Reports

Reports

Sugar Confectionery Market: Snapshot

The sugar confectionery market in Asia Pacific and Latin America has been expanding at a robust pace over the past few years owing to the surging demand for confectionery foods, sweet snacks, and medicated confectioneries. The scenario in the sugar confectionery market in APAC and LATAM has been changing of late as consumers in the rural areas of both regions make the most of their rising disposable income and changing lifestyle. Manufacturers of sugar confectionery products are presented with various expansion opportunities given the limited presence of major players in the market.

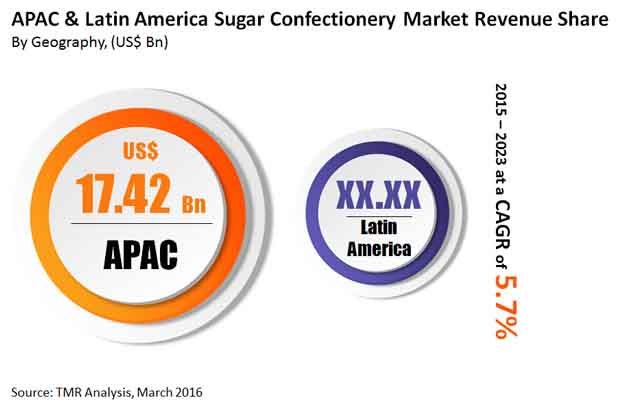

The opportunity in the Asia Pacific and Latin America sugar confectionery market was worth US$26.1 bn in 2014, which is expected to rise to US$46.1 bn by 2023 at a CAGR of 5.7%.

Dominance of Local Players in China Sugar Confectioneries Market

Asia Pacific, comprising China, Japan, South Korea, and others, accounted for more than 60% of the overall market in 2014 and this region is expected to witness steady growth during the forecast period. This can be attributed to the booming retail industry and the rise in disposable income. In addition, huge capital investments by major companies in emerging markets have resulted in the gradual decrease of the prices of sugar confectioneries. This reduction in price is predicted to fuel the demand for sugar confectionery products, especially in rural areas. There has also been a rising demand for premium confectionery products, a trend that is expected to boost the APAC market over the forecast period.

The sugar confectionery market in China is supported by the growing purchasing power of the consumers and the increasing use of confectionery as gifts on special occasions. Although international companies have a strong presence in China, particularly in high-end markets, domestic brands are more affordable and as a result remain popular in rural areas. The aging population, rising stress at work, and growing health consciousness have been influencing the trajectory of the Japanese sugar confectionery market at present.

The Latin America sugar confectionery market, comprising Brazil, Argentina, and the rest of Latin America, has been strongly supported by the growing sugarcane industry. The innovation in sugar confectioneries has also enhanced the market in this region. The consumption of candy, pastilles, gum, and nougat is expected to increase as alternatives to chocolate and this trend has been driving local players to invest significantly in the sugar confectionary market in Latin America.

Growth Opportunities in Medicated Sugar Confectioneries

Sugar confectionery comprises various products, such as boiled sweets, medicated confectionery, lollipops, mint, gums, pastilles, jellies and chews, and toffees, caramels and nougats. The toffees, caramels, and nougats segment was the key contributor to the Asia Pacific and Latin America sugar confectionery market and is likely to retain its lead throughout the forecast period. Medicated confectionery is widely used in the formulation of drugs for conditions such as cold, respiratory tract congestion, cough, and allergies. This segment is projected expand at the fastest pace by 2023 owing to its wide product range, especially in children’s medications.

Mondelez International, Nestle S.A., Lindt & Sprungli, Ferrero SpA, The Hershey Company, Mars Inc., Lotte Confectionery Co. Ltd., and Perfetti Van Mella SpA are the leading players in the sugar confectionery market.

Availability of Varieties of Flavor and Sweet Taste to Favor Sugar Confectionery Market

Sugar confectioneries refer to an extensive variety of products that use sugar as a primary ingredient, whether natural or artificial. Sugar confectioneries, also known as sweets, are eaten by people of all socio-economic levels and ages all over the world, which is likely to widen the scope of growth of the global sugar confectionery market in near future. These products come in a wide range of flavors, from individually packaged candies to elegant packaging for less costly items. Because of discrepancies in regulatory norms and other factors such as economy, variations in consumer preferences and tastes, the types of confectioneries eaten vary with regions.

Rapidly evolving technology, new product development, and ongoing research and activities in this industry are foreseen to trigger demand for new flavor profiles and ingredients. This factor is likely to spur demand for sugar confectionaries.

Increasing Importance of Sweets in Gifting to Widen Scope of its Application in the Market

The growing attraction of these sugar-filled treats amongst customers of all ages is attributed to their nice sweet taste and a variety of flavor. Besides, their organoleptic properties, which are regarded as key reasons for their widespread popularity and a major contributor to market development. In addition, there is a growing trend of giving confectionery products as gifts on special occasions including anniversaries, birthdays and festivals, which is further likely to work in favor of the global sugar confectionery market in near future.

To broaden their horizons and achieve a strategic edge in the market, the leading players are focusing heavily on social media marketing, advertisement promotions, and promotional events. In addition to that, these companies are putting in significant attempts to access markets of developing countries in order to take advantage of the attractive business prospects. The smaller traders, numerous malls, convenience stores, grocery stores, and department stores all contribute significantly to the expansion of the global sugar confectionery market.

Chapter 1 Preface

1.1 Report description

1.2 Research scope

1.3 Research methodology

Chapter 2 Executive Summary

Chapter 3 Market Overview

3.1 Introduction

3.2 Supply Chain analysis

3.3 Market Dynamics

3.3.1 Market Drivers

3.3.1.1 Growing Consumer Demand for Healthy Confectionery Product

3.7.1.2 Growing Young-Age Population Base, Drives the Sugar confectionery Market

3.7.1.3 Large Untapped Market for Penetration

3.3.2 Market Restraints

3.2.2.1 Health Issue

3.3.3 Market Opportunities

3.3.3.1 Market Opportunity in Medicated Confectionery Products

3.3.3.2 Untapped Sugar Confectionery Market in rural Area

3.4 Key Trend Analysis

3.5 Sugar Confectionery Market: Market Attractiveness Analysis

3.5.1 APAC Sugar Confectionery Market Attractiveness Analysis

3.5.1 Latin America Sugar confectionery Market Attractiveness Analysis

3.6 Sugar confectionery MArket : Competitive Landscape

3.6.1 APAC Sugar Confectionery Market : Company Market Share Analysis (2015)

3.6.2 Latin America Sugar confectionery MArket : Company Market Share Analysis (2015)

Chapter 4 APAC and Latin America Sugar Confectionery Market Revenue, by Type, 2015 – 2023 (USD Billion)

4.1 Introduction

4.2 APAC and Latin America Sugar Confectionery Market : By Type, Revenue Share 2014 v/s 2023

4.3 Boiled Sweet

4.3.1 Boiled Sweet Market Revenue and Forecast, 2014 – 2023 (USD Billion)

4.4 Lollipops

4.4.1 Lolipops Market Revenue and Forecast, 2014 – 2023 (USD Billion)

4.5 Medicated Confectionery

4.5.1 Medicated Confectionery Market Revenue and Forecast, 2014 – 2023 (USD Billion)

4.6 Pastilles, Gums, Jellies and Chews

4.6.1 Pastilles, Gums, Jellies and Chews Market Revenue and Forecast, 2014 – 2023 (USD Billion)

4.7 Toffees, Caramels and Nougat

4.7.1 Toffees, Caramels and Nougat Market Revenue and Forecast, 2014 – 2023 (USD Billion)

4.8 Others Confectionery

4.8.1O thers Confectionery Market Revenue and Forecast, 2014 – 2023 (USD Billion)

Chapter 5 Sugar Confectionery Market Revenue, by Geography, 2015 – 2023 (USD Billion)

5.1 Overview

5.2 APAC and Latin America Sugar Confectionery MArket : by Geography, Revenue Share 2014 v/s 2023

5.3 Asia Pacific

5.3.1 Asia Pacific Sugar Confectionery market by Country, 2014 – 2023: revenue forecast

5.3.2 Asia Pacific Sugar Confectionery market by Product Type, 2014 – 2023: revenue forecast

5.3.2.1 India Sugar Confectionery market, 2014 – 2023: revenue forecast

5.3.2.1 1India Sugar Confectionery market by Product Type, 2014 – 2023: revenue forecast

5.3.2.2 China Sugar Confectionery market, 2014 – 2023: revenue forecast

5.3.2.2.1 China Sugar Confectionery market by Product Type, 2014 – 2023: revenue forecast

5.3.2.3 Japan Sugar Confectionery market ,2014 – 2023: revenue forecast

5.3.2.3.1 Japan Sugar Confectionery market by Product Type, 2014 – 2023: revenue forecast

5.3.2.4 South Korea Sugar Confectionery market, 2014 – 2023: revenue forecast

5.3.2.4.1 South Korea Sugar Confectionery market by Product Type, 2014 – 2023: revenue forecast

5.3.2.5 Rest of APAC Sugar Confectionery market, 2014 – 2023: revenue forecast

5.3.2.5.1 Rest of APAC Sugar Confectionery market by Product Type, 2014 – 2023: revenue forecast

5.4 Latin America

5.4.1 Latin America Sugar Confectionery market by Country, 2014 – 2023: revenue forecast

5.4.2 Latin America Sugar Confectionery market by Product Type, 2014 – 2023: revenue forecast

5.4.2.1 Brazil Sugar Confectionery market, 2014 – 2023: revenue forecast

5.4.2.1.1 Brazil Sugar Confectionery market by Product Type, 2014 – 2023: revenue forecast

5.4.2.2 Argentina Sugar Confectionery market, 2014 – 2023: revenue forecast

5.4.2.2.1 Agentina Sugar Confectionery market by Product Type, 2014 – 2023: revenue forecast

5.4.2.3 Rest of Latin America Sugar Confectionery market ,2014 – 2023: revenue forecast

5.4.2.3.1 Rest of Latin America Sugar Confectionery market by Product Type, 2014 – 2023: revenue forecast

Chapter 6 Company Profiles

6.1 The Hershey Company

6.1.1 Company Details (HQ, Foundation Year, Employee Strength)

6.1.2 Market Presence, By Segment and Geography

6.1.3 Key Developments

6.1.4 Strategy and Historical Roadmap

6.1.5 Revenue and Operating Profits

6.2 Nestle S.A..

6.2.1 Company Details (HQ, Foundation Year, Employee Strength)

6.2.2 Market Presence, By Segment and Geography

6.2.3 Key Developments

6.2.4 Strategy and Historical Roadmap

6.2.5 Revenue and Operating Profits

6.3 Mondelez International

6.3.1 Company Details (HQ, Foundation Year, Employee Strength)

6.3.2 Market Presence, By Segment and Geography

6.3.3 Key Developments

6.3.4 Strategy and Historical Roadmap

6.3.5 Revenue and Operating Profits

6.4 Mars Inc.

6.4.1 Company Details (HQ, Foundation Year, Employee Strength)

6.4.2 Market Presence, By Segment and Geography

6.4.3 Key Developments

6.4.4 Strategy and Historical Roadmap

6.4.5 Revenue and Operating Profits

6.5 Ferrero SpA

6.5.1 Company Details (HQ, Foundation Year, Employee Strength)

6.5.2 Market Presence, By Segment and Geography

6.5.3 Key Developments

6.5.4 Strategy and Historical Roadmap

6.5 Revenue and Operating Profits

6.6 Lindt & Sprunli

6.6.1 Company Details (HQ, Foundation Year, Employee Strength)

6.6.2 Market Presence, By Segment and Geography

6.6.3 Key Developments

6.6.4 Strategy and Historical Roadmap

6.6.5 Revenue and Operating Profits

6.7 Lotte Confectionery

6.7.1 Company Details (HQ, Foundation Year, Employee Strength)

6.7.2 Market Presence, By Segment and Geography

6.7.3 Key Developments

6.7.4 Strategy and Historical Roadmap

6.7.5 Revenue and Operating Profits

6.8 Perfetti Van MElla SpA.

6.8.1 Company Details (HQ, Foundation Year, Employee Strength)

6.8.2 Market Presence, By Segment and Geography

6.8.3 Key Developments

6.8.4 Strategy and Historical Roadmap

6.8.5 Revenue and Operating Profits

List of Tables

TABLE 1 APAC and Latin America Sugar Confectionerys Market Snapshot (revenue), 2014 and 2023

TABLE 2 Asia Pacific Sugar Confectionerys market, 2014 – 2023, revenue forecast, by Country

TABLE 3 Asia Pacific Sugar Confectionerys market, 2014 – 2023, revenue forecast, by Product Type

TABLE 4 India Sugar Confectionerys market, 2014 – 2023, revenue forecast, by Product Type.

TABLE 5 China Sugar Confectionerys market, 2014 – 2023, revenue forecast, by Product Type.

TABLE 6 Japan Sugar Confectionerys market, 2014 – 2023, revenue forecast, by Product Type.

TABLE 7 South Korea Sugar Confectionerys market, 2014 – 2023, revenue forecast, by Product Type

TABLE 8 Rest of APAC Sugar Confectionerys market, 2014 – 2023, revenue forecast, by Product Type.

TABLE 9 Latin America Sugar Confectionerys market, 2014 – 2023, revenue forecast, by Country.

TABLE 10 Latin America Sugar Confectionerys market, 2014 – 2023, revenue forecast, by Product Type

TABLE 11 Brazil Sugar Confectionerys Market, 2014 – 2023, revenue forecast, by Product Type.

TABLE 12 Argentina Sugar Confectionerys Market, 2014 – 2023, revenue forecast, byProduct Type

TABLE 13 Rest of Latin America Sugar Confectionerys market, 2014 – 2023, revenue forecast, by Product Type

List of Figures

FIG. 1 Market segmentation: APAC and Latin America Sugar Confectionerys Market

FIG. 2 Supply chain analysis for APAC and Latin America Sugar Confectionerys market

FIG. 3 APAC Market Attractiveness Analysis, by Product Type, 2015

FIG. 4 Latin America Market Attractiveness Analysis, by Product Type, 2015

FIG. 5 APAC Market Share, by Key Sugar Confectionerys Vendors, 2015 (Value %)

FIG. 6 Latin America Market Share, by Key Sugar Confectionerys Vendors, 2015 (Value %)

FIG. 7 APAC and Latin America Sugar Confectionerys Market Revenue Share (%), By Product, 2014 vs 2023

FIG. 8 Boiled Sweet Market Revenue and Forecast, 2014 – 2023 (USD Billion)

FIG. 9 Lollipops Market Revenue and Forecast, 2014 – 2023 (USD Billion)

FIG. 10 Medicated Confectionery Market Revenue and Forecast, 2014 – 2023 (USD Billion)

FIG. 11 Mint Market Revenue and Forecast, 2014 – 2023 (USD Billion)

FIG. 12 Pastilles, Gums, Jellies and Chews Market Revenue and Forecast, 2014 – 2023 (USD Billion)

FIG. 13 Toffees, Caramels and Nougat Market Revenue and Forecast, 2014 – 2023 (USD Billion)

FIG. 14 Others Market Revenue and Forecast, 2014 – 2023 (USD Billion)

FIG. 15 APAC and Latin America Sugar Confectionerys market, by Gerography,2014 VS 2023

FIG. 16 Asia Pacific Sugar Confectionerys market , 2014 – 2023(USD Billion)

FIG. 17 India Sugar Confectionerys Market , 2014 – 2023: revenue forecast (USD Billion)

FIG. 18 China Sugar Confectionerys market, 2014 – 2023: Revenue forecast(USD Billion)

FIG. 19 Japan Sugar Confectionerys market, 2014 – 2023: Revenue forecast(USD Billion)

FIG. 20 South Korea Sugar Confectionerys market , 2014 – 2023(USD Billion)

FIG. 21 Rest of APAC Sugar Confectionerys Market , 2014 – 2023: revenue forecast (USD Billion)

FIG. 22 Latin America Sugar Confectionerys market, 2014 – 2023: Revenue forecast(USD Billion)

FIG. 23 Brazil Sugar Confectionerys market, 2014 – 2023: Revenue forecast(USD Billion)

FIG. 24 Argentina Sugar Confectionerys market, 2014 – 2023: Revenue forecast(USD Billion)

FIG. 25 Rest of Latin America Sugar Confectionerys market, 2014 – 2023: Revenue forecast(USD Billion)