Global Arak Market: Snapshot

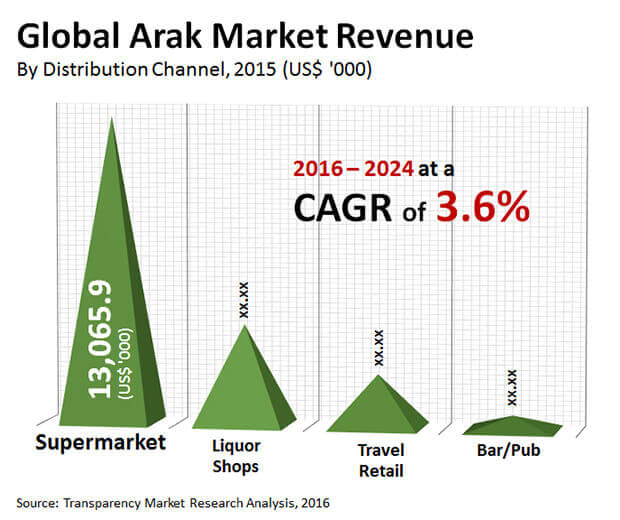

The global arak market has been growing at a steady pace due to its rising popularity amongst the younger generation. The report states that the global market is likely to benefit from the adoption of arak as a key ingredient in a variety of cocktails in the coming years. Additionally, increasing production of arak and efforts put in by producers to preserve the ethnic drink are also expected to benefit the global market. Owing to these reasons, the global arak market is expected to be worth US$27.6 mn by 2024 end from US$20.8 mn in 2016. Between the forecast years of 2016 and 2024, the global market is projected to rise at a CAGR of 3.6%.

The research report states that the rise of bars, pubs, restaurants, and gourmet joints are expected to boost the growth of the global arak market in the coming years. The introduction of new brands and revival of this traditional drink with brilliant marketing strategies is expected to play an important role in the development of the overall market. Analysts predict that changing lifestyles, increasing disposable incomes, and emerging hospitality industry in countries such as Lebanon, Syria, Israel, and Palestine is also expected to make a significant contribution to the soaring profits of the global arak market. The launch of types of arak such as delicate premium green, premium red classic, and premium black are also anticipated to lure in a new consumer base.

Volatile Political Climate Increases Cost of Arak

The biggest challenge in the global arak market is the volatile political situation in Syria, which has considerably raised the prices of raw materials required for manufacturing arak. Thus, the high production costs have rendered higher selling prices, thereby creating a negative impact on the sales. The poor licensing policies and lack of regulatory norms governing the production of arak have also hampered the profits of arak market as it has allowed the production of homemade and unlabeled arak. Collectively, these factors are expected to restrain the global market in the coming years.

In terms of the distribution channel, the global arak market is segmented into the supermarket, travel retail, liquor shop, and bar or pub. Analysts have high hopes from supermarkets to drive the sales of arak across the globe. The wide reach of supermarkets, ability to provide a broader range of products, and bulk storage are anticipated to work in favor of this segment. As of 2015, the supermarket segment was worth US$13.0 mn. The report concludes, that this distribution channel will continue to dominate the global market in the coming years.

Middle East to Remain Key Consumer of Arak

In terms of geography, the global arak market is segmented into North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America. The report indicates that the high demand for arak from the Middle Eastern countries is expected to keep this geographical segment at the forefront in the coming years. As of 2016, the Middle East and Africa held a share of 64.5% in the global market. Jordan, Syria, and Lebanon are expected to be the key consumers of arak in the near future.

The key players operating in the global arak market are Lebanese Arak Corporation, Abi Raad Group Sarl, Kawar Arak, Eagle Distilleries Co, Haddad Distilleries, Château Ksara, Lebanese Fine Wines Ltd., and Domaine des Tourelles. These players are expected to strengthen their partnerships to expand businesses. Furthermore, companies are also expected to focus on product innovation and launch of new flavors to appeal to the younger population in the coming years.

Arak Market to Gain Impetus from Increasing Preference for Plant-based Beverages Worldwide

The worldwide arak market has been developing at a consistent speed because of its rising notoriety among the more youthful age. The report expresses that the worldwide market is probably going to profit by the appropriation of arak as a vital fixing in an assortment of mixed drinks in the coming years. Moreover, expanding creation of arak and endeavors put in by makers to safeguard the ethnic beverage are additionally expected to profit the worldwide market.

The ascent in the quantity of bars, bars, cafés, and connoisseur joints are relied upon to help the development of the worldwide arak market in the coming years. The presentation of new brands and restoration of this customary beverage with splendid promoting methodologies is required to assume a significant part in the advancement of the general market. Investigators foresee that evolving ways of life, expanding expendable livelihoods, and arising cordiality industry in nations, for example, Lebanon, Syria, Israel, and Palestine is likewise expected to make a huge commitment to the taking off benefits of the worldwide arak market. The dispatch of kinds of arak like fragile premium green, premium red work of art, and premium dark are additionally expected to bait in another shopper base.

The worldwide arak market is essentially being driven by the consistently rising interest for arak among youthful grown-up populaces in creating and created locales. The broad fame of ethnic cocktails in various nations in the Middle East, for example, Lebanon, Jordan, Israel, Palestine, and Syria is a vital factor moving the interest for arak. The well-known interest for aniseed-seasoned spirits across the millennial age in these nations is reinforcing the utilization of arak in significant districts.

The rising utilization of arak as a colorful fixing in making great mixed drinks and their considerable interest in cafés in different nations of Middle East is relied upon to complement the development of the worldwide market. Exceptional endeavors by arak makers in the area to extend their creation limit lately are giving a powerful impulse to the development of the market. Moreover, considered as a piece of ethnic beverage, an expanding neighborliness industry in nations, for example, Lebanon is a critical factor offering a vigorous fillip to the interest for arak.

|

By Source Type |

|

|

By Distribution Channel |

|

|

Key Regions Covered |

|

1. Arak Market - Executive Summary

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Global Arak Market Analysis Scenario

3.1. Market Size and Forecast

3.1.1. Market Size and Y-o-Y Growth

3.1.2. Absolute $ Opportunity

3.2. Market Volume Analysis

3.2.1. Regional Production Outlook

3.2.2. Regional Consumption Outlook

4. Market Dynamics

4.1. Macro-economic Factors

4.2. Drivers

4.2.1. Supply Side

4.2.2. Demand Side

4.3. Restraints

4.4. Opportunity

4.5. Forecast Factors – Relevance and Impact

5. Global Arak Market Analysis, By Source

5.1. Introduction

5.1.1. Y-o-Y Growth Comparison, By Source

5.1.2. Basis Point Share (BPS) Analysis, By Source

5.2. Market Size and Forecast By Source

5.2.1. Obeidi or Merwah grapes

5.2.2. Anise seed

5.3. Market Attractiveness Analysis, By Source

5.4. Prominent Trends

6. Global Arak Market Analysis, By Distribution Channel

6.1. Introduction

6.1.1. Y-o-Y Growth Comparison, By Distribution Channel

6.1.2. Basis Point Share (BPS) Analysis, By Distribution Channel

6.2. Market Size and Forecast By Distribution Channel

6.2.1. Liquor Shops

6.2.2. Bar/Pub

6.2.3. Travel Retail

6.2.4. Supermarkets

6.3. Market Attractiveness Analysis, By Distribution Channel

6.4. Prominent Trends

7. Global Arak Market Analysis and Forecast, By Region

7.1. Introduction

7.1.1. Basis Point Share (BPS) Analysis By Region

7.1.2. Y-o-Y Growth Projections By Region

7.2. Market Size and Forecast By Region

7.2.1. North America

7.2.2. Latin America

7.2.3. Europe

7.2.4. APAC

7.2.5. Middle East & Africa

7.3. Market Attractiveness Analysis By Region

8. North America Arak Market Analysis and Forecast

8.1. Introduction

8.1.1. Basis Point Share (BPS) Analysis By Country

8.1.2. Y-o-Y Growth Projections By Country

8.2. Market Size and Forecast By Country

8.2.1. U.S.

8.2.2. Canada

8.3. Market Size and Forecast By Source

8.3.1. Obeidi or Merwah grapes

8.3.2. Anise seed

8.4. Market Size and Forecast By Distribution Channel

8.4.1. Liquor Shops

8.4.2. Bar/Pub

8.4.3. Travel Retail

8.4.4. Supermarkets

8.5. Market Attractiveness Analysis

8.5.1. By Country

8.5.2. By Source

8.5.3. By Distribution Channel

9. Latin America Arak Market Analysis and Forecast

9.1. Introduction

9.1.1. Basis Point Share (BPS) Analysis By Country

9.1.2. Y-o-Y Growth Projections By Country

9.2. Market Size and Forecast By Country

9.2.1. Brazil

9.2.2. Mexico

9.2.3. Rest of Latin America

9.3. Market Size and Forecast By Source

9.3.1. Obeidi or Merwah grapes

9.3.2. Anise seed

9.4. Market Size and Forecast By Distribution Channel

9.4.1. Liquor Shops

9.4.2. Bar/Pub

9.4.3. Travel Retail

9.4.4. Supermarkets

9.5. Market Attractiveness Analysis

9.5.1. By Country

9.5.2. By Source

9.5.3. By Distribution Channel

10. Europe Arak Market Analysis and Forecast

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis By Country

10.1.2. Y-o-Y Growth Projections By Country

10.2. Market Size and Forecast By Country

10.2.1. Germany

10.2.2. France

10.2.3. Italy

10.2.4. Spain

10.2.5. U.K.

10.2.6. Nordic

10.2.7. Russia

10.2.8. Poland

10.2.9. BENELUX

10.2.10. Rest of Europe

10.3. Market Size and Forecast By Source

10.3.1. Obeidi or Merwah grapes

10.3.2. Anise seed

10.4. Market Size and Forecast By Distribution Channel

10.4.1. Liquor Shops

10.4.2. Bar/Pub

10.4.3. Travel Retail

10.4.4. Supermarkets

10.5. Market Attractiveness Analysis

10.5.1. By Country

10.5.2. By Source

10.5.3. By Distribution Channel

11. APAC Arak Market Analysis and Forecast

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis By Country

11.1.2. Y-o-Y Growth Projections By Country

11.2. Market Size and Forecast By Country

11.2.1. China

11.2.2. India

11.2.3. Japan

11.2.4. ASEAN

11.2.5. Australia & New Zealand

11.2.6. Rest of APAC

11.3. Market Size and Forecast By Source

11.3.1. Obeidi or Merwah grapes

11.3.2. Anise seed

11.4. Market Size and Forecast By Distribution Channel

11.4.1. Liquor Shops

11.4.2. Bar/Pub

11.4.3. Travel Retail

11.4.4. Supermarkets

11.5. Market Attractiveness Analysis

11.5.1. By Country

11.5.2. By Source

11.5.3. By Distribution Channel

12. Middle East & Africa Arak Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.2. Market Size and Forecast By Country

12.2.1. GCC

12.2.2. Lebanon

12.2.3. Syria

12.2.4. Africa

12.2.5. Rest of MEA

12.3. Market Size and Forecast By Source

12.3.1. Obeidi or Merwah grapes

12.3.2. Anise seed

12.4. Market Size and Forecast By Distribution Channel

12.4.1. Liquor Shops

12.4.2. Bar/Pub

12.4.3. Travel Retail

12.4.4. Supermarkets

12.5. Market Attractiveness Analysis

12.5.1. By Country

12.5.2. By Source

12.5.3. By Distribution Channel

13. Competition Landscape

13.1. Competition Dashboard

13.2. Company Profiles

13.2.1. Abi Raad Group Sarl

13.2.1.1. Overview

13.2.1.2. Financials

13.2.1.3. Products

13.2.1.4. Strategy

13.2.1.5. Recent Developments

13.2.2. Kawar Arak

13.2.2.1. Overview

13.2.2.2. Financials

13.2.2.3. Products

13.2.2.4. Strategy

13.2.2.5. Recent Developments

13.2.3. Lebanese Fine Wines

13.2.3.1. Overview

13.2.3.2. Financials

13.2.3.3. Products

13.2.3.4. Strategy

13.2.3.5. Recent Developments

13.2.4. Haddad Distilleries

13.2.4.1. Overview

13.2.4.2. Financials

13.2.4.3. Products

13.2.4.4. Strategy

13.2.4.5. Recent Developments

13.2.5. Eagle Distilleries Co

13.2.5.1. Overview

13.2.5.2. Financials

13.2.5.3. Products

13.2.5.4. Strategy

13.2.5.5. Recent Developments

13.2.6. Chateau Ksara

13.2.6.1. Overview

13.2.6.2. Financials

13.2.6.3. Products

13.2.6.4. Strategy

13.2.6.5. Recent Developments

13.2.7. Lebanese Arak Corporation

13.2.7.1. Overview

13.2.7.2. Financials

13.2.7.3. Products

13.2.7.4. Strategy

13.2.7.5. Recent Developments

13.2.8. Domaine des Tourelles

13.2.8.1. Overview

13.2.8.2. Financials

13.2.8.3. Products

13.2.8.4. Strategy

13.2.8.5. Recent Developments

14. Assumptions and Acronyms used

15. Research Methodology

List of Tables

Table 1: Global Arak Market Value Forecast (US$ '000), by Source, 2016-2024

Table 2: Global Arak Market Value Forecast (US$ '000), by Distribution Channel, 2016-2024

Table 3: Global Arak Market Value Forecast (US$ '000), by Region, 2016-2024

Table 4: North America Arak Market Value Forecast (US$ '000), by Country, 2016-2024

Table 5: North America Arak Market Value Forecast (US$ '000), by Source, 2016-2024

Table 6: North America Arak Market Value Forecast (US$ '000), by Distribution Channel, 2016-2024

Table 7: Latin America Arak Market Value Forecast (US$ '000), by Country, 2016-2024

Table 8: Latin America Arak Market Value Forecast (US$ '000), by Source, 2016-2024

Table 9: Latin America Arak Market Value Forecast (US$ '000), by Distribution Channel, 2016-2024

Table 10: Europe Arak Market Value Forecast (US$ '000), by Country, 2016-2024

Table 11: Europe Arak Market Value Forecast (US$ '000), by Source, 2016-2024

Table 12: Europe Arak Market Value Forecast (US$ '000), by Distribution Channel, 2016-2024

Table 13: APAC Arak Market Value Forecast (US$ '000), by Country, 2016-2024

Table 14: APAC Arak Market Value Forecast (US$ '000), by Source, 2016-2024

Table 15: APAC Arak Market Value Forecast (US$ '000), by Distribution Channel, 2016-2024

Table 16: MEA Arak Market Value Forecast (US$ '000), by Country, 2016-2024

Table 17: MEA Arak Market Value Forecast (US$ '000), by Source, 2016-2024

Table 18: MEA Arak Market Value Forecast (US$ '000), by Distribution Channel, 2016-2024

List of Figures

Figure 1 : Global Arak Market Value Forecast (US$ '000) 2015–2024

Figure 2 : Global Arak Market Absolute $ Opportunity (US$ '000), 2015—2024

Figure 3: Global Arak Market Y-o-Y Growth (%) by Source, 2016–2024

Figure 4: Global Arak Market Value (US$ '000) Share and BPS Analysis, by Source, 2016 & 2024

Figure 5: Global Arak Market Value (US$ '000), by Obeidi or Merwah Grapes Segment, 2015–2024

Figure 6: Global Arak Market Absolute $ Opportunity (US$ '000), by Obeidi or Merwah Grapes Segment, 2015–2024

Figure 7: Global Arak Market Value (US$ '000), by Anise Seeds Segment, 2015–2024

Figure 8: Global Arak Market Absolute $ Opportunity (US$ '000), by Anise Seeds Segment, 2015–2024

Figure 9: Global Arak Market Attractiveness Analysis, by Source, 2016–2024

Figure 10: Global Arak Market Y-o-Y Growth (%) by Distribution Channel, 2016–2024

Figure 11: Global Arak Market Value (US$ '000) Share and BPS Analysis, by Distribution Channel, 2016 & 2024

Figure 12: Global Arak Market Value (US$ '000), by Supermarket Segment, 2015–2024

Figure 13: Global Arak Market Absolute $ Opportunity (US$ '000), by Supermarket Segment, 2015–2024

Figure 14: Global Arak Market Value (US$ '000), by Liquor Shops Segment, 2015–2024

Figure 15: Global Arak Market Absolute $ Opportunity (US$ '000), by Liquor Shops Segment, 2015–2024

Figure 16: Global Arak Market Value (US$ '000), by Travel Retail Segment, 2015–2024

Figure 17: Global Arak Market Absolute $ Opportunity (US$ '000), by Travel Retail Segment, 2015–2024

Figure 18: Global Arak Market Value (US$ '000), by Bar/Pub Segment, 2015–2024

Figure 19: Global Arak Market Absolute $ Opportunity (US$ '000), by Bar/Pub Segment, 2015–2024

Figure 20: Global Arak Market Attractiveness Analysis, by Distribution Channel, 2016–2024

Figure 21: Global Arak Market Y-o-Y Growth, by Region, 2015–2024

Figure 22: Global Arak Market Value (US$ '000) Share and BPS Analysis, by Region, 2015 & 2024

Figure 23: Global Arak Market Attractiveness Analysis, by Region, 2016–2024

Figure 24: North America Arak Market Value Forecast (US$ '000) 2015–2024

Figure 25: North America Arak Market Absolute $ Opportunity (US$ '000), 2015—2024

Figure 26: North America Arak Market Y-o-Y Growth (%) by Source, 2016–2024

Figure 27: North America Arak Market Value (US$ '000) Share and BPS Analysis, by Source, 2016 & 2024

Figure 28: U.S. Arak Market Value (US$ '000), 2015–2024

Figure 29: U.S. Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 30: Canada Arak Market Value (US$ '000), 2015–2024

Figure 31: Canada Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 32: North America Arak Market Attractiveness Analysis, by Source, 2016–2024

Figure 33: North America Arak Market Attractiveness Analysis, by Distribution Channel, 2016–2024

Figure 34: North America Arak Market Attractiveness Analysis, by Country, 2016–2024

Figure 35: Latin America Arak Market Value Forecast (US$ '000) 2015–2024

Figure 36: Latin America Arak Market Absolute $ Opportunity (US$ '000), 2015—2024

Figure 37: Latin America Arak Market Y-o-Y Growth (%) by Source, 2016–2024

Figure 38: Latin America Arak Market Value (US$ '000) Share and BPS Analysis, by Source, 2016 & 2024

Figure 39: Brazil Arak Market Value (US$ '000), 2015–2024

Figure 40: Brazil Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 41: Mexico Arak Market Value (US$ '000), 2015–2024

Figure 42: Mexico Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 43: Rest of Latin America Arak Market Value (US$ '000), 2015–2024

Figure 44: Rest of Latin America Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 45: Latin America Arak Market Attractiveness Analysis, by Source, 2016–2024

Figure 46: Latin America Arak Market Attractiveness Analysis, by Distribution Channel, 2016–2024

Figure 47: Latin America Arak Market Attractiveness Analysis, by Country, 2016–2024

Figure 48: Europe Arak Market Value Forecast (US$ '000) 2015–2024

Figure 49: Europe Arak Market Absolute $ Opportunity (US$ '000), 2015—2024

Figure 50: Europe Arak Market Y-o-Y Growth (%) by Source, 2016–2024

Figure 51: Europe Arak Market Value (US$ '000) Share and BPS Analysis, by Source, 2016 & 2024

Figure 52: Germany Arak Market Value (US$ '000), 2015–2024

Figure 53: Germany Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 54: France Arak Market Value (US$ '000), 2015–2024

Figure 55: France Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 56: Italy Arak Market Value (US$ '000), 2015–2024

Figure 57: Italy Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 58: Spain Arak Market Value (US$ '000), 2015–2024

Figure 59: Spain Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 60: U.K. Arak Market Value (US$ '000), 2015–2024

Figure 61: U.K. Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 62: Nordic Arak Market Value (US$ '000), 2015–2024

Figure 63: Nordic Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 64: Russia Arak Market Value (US$ '000), 2015–2024

Figure 65: Russia Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 66: Poland Arak Market Value (US$ '000), 2015–2024

Figure 67: Poland Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 68: BENELUX Arak Market Value (US$ '000), 2015–2024

Figure 69: BENELUX Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 70: Rest of Europe Arak Market Value (US$ '000), 2015–2024

Figure 71: Rest of Europe Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 72: Europe Arak Market Attractiveness Analysis, by Source, 2016–2024

Figure 73: Europe Arak Market Attractiveness Analysis, by Distribution Channel, 2016–2024

Figure 74: Europe Arak Market Attractiveness Analysis, by Country, 2016–2024

Figure 75: APAC Arak Market Value Forecast (US$ '000) 2015–2024

Figure 76: APAC Arak Market Absolute $ Opportunity (US$ '000), 2015—2024

Figure 77: APAC Arak Market Y-o-Y Growth (%) by Source, 2016–2024

Figure 78: APAC Arak Market Value (US$ '000) Share and BPS Analysis, by Source, 2016 & 2024

Figure 79: China Arak Market Value (US$ '000), 2015–2024

Figure 80: China Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 81: India Arak Market Value (US$ '000), 2015–2024

Figure 82: India Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 83: Japan Arak Market Value (US$ '000), 2015–2024

Figure 84: Japan Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 85: ASEAN Arak Market Value (US$ '000), 2015–2024

Figure 86: ASEAN Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 87: Australia & New Zealand Arak Market Value (US$ '000), 2015–2024

Figure 88: Australia & New Zealand Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 89: Rest of APAC Arak Market Value (US$ '000), 2015–2024

Figure 90: Rest of APAC Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 91: APAC Arak Market Attractiveness Analysis, by Source, 2016–2024

Figure 92: APAC Arak Market Attractiveness Analysis, by Distribution Channel, 2016–2024

Figure 93: APAC Arak Market Attractiveness Analysis, by Country, 2016–2024

Figure 94: MEA Arak Market Value Forecast (US$ '000) 2015–2024

Figure 95: MEA Arak Market Absolute $ Opportunity (US$ '000), 2015—2024

Figure 96: MEA Arak Market Y-o-Y Growth (%) by Source, 2016–2024

Figure 97: MEA Arak Market Value (US$ '000) Share and BPS Analysis, by Source, 2016 & 2024

Figure 98: GCC Arak Market Value (US$ '000), 2015–2024

Figure 99: GCC Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 100: Lebanon Arak Market Value (US$ '000), 2015–2024

Figure 101: Lebanon Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 102: Syria Arak Market Value (US$ '000), 2015–2024

Figure 103: Syria Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 104: Africa Arak Market Value (US$ '000), 2015–2024

Figure 105: Africa Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 106: Rest of MEA Arak Market Value (US$ '000), 2015–2024

Figure 107: Rest of MEA Arak Market Absolute $ Opportunity (US$ '000), 2015–2024

Figure 108: MEA Arak Market Attractiveness Analysis, by Source, 2016–2024

Figure 109: MEA Arak Market Attractiveness Analysis, by Distribution Channel, 2016–2024

Figure 110: MEA Arak Market Attractiveness Analysis, by Country, 2016–2024