Reports

Reports

As individuals are adapting to the new normal due to the transformation of the global society as a result of the COVID-19 outbreak, new product development is growing prominent. Companies in the biodegradable plastics market are increasing their R&D capabilities to draw product innovations in order to revive market growth and contribute toward a cleaner planet.

Companies in the biodegradable plastics market are taking data-driven decisions before investing in new technologies. They are entering into mergers & acquisitions (M&A) in order to stay afloat during the pandemic, and collaborate on mission-critical projects in essential industries such as packaging, agriculture, and consumer goods. Manufacturers are increasing efforts to ensure business continuity by maintaining robust supply chains and after-sales services to establish long-term business relations with clients, customers, and partners.

New bioplastics innovations and supportive public policies are contributing to the growth of the global biodegradable plastics market biodegradable plastics market. It has been found that Japan switched to plant-derived bioplastic wrappers for all rice ball offerings since July 2019. On the other hand, Germany has supported the use of certified bio-based and compostable biowaste plastic bags since 2015.

Exciting bioplastic innovations such as bioplastic containers made from rice starch with a high degree of thermal resistance and mechanical strength are grabbing the attention of consumers and companies alike. Manufacturers in the biodegradable plastics market are increasing production for edible food wrappers made from corn and shellfish byproducts. Lego kits are coming into the fore for containing sugarcane-derived bioplastics.

The biodegradable plastics market is expected to cross the valuation of US$ 7.1 Bn by 2031. However, there is a need for 100% bioplastics, which are compostable, recyclable, and biodegradable and at the same time help reduce the global society’s carbon footprint relative to incumbent plastics. Hence, companies are investing in R&D to reduce their dependence on crude oil and minimize the amount of waste in landfills & oceans.

The growing demand for greener and safer products is triggering innovations in bioplastics made from polyhydroxyalkanoates (PHAs) that are being publicized for their intriguing biodegradability and physical properties that are comparable to polypropylene (PP).

Apart from product innovations, robust mechanical and chemical recycling methods are being implemented for bioplastics. These methods involve depolymerization, pyrolysis, and other methods to break plastics down and recover raw materials from which the plastics were synthesized. Chemical recycling processes are a promising way to turn used bioplastics into renewable chemicals or fossil fuel chemicals for use in new products with a minimum amount of waste.

Companies in the biodegradable plastics market should increase awareness about the recycling of bioplastics through social media and traditional marketing channels to establish a developing circular economy. Recycling of bioplastics plays a pivotal role in the biobased economy, which involves turning bioplastics and fossil fuel plastics waste into new value-added materials.

Analysts’ Viewpoint

Apart from being budget conscious, manufacturers in the biodegradable plastics market are becoming environmental conscious and increasing research in new product developments to create value addition for customers during the coronavirus pandemic. However, there is a need for 100% biodegradable plastics that are compostable and recyclable. Thus, to achieve this, manufacturers should increase product innovations with polylactic acid and PHAs. On the other hand, manufacturers should capitalize on government support for developing bioplastics such as it is being observed in Japan and Germany. Manufacturers should increase awareness about recycling of bioplastics into useful value-added materials. New recycling technologies are expediting the prevention of plastic waste in oceans and landfills.

Biodegradable Plastics Market Snapshot

|

Attribute |

Detail |

|

Market Size Value in 2020 |

US$ 3,6 Bn |

|

Market Forecast Value in 2031 |

US$ 7.1 Bn |

|

Growth Rate (CAGR) |

6.5 % |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value & Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, value chain analysis, key trend analysis, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

Biodegradable Plastics Market is expected to reach US$ 7.1 Bn By 2031

Biodegradable Plastics Market is estimated to rise at a CAGR of 6.5% during forecast period

Increase in applications of biodegradable plastics in packaging and textiles sectors is propelling the global biodegradable plastics market

Key players operating in the global biodegradable plastics market are BASF SE, Total Corbion, Mitsubishi Chemical Corporation, Biome Bioplastics Ltd., Plantic Technologies, Toray Industries Inc., Novamont S.p.A., and Bioplastics International.

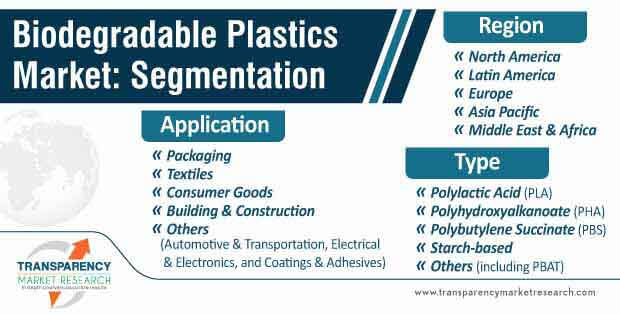

Packaging, Textiles, Consumer Goods, Building & Construction, Automotive & Transportation, Electrical & Electronics, Coatings & Adhesives are the application segments in the Biodegradable Plastics Market

1. Executive Summary

1.1. Biodegradable Plastics Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Potential Customers

3. COVID-19 Impact Analysis

4. Biodegradable Plastics Market Production Outlook

5. Biodegradable Plastics Price Trend Analysis, 2020–2031

5.1. By Type

5.2. By Region

6. Global Biodegradable Plastics Market Analysis and Forecast, by Type, 2020–2031

6.1. Introduction and Definitions

6.2. Global Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

6.2.1. Polylactic Acid (PLA)

6.2.2. Polyhydroxyalkanoate (PHA)

6.2.3. Polybutylene Succinate (PBS)

6.2.4. Starch-based

6.2.5. Others

6.3. Global Biodegradable Plastics Market Attractiveness, by Type

7. Global Biodegradable Plastics Market Analysis and Forecast, by Application, 2020–2031

7.1. Introduction and Definitions

7.2. Global Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.2.1. Packaging

7.2.2. Textiles

7.2.3. Agriculture & Horticulture

7.2.4. Consumer Goods

7.2.5. Building & Construction

7.2.6. Others

7.3. Global Biodegradable Plastics Market Attractiveness, by Application

8. Global Biodegradable Plastics Market Analysis and Forecast, by Region, 2020–2031

8.1. Key Findings

8.2. Global Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Biodegradable Plastics Market Attractiveness, by Region

9. North America Biodegradable Plastics Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. North America Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.3. North America Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4. North America Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

9.4.1. U.S. Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.4.2. U.S. Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.3. Canada Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.4.4. Canada Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5. North America Biodegradable Plastics Market Attractiveness Analysis

10. Europe Biodegradable Plastics Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Europe Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.3. Europe Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. Europe Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

10.4.1. Germany Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.2. Germany Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.3. France Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.4. France Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.5. U.K. Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.6. U.K. Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.7. Italy Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.8. Italy Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.9. Spain Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.10. Spain Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.11. Russia & CIS Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.12. Russia & CIS Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.13. Rest of Europe Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.14. Rest of Europe Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5. Europe Biodegradable Plastics Market Attractiveness Analysis

11. Asia Pacific Biodegradable Plastics Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Asia Pacific Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.3. Asia Pacific Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4. Asia Pacific Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

11.4.1. China Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.2. China Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.3. Japan Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.4. Japan Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.5. India Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.6. India Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.7. ASEAN Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.8. ASEAN Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.9. Rest of Asia Pacific Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.10. Rest of Asia Pacific Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5. Asia Pacific Biodegradable Plastics Market Attractiveness Analysis

12. Latin America Biodegradable Plastics Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Latin America Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.3. Latin America Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4. Latin America Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

12.4.1. Brazil Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.2. Brazil Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4.3. Mexico Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.4. Mexico Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4.5. Rest of Latin America Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.6. Rest of Latin America Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5. Latin America Biodegradable Plastics Market Attractiveness Analysis

13. Middle East & Africa Biodegradable Plastics Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Middle East & Africa Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.3. Middle East & Africa Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4. Middle East & Africa Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

13.4.1. GCC Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.2. GCC Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4.3. South Africa nada Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.4. South Africa Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4.5. Rest of Middle East & Africa Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.6. Rest of Middle East & Africa Biodegradable Plastics Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5. Middle East & Africa Biodegradable Plastics Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Biodegradable Plastics Company Market Share Analysis, 2020

14.2. Competition Matrix

14.3. Market Footprint Analysis

14.3.1. By Type

14.3.2. By Application

14.4. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.4.1. BASF SE

14.4.1.1. Company Description

14.4.1.2. Business Overview

14.4.1.3. Financial Details

14.4.1.4. Strategic Overview

14.4.2. Total Corbion

14.4.2.1. Company Description

14.4.2.2. Business Overview

14.4.2.3. Financial Details

14.4.2.4. Strategic Overview

14.4.3. Mitsubishi Chemical Corporation

14.4.3.1. Company Description

14.4.3.2. Business Overview

14.4.4. Biome Bioplastics Ltd.

14.4.4.1. Company Description

14.4.4.2. Business Overview

14.4.5. Plantic Technologies

14.4.5.1. Company Description

14.4.5.2. Business Overview

14.4.6. Toray Industries Inc.

14.4.6.1. Company Description

14.4.6.2. Business Overview

14.4.7. Bioplastics International

14.4.7.1. Company Description

14.4.7.2. Business Overview

14.4.8. Others

14.4.8.1. Company Description

14.4.8.2. Business Overview

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 2: Global Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 3: Global Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 4: Global Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 5: Global Biodegradable Plastics Market Volume (Tons) Forecast, by Region, 2020–2031

Table 6: Global Biodegradable Plastics Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 7: North America Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 8: North America Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 9: North America Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 10: North America Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 11: North America Biodegradable Plastics Market Volume (Tons) Forecast, by Country, 2020–2031

Table 12: North America Biodegradable Plastics Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 13: U.S. Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 14: U.S. Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 15: U.S. Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 16: U.S. Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 17: Canada Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 18: Canada Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 19: Canada Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 20: Canada Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 21: Europe Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 22: Europe Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 23: Europe Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 24: Europe Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 25: Europe Biodegradable Plastics Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 26: Europe Biodegradable Plastics Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 27: Germany Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 28: Germany Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 29: Germany Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 30: Germany Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: U.K. Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 32: U.K. Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 33: U.K. Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 34: U.K. Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 35: France Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 36: France Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 37: France Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 38: France Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 39: Italy Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 40: Italy Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 41: Italy Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 42: Italy Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: Spain Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 44: Spain Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 45: Spain Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 46: Spain Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 47: Russia & CIS Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 48: Russia & CIS Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 49: Russia & CIS Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 50: Russia & CIS Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 51: Rest of Europe Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 52: Rest of Europe Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 53: Rest of Europe Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 54: Rest of Europe Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 55: Asia Pacific Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 56: Asia Pacific Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 57: Asia Pacific Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 58: Asia Pacific Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 59: Asia Pacific Biodegradable Plastics Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 60: Asia Pacific Biodegradable Plastics Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 61: China Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 62: China Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 63: China Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 64: China Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 65: Japan Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 66: Japan Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 67: Japan Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 68: Japan Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 69: India Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 70: India Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 71: India Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 72: India Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 73: ASEAN Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 74: ASEAN Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 75: ASEAN Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 76: ASEAN Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 81: Rest of Asia Pacific Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 82: Rest of Asia Pacific Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 83: Rest of Asia Pacific Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 84: Rest of Asia Pacific Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 85: Latin America Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 86: Latin America Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 87: Latin America Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 88: Latin America Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 89: Latin America Biodegradable Plastics Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 90: Latin America Biodegradable Plastics Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 91: Brazil Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 92: Brazil Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 93: Brazil Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 94: Brazil Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 95: Mexico Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 96: Mexico Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 97: Mexico Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 98: Mexico Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 99: Rest of Latin America Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 100: Rest of Latin America Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 101: Rest of Latin America Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 102: Rest of Latin America Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 103: Middle East & Africa Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 104: Middle East & Africa Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 105: Middle East & Africa Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 106: Middle East & Africa Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 107: Middle East & Africa Biodegradable Plastics Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 108: Middle East & Africa Biodegradable Plastics Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 109: GCC Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 110: GCC Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 111: GCC Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 112: GCC Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 113: South Africa Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 114: South Africa Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 115: South Africa Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 116: South Africa Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 117: Rest of Middle East & Africa Biodegradable Plastics Market Volume (Tons) Forecast, by Type, 2020–2031

Table 118: Rest of Middle East & Africa Biodegradable Plastics Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 119: Rest of Middle East & Africa Biodegradable Plastics Market Volume (Tons) Forecast, by Application, 2020–2031

Table 120: Rest of Middle East & Africa Biodegradable Plastics Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Global Biodegradable Plastics Price Trend, by Application, 2020–2031 (US$/Ton)

Figure 2: Global Biodegradable Plastics Price Trend, by Region, 2020–2031 (US$/Ton)

Figure 3: Global Biodegradable Plastics Market Volume Share, by Type, 2020, 2025, and 2031

Figure 4: Global Biodegradable Plastics Market Attractiveness, by Type

Figure 5: Global Biodegradable Plastics Market Volume Share, by Application, 2020, 2025, and 2031

Figure 6: Global Biodegradable Plastics Market Attractiveness, by Application

Figure 7: Global Biodegradable Plastics Market Volume Share, by Region, 2020, 2025, and 2031

Figure 8: Global Biodegradable Plastics Market Attractiveness, by Region

Figure 9: North America Biodegradable Plastics Market Volume Share, by Type, 2020, 2025, and 2031

Figure 10: North America Biodegradable Plastics Market Attractiveness, by Type

Figure 11: North America Biodegradable Plastics Market Volume Share, by Application, 2020, 2025, and 2031

Figure 12: North America Biodegradable Plastics Market Attractiveness, by Application

Figure 13: North America Biodegradable Plastics Market Volume Share, by Country, 2020, 2025, and 2031

Figure 14: North America Biodegradable Plastics Market Attractiveness, by Country

Figure 15: Europe Biodegradable Plastics Market Volume Share, by Type, 2020, 2025, and 2031

Figure 16: Europe Biodegradable Plastics Market Attractiveness, by Type

Figure 17: Europe Biodegradable Plastics Market Volume Share, by Application, 2020, 2025, and 2031

Figure 18: Europe Biodegradable Plastics Market Attractiveness, by Application

Figure 19: Europe Biodegradable Plastics Market Volume Share, by Country and Sub-region, 2020, 2025, and 2031

Figure 20: Europe Biodegradable Plastics Market Attractiveness, by Country and Sub-region

Figure 21: Asia Pacific Biodegradable Plastics Market Volume Share, by Type, 2020, 2025, and 2031

Figure 22: Asia Pacific Biodegradable Plastics Market Attractiveness, by Type

Figure 23: Asia Pacific Biodegradable Plastics Market Volume Share, by Application, 2020, 2025, and 2031

Figure 24: Asia Pacific Biodegradable Plastics Market Attractiveness, by Application

Figure 25: Asia Pacific Biodegradable Plastics Market Volume Share, by Country and Sub-region, 2020, 2025, and 2031

Figure 26: Asia Pacific Biodegradable Plastics Market Attractiveness, by Country and Sub-region

Figure 27: Latin America Biodegradable Plastics Market Volume Share, by Type, 2020, 2025, and 2031

Figure 28: Latin America Biodegradable Plastics Market Attractiveness, by Type

Figure 29: Latin America Biodegradable Plastics Market Volume Share, by Application, 2020, 2025, and 2031

Figure 30: Latin America Biodegradable Plastics Market Attractiveness, by Application

Figure 31: Latin America Biodegradable Plastics Market Volume Share, by Country and Sub-region, 2020, 2025, and 2031

Figure 32: Latin America Biodegradable Plastics Market Attractiveness, by Country and Sub-region

Figure 33: Middle East & Africa Biodegradable Plastics Market Volume Share, by Type, 2020, 2025, and 2031

Figure 34: Middle East & Africa Biodegradable Plastics Market Attractiveness, by Type

Figure 35: Middle East & Africa Biodegradable Plastics Market Volume Share, by Application, 2020, 2025, and 2031

Figure 36: Middle East & Africa Biodegradable Plastics Market Attractiveness, by Application

Figure 37: Middle East & Africa Biodegradable Plastics Market Volume Share, by Country and Sub-region, 2020, 2025, and 2031

Figure 38: Middle East & Africa Biodegradable Plastics Market Attractiveness, by Country and Sub-region

Figure 39: Global Biodegradable Plastics Market Share Analysis, by Company, 2020