Reports

Reports

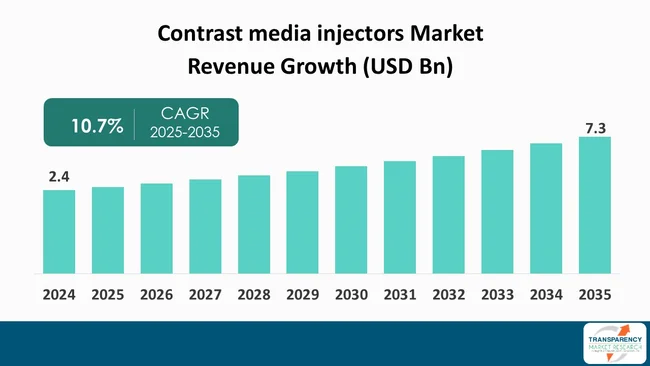

The global contrast media injectors market size was valued at US $ 2.4 billion in 2024 and is projected to reach US $ 7.3 billion by 2035, expanding at a CAGR of 10.7% from 2025 to 2035. The market growth is driven by increasing demand for diagnostic imaging procedures and focus on minimally invasive procedures.

The contrast media injectors market is undergoing a substantial expansion attributed to increased diagnostic imaging procedures like MRI and CT scans that need the use of contrast agents for better visualization of the internal body parts. Besides, the increased uptake of minimally-invasive procedures and the expanding geriatric population are some of the factors that have escalated the demand for diagnostic imaging.

Companies leading the market are heavily investing in the innovation of their products, for instance, the creation of dual-head injectors and smart injectors that provide the injection processes’ real-time monitoring. These innovations not only provide better imaging quality but also the lessening of the potential side-effects that may be caused by the administration of contrast media. The market growth is, therefore, positively influenced by the rise in expenditure on healthcare infrastructure, especially in the developing countries.'

On the contrary, issues like the costly advanced contrast media injectors and the possible side-effects of the contrast agents that may restrict the market expansion are there. As a result, the contrast media injectors market is a source of significant potential for the people who have a stake in it, especially those driven by technological advancements and an increasing focus on efficiency and safety in diagnostic imaging.

The increased demand for imaging tests is amongst the key drivers driving the rising use of contrast media injectors. With increased incidences of chronic diseases like cardiovascular conditions, cancer, and neurological disorders, more number of patients need advanced diagnostic imaging. As such, such illnesses could be detected, monitored, and managed with utmost efficiency. As per NHS England, 47.2 million imaging tests were conducted in England alone between June 2023 and Mar 2024.

At the same time, increased incidences of chronic diseases like neurological disorders, cancer, and heart ailments is expected to drive the demand for contrast media injectors in the North American continent. As per data published by Brain Injury Canada in March 2025, more than 10 million Canadians are battling neurological conditions, which, in turn, indicates need for diagnostic imaging.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The demand for diagnostic imaging procedures is one of the major factors resulting to the growth of the contrast media injectors Market. Along with the medical imaging technologies turning out to be more advanced, such as magnetic resonance imaging (MRI), computed tomography (CT), and ultrasound, the healthcare providers are extensively using such modalities for diagnosing a broad spectrum of diseases, starting from tumors and going up to vascular diseases.

Besides, the awareness among patients and healthcare workers regarding the benefits of early diagnosis is leading to higher numbers of imaging referrals. This trend is visible in the developed regions, where the healthcare systems are well-equipped to make use of the advanced imaging technologies.

Aging population is one of the major factors that fuel the growth of the contrast media injectors market as older adults generally have the highest number of chronic conditions that require diagnostic imaging. With aging, susceptibility to health problems increases and among them are cardiovascular diseases, cancer, and neurological disorders. These diseases often have to resort to the advanced imaging techniques for a timely and accurate diagnosis, consequently, contrast media injectors become heavily relied on in procedures like CT and MRI scans.

The shift in the global population structure toward the elderly is recognizable in all parts of the world. However, it is more pronounced in developed countries where healthcare advancements have resulted in an increased life span. Healthcare systems are, therefore, adjusting to the changes brought about by the demand for diagnostic services suitable for the aged population. Besides, older patients usually require regular check-ups and follow-up imaging, which is why the need for efficient contrast media administration is continuously increasing.

Besides, the effect of the elderly population on healthcare policies is quite substantial as it is reshaping the sector through technological and infrastructural investments to improve diagnostic capabilities. This trend not only elevates the contrast media injectors market but also signifies the demand for new inventions that enhance patient safety and comfort during imaging, which is in line with the increasing quality care focus in the aging populations.

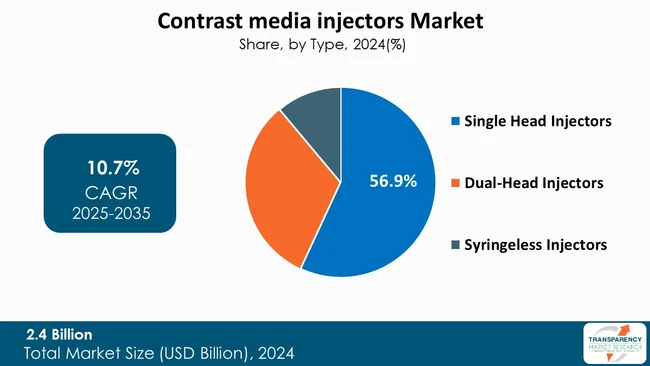

Single head injectors type segment is the main factor that explains the growth of the contrast media injectors market. Primarily this is due to their simplicity, efficiency, and low price. These injectors are made for easy handling, thus they can be used for different imaging procedures, especially in places where a quick and accurate contrast administration is a must. Their trouble-free construction enables medical staff to operate them without delay, and thus the workflow efficiency in the busy imaging departments gets elevated.

Besides, single head Injectors are mainly chosen by the facilities that have less patient flow and in the case where the imaging procedures inject less complex protocols. They usually have a small design and thus it is easier for them to be accommodated in the current imaging setups without the need for major changes. The importance of this adaptability is very high for small hospitals and outpatient facilities that are on a tight budget but still need effective contrast media delivery.

Furthermore, the small starting capital and the low maintenance costs that are connected with the single head injectors make them a satisfactory solution to the healthcare providers who are willing to optimize their operational budgets. The rising demand for diagnostic imaging coupled with the practicality and affordability of single head injectors places them as the prominent segment that engages market growth. They are the ones who fulfill the requirements of different healthcare environments and at the same time assure quality patient care.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is the major market for contrast media injectors, holding the largest revenue share of 37.2%, which is influenced by the factors like its well-developed healthcare infrastructure, quick adoption of new technologies, and the rising trend of early diagnosis and preventive care. This area comprises some of the most advanced healthcare facilities in the world, which are fully equipped with the latest imaging technologies that are in need of efficient contrast media delivery systems. Such a trend of the fusion of advanced imaging modalities such as CT and MRI machines is a natural way of creating a huge demand for reliable contrast media injectors.

Moreover, North America is very much focused on research and development, which is a great source of innovation for medical devices, including contrast injectors. The companies in this region are always coming up with the technologically advanced solutions, such as automated injectors with the user's safety enhanced, thus addressing the rapidly growing complexity of imaging procedures.

Besides, the older population in the U.S. and Canada is the main reason behind the demand for diagnostic imaging services as elderly will need medical assessments more frequently. Health policies in North America place more emphasis on early detection, thus leading to a greater use of contrast agents in imaging. All these factors combined create a strong market environment, which makes North America the leader in the contrast media injectors market with a continuous expansion being forecast in the subsequent years.

GE HealthCare, Bayer, ANITA MEDICAL SYSTEMS PVT. LTD., Guerbet LLC, Bracco Diagnostics Inc, ulrich GmbH & Co. KG, B.Braun SE, Shenzhen Antmed Co., Ltd., Ecomed Solutions, Nemoto Kyorindo Co., Ltd, MEDTRON AG, Sino Medical‑Device Technology Co., Ltd., APOLLO RT Co., Ltd., AngioDynamics Inc., LnkMed Tech are the key players governing the global contrast media injectors market.

Each of these players has been profiled in the contrast media injectors industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 2.4 Bn |

| Forecast Value in 2035 | More than US$ 7.3 Bn |

| CAGR | 10.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 2.4 Bn in 2024

It is projected to cross US$ 7.3 Bn by the end of 2035

Increasing demand for diagnostic imaging procedures and focus on minimally invasive procedures

It is anticipated to grow at a CAGR of 10.7% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

GE Healthcare, Bayer, ANITA MEDICAL SYSTEMS PVT. LTD., Guerbet LLC, Bracco Diagnostics Inc, ulrich GmbH & Co. KG, B.Braun SE, Shenzhen Antmed Co., Ltd., Ecomed Solutions, Nemoto Kyorindo Co., Ltd, MEDTRON AG, Sino Medical‑Device Technology Co., Ltd., APOLLO RT Co., Ltd., AngioDynamics Inc., LnkMed Tech

Table 01: Global Contrast Media Injectors Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 02: Global Contrast Media Injectors Market Value (US$ Bn) Forecast, By Injector Systems, 2020 to 2035

Table 03: Global Contrast Media Injectors Market Value (US$ Bn) Forecast, By Consumables, 2020 to 2035

Table 04: Global Contrast Media Injectors Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 05: Global Contrast Media Injectors Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 06: Global Contrast Media Injectors Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 07: Global Contrast Media Injectors Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Contrast Media Injectors Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 09: North America Contrast Media Injectors Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 10: North America Contrast Media Injectors Market Value (US$ Bn) Forecast, By Injector Systems, 2020 to 2035

Table 11: North America Contrast Media Injectors Market Value (US$ Bn) Forecast, By Consumables, 2020 to 2035

Table 12: North America Contrast Media Injectors Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 13: North America Contrast Media Injectors Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 14: North America Contrast Media Injectors Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 15: Europe Contrast Media Injectors Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 16: Europe Contrast Media Injectors Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 17: Europe Contrast Media Injectors Market Value (US$ Bn) Forecast, By Injector Systems, 2020 to 2035

Table 18: Europe Contrast Media Injectors Market Value (US$ Bn) Forecast, By Consumables, 2020 to 2035

Table 19: Europe Contrast Media Injectors Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 20: Europe Contrast Media Injectors Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 21: Europe Contrast Media Injectors Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 22: Asia Pacific Contrast Media Injectors Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 23: Asia Pacific Contrast Media Injectors Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 24: Asia Pacific Contrast Media Injectors Market Value (US$ Bn) Forecast, By Injector Systems, 2020 to 2035

Table 25: Asia Pacific Contrast Media Injectors Market Value (US$ Bn) Forecast, By Consumables, 2020 to 2035

Table 26: Asia Pacific Contrast Media Injectors Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 27: Asia Pacific Contrast Media Injectors Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 28: Asia Pacific Contrast Media Injectors Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 29: Latin America Contrast Media Injectors Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 30: Latin America Contrast Media Injectors Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 31: Latin America Contrast Media Injectors Market Value (US$ Bn) Forecast, By Injector Systems, 2020 to 2035

Table 32: Latin America Contrast Media Injectors Market Value (US$ Bn) Forecast, By Consumables, 2020 to 2035

Table 33: Latin America Contrast Media Injectors Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 34: Latin America Contrast Media Injectors Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 35: Latin America Contrast Media Injectors Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 36: Middle East & Africa Contrast Media Injectors Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 37: Middle East & Africa Contrast Media Injectors Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 38: Middle East & Africa Contrast Media Injectors Market Value (US$ Bn) Forecast, By Injector Systems, 2020 to 2035

Table 39: Middle East & Africa Contrast Media Injectors Market Value (US$ Bn) Forecast, By Consumables, 2020 to 2035

Table 40: Middle East & Africa Contrast Media Injectors Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 41: Middle East & Africa Contrast Media Injectors Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 42: Middle East & Africa Contrast Media Injectors Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Contrast Media Injectors Market Value Share Analysis, By Product, 2024 and 2035

Figure 02: Global Contrast Media Injectors Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 03: Global Contrast Media Injectors Market Revenue (US$ Bn), by Injector Systems, 2020 to 2035

Figure 04: Global Contrast Media Injectors Market Revenue (US$ Bn), by Consumables, 2020 to 2035

Figure 05: Global Contrast Media Injectors Market Value Share Analysis, By Type, 2024 and 2035

Figure 06: Global Contrast Media Injectors Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 07: Global Contrast Media Injectors Market Revenue (US$ Bn), by Single Head Injectors, 2020 to 2035

Figure 08: Global Contrast Media Injectors Market Revenue (US$ Bn), by Dual-Head Injectors, 2020 to 2035

Figure 09: Global Contrast Media Injectors Market Revenue (US$ Bn), by Syringeless Injectors, 2020 to 2035

Figure 10: Global Contrast Media Injectors Market Value Share Analysis, By Application, 2024 and 2035

Figure 11: Global Contrast Media Injectors Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 12: Global Contrast Media Injectors Market Revenue (US$ Bn), by Radiology, 2020 to 2035

Figure 13: Global Contrast Media Injectors Market Revenue (US$ Bn), by Interventional Radiology, 2020 to 2035

Figure 14: Global Contrast Media Injectors Market Revenue (US$ Bn), by Interventional Cardiology, 2020 to 2035

Figure 15: Global Contrast Media Injectors Market Value Share Analysis, By End-user, 2024 and 2035

Figure 16: Global Contrast Media Injectors Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 17: Global Contrast Media Injectors Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 18: Global Contrast Media Injectors Market Revenue (US$ Bn), by Diagnostic Centers, 2020 to 2035

Figure 19: Global Contrast Media Injectors Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Contrast Media Injectors Market Value Share Analysis, By Region, 2024 and 2035

Figure 21: Global Contrast Media Injectors Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 22: North America Contrast Media Injectors Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 23: North America Contrast Media Injectors Market Value Share Analysis, by Country, 2024 and 2035

Figure 24: North America Contrast Media Injectors Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 25: North America Contrast Media Injectors Market Value Share Analysis, By Product, 2024 and 2035

Figure 26: North America Contrast Media Injectors Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 27: North America Contrast Media Injectors Market Value Share Analysis, By Type, 2024 and 2035

Figure 28: North America Contrast Media Injectors Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 29: North America Contrast Media Injectors Market Value Share Analysis, By Application, 2024 and 2035

Figure 30: North America Contrast Media Injectors Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 31: North America Contrast Media Injectors Market Value Share Analysis, By End-user, 2024 and 2035

Figure 32: North America Contrast Media Injectors Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 33: Europe Contrast Media Injectors Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Europe Contrast Media Injectors Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 35: Europe Contrast Media Injectors Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 36: Europe Contrast Media Injectors Market Value Share Analysis, By Product, 2024 and 2035

Figure 37: Europe Contrast Media Injectors Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 38: Europe Contrast Media Injectors Market Value Share Analysis, By Type, 2024 and 2035

Figure 39: Europe Contrast Media Injectors Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 40: Europe Contrast Media Injectors Market Value Share Analysis, By Application, 2024 and 2035

Figure 41: Europe Contrast Media Injectors Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 42: Europe Contrast Media Injectors Market Value Share Analysis, By End-user, 2024 and 2035

Figure 43: Europe Contrast Media Injectors Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 44: Asia Pacific Contrast Media Injectors Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Asia Pacific Contrast Media Injectors Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 46: Asia Pacific Contrast Media Injectors Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 47: Asia Pacific Contrast Media Injectors Market Value Share Analysis, By Product, 2024 and 2035

Figure 48: Asia Pacific Contrast Media Injectors Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 49: Asia Pacific Contrast Media Injectors Market Value Share Analysis, By Type, 2024 and 2035

Figure 50: Asia Pacific Contrast Media Injectors Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 51: Asia Pacific Contrast Media Injectors Market Value Share Analysis, By Application, 2024 and 2035

Figure 52: Asia Pacific Contrast Media Injectors Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 53: Asia Pacific Contrast Media Injectors Market Value Share Analysis, By End-user, 2024 and 2035

Figure 54: Asia Pacific Contrast Media Injectors Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 55: Latin America Contrast Media Injectors Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Latin America Contrast Media Injectors Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 57: Latin America Contrast Media Injectors Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 58: Latin America Contrast Media Injectors Market Value Share Analysis, By Product, 2024 and 2035

Figure 59: Latin America Contrast Media Injectors Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 60: Latin America Contrast Media Injectors Market Value Share Analysis, By Type, 2024 and 2035

Figure 61: Latin America Contrast Media Injectors Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 62: Latin America Contrast Media Injectors Market Value Share Analysis, By Application, 2024 and 2035

Figure 63: Latin America Contrast Media Injectors Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 64: Latin America Contrast Media Injectors Market Value Share Analysis, By End-user, 2024 and 2035

Figure 65: Latin America Contrast Media Injectors Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 66: Middle East & Africa Contrast Media Injectors Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 67: Middle East & Africa Contrast Media Injectors Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 68: Middle East & Africa Contrast Media Injectors Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 69: Middle East & Africa Contrast Media Injectors Market Value Share Analysis, By Product, 2024 and 2035

Figure 70: Middle East & Africa Contrast Media Injectors Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 71: Middle East & Africa Contrast Media Injectors Market Value Share Analysis, By Type, 2024 and 2035

Figure 72: Middle East & Africa Contrast Media Injectors Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 73: Middle East & Africa Contrast Media Injectors Market Value Share Analysis, By Application, 2024 and 2035

Figure 74: Middle East & Africa Contrast Media Injectors Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 75: Middle East & Africa Contrast Media Injectors Market Value Share Analysis, By End-user, 2024 and 2035

Figure 76: Middle East & Africa Contrast Media Injectors Market Attractiveness Analysis, By End-user, 2025 to 2035