Reports

Reports

Global Bulk Acoustic Wave Devices Market: Snapshot

The market for bulk acoustic wave (BAW) devices has witnessed a significant rise in investment aimed at the development and commercialization of these devices across an increasing number of application areas. These devices find applications in high-end applications across industries such as telecommunications and consumer electronics. For a long time, the high prices of BAW devices restricted their use to industries such as military and defense, however, encouraging R&D activities have allowed the development of low-cost devices over the past few years, significantly increasing their set of applications.

Of late, the market has witnessed a vast rise in demand due to the emergence of the 4G technology. BAW devices are considered superior substitutes over surface acoustic wave (SAW) devices as the former are more compact and suitable for handset designs. Rising demand for miniaturized consumer electronic devices is expected to significantly benefit the global demand for bulk acoustic wave devices in the next few years. The market is also witnessing thorough research activities focused on the reduction of the cost of devices, which could further help their commercialization, driving the market.

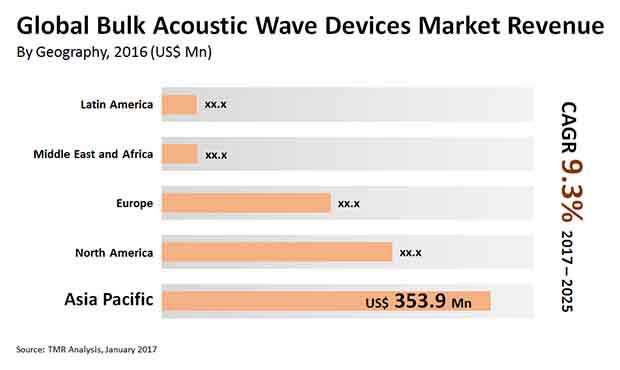

Transparency Market Research states that the global bulk acoustic wave devices market will exhibit a promising 9.3% CAGR over the period between 2017 and 2025, rising from a valuation of US$860.4 mn in 2016 to US$1869.6 mn by 2025.

BAW Filters to Account for Massive Chunk in Global Revenue

The global bulk acoustic wave devices market has been segmented in the report in terms of device type into filters, resonators, and transducers. Of these, the segment of filters accounted for a massive chunk in the overall revenue of the global BAW devices market in 2016. The segment valued at US$510.6 mn in 2016 and is expected to remain the leading segment, exhibiting a promising 9.3% CAGR from 2017 to 2025.

Bulk acoustic wave filters are preferred over the traditionally used surface acoustic wave filters owing to their several advantages such as much smaller shapes and sizes and capability of providing higher frequency despite having smaller form factor compared to surface acoustic wave filters. These factors make BAW filters the most preferred filters in 3G and 4G applications. Furthermore, bulk acoustic wave filters are much less sensitive to temperature variations at wide bandwidths. This provides steep filter skirt with low loss. Thus, as the usage of 4G technology increases, the demand for BAW filters is also expected to grow over the forecast period 2017 to 2025.

Strong Growth of Key End-use Industries to Keep Asia Pacific BAW Devices Market in Top Spot

Asia Pacific dominated the global market for BAW devices in 2016, retaining its position as the leading contributor of revenue to the global market. The market for BAW devices in Asia Pacific is primarily driven by high concentration of semiconductor companies in emerging countries such as China, Taiwan, Japan, South Korea and India. Moreover, most of the world’s leading telecommunication and consumer electronics companies have their manufacturing facility in this region. Thus, the demand for bulk acoustic wave devices in this region is expected to remain strong in the next few years as well.

North America, which is another promising regional market for BAW devices with high-growth potential, is also expected to retain its position as one of the leading demand drivers and contributors of revenue to the global market. The aerospace and defense industries in the region are the key consumers of a variety of BAW devices. U.S. held the dominant market share in terms of revenue in the North America BAW devices market in 2016.

Some of the leading players operating in the global bulk acoustic wave devices market are Tai Saw Technology Co. Ltd. (Taiwan, China), Taiyo Yuden (Tokyo, Japan), Skyworks Solutions (Massachusetts, U.S.), TDK Corporation (Tokyo, Japan), Murata Manufacturing Co. Ltd. (Kyoto, Japan), Honeywell International, Inc. (New Jersey, U.S.), Teledyne Microwave Solutions (California, U.S), Kyocera Corporation (Kyoto, Japan), Infineon Technologies AG (Neubiberg, Germany), API Technologies (Massachusetts, U.S.).

Rising Inclination from 3G to 4G Network will Augment Bulk Acoustic Wave Devices Market Growth

The market for mass acoustic wave (BAW) gadgets has seen a critical ascent in speculation focused on the turn of events and commercialization of these gadgets across an expanding number of utilization regions. These gadgets discover applications in very good quality applications across enterprises like broadcast communications and buyer hardware. For quite a while, the exorbitant costs of BAW gadgets confined their utilization to businesses like military and protection, in any case, empowering R&D exercises have permitted the improvement of ease gadgets in the course of recent years, fundamentally expanding their arrangement of uses.

Increasing popularity of cell phones, PCs, PCs, and other electronic equipment is one of the key factors driving development in the worldwide mass acoustic wave gadgets market. Expanding utilization of trend setting innovations, moving concentration from 3G to 4G advances that require superior channels has energized development in the worldwide mass acoustic wave gadgets market.

Rising use of mass acoustic wave gadgets in different enterprises like media transmission, aviation and protection, car, climate and modern, medical care and clinical, and customer hardware has additionally increased development in the worldwide mass acoustic wave gadgets market. Adding further, rising interest for associated gadgets and brilliant gadgets, for example, cell phones, GPS frameworks, and infotainment frameworks are additionally expected to prod interest in this market.

At present, the market is witnessing an accelerating growth rate owing to the rise of the 4G innovation. BAW devices are viewed as better substitutes over surface acoustic wave (SAW) devices as the previous are more conservative and appropriate for handset plans. Rising interest for scaled down shopper electronic devices is required to essentially profit the worldwide interest for bulk acoustic wave devices in the following not many years. The market is additionally seeing intensive examination exercises zeroed in on the decrease of the expense of devices, which could additionally help their commercialization, driving the market.

Section 1. Preface

Section 2. Assumptions and Research Methodology

2.1. Assuptions and Acronyms Used

2.2. Research Methodolgy

Section 3. Executive Summary

3.1. Executive Summary

Section 4. Global Bulk Acoustic Devices Market: Market Overview

4.1. Introduction

4.2. Market Dynamics Drivers and Restraints Snapshot Analysis

4.2.1. Market Drivers

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.3. Competitive Landscape

4.3.1. Market Attractiveness Analysis

4.3.2. Competitive Strategy adopted by leading players

4.4. Market Positioning of Key Players, 2015

Section 5. Global Bulk Acoustic Devices Market Analysis By Devices Analysis

5.1. Key Findings

5.2. Introduction

5.3. Global BAW Devices Market Value Share Analysis, by Device Analysis

5.4. Global BAW Devices Market Forecast, by Devices, 2016–2025

Section 6. Global Bulk Acoustic Devices Market Analysis, ByEnd Use Industry

6.1. KeyFindings

6.2. Introduction

6.3. Global BAW Devices Market Revenue Share (%)

Analysis, By End Use Industry

6.4. Global BAW Devices Market Size (US$ Mn)

Forecast, By End Use Industry, 2016–2025

Section 7. Bulk Acoustic Devices Market Analysis, By Region

Section8. North America Bulk Acoustic Devices Market Analysis

8.1. Key Findings

8.2. North America Bulk acoustic wave devices Market Size (US$ Mn) Forecast, by Devices, 2016–2025

8.3. North America Bulk acoustic wave devices Market Size (US$ Mn) Forecast, End Use Industry, 2016–2025

8.4. North America Bulk Acoustic Devices Market Analysis, By Country

Section 9. Europe Bulk Acoustic Devices Market Analysis

9.1. Key Findings

9.2. Europe Bulk acoustic wave devices Market Size (US$ Mn) Forecast, by Devices, 2016–2025

9.3. Europe Bulk acoustic wave devices Market Size (US$ Mn) Forecast, End Use Industry, 2016–2025

9.4. Europe Bulk Acoustic Devices Market Analysis, By Country

Section 10. Asia Pacific Bulk Acoustic Devices Market Analysis

10.1. Key Findings

10.2. Asia Pacific Bulk acoustic wave devices Market Size (US$ Mn) Forecast, by Devices, 2016–2025

10.3. Asia Pacific Bulk acoustic wave devices Market Size (US$ Mn) Forecast, End Use Industry, 2016–2025

10.4. Asia Pacific Bulk Acoustic Devices Market Analysis, By Country

Section 11. Middle East and AfricaBulk Acoustic Devices Market Analysis

11.1. Key Findings

11.2. Middle East Bulk acoustic wave devices Market Size (US$ Mn) Forecast, by Devices, 2016–2025

11.3. Middle East Bulk acoustic wave devices Market Size (US$ Mn) Forecast, End Use Industry, 2016–2025

11.4. Middle East Bulk Acoustic Devices Market Analysis, By Country

Section 12. Latin America Bulk Acoustic Devices Market Analysis

12.1. Key Findings

12.2. Latin America Bulk acoustic wave devices Market Size (US$ Mn) Forecast, by Devices, 2016–2025

12.3. Latin America Bulk acoustic wave devices Market Size (US$ Mn) Forecast, End Use Industry, 2016–2025

12.4. Latin America Bulk Acoustic Devices Market Analysis, By Country

Section 13. Company Profiles

13.1. Taiyo Yuden

13.1.1. Company Details

13.1.2. Company Description

13.1.3. Business Overview

13.1.4. SWOT Analysis

13.1.5. Financial Overview

13.1.6. Strategic Overview

13.2. Tai Saw Technology Co. Ltd.

13.2.1. Company Details

13.2.2. Company Description

13.2.3. Business Overview

13.2.4. SWOT Analysis

13.2.5. Financial Overview

13.2.6. Strategic Overview

13.3. Skyworks Solutions

13.3.1. Company Details

13.3.2. Company Description

13.3.3. Business Overview

13.3.4. SWOT Analysis

13.3.5. Financial Overview

13.3.6. Strategic Overview

13.4. Infineon Technologies AG

13.4.1. Company Details

13.4.2. Company Description

13.4.3. Business Overview

13.4.4. SWOT Analysis

13.4.5. Financial Overview

13.4.6. Strategic Overview

13.5. TDK Corporation

13.5.1. Company Details

13.5.2. Company Description

13.5.3. Business Overview

13.5.4. SWOT Analysis

13.5.5. Financial Overview

13.5.6. Strategic Overview

13.6. Murata Manufacturing Co. Ltd.

13.6.1. Company Details

13.6.2. Company Description

13.6.3. Business Overview

13.6.4. SWOT Analysis

13.6.5. Financial Overview

13.6.6. Strategic Overview

13.7. API Technologies

13.7.1. Company Details

13.7.2. Company Description

13.7.3. Business Overview

13.7.4. SWOT Analysis

13.7.5. Financial Overview

13.7.6. Strategic Overview

13.8. Honeywell International, Inc.

13.7.1. Company Details

13.7.2. Company Description

13.7.3. Business Overview

13.7.4. SWOT Analysis

13.7.5. Financial Overview

13.7.6. Strategic Overview

13.9. Kyocera Corporation

13.1.1. Company Details

13.1.2. Company Description

13.1.3. Business Overview

13.1.4. SWOT Analysis

13.1.5. Financial Overview

13.1.6. Strategic Overview

13.10. Teledyne Microwave Solutions

13.1.1. Company Details

13.1.2. Company Description

13.1.3. Business Overview

13.1.4. SWOT Analysis

13.1.5. Financial Overview

13.1.6. Strategic Overview

List of Tables

TABLE 1 Global BAW Devices Market Size (USD Mn) Forecast, by Device Analysis, 2016–2025

TABLE 2 Global BAW Devices Market Size (US$ Mn) Forecast, By End Use Industry, 2016–2025

TABLE 3 North America Bulk acoustic wave devices Market Size (US$ Mn) Forecast, by Devices, 2016–2025

TABLE 4 North America Bulk acoustic wave devices Market Size (US$ Mn) Forecast, End Use Industry, 2016–2025

TABLE 5 Europe Bulk acoustic wave devices Market Size (US$ Mn) Forecast, by Devices Analysis, 2016–2025

TABLE 6 Europe Bulk acoustic wave devices Market Size (US$ Mn) Forecast, End Use Industry, 2016–2025

TABLE 7 Asia Pacific Bulk acoustic wave devices Market Size (US$ Mn) Forecast, by Devices, 2016–2025

TABLE 8 Asia Pacific Bulk acoustic wave devices Market Size (US$ Mn) Forecast, End Use Industry, 2016–2025

TABLE 9 Middle East and Africa Bulk acoustic wave devices Market Size (US$ Mn) Forecast, by Devices, 2016–2025

TABLE 10 Middle East and Africa Bulk acoustic wave devices Market Size (US$ Mn) Forecast, End Use Industry, 2016–2025

TABLE 11 Latin America Bulk acoustic wave devices Market Size (US$ Mn) Forecast, by Devices, 2016–2025

TABLE 12 Latin America Bulk acoustic wave devices Market Size (US$ Mn) Forecast, End Use Industry, 2016–2025

List of Figures

FIG. 1Bulk Acoustic Wave Devices Market Attractiveness Analysis, by Device, 2016

FIG. 2Market Share of key players, (%), 2016

FIG. 3Global Filters BAW Devices Market Revenue (USD Mn), by Device Analysis, 2016 - 2025

FIG. 4Global Resonators BAW Devices Market Revenue (USD Mn), By device analysis, 2016 - 2025

FIG. 5Global Transducers BAW Devices Market Revenue (USD Mn), by Device Analysis, 2016 - 2025

FIG. 6. Global Others BAW Devices Market Revenue (USD Mn), by Oscillators, 2016 - 2025

FIG. 7Global Aerospace & Defense BAW Devices Market

Revenue (USD Mn), 2016–2025

FIG. 8Global Telecommunication BAW Devices Market

Revenue (USD Mn), 2016–2025

FIG. 9Global Environmental and industrial BAW Devices Market Revenue (USD Mn), 2016–2025

FIG. 10Global Automotive BAW Devices Market

Revenue (USD Mn), 2016–2025

FIG. 11Global Consumer Electronics BAW Devices Market

Revenue (USD Mn), 2016–2025

FIG. 12Global Healthcare & Medical BAW Devices Market

Revenue (USD Mn), 2016–2025

FIG. 13Global Others BAW Devices Market Revenue (USD Mn), 2016–2025

FIG. 14U.S. Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 15Canada Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 16Mexico Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 17U.K Bulk Acoustic Wave Devices Market Analysis, Revenue (USD Mn)

FIG. 18Germany Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 19The Netherlands Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 20Rest of Europe Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 21China (Including Taiwan) Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 22India Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 23Japan Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 24Oceania Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 25Rest of Asia Pacific Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 26UAE Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 27Saudi Arabia Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 28South Africa Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 29Others Bulk acoustic Wave Devices Market Analysis, Revenue

FIG. 30Brazil Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 31Argentina Bulk Acoustic Wave Devices Market Analysis, Revenue

FIG. 32Others Bulk Acoustic Wave Devices Market Analysis, Revenue