Reports

Reports

Global Automotive Refinish Coatings Market: Snapshot

Due to strict environment protection regulations, the global automotive refinish coatings market is witnessing pivotal transformation. Water-borne coatings due to VoC emission norms, especially in developed countries are increasingly replacing solvent-based products. However, the newer trend has impacted revenue of the overall market. This is because solvent-based coatings have dominated the automotive refinish coatings market due to their long lasting property. Nevertheless, efforts for formulation of water-borne coatings is likely to open new growth avenues for automotive refinish coatings market.

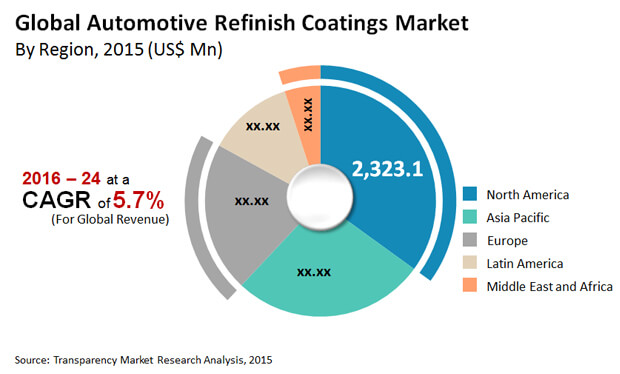

A report by Transparency Market Research (TMR) predicts the global automotive refinish coatings market to rise at a CAGR of 5.7% between 2016 and 2024. Rising at this pace, the market’s valuation of US$6.6 bn in 2015 is likely to be valued at US$10.8 bn by 2024.

Activators Product Type to emerge Most Promising in future

By product type, the report segments the automotive refinish coatings market into primers, base coats, clean coats, fillers, and activators. Among them, in 2015, base coat segment held the dominant over 30% share of the overall market. The rising ownership of used vehicles and rising number of road accidents have led to substantial growth of base coat segment of the market. However, the base coat product segment is likely to witness moderate decline in its growth over the forecast horizon. This is mainly due to the increasing availability of alternatives such as additives with primer.

On the other hand, activators segment is projected to witness the most notable growth in the global automotive refinish coatings market in the upcoming years. This is mainly because of the chemical composition of activators that allows them to dry faster. Expansion of car parks in emerging economies is likely to serve to be a key factor for activators segment to register an increased share from 12.6% in 2016 to 14 % by 2024.

Regulatory Reforms to Discontinue Certain Solvent-based Coatings to hamper North America Market

Geography-wise, North America held supremacy in the global automotive refinish coatings market in 2015. The growth of the region is mainly because of high disposable incomes and general tendency among individuals to undertake timely repairs of their vehicles. The expansion of used vehicle market is also serving to boost the North America automotive refinish coatings market. However, on the downside, strict regulatory reforms to discontinue the use of certain solvent-based varieties is likely to hamper this market over the forecast period.

Asia Pacific, on the other hand, is expected to display exciting growth in the automotive refinish coatings market in the next few years. The rising affluent population in emerging economies of the region, who are mindful to undertake timely repair and maintenance of their vehicles is aiding the automotive refinish coatings market in Asia Pacific.

Prominent companies in the global automotive refinish coatings market include 3M, Axalta Coating Systems, KANSAI PAINT CO. LTD., Nippon Paint Holdings Co. Ltd., Akzo Nobel N.V, The Sherwin-Williams Company, BASF SE, Donglai Coating Technology, PPG Industries, and The Valspar Corporation.

The global automotive refinish coatings market is expected to experience promising growth opportunities in the coming years of the forecast because of the increasing vehicle ownership in the emerging economics such as Brazil, South Korea, Mexico, India, and China. Increasing trend of aftermarket modifications and growing collisions are projected to fuel the product demand.

Increasing usage of automotive refinish coatings for vehicle maintenance, surface protection, resistance to corrosion, aftermarket painting on account of visual appearances, and survival extreme weather water, heat, and temperature is projected to promote the growth of the market. In addition to this, an increasing demand for customized paints and designed on the vehicles is projected support the overall development.

The global automotive refinish coatings market is expected to witness slow recovery in the second half of 2021. The market witnessed a slump in revenue and sales as the COVID-19 pandemic broke out. Several governments issued strict lockdowns and travel restrictions that affected the manufacturing processes. This led to stopping of production processes and logistical operation, hampering market growth. However, with the gradual opening of the global economy, the automotive refinish coatings market is expected witness staggered recovery in the coming months.

In terms of technology, the global automotive refinish coatings market has been divided into solvent-borne, water-borne, and others (including powder and UV-curing). The solvent-borne segment accounts for major share of the market. However, demand for solvent-borne coatings is gradually decreasing, as they contain volatile organic compounds (VOCs). Solvent-borne coatings are made up of liquefying agents that are meant to evaporate via the chemical reaction with oxygen. The water-borne segment is projected to expand at a rapid pace owing to its low VOC content and environment friendly nature. Water-borne coatings offer an eco-friendly surface treatment. Water is used as a solvent in these coatings to disperse the resin used to make coatings or paints. Water-borne coatings are widely used due to their low volatile organic compound (VOC) content (less than 3.5 pounds per gallon of water).

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Report Assumptions

2.3. Research Methodology

3. Executive Summary

3.1. Global Automotive Refinish Coatings Market Size, By Market Value (US$ Bn) and Market Value Share, By Region

3.2. Top 3 Trends

4. Market Overview

4.1. Product Overview

4.2. Market Indicators

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.2. Drivers

5.3. Restraints

5.4. Opportunity Analysis

5.5. Global Automotive Refinish Coatings Market Analysis and Forecasts, 2015 – 2024

5.6. Porter’s Analysis

5.6.1. Threat of New Entrants

5.6.2. Threat of Substitutes

5.6.3. Degree of Competition

5.6.4. Threat of Suppliers

5.6.5. Threat of Buyers

5.6.6. Degree of Competition

5.7. Value Chain Analysis

6. Automotive Refinish Market Analysis and Forecast, By Product Type

6.1. Primer, 2015 – 2024 (US$ Mn) (Kilo Tons)

6.2. Base Coat, 2015 – 2024 (US$ Mn)

6.3. Clear Coat, 2015 – 2024 (US$ Mn

6.4. Activator, 2015 – 2024 (US$ Mn)

6.5. Filler, 2015 – 2024 (US$ Mn)

6.6. Others, 2015 – 2024 (US$ Mn)

6.7. Automotive Refinish Market Attractiveness Analysis by Product Type

6.8. Key Trends

7. Global Automotive Refinish Market Analysis by Technology

7.1. Solvent borne Coatings, 2015 – 2024 (US$ Mn) (Kilo Tons)

7.2. Water borne coatings, 2015 – 2024 (US$ Mn) (Kilo Tons)

7.3. Others, 2015 – 2024 (US$ Mn) (Kilo Tons)

7.4. Automotive Refinish Market Attractiveness Analysis, By Technology Type

7.5. Key Trends

8. Automotive Refinish Market Analysis By Region

8.1. Global Regulatory Scenario

8.2. Global Automotive Refinish Market Value Share Analysis, By Region Type

8.3. North America Automotive Refinish Market Analysis

8.3.1. Key Findings

8.3.2. North America Automotive Refinish Market Overview

8.3.3. North America Market Value Share Analysis, By Product Type

8.3.4. North America Market Forecast By Product Type

8.3.5. North America Market Value Share Analysis, By Technology

8.3.6. North America Market Forecast By Technology Type

8.3.7. North America Market Value Share Analysis, By Country

8.3.8. North America Market Forecast By Country

8.3.8.1. U.S.

8.3.8.2. Canada

8.3.9. North America Market Attractiveness Analysis

8.3.10. Market Trends

8.4. Asia Pacific Automotive Refinish Market Analysis

8.4.1. Key Findings

8.4.2. Asia Pacific Automotive Refinish Market Overview

8.4.3. Asia Pacific Market Value Share Analysis, By Product Type

8.4.4. Asia Pacific Market Forecast by Product Type

8.4.5. Asia Pacific Market Value Share Analysis, By Technology

8.4.6. Asia Pacific Market Forecast By Technology Type

8.4.7. Asia Pacific Market Value Share Analysis, By Country

8.4.8. Asia Pacific Market Forecast By Country

8.4.8.1. China

8.4.8.2. India

8.4.8.3. Japan

8.4.8.4. ASEAN

8.4.8.5. Rest of Asia Pacific

8.4.9. Asia Pacific Market Attractiveness Analysis

8.4.10. Market Trends

8.5. Europe Automotive Refinish Market Analysis

8.5.1. Key Findings

8.5.2. Europe Automotive Refinish Market Overview

8.5.3. Europe Market Value Share Analysis, By Product Type

8.5.4. Europe Market Forecast By Product Type

8.5.5. Europe Market Value Share Analysis, By Technology

8.5.6. Europe Market Forecast By Technology Type

8.5.7. Europe Market Value Share Analysis, By Country

8.5.8. Europe Market Forecast By Country

8.5.8.1. Germany

8.5.8.2. France

8.5.8.3. U.K.

8.5.8.4. Italy

8.5.8.5. Spain

8.5.8.6. Rest of Europe

8.5.9. Europe Market Attractiveness Analysis

8.5.10. Market Trends

8.6. Middle East & Africa Automotive Refinish Market Analysis

8.6.1. Key Findings

8.6.2. Middle East & Africa Automotive Refinish Market Overview

8.6.3. Middle East & Africa Market Value Share Analysis, By Product Type

8.6.4. Middle East & Africa Market Forecast By Product Type

8.6.5. Middle East & Africa Market Value Share Analysis, By Technology

8.6.6. Middle East & Africa Market Forecast by Technology Type

8.6.7. Middle East & Africa Market Value Share Analysis, By Country

8.6.8. Middle East & Africa Market Forecast By Country

8.6.8.1. GCC

8.6.8.2. Egypt

8.6.8.3. South Africa

8.6.8.4. Rest of Middle East & Africa

8.6.9. Middle East & Africa Market Attractiveness Analysis

8.6.10. Market Trends

8.7. Latin America Automotive Refinish Market Analysis

8.7.1. Key Findings

8.7.2. Latin America Automotive Refinish Market Overview

8.7.3. Latin America Market Value Share Analysis, By Product Type

8.7.4. Latin America Market Forecast By Product Type

8.7.5. Latin America Market Value Share Analysis, By Technology

8.7.6. Latin America Market Forecast By Technology Type

8.7.7. Latin America Market Value Share Analysis, By Country

8.7.8. Latin America Market Forecast By Country

8.7.8.1. Brazil

8.7.8.2. Mexico

8.7.8.3. Rest of Latin America

8.7.9. Latin America Market Attractiveness Analysis

8.7.10. Market Trends

9. Competition Landscape

9.1. Automotive Refinish Market Share Analysis By Company

9.2. Akzo Nobel N.V

9.3. BASF SE

9.4. Axalta Coating Systems

9.5. Donglai Coating Technology

9.6. 3M

9.7. KANSAI PAINT CO.,LTD

9.8. PPG Industries

9.9. Nippon Paint Holdings Co. Ltd

9.10. The Valspar Corporation

9.11. The Sherwin-Williams Company.

10. Company Profiles

10.1. Akzo Nobel N.V

10.1.1. Company Description

10.1.2. Business Overview

10.1.3. SWOT Analysis

10.1.4. Financial Details

10.1.5. Strategic Overview

10.2. BASF SE

10.2.1. Company Description

10.2.2. Business Overview

10.2.3. SWOT Analysis

10.2.4. Financial Details

10.2.5. Strategic Overview

10.3. Axalta Coating Systems

10.3.1. Company Description

10.3.2. Business Overview

10.3.3. SWOT Analysis

10.3.4. Financial Details

10.3.5. Strategic Overview

10.4. Donglai Coating Technology

10.4.1. Company Description

10.4.2. Business Overview

10.5. 3M

10.5.1. Company Description

10.5.2. Business Overview

10.5.3. SWOT Analysis

10.5.4. Financial Details

10.5.5. Strategic Overview

10.6. KANSAI PAINT CO.,LTD

10.6.1. Company Description

10.6.2. Business Overview

10.6.3. SWOT Analysis

10.6.4. Financial Details

10.6.5. Strategic Overview

10.7. PPG Industries

10.7.1. Company Description

10.7.2. Business Overview

10.7.3. SWOT Analysis

10.7.4. Financial Details

10.7.5. Strategic Overview

10.8. Nippon Paint Holdings Co. Ltd

10.8.1. Company Description

10.8.2. Business Overview

10.9. The Valspar Corporation

10.9.1. Company Description

10.9.2. Business Overview

10.9.3. SWOT Analysis

10.9.4. Financial Details

10.9.5. Strategic Overview

10.10. The Sherwin-Williams Company.

10.10.1. Company Description

10.10.2. Business Overview

10.10.3. SWOT Analysis

10.10.4. Financial Details

10.10.5. Strategic Overview

11. Key Takeaways

List of Tables

Table 1: Global Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product Type, 2015–2024

Table 2: Global Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Technology, 2015–2024

Table 3: Global Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Region, 2015–2024

Table 4: Global Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Region Type, 2015–2024

Table 5: North America Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product Type, 2015–2024

Table 6: North America Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Technology Type, 2015–2024

Table 7: North America Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 8: Asia Pacific Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product Type, 2015–2024

Table 9: Asia Pacific Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Technology Type, 2015–2024

Table 10: Asia Pacific Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 11: Europe Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product Type, 2015–2024

Table 12: Europe Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Technology Type, 2015–2024

Table 13: Europe Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 14: Middle East & Africa Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product Type, 2015–2024

Table 15: Middle East & Africa Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Technology, 2015–2024

Table 16: Middle East & Africa Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 17: Latin America Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product Type, 2015–2024

Table 18: Latin America Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Technology, 2015–2024

Table 19: Latin America Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

List of Figures

Figure 1: Global Automotive Refinish Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 2: Global Automotive Refinish Coatings Average Price (US$/ Unit) 2015–2024

Figure 3: Global Automotive Refinish Market Value Share Analysis By Product Type, 2016 and 2024

Figure 4: Primer, 2015 – 2024 (US$ Mn) (Kilo Tons)

Figure 5: Base Coat, 2015 – 2024 (US$ Mn) (Kilo Tons)

Figure 6: Activator, 2015 – 2024 (US$ Mn) (Kilo Tons)

Figure 7: Filler, 2015 – 2024 (US$ Mn) (Kilo Tons)

Figure 8: Automotive Refinish Market Attractiveness Analysis By Product Type

Figure 9: Global Automotive Refinish Market Value Share Analysis By Technology Type, 2016 and 2024

Figure 10:Solvent borne Coatings, 2015 – 2024 (US$ Mn) (Kilo Tons)

Figure 11: Water borne coatings, 2015 – 2024 (US$ Mn) (Kilo Tons)

Figure 12: Others, 2015 – 2024 (US$ Mn) (Kilo Tons)

Figure 13: Automotive Refinish Market Attractiveness Analysis By Product Type

Figure 14: North America Automotive Refinish Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 15: North America Automotive Refinish Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 16: North America Market Attractiveness Analysis By Country

Figure 17: North America Market Value Share Analysis By Product Type, 2016 and 2024

Figure 18: North America Market Value Share Analysis By Technology Type, 2016 and 2024

Figure 19: North America Market Value Share Analysis By Country, 2016 and 2024

Figure 20: U.S. Automotive Refinish Market Analysis

Figure 21: Canada Automotive Refinish Market Analysis

Figure 22: Asia Pacific Automotive Refinish Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 23: Asia Pacific Automotive Refinish Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 24: Asia Pacific Market Attractiveness Analysis By Country

Figure 25: Asia Pacific Market Value Share Analysis By Product Type, 2016 and 2024

Figure 26: Asia Pacific Market Value Share Analysis By Technology Type, 2016 and 2024

Figure 27: Asia Pacific Market Value Share Analysis By Country, 2016 and 2024

Figure 28: China Automotive Refinish Coatings Analysis

Figure 29: Japan & Korea Automotive Refinish Coatings Analysis

Figure 30: India Automotive Refinish Coatings Analysis

Figure 31: ASEAN Automotive Refinish Coatings Analysis

Figure 32: Rest of Asia Pacific Automotive Refinish Coatings Analysis

Figure 33: Europe Automotive Refinish Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 34: Europe Automotive Refinish Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 35: Europe Market Attractiveness Analysis By Country

Figure 36: Europe Market Value Share Analysis By Product Type, 2016 and 2024

Figure 37: Europe Market Value Share Analysis By Technology Type, 2016 and 2024

Figure 38: Europe Market Value Share Analysis By Country, 2016 and 2024

Figure 39: Germany Automotive Refinish Market Analysis

Figure 40: France Automotive Refinish Market Analysis

Figure 41: U.K. Automotive Refinish Market Analysis

Figure 42: Italy Automotive Refinish Market Analysis

Figure 43: Spain Automotive Refinish Market Analysis

Figure 44: Rest of Europe Automotive Refinish Market Analysis

Figure 45: MEA Automotive Refinish Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 46: MEA Automotive Refinish Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 47: MEA Market Attractiveness Analysis By Country

Figure 48: MEA Market Value Share Analysis By Product Type, 2016 and 2024

Figure 49: MEA Market Value Share Analysis By Technology Type, 2016 and 2024

Figure 50: MEA Market Value Share Analysis By Country, 2016 and 2024

Figure 51: GCC Automotive Refinish Market Analysis

Figure 52: Egypt Automotive Refinish Market Analysis

Figure 53: South Africa Automotive Refinish Market Analysis

Figure 54: Rest of Middle East and Africa Automotive Refinish Market Analysis

Figure 55: Latin America Automotive Refinish Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 56: Latin America Automotive Refinish Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 57: Latin America Market Attractiveness Analysis By Country

Figure 58: Latin America Market Value Share Analysis By Product Type, 2016 and 2024

Figure 59: Latin America Market Value Share Analysis By Technology Type, 2016 and 2024

Figure 60: Latin America Market Value Share Analysis By Country, 2016 and 2024

Figure 61: Brazil Automotive Refinish Market Analysis

Figure 62: Mexico Automotive Refinish Market Analysis

Figure 63: Rest of Latin America Pacific Automotive Refinish Market Analysis

Figure 64: Global Automotive Refinish Market Share Analysis By Company (2015)