Reports

Reports

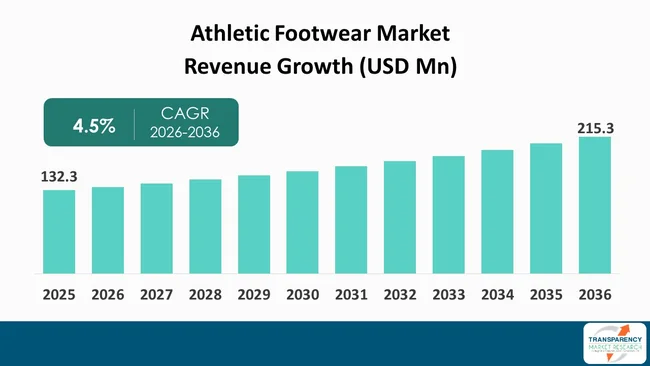

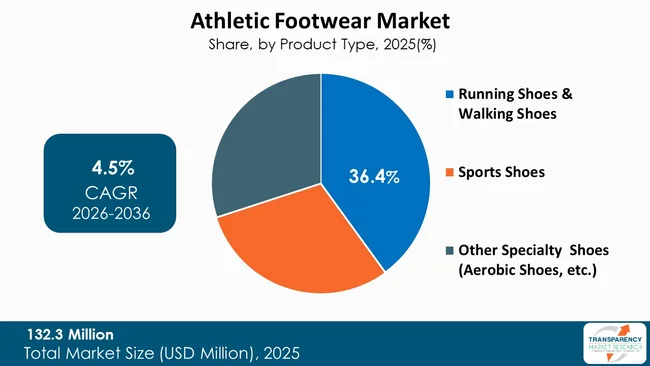

The global Athletic Footwear market size was valued at US$ 132.3 Mn in 2025 and is projected to reach US$ 215.3 Mn by 2036, expanding at a CAGR of 4.6% from 2026 to 2036. The market growth is driven by the growth of athleisure and casual wear and increasing sports participation and events.

The athletic footwear industry functions as an international market which develops and produces and sells shoes that enable people to participate in sports and fitness activities and maintain active lifestyles. The products use specialized design features that include cushioning systems, traction-enhancing outsoles, breathability, stability control, and impact absorption to deliver performance support, comfort, safety, and durability. Athletic footwear serves multiple purposes because people use it for both professional sports and organized training sessions and casual workouts and normal daily activities.

The market includes multiple product categories including running shoes, training and gym footwear and sport-specific shoes that people use for activities like football, basketball, and for the other purposes that combine functional performance with casual aesthetics.

The main product category for the business consists of running shoes and walking shoes that customers use for fitness activities, leisure time, and their daily routines. The Asia-Pacific region functions as the primary market due to its extensive customer population, its common use of sports, casual shoes, and its robust production capabilities in the area. The athletic footwear market features various products that are available worldwide and meet both performance requirements and the needs of customers who prefer lifestyle products.

The athletic footwear market refers to the global industry that designs, manufactures, distribute, and sells shoes that are purposefully created to assist people who engage in physical activities, sports and fitness training, and maintain active lifestyles. Athletic footwear develops performance advantages, comfort enhancements, safety improvements, and durability through its specialized design, ergonomic features, and new material technologies. These products generally include cushioning systems, traction-enhancing outsoles, breathability, stability control, and impact absorption systems that they use to achieve the performance needs of various sports and different usage environments.

The market offers various product categories that include running shoes, training and gym shoes, walking footwear, sports-specific shoes for football, basketball, tennis, cricket, and lifestyle athletic shoes that combine performance features with regular use. Professional athletes, recreational sports participants, fitness enthusiasts, and comfort-seeking consumers use athletic footwear.

The market operates across multiple price segments, distribution channels, and different regions while manufacturers maintain their dedication to innovation, sustainability efforts, and brand differentiation activities to meet changing consumer demands and market competition.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The athletic footwear market expands as athleisure and casual apparel have become popular among consumers who want to wear comfortable clothes that follow their new lifestyle habits and health priorities.

The World Health Organization (WHO) reports that 31% of adults worldwide do not engage in sufficient physical activity while governments worldwide focus on increasing outdoor and fitness activity participation until 2030. The statistics demonstrate that a significant segment of the population requires government and health organizations to promote physical activity through walking, light exercise, fitness training, and recreational sports activities.

Athleisure and casual wear footwear provide a solution that combines athletic performance components through its cushioned, flexible, and ergonomically designed footwear that remains suitable for everyday use. As people work to include more exercise into their regular activities instead of participating exclusively in organized sports, they require shoes that can be worn during both - casual and light workout activities.

People now choose to work from home or office according to their personal preferences. Consumers now choose to buy footwear that lets them walk comfortably and last for extended periods as they want practical solutions and comfortable walking experience. The design evolution of athletic shoes into minimalist and trendy fashion styles has led to their acceptance as daily wear footwear, which appeals to consumers who do not practice sports.

The fast growth of private label products, ready-to-eat meals, and portion-controlled packs in both - supermarkets and online grocery platforms leads to increased SKU complexity and more frequent product changes, which create a need for packaging machinery that can handle multiple packaging formats. The expansion of these channels creates a need for brands to establish scalable packaging systems as brands need to quickly adapt to consumer preferences and promotional activities.

The ongoing rise in sports participation together with increased physical activity levels that government data proves shows that these two factors drive athletic footwear market expansion as they create a larger group of active consumers who need these specialized performance shoes.

The latest Active Lives Adult Survey from Sport England provides official data showing that between November 2023 and November 2024 approximately 30 million people or 63.7% of adults in England achieved the Chief Medical Officers' guidelines, which require atleast 150 minutes of moderate-intensity physical activity per week. The current participation rate represents the highest participation rate ever recorded as it shows that more than 2.4 million active adults have joined since the beginning of the survey in 2016.

The athletic participation of people is evident through their active movements that include running, gym workouts, team sports, and various recreational activities that require special athletic shoes. The growth of active adult population leads to higher needs for footwear products, which deliver essential support, cushioning, traction, and durability needed for various physical activities. People who establish consistent exercise habits are more inclined to buy shoes that meet their needs for road running or gym cross-training or specific sports activities.

The active population growth together with increased participation from all age demographics results in a sustained requirement for athletic footwear that extends throughout the entire population. The public health initiatives together with the community sport programs create pathways for more people to engage in regular physical activity, which results in two benefits for the athletic footwear market: first-time purchases and ongoing product replacement or upgrade due to changing fitness patterns.

The global athletic footwear market shows running shoes and walking shoes as its leading product category as these two types of footwear make up for 36.4% of total market share. The primary reason for this market leadership exists as running and walking serve as basic physical activities that people of all ages and fitness levels can easily practice. The athletic market for running and walking shoes extends beyond sport-specific footwear as professional athletes, fitness enthusiasts, and casual consumers use them.

This segment maintains its market lead as it delivers products that meet common daily requirements. People now use running and walking shoes as everyday footwear as they serve as suitable options for work and travel and daily commuting. The product's multiple uses enable customers to buy fitness equipment that they can use for both - exercise and casual activities, which leads to higher sales than dedicated sports footwear.

The combination of running and walking activities results in continuous product damage that leads to customers needing to buy new items that provide comfort and cushioning and protection against injuries. The process establishes a reliable demand pattern which enables continuous income streams. Manufacturers develop new products for this product category because they need to create systems, which provide better cushioning and lightweight materials and breathable comfort and ergonomic design features, desired by consumers who want premium products.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia-Pacific accounts for an estimated 33.5% share of the global athletic footwear market, making it the dominant regional segment by value. The region's leadership results from its extensive population base which contains various groups and its ongoing urban development and growth of middle-class consumers who have increasing spending power. The athletic footwear industry experiences direct demand growth because people throughout Asia-Pacific are increasingly participating in sports and becoming more aware of fitness while adopting healthier lifestyles.

The company maintains its market dominance as it has built an extensive customer base. The Asia-Pacific region contains a substantial portion of the global youth population who participate in sports and gym activities and running and casual athletic wear. The demographic trend together with increasing health and wellness awareness has led more people to use athletic footwear for their everyday activities.

The region derives advantages from its robust manufacturing abilities and established footwear manufacturing systems which operate efficiently in countries like China and Vietnam and Indonesia and India. The company achieves its competitive edge through local production which allows them to offer products at lower prices and deliver items to customers more quickly while providing a complete range of products from budget-friendly to premium options. The area achieves better market access because of its local production capabilities which reduce its dependence on imported goods. The combined forces of expanding athleisure trends and international sports culture establish Asia-Pacific as the biggest athletic footwear market and its most important regional market.

The athletic footwear market presents an expanding business opportunity through the combination of smart features and performance tracking capabilities. The development of sensor technology together with improved connectivity options and advanced data analytics capabilities now enables the integration of various athletic shoe features. This includes step tracking and distance measurement and gait analysis and pressure mapping and impact monitoring

The current opportunity matches the increasing use of digital fitness ecosystems and mobile health applications. The smart athletic footwear system which provides users with tracking capabilities and goal-setting options and training customization features connects to both smartphones and cloud platforms.

The system enables recreational users to track their progress while serious athletes gain access to advanced performance analysis which includes information about their body movements and running performance and ways to avoid injuries.

Smart footwear provides market advantages through its ability to create unique products which businesses can sell at higher prices. Brands that integrate advanced technology into their footwear products can charge premium prices because their products deliver additional benefits through software updates and analytics dashboards and personalized recommendations.

The business model creates additional revenue opportunities which include app subscription services and coaching services and performance data insights. This convergence of footwear and technology and digital wellness creates a strategic market expansion opportunity through smart features and performance tracking capabilities.

Adidas AG, Anta Sports Products Limited, ASICS Corporation, Columbia Sportswear Company, Decathlon S.A., Fila Holdings Corp., Li-Ning Company Limited, Mizuno Corporation, New Balance Athletics, Inc., Nike, Inc., Puma SE, Skechers USA, Inc., Under Armour, Inc., VF Corporation, and Yonex Co., Ltd. are some of the leading companies operating in the global Athletic Footwear.

Each of these companies has been profiled in the athletic footwear market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | US$ 132.3 Mn |

| Market Forecast Value in 2036 | US$ 215.3 Mn |

| Growth Rate (CAGR 2026 to 2036) | 4.6% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2024 |

| Quantitative Units | US$ Mn for Value and Thousand Units for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global athletic footwear market was valued at US$ 132.3 Mn in 2025

The global athletic footwear industry is projected to reach at US$ 215.3 Mn by the end of 2036

Growth of athleisure and casual wear, automation & productivity improvement in food manufacturing are some of the driving factors for this market

The CAGR is anticipated to be 4.6% from 2026 to 2036

Adidas AG, Anta Sports Products Limited, ASICS Corporation, Columbia Sportswear Company, Decathlon S.A., Fila Holdings Corp., Li-Ning Company Limited, Mizuno Corporation, New Balance Athletics, Inc., Nike, Inc., Puma SE, Skechers USA, Inc., Under Armour, Inc., VF Corporation, Yonex Co., Ltd. and other key players.

Table 01: Global Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 02: Global Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 03: Global Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 04: Global Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 05: Global Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 06: Global Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 07: Global Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 08: Global Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 09: Global Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 10: Global Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 11: Global Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 12: Global Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 13: Global Athletic Footwear Market Value (US$ Mn) Projection, By Region 2021 to 2036

Table 14: Global Athletic Footwear Market Volume (Thousand Units) Projection, By Region 2021 to 2036

Table 15: North America Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 16: North America Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 17: North America Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 18: North America Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 19: North America Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 20: North America Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 21: North America Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 22: North America Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 23: North America Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 24: North America Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 25: North America Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 26: North America Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 27: North America Athletic Footwear Market Value (US$ Mn) Projection, By Country 2021 to 2036

Table 28: North America Athletic Footwear Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 29: U.S. Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 30: U.S. Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 31: U.S. Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 32: U.S. Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 33: U.S. Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 34: U.S. Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 35: U.S. Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 36: U.S. Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 37: U.S. Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 38: U.S. Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 39: U.S. Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 40: U.S. Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 41: Canada Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 42: Canada Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 43: Canada Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 44: Canada Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 45: Canada Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 46: Canada Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 47: Canada Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 48: Canada Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 49: Canada Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 50: Canada Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 51: Canada Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 52: Canada Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 53: Europe Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 54: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 55: Europe Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 56: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 57: Europe Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 58: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 59: Europe Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 60: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 61: Europe Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 62: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 63: Europe Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 64: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 65: Europe Athletic Footwear Market Value (US$ Mn) Projection, By Country 2021 to 2036

Table 66: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 67: U.K. Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 68: U.K. Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 69: U.K. Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 70: U.K. Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 71: U.K. Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 72: U.K. Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 73: U.K. Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 74: U.K. Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 75: U.K. Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 76: U.K. Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 77: U.K. Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 78: U.K. Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 79: Germany Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 80: Germany Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 81: Germany Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 82: Germany Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 83: Germany Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 84: Germany Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 85: Germany Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 86: Germany Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 87: Germany Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 88: Germany Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 89: Germany Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 90: Germany Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 91: France Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 92: France Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 93: France Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 94: France Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 95: France Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 96: France Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 97: France Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 98: France Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 99: France Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 100: France Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 101: France Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 102: France Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 103: Italy Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 104: Italy Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 105: Italy Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 106: Italy Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 107: Italy Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 108: Italy Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 109: Italy Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 110: Italy Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 111: Italy Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 112: Italy Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 113: Italy Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 114: Italy Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 115: Spain Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 116: Spain Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 117: Spain Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 118: Spain Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 119: Spain Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 120: Spain Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 121: Spain Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 122: Spain Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 123: Spain Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 124: Spain Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 125: Spain Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 126: Spain Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 127: The Netherlands Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 128: The Netherlands Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 129: The Netherlands Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 130: The Netherlands Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 131: The Netherlands Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 132: The Netherlands Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 133: The Netherlands Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 134: The Netherlands Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 135: The Netherlands Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 136: The Netherlands Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 137: The Netherlands Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 138: The Netherlands Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 139: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 140: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 141: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 142: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 143: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 144: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 145: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 146: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 147: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 148: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 149: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 150: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 151: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By Country 2021 to 2036

Table 152: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 153: China Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 154: China Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 155: China Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 156: China Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 157: China Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 158: China Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 159: China Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 160: China Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 161: China Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 162: China Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 163: China Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 164: China Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 165: India Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 166: India Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 167: India Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 168: India Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 169: India Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 170: India Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 171: India Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 172: India Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 173: India Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 174: India Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 175: India Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 176: India Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 177: Japan Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 178: Japan Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 179: Japan Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 180: Japan Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 181: Japan Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 182: Japan Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 183: Japan Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 184: Japan Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 185: Japan Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 186: Japan Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 187: Japan Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 188: Japan Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 189: Australia Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 190: Australia Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 191: Australia Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 192: Australia Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 193: Australia Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 194: Australia Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 195: Australia Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 196: Australia Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 197: Australia Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 198: Australia Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 199: Australia Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 200: Australia Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 201: South Korea Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 202: South Korea Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 203: South Korea Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 204: South Korea Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 205: South Korea Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 206: South Korea Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 207: South Korea Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 208: South Korea Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 209: South Korea Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 210: South Korea Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 211: South Korea Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 212: South Korea Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 213: ASEAN Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 214: ASEAN Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 215: ASEAN Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 216: ASEAN Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 217: ASEAN Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 218: ASEAN Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 219: ASEAN Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 220: ASEAN Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 221: ASEAN Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 222: ASEAN Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 223: ASEAN Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 224: ASEAN Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 225: Middle East & Africa Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 226: Middle East & Africa Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 227: Middle East & Africa Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 228: Middle East & Africa Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 229: Middle East & Africa Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 230: Middle East & Africa Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 231: Middle East & Africa Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 232: Middle East & Africa Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 233: Middle East & Africa Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 234: Middle East & Africa Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 235: Middle East & Africa Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 236: Middle East & Africa Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 237: Middle East & Africa Athletic Footwear Market Value (US$ Mn) Projection, By Country 2021 to 2036

Table 238: Middle East & Africa Athletic Footwear Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 239: GCC Countries Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 240: GCC Countries Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 241: GCC Countries Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 242: GCC Countries Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 243: GCC Countries Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 244: GCC Countries Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 245: GCC Countries Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 246: GCC Countries Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 247: GCC Countries Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 248: GCC Countries Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 249: GCC Countries Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 250: GCC Countries Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 251: South Africa Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 252: South Africa Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 253: South Africa Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 254: South Africa Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 255: South Africa Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 256: South Africa Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 257: South Africa Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 258: South Africa Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 259: South Africa Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 260: South Africa Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 261: South Africa Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 262: South Africa Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 263: Latin America Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 264: Latin America Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 265: Latin America Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 266: Latin America Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 267: Latin America Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 268: Latin America Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 269: Latin America Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 270: Latin America Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 271: Latin America Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 272: Latin America Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 273: Latin America Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 274: Latin America Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 275: Latin America Athletic Footwear Market Value (US$ Mn) Projection, By Country 2021 to 2036

Table 276: Latin America Athletic Footwear Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 277: Brazil Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 278: Brazil Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 279: Brazil Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 280: Brazil Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 281: Brazil Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 282: Brazil Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 283: Brazil Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 284: Brazil Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 285: Brazil Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 286: Brazil Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 287: Brazil Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 288: Brazil Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 289: Mexico Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 290: Mexico Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 291: Mexico Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 292: Mexico Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 293: Mexico Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 294: Mexico Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 295: Mexico Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 296: Mexico Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 297: Mexico Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 298: Mexico Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 299: Mexico Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 300: Mexico Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 301: Argentina Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Table 302: Argentina Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 303: Argentina Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Table 304: Argentina Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Table 305: Argentina Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Table 306: Argentina Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 307: Argentina Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Table 308: Argentina Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Table 309: Argentina Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Table 310: Argentina Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Table 311: Argentina Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 312: Argentina Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 01: Global Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 02: Global Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 03: Global Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 04: Global Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 05: Global Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 06: Global Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 07: Global Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 08: Global Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 09: Global Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 10: Global Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 11: Global Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 12: Global Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 13: Global Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 14: Global Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 15: Global Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 16: Global Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 17: Global Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 18: Global Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 19: Global Athletic Footwear Market Value (US$ Mn) Projection, By Region 2021 to 2036

Figure 20: Global Athletic Footwear Market Volume (Thousand Units) Projection, By Region 2021 to 2036

Figure 21: Global Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Region 2026 to 2036

Figure 22: North America Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 23: North America Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 24: North America Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 25: North America Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 26: North America Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 27: North America Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 28: North America Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 29: North America Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 30: North America Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 31: North America Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 32: North America Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 33: North America Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 34: North America Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 35: North America Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 36: North America Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 37: North America Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 38: North America Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 39: North America Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 40: North America Athletic Footwear Market Value (US$ Mn) Projection, By Country 2021 to 2036

Figure 41: North America Athletic Footwear Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 42: North America Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Country 2026 to 2036

Figure 43: U.S. Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 44: U.S. Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 45: U.S. Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 46: U.S. Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 47: U.S. Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 48: U.S. Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 49: U.S. Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 50: U.S. Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 51: U.S. Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 52: U.S. Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 53: U.S. Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 54: U.S. Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 55: U.S. Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 56: U.S. Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 57: U.S. Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 58: U.S. Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 59: U.S. Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 60: U.S. Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 61: Canada Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 62: Canada Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 63: Canada Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 64: Canada Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 65: Canada Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 66: Canada Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 67: Canada Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 68: Canada Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 69: Canada Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 70: Canada Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 71: Canada Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 72: Canada Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 73: Canada Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 74: Canada Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 75: Canada Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 76: Canada Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 77: Canada Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 78: Canada Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 79: Europe Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 80: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 81: Europe Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 82: Europe Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 83: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 84: Europe Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 85: Europe Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 86: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 87: Europe Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 88: Europe Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 89: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 90: Europe Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 91: Europe Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 92: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 93: Europe Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 94: Europe Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 95: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 96: Europe Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 97: Europe Athletic Footwear Market Value (US$ Mn) Projection, By Country 2021 to 2036

Figure 98: Europe Athletic Footwear Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 99: Europe Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Country 2026 to 2036

Figure 100: U.K. Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 101: U.K. Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 102: U.K. Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 103: U.K. Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 104: U.K. Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 105: U.K. Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 106: U.K. Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 107: U.K. Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 108: U.K. Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 109: U.K. Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 110: U.K. Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 111: U.K. Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 112: U.K. Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 113: U.K. Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 114: U.K. Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 115: U.K. Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 116: U.K. Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 117: U.K. Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 118: Germany Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 119: Germany Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 120: Germany Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 121: Germany Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 122: Germany Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 123: Germany Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 124: Germany Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 125: Germany Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 126: Germany Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 127: Germany Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 128: Germany Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 129: Germany Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 130: Germany Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 131: Germany Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 132: Germany Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 133: Germany Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 134: Germany Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 135: Germany Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 136: France Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 137: France Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 138: France Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 139: France Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 140: France Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 141: France Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 142: France Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 143: France Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 144: France Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 145: France Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 146: France Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 147: France Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 148: France Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 149: France Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 150: France Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 151: France Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 152: France Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 153: France Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 154: Italy Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 155: Italy Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 156: Italy Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 157: Italy Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 158: Italy Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 159: Italy Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 160: Italy Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 161: Italy Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 162: Italy Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 163: Italy Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 164: Italy Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 165: Italy Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 166: Italy Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 167: Italy Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 168: Italy Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 169: Italy Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 170: Italy Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 171: Italy Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 172: Spain Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 173: Spain Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 174: Spain Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 175: Spain Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 176: Spain Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 177: Spain Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 178: Spain Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 179: Spain Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 180: Spain Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 181: Spain Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 182: Spain Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 183: Spain Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 184: Spain Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 185: Spain Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 186: Spain Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 187: Spain Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 188: Spain Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 189: Spain Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 190: The Netherlands Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 191: The Netherlands Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 192: The Netherlands Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 193: The Netherlands Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 194: The Netherlands Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 195: The Netherlands Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 196: The Netherlands Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 197: The Netherlands Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 198: The Netherlands Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 199: The Netherlands Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 200: The Netherlands Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 201: The Netherlands Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 202: The Netherlands Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 203: The Netherlands Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 204: The Netherlands Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 205: The Netherlands Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 206: The Netherlands Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 207: The Netherlands Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 208: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 209: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 210: Asia Pacific Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 211: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 212: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 213: Asia Pacific Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 214: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 215: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 216: Asia Pacific Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 217: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 218: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 219: Asia Pacific Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 220: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 221: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 222: Asia Pacific Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 223: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 224: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 225: Asia Pacific Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 226: Asia Pacific Athletic Footwear Market Value (US$ Mn) Projection, By Country 2021 to 2036

Figure 227: Asia Pacific Athletic Footwear Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 228: Asia Pacific Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Country 2026 to 2036

Figure 229: China Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 230: China Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 231: China Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 232: China Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 233: China Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 234: China Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 235: China Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 236: China Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 237: China Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 238: China Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 239: China Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 240: China Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 241: China Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 242: China Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 243: China Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 244: China Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 245: China Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 246: China Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 247: India Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 248: India Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 249: India Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 250: India Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 251: India Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 252: India Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 253: India Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 254: India Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 255: India Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 256: India Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 257: India Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 258: India Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 259: India Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 260: India Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036

Figure 261: India Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By End-user 2026 to 2036

Figure 262: India Athletic Footwear Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 263: India Athletic Footwear Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 264: India Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036

Figure 265: Japan Athletic Footwear Market Value (US$ Mn) Projection, By Product Type 2021 to 2036

Figure 266: Japan Athletic Footwear Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 267: Japan Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2026 to 2036

Figure 268: Japan Athletic Footwear Market Value (US$ Mn) Projection, By Material 2021 to 2036

Figure 269: Japan Athletic Footwear Market Volume (Thousand Units) Projection, By Material 2021 to 2036

Figure 270: Japan Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Material 2026 to 2036

Figure 271: Japan Athletic Footwear Market Value (US$ Mn) Projection, By Price 2021 to 2036

Figure 272: Japan Athletic Footwear Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 273: Japan Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Price 2026 to 2036

Figure 274: Japan Athletic Footwear Market Value (US$ Mn) Projection, By Style 2021 to 2036

Figure 275: Japan Athletic Footwear Market Volume (Thousand Units) Projection, By Style 2021 to 2036

Figure 276: Japan Athletic Footwear Market Incremental Opportunities (US$ Mn) Forecast, By Style 2026 to 2036

Figure 277: Japan Athletic Footwear Market Value (US$ Mn) Projection, By End-user 2021 to 2036

Figure 278: Japan Athletic Footwear Market Volume (Thousand Units) Projection, By End-user 2021 to 2036