic sensors market in 2022. North America accounted for a significant share of 28.79% in 2022.

Asia Pacific dominated the global market, because China is the first county to modernize its oil & gas industry, which extensively utilizes fiber optic sensors. Moreover, according to Energy Information Administration (EIA), in 2021, China was the fifth-largest oil producer in the world. Furthermore, presence of a large number of fiber optic sensor manufacturers in the region is also a key factor boosting the market for fiber optic sensors market in Asia Pacific.

North America is expected to dominate the global market during the forecast period due to the presence of a robust oil & gas industry in this region, which contributes to the high rate of adoption of fiber optic sensors.

The global fiber optic sensors industry is fragmented due to the presence of a large number of players. Majority of companies are spending significantly on providing technologically advanced fiber optic sensors. Expansion of product portfolios and mergers and acquisitions are notable strategies adopted by the prominent players. Key players in the fiber optic sensor business include Althen, Baumer, ifm electronic gmbh, KEYENCE CORPORATION, Leuze electronic GmbH + Co. KG, Luna, OFS Fitel, LLC, Pepperl+Fuchs (India) Pvt. Ltd, Rockwell Automation, Inc, and Wenglor Sensoric Group.

The fiber optic sensors market report also includes profiles of key players who have been analyzed based on parameters such as company overview, financial overview, product portfolio, business segments, business strategies, and recent developments.

| Attribute | Details |

|---|---|

| Market Size Value in 2022 | US$ 3.4 Bn |

| Market Forecast Value in 2031 | US$ 7.6 Bn |

| Growth Rate (CAGR) | 9.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value & Billion Units for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global market size was valued at US$ 3.4 Bn in 2022.

It is expected to expand at a CAGR of 9.6% from 2023 to 2031.

Rise in demand for fiber optic sensor in automotive industry and increase in adoption of fiber optic sensors in gas detection.

Through beam sensor type segment accounted for major share of 42.34% in 2022.

The temperature sensing segment accounted for 34.23% share in 2022.

Asia Pacific is highly attractive for vendors in 2022.

The China fiber optic sensors market was valued at US$ 0.51 Bn in 2022.

Althen, Baumer, ifm electronic gmbh, KEYENCE CORPORATION, Leuze electronic GmbH + Co. KG, Luna, OFS Fitel, LLC, Pepperl+Fuchs (India) Pvt. Ltd, Rockwell Automation, Inc., Wenglor Sensoric Group.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Fiber Optic Sensors Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Sensing Devices Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Fiber Optic Sensors Market Analysis, by Type

5.1. Fiber Optic Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Type, 2017-2031

5.1.1. Diffused Sensor

5.1.2. Through Beam Sensor

5.1.3. Retroreflective Sensors

5.2. Market Attractiveness Analysis, by Type

6. Fiber Optic Sensors Market Analysis, by Range

6.1. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by Range, 2017-2031

6.1.1. Up to 100 mm

6.1.2. 101 to 500 mm

6.1.3. 501 to 1000 mm

6.1.4. 1001 to 2000 mm

6.1.5. Above 2000 mm

6.2. Market Attractiveness Analysis, by Range

7. Fiber Optic Sensors Market Analysis, by Application

7.1. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

7.1.1. Temperature Sensing

7.1.2. Pressure Sensing

7.1.3. Strain Sensing

7.1.4. Acceleration Sensing

7.1.5. Others

7.2. Market Attractiveness Analysis, by Application

8. Fiber Optic Sensors Market Analysis, by End-use Industry

8.1. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

8.1.1. Energy & Power

8.1.2. Oil & Gas

8.1.3. Industrial

8.1.4. Building & Construction

8.1.5. IT & Telecommunication

8.1.6. Aerospace & Defense

8.1.7. Automotive & Transportation

8.1.8. Healthcare

8.1.9. Others

8.2. Market Attractiveness Analysis, by End-use Industry

9. Fiber Optic Sensors Market Analysis and Forecast, by Region

9.1. Fiber Optic Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Region, 2017-2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Fiber Optic Sensors Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Fiber Optic Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Type, 2017-2031

10.3.1. Diffused Sensor

10.3.2. Through Beam Sensor

10.3.3. Retroreflective Sensors

10.4. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by Range, 2017-2031

10.4.1. Up to 100 mm

10.4.2. 101 to 500 mm

10.4.3. 501 to 1000 mm

10.4.4. 1001 to 2000 mm

10.4.5. Above 2000 mm

10.5. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

10.5.1. Temperature Sensing

10.5.2. Pressure Sensing

10.5.3. Strain Sensing

10.5.4. Acceleration Sensing

10.5.5. Others

10.6. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

10.6.1. Energy & Power

10.6.2. Oil & Gas

10.6.3. Industrial

10.6.4. Building & Construction

10.6.5. IT & Telecommunication

10.6.6. Aerospace & Defense

10.6.7. Automotive & Transportation

10.6.8. Healthcare

10.6.9. Others

10.7. Fiber Optic Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Type

10.8.2. By Range

10.8.3. By Application

10.8.4. By End-use Industry

10.8.5. By Country/Sub-region

11. Europe Fiber Optic Sensors Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Fiber Optic Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Type, 2017-2031

11.3.1. Diffused Sensor

11.3.2. Through Beam Sensor

11.3.3. Retroreflective Sensor

11.4. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by Range, 2017-2031

11.4.1. Up to 100 mm

11.4.2. 101 to 500 mm

11.4.3. 501 to 1000 mm

11.4.4. 1001 to 2000 mm

11.4.5. Above 2000 mm

11.5. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

11.5.1. Temperature Sensing

11.5.2. Pressure Sensing

11.5.3. Strain Sensing

11.5.4. Acceleration Sensing

11.5.5. Others

11.6. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

11.6.1. Energy & Power

11.6.2. Oil & Gas

11.6.3. Industrial

11.6.4. Building & Construction

11.6.5. IT & Telecommunication

11.6.6. Aerospace & Defense

11.6.7. Automotive & Transportation

11.6.8. Healthcare

11.6.9. Others

11.7. Fiber Optic Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Type

11.8.2. By Range

11.8.3. By Application

11.8.4. By End-use Industry

11.8.5. By Country/Sub-region

12. Asia Pacific Fiber Optic Sensors Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Fiber Optic Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Type, 2017-2031

12.3.1. Diffused Sensor

12.3.2. Through Beam Sensor

12.3.3. Retroreflective Sensor

12.4. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by Range, 2017-2031

12.4.1. Up to 100 mm

12.4.2. 101 to 500 mm

12.4.3. 501 to 1000 mm

12.4.4. 1001 to 2000 mm

12.4.5. Above 2000 mm

12.5. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

12.5.1. Temperature Sensing

12.5.2. Pressure Sensing

12.5.3. Strain Sensing

12.5.4. Acceleration Sensing

12.5.5. Others

12.6. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

12.6.1. Energy & Power

12.6.2. Oil & Gas

12.6.3. Industrial

12.6.4. Building & Construction

12.6.5. IT & Telecommunication

12.6.6. Aerospace & Defense

12.6.7. Automotive & Transportation

12.6.8. Healthcare

12.6.9. Others

12.7. Fiber Optic Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Type

12.8.2. By Range

12.8.3. By Application

12.8.4. By End-use Industry

12.8.5. By Country/Sub-region

13. Middle East & Africa Fiber Optic Sensors Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Fiber Optic Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Type, 2017-2031

13.3.1. Diffused Sensor

13.3.2. Through Beam Sensor

13.3.3. Retroreflective Sensor

13.4. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by Range, 2017-2031

13.4.1. Up to 100 mm

13.4.2. 101 to 500 mm

13.4.3. 501 to 1000 mm

13.4.4. 1001 to 2000 mm

13.4.5. Above 2000 mm

13.5. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

13.5.1. Temperature Sensing

13.5.2. Pressure Sensing

13.5.3. Strain Sensing

13.5.4. Acceleration Sensing

13.5.5. Others

13.6. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

13.6.1. Energy & Power

13.6.2. Oil & Gas

13.6.3. Industrial

13.6.4. Building & Construction

13.6.5. IT & Telecommunication

13.6.6. Aerospace & Defense

13.6.7. Automotive & Transportation

13.6.8. Healthcare

13.6.9. Others

13.7. Fiber Optic Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Type

13.8.2. By Range

13.8.3. By Application

13.8.4. By End-use Industry

13.8.5. By Country/Sub-region

14. South America Fiber Optic Sensors Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Fiber Optic Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Type, 2017-2031

14.3.1. Diffused Sensor

14.3.2. Through Beam Sensor

14.3.3. Retroreflective Sensor

14.4. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by Range, 2017-2031

14.4.1. Up to 100 mm

14.4.2. 101 to 500 mm

14.4.3. 501 to 1000 mm

14.4.4. 1001 to 2000 mm

14.4.5. Above 2000 mm

14.5. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

14.5.1. Temperature Sensing

14.5.2. Pressure Sensing

14.5.3. Strain Sensing

14.5.4. Acceleration Sensing

14.5.5. Others

14.6. Fiber Optic Sensors Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

14.6.1. Energy & Power

14.6.2. Oil & Gas

14.6.3. Industrial

14.6.4. Building & Construction

14.6.5. IT & Telecommunication

14.6.6. Aerospace & Defense

14.6.7. Automotive & Transportation

14.6.8. Healthcare

14.6.9. Others

14.7. Fiber Optic Sensors Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Type

14.8.2. By Range

14.8.3. By Application

14.8.4. By End-use Industry

14.8.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Fiber Optic Sensors Market Competition Matrix - a Dashboard View

15.1.1. Global Fiber Optic Sensors Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Althen

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Baumer

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. ifm electronic gmbh

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. KEYENCE CORPORATION

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Leuze electronic GmbH + Co. KG

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Luna

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. OFS Fitel, LLC

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Pepperl+Fuchs (India) Pvt. Ltd.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Rockwell Automation, Inc.

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Wenglor Sensoric Group

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Understanding Buying Process of Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 2: Global Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Type, 2017-2031

Table 3: Global Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Range, 2017-2031

Table 4: Global Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 5: Global Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 6: Global Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Region, 2017-2031

Table 7: Global Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Region, 2017-2031

Table 8: North America Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 9: North America Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Type, 2017-2031

Table 10: North America Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Range, 2017-2031

Table 11: North America Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 12: North America Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 13: North America Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 14: North America Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 15: Europe Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 16: Europe Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Type, 2017-2031

Table 17: Europe Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Range, 2017-2031

Table 18: Europe Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Range, 2017-2031

Table 19: Europe Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 20: Europe Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Application, 2017-2031

Table 21: Europe Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 22: Europe Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 23: Europe Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 24: Europe Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 25: Asia Pacific Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 26: Asia Pacific Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Type, 2017-2031

Table 27: Asia Pacific Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Range, 2017-2031

Table 28: Asia Pacific Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 29: Asia Pacific Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 30: Asia Pacific Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 31: Asia Pacific Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 32: Middle East & Africa Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 33: Middle East & Africa Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Type, 2017-2031

Table 34: Middle East & Africa Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Range, 2017-2031

Table 35: Middle East & Africa Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 36: Middle East & Africa Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 37: Middle East & Africa Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 38: Middle East & Africa Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 39: South America Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 40: South America Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Type, 2017-2031

Table 41: South America Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Range, 2017-2031

Table 42: South America Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 43: South America Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 44: South America Fiber Optic Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 45: South America Fiber Optic Sensors Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global Fiber Optic Sensors

Figure 02: Porter Five Forces Analysis - Global Fiber Optic Sensors

Figure 03: Technology Road Map - Global Fiber Optic Sensors

Figure 04: Global Fiber Optic Sensors Market, Value (US$ Bn), 2017-2031

Figure 05: Global Fiber Optic Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 06: Global Fiber Optic Sensors Market Projections by Type, Value (US$ Bn), 2017-2031

Figure 07: Global Fiber Optic Sensors Market, Incremental Opportunity, by Type, 2023-2031

Figure 08: Global Fiber Optic Sensors Market Share Analysis, by Type, 2023 and 2031

Figure 09: Global Fiber Optic Sensors Market Projections by Range, Value (US$ Bn), 2017-2031

Figure 10: Global Fiber Optic Sensors Market, Incremental Opportunity, by Range, 2023-2031

Figure 11: Global Fiber Optic Sensors Market Share Analysis, by Range, 2023 and 2031

Figure 12: Global Fiber Optic Sensors Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 13: Global Fiber Optic Sensors Market, Incremental Opportunity, by Application, 2023-2031

Figure 14: Global Fiber Optic Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 15: Global Fiber Optic Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017-2031

Figure 16: Global Fiber Optic Sensors Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 17: Global Fiber Optic Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 18: Global Fiber Optic Sensors Market Projections by Region, Value (US$ Bn), 2017-2031

Figure 19: Global Fiber Optic Sensors Market, Incremental Opportunity, by Region, 2023-2031

Figure 20: Global Fiber Optic Sensors Market Share Analysis, by Region, 2023 and 2031

Figure 21: North America Fiber Optic Sensors Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 22: North America Fiber Optic Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 23: North America Fiber Optic Sensors Market Projections by Type Value (US$ Bn), 2017-2031

Figure 24: North America Fiber Optic Sensors Market, Incremental Opportunity, by Type, 2023-2031

Figure 25: North America Fiber Optic Sensors Market Share Analysis, by Type, 2023 and 2031

Figure 26: North America Fiber Optic Sensors Market Projections by Range Value (US$ Bn), 2017-2031

Figure 27: North America Fiber Optic Sensors Market, Incremental Opportunity, by Range, 2023-2031

Figure 28: North America Fiber Optic Sensors Market Share Analysis, by Range, 2023 and 2031

Figure 29: North America Fiber Optic Sensors Market Projections by Application (US$ Bn), 2017-2031

Figure 30: North America Fiber Optic Sensors Market, Incremental Opportunity, by Application, 2023-2031

Figure 31: North America Fiber Optic Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 32: North America Fiber Optic Sensors Market Projections by End-use Industry Value (US$ Bn), 2017-2031

Figure 33: North America Fiber Optic Sensors Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 34: North America Fiber Optic Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 35: North America Fiber Optic Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 36: North America Fiber Optic Sensors Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 37: North America Fiber Optic Sensors Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 38: Europe Fiber Optic Sensors Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 39: Europe Fiber Optic Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 40: Europe Fiber Optic Sensors Market Projections by Type Value (US$ Bn), 2017-2031

Figure 41: Europe Fiber Optic Sensors Market, Incremental Opportunity, by Type, 2023-2031

Figure 42: Europe Fiber Optic Sensors Market Share Analysis, by Type, 2023 and 2031

Figure 43: Europe Fiber Optic Sensors Market Projections by Range, Value (US$ Bn), 2017-2031

Figure 44: Europe Fiber Optic Sensors Market, Incremental Opportunity, by Range, 2023-2031

Figure 45: Europe Fiber Optic Sensors Market Share Analysis, by Range, 2023 and 2031

Figure 46: Europe Fiber Optic Sensors Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 47: Europe Fiber Optic Sensors Market, Incremental Opportunity, by Application, 2023-2031

Figure 48: Europe Fiber Optic Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 49: Europe Fiber Optic Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017-2031

Figure 50: Europe Fiber Optic Sensors Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 51: Europe Fiber Optic Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 52: Europe Fiber Optic Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 53: Europe Fiber Optic Sensors Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 54: Europe Fiber Optic Sensors Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 55: Asia Pacific Fiber Optic Sensors Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 56: Asia Pacific Fiber Optic Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 57: Asia Pacific Fiber Optic Sensors Market Projections by Type Value (US$ Bn), 2017-2031

Figure 58: Asia Pacific Fiber Optic Sensors Market, Incremental Opportunity, by Type, 2023-2031

Figure 59: Asia Pacific Fiber Optic Sensors Market Share Analysis, by Type, 2023 and 2031

Figure 60: Asia Pacific Fiber Optic Sensors Market Projections by Range Value (US$ Bn), 2017-2031

Figure 61: Asia Pacific Fiber Optic Sensors Market, Incremental Opportunity, by Range, 2023-2031

Figure 62: Asia Pacific Fiber Optic Sensors Market Share Analysis, by Range, 2023 and 2031

Figure 63: Asia Pacific Fiber Optic Sensors Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 64: Asia Pacific Fiber Optic Sensors Market, Incremental Opportunity, by Application, 2023-2031

Figure 65: Asia Pacific Fiber Optic Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 66: Asia Pacific Fiber Optic Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017-2031

Figure 67: Asia Pacific Fiber Optic Sensors Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 68: Asia Pacific Fiber Optic Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 69: Asia Pacific Fiber Optic Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 70: Asia Pacific Fiber Optic Sensors Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 71: Asia Pacific Fiber Optic Sensors Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 72: MEA Fiber Optic Sensors Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 73: MEA Fiber Optic Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 74: MEA Fiber Optic Sensors Market Projections by Type Value (US$ Bn), 2017-2031

Figure 75: MEA Fiber Optic Sensors Market, Incremental Opportunity, by Type, 2023-2031

Figure 76: MEA Fiber Optic Sensors Market Share Analysis, by Type, 2023 and 2031

Figure 77: MEA Fiber Optic Sensors Market Projections by Range Value (US$ Bn), 2017-2031

Figure 78: MEA Fiber Optic Sensors Market, Incremental Opportunity, by Range, 2023-2031

Figure 79: MEA Fiber Optic Sensors Market Share Analysis, by Range, 2023 and 2031

Figure 80: MEA Fiber Optic Sensors Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 81: MEA Fiber Optic Sensors Market, Incremental Opportunity, by Application, 2023-2031

Figure 82: MEA Fiber Optic Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 83: MEA Fiber Optic Sensors Market Projections by End-use Industry Value (US$ Bn), 2017-2031

Figure 84: MEA Fiber Optic Sensors Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 85: MEA Fiber Optic Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 86: MEA Fiber Optic Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 87: MEA Fiber Optic Sensors Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 88: MEA Fiber Optic Sensors Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 89: South America Fiber Optic Sensors Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 90: South America Fiber Optic Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 91: South America Fiber Optic Sensors Market Projections by Type Value (US$ Bn), 2017-2031

Figure 92: South America Fiber Optic Sensors Market, Incremental Opportunity, by Type, 2023-2031

Figure 93: South America Fiber Optic Sensors Market Share Analysis, by Type, 2023 and 2031

Figure 94: South America Fiber Optic Sensors Market Projections by Range Value (US$ Bn), 2017-2031

Figure 95: South America Fiber Optic Sensors Market, Incremental Opportunity, by Range, 2023-2031

Figure 96: South America Fiber Optic Sensors Market Share Analysis, by Range, 2023 and 2031

Figure 97: South America Fiber Optic Sensors Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 98: South America Fiber Optic Sensors Market, Incremental Opportunity, by Application, 2023-2031

Figure 99: South America Fiber Optic Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 100: South America Fiber Optic Sensors Market Projections by End-use Industry Value (US$ Bn), 2017-2031

Figure 101: South America Fiber Optic Sensors Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 102: South America Fiber Optic Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 103: South America Fiber Optic Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 104: South America Fiber Optic Sensors Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 105: South America Fiber Optic Sensors Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 106: Global Fiber Optic Sensors Market Competition

Figure 107: Global Fiber Optic Sensors Market Company Share Analysis