Analysts’ Viewpoint on Market Scenario

Companies operating in the drilling fluids market are growing their regional presence due to the increase in the adoption of crude oil as a source of energy. Companies are increasing their import & export activities due to the reopening of country borders post the COVID-19 pandemic. The market has become highly competitive due to the large presence of multinationals. These key players are involved in product innovations pertaining to air drilling fluids, water-based muds, and other specialty chemicals. Companies are investing in R&D to develop multi-functional fluid additives, which offer a competitive edge over other market players. Different companies have their own patented drilling fluid solutions meant for specific types of wellbore conditions.

Drilling fluid, also called drilling mud, aids in the process of drilling a borehole into the earth. Boreholes are drilled for oil & gas extraction, core sampling, and other purposes. Drilling fluids serve many functions such as controlling formation pressures, removing cuttings from the wellbore, sealing permeable formations encountered while drilling, cooling, lubricating the bit, transmitting hydraulic energy to downhole bit and tools, and maintaining wellbore stability & well control.

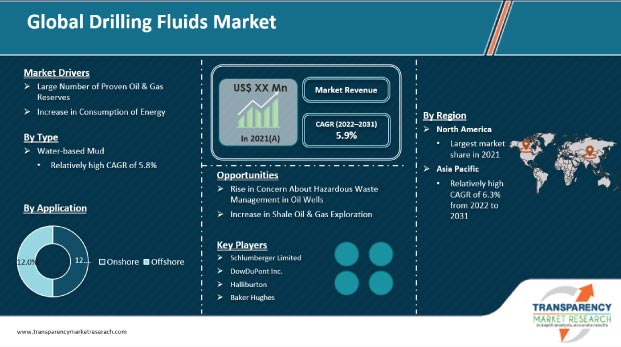

The global market for drilling fluids is projected to grow at a decent pace from 2022 to 2031, due to the rise in investment for the exploration and production of offshore oil & gas. Growth in shale oil & gas exploration has encouraged many countries around the world to exploit their own unconventional gas resources. Apart from innovations in drilling fluids, companies are manufacturing robust drill pipes. Drill pipe is an important tool for drilling in oil fields. Drill pipes are subjected to various types of loads and are operated under different environmental conditions.

Request a sample to get extensive insights into the Drilling Fluids Market

Currently, 79.4% of the world's proven oil reserves are located in OPEC (Organization of the Petroleum Exporting Countries) member countries. It has been found that a large bulk of OPEC oil reserves are located in the Middle East, amounting to 64.5% of the total reserves.

OPEC member countries have made significant additions to their oil reserves in recent years by adopting the best practices in the industry. These countries engage in intensive exploration and recovery operations. OPEC's proven oil reserves currently stand at 1,189.80 billion barrels.

It has been found that oil & gas resources are not distributed evenly around the world. According to the U.S. Department of Energy, about 15 countries account for more than 75% of the world’s oil production and hold roughly 93% of its reserves. These countries are projected to constitute a correspondingly large percentage of the world’s remaining undiscovered oil resources. Hence, companies in this market are unlocking revenue opportunities in key OPEC countries such as Saudi Arabia, Iran, and Kuwait among others.

The U.S. and Russia are low on the list of oil reserves; however, they rank high in terms of oil production. More than 95 million barrels of oil were produced globally every day in 2020. The U.S., Saudi Arabia, and Russia are among the top oil-producing countries in the world.

The rise in industrialization activities and population has led to high consumption of energy per day. It has been found that fossil fuels supply about 84% of the world’s energy. Hence, the extraction of oil & gas, and fossil fuels has increased across the globe. A rise in investment in the exploration and production of offshore oil & gas is propelling the adoption of drilling fluids around the world.

The International Energy Agency (IEA) prepares annual projections about potential energy demand using a number of different scenarios. According to the IEA 2021 report, global demand for natural gas is expected to increase by 31% by 2040, supplying 17% of the total energy consumed worldwide. The global demand for crude oil is likely to increase by 21%, supplying 35% of the total energy consumed by 2040. Such trends are fueling the demand for drilling fluids.

Request a custom report on Drilling Fluids Market

In terms of type, the global market for drilling fluids has been classified into water-based muds, oil-based muds, and synthetic-based muds. The water-based muds segment accounted for a significant share of 53.4% of the global market in 2021. The segment is estimated to expand at a growth rate of 5.8% during the forecast period. This is evident since water-based mud is the most common drilling fluid, owing to its environment-friendly characteristics and non-toxic nature.

Some water-based specialty chemical fluids can be designed and engineered to be suitable for high-temperature & high-pressure environments. In water-based mud, the base fluid is water. Water-based mud is considered the most environmentally favorable and less expensive mud. It is typically used to drill the top section of the well. Water-based mud falls into two basic categories which are dispersed and non-dispersed mud. The basic difference between dispersed and non-dispersed mud is the lack of dispersants. Non-dispersed drilling mud does not require an elevated pH, while dispersed mud has a chemical dispersant added to the system that is used to deflocculate mud soils.

Based on application, the onshore segment dominated the global drilling fluids market with a 66.16% share in 2021. Furthermore, the segment is expected to grow at a notable CAGR of 5.3% during the forecast period. This is evident since onshore drilling has risen compared to offshore drilling over the past 20 years. Additionally, an increase in awareness about safe oilfield equipment operations is likely to boost the demand for onshore drilling fluids.

The global oil industry is expected to grow steadily in the near future due to the rise in demand for gasoline and fuels. Key players in the oil & gas industry are focusing on mergers and acquisitions (M&A) in order to expand their global presence.

Drilling fluids are essential during drilling operations. A rise in investment in drilling activities in the North Sea, the Gulf of Mexico, and the South China Sea has propelled the onshore segment of the global market. New approvals for drilling operations from governments of different countries are also expected to boost the consumption of drilling fluids during the forecast period. Though the onshore segment is growing at a rapid pace, stable revenue opportunities in offshore applications are benefitting market players. Hence, companies are utilizing robust marine propulsion systems in vessels to tap incremental opportunities in offshore applications.

In terms of volume, North America held a 51.55%% share of the global market in 2021. The high demand for drilling fluids in the region can be ascribed to the rise in exploration and drilling activities for shale gas in North America.

In terms of volume, the Asia Pacific and Europe are also prominent regions of the drilling fluids market. These regions held 16% and 27.0% share, respectively, of the global market in 2021. The demand for drilling fluids is anticipated to increase in the Asia Pacific, owing to the growth in drilling operations in countries such as India, China, Indonesia, and Australia.

Latin America is a relatively minor consumer of drilling fluids; however, it has been found that countries such as Argentina and Brazil in Latin America have increased their capital expenditure on drilling wells. This is expected to boost the demand for drilling fluids in the region.

The global drilling fluids industry comprises several small and large-scale manufacturers & suppliers that control a majority of the share. Most of the firms are adopting new technologies and strategies with comprehensive research & development (R&D) in large numbers of oil & gas reservoirs.

Diversification of product portfolios and mergers & acquisitions (M&A) are important strategies adopted by key players. Schlumberger Limited, DowDuPont Inc., Halliburton, Baker Hughes, GE Company, Akzo Nobel N.V., Weatherford International Plc., Clariant International Ltd, Solvay S.A., Gumpro Drilling Fluids Private Limited, Newpark Resources Inc., Oren Hydrocarbons Middle East Inc, NuGenTec, Petrochem Performance Chemicals Ltd. LLC, National Oilwell Varco L.P., and Royal Dutch Shell plc are prominent entities operating in the market.

Each of these players has been profiled in this market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 8.2 Bn |

|

Market Forecast Value in 2031 |

US$ 14.5 Bn |

|

Growth Rate (CAGR) |

5.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Bbls for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood at US$ 8.2 Bn in 2021

The market is expected to grow at a CAGR of 5.9% from 2022 to 2031

Large number of proven oil & gas reserves and increase in consumption of energy

Onshore was the largest application segment that held 66.16% share in 2021

North America was the most lucrative region of the global market in 2021

Schlumberger Limited, DowDuPont Inc., Halliburton, Baker Hughes, GE Company, and Akzo Nobel N.V

1. Executive Summary

1.1. Drilling Fluids Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Key Manufacturers

2.6.2. List of Suppliers/ Distributors

2.6.3. List of Potential Customers

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2021

5. Price Trend Analysis

6. Global Drilling Fluids Market Analysis and Forecast, by Type, 2020–2031

6.1. Introduction and Definitions

6.2. Global Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

6.2.1. Water Based Muds

6.2.2. Oil Based Muds

6.2.3. Synthetic based Muds

6.3. Global Drilling Fluids Market Attractiveness, by Type

7. Global Drilling Fluids Market Analysis and Forecast, by Application, 2020–2031

7.1. Introduction and Definitions

7.2. Global Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.2.1. Onshore

7.2.2. Offshore

7.3. Global Drilling Fluids Market Attractiveness, by Application

8. Global Drilling Fluids Market Analysis and Forecast, by Region, 2020–2031

8.1. Key Findings

8.2. Global Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Region, 2020–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. Latin America

8.3. Global Drilling Fluids Market Attractiveness, by Region

9. North America Drilling Fluids Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. North America Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.3. North America Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4. North America Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Country, 2020–2031

9.4.1. U.S. Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.4.2. U.S. Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.3. Canada Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.4.4. Canada Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5. North America Drilling Fluids Market Attractiveness Analysis

10. Europe Drilling Fluids Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Europe Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.3. Europe Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. Europe Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022‒2031

10.4.1. Germany Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Form, 2020–2031

10.4.2. Germany Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.3. Norway Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.4. Norway Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.5. U.K. Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.6. U.K. Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.7. Netherland Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.8. Netherland. Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.9. Russia & CIS Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.10. Russia & CIS Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.11. Rest of Europe Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.12. Rest of Europe Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5. Europe Drilling Fluids Market Attractiveness Analysis

11. Asia Pacific Drilling Fluids Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Asia Pacific Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type

11.3. Asia Pacific Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4. Asia Pacific Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022‒2031

11.4.1. China Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.2. China Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.3. Indonesia Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.4. Indonesia Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.5. India Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.6. India Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.7. Thailand Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.8. Thailand Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.9. Pakistan Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.10. Pakistan Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.11. ASEAN Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.12. ASEAN Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.13. Rest of Asia Pacific Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.14. Rest of Asia Pacific Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.15. Rest of Asia Pacific Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5. Asia Pacific Drilling Fluids Market Attractiveness Analysis

12. Latin America Drilling Fluids Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Latin America Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.3. Latin America Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4. Latin America Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022‒2031

12.4.1. Brazil Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.2. Brazil Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4.3. Mexico Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.4. Mexico Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4.5. Argentina Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.6. Argentina Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4.7. Rest of Latin America Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.8. Rest of Latin America Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5. Latin America Drilling Fluids Market Attractiveness Analysis

13. Middle East & Africa Drilling Fluids Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Middle East & Africa Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.3. Middle East & Africa Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4. Middle East & Africa Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022‒2031

13.4.1. Saudi Arabia Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.2. Saudi Arabia Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4.3. Oman Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.4. Oman Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4.5. Nigeria Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.6. Nigeria Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4.7. Rest of Middle East & Africa Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.8. Rest of Middle East & Africa Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5. Middle East & Africa Drilling Fluids Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Ink Company Market Share Analysis, 2021

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.2.1. Schlumberger Limited

14.2.1.1. Company Description

14.2.1.2. Business Overview

14.2.1.3. Financial Overview

14.2.1.4. Strategic Overview

14.2.2. DowDuPont Inc.

14.2.2.1. Company Description

14.2.2.2. Business Overview

14.2.2.3. Financial Overview

14.2.2.4. Strategic Overview

14.2.3. Halliburton

14.2.3.1. Company Description

14.2.3.2. Business Overview

14.2.3.3. Financial Overview

14.2.3.4. Strategic Overview

14.2.4. Baker Hughes, a GE Company (BHGE)

14.2.4.1. Company Description

14.2.4.2. Business Overview

14.2.4.3. Financial Overview

14.2.4.4. Strategic Overview

14.2.5. Akzo Nobel N.V.

14.2.5.1. Company Description

14.2.5.2. Business Overview

14.2.5.3. Financial Overview

14.2.5.4. Strategic Overview

14.2.6. Weatherford International Plc.

14.2.6.1. Company Description

14.2.6.2. Business Overview

14.2.6.3. Financial Overview

14.2.6.4. Strategic Overview

14.2.7. Clariant International Ltd.

14.2.7.1. Company Description

14.2.7.2. Business Overview

14.2.7.3. Financial Overview

14.2.7.4. Strategic Overview

14.2.8. Solvay S.A.

14.2.8.1. Company Description

14.2.8.2. Business Overview

14.2.8.3. Financial Overview

14.2.8.4. Strategic Overview

14.2.9. Gumpro Drilling Fluids Private Limited

14.2.9.1. Company Description

14.2.9.2. Business Overview

14.2.9.3. Financial Overview

14.2.9.4. Strategic Overview

14.2.10. Newpark Resources Inc.

14.2.10.1. Company Description

14.2.10.2. Business Overview

14.2.10.3. Financial Overview

14.2.10.4. Strategic Overview

14.2.11. Oren Hydrocarbons Middle East Inc.

14.2.11.1. Company Description

14.2.11.2. Business Overview

14.2.11.3. Financial Overview

14.2.11.4. Strategic Overview

14.2.12. NuGenTec

14.2.12.1. Company Description

14.2.12.2. Business Overview

14.2.12.3. Financial Overview

14.2.12.4. Strategic Overview

14.2.13. Kansai Paints Co, Ltd.

14.2.13.1. Company Description

14.2.13.2. Business Overview

14.2.13.3. Financial Overview

14.2.13.4. Strategic Overview

14.2.14. Petrochem Performance Chemicals Ltd. LLC

14.2.14.1. Company Description

14.2.14.2. Business Overview

14.2.14.3. Financial Overview

14.2.14.4. Strategic Overview

14.2.15. National Oilwell Varco, L.P.

14.2.15.1. Company Description

14.2.15.2. Business Overview

14.2.15.3. Financial Overview

14.2.15.4. Strategic Overview

14.2.16. Royal Dutch Shell plc.

14.2.16.1. Company Description

14.2.16.2. Business Overview

14.2.16.3. Financial Overview

14.2.16.4. Strategic Overview

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 01: Global Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 02: Global Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 03: Global Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 04: Global Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 05: Global Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Region, 2020–2031

Table 06: Drilling Fluids Market, Value (US$ Mn) Forecast, by Region, 2020–2031

Table 07: North America Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Country, 2020–2031

Table 08: North America Drilling Fluids Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 09: North America Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 10: North America Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 11: North America Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 12: North America Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 13: U.S. Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 14: U.S. Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 15: U.S. Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 16: U.S. Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 17: Canada Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 18: Canada Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 19: Canada Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 20: Canada Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 21: Europe Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Country/ Sub-Region and Sub-region, 2020–2031

Table 22: Europe Drilling Fluids Market Value (US$ Mn) Forecast, by Country/ Sub-Region and Sub-region, 2020–2031

Table 23: Europe Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 24: Europe Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 25: Europe Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 26: Europe Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 27: Germany Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 28: Germany Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 29: Germany Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 30: Germany Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: U.K. Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 32: U.K. Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 33: U.K. Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 34: U.K. Drilling Fluids Market Volume (US$ Mn) Forecast, by Application, 2020–2031

Table 35: Netherland Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 36: Netherland Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 37: Netherland Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 38: Netherlands Drilling Fluids Market Volume (US$ Mn) Forecast, by Application, 2020–2031

Table 39: Norway Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 40: Norway Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 41: Norway Drilling Fluids Market Volume (US$ Mn) Forecast, by Application, 2020–2031

Table 42: Russia & CIS Drilling Fluids Market Value (Thousand Bbls) Forecast, by Type, 2020–2031

Table 43: Russia & CIS Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 44: Russia & CIS Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 45: Russia & CIS Drilling Fluids Market Volume (US$ Mn) Forecast, by Application, 2020–2031

Table 46: Rest of Europe Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 47: Rest of Europe Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 48: Rest of Europe Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 49: Rest of Europe Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 50: Asia Pacific Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Country/ Sub-Region and Sub-region, 2020–2031

Table 51: Asia Pacific Drilling Fluids Market Value (US$ Mn) Forecast, by Country/ Sub-Region and Sub-region, 2020–2031

Table 52: Asia Pacific Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 53: Asia Pacific Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 54: Asia Pacific Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 55: Asia Pacific Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 56: China Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 57: China Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 58: China Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 59: China Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 60: India Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 61: India Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 62: India Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 63: Indonesia Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 64: Indonesia Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 65: Indonesia Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 66: Indonesia Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 67: Thailand Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 68: Thailand Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 69: Thailand Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 70: Thailand Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 71: ASEAN Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 72: ASEAN Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 73: ASEAN Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 74: ASEAN Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 75: Rest of Asia Pacific Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 76: Rest of Asia Pacific Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 77: Rest of Asia Pacific Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 78: Rest of Asia Pacific Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 79: Middle East & Africa Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Country/Sub-Region, 2020–2031

Table 80: Middle East & Africa Drilling Fluids Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2020–2031

Table 81: Middle East & Africa Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 82: Middle East & Africa Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 83: Middle East & Africa Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 84: Middle East & Africa Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 85: Saudi Arabia Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 86: Saudi Arabia Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 87: Saudi Arabia Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 88: Saudi Arabia Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 89: Oman Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 90: Oman Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 91: Oman Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 92: Oman Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 93: Nigeria Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 94: Nigeria Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 95: Nigeria Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 96: Nigeria Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 97: Rest of Middle East & Africa Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 98: Rest of Middle East & Africa Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 99: Rest of Middle East & Africa Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 100: Rest of Middle East & Africa Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 101: Latin America Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Country/ Sub-Region, 2020–2031

Table 102: Latin America Drilling Fluids Market Value (US$ Mn) Forecast, by Country/ Sub-Region , 2020–2031

Table 103: Latin America Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 104: Latin America Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 105: Latin America Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 106: Latin America Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 107: Brazil Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 108: Brazil Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 109: Brazil Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 110: Brazil Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 111: Mexico Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 112: Mexico Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 113: Mexico Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 114: Mexico Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 115: Argentina Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 116: Argentina Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 117: Argentina Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 118: Argentina Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 119: Rest of Latin America Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Type, 2020–2031

Table 120: Rest of Latin America Drilling Fluids Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 121: Rest of Latin America Drilling Fluids Market Volume (Thousand Bbls) Forecast, by Application, 2020–2031

Table 122: Rest of Latin America Drilling Fluids Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 01: Global Drilling Fluids Market (US$ Mn), 2021, 2025, and 2031

Figure 02: Exploration of deep and ultra-deep offshore oil & gas horizons

Figure 03: Rising costs of drilling fluids

Figure 04: Global Drilling Fluids Market Value Share Analysis, by Type, 2021, 2025, and 2031

Figure 05: Global Drilling Fluids Market Analysis, by Water Based Muds (WBM)(US$ Mn), 2021, 2025, and 2031

Figure 06: Global Drilling Fluids Market Analysis, by Oil Based Muds (OBM)(US$ Mn), 2021, 2025, and 2031

Figure 07: Global Drilling Fluids Market Analysis, by Synthetic Based Muds (SBM) (US$ Mn), 2021, 2025, and 2031

Figure 08: Global Drilling Fluids Market Attractiveness Analysis, by Type, 2021, 2025, and 2031

Figure 09: Global Drilling Fluids Market Value Share Analysis, by Application, 2021, 2025, and 2031

Figure 10: Global Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn), by Onshore, 2021, 2025, and 2031

Figure 11: Global Drilling Fluids Market Volume (Thousand Bbls) and Value (US$ Mn), by Offshore, 2021, 2025, and 2031

Figure 12: Global Drilling Fluids Market Attractiveness Analysis, by Application, 2021, 2025, and 2031

Figure 13: Drilling Fluids Market Value Share Analysis, by Region, 2021, 2025, and 2031

Figure 14: Drilling Fluids Market Attractiveness Analysis, by Region, 2021, 2025, and 2031

Figure 15: North America Drilling Fluids Market Volume (Thousand Bbls) & Value (US$ Mn) Forecast, 2021, 2025, and 2031

Figure 16: North America Drilling Fluids Market, Value Share (US$ Mn) Analysis, by Country,2021, 2025, and 2031

Figure 17: North America Drilling Fluids Market Attractiveness Analysis, by Type, 2021, 2025, and 2031

Figure 18: North America Drilling Fluids Market Attractiveness Analysis, by End-use, 2021, 2025, and 2031

Figure 19: North America Drilling Fluids Market Attractiveness Analysis, by Region, 2021, 2025, and 2031

Figure 20: Europe Drilling Fluids Market Volume (Thousand Bbls) & Value (US$ Mn) Forecast, 2021, 2025, and 2031

Figure 21: Europe Drilling Fluids Market, Value Share (US$ Mn) Analysis, by Country/ Sub-Region and Sub-region,2021, 2025, and 2031

Figure 22: Europe Drilling Fluids Market Attractiveness Analysis, by Type, 2021, 2025, and 2031

Figure 23: Europe Drilling Fluids Market Attractiveness Analysis, by Application, 2021, 2025, and 2031

Figure 24: Europe Drilling Fluids Market Attractiveness Analysis, by Region, 2021, 2025, and 2031

Figure 25: Asia Pacific Drilling Fluids Market Volume (Thousand Bbls) and Market Value (US$ Mn) Forecast, 2021, 2025, and 2031

Figure 26: Asia Pacific Drilling Fluids Market Value Share (US$ Mn) Analysis, by Country/ Sub-Region and Sub-region, 2021, 2025, and 2031

Figure 27: Asia Pacific Drilling Fluids Market Attractiveness Analysis, by Type, 2021, 2025, and 2031

Figure 28: Asia Pacific Drilling Fluids Market Attractiveness Analysis, by Application, 2021, 2025, and 2031

Figure 29: Asia Pacific Drilling Fluids Market Attractiveness Analysis, by Country/ Sub-Region, 2021, 2025, and 2031

Figure 30: Middle East & Africa Drilling Fluids Market Volume (Thousand Bbls) & Value (US$ Mn) Forecast, 2021, 2025, and 2031

Figure 31: Middle East & Africa Drilling Fluids Market, Value Share (US$ Mn) Analysis, by Country,2021, 2025, and 2031

Figure 32: Middle East & Africa Drilling Fluids Market Attractiveness Analysis, by Type, 2021, 2025, and 2031

Figure 33: Middle East & Africa Drilling Fluids Market Attractiveness Analysis, by Application, 2021, 2025, and 2031

Figure 34: Middle East & Africa Drilling Fluids Market Attractiveness Analysis, by Country/Sub-Region, 2021, 2025, and 2031

Figure 35: Latin America Drilling Fluids Market Volume (Thousand Bbls) & Value (US$ Mn) Forecast, 2021, 2025, and 2031

Figure 36: Latin America Drilling Fluids Market, Value Share (US$ Mn) Analysis, by Country,2021, 2025, and 2031

Figure 37: Latin America Drilling Fluids Market Attractiveness Analysis, by Type, 2021, 2025, and 2031

Figure 38: Latin America Drilling Fluids Market Attractiveness Analysis, by End-use, 2021, 2025, and 2031

Figure 39: Latin America Drilling Fluids Market Attractiveness Analysis, by Country/Sub-Region 2021, 2025, and 2031

Figure 40: Global Drilling Fluids Market Share Analysis By Company (2021)

Figure 41: Global Drilling Fluids Market (US$ Mn), 2021, 2025, and 2031

Figure 42: Exploration of deep and ultra-deep offshore oil & gas horizons

Figure 43: Rising costs of drilling fluids

Figure 44: Global Drilling Fluids Market Value Share Analysis, by Type, 2021, 2025, and 2031

Figure 45: Global Drilling Fluids Market Analysis, by Water Based Muds (WBM)(US$ Mn), 2021, 2025, and 2031

Figure 46: Global Drilling Fluids Market Analysis, by Oil Based Muds (OBM)(US$ Mn), 2021, 2025, and 2031

Figure 47: Global Drilling Fluids Market Analysis, by Synthetic Based Muds (SBM) (US$ Mn), 2021, 2025, and 2031

Figure 48: Global Drilling Fluids Market Attractiveness Analysis, by Type, 2021, 2025, and 2031