Reports

Reports

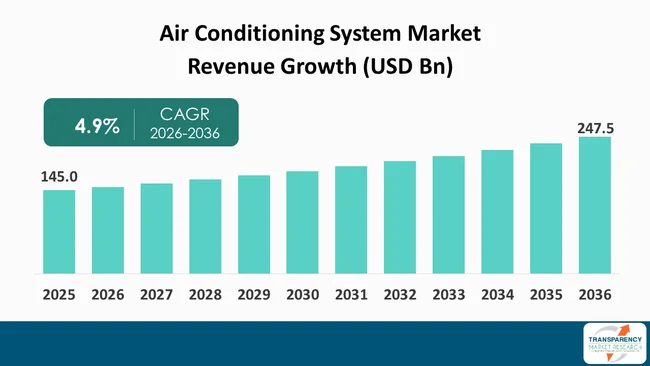

The global air conditioning system market size was valued at US$ 145.0 Bn in 2025 and is projected to reach US$ 247.5 Bn by 2036, expanding at a CAGR of 4.9% from 2026 to 2036. The market growth is driven by rising global cooling demand and energy efficiency regulations and technology innovation.

The air conditioning system market stands at a crucial stage with energy usage changing worldwide coupled with the rising need for cooling systems in homes and businesses. The combination of climate change with urban expansion and rising consumer demands for indoor comfort has led to an increased adoption of advanced energy-efficient air conditioning systems.

Businesses are now focusing on energy performance as their main sustainability goal that drives them to change their existing product development methods. Manufacturers are aligning their product development schedules with the changing energy efficiency regulations that different regions have established. The market experiences both - volume expansion and a fundamental transition toward solutions, which combine intelligent control systems with inverter technology and eco-friendly refrigerants that help companies create unique products for new markets.

The infrastructure system of an organization faces serious challenges while its efficiency operations remain unsolved. A core underlying trend shaping the demand is the existing global air conditioner stock: about 2 billion units are now operating worldwide, indicating both - the maturity of the installed base and the vast potential for upgrades to more efficient units in emerging and developed markets alike. The quantity of installed equipment establishes a major chance to implement retrofitting practices and groundbreaking technologies, which will cut energy expenses without compromising cooling output.

The global air conditioning system market encompasses all technologies and products designed to provide controlled indoor cooling across residential, commercial, and industrial applications. The systems include window and portable units as well as central and split/multi-split systems that meet different user needs and installation requirements.

The building design process now relies on cooling systems as rising global temperatures and increased building construction work together to create better indoor climate conditions for occupants and better work efficiency for employees. The industry is also influenced by regulatory trends that focus on energy efficiency standards, refrigerant phase-downs, and grid impact considerations as these factors determine product development priorities and competitive market dynamics.

Air conditioning technologies have evolved from basic thermal regulation functions into complete solutions for indoor climate control. The current systems use variable-speed compressors, smart thermostats, connectivity features, and zoned temperature management systems to improve their operational efficiency, decrease their running expenses, and work with existing building automation systems.

The market becomes more complicated as diverse regions have their own climate conditions and building regulations and customers show different levels of financial capacity. The market grows through two different processes as matured markets use energy-efficient technology replacements while emerging markets experience growth through first-time product adoption. The market depends on innovation, sustainability, and efficiency as these factors create growth opportunities that compete with the basic supply and demand.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Worldwide cooling requirements are increasing due to two factors, which are rising urban population and more frequent heatwaves. The world experiences higher average temperatures as people in both - newly electrified regions and established markets use air conditioning systems more frequently. The change has been driven by two factors that are demographic growth in warm climates and economic development that increases people's ability to buy things and use modern technology.

People in developing economies now consider cooling systems to be essential for their homes as these systems provide both - necessary indoor comfort and better work efficiency. Energy planners and manufacturers throughout the world focus their attention on creating energy-efficient system designs, which can grow to handle increasing demand.

The current thermal comfort requirements need advanced cooling technologies to be incorporated into building infrastructure. Manufacturers who provide solutions that meet both - performance and compliance requirements will achieve financial success because consumer demand continues to grow.

The International Energy Agency reports that 2 billion air conditioning units currently operate worldwide, which demonstrates the extensive cooling infrastructure present and the ongoing need for replacement and upgrade work.

Energy efficiency drives air conditioning system industry growth as international regulations require lower operational costs that consumers demand. Governments and intergovernmental organizations are increasingly adopting and enforcing minimum energy performance standards (MEPS) and labeling programs to mitigate energy consumption and associated greenhouse gas emissions.

The manufacturers create systems that achieve higher Seasonal Energy Efficiency Ratios (SEER) through inverter technology and advanced refrigerants that have reduced global warming potential (GWP). The regulatory framework creates competition between companies that drives research and development funding while forcing businesses to create environmentally sustainable products that meet their sustainability objectives.

The adoption of energy-efficient components has made air conditioning systems more sophisticated while boosting their market value. Inverter compressors use real-time cooling requirements to adjust engine output that leads to major electricity savings when compared to fixed-speed systems. The system enables users to enhance operational performance through smart controls and connectivity that helps them achieve both - comfort and cost reductions. The market transformation from conventional mechanical cooling systems to intelligent data-driven solutions receives acceleration through the combination of policy initiatives and technological advancements.

The global air conditioning system market shows its most attractive growth potential through the combination of electrification trends and smart grid technology. The introduction of variable renewable energy sources into power systems creates an opportunity for air conditioning systems to act as flexible loads, which enable grid stability through demand response and peak shaving operations. The worldwide electrification initiatives that focus on residential and commercial areas as their primary target for electricity consumption growth have established advanced air conditioning systems as essential components for achieving decarbonization goals and creating resilient systems.

The current trend allows manufacturers and solution providers to develop products that enable smart grid communication and load management functions while supporting distributed energy resources like rooftop solar power systems and battery storage devices. The system creates a platform for different sectors to work together which includes utilities and technology companies and equipment manufacturers. The cooling solutions enable users to reduce energy expenses while helping system operators achieve effective supply-demand management through their capacity to modify operations according to grid signals.

Energy modeling reveals that energy demand for cooling will rise significantly in the upcoming decades, which includes air conditioning systems and this increase will drive electricity consumption and lead to development of energy-efficient systems that operate with grid awareness.

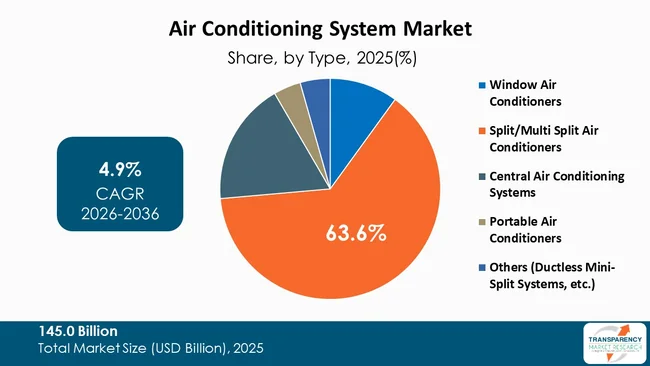

Current global air conditioning system market research shows that split and multi-split air conditioners dominate the market with 63.6% of the overall share. The systems have become more popular as they can be used in all three types of spaces, which include residential, commercial, and light commercial areas.

Split systems operate differently from window units and portable systems as they use separate components for their indoor units, which leads to quieter operation and better aesthetic design and increased efficiency. Multi-split systems enable users to connect multiple indoor units with a single outdoor compressor, which provides them with control over different temperature zones without affecting system performance. The technology has gained worldwide usage as it can adapt to different building designs and individual user requirements through its split technology.

The breakthroughs in inverter technology enable split and multi-split systems to operate better at partial loads while saving operating expenses better than fixed-speed systems. Modern split systems achieve their highest energy efficiency ratings that regulatory standards across multiple markets demand. Facility managers and equipment owners prefer split solutions as they deliver the best value during equipment lifespan while their energy expenses decrease across time.

The existing widespread use of split systems enables forthcoming system improvements that include smart thermostats, integrated sensors, and IoT-enabled controls to enhance cooling technologies. The combination of performance, efficiency, and user-friendly design makes split and multi-split systems the best choice for both - established markets and new developing markets.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia Pacific region holds 44.3% share of the global air conditioning system market as demographic changes, climate patterns, economic growth, and urban development combine to create a rising demand for cooling systems. The development of residential and commercial infrastructure in China, Southeast Asia, and Australia has increased its construction needs due to the country's growing industrial base and urban population.

The expanding middle class, which receives higher income levels, has created new demand for air conditioning systems throughout the region, while first-time buyers and replacement markets experience growing demand. The region's structural drivers are strengthened by its warm and humid weather conditions, which make cooling solutions necessary for maintaining comfort and productivity and improving quality of life.

The Asia Pacific region maintains its international standing as it serves as a worldwide production center for air conditioning systems. Companies that lead their industries achieve cost advantages through their supply chain operations and their ability to produce goods at large volumes, which allows them to maintain price competitiveness while offering their entire product range in both - local and international markets.

The major economies of the world create local innovation systems that enable businesses to develop unique products that include energy-efficient capabilities together with intelligent technology and systems for using renewable energy sources. The region shows increasing demand for high-efficiency products as consumers become more aware of sustainability standards and governments establish regulations, which confirms Asia Pacific's position as an industry leader.

The combination of these elements sustains Asia Pacific's market dominance as they create permanent consumer demand and manufacturing capacity in the region. The region will establish its future cooling technology and policy directions according to its ongoing commitment to develop infrastructure and enhance energy efficiency.

Bosch Thermotechnology GmbH, Carrier Global Corporation, Daikin Industries Ltd., Fujitsu General Ltd., Gree Electric Appliances, Hitachi Ltd., Johnson Controls, Lennox International Inc., LG Electronics, Midea Group, Mitsubishi Electric Corporation, Panasonic Holdings Corporation, Rheem Manufacturing Company, Samsung Electronics, Trane Technologies are some of the leading manufacturers operating in the global air conditioning system market.

Each of these companies has been profiled in the air conditioning system market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | US$ 145.0 Bn |

| Market Forecast Value in 2036 | US$ 247.5 Bn |

| Growth Rate (CAGR 2026 to 2036) | 4.9% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2024 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2025 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global air conditioning system market was valued at US$ 145.0 Bn in 2025

The global air conditioning system industry is projected to reach at US$ 247.5 Bn by the end of 2036

Rising global cooling demand and energy efficiency regulations & technology innovation, are some of the driving factors for this market

The CAGR is anticipated to be 4.9% from 2026 to 2036

Bosch Thermotechnology GmbH, Carrier Global Corporation, Daikin Industries Ltd., Fujitsu General Ltd., Gree Electric Appliances, Hitachi Ltd., Johnson Controls, Lennox International Inc., LG Electronics, Midea Group, Mitsubishi Electric Corporation, Panasonic Holdings Corporation, Rheem Manufacturing Company, Samsung Electronics, Trane Technologies, and others.

Table 01: Global Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 02: Global Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 03: Global Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 04: Global Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 05: Global Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 06: Global Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 07: Global Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 08: Global Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 09: Global Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 10: Global Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 11: Global Air Conditioning System Market Value (US$ Bn) Projection, By Region 2021 to 2036

Table 12: Global Air Conditioning System Market Volume (Thousand Units) Projection, By Region 2021 to 2036

Table 13: North America Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 14: North America Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 15: North America Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 16: North America Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 17: North America Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 18: North America Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 19: North America Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 20: North America Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 21: North America Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 22: North America Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 23: North America Air Conditioning System Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 24: North America Air Conditioning System Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 25: U.S. Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 26: U.S. Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 27: U.S. Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 28: U.S. Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 29: U.S. Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 30: U.S. Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 31: U.S. Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 32: U.S. Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 33: U.S. Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 34: U.S. Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 35: Canada Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 36: Canada Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 37: Canada Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 38: Canada Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 39: Canada Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 40: Canada Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 41: Canada Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 42: Canada Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 43: Canada Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 44: Canada Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 45: Europe Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 46: Europe Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 47: Europe Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 48: Europe Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 49: Europe Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 50: Europe Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 51: Europe Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 52: Europe Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 53: Europe Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 54: Europe Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 55: Europe Air Conditioning System Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 56: Europe Air Conditioning System Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 57: U.K. Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 58: U.K. Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 59: U.K. Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 60: U.K. Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 61: U.K. Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 62: U.K. Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 63: U.K. Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 64: U.K. Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 65: U.K. Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 66: U.K. Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 67: Germany Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 68: Germany Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 69: Germany Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 70: Germany Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 71: Germany Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 72: Germany Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 73: Germany Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 74: Germany Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 75: Germany Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 76: Germany Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 77: France Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 78: France Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 79: France Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 80: France Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 81: France Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 82: France Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 83: France Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 84: France Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 85: France Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 86: France Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 87: Italy Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 88: Italy Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 89: Italy Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 90: Italy Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 91: Italy Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 92: Italy Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 93: Italy Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 94: Italy Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 95: Italy Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 96: Italy Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 97: Spain Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 98: Spain Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 99: Spain Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 100: Spain Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 101: Spain Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 102: Spain Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 103: Spain Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 104: Spain Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 105: Spain Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 106: Spain Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 107: The Netherlands Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 108: The Netherlands Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 109: The Netherlands Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 110: The Netherlands Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 111: The Netherlands Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 112: The Netherlands Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 113: The Netherlands Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 114: The Netherlands Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 115: The Netherlands Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 116: The Netherlands Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 117: Asia Pacific Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 118: Asia Pacific Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 119: Asia Pacific Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 120: Asia Pacific Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 121: Asia Pacific Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 122: Asia Pacific Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 123: Asia Pacific Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 124: Asia Pacific Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 125: Asia Pacific Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 126: Asia Pacific Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 127: Asia Pacific Air Conditioning System Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 128: Asia Pacific Air Conditioning System Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 129: China Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 130: China Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 131: China Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 132: China Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 133: China Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 134: China Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 135: China Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 136: China Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 137: China Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 138: China Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 139: India Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 140: India Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 141: India Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 142: India Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 143: India Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 144: India Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 145: India Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 146: India Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 147: India Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 148: India Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 149: Japan Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 150: Japan Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 151: Japan Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 152: Japan Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 153: Japan Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 154: Japan Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 155: Japan Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 156: Japan Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 157: Japan Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 158: Japan Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 159: Australia Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 160: Australia Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 161: Australia Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 162: Australia Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 163: Australia Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 164: Australia Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 165: Australia Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 166: Australia Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 167: Australia Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 168: Australia Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 169: South Korea Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 170: South Korea Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 171: South Korea Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 172: South Korea Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 173: South Korea Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 174: South Korea Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 175: South Korea Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 176: South Korea Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 177: South Korea Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 178: South Korea Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 179: ASEAN Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 180: ASEAN Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 181: ASEAN Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 182: ASEAN Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 183: ASEAN Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 184: ASEAN Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 185: ASEAN Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 186: ASEAN Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 187: ASEAN Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 188: ASEAN Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 189: Middle East & Africa Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 190: Middle East & Africa Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 191: Middle East & Africa Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 192: Middle East & Africa Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 193: Middle East & Africa Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 194: Middle East & Africa Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 195: Middle East & Africa Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 196: Middle East & Africa Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 197: Middle East & Africa Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 198: Middle East & Africa Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 199: Middle East & Africa Air Conditioning System Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 200: Middle East & Africa Air Conditioning System Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 201: GCC Countries Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 202: GCC Countries Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 203: GCC Countries Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 204: GCC Countries Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 205: GCC Countries Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 206: GCC Countries Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 207: GCC Countries Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 208: GCC Countries Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 209: GCC Countries Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 210: GCC Countries Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 211: South Africa Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 212: South Africa Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 213: South Africa Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 214: South Africa Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 215: South Africa Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 216: South Africa Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 217: South Africa Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 218: South Africa Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 219: South Africa Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 220: South Africa Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 221: Latin America Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 222: Latin America Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 223: Latin America Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 224: Latin America Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 225: Latin America Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 226: Latin America Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 227: Latin America Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 228: Latin America Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 229: Latin America Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 230: Latin America Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 231: Latin America Air Conditioning System Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 232: Latin America Air Conditioning System Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 233: Brazil Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 234: Brazil Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 235: Brazil Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 236: Brazil Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 237: Brazil Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 238: Brazil Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 239: Brazil Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 240: Brazil Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 241: Brazil Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 242: Brazil Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 243: Mexico Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 244: Mexico Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 245: Mexico Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 246: Mexico Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 247: Mexico Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 248: Mexico Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 249: Mexico Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 250: Mexico Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 251: Mexico Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 252: Mexico Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 253: Argentina Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 254: Argentina Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 255: Argentina Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Table 256: Argentina Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Table 257: Argentina Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Table 258: Argentina Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Table 259: Argentina Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Table 260: Argentina Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Table 261: Argentina Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 262: Argentina Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 01: Global Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 02: Global Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 03: Global Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 04: Global Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 05: Global Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 06: Global Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 07: Global Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 08: Global Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 09: Global Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 10: Global Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 11: Global Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 12: Global Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 13: Global Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 14: Global Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 15: Global Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 16: Global Air Conditioning System Market Value (US$ Bn) Projection, By Region 2021 to 2036

Figure 17: Global Air Conditioning System Market Volume (Thousand Units) Projection, By Region 2021 to 2036

Figure 18: Global Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Region 2026 to 2036

Figure 19: North America Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 20: North America Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 21: North America Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 22: North America Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 23: North America Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 24: North America Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 25: North America Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 26: North America Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 27: North America Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 28: North America Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 29: North America Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 30: North America Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 31: North America Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 32: North America Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 33: North America Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 34: North America Air Conditioning System Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 35: North America Air Conditioning System Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 36: North America Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 37: U.S. Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 38: U.S. Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 39: U.S. Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 40: U.S. Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 41: U.S. Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 42: U.S. Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 43: U.S. Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 44: U.S. Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 45: U.S. Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 46: U.S. Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 47: U.S. Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 48: U.S. Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 49: U.S. Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 50: U.S. Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 51: U.S. Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 52: Canada Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 53: Canada Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 54: Canada Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 55: Canada Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 56: Canada Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 57: Canada Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 58: Canada Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 59: Canada Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 60: Canada Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 61: Canada Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 62: Canada Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 63: Canada Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 64: Canada Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 65: Canada Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 66: Canada Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 67: Europe Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 68: Europe Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 69: Europe Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 70: Europe Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 71: Europe Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 72: Europe Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 73: Europe Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 74: Europe Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 75: Europe Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 76: Europe Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 77: Europe Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 78: Europe Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 79: Europe Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 80: Europe Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 81: Europe Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 82: Europe Air Conditioning System Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 83: Europe Air Conditioning System Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 84: Europe Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 85: U.K. Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 86: U.K. Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 87: U.K. Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 88: U.K. Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 89: U.K. Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 90: U.K. Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 91: U.K. Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 92: U.K. Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 93: U.K. Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 94: U.K. Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 95: U.K. Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 96: U.K. Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 97: U.K. Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 98: U.K. Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 99: U.K. Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 100: Germany Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 101: Germany Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 102: Germany Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 103: Germany Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 104: Germany Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 105: Germany Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 106: Germany Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 107: Germany Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 108: Germany Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 109: Germany Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 110: Germany Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 111: Germany Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 112: Germany Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 113: Germany Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 114: Germany Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 115: France Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 116: France Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 117: France Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 118: France Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 119: France Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 120: France Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 121: France Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 122: France Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 123: France Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 124: France Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 125: France Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 126: France Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 127: France Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 128: France Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 129: France Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 130: Italy Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 131: Italy Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 132: Italy Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 133: Italy Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 134: Italy Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 135: Italy Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 136: Italy Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 137: Italy Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 138: Italy Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 139: Italy Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 140: Italy Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 141: Italy Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 142: Italy Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 143: Italy Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 144: Italy Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 145: Spain Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 146: Spain Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 147: Spain Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 148: Spain Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 149: Spain Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 150: Spain Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 151: Spain Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 152: Spain Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 153: Spain Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 154: Spain Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 155: Spain Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 156: Spain Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 157: Spain Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 158: Spain Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 159: Spain Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 160: The Netherlands Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 161: The Netherlands Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 162: The Netherlands Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 163: The Netherlands Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 164: The Netherlands Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 165: The Netherlands Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 166: The Netherlands Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 167: The Netherlands Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 168: The Netherlands Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 169: The Netherlands Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 170: The Netherlands Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 171: The Netherlands Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 172: The Netherlands Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 173: The Netherlands Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 174: The Netherlands Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 175: Asia Pacific Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 176: Asia Pacific Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 177: Asia Pacific Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 178: Asia Pacific Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 179: Asia Pacific Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 180: Asia Pacific Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 181: Asia Pacific Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 182: Asia Pacific Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 183: Asia Pacific Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 184: Asia Pacific Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 185: Asia Pacific Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 186: Asia Pacific Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 187: Asia Pacific Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 188: Asia Pacific Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 189: Asia Pacific Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 190: Asia Pacific Air Conditioning System Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 191: Asia Pacific Air Conditioning System Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 192: Asia Pacific Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 193: China Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 194: China Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 195: China Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 196: China Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 197: China Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 198: China Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 199: China Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 200: China Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 201: China Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 202: China Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 203: China Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 204: China Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 205: China Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 206: China Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 207: China Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 208: India Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 209: India Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 210: India Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 211: India Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 212: India Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 213: India Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 214: India Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 215: India Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 216: India Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 217: India Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 218: India Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 219: India Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 220: India Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 221: India Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 222: India Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 223: Japan Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 224: Japan Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 225: Japan Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 226: Japan Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 227: Japan Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 228: Japan Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 229: Japan Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 230: Japan Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 231: Japan Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 232: Japan Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 233: Japan Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 234: Japan Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 235: Japan Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 236: Japan Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 237: Japan Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 238: Australia Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 239: Australia Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 240: Australia Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 241: Australia Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 242: Australia Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 243: Australia Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 244: Australia Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 245: Australia Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 246: Australia Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 247: Australia Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 248: Australia Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 249: Australia Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 250: Australia Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 251: Australia Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 252: Australia Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 253: South Korea Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 254: South Korea Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 255: South Korea Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 256: South Korea Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 257: South Korea Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 258: South Korea Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 259: South Korea Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 260: South Korea Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 261: South Korea Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 262: South Korea Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 263: South Korea Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 264: South Korea Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 265: South Korea Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 266: South Korea Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 267: South Korea Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 268: ASEAN Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 269: ASEAN Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 270: ASEAN Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 271: ASEAN Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 272: ASEAN Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 273: ASEAN Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 274: ASEAN Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 275: ASEAN Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 276: ASEAN Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 277: ASEAN Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036

Figure 278: ASEAN Air Conditioning System Market Volume (Thousand Units) Projection, By End-Use 2021 to 2036

Figure 279: ASEAN Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By End-Use 2026 to 2036

Figure 280: ASEAN Air Conditioning System Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 281: ASEAN Air Conditioning System Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 282: ASEAN Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 283: Middle East & Africa Air Conditioning System Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 284: Middle East & Africa Air Conditioning System Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 285: Middle East & Africa Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 286: Middle East & Africa Air Conditioning System Market Value (US$ Bn) Projection, By Technology 2021 to 2036

Figure 287: Middle East & Africa Air Conditioning System Market Volume (Thousand Units) Projection, By Technology 2021 to 2036

Figure 288: Middle East & Africa Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2026 to 2036

Figure 289: Middle East & Africa Air Conditioning System Market Value (US$ Bn) Projection, By Capacity 2021 to 2036

Figure 290: Middle East & Africa Air Conditioning System Market Volume (Thousand Units) Projection, By Capacity 2021 to 2036

Figure 291: Middle East & Africa Air Conditioning System Market Incremental Opportunities (US$ Bn) Forecast, By Capacity 2026 to 2036

Figure 292: Middle East & Africa Air Conditioning System Market Value (US$ Bn) Projection, By End-Use 2021 to 2036