Analysts’ Viewpoint on Automotive Engine Management System Market Scenario

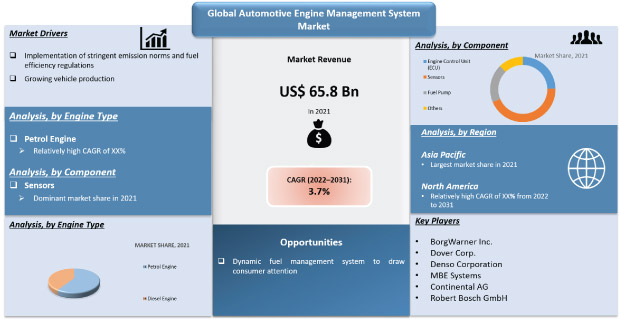

Companies in the automotive engine management system market are focusing on high-growth applications such as engine control unit (ECU), sensors, fuel pumps, and others to keep their businesses growing post the COVID-19 pandemic. As such, the market is estimated to witness a considerable growth rate (CAGR) of 3.7% during the forecast period, owing to its numerous factors. For instance, the demand for automotive engine management system is driven by the implementation of stringent emission norms, fuel efficiency regulations, and growing vehicle production around the globe. The rising demand for improved engine performance across all vehicle segments and developments in ECU, sensor, and lightweight components are expected to further boost the market. Manufacturers should tap into incremental opportunities in replacing the electronic control unit (ECU) due to increase in average life of vehicles, and to boost their revenue streams.

Engine management system has become a vital part of vehicle with increasing complexity in vehicles. It is a type of electronic control unit that controls the running of an engine by monitoring the engine speed and ensure optimal engine performance. It consisting of a wide range of electronic and electrical components such as sensors, relays, actuators, and an engine control unit. They work together to provide the engine management system with vital data parameters. These are essential for governing various engine functions effectively. Furthermore, modern-day engine technologies incorporate the engine management system. These include MPFi & GDi systems in petrol engines and CRDi systems in diesel engines for improved performance.

Request a sample to get extensive insights into the Automotive Engine Management System Market

The engine control unit (ECU) is a central part of the engine management system and also called as the brain of the engine. It used for collecting, analyzing, processing, and executing the data it receives from various other sub-systems. Furthermore, an ECU comprises a computer that uses a microchip to process the inputs from multiple engine sensors in real-time. All the engine sensors send data inputs through electrical signals to the ECU. In turn, the ECU controls various actuators, ignition timing, variable valve timing, etc.

Based on this data input, the electronic control unit (ECU) precisely calculates and delivers the ideal air-fuel mixture. It also regulates the engine idle speed and limits the top speed of a vehicle. This is also widely referred to as an electronic engine management system. Furthermore, it is possible to customize the modern day ECU’s to suit different types of vehicular applications and varying customer demands. Some cars also come with individual control module for all major systems.

Rise in demand for individual control module, which controls the respective systems in developed as well as developing countries is a key factor boosting the demand for passenger vehicles, light duty hybrid vehicles, etc. and therefore, the automotive engine management system market.

The rise in awareness of people regarding emission of CO2 and high pollution levels has driven manufacturers to develop more advanced vehicles with no emission of gases. Moreover, increasing levels of greenhouse gases and decreasing deposits of conventional fuel across the globe have forced government bodies in developed and underdeveloped countries to implement emission and fuel economy standards. The U.S. National Highway Traffic Safety Administration and Environmental Protection Agency mandated the greenhouse gas emission and Corporate Average Fuel Economy (CAFE) standards for passenger cars and light trucks, and established new less stringent standards, model years 2017 to 2025 in phase 2. The introduction of this mandate will further act as a major driver for the adoption of the engine control system technology.

Moreover, to meet these norms and standards, manufacturers have been working at developing improved and efficient engine management systems for automobiles. Major manufacturers/OEMs are involved in the R&D activities of advanced engine control management systems so that automobile can run on minimum fuel intake and exhaust emissions. This, in turn, is likely to propel the growth of the market during the forecast period.

Dynamic fuel management (DFM) system is an engine technology that shuts down the engine cylinder to optimize power delivery and efficiency. DFM is an improvement to active fuel management. It is a revolutionary system for internal combustion engines, as it enables the car to switch between the number of cylinders that it uses while driving. Moreover, dynamic fuel management system allows the engine to turn cylinders off when driving in situations that do not require full power, like cruising on the highway. Many consumers choose V-8 engines for driving performance or towing and hauling, but during every day driving, that powerful engine operates at a fraction of its capability, which reduces engine efficiency and results in less-than-optimal fuel economy.

For instance, General motors (GM) has announced $22 Mn investment to build V-8 DFM engines. Additionally, the 2021 Cadillac Escalade is equipped with DFM.

In terms of engine type, the global automotive engine management system market is bifurcated into petrol engine and diesel engine. The petrol engine segment held a major share of 58.12% in 2021, and will maintain the status quo with a growth rate of more than 4.12% during the forecast period. In addition, the implementation of Euro 6 and EPA Tier 3 norms have compelled OEMs to decrease the production of diesel powered passenger cars. Alternatively, the adoption of EV is facing challenges such as limited battery range and higher charging time. Owing to this, the gasoline (petrol) passenger cars is witnessing growth mainly in North America and Europe regions.

Moreover, similar trend can be seen in the Asia Pacific region due to upcoming regulations such as China 6a and 6b and India’s BS-VI. The market for gasoline (petrol) vehicle is expected grow at a prominent rate in the upcoming years and boost the market for automotive engine management systems for gasoline (petrol) vehicles.

In terms of component, the global automotive engine management system market is classified into engine control unit (ECU), sensors, fuel pump, and others. The sensors segment held a major share of 34.67% in 2021 and will maintain the status quo with a growth rate of more than 5.09% during the forecast period. The growing need for various types of sensors, including mass airflow sensor, engine speed sensor, oxygen sensor, knock sensor, thermocouple (temperature) sensor, position sensor, and coolant sensor, among others, is expected to propel the growth of the sensor segment. Moreover, the engine sensors are vital part of the engine management system because it provides data parameters in real-time. Furthermore, these engine sensors continuously monitor the engine parameters. They also provide the ECU with changes that occur in the data from time to time. Based on these inputs, the ECU re-calculates the correct air-fuel ratio. In addition, it re-calculates the ignition timing. Besides, it also calculates and supplies the proper amount of fuel to the engine under various load conditions. All these factors are likely to propel the growth of the segment during the forecast period.

Asia Pacific held the largest volume share of 38.89% in 2021 in the global automotive engine management system market. The upcoming emission norms in the Asia Pacific are the most prominent driving forces for the engine management system market. For instance, China implemented China 6a & 6b, India implemented BS VI norms in 2020. Moreover, at the same time, the demand for luxury cars has increased considerably. Thus, the market for engine management systems in the region is expected to grow significantly in the upcoming years.

North America and Europe together hold significant share of the automotive engine management system market globally. There is a trend of automotive customization in the regions that has driven the automotive engine management systems market significantly.

The South Africa region on account of stagnant sales, primarily in Brazil, is forecast to be the slowest growing market over the next five years.

The global automotive engine management system market is consolidated with a small number of manufacturers controlling majority of the market share. Firms are spending significant sums of money on comprehensive research and development, primarily to develop environment-friendly products. Expansion of product portfolios and mergers and acquisitions are the key strategies adopted by the key players. BorgWarner Inc., Continental AG, Dover Corp., Robert Bosch GmbH, Denso Corporation, MBE Systems, NGK Spark Plug, HELLA GmbH & Co. KGaA, Sensata Technologies, Infineon Technologies AG are the prominent entities operating in this market.

Each of these players has been profiled in the automotive engine management system market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Request a custom report on Automotive Engine Management System Market

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 65.8 Bn |

|

Market Forecast Value in 2031 |

US$ 95.4 Bn |

|

Growth Rate (CAGR) |

3.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The automotive engine management system market was valued at US$ 65.8 Bn in 2021

The automotive engine management system market is expected to grow with a CAGR of 3.79%, by 2031

The automotive engine management system market will value over US$ 95.4 Bn in 2031

Implementation of stringent emission norms, fuel efficiency regulations, and growing vehicle production are drivers of the automotive engine management system market

The passenger vehicle segment accounts for 40.24% market share

Asia Pacific is the most lucrative region in the global automotive engine management system market

The prominent players operating in the automotive engine management system market are: BorgWarner Inc., Continental AG, Dover Corp., Robert Bosch GmbH, Denso Corporation, MBE Systems, NGK Spark Plug, HELLA GmbH & Co. KGaA, Sensata Technologies, and Infineon Technologies AG

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunity

2.3. Market Factor Analysis

2.3.1. Porter’s Five Force Analysis

2.3.2. SWOT Analysis

2.3.3. Value Chain Analysis

2.3.3.1. Raw Material

2.3.3.2. Tier 2 Suppliers

2.3.3.3. Tier 1 Suppliers

2.3.3.4. End-users

2.4. Regulatory Scenario

2.5. Key Trend Analysis

3. COVID-19 Impact Analysis – Automotive Engine Management System Market

4. Global Automotive Engine Management System Market, By Component

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Component

4.2.1. Engine Control Unit (ECU)

4.2.2. Sensors

4.2.3. Fuel Pump

4.2.4. Others

5. Global Automotive Engine Management System Market, By Engine Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Engine Type

5.2.1. Petrol Engine

5.2.1.1. MPFi System

5.2.1.2. GDi System

5.2.2. Diesel Engine

5.2.2.1. CRDi System

6. Global Automotive Engine Management System Market, By Sensor Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Sensor Type

6.2.1. Oxygen Sensor

6.2.2. Temperature Sensor

6.2.3. Position Sensor

6.2.4. Knock Sensor

6.2.5. Others

7. Global Automotive Engine Management System Market, By Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

7.2.1. Two Wheelers

7.2.2. Passenger Vehicle

7.2.2.1. Hatchback

7.2.2.2. Sedan

7.2.2.3. Utility Vehicles

7.2.3. Light Commercial Vehicles

7.2.4. Trucks

7.2.5. Buses & Coaches

8. Global Automotive Engine Management System Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Automotive Engine Management System Market

9.1. Market Snapshot

9.2. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Component

9.2.1. Engine Control Unit (ECU)

9.2.2. Sensors

9.2.3. Fuel Pump

9.2.4. Others

9.3. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Engine Type

9.3.1. Petrol Engine

9.3.1.1. MPFi System

9.3.1.2. GDi System

9.3.2. Diesel Engine

9.3.2.1. CRDi System

9.4. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Sensor Type

9.4.1. Oxygen Sensor

9.4.2. Temperature Sensor

9.4.3. Position Sensor

9.4.4. Knock Sensor

9.4.5. Others

9.5. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

9.5.1. Two Wheelers

9.5.2. Passenger Vehicle

9.5.2.1. Hatchback

9.5.2.2. Sedan

9.5.2.3. Utility Vehicles

9.5.3. Light Commercial Vehicles

9.5.4. Trucks

9.5.5. Buses & Coaches

9.6. Key Country Analysis – North America Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Automotive Engine Management System Market

10.1. Market Snapshot

10.2. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Component

10.2.1. Engine Control Unit (ECU)

10.2.2. Sensors

10.2.3. Fuel Pump

10.2.4. Others

10.3. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Engine Type

10.3.1. Petrol Engine

10.3.1.1. MPFi System

10.3.1.2. GDi System

10.3.2. Diesel Engine

10.3.2.1. CRDi System

10.4. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Sensor Type

10.4.1. Oxygen Sensor

10.4.2. Temperature Sensor

10.4.3. Position Sensor

10.4.4. Knock Sensor

10.4.5. Others

10.5. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

10.5.1. Two Wheelers

10.5.2. Passenger Vehicle

10.5.2.1. Hatchback

10.5.2.2. Sedan

10.5.2.3. Utility Vehicles

10.5.3. Light Commercial Vehicles

10.5.4. Trucks

10.5.5. Buses & Coaches

10.6. Key Country Analysis – Europe Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Automotive Engine Management System Market

11.1. Market Snapshot

11.2. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Component

11.2.1. Engine Control Unit (ECU)

11.2.2. Sensors

11.2.3. Fuel Pump

11.2.4. Others

11.3. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Engine Type

11.3.1. Petrol Engine

11.3.1.1. MPFi System

11.3.1.2. GDi System

11.3.2. Diesel Engine

11.3.2.1. CRDi System

11.4. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Sensor Type

11.4.1. Oxygen Sensor

11.4.2. Temperature Sensor

11.4.3. Position Sensor

11.4.4. Knock Sensor

11.4.5. Others

11.5. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.5.1. Two Wheelers

11.5.2. Passenger Vehicle

11.5.2.1. Hatchback

11.5.2.2. Sedan

11.5.2.3. Utility Vehicles

11.5.3. Light Commercial Vehicles

11.5.4. Trucks

11.5.5. Buses & Coaches

11.6. Key Country Analysis – Asia Pacific Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Automotive Engine Management System Market

12.1. Market Snapshot

12.2. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Component

12.2.1. Engine Control Unit (ECU)

12.2.2. Sensors

12.2.3. Fuel Pump

12.2.4. Others

12.3. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Engine Type

12.3.1. Petrol Engine

12.3.1.1. MPFi System

12.3.1.2. GDi System

12.3.2. Diesel Engine

12.3.2.1. CRDi System

12.4. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Sensor Type

12.4.1. Oxygen Sensor

12.4.2. Temperature Sensor

12.4.3. Position Sensor

12.4.4. Knock Sensor

12.4.5. Others

12.5. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.5.1. Two Wheelers

12.5.2. Passenger Vehicle

12.5.2.1. Hatchback

12.5.2.2. Sedan

12.5.2.3. Utility Vehicles

12.5.3. Light Commercial Vehicles

12.5.4. Trucks

12.5.5. Buses & Coaches

12.6. Key Country Analysis – Middle East & Africa Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Automotive Engine Management System Market

13.1. Market Snapshot

13.2. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Component

13.2.1. Engine Control Unit (ECU)

13.2.2. Sensors

13.2.3. Fuel Pump

13.2.4. Others

13.3. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Engine Type

13.3.1. Petrol Engine

13.3.1.1. MPFi System

13.3.1.2. GDi System

13.3.2. Diesel Engine

13.3.2.1. CRDi System

13.4. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Sensor Type

13.4.1. Oxygen Sensor

13.4.2. Temperature Sensor

13.4.3. Position Sensor

13.4.4. Knock Sensor

13.4.5. Others

13.5. Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.5.1. Two Wheelers

13.5.2. Passenger Vehicle

13.5.2.1. Hatchback

13.5.2.2. Sedan

13.5.2.3. Utility Vehicles

13.5.3. Light Commercial Vehicles

13.5.4. Trucks

13.5.5. Buses & Coaches

13.6. Key Country Analysis – South America Automotive Engine Management System Market Size Analysis & Forecast, 2017-2031

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2020

14.2. Pricing comparison among key players

14.3. Company Analysis for each player

(Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

14.3.1. BorgWarner Inc.

14.3.1.1. Company Overview

14.3.1.2. Company Footprints

14.3.1.3. Production Locations

14.3.1.4. Product Portfolio

14.3.1.5. Competitors & Customers

14.3.1.6. Subsidiaries & Parent Organization

14.3.1.7. Recent Developments

14.3.1.8. Financial Analysis

14.3.1.9. Profitability

14.3.1.10. Revenue Share

14.3.2. Continental AG

14.3.2.1. Company Overview

14.3.2.2. Company Footprints

14.3.2.3. Production Locations

14.3.2.4. Product Portfolio

14.3.2.5. Competitors & Customers

14.3.2.6. Subsidiaries & Parent Organization

14.3.2.7. Recent Developments

14.3.2.8. Financial Analysis

14.3.2.9. Profitability

14.3.2.10. Revenue Share

14.3.3. Dover Corp.

14.3.3.1. Company Overview

14.3.3.2. Company Footprints

14.3.3.3. Production Locations

14.3.3.4. Product Portfolio

14.3.3.5. Competitors & Customers

14.3.3.6. Subsidiaries & Parent Organization

14.3.3.7. Recent Developments

14.3.3.8. Financial Analysis

14.3.3.9. Profitability

14.3.3.10. Revenue Share

14.3.4. Denso Corporation

14.3.4.1. Company Overview

14.3.4.2. Company Footprints

14.3.4.3. Production Locations

14.3.4.4. Product Portfolio

14.3.4.5. Competitors & Customers

14.3.4.6. Subsidiaries & Parent Organization

14.3.4.7. Recent Developments

14.3.4.8. Financial Analysis

14.3.4.9. Profitability

14.3.4.10. Revenue Share

14.3.5. Hitachi Automotive Systems, Ltd.

14.3.5.1. Company Overview

14.3.5.2. Company Footprints

14.3.5.3. Production Locations

14.3.5.4. Product Portfolio

14.3.5.5. Competitors & Customers

14.3.5.6. Subsidiaries & Parent Organization

14.3.5.7. Recent Developments

14.3.5.8. Financial Analysis

14.3.5.9. Profitability

14.3.5.10. Revenue Share

14.3.6. HELLA GmbH & Co. KGaA

14.3.6.1. Company Overview

14.3.6.2. Company Footprints

14.3.6.3. Production Locations

14.3.6.4. Product Portfolio

14.3.6.5. Competitors & Customers

14.3.6.6. Subsidiaries & Parent Organization

14.3.6.7. Recent Developments

14.3.6.8. Financial Analysis

14.3.6.9. Profitability

14.3.6.10. Revenue Share

14.3.7. Infineon Technologies AG

14.3.7.1. Company Overview

14.3.7.2. Company Footprints

14.3.7.3. Production Locations

14.3.7.4. Product Portfolio

14.3.7.5. Competitors & Customers

14.3.7.6. Subsidiaries & Parent Organization

14.3.7.7. Recent Developments

14.3.7.8. Financial Analysis

14.3.7.9. Profitability

14.3.7.10. Revenue Share

14.3.8. MBE Systems

14.3.8.1. Company Overview

14.3.8.2. Company Footprints

14.3.8.3. Production Locations

14.3.8.4. Product Portfolio

14.3.8.5. Competitors & Customers

14.3.8.6. Subsidiaries & Parent Organization

14.3.8.7. Recent Developments

14.3.8.8. Financial Analysis

14.3.8.9. Profitability

14.3.8.10. Revenue Share

14.3.9. NGK Spark Plug

14.3.9.1. Company Overview

14.3.9.2. Company Footprints

14.3.9.3. Production Locations

14.3.9.4. Product Portfolio

14.3.9.5. Competitors & Customers

14.3.9.6. Subsidiaries & Parent Organization

14.3.9.7. Recent Developments

14.3.9.8. Financial Analysis

14.3.9.9. Profitability

14.3.9.10. Revenue Share

14.3.10. Robert Bosch GmbH

14.3.10.1. Company Overview

14.3.10.2. Company Footprints

14.3.10.3. Production Locations

14.3.10.4. Product Portfolio

14.3.10.5. Competitors & Customers

14.3.10.6. Subsidiaries & Parent Organization

14.3.10.7. Recent Developments

14.3.10.8. Financial Analysis

14.3.10.9. Profitability

14.3.10.10. Revenue Share

14.3.11. Sensata Technologies

14.3.11.1. Company Overview

14.3.11.2. Company Footprints

14.3.11.3. Production Locations

14.3.11.4. Product Portfolio

14.3.11.5. Competitors & Customers

14.3.11.6. Subsidiaries & Parent Organization

14.3.11.7. Recent Developments

14.3.11.8. Financial Analysis

14.3.11.9. Profitability

14.3.11.10. Revenue Share

14.3.12. Other Key Players

14.3.12.1. Company Overview

14.3.12.2. Company Footprints

14.3.12.3. Production Locations

14.3.12.4. Product Portfolio

14.3.12.5. Competitors & Customers

14.3.12.6. Subsidiaries & Parent Organization

14.3.12.7. Recent Developments

14.3.12.8. Financial Analysis

14.3.12.9. Profitability

14.3.12.10. Revenue Share

List of Tables

Table 1: Global Automotive Engine Management System Market Volume (Units) Forecast, by Component, 2017-2031

Table 2: Global Automotive Engine Management System Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 3: Global Automotive Engine Management System Market Volume (Units) Forecast, by Engine Type, 2017-2031

Table 4: Global Automotive Engine Management System Market Value (US$ Mn) Forecast, by Engine Type, 2017‒2031

Table 5: Global Automotive Engine Management System Market Volume (Units) Forecast, by Sensor Type, 2017-2031

Table 6: Global Automotive Engine Management System Market Value (US$ Mn) Forecast, by Sensor Type, 2017‒2031

Table 7: Global Automotive Engine Management System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Automotive Engine Management System Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 9: Global Automotive Engine Management System Market Volume (Units) Forecast, by Region, 2017-2031

Table 10: Global Automotive Engine Management System Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 11: North America Automotive Engine Management System Market Volume (Units) Forecast, by Component, 2017-2031

Table 12: North America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 13: North America Automotive Engine Management System Market Volume (Units) Forecast, by Engine Type, 2017-2031

Table 14: North America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Engine Type, 2017‒2031

Table 15: North America Automotive Engine Management System Market Volume (Units) Forecast, by Sensor Type, 2017-2031

Table 16: North America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Sensor Type, 2017‒2031

Table 17: North America Automotive Engine Management System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 18: North America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 19: North America Automotive Engine Management System Market Volume (Units) Forecast, by Country, 2017-2031

Table 20: North America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 21: Europe Automotive Engine Management System Market Volume (Units) Forecast, by Component, 2017-2031

Table 22: Europe Automotive Engine Management System Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 23: Europe Automotive Engine Management System Market Volume (Units) Forecast, by Engine Type, 2017-2031

Table 24: Europe Automotive Engine Management System Market Value (US$ Mn) Forecast, by Engine Type, 2017‒2031

Table 25: Europe Automotive Engine Management System Market Volume (Units) Forecast, by Sensor Type, 2017-2031

Table 26: Europe Automotive Engine Management System Market Value (US$ Mn) Forecast, by Sensor Type, 2017‒2031

Table 27: Europe Automotive Engine Management System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 28: Europe Automotive Engine Management System Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 29: Europe Automotive Engine Management System Market Volume (Units) Forecast, by Country, 2017-2031

Table 30: Europe Automotive Engine Management System Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 31: Asia Pacific Automotive Engine Management System Market Volume (Units) Forecast, by Component, 2017-2031

Table 32: Asia Pacific Automotive Engine Management System Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 33: Asia Pacific Automotive Engine Management System Market Volume (Units) Forecast, by Engine Type, 2017-2031

Table 34: Asia Pacific Automotive Engine Management System Market Value (US$ Mn) Forecast, by Engine Type, 2017‒2031

Table 35: Asia Pacific Automotive Engine Management System Market Volume (Units) Forecast, by Sensor Type, 2017-2031

Table 36: Asia Pacific Automotive Engine Management System Market Value (US$ Mn) Forecast, by Sensor Type, 2017‒2031

Table 37: Asia Pacific Automotive Engine Management System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 38: Asia Pacific Automotive Engine Management System Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 39: Asia Pacific Automotive Engine Management System Market Volume (Units) Forecast, by Country, 2017-2031

Table 40: Asia Pacific Automotive Engine Management System Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 41: Middle East & Africa Automotive Engine Management System Market Volume (Units) Forecast, by Component, 2017-2031

Table 42: Middle East & Africa Automotive Engine Management System Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 43: Middle East & Africa Automotive Engine Management System Market Volume (Units) Forecast, by Engine Type, 2017-2031

Table 44: Middle East & Africa Automotive Engine Management System Market Value (US$ Mn) Forecast, by Engine Type, 2017‒2031

Table 45: Middle East & Africa Automotive Engine Management System Market Volume (Units) Forecast, by Sensor Type, 2017-2031

Table 46: Middle East & Africa Automotive Engine Management System Market Value (US$ Mn) Forecast, by Sensor Type, 2017‒2031

Table 47: Middle East & Africa Automotive Engine Management System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 48: Middle East & Africa Automotive Engine Management System Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 49: Middle East & Africa Automotive Engine Management System Market Volume (Units) Forecast, by Country, 2017-2031

Table 50: Middle East & Africa Automotive Engine Management System Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 51: South America Automotive Engine Management System Market Volume (Units) Forecast, by Component, 2017-2031

Table 52: South America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 53: South America Automotive Engine Management System Market Volume (Units) Forecast, by Engine Type, 2017-2031

Table 54: South America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Engine Type, 2017‒2031

Table 55: South America Automotive Engine Management System Market Volume (Units) Forecast, by Sensor Type, 2017-2031

Table 56: South America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Sensor Type, 2017‒2031

Table 57: South America Automotive Engine Management System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 58: South America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 59: South America Automotive Engine Management System Market Volume (Units) Forecast, by Country, 2017-2031

Table 60: South America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Engine Management System Market Volume (Units) Forecast, by Component, 2017-2031

Figure 2: Global Automotive Engine Management System Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 3: Global Automotive Engine Management System Market, Incremental Opportunity, by Component, Value (US$ Mn), 2021-2031

Figure 4: Global Automotive Engine Management System Market Volume (Units) Forecast, by Engine Type, 2017-2031

Figure 5: Global Automotive Engine Management System Market Value (US$ Mn) Forecast, by Engine Type, 2017-2031

Figure 6: Global Automotive Engine Management System Market, Incremental Opportunity, by Engine Type, Value (US$ Mn), 2021-2031

Figure 7: Global Automotive Engine Management System Market Volume (Units) Forecast, by Sensor Type, 2017-2031

Figure 8: Global Automotive Engine Management System Market Value (US$ Mn) Forecast, by Sensor Type, 2017-2031

Figure 9: Global Automotive Engine Management System Market, Incremental Opportunity, by Sensor Type, Value (US$ Mn), 2021-2031

Figure 10: Global Automotive Engine Management System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Automotive Engine Management System Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Automotive Engine Management System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 13: Global Automotive Engine Management System Market Volume (Units) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Engine Management System Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 15: Global Automotive Engine Management System Market, Incremental Opportunity, by Region, Value (US$ Mn), 2021-2031

Figure 16: North America Automotive Engine Management System Market Volume (Units) Forecast, by Component, 2017-2031

Figure 17: North America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 18: North America Automotive Engine Management System Market, Incremental Opportunity, by Component, Value (US$ Mn), 2021-2031

Figure 19: North America Automotive Engine Management System Market Volume (Units) Forecast, by Engine Type, 2017-2031

Figure 20: North America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Engine Type, 2017-2031

Figure 21: North America Automotive Engine Management System Market, Incremental Opportunity, by Engine Type, Value (US$ Mn), 2021-2031

Figure 22: North America Automotive Engine Management System Market Volume (Units) Forecast, by Sensor Type, 2017-2031

Figure 23: North America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Sensor Type, 2017-2031

Figure 24: North America Automotive Engine Management System Market, Incremental Opportunity, by Sensor Type, Value (US$ Mn), 2021-2031

Figure 25: North America Automotive Engine Management System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 26: North America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 27: North America Automotive Engine Management System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 28: North America Automotive Engine Management System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 29: North America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 30: North America Automotive Engine Management System Market, Incremental Opportunity, by Country, Value (US$ Mn), 2021-2031

Figure 31: Europe Automotive Engine Management System Market Volume (Units) Forecast, by Component, 2017-2031

Figure 32: Europe Automotive Engine Management System Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 33: Europe Automotive Engine Management System Market, Incremental Opportunity, by Component, Value (US$ Mn), 2021-2031

Figure 34: Europe Automotive Engine Management System Market Volume (Units) Forecast, by Engine Type, 2017-2031

Figure 35: Europe Automotive Engine Management System Market Value (US$ Mn) Forecast, by Engine Type, 2017-2031

Figure 36: Europe Automotive Engine Management System Market, Incremental Opportunity, by Engine Type, Value (US$ Mn), 2021-2031

Figure 37: Europe Automotive Engine Management System Market Volume (Units) Forecast, by Sensor Type, 2017-2031

Figure 38: Europe Automotive Engine Management System Market Value (US$ Mn) Forecast, by Sensor Type, 2017-2031

Figure 39: Europe Automotive Engine Management System Market, Incremental Opportunity, by Sensor Type, Value (US$ Mn), 2021-2031

Figure 40: Europe Automotive Engine Management System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 41: Europe Automotive Engine Management System Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 42: Europe Automotive Engine Management System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 43: Europe Automotive Engine Management System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 44: Europe Automotive Engine Management System Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 45: Europe Automotive Engine Management System Market, Incremental Opportunity, by Country, Value (US$ Mn), 2021-2031

Figure 46: Asia Pacific Automotive Engine Management System Market Volume (Units) Forecast, by Component, 2017-2031

Figure 47: Asia Pacific Automotive Engine Management System Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 48: Asia Pacific Automotive Engine Management System Market, Incremental Opportunity, by Component, Value (US$ Mn), 2021-2031

Figure 49: Asia Pacific Automotive Engine Management System Market Volume (Units) Forecast, by Engine Type, 2017-2031

Figure 50: Asia Pacific Automotive Engine Management System Market Value (US$ Mn) Forecast, by Engine Type, 2017-2031

Figure 51: Asia Pacific Automotive Engine Management System Market, Incremental Opportunity, by Engine Type, Value (US$ Mn), 2021-2031

Figure 52: Asia Pacific Automotive Engine Management System Market Volume (Units) Forecast, by Sensor Type, 2017-2031

Figure 53: Asia Pacific Automotive Engine Management System Market Value (US$ Mn) Forecast, by Sensor Type, 2017-2031

Figure 54: Asia Pacific Automotive Engine Management System Market, Incremental Opportunity, by Sensor Type, Value (US$ Mn), 2021-2031

Figure 55: Asia Pacific Automotive Engine Management System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 56: Asia Pacific Automotive Engine Management System Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 57: Asia Pacific Automotive Engine Management System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 58: Asia Pacific Automotive Engine Management System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific Automotive Engine Management System Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific Automotive Engine Management System Market, Incremental Opportunity, by Country, Value (US$ Mn), 2021-2031

Figure 61: Middle East & Africa Automotive Engine Management System Market Volume (Units) Forecast, by Component, 2017-2031

Figure 62: Middle East & Africa Automotive Engine Management System Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 63: Middle East & Africa Automotive Engine Management System Market, Incremental Opportunity, by Component, Value (US$ Mn), 2021-2031

Figure 64: Middle East & Africa Automotive Engine Management System Market Volume (Units) Forecast, by Engine Type, 2017-2031

Figure 65: Middle East & Africa Automotive Engine Management System Market Value (US$ Mn) Forecast, by Engine Type, 2017-2031

Figure 66: Middle East & Africa Automotive Engine Management System Market, Incremental Opportunity, by Engine Type, Value (US$ Mn), 2021-2031

Figure 67: Middle East & Africa Automotive Engine Management System Market Volume (Units) Forecast, by Sensor Type, 2017-2031

Figure 68: Middle East & Africa Automotive Engine Management System Market Value (US$ Mn) Forecast, by Sensor Type, 2017-2031

Figure 69: Middle East & Africa Automotive Engine Management System Market, Incremental Opportunity, by Sensor Type, Value (US$ Mn), 2021-2031

Figure 70: Middle East & Africa Automotive Engine Management System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 71: Middle East & Africa Automotive Engine Management System Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 72: Middle East & Africa Automotive Engine Management System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 73: Middle East & Africa Automotive Engine Management System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 74: Middle East & Africa Automotive Engine Management System Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 75: Middle East & Africa Automotive Engine Management System Market, Incremental Opportunity, by Country, Value (US$ Mn), 2021-2031

Figure 76: South America Automotive Engine Management System Market Volume (Units) Forecast, by Component, 2017-2031

Figure 77: South America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 78: South America Automotive Engine Management System Market, Incremental Opportunity, by Component, Value (US$ Mn), 2021-2031

Figure 79: South America Automotive Engine Management System Market Volume (Units) Forecast, by Engine Type, 2017-2031

Figure 80: South America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Engine Type, 2017-2031

Figure 81: South America Automotive Engine Management System Market, Incremental Opportunity, by Engine Type, Value (US$ Mn), 2021-2031

Figure 82: South America Automotive Engine Management System Market Volume (Units) Forecast, by Sensor Type, 2017-2031

Figure 83: South America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Sensor Type, 2017-2031

Figure 84: South America Automotive Engine Management System Market, Incremental Opportunity, by Sensor Type, Value (US$ Mn), 2021-2031

Figure 85: South America Automotive Engine Management System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 86: South America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 87: South America Automotive Engine Management System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 88: South America Automotive Engine Management System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 89: South America Automotive Engine Management System Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 90: South America Automotive Engine Management System Market, Incremental Opportunity, by Country, Value (US$ Mn), 2021-2031