Reports

Reports

Global Benzyl Alcohol Market: Snapshot

Benzyl alcohol is a solvent, or a substance that breaks down a solute (typically a strong, in spite of the fact that it tends to be another fluid or a gas) to make a solution. In contrast to different solvents, benzyl alcohol isn't combustible. This little certainty makes benzyl alcohol safe to transport across the world. Its other benefit is as an antecedent to various esters, or synthetic mixes got from a corrosive in which at least one hydroxyl bunches are supplanted with an alkoxy bonding. Esters are ordinarily utilized in the restorative business. Owing to these benefits, the global benzyl alcohol market shall witness a substantial growth in coming years.

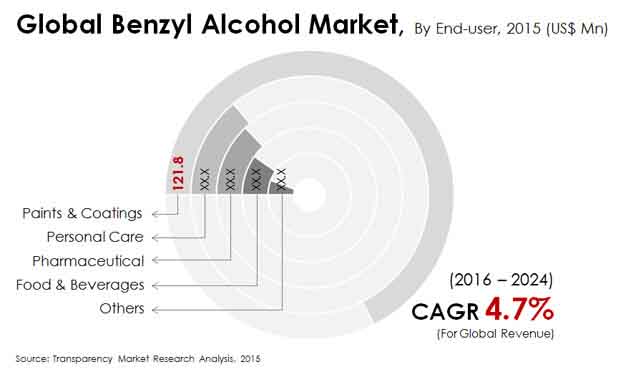

The global market for benzyl alcohol has been expanding at a steady pace over the years owing to the consistent demand arising from various end-use industries. The growing applications of benzyl alcohol in the paints and coatings, food and beverages, pharmaceutical, and personal care industries are likely to continue driving the demand for the same over the course of the forecast period. The global benzyl alcohol market was valued at US$198 mn in 2015 and is projected to reach US$299.2 mn by 2024, expanding at a CAGR of 4.7% therein.

This highly consolidated market is marked by the presence of multinational manufacturing companies with a strong regional foothold. Retaining a high degree of competition throughout the forecast period, the benzyl alcohol market will present numerous growth opportunities for players in various avenues.

Benzyl alcohol plays an important role in a wide range of end-use industries such as personal care, food and beverages, pharmaceutical, and paints and coatings. By application, paints and coatings was the leading end-use segment in the global benzyl alcohol market, constituting more than 60% in 2015. Benzyl alcohol is employed in several applications in the paints and coatings industry. It is used as a solvent for manufacturing paints, inks, and epoxy resins and as a paint stripper in industries such as automotive and aviation.

The pharmaceutical sector is estimated to be the fastest growing end-use segment during the forecast period. A significant increase in the usage of benzyl alcohol in the pharmaceutical industries in developing regions is projected to propel this segment in the near future.

The global benzyl alcohol market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

In terms of volume, North America accounted for a share of more than 35% in 2015. The region is estimated to maintain its lead during the forecast period, with the U.S. likely to be one of the prime manufacturers and consumers of benzyl alcohol in the next few years. The growth of the North America market can be attributed to the increased demand for benzyl alcohol from the paints and coatings, pharmaceutical, and personal care industries. However, the benzyl alcohol market is likely to expand at a sluggish rate in North America and Europe over the course of the forecast period.

Asia Pacific is anticipated to be the fastest growing regional market for benzyl alcohol. Increased demand for benzyl alcohol in the pharmaceutical and personal care industries is estimated to be the key factor driving the market in the region. This trend is projected to shift the momentum of demand between 2016 and 2024 from the developed markets to developing regions.

Key players in the global benzyl alcohol market include Emerald Performance Materials, Lanxess, Pharmco-Aaper, Avantor Performance Materials, Merck KGaA, Alfa Aesar, Finar Limited, Gujarat Alkalies and Chemicals Limited, Elan Chemical Company Inc., Wuhan Youji Industries Co., Ltd., Wuhan Biet Co., Ltd., Hubei Greenhome Fine Chemical Co., Ltd., and Ineos AG.

1. Preface

1.1. Report Description

1.2. Research Scope

1.3. Assumptions

1.4. Market Segmentation

1.5. Research Methodology

2. Executive Summary

2.1. Global Benzyl Alcohol Market, 2013 - 2024, (Kilo Tons) (US$ Mn)

2.2. Global Benzyl Alcohol: Market Snapshot

3. Benzyl Alcohol Market– Industry Analysis

3.1. Introduction

3.2. Value Chain Analysis

3.3. Market Drivers

3.3.1. Growth of Global Pharmaceutical Market

3.3.2. Rising Sales of Personal Care Products and Food & Beverages Industry

3.3.3. Rising Demand for Paints and Coatings due to Growth in Construction and Automobile Industries

3.4. Restraints

3.4.1.Toxic Effects of Benzyl Alcohol

3.5. Opportunity

3.5.1. Rising Sales of Cosmetics and Beauty Products in BRIC Countries

3.6. Porter’s Five Forces Analysis

3.6.1. Bargaining Power of Suppliers

3.6.2. Bargaining Power of Buyers

3.6.3. Threat of Substitutes

3.6.4. Threat of New Entrants

3.6.5. Degree of Competition

3.7. Global Benzyl Alcohol Market Attractiveness, by End-user

3.8. Global Benzyl Alcohol Market Attractiveness, by Country and Region

3.9. Benzyl Alcohol: Company Market Share Analysis, 2015

3.10. Product Differentiation in Various End-user Segments

4. Price Trend Analysis

4.1. Benzyl Alcohol Global Average Price Trend, 2013 - 2024, (US$/Ton)

5. Benzyl Alcohol Market – End-user Analysis

5.1. Global Benzyl Alcohol Market: End-user Overview

5.2. Benzyl Alcohol Market – By End-user Analysis

5.2.1. Global Benzyl Alcohol Market for Personal Care (Kilo Tons) (US$ Mn), 2013 – 2024

5.2.2. Global Benzyl Alcohol Market for Food & Beverages (Kilo Tons) (US$ Mn), 2013 – 2024

5.2.3. Global Benzyl Alcohol Market for Pharmaceutical (Kilo Tons) (US$ Mn), 2013 – 2024

5.2.4. Global Benzyl Alcohol Market for Paints & Coatings (Kilo Tons) (US$ Mn), 2013 – 2024

5.2.5. Global Benzyl Alcohol Market for Others (Kilo Tons) (US$ Mn), 2013 – 2024

6. Benzyl Alcohol Market - Regional Analysis

6.1. Global Benzyl Alcohol Market: Regional Overview

6.2. Global Benzyl Alcohol Derivatives Market: Regional Overview

6.3. North America

6.3.1. North America Benzyl Alcohol Market Volume, by End-user (Kilo Tons), 2013 – 2024

6.3.2. North America Benzyl Alcohol Market Volume, by End-user (US$ Mn), 2013 – 2024

6.3.3. U.S. Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.3.4. U.S. Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.3.5. Rest of North America Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.3.6. Rest of North America Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.4. Europe

6.4.1. Europe Benzyl Alcohol Market Volume, by End-user (Kilo Tons), 2013 – 2024

6.4.2. Europe Benzyl Alcohol Market Revenue, by End-user (US$ Mn), 2013 – 2024

6.4.3. France Benzyl Alcohol Market Volume,by End-user (Tons), 2013 – 2024

6.4.4. France Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.4.5. U.K. Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.4.6. U.K.Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.4.7. Spain Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.4.8. Spain Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.4.9. Germany Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.4.10. Germany Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.4.11. Italy Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.4.12. Italy Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.4.13. Rest of Europe Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.4.14.Rest of Europe Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.5. Asia Pacific

6.5.1. Asia Pacific Benzyl Alcohol Market Volume, by End-user (Kilo Tons), 2013 – 2024

6.5.2. Asia Pacific Benzyl Alcohol Market Revenue,by End-user (US$ Mn), 2013 – 2024

6.5.3. China Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.5.4. China Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.5.5. Japan Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.5.6. Japan Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.5.7. ASEAN Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.5.8. ASEAN Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.5.9. Rest of Asia Pacific Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.5.10. Rest of Asia Pacific Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.6. Latin America

6.6.1. Latin America Benzyl Alcohol Market Volume, by End-user (Kilo Tons), 2013 – 2024

6.6.2. Latin America Benzyl Alcohol Market Revenue, by End-user (US$ Mn), 2013 – 2024

6.6.3. Brazil Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.6.4. Brazil Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.6.5. Rest of Latin America Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.6.6. Rest of Latin America Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.7. Middle East & Africa

6.7.1. Middle East & Africa Benzyl Alcohol Market Volume, by End-user (Kilo Tons), 2013 – 2024

6.7.2. Middle East & Africa Benzyl Alcohol Market Revenue, by End-user (US$ Mn), 2013 – 2024

6.7.3. GCC Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.7.4. GCC Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.7.5. South Africa Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.7.6. South Africa Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

6.7.7. Rest of Middle East & Africa Benzyl Alcohol Market Volume, by End-user (Tons), 2013 – 2024

6.7.8. Rest of Middle East & Africa Benzyl Alcohol Market Revenue, by End-user (US$ Thousand), 2013 – 2024

7. Company Profiles

7.1. Emerald Performance Materials, LLC

7.1.1 Company Details

7.1.2 Business Overview

7.1.3 Recent Developments

7.1.4 Business Strategy

7.2. Lanxess

7.2.1 Company Details

7.2.2 Business Overview

7.2.3 Business Strategy

7.2.4 Financial Details

7.3. Pharmco-Aaper

7.3.1 Company Details

7.3.2 Business Overview

7.3.3 Recent Developments

7.3.4 Business Strategy

7.4. Avantor Performance Materials

7.4.1 Company Details

7.4.2 Business Overview

7.4.3 Recent Developments

7.4.4 Business Strategy

7.5. Merck KGaA

7.5.1 Company Details

7.5.2 Business Overview

7.5.3 Business Strategy

7.5.4 Financial Details

7.6. Alfa Aesar

7.6.1 Company Details

7.6.2 Business Overview

7.6.3 Recent Developments

7.6.4 Business Strategy

7.7. Finar Limited

7.7.1 Company Details

7.7.2 Business Overview

7.7.3 Business Strategy

7.8. Gujarat Alkalies and Chemicals Limited

7.8.1 Company Details

7.8.2 Business Overview

7.8.3 Business Strategy

7.9. Elan Chemical Company Inc.

7.9.1 Company Details

7.9.2 Business Overview

7.9.3 Business Strategy

7.10. Wuhan Youji Industries Co., Ltd.

7.10.1 Company Details

7.10.2 Business Overview

7.10.3 Business Strategy

7.11. Wuhan Biet Co., Ltd.

7.11.1 Company Details

7.11.2 Business Overview

7.11.3 Business Strategy

7.12. Hubei Greenhome Fine Chemical Co., Ltd.

7.12.1 Company Details

7.12.2 Business Overview

7.12.3 Business Strategy

7.13. Ineos AG

7.13.1 Company Details

7.13.2 Business Overview

7.13.3 Business Strategy

8. List of Customers

9. Primary Research – Key Finding

List of Tables

Table 1: Market Snapshot

Table 2: North America Benzyl Alcohol Market, End-user Segment Analysis by Volume (Kilo Tons), 2013–2024

Table 3: North America Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Mn), 2013–2024

Table 4: U.S. Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 5: U.S. Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 6: Rest of North America Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 7: Rest of North America Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 8: Europe Benzyl Alcohol Market, End-user Segment Analysis by Volume (Kilo Tons), 2013–2024

Table 9: Europe Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Mn), 2013–2024

Table 10: Germany Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 11: Germany Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 12: France Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 13: France Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 14: U.K. Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 15: U.K. Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 16: Italy Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 17: Italy Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 18: Spain Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 19: Spain Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 20: Rest of Europe Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 21: Rest of Europe Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 22: Asia Pacific Benzyl Alcohol Market, End-user Segment Analysis by Volume (Kilo Tons), 2013–2024

Table 23: Asia Pacific Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Mn), 2013–2024

Table 24: China Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 25: China Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 26: Japan Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 27: Japan Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 28: ASEAN Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 29: ASEAN Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 30: Rest of Asia Pacific Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 31: Rest of Asia Pacific Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 32: Latin America Benzyl Alcohol Market, End-user Segment Analysis by Volume (Kilo Tons), 2013–2024

Table 33: Latin America Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Mn), 2013–2024

Table 34: Brazil Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 35: Brazil Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 36: Rest of Latin America Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 37: Rest of Latin America Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 38: Middle East and Africa Benzyl Alcohol Market, End-user Segment Analysis by Volume (Kilo Tons), 2013–2024

Table 39: Middle East and Africa Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Mn), 2013–2024

Table 40: GCC Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 41: GCC Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 42: South Africa Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 43: South Africa Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

Table 44: Rest of Middle East & Africa Benzyl Alcohol Market, End-user Segment Analysis by Volume (Tons), 2013–2024

Table 45: Rest of Middle East & Africa Benzyl Alcohol Market, End-user Segment Analysis by Revenue (US$ Thousand), 2013–2024

List of Figures

Figure 1: Market Segmentation

Figure 2: Global Benzyl Alcohol Market, Volume and Revenue (Kilo Tons) (US$ Mn), 2013-2024

Figure 3: Value Chain Analysis

Figure 4: Market Dynamics

Figure 5: Growth of Global Pharmaceutical Market

Figure 6: Increasing Usage of Personal Care Products

Figure 7: Global Food & Beverages Market Revenue, 2015–2024 (US$ Trn)

Figure 8: Global Construction Market Revenue, 2015–2024 (US$ Trn)

Figure 9: Global Automobile Market Production Capacity, 2005–2015 (Million Units)

Figure 10: Rising Sales of Cosmetics and Beauty Products in BRIC Countries

Figure 11: Porter’s Five Forces Analysis

Figure 12: Market Share of Players, Benzyl Alcohol Market (2015)

Figure 13: Market Attractiveness Analysis, by End-user (2015)

Figure 14: Market Attractiveness Analysis, by Country & Region (2015)

Figure 15: Global Average Price Trend Analysis – Benzyl Alcohol, 2013–2024 (US$/Ton)

Figure 16: End-user Segment, Volume Share, 2013 (A)

Figure 17: End-user Segment, Volume Share, 2024 (F)

Figure 18: Global Benzyl Alcohol Market for Personal Care, Volume and Revenue (Kilo Tons) (US$ Mn), 2013–2024

Figure 19: Global Benzyl Alcohol Market for Food &

Figure 20: Global Benzyl Alcohol Market for Pharmaceutical, Volume and Revenue (Kilo Tons) (US$ Mn), 2013–2024

Figure 21: Global Benzyl Alcohol Market for Paints & Coatings, Volume and Revenue (Tons) (US$ Mn), 2013–2024

Figure 22: Global Benzyl Alcohol Market for Others, Volume and Revenue (Kilo Tons) (US$ Mn), 2013–2024

Figure 23: Global Benzyl Alcohol Market Snapshot

Figure 24: North America Benzyl Alcohol Market Snapshot

Figure 25: Europe Benzyl Alcohol Market Snapshot

Figure 26: Asia Pacific Metal Recycling Market Snapshot

Figure 27: Latin America Metal Recycling Market Snapshot

Figure 28: Middle East & Africa Metal Recycling Market Snapshot

Figure 29: Primary Respondents Matrix