Analysts’ Viewpoint

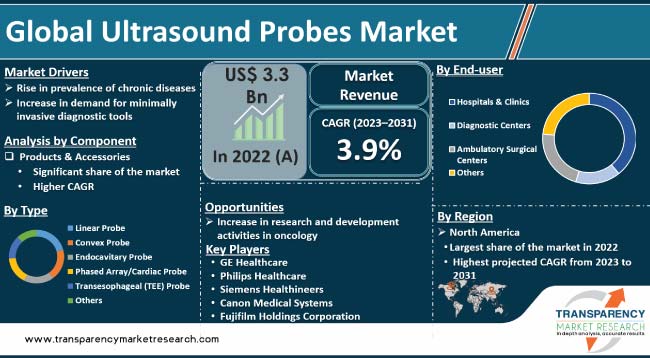

Technological advancements and increase in healthcare expenditure are driving the global ultrasound probes market. Development of new and advanced ultrasound probes, such as 3D and 4D probes, is propelling market progress. Rise in prevalence of chronic diseases, such as cancer, cardiovascular diseases, and neurological disorders, are fueling the global market growth. Surge in demand for portable ultrasound devices and growing awareness about the benefits of ultrasound imaging are expected to propel the global ultrasound probes market size during the forecast period.

Technological advancements in medical equipment, including ultrasound probes, that are non-invasive and painless offers lucrative opportunities to market players. Companies are focusing on developing portable and cost-efficient ultrasound devices to increase market share and presence.

The market is a rapidly growing segment of the medical device industry, driven by increase in demand for non-invasive diagnostic and therapeutic procedures. Ultrasound probes are essential tools for imaging the internal organs and tissues of the body, and are used in various medical applications, including obstetrics and gynecology, cardiology, radiology, and gastroenterology.

The industry has witnessed significant product development such as introduction of new and advanced ultrasound probes such as 3D and 4D probes or transducers. Moreover, demand for portable ultrasound devices has increased in the past few years.

GE Healthcare recently launched its most advanced ultrasound system yet, the next-generation Voluson Expert 22. BD also launched the BD Prevue II System, an easy-to-use ultrasound device with a specialized probe for optimal IV placement, which features the BD Cue Needle Tracking System and needle depth markers. These advancements and emerging technologies are expected to bolster global ultrasound probes market growth in the next few years.

Rise in prevalence of chronic diseases is one of the major drivers of the global ultrasound probes market demand. Chronic diseases are long-term medical conditions that often require ongoing care and management. These diseases are typically non-communicable and include conditions such as cardiovascular diseases, cancer, diabetes, and respiratory diseases.

According to the World Health Organization (WHO), chronic diseases account for approximately 71% of all deaths globally, with cardiovascular diseases being the leading cause of death. Chronic diseases require frequent imaging tests for diagnosis and monitoring.

Ultrasound probes are critical tools for diagnosing and monitoring these conditions, as they offer real-time imaging that is non-invasive and does not expose the patient to ionizing radiation.

Cancer is one of the most prevalent chronic diseases. Ultrasound probes are commonly used in the diagnosis and staging of various types of cancer. For instance, breast ultrasound is often used to detect breast cancer in women, while transrectal ultrasound is used to detect prostate cancer in men. Additionally, ultrasound-guided biopsies are often used to obtain tissue samples for further analysis.

Cardiovascular diseases are a major cause of morbidity and mortality across the world. Ultrasound probes are commonly used to diagnose and monitor these conditions. For instance, echocardiography is used to diagnose heart conditions such as heart failure and congenital heart defects. Ultrasound probes are also used to monitor the progression of cardiovascular diseases and to guide interventions such as cardiac catheterization.

Minimally invasive procedures require real-time imaging to guide the surgeon. Ultrasound probes are essential tools for this purpose. Minimally invasive procedures are becoming increasingly popular due to benefits such as reduced pain, shorter hospital stay, faster recovery, and fewer complications.

Ultrasound probes play a critical role in minimally invasive procedures, including laparoscopic surgeries, which are used to diagnose and treat various conditions such as tumors, cysts, and gallstones. They are also used in procedures such as endoscopic ultrasounds, which are utilized to diagnose gastrointestinal conditions and transesophageal echocardiograms.

Usage of ultrasound probes in minimally invasive procedures has several advantages. They offer real-time imaging, allowing the surgeon to visualize the area being operated on and make precise movements. This improves the accuracy and safety of the procedure, reducing the risk of complications. Additionally, ultrasound probes are non-invasive and do not expose the patient to ionizing radiation, making them a safer option than other imaging modalities.

In terms of component, the products & accessories segment dominated the global ultrasound probes industry in 2022. The market has witnessed significant product development in the past few years, with the introduction of new and advanced ultrasound probes, such as 3D and 4D probes. These developments have driven the demand for associated accessories such as cables, connectors, and gels. This is propelling the products & accessories segment.

Increase in demand for ultrasound probes in various medical applications is expected to bolster the products & accessories segment in the next few years. The segment includes a range of products and accessories at different price points, making it accessible to end-users, from small clinics to large hospitals and diagnostic centers. This has contributed to the segment's significant market share.

Based on application, the obstetrics & gynecology (OB/GYN) segment accounted for the largest global ultrasound probes market share in 2022. Ultrasound imaging is an essential tool in obstetrics & gynecology for pregnancy monitoring and diagnosis of gynecological conditions.

Ultrasound probes are used to monitor fetal development, screen for birth defects, and assess the health of the mother and fetus during pregnancy. These probes are also used in gynecology to diagnose conditions such as ovarian cysts, fibroids, and endometrial cancer.

The obstetrics & gynecology segment is expected to witness robust growth in the next few years. This is ascribed to increase in demand for non-invasive diagnostic and therapeutic procedures. The segment is also driven by high prevalence of gynecological conditions, particularly in developing countries. According to the World Health Organization, maternal mortality rates are the highest in low-income countries, with complications during pregnancy and childbirth being the leading causes of death among women of reproductive age.

In terms of end-user, the hospitals & clinics segment dominated the global ultrasound probes market in 2022. Hospitals and clinics are significant end-users of ultrasound probes, as they are essential tools in the diagnosis and treatment of various medical conditions.

Hospitals and clinics use ultrasound probes in various domains such as obstetrics & gynecology, cardiology, radiology, and gastroenterology. These settings are aware of the benefits of ultrasound imaging, which has led to high preference for this non-invasive and painless diagnostic tool over other imaging modalities.

As per ultrasound probes market trends, North America accounted for major share of the global industry in 2022. This is ascribed to technological advancements and innovation in the medical device industry, which has led to the development of new and advanced ultrasound probes.

Rise in demand for ultrasound probes and presence of key players, including GE Healthcare and Philips Healthcare, and development of new and advanced ultrasound probes are driving the market in North America.

The European Union has taken several initiatives to encourage the adoption of ultrasound technology in healthcare. For instance, the European Commission has funded several research projects to explore the potential of ultrasound in disease diagnosis and treatment. High awareness about the benefits of ultrasound imaging has led to significant preference for ultrasound probes over other imaging modalities.

Asia Pacific has a large and rapidly growing population, which has led to rise in prevalence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders. This is driving demand for ultrasound probes. Additionally, the region has large number of hospitals and diagnostic centers, which are major end-users of ultrasound probes.

Surge in healthcare expenditure in countries such as China, India, and Japan has also driven demand for advanced medical equipment, including ultrasound probes. The region has witnessed significant technological advancements in the medical device industry, leading to the development of new and advanced ultrasound probes.

The global ultrasound probes market is fragmented, with the presence of large number of players. Companies are adopting strategies such new product launches and merger & acquisition to increase market share.

GE Healthcare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems, Fujifilm Holdings Corporation, Hitachi Medical Systems, Samsung Medison Co., Ltd., Mindray Medical International Limited, Analogic Corporation, Esaote SpA, Terason Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., SonoScape Medical Corporation, BK Ultrasound, and Healcerion Co., Ltd. are the prominent players in the market.

Each of these players has been profiled in the ultrasound probes market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 3.3 Bn |

|

Forecast Value in 2031 |

More than US$ 4.6 Bn |

|

Growth Rate (CAGR) |

3.9% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

It was valued at US$ 3.3 Bn in 2022

It is projected to reach more than US$ 4.6 Bn by 2031

It is anticipated to expand at a CAGR of 3.9% from 2023 to 2031

North America is expected to account for the largest share from 2023 to 2031

GE Healthcare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems, Fujifilm Holdings Corporation, Hitachi Medical Systems, Samsung Medison Co., Ltd., Mindray Medical International Limited, Analogic Corporation, Esaote SpA, Terason Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., SonoScape Medical Corporation, BK Ultrasound, and Healcerion Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumption and Research Methodology

3. Executive Summary: Global Ultrasound Probes Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Ultrasound Probes Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Insights on Ultrasonic Transducers Used in Medical Applications

5.2. Overview of Emerging Trends in Ultrasound Imaging Technology

5.3. Pricing Analysis

5.4. COVID-19 Impact Analysis

6. Global Ultrasound Probes Market Analysis and Forecast, by Component

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value & Volume Forecast, by Component, 2017 - 2031

6.3.1. Products & Accessories

6.3.2. Software & Services

6.4. Market Attractiveness Analysis, by Component

7. Global Ultrasound Probes Market Analysis and Forecast, by Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value & Volume Forecast, by Type, 2017 - 2031

7.3.1. Linear Probe

7.3.2. Convex Probe

7.3.3. Endocavitary Probe

7.3.4. Phased Array/Cardiac Probe

7.3.5. Transesophageal (TEE) Probe

7.3.6. Others

7.4. Market Attractiveness Analysis, by Type

8. Global Ultrasound Probes Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017 - 2031

8.3.1. Musculoskeletal

8.3.2. Oncology

8.3.3. Cardiovascular

8.3.4. Obstetrics & Gynecology

8.3.5. General Imaging

8.3.6. Others (neonatal and pediatric exams, etc.)

8.4. Market Attractiveness Analysis, by Application

9. Global Ultrasound Probes Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017 - 2031

9.3.1. Hospitals & Clinics

9.3.2. Diagnostic Centers

9.3.3. Ambulatory Surgical Centers

9.3.4. Others

9.4. Market Attractiveness Analysis, by End-user

10. Global Ultrasound Probes Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Ultrasound Probes Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value & Volume Forecast, by Component, 2017 - 2031

11.2.1. Products & Accessories

11.2.2. Software & Services

11.3. Market Value & Volume Forecast, by Type, 2017 - 2031

11.3.1. Linear Probe

11.3.2. Convex Probe

11.3.3. Endocavitary Probe

11.3.4. Phased Array/Cardiac Probe

11.3.5. Transesophageal (TEE) Probe

11.3.6. Others

11.4. Market Value Forecast, by Application, 2017-2031

11.4.1. Musculoskeletal

11.4.2. Oncology

11.4.3. Cardiovascular

11.4.4. Obstetrics & Gynecology

11.4.5. General Imaging

11.4.6. Others (neonatal and pediatric exams, etc.)

11.5. Market Value Forecast, by End-user, 2017-2031

11.5.1. Hospitals & Clinics

11.5.2. Diagnostic Centers

11.5.3. Ambulatory Surgical Centers

11.5.4. Others

11.6. Market Value Forecast, by Country, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Component

11.7.2. By Type

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Ultrasound Probes Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value & Volume Forecast, by Component, 2017 - 2031

12.2.1. Products & Accessories

12.2.2. Software & Services

12.3. Market Value & Volume Forecast, by Type, 2017 - 2031

12.3.1. Linear Probe

12.3.2. Convex Probe

12.3.3. Endocavitary Probe

12.3.4. Phased Array/Cardiac Probe

12.3.5. Transesophageal (TEE) Probe

12.3.6. Others

12.4. Market Value Forecast, by Application, 2017-2031

12.4.1. Musculoskeletal

12.4.2. Oncology

12.4.3. Cardiovascular

12.4.4. Obstetrics & Gynecology

12.4.5. General Imaging

12.4.6. Others (neonatal and pediatric exams, etc.)

12.5. Market Value Forecast, by End-user, 2017-2031

12.5.1. Hospitals & Clinics

12.5.2. Diagnostic Centers

12.5.3. Ambulatory Surgical Centers

12.5.4. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017-2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Component

12.7.2. By Application

12.7.3. By End-user

12.7.4. By Country/Sub-region

13. Asia Pacific Ultrasound Probes Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value & Volume Forecast, by Component, 2017 - 2031

13.2.1. Products & Accessories

13.2.2. Software & Services

13.3. Market Value & Volume Forecast, by Type, 2017 - 2031

13.3.1. Linear Probe

13.3.2. Convex Probe

13.3.3. Endocavitary Probe

13.3.4. Phased Array/Cardiac Probe

13.3.5. Transesophageal (TEE) Probe

13.3.6. Others

13.4. Market Value Forecast, by Application, 2017-2031

13.4.1. Musculoskeletal

13.4.2. Oncology

13.4.3. Cardiovascular

13.4.4. Obstetrics & Gynecology

13.4.5. General Imaging

13.4.6. Others (neonatal and pediatric exams, etc.)

13.5. Market Value Forecast, by End-user, 2017-2031

13.5.1. Hospitals & Clinics

13.5.2. Diagnostic Centers

13.5.3. Ambulatory Surgical Centers

13.5.4. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017-2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Component

13.7.2. By Application

13.7.3. By End-user

13.7.4. By Country/Sub-region

14. Latin America Ultrasound Probes Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value & Volume Forecast, by Component, 2017 - 2031

14.2.1. Products & Accessories

14.2.2. Software & Services

14.3. Market Value & Volume Forecast, by Type, 2017 - 2031

14.3.1. Linear Probe

14.3.2. Convex Probe

14.3.3. Endocavitary Probe

14.3.4. Phased Array/Cardiac Probe

14.3.5. Transesophageal (TEE) Probe

14.3.6. Others

14.4. Market Value Forecast, by Application, 2017-2031

14.4.1. Musculoskeletal

14.4.2. Oncology

14.4.3. Cardiovascular

14.4.4. Obstetrics & Gynecology

14.4.5. General Imaging

14.4.6. Others (neonatal and pediatric exams, etc.)

14.5. Market Value Forecast, by End-user, 2017-2031

14.5.1. Hospitals & Clinics

14.5.2. Diagnostic Centers

14.5.3. Ambulatory Surgical Centers

14.5.4. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Component

14.7.2. By Application

14.7.3. By End-user

14.7.4. By Country/Sub-region

15. Middle East & Africa Ultrasound Probes Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value & Volume Forecast, by Component, 2017 - 2031

15.2.1. Products & Accessories

15.2.2. Software & Services

15.3. Market Value & Volume Forecast, by Type, 2017 - 2031

15.3.1. Linear Probe

15.3.2. Convex Probe

15.3.3. Endocavitary Probe

15.3.4. Phased Array/Cardiac Probe

15.3.5. Transesophageal (TEE) Probe

15.3.6. Others

15.4. Market Value Forecast, by Application, 2017-2031

15.4.1. Musculoskeletal

15.4.2. Oncology

15.4.3. Cardiovascular

15.4.4. Obstetrics & Gynecology

15.4.5. General Imaging

15.4.6. Others (neonatal and pediatric exams, etc.)

15.5. Market Value Forecast, by End-user, 2017-2031

15.5.1. Hospitals & Clinics

15.5.2. Diagnostic Centers

15.5.3. Ambulatory Surgical Centers

15.5.4. Others

15.6. Market Value Forecast, by Country/Sub-region, 2017-2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Component

15.7.2. By Application

15.7.3. By End-user

15.7.4. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company (2021)

16.3. Company Profiles

16.3.1. GE Healthcare

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Philips Healthcare

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Siemens Healthineers

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Canon Medical Systems

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Fujifilm Holdings Corporation

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Hitachi Medical Systems

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Samsung Medison Co., Ltd.

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Mindray Medical International Limited.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Analogic Corporation

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Esaote SpA

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. Terason Corporation

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Portfolio

16.3.11.3. Financial Overview

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

16.3.12. Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

16.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.12.2. Product Portfolio

16.3.12.3. Financial Overview

16.3.12.4. SWOT Analysis

16.3.12.5. Strategic Overview

16.3.13. SonoScape Medical Corporation

16.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.13.2. Product Portfolio

16.3.13.3. Financial Overview

16.3.13.4. SWOT Analysis

16.3.13.5. Strategic Overview

16.3.14. BK Ultrasound

16.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.14.2. Product Portfolio

16.3.14.3. Financial Overview

16.3.14.4. SWOT Analysis

16.3.14.5. Strategic Overview

16.3.15. Healcerion Co., Ltd

16.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.15.2. Product Portfolio

16.3.15.3. Financial Overview

16.3.15.4. SWOT Analysis

16.3.15.5. Strategic Overview

List of Tables

Table 01: Global Ultrasound Probes Market Size (US$ Bn) Forecast, by Component, 2017-2031

Table 02: Global Ultrasound Probes Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 03: Global Ultrasound Probes Market Size (US$ Bn) Forecast, by Application, 2017-2031

Table 04: Global Ultrasound Probes Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 05: Global Ultrasound Probes Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 06: North America Ultrasound Probes Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 07: North America Ultrasound Probes Market Size (US$ Bn) Forecast, by Component, 2017-2031

Table 08: North America Ultrasound Probes Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 09: North America Ultrasound Probes Market Size (US$ Bn) Forecast, by Application, 2017-2031

Table 10: North America Ultrasound Probes Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 11: Europe Ultrasound Probes Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 12: Europe Ultrasound Probes Market Size (US$ Bn) Forecast, by Component, 2017-2031

Table 13: Europe Ultrasound Probes Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 14: Europe Ultrasound Probes Market Size (US$ Bn) Forecast, by Application, 2017-2031

Table 15: Europe Ultrasound Probes Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 16: Asia Pacific Ultrasound Probes Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Asia Pacific Ultrasound Probes Market Size (US$ Bn) Forecast, by Component, 2017-2031

Table 18: Asia Pacific Ultrasound Probes Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 19: Asia Pacific Ultrasound Probes Market Size (US$ Bn) Forecast, by Application, 2017-2031

Table 20: Asia Pacific Ultrasound Probes Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 21: Latin America Ultrasound Probes Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Latin America Ultrasound Probes Market Size (US$ Bn) Forecast, by Component, 2017-2031

Table 23: Latin America Ultrasound Probes Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 24: Latin America Ultrasound Probes Market Size (US$ Bn) Forecast, by Application, 2017-2031

Table 25: Latin America Ultrasound Probes Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 26: Middle East and Africa Ultrasound Probes Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 27: Middle East and Africa Ultrasound Probes Market Size (US$ Bn) Forecast, by Component, 2017-2031

Table 28: Middle East and Africa Ultrasound Probes Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 29: Middle East and Africa Ultrasound Probes Market Size (US$ Bn) Forecast, by Application, 2017-2031

Table 30: Middle East and Africa Ultrasound Probes Market Size (US$ Bn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Ultrasound Probes Market Value (US$ Bn) Forecast, 2017-2031

Figure 02: Global Ultrasound Probes Market Value Share, by Component, 2022

Figure 03: Global Ultrasound Probes Market Value Share, by Type 2022

Figure 04: Global Ultrasound Probes Market Value Share, by Application, 2022

Figure 05: Global Ultrasound Probes Market Value Share, by End-user, 2022

Figure 06: Global Ultrasound Probes Market Value Share Analysis, by Component, 2022 and 2031

Figure 07: Global Ultrasound Probes Market Revenue (US$ Bn), by Products & Accessories, 2017-2031

Figure 08: Global Ultrasound Probes Market Value Share Analysis, by Software & Services, 2022 and 2031

Figure 09: Global Ultrasound Probes Market Attractiveness Analysis, by Component, 2023-2031

Figure 10: Global Ultrasound Probes Market Value Share Analysis, by Type 2022 and 2031

Figure 11: Global Ultrasound Probes Market Revenue (US$ Bn), by Linear Probe, 2017-2031

Figure 12: Global Ultrasound Probes Market Revenue (US$ Bn), by Convex Probe, 2017-2031

Figure 13: Global Ultrasound Probes Market Revenue (US$ Bn), by Endocavitary Probe, 2017-2031

Figure 14: Global Ultrasound Probes Market Revenue (US$ Bn), by Phased Array/Cardiac Probe, 2017-2031

Figure 15: Global Ultrasound Probes Market Revenue (US$ Bn), by Transesophageal (TEE) Probe, 2017-2031

Figure 16: Global Ultrasound Probes Market Revenue (US$ Bn), by Others, 2017-2031

Figure 17: Global Ultrasound Probes Market Attractiveness Analysis, by Type 2023-2031

Figure 18: Global Ultrasound Probes Market Value Share Analysis, by Application, 2022 and 2031

Figure 19: Global Ultrasound Probes Market Revenue (US$ Bn), by Musculoskeletal, 2017-2031

Figure 20: Global Ultrasound Probes Market Revenue (US$ Bn), by Oncology, 2017-2031

Figure 21: Global Ultrasound Probes Market Revenue (US$ Bn), by Cardiovascular, 2017-2031

Figure 22: Global Ultrasound Probes Market Revenue (US$ Bn), by Obstetrics & Gynecology, 2017-2031

Figure 23: Global Ultrasound Probes Market Revenue (US$ Bn), by General Imaging, 2017-2031

Figure 24: Global Ultrasound Probes Market Revenue (US$ Bn), by Other, 2017-2031

Figure 25: Global Ultrasound Probes Market Attractiveness Analysis, by Application, 2023-2031

Figure 26: Global Ultrasound Probes Market Value Share Analysis, by End-user, 2022 and 2031

Figure 27: Global Ultrasound Probes Market Revenue (US$ Bn), by Hospitals & Clinics, 2017-2031

Figure 28: Global Ultrasound Probes Market Revenue (US$ Bn), by Diagnostic Centers, 2017-2031

Figure 29: Global Ultrasound Probes Market Revenue (US$ Bn), by Ambulatory Surgical Centers, 2017-2031

Figure 30: Global Ultrasound Probes Market Revenue (US$ Bn), by Others, 2017-2031

Figure 31: Global Ultrasound Probes Market Attractiveness Analysis, by End-user, 2023-2031

Figure 32: Global Ultrasound Probes Market Value Share Analysis, by Region, 2022 and 2031

Figure 33: Global Ultrasound Probes Market Attractiveness Analysis, by Region, 2023-2031

Figure 34: North America Ultrasound Probes Market Value (US$ Bn) Forecast, 2017-2031

Figure 35: North America Ultrasound Probes Market Value Share Analysis, by Country, 2022 and 2031

Figure 36: North America Ultrasound Probes Market Attractiveness Analysis, by Country, 2023-2031

Figure 37: North America Ultrasound Probes Market Value Share Analysis, by Component, 2022 and 2031

Figure 38: North America Ultrasound Probes Market Attractiveness Analysis, by Component, 2023-2031

Figure 39: North America Ultrasound Probes Market Value Share Analysis, by Type, 2022 and 2031

Figure 40: North America Ultrasound Probes Market Attractiveness Analysis, by Type, 2023-2031

Figure 41: North America Ultrasound Probes Market Value Share Analysis, by Application, 2022 and 2031

Figure 42: North America Ultrasound Probes Market Attractiveness Analysis, by Application, 2023-2031

Figure 43: North America Ultrasound Probes Market Value Share Analysis, by End-user, 2022 and 2031

Figure 44: North America Ultrasound Probes Market Attractiveness Analysis, by End-user, 2023-2031

Figure 45: Europe Ultrasound Probes Market Value (US$ Bn) Forecast, 2017-2031

Figure 46: Europe Ultrasound Probes Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 47: Europe Ultrasound Probes Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 48: Europe Ultrasound Probes Market Value Share Analysis, by Component, 2022 and 2031

Figure 49: Europe Ultrasound Probes Market Attractiveness Analysis, by Component, 2023-2031

Figure 50: Europe Ultrasound Probes Market Value Share Analysis, by Type, 2022 and 2031

Figure 51: Europe Ultrasound Probes Market Attractiveness Analysis, by Type, 2023-2031

Figure 52: Europe Ultrasound Probes Market Value Share Analysis, by Application, 2022 and 2031

Figure 53: Europe Ultrasound Probes Market Attractiveness Analysis, by Application, 2023-2031

Figure 54: Europe Ultrasound Probes Market Value Share Analysis, by End-user, 2022 and 2031

Figure 55: Europe Ultrasound Probes Market Attractiveness Analysis, by End-user, 2023-2031

Figure 56: Asia Pacific Ultrasound Probes Market Value (US$ Bn) Forecast, 2017-2031

Figure 57: Asia Pacific Ultrasound Probes Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 58: Asia Pacific Ultrasound Probes Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 59: Asia Pacific Ultrasound Probes Market Value Share Analysis, by Component, 2022 and 2031

Figure 60: Asia Pacific Ultrasound Probes Market Attractiveness Analysis, by Component, 2023-2031

Figure 61: Asia Pacific Ultrasound Probes Market Value Share Analysis, by Type, 2022 and 2031

Figure 62: Asia Pacific Ultrasound Probes Market Attractiveness Analysis, by Type, 2023-2031

Figure 63: Asia Pacific Ultrasound Probes Market Value Share Analysis, by Application, 2022 and 2031

Figure 64: Asia Pacific Ultrasound Probes Market Attractiveness Analysis, by Application, 2023-2031

Figure 65: Asia Pacific Ultrasound Probes Market Value Share Analysis, by End-user, 2022 and 2031

Figure 66: Asia Pacific Ultrasound Probes Market Attractiveness Analysis, by End-user, 2023-2031

Figure 67: Latin America Ultrasound Probes Market Value (US$ Bn) Forecast, 2017-2031

Figure 68: Latin America Ultrasound Probes Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 69: Latin America Ultrasound Probes Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 70: Latin America Ultrasound Probes Market Value Share Analysis, by Component, 2022 and 2031

Figure 71: Latin America Ultrasound Probes Market Attractiveness Analysis, by Component, 2023-2031

Figure 72: Latin America Ultrasound Probes Market Value Share Analysis, by Type, 2022 and 2031

Figure 73: Latin America Ultrasound Probes Market Attractiveness Analysis, by Type, 2023-2031

Figure 74: Latin America Ultrasound Probes Market Value Share Analysis, by Application, 2022 and 2031

Figure 75: Latin America Ultrasound Probes Market Attractiveness Analysis, by Application, 2023-2031

Figure 76: Latin America Ultrasound Probes Market Value Share Analysis, by End-user, 2022 and 2031

Figure 77: Latin America Ultrasound Probes Market Attractiveness Analysis, by End-user, 2023-2031

Figure 78: Middle East and Africa Ultrasound Probes Market Value (US$ Bn) Forecast, 2017-2031

Figure 79: Middle East and Africa Ultrasound Probes Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 80: Middle East and Africa Ultrasound Probes Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 81: Middle East and Africa Ultrasound Probes Market Value Share Analysis, by Component, 2022 and 2031

Figure 82: Middle East and Africa Ultrasound Probes Market Attractiveness Analysis, by Component, 2023-2031

Figure 83: Middle East and Africa Ultrasound Probes Market Value Share Analysis, by Type, 2022 and 2031

Figure 84: Middle East and Africa Ultrasound Probes Market Attractiveness Analysis, by Type, 2023-2031

Figure 85: Middle East and Africa Ultrasound Probes Market Value Share Analysis, by Application, 2022 and 2031

Figure 86: Middle East and Africa Ultrasound Probes Market Attractiveness Analysis, by Application, 2023-2031

Figure 87: Middle East and Africa Ultrasound Probes Market Value Share Analysis, by End-user, 2022 and 2031

Figure 88: Middle East and Africa Ultrasound Probes Market Attractiveness Analysis, by End-user, 2023-2031

Figure 89: Company Share Analysis