The urging need for innovative solutions in food production has led the widespread penetration of precision farming concepts, which rely on technologies such as drones, IoT connectivity, and autonomous tractors. A sister industry that is equally imperative for the global food security and less permeated by technological advances is ‘aquaculture’. However, recent surge in the popularity and acceptance of data-driven management platforms, which integrate data from myriad sources into unified cloud platform, and encapsulate complete dynamics of the aquaculture farm environment in real time, will favor growth of the aquaculture market.

TMR’s research finds that the aquaculture market was valued at over US$ 750 Mn in 2018, and is estimated to record a 2.4% Y-o-Y growth in 2019. Aquaculture remains a profitable business for not only combating the global food demand, but also helping rehabilitate the oceans. Leading operators in the aquaculture market continue to leverage the viability of three key areas, namely, seaweed & bivalve aquaculture systems, offshore aquaculture systems, and on-land aquaculture systems. The study opines that the fish industry will witness a radical transformation in the foreseeable future; and with the depletion in ocean’s fisheries vis-à-vis rising demand from the global demographic, aquaculture continues to forestall challenges entailed by these and bring more farmed fishes to plates globally.

According to the study, limited abilities in extracting more seafood from oceans has been driving the need for boosting aquaculture production to meet rising demand and protect wild fish stocks. Global sales of aquaculture products were in excess of US$ 750 Mn in 2018. Overfishing has put pressure on wild fish stocks, which has provided an impetus to aquaculture production in recent years. As concerns regarding environmental repercussions prevail, have driven the shift toward sustainability and longevity of aquaculture.

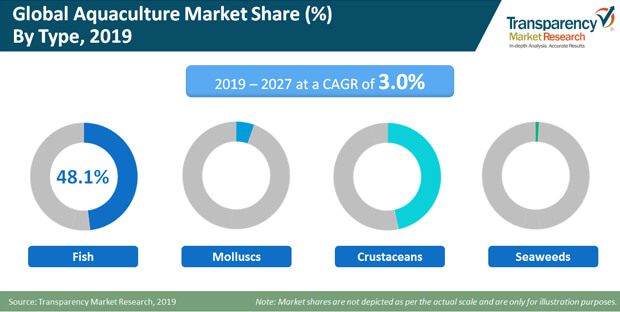

Advances in water circulation and filtration have meant that indoor fish farms will grow at an unprecedented rate, both in terms of production and size. TMR estimates global sales of aquaculture-produced fish to exceed US$ 480 Mn in 2019, accounting for a sizeable 60% market share. Fish farming has traditionally been touted as efficient solution for the production of animal protein, and indoor aquaculture plays a vital role in meeting the requirement of swelling global population. Although environmental risks prevail in the indoor approach as well, however the fact that risks associated with land-based systems is significantly smaller, than that of outdoor systems, continues to propel adoption of indoor fish farming.

Positive influences of aquaculture production is not limited to fish, but extends to crustaceans, molluscs, and seaweed – in descending order. Emergence of semi-intensive and intensive farms, along with professionalization and modernization practices have made the crustaceans an attractive segment of the aquaculture industry in the recent past. According to the study, crustaceans hold over 30% value of the aquaculture market, marked by major iterations to farm designs, water processing ponds, and nurseries, by leveraging better data genetics to prevent EMS outbreaks.

Production of crustaceans through aquaculture will grow unabated, as the industry moves toward digital transformation for strategic improvements in supply planning, purchases and sales, meanwhile improving real-time business and optimizing profits. The study finds that crustaceans supply currently exceeds demand, making the market players to lower prices and compete amid tight margins. However, this paves an opportunistic pathway for innovative players toward value creation with new products.

Asia-Pacific continues to remain an attractive market for aquaculture, with over US$ 650 Mn opportunity estimated in 2019 by TMR. Aquaculture producers in the region are increasingly leveraging the popular trend of recirculating aquaculture systems (RAC), which acts as an effective enabler of reducing pollution as well as consumption of water, while mitigating risks of ailments entailed by water pumped from rivers in proximity. Key producers in Asia-Pacific are currently investing in automation systems, along with RAS, to raise yields and enhance production reliability. Technology providers in the Asia-Pacific aquaculture market are focusing on including facility management systems led by artificial intelligence in their offerings, as these hold potential in unlocking yields for fish and shrimp farmers.

Aforementioned trends allude ever-increasing environmental footprint of aquaculture industry in Asia-Pacific, with Greater China and Japan leading the way even as accounting for greater market value. This has led the aquaculture producers to shift away from inland freshwater to offshore, complemented by government efforts to crack down on illegal aquaculture operations. This is particularly prevalent in Greater China, and Vietnam is following the suit by considering merits of extensive instead of intensive aquaculture, in light of the former’s lower impacts on mangrove and riverine habitats, although they produce lower yields.

According to TMR, competition in the aquaculture market has been intense, with collaborations and partnerships between potential investors and innovative businesses who focus on creating a community and network-based industry to work together for more sustainable growth in seafood sector. With technology at the fore, leading players in the aquaculture market are leveraging predictive solutions, real-time monitoring systems, and advanced sensors to maintain a competitive edge in this sustainability-driven, dynamic landscape. The study states that the moderately fragmented nature of the aquaculture market is here to stay, with the occupancy of numerous players – both large and small, who continuously focus on strengthening their distribution.

Key players operating in the aquaculture market, as profiled in the study, include MOWI ASA, Nippon Suisan Kaisha Ltd, Austevoll Seafood ASA, SalMar ASA, Cooke Aquaculture, Inc., Norway Royal Salmon ASA, Tassal Group Ltd, Campania Pesquera, Multiexport Foods SA, Camanchaca SA, Dainichi Corporation, P/F Bakkafrost, Stoly Sea Farm SA, Nireus SA, Tongwei Group Co., Ltd., Kyokuyo Co., Ltd., Thai Union Group PCL, Surapon Foods Public Company Limited, and Maruha Nichiro Corporation.

The following section of the report provides analysis of the aquaculture market based on the product type. The aquaculture market based on the product type is segmented into

|

Product Type |

|

|

Section |

|

|

form |

|

|

End-Use |

|

|

Region |

|

Global Aquaculture Market - Executive Summary

1.1. Global Aquaculture Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Summary of Key Findings

1.5. Summary of Statistics

1.6. Technological Roadmap

1.7. Opportunity Analysis

1.8. TMR Analysis and Recommendations

Market Overview

1.9. Market Introduction

1.10. Market Definition

1.11. Market Taxonomy

Highlights on Fragmentary Studies

1.12. Climate Change Impacts and Responses

1.13. Small-scale Fisheries and Aquaculture

1.14. Realizing Aquaculture’s Potential

1.15. International Trade, Sustainable Value Chains and Consumer Protection

1.16. Selected Ocean Pollution Concerns

1.17. Social Issues

Outlook and Emerging Issues

1.18. Blue Growth in Action

1.19. The Emerging Role of Regional Cooperation for Sustainable Development

1.20. Role of Regional Fishery Bodies in Aquaculture Development

1.21. Projections of Fisheries, Aquaculture and Markets

Market Background

1.22. World Fisheries and Aquaculture Production and Utilization

1.23. Marine Capture Production: Major Producer Countries

1.24. Capture Production: Major Fishing Areas

1.25. Aquaculture Farming – Parameters to be Considered

1.25.1. Aquaculture Farming in Fresh Water Overview

1.25.1.1. Freshwater fish production (MT),

1.25.1.2. Freshwater fish Per-capita demand (Kg)

1.25.1.3. Demand-supply gap (million tonnes) of Freshwater fish

1.25.1.4. Ratio of supply growth to demand growth (%)

1.25.1.5. Major farmed seaweed producers

1.25.2. Number of fishers and fish farmers in selected countries and territories and worldwide

1.25.3. Improving the Technical and Economic Performance of Fish Farming under Climate Variation from a Bio-Economic Modelling Perspective

1.26. Water quality: The Key to Success

1.26.1. Water Quality Monitoring Technologies

1.26.2. Production from Different Aquaculture Systems

1.27. Maximum Substantial Yields Comprehensions

Market Dynamics

1.28. Macro-economic Factors

1.28.1. Total and per capita apparent fish consumption by region and economic grouping

1.28.2. Change in Consumer Price Indexes (Percentage Change) 2018 (Forecast)

1.28.3. Population of Key Countries

1.28.4. Global Retail Dynamics

1.29. Drivers

1.29.1. Economic Drivers

1.29.2. Supply Side Drivers

1.29.3. Demand Side Drivers

1.30. Market Restraints

1.30.1. Pollution and change in climatic conditions globally disturb the aquatic ecosystem

1.30.2. Others

1.31. Market Trends

1.31.1. Rise in concern of the consumer worldwide about the intake of protein

1.31.2. Ongoing advancements in aquaculture owing to innovative efforts

1.31.3. Farmers and harvesters, spending on better nutrition and feeding technologies for the better growth of species

1.31.4. Others

1.32. Trend Analysis- Impact on Time Line (2019-2029)

Associated Industry Assessment

1.33. Supply and Value Chain Analysis

1.33.1. Profitability and Gross Margin Analysis By Competition

1.33.2. List of Active Participants

1.33.3. Key Manufacturers

1.33.4. Key Distributor/Retailers

1.34. Regulatory Framework

1.35. Market Positioning Assessment by Region

1.36. Aquaculture - Trade Analysis

1.36.1. Top Importers & Exporters, 2018

1.36.2. Value Imported & Exported (US$), 2018

1.36.3. Annual Growth in Value, 2014-2018 (%)

1.36.4. Share (%) of Top Importer & Exporters in World Import & Export resp. of Aquaculture

Investment Perspective

1.37. Geographical Cluster Assessment

1.37.1. Large customer geographies - deep investment pockets

1.37.2. Opportunity matrix – tapping the potential categorically

1.37.3. Product Life Cycle Vs Investment Feasibility in key regions

1.38. Investment Perspective- Who, When and How Much?

1.38.1. Investment seeking profit making companies – spotting the trump card

1.38.2. Short term vs long term investments – a tough call

1.38.3. How much to invest – gauzing the correct depth

1.38.4. Investment Feasibility Matrix

Global Aquaculture Market Pricing Analysis

1.39. Price Point Assessment by Product Type

1.40. Regional Average Pricing Analysis

1.40.1. North America

1.40.2. Latin America

1.40.3. Europe

1.40.4. Asia Pacific

1.40.5. Middle East and Africa

1.41. Price Forecast till 2026

1.42. Factors Influencing Pricing

Global Aquaculture Market Analysis and Forecast

1.43. Global Aquaculture Market Outlook

1.43.1. Market Value (US$ Mn) and Volume (MT) Forecast and Analysis

1.43.2. Regional Demand Assessment

1.44. Global Aquaculture Market Scenario Forecast

1.44.1. Likely Scenario of the Global Aquaculture Market

1.44.2. Conservative Scenario of the Global Aquaculture Market

1.44.3. Optimistic Scenario of the Global Aquaculture Market

1.44.4. Forecast Factors & its Relevance of Impact

Global Aquaculture Market Analysis By Product Type

1.45. Introduction

1.45.1. Y-o-Y Growth Comparison By Product Type

1.45.2. Basis Point Share (BPS) Analysis By Product Type

1.46. Aquaculture Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Product Type

1.46.1. Fish

1.46.1.1. Tuna

1.46.1.2. Tilapia

1.46.1.3. Swordfish

1.46.1.4. Salmons

1.46.1.5. Others

1.46.2. Molluscs

1.46.3. Crustaceans

1.46.3.1. Shrimp & Prawns

1.46.3.1.1. Giant tiger prawn

1.46.3.1.2. Fleshy prawn

1.46.3.1.3. Whiteleg shrimp

1.46.3.1.4. Others (Krill, etc.)

1.46.3.2. Others

1.46.4. Seaweed

1.47. Market Attractiveness Analysis By Product Type

Global Aquaculture Market Analysis By Form

1.48. Introduction

1.48.1. Y-o-Y Growth Comparison By Form

1.48.2. Basis Point Share (BPS) Analysis By Form

1.49. Aquaculture Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Form

1.49.1. Raw

1.49.2. Frozen

1.49.3. Canned

1.49.4. Processed

1.50. Market Attractiveness Analysis By Form

Global Aquaculture Market Analysis By Culture Type

1.51. Introduction

1.51.1. Y-o-Y Growth Comparison By Culture Type

1.51.2. Basis Point Share (BPS) Analysis By Culture Type

1.52. Aquaculture Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Culture Type

1.52.1. Fresh Water

1.52.2. Marine Water

1.53. Market Attractiveness Analysis By Culture Type

Global Aquaculture Market Analysis By Nature

1.54. Introduction

1.54.1. Y-o-Y Growth Comparison By Nature

1.54.2. Basis Point Share (BPS) Analysis By Nature

1.55. Aquaculture Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Nature

1.55.1. Organic

1.55.2. Conventional

1.56. Market Attractiveness Analysis By Nature

Global Aquaculture Market Analysis By End-Use

1.57. Introduction

1.57.1. Y-o-Y Growth Comparison By End-Use

1.57.2. Basis Point Share (BPS) Analysis By End-Use

1.58. Aquaculture Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By End-Use

1.58.1. B2B

1.58.1.1. Food Industry

1.58.1.2. Food Service Provider

1.58.1.3. Cosmetics & Pharmaceuticals

1.58.1.4. Animal Feed

1.58.2. B2C

1.58.2.1. Store Based Retailing

1.58.2.1.1. Hypermarket/Supermarket

1.58.2.1.2. Convenience Stores

1.58.2.1.3. Specialty Stores

1.58.2.1.4. Traditional Grocery Stores

1.58.2.1.5. Other Retail Formats

1.58.2.2. Online Retailer

1.59. Market Attractiveness Analysis By End-Use

Global Aquaculture Market Analysis and Forecast, By Region

1.60. Introduction

1.60.1. Basis Point Share (BPS) Analysis By Region

1.60.2. Y-o-Y Growth Projections By Region

1.61. Aquaculture Market Size (US$ Mn) and Volume (MT) & Forecast (2019-2029) Analysis By Region

1.61.1. North America

1.61.2. Latin America

1.61.3. Europe

1.61.4. Asia Pacific

1.61.5. Middle East and Africa

1.62. Market Attractiveness Analysis By Region

North America Aquaculture Market Analysis and Forecast

1.63. Introduction

1.63.1. Basis Point Share (BPS) Analysis By Country

1.63.2. Y-o-Y Growth Projections By Country

1.64. Aquaculture Market Size (Value (US$) and Volume (MT)) Analysis (2014-2018) and Forecast (2019-2029)

1.64.1. Market Attractiveness By Country

1.64.1.1. U.S.

1.64.1.2. Canada

1.64.2. By Product Type

1.64.3. By Form

1.64.4. By Culture Type

1.64.5. By Nature

1.64.6. By End-Use

1.65. Market Attractiveness Analysis

1.65.1. By Product Type

1.65.2. By Form

1.65.3. By Culture Type

1.65.4. By Nature

1.65.5. By End-Use

1.66. Drivers and Restraints: Impact Analysis

Latin America Aquaculture Market Analysis and Forecast

1.67. Introduction

1.67.1. Basis Point Share (BPS) Analysis By Country

1.67.2. Y-o-Y Growth Projections By Country

1.67.3. Key Regulations

1.68. Aquaculture Market Size (Value (US$) and Volume (MT)) Analysis (2014-2018) and Forecast (2019-2029)

1.68.1. By Country

1.68.1.1. Brazil

1.68.1.2. Mexico

1.68.1.3. Chile

1.68.1.4. Peru

1.68.1.5. Argentina

1.68.1.6. Rest of Latin America

1.68.2. By Product Type

1.68.3. By Form

1.68.4. By Culture Type

1.68.5. By Nature

1.68.6. By End-Use

1.69. Market Attractiveness Analysis

1.69.1. By Product Type

1.69.2. By Form

1.69.3. By Culture Type

1.69.4. By Nature

1.69.5. By End-Use

1.70. Drivers and Restraints: Impact Analysis

Europe Aquaculture Market Analysis and Forecast

1.71. Introduction

1.71.1. Basis Point Share (BPS) Analysis By Country

1.71.2. Y-o-Y Growth Projections By Country

1.71.3. Key Regulations

1.72. Aquaculture Market Size (Value (US$) and Volume (MT)) Analysis (2014-2018) and Forecast (2019-2029)

1.72.1. By Country

1.72.1.1. EU-4 (Germany, France, Italy, Spain)

1.72.1.2. U.K.

1.72.1.3. BENELUX

1.72.1.4. Nordic

1.72.1.5. Russia

1.72.1.6. Poland

1.72.1.7. Rest of Europe

1.72.2. By Product Type

1.72.3. By Form

1.72.4. By Culture Type

1.72.5. By Nature

1.72.6. By End-Use

1.73. Market Attractiveness Analysis

1.73.1. By Country

1.73.2. By Product Type

1.73.3. By Form

1.73.4. By Culture Type

1.73.5. By Nature

1.73.6. By End-Use

1.74. Drivers and Restraints: Impact Analysis

Asia Pacific Aquaculture Market Analysis and Forecast

1.75. Introduction

1.75.1. Basis Point Share (BPS) Analysis By Country

1.75.2. Y-o-Y Growth Projections By Country

1.75.3. Key Regulations

1.76. Aquaculture Market Size (Value (US$) and Volume (MT)) Analysis (2014-2018) and Forecast (2019-2029)

1.76.1. By Country

1.76.1.1. Greater China

1.76.1.2. Japan

1.76.1.3. India

1.76.1.4. ASEAN Countries

1.76.1.5. Australia & New Zealand

1.76.1.6. South Korea

1.76.1.7. Rest of Asia Pacific

1.76.2. By Product Type

1.76.3. By Form

1.76.4. By Culture Type

1.76.5. By Nature

1.76.6. By End-Use

1.77. Market Attractiveness Analysis

1.77.1. By Product Type

1.77.2. By Form

1.77.3. By Culture Type

1.77.4. By Nature

1.77.5. By End-Use

1.78. Drivers and Restraints: Impact Analysis

Middle East and Africa (MEA) Aquaculture Market Analysis and Forecast

1.79. Introduction

1.79.1. Basis Point Share (BPS) Analysis By Country

1.79.2. Y-o-Y Growth Projections By Country

1.79.3. Key Regulations

1.80. Aquaculture Market Size (Value (US$) and Volume (MT)) Analysis (2014-2018) and Forecast (2019-2029)

1.80.1. By Country

1.80.1.1. GCC Countries

1.80.1.2. South Africa

1.80.1.3. North Africa

1.80.1.4. Rest of MEA

1.80.2. By Product Type

1.80.3. By Form

1.80.4. By Culture Type

1.80.5. By Nature

1.80.6. By End-Use

1.81. Market Attractiveness Analysis

1.81.1. By Product Type

1.81.2. By Form

1.81.3. By Culture Type

1.81.4. By Nature

1.81.5. By End-Use

1.82. Drivers and Restraints: Impact Analysis

Competition Assessment

1.83. Global Aquaculture Market Structure Analysis

1.84. Global Aquaculture Market Company Share Analysis

1.84.1. For Tier 1 Market Players, 2018

1.84.2. Company Market Share Analysis of Top 10 Players, By Region

1.85. Key Participants Market Presence (Intensity Mapping) by Region

Competition Deep-dive (Manufacturers/Suppliers)

1.86. Chr. Hansen Holding A/S

1.86.1. Overview

1.86.2. Product Portfolio

1.86.3. Sales Footprint

1.86.4. Channel Footprint

1.86.4.1. Distributors List

1.86.4.2. Form (Clients)

1.86.5. Strategy Overview

1.86.5.1. Marketing Strategy

1.86.5.2. Culture Strategy

1.86.5.3. Channel Strategy

1.86.6. SWOT Analysis

1.86.7. Financial Analysis

1.86.8. Revenue Share

1.86.8.1. By Form

1.86.8.2. By Region

1.86.9. Key Clients

1.86.10. Analyst Comments

1.87. Danisco

1.88. DSM Nutritional Product AG

1.89. CSK Food Enrichment B.V.

1.90. Lallemand

1.91. Hundsbichler GmbH

1.92. Bioprox

1.93. Lactina

1.94. Lb Bulgaricum

1.95. Anhui Jinlac Biotech

1.96. Probio-Plus

1.97. Prodinvest

1.98. Custom Probiotics Inc.

1.99. Genesis Laboratories

1.100. Clerici-Sacco Group

1.101. Bioprox

1.102. Mad Millie

1.103. ArtisanFish LLC

1.104. Cooke Aquaculture

1.105. ALGOLESKO

1.106. THE CORNISH SEAWEED COMPANY LIMITED

1.107. Organic Denmark

1.108. ANOVA SEAFOOD BV

1.109. Organic Shrimp Farming Co., Ltd

1.110. SALMAR

1.111. Irish SeaSpray

1.112. CROMARIS D.D

1.113. ORGANIC OCEAN SEAFOOD

1.114. Irish Seaweeds

1.115. Marine Harvest Ireland

1.116. Lochduart Ltd

1.117. Maresca Ltd

1.118. BioMar SAS

1.119. Seacore Seafood Inc.

1.120. Omarsa S.A

1.121. Others (On additional request)

Recommendation- Critical Success Factors

Research Methodology

Assumptions & Acronyms Used

List of Tables

Table 01: Global Aquaculture Market Value (US$ Mn) 2014–2018 and Forecast 2019–2027 by Product Type

Table 02: Global Aquaculture Market Volume (Metric Tons) 2014–2018 and Forecast 2019–2027 by Product Type

Table 03: Global Aquaculture Market Value (US$ Mn) 2014–2018 and Forecast 2019–2027 by Culture Type

Table 04: Global Aquaculture Market Volume (Metric Tons) 2014–2018 and Forecast 2019–2027 by Culture Type

Table 05: Global Aquaculture Market Value (US$ Mn) 2014–2018 and Forecast 2019–2027 by Region

Table 06: Global Aquaculture Market Volume (Metric Tons) 2014–2018 and Forecast 2019–2027 by Region

List of Figures

Figure 01: Global Aquaculture Market Size (US$ Mn) and Volume (Metric Tons) Forecast, 2019–2027

Figure 02: Global Aquaculture Market Absolute $ Opportunity, 2019–2027

Figure 03: Global Aquaculture Market Share Analysis by Product Type, 2019 and 2027

Figure 04: Global Aquaculture Market Y-o-Y Growth Analysis by Product Type, 2019 and 2027

Figure 05: Global Aquaculture Market Attractiveness Analysis by Product Type, 2019–2027

Figure 06: Global Aquaculture Market Share Analysis by Culture Type, 2019 and 2027

Figure 07: Global Aquaculture Market Y-o-Y Growth Analysis by Culture Type, 2019–2027

Figure 08: Global Aquaculture Market Attractiveness Analysis by Culture Type, 2019–2027

Figure 09: Global Aquaculture Market Share Analysis by Region, 2019 and 2027

Figure 10: Global Aquaculture Market Y-o-Y Growth Analysis by Region, 2019–2027

Figure 11: Global Aquaculture Market Attractiveness Analysis by Region, 2019–2027