Reports

Reports

Identifying zero day vulnerabilities is of utmost importance for governments to prevent them from being used by extremist groups for infiltrating a nation’s critical infrastructure. This is a primary factor fuelling demand from the global cyber weapon market, states Transparency Market Research (TMR). Cyber weapons developed by hackers are aimed at exploiting confidentiality. However, depending on the method of use, they can be classified as either defensive or offensive cyber weapons. Both these market segments are presently gaining from the increasing demand for identifying zero-day vulnerabilities.

When used for offensive purposes cyber weapons can lead to mass destruction. Due to growing threats associated with cyber weapons, various international organizations have described them as malicious codes. Stringent regulations are thus being implemented to curb their use against the human race. This factor is likely to inhibit the market’s expansion to an extent. Nevertheless, in regions such as North America, governments are proactively investing in the development of advanced cyber weapons to protect their critical utilities. This will create new opportunities for growth for the market in the near future.

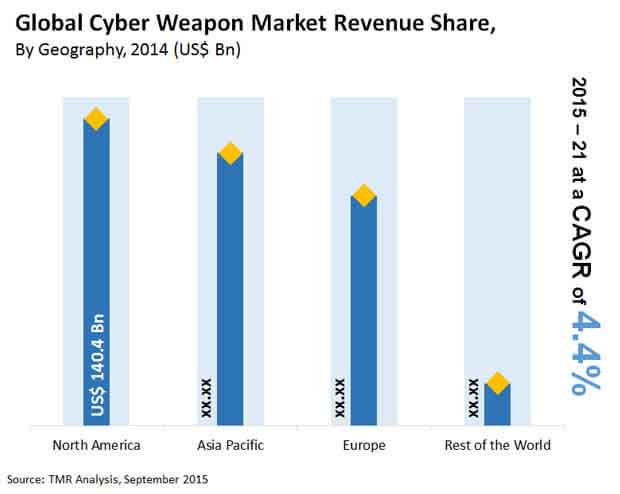

According to TMR, the global cyber weapon market was valued at US$390 bn in 2014. Exhibiting a CAGR of 4.4%, the market is expected to reach US$521.87 bn by the end of 2021.

Based on type, the global cyber weapon market has been fragmented into defensive and offensive cyber weapon segments. In terms of revenue, the defensive cyber weapon held the larger share of 73.8% in the market in 2014. The increasing cases of cyber espionage have compelled governments and private organizations to focus on technologies to safeguard their critical infrastructure. Since information technology is integral to industries such as manufacturing, defense, and aerospace, they are more vulnerable to cyber thefts. The demand for defensive cyber weapons is therefore expected to continue to surge through the forecast period.

The offensive cyber weapons segment is currently at a premature stage. However, TMR expects the cyber weapons market to gradually shift from defensive to offensive weapons. Nations around the world are strengthening their offensive cyber capabilities due to the emergence of cyber as new platform for warfare. However political and legal issues associated with offensive cyber weapons have compelled governments to implement stringent regulations to ensure non-proliferation of offensive cyber weapons. This has a negative impact on the segment.

From the geographical standpoint, North America dominated the global cyber weapons market with a share of 36% in 2014. TMR forecasts the region to maintain its dominance in the market through the forecast period. The Internet is the backbone of critical infrastructure such as industrial control, air traffic control systems, and military defense in the U.S. The country has witnessed several attacks on its critical infrastructure in the past. Its government is therefore investing in developing novel technologies to prevent future cyber-attacks on such critical utilities. Such developments will significantly aid the expansion of the cyber weapons market in North America.

In 2014, Asia Pacific was another key market for cyber weapons. The rising demand from countries such as India, China, North Korea, Australia, South Korea, and Japan will boost the cyber weapons sales in the region. Furthermore, the increasing investment by China in the development of advanced cyber warfare technique will significantly aid the market’s expansion in Asia Pacific.

The Boeing Company, Lockheed Martin Corporation, General Dynamics Corporation, Raytheon Company, BAE Systems plc, and Northrop Grumman Corporation are some of the leading players operating in the cyber weapon market.

Increased Prevalence of Cyber Threats to Boost Global Cyber Weapon Market

The global cyber weapons market is likely to observe considerable growth due to increased prevalence of threats to critical infrastructure across several sectors, comprising government and information technology (IT). Augmented defense expenses together with constant evolution of cyber weapons in the form of warfare tool are foreseen to support development of the global cyber weapons market. Intelligence, paramilitary and military agencies infiltrate through the enemy’s network with the use of cyber weapons, particularly a virus or malware.

Rising demand for the violation of target’s privacy and for securing the host nation’s sovereignty is anticipated to trigger growth of the global cyber weapons market in the near future. Cybercriminals make offensive use of cyber weapons and defensive use by officials of various law enforcement agencies are likely to add to the development of the global cyber weapons market in the forthcoming years.

Extensive Use of Internet for all Businesses to Shoot Up Demand in the Market

The internet is critical to infrastructures of various sectors, such as air traffic control, industrial control, military, and defense. As such, there has been increased investment for the development of technologies so as to deter cyber attacks. These factors are likely to support growth of the global cyber weapons market in the forthcoming years. Expansion of the traditional arms manufacturing companies in the cyber security systems and increasing demand for cyber weapons are likely to work in favor of the global cyber weapons market in the near future.

The global cyber weapons market is likely to exhibit rapid growth rate due to growing dependence on internet for all types of activities from business to government. Dependence on internet for wide range of activities make nation states vulnerable to cyber attacks, which is likely to foster development of the global cyber weapons market in the years to come.

Chapter 1 Preface

1.1 Research description

1.2 Research Scope

1.3 Research Methodology

Chapter 2 Executive Summary

Chapter 3 Market Overview

3.1 Introduction

3.2 Key Trend Analysis

3.3 Market Drivers

3.3.1 Impact Analysis of Drivers

3.3.2 Supply Side

3.3.2.1 Increasing investment by organizations to identify zero-day vulnerabilities

3.3.2.2 Expansion by traditional arms manufacturing companies in the cybersecurity business and demand for advanced cyber weapons

3.3.3 DemandSide

3.3.3.1 Increasing need for security in critical infrastructure and utilities

3.4 Market Restraints

3.4.1 Government regulations regarding non-proliferation of cyber weapons

3.5 Market Opportunities

3.5.1 Emergence of cyberspace as a new domain for warfare

3.6 Market Attractiveness, by Application, 2021

3.7 Market Share of Key Players

Chapter 4 Global Cyber Weapon Market Analysis, by Type 2014–2021 (USD Billion)

4.1 Overview

4.2 Defensive

4.2.1 Defensive market size and forecast, 2014–2021 (USD billion)

4.3 Offensive

4.3.1 Offensive market size and forecast, 2014–2021 (USD billion)

Chapter 5 Global Cyber Weapon Market Analysis, by Application 2014–2021 (USD Billion)

5.1 Overview

5.2 National Defense System

5.2.1 National defense system market size and forecast, 2014–2021 (USD billion)

5.3 Communication Network

5.3.1 Communication network market size and forecast, 2014–2021 (USD billion)

5.4 Industrial Control System

5.4.1 Industrial control system market size and forecast, 2014–2021 (USD billion)

5.5 Financial and Banking

5.5.1 Financial and banking market size and forecast, 2014–2021 (USD billion)

5.6 Smart Power Grid

5.6.1 Smart power grid market size and forecast, 2014–2021 (USD billion)

5.7 Air Traffic Control

5.7.1 Air traffic control market size and forecast, 2014–2021 (USD billion)

5.8 Automated Transportation System

5.8.1 Automated transportation system market size and forecast, 2014–2021 (USD billion)

5.9 Hospital

5.9.1 Hospital market size and forecast, 2014–2021 (USD billion)

Chapter 6 Global Cyber Weapon Market Analysis by Geography 2014–2021 (USD Billion)

6.1 Overview

6.2 North America Cyber Weapon Market

6.2.1 North America Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.2.2 North America Cyber Weapon Market Revenue and Forecast, by Country, 2014–2021 (USD Billion)

6.2.2.1 U.S. Cyber Weapon Market Size and Forecast, 2014–2021 (USD billion)

6.2.2.2 Canada Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.2.2.3 Mexico Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.3 Europe Cyber Weapon Market

6.3.1 Europe Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.3.2 Europe Cyber Weapon Market Revenue and Forecast, by Country, 2014–2021 (USD Billion)

6.3.2.1 U.K. Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.3.2.2 Germany Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.3.2.3 France Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.3.2.4 Rest of Europe Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.4 Asia Pacific Cyber Weapon Market

6.4.1 Asia Pacific Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.4.2 Asia Pacific Cyber Weapon Market Revenue and Forecast, by Country, 2014–2021 (USD Billion)

6.4.2.1 India Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.4.2.2 China Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.4.2.3 Japan Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.4.2.4 Rest of Asia Pacific Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.5 RoW Cyber Weapon Market

6.5.1 RoW Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.5.2 RoW Cyber Weapon Market Revenue and Forecast, by Country, 2014–2021 (USD Billion)

6.5.2.1 Latin America Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.5.2.2 Middle East Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

6.5.2.3 Africa Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

Chapter 7 Company Profiles

7.1 Lockheed Martin Corporation

7.2 The Boeing Company

7.3 BAE Systems Plc

7.4 Raytheon Company

7.5 General Dynamics Corporation

7.6 Northrop Grumman Corporation

7.7 Airbus Group SE

7.8 FireEye, Inc.

7.9 Cisco Systems, Inc.

7.10 Thales SA

List of Tables

TABLE 1 Global Cyber Weapon Market Snapshot

TABLE 2 Cyber Weapon Market Size and Forecast, by Application, 2014–2021 (USD Billion)

TABLE 3 Drivers for Cyber Weapon Market: Impact Analysis

TABLE 4 North America Cyber Weapon Market Revenue and Forecast by Type, 2014–2021 (USD Billion)

TABLE 5 North America Cyber Weapon Market Revenue and Forecast by Application, 2014–2021 (USD Billion)

TABLE 6 Europe Cyber Weapon Market Revenue and Forecast by Type, 2014–2021 (USD Billion)

TABLE 7 Europe Cyber Weapon Market Revenue and Forecast by Application, 2014–2021 (USD Billion)

TABLE 8 Asia Pacific Cyber Weapon Market Revenue and Forecast by Type, 2014–2021 (USD Billion)

TABLE 9 Asia Pacific Cyber Weapon Market Revenue and Forecast by Application, 2014–2021 (USD Billion)

TABLE 10 RoW Cyber Weapon Market Revenue and Forecast by Type, 2014–2021 (USD Billion)

TABLE 11 RoW Cyber Weapon Market Revenue and Forecast by Application, 2014–2021 (USD Billion)

List of Figures

FIG. 1 Market Segmentation: Global Cyber Weapon Market

FIG. 2 Global Cyber Weapon Market Attractiveness, by Application

FIG. 3 Global Cyber Weapon Market Share and Forecast by Type, 2014 vs. 2021 (Value %)

FIG. 4 Defensive market size and forecast, 2014–2021 (USD Billion)

FIG. 5 Offensive market size and forecast, 2014–2021 (USD billion)

FIG. 6 Global cyber weapon market share and forecast by application, 2014 vs. 2021 (Value %)

FIG. 7 National defense system market size and forecast, 2014–2021 (USD billion)

FIG. 8 Communication network market size and forecast, 2014–2021(USD billion)

FIG. 9 Industrial control system market size and forecast, 2014–2021 (USD billion)

FIG. 10 Financial and banking market size and forecast, 2014–2021 (USD billion)

FIG. 11 Smart power grid market size and forecast, 2014–2021 (USD billion)

FIG. 12 Air traffic control market size and forecast, 2014–2021 (USD billion)

FIG. 13 Automated transportation system market size and forecast, 2014–2021 (USD billion)

FIG. 14 Hospital market size and forecast, 2014–2021 (USD billion)

FIG. 15 Global Cyber Weapon Market Trend by Geography, 2014–2021 (USD Billion)

FIG. 16 North America Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 17 U.S. Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 18 Canada Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 19 Mexico Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 20 Europe Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 21 U.K. Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 22 Germany Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 23 France Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 24 Rest of Europe Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 25 Asia Pacific Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 26 India Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 27 China Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 28 Japan Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 29 Rest of Asia Pacific Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 30 RoW Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 31 Latin America Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 32 Middle East Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)

FIG. 33 Africa Cyber Weapon Market Size and Forecast, 2014–2021 (USD Billion)