Analysts’ Viewpoint on Knitwear Market Scenario

Companies in the knitwear market are focusing on natural and eco-friendly materials to keep their businesses growing post the COVID-19 pandemic, as consumers nowadays are moving toward more sustainable products. Knitwear material is anti-wrinkle, has high absorption capacity, and good elasticity as compared to woven fabrics. Hence, there is an increase in demand for branded knitwear products. The growing demand for 3D-knitted garments is due to the rising adoption of 3D software, which helps in creating virtual images on clothing and saves time, energy, and money. Manufacturers should tap into incremental opportunities and focus on innovative & high-technology knitting machines, which can design products as per recent trends to broaden their revenue streams.

Knitwear are garments that are made using knitted fabrics. Knitwear are more comfortable and soft as compared to woven wear. They are made using natural, synthetic, and blended materials. Compared to woven fabrics, they possess better absorption capacity, elasticity, and wrinkle resistance properties, which make them a better material within the mentioned application segments. However, manufacturers in many countries are still unaware of the existence of this technology. Woven apparel is still a key type in the global apparel market. Companies in this market should increase their R&D in natural and eco-friendly knitwear products to enable wrinkle-resistant properties and fabric that requires low maintenance. Stiff competition with local companies catering to smaller regions who work on narrow margins and also provide personal support is expected to hamper the knitwear market during the forecast period. Nevertheless, it is possible to further reduce the price of knitwear and increase its penetration across the world with the development of innovative and high-technology knitting machines. This creates lucrative opportunities for manufacturers of knitwear.

Request a sample to get extensive insights into the Knitwear Market

Growing demand for different knitted sportswear (t-shirts, pants, shorts, socks, etc.) can be attributed to the increase in sports activities such as aerobics, athletics, football, and cricket. An increase in penetration of the Internet is further expected to drive the sports segment, and consequently the knitwear market during the forecast period.

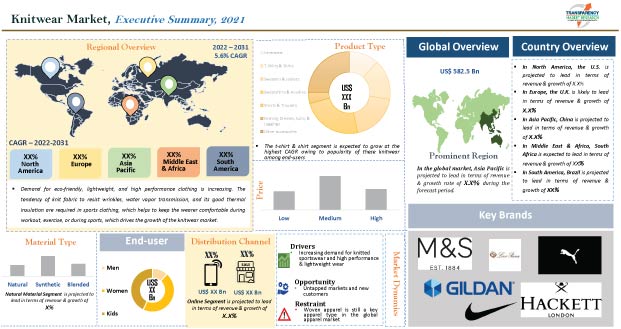

The surging demand for knitwear is primarily due to its moisture-wicking ability, anti-wrinkle properties, easy breathability, etc. Furthermore, it is more comfortable and soft as compared to woven fabrics, which, in turn, is driving its demand in various applications. Knit fabrics resist wrinkles. Its water vapor transmission and good thermal insulation are required in sports clothing which helps to keep the wearer comfortable during workouts, exercise, and sports performance. Knitwear fabric has all these properties due to which its demand is projected to be more than other fabrics.

The growing demand for lightweight and high-performance clothing is driving the demand for different types of knitwear made from natural, synthetic, and blended materials. Knitwear products have better breathability, and chlorine resistance, are anti-tear, and have better durable materials. Furthermore, the application of knitted fabric has been growing in denim clothing as consumer preference is shifting more toward softer material in clothing with high compression, flexibility, and soft wear. The rising popularity of different types of knitwear, owing to increase in social media trends and Internet penetration, is boosting the demand for knitwear. Manufacturers catering to the demand of customers as per recent trends are launching different designs, patterns, trendy colors, and styles in knitwear such as letter pattern craft, asymmetric patchwork, and Scandi folk style, to strengthen the sense of fashion in knitwear for end-users, including men, women, and kids.

In terms of product type, the global knitwear market has been segmented into innerwear, t-shirts & shirts, jackets & sweaters, sweatshirts & hoodies, shorts & trousers, evening dresses, suits, & leggings, and others such as caps, scarves, gloves, socks, etc. T-shirts & shirts type and sweatshirts & hoodies of the knitwear market held a major share and are expected to grow at the highest CAGR during the forecast period.

Knitwear are classified into natural, synthetic, and blended, in terms of material type. The natural material segment dominates the global knitwear market. Furthermore, this segment is expected to register the highest CAGR during the forecast period. Rising demand for eco-friendly and recycled products, owing to increasing awareness regarding sustainability and anti-wrinkle & high absorption capacity of natural material has increased in demand for knitwear from natural material. However, rising cotton and yarn prices are a concern for many manufacturers; moreover, low technology awareness in many developing countries results in low production which could hamper the growth of the market. Thus, manufacturers are focusing on adopting machines that could increase their production capacity.

Asia Pacific held the largest volume share of the global knitwear market. The high share of the region can be ascribed to the large demand from China, Japan, India, etc. China accounts for almost one-third of the overall knitwear market in Asia Pacific. Rapidly changing fashion trends, along with affordability of the product at a competitive price point, comfort, style, etc., attracts customers in Asia Pacific to buy knitwear products.

North America and Europe are also key markets for knitwear. The popularity of knitwear among celebrities and consumers is expected to boost the demand for knitwear in these regions.

The knitwear market is fragmented due to the presence of several players. Competition is expected to intensify in the near future due to the entry of several local players. Manufacturers in the knitwear market are also focusing on style and classic designs, along with comfort, and promoting new designs periodically. Many companies are trying to meet the demand of the younger generation as per the latest trends by introducing fresh and quirky designs, while adhering to the quality of different knitwear.

Key players operating in the global knitwear market are Nike Inc., Adidas AG, Gap Inc., Fast Retailing Co., Ltd., Marks and Spencer Group plc., Gildan Activewear Inc., Hackett Ltd, Abercrombie & Fitch Co., Loro Piana S.P.A., Ralph Lauren Corp., Lactose, The Nautical Company (U.K.) Ltd., Victoria’s Secret, YOOX NET-A-PORTER GROUP, etc.

Each of these players has been profiled in the knitwear market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Request a custom report on Knitwear Market

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 582.5 Bn |

|

Market Forecast Value in 2031 |

US$ 998.6 Bn |

|

Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, key supplier analysis, consumer buying behavior, and brand analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The knitwear market contributed US$ 582.5 Bn in 2021

The knitwear market is expected to reach US$ 998.6 Bn by 2031

The knitwear market is estimated to grow at a CAGR of 5.6% by 2031

Increasing demand for knitted sportswear, and high-performance & lightweight wear

Natural material segment contributed 39.5% share to the knitwear market in 2021

Asia Pacific is a more attractive region for vendors in the knitwear market, followed by North America and Europe

Adidas AG, GAP Inc., Gildan Activewear Inc., Hackett Limited, Hollister Co., Loro Piana S.p.A., Marks and Spencer plc., Nike Inc., Puma SE, Ralph Lauren Corporation, Lyle & Scott, The Lacoste Group, The Nautical Company (UK) Ltd, Uniqlo co., Ltd., Victoria’s Secret, and YOOX NET-A-PORTER GROUP S.P.A etc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Apparel Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Raw Material Analysis

5.9. Key Trends Analysis

5.9.1. Supplier Side

5.9.2. Demand Side

5.10. Global Knitwear Market Analysis and Forecast, 2017-2031

5.10.1. Market Revenue Projections (US$ Bn )

5.10.2. Market Volume Projections (Million Units)

6. Global Knitwear Market Analysis and Forecast, By Product Type

6.1. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Product Type, 2017-2031

6.1.1. T-Shirts & Shirts

6.1.2. Jackets & Sweaters

6.1.3. Sweatshirts & Hoodies

6.1.4. Shorts & Trousers

6.1.5. Innerwear

6.1.6. Evening Dresses, Suits, & Leggings

6.1.7. Others

6.2. Incremental Opportunity, By Product Type

7. Global Knitwear Market Analysis and Forecast, By Material Type

7.1. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Material Type , 2017-2031

7.1.1. Natural

7.1.2. Synthetic

7.1.3. Blended

7.2. Incremental Opportunity, By Material Type

8. Global Knitwear Market Analysis and Forecast, By Price Category

8.1. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Price Category, 2017-2031

8.1.1. Low

8.1.2. Medium

8.1.3. High

8.2. Incremental Opportunity, By Price Category

9. Global Knitwear Market Analysis and Forecast, By End-user

9.1. Knitwear Market Size (US$ Bn & Million Units) Forecast, By End-user, 2017-2031

9.1.1. Men

9.1.2. Women

9.1.3. Kids

9.2. Incremental Opportunity, By End-user

10. Global Knitwear Market Analysis and Forecast, By Distribution Channel

10.1. Global Knitwear Market Size (US$ Bn & Million Units) Forecast, By Distribution Channel , 2017-2031

10.1.1. Online

10.1.1.1. E-commerce Website

10.1.1.2. Company Owned Websites

10.1.2. Offline

10.1.2.1. Specialty Stores

10.1.2.2. Departmental Stores

10.1.2.3. Other Retail Stores

10.2. Incremental Opportunity, By Distribution Channel

11. Global Knitwear Market Analysis and Forecast, By Region

11.1. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Region, 2017-2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia-Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Knitwear Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trends Analysis

12.2.1. Supplier Side

12.2.2. Demand Side

12.3. Brand Analysis

12.4. Key Supplier Analysis

12.5. Price Trend Analysis

12.5.1. Weighted Average Price

12.6. Consumer Buying Behavior

12.7. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Product Type, 2017-2031

12.7.1. T-Shirts & Shirts

12.7.2. Jackets & Sweaters

12.7.3. Sweatshirts & Hoodies

12.7.4. Shorts & Trousers

12.7.5. Innerwear

12.7.6. Evening Dresses, Suits, & Leggings

12.7.7. Others

12.8. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Material Type, 2017-2031

12.8.1. Natural

12.8.2. Synthetic

12.8.3. Blended

12.9. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Price Category, 2017-2031

12.9.1. Low

12.9.2. Medium

12.9.3. High

12.10. Knitwear Market Size (US$ Bn & Million Units) Forecast, By End-user, 2017-2031

12.10.1. Men

12.10.2. Women

12.10.3. Kids

12.11. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Distribution Channel, 2017-2031

12.11.1. Online

12.11.1.1. E-commerce Website

12.11.1.2. Company Owned Websites

12.11.2. Offline

12.11.2.1. Specialty Stores

12.11.2.2. Departmental Stores

12.11.2.3. Other Retail Stores

12.12. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Country & Sub-region, 2017-2031

12.12.1. U.S.

12.12.2. Canada

12.12.3. Rest of North America

13. Europe Knitwear Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trends Analysis

13.2.1. Supplier Side

13.2.2. Demand Side

13.3. Brand Analysis

13.4. Key Supplier Analysis

13.5. Price Trend Analysis

13.5.1. Weighted Average Price

13.6. Consumer Buying Behavior

13.7. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Product Type, 2017-2031

13.7.1. T-Shirts & Shirts

13.7.2. Jackets & Sweaters

13.7.3. Sweatshirts & Hoodies

13.7.4. Shorts & Trousers

13.7.5. Innerwear

13.7.6. Evening Dresses, Suits, & Leggings

13.7.7. Others

13.8. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Material Type, 2017-2031

13.8.1. Natural

13.8.2. Synthetic

13.8.3. Blended

13.9. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Price Category, 2017-2031

13.9.1. Low

13.9.2. Medium

13.9.3. High

13.10. Knitwear Market Size (US$ Bn & Million Units) Forecast, By End-user, 2017-2031

13.10.1. Men

13.10.2. Women

13.10.3. Kids

13.11. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Distribution Channel, 2017-2031

13.11.1. Online

13.11.1.1. E-commerce Website

13.11.1.2. Company Owned Websites

13.11.2. Offline

13.11.2.1. Specialty Stores

13.11.2.2. Departmental Stores

13.11.2.3. Other Retail Stores

13.12. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Country & Sub-region, 2017-2031

13.12.1. U.K.

13.12.2. Germany

13.12.3. France

13.12.4. Rest of Europe

13.13. Incremental Opportunity Analysis

14. Asia Pacific Knitwear Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trends Analysis

14.2.1. Supplier Side

14.2.2. Demand Side

14.3. Brand Analysis

14.4. Key Supplier Analysis

14.5. Price Trend Analysis

14.5.1. Weighted Average Price

14.6. Consumer Buying Behavior

14.7. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Product Type, 2017-2031

14.7.1. T-Shirts & Shirts

14.7.2. Jackets & Sweaters

14.7.3. Sweatshirts & Hoodies

14.7.4. Shorts & Trousers

14.7.5. Innerwear

14.7.6. Evening Dresses, Suits, & Leggings

14.7.7. Others

14.8. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Material Type, 2017-2031

14.8.1. Natural

14.8.2. Synthetic

14.8.3. Blended

14.9. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Price Category, 2017-2031

14.9.1. Low

14.9.2. Medium

14.9.3. High

14.10. Knitwear Market Size (US$ Bn & Million Units) Forecast, By End-user, 2017-2031

14.10.1. Men

14.10.2. Women

14.10.3. Kids

14.11. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Distribution Channel, 2017-2031

14.11.1. Online

14.11.1.1. E-commerce Website

14.11.1.2. Company Owned Websites

14.11.2. Offline

14.11.2.1. Specialty Stores

14.11.2.2. Departmental Stores

14.11.2.3. Other Retail Stores

14.12. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Country & Sub-region, 2017-2031

14.12.1. China

14.12.2. India

14.12.3. Japan

14.12.4. Rest of Asia Pacific

14.13. Incremental Opportunity Analysis

15. Middle East & Africa Knitwear Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Trends Analysis

15.2.1. Supplier Side

15.2.2. Demand Side

15.3. Brand Analysis

15.4. Key Supplier Analysis

15.5. Price Trend Analysis

15.5.1. Weighted Average Price

15.6. Consumer Buying Behavior

15.7. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Product Type, 2017-2031

15.7.1. T-Shirts & Shirts

15.7.2. Jackets & Sweaters

15.7.3. Sweatshirts & Hoodies

15.7.4. Shorts & Trousers

15.7.5. Innerwear

15.7.6. Evening Dresses, Suits, & Leggings

15.7.7. Others

15.8. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Material Type, 2017-2031

15.8.1. Natural

15.8.2. Synthetic

15.8.3. Blended

15.9. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Price Category, 2017-2031

15.9.1. Low

15.9.2. Medium

15.9.3. High

15.10. Knitwear Market Size (US$ Bn & Million Units) Forecast, By End-user, 2017-2031

15.10.1. Men

15.10.2. Women

15.10.3. Kids

15.11. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Distribution Channel, 2017-2031

15.11.1. Online

15.11.1.1. E-commerce Website

15.11.1.2. Company Owned Websites

15.11.2. Offline

15.11.2.1. Specialty Stores

15.11.2.2. Departmental Stores

15.11.2.3. Other Retail Stores

15.12. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Country & Sub-region, 2017-2031

15.12.1. GCC

15.12.2. South Africa

15.12.3. Rest of Middle East & Africa

15.13. Incremental Opportunity Analysis

16. South America Knitwear Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Trends Analysis

16.2.1. Supplier Side

16.2.2. Demand Side

16.3. Brand Analysis

16.4. Key Supplier Analysis

16.5. Price Trend Analysis

16.5.1. Weighted Average Price

16.6. Consumer Buying Behavior

16.7. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Product Type, 2017-2031

16.7.1. T-Shirts & Shirts

16.7.2. Jackets & Sweaters

16.7.3. Sweatshirts & Hoodies

16.7.4. Shorts & Trousers

16.7.5. Innerwear

16.7.6. Evening Dresses, Suits, & Leggings

16.7.7. Others

16.8. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Material Type, 2017-2031

16.8.1. Natural

16.8.2. Synthetic

16.8.3. Blended

16.9. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Price Category, 2017-2031

16.9.1. Low

16.9.2. Medium

16.9.3. High

16.10. Knitwear Market Size (US$ Bn & Million Units) Forecast, By End-user, 2017-2031

16.10.1. Men

16.10.2. Women

16.10.3. Kids

16.11. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Distribution Channel, 2017-2031

16.11.1. Online

16.11.1.1. E-commerce Website

16.11.1.2. Company Owned Websites

16.11.2. Offline

16.11.2.1. Specialty Stores

16.11.2.2. Departmental Stores

16.11.2.3. Other Retail Stores

16.12. Knitwear Market Size (US$ Bn & Million Units) Forecast, By Country & Sub-region, 2017-2031

16.12.1. Brazil

16.12.2. Rest of South America

16.13. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player – Competition Dashboard

17.2. Market Revenue Share Analysis (%), by Company, (2021)

17.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

17.3.1. Adidas AG

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Revenue

17.3.1.4. Strategy & Business Overview

17.3.2. GAP Inc.

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Revenue

17.3.2.4. Strategy & Business Overview

17.3.3. Gildan Activewear Inc.

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Revenue

17.3.3.4. Strategy & Business Overview

17.3.4. Hackett Limited

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Revenue

17.3.4.4. Strategy & Business Overview

17.3.5. Hollister Co.

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Revenue

17.3.5.4. Strategy & Business Overview

17.3.6. Loro Piana S.p.A.

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Revenue

17.3.6.4. Strategy & Business Overview

17.3.7. Marks and Spencer plc.

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Revenue

17.3.7.4. Strategy & Business Overview

17.3.8. Nike Inc.

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Revenue

17.3.8.4. Strategy & Business Overview

17.3.9. Puma SE

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Revenue

17.3.9.4. Strategy & Business Overview

17.3.10. Ralph Lauren Corporation

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Revenue

17.3.10.4. Strategy & Business Overview

17.3.11. The Lacoste Group

17.3.11.1. Company Overview

17.3.11.2. Sales Area/Geographical Presence

17.3.11.3. Revenue

17.3.11.4. Strategy & Business Overview

17.3.12. The Nautical Company (UK) Ltd

17.3.12.1. Company Overview

17.3.12.2. Sales Area/Geographical Presence

17.3.12.3. Revenue

17.3.12.4. Strategy & Business Overview

17.3.13. Uniqlo co., Ltd.

17.3.13.1. Company Overview

17.3.13.2. Sales Area/Geographical Presence

17.3.13.3. Revenue

17.3.13.4. Strategy & Business Overview

17.3.14. Victoria’s Secret

17.3.14.1. Company Overview

17.3.14.2. Sales Area/Geographical Presence

17.3.14.3. Revenue

17.3.14.4. Strategy & Business Overview

17.3.15. YOOX NET-A-PORTER GROUP S.P.A

17.3.15.1. Company Overview

17.3.15.2. Sales Area/Geographical Presence

17.3.15.3. Revenue

17.3.15.4. Strategy & Business Overview

17.3.16. Lyle & Scott.

17.3.16.1. Company Overview

17.3.16.2. Sales Area/Geographical Presence

17.3.16.3. Revenue

17.3.16.4. Strategy & Business Overview

18. Key Takeaway

18.1. Identification of Potential Market Spaces

18.1.1. Product Type

18.1.2. Material

18.1.3. Price Category

18.1.4. End-user

18.1.5. Distribution Channel

18.1.6. Region

18.2. Understanding the Buying Process of Customers

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Knitwear Market, by Product type, Million Units, 2017-2031

Table 2: Global Knitwear Market, by Product type, US$ Bn , 2017-2031

Table 3: Global Knitwear Market, By Material Type, Million Units 2017-2031

Table 4: Global Knitwear Market, By Material Type, US$ Bn 2017-2031

Table 5: Global Knitwear Market, by Price Category, Million Units, 2017-2031

Table 6: Global Knitwear Market, by Price Category, US$ Bn 2017-2031

Table 7: Global Knitwear Market, by End-user, Million Units, 2017-2031

Table 8: Global Knitwear Market, by End-user, US$ Bn 2017-2031

Table 9: Global Knitwear Market, by Distribution Channel, Million Units, 2017-2031

Table 10: Global Knitwear Market, by Distribution Channel, US$ Bn 2017-2031

Table 11: Global Knitwear Market, by Region, Million Units, 2017-2031

Table 12: Global Knitwear Market, by Region, US$ Bn 2017-2031

Table 13: North America Knitwear Market, by Product type, Million Units, 2017-2031

Table 14: North America Knitwear Market, by Product type, US$ Bn , 2017-2031

Table 15: North America Knitwear Market, By Material Type, Million Units 2017-2031

Table 16: North America Knitwear Market, By Material Type, US$ Bn 2017-2031

Table 17: North America Knitwear Market, by Price Category, Million Units, 2017-2031

Table 18: North America Knitwear Market, by Price Category, US$ Bn 2017-2031

Table 19: North America Knitwear Market, by End-user, Million Units, 2017-2031

Table 20: North America Knitwear Market, by End-user, US$ Bn 2017-2031

Table 21: North America Knitwear Market, by Distribution Channel, Million Units, 2017-2031

Table 22: North America Knitwear Market, by Distribution Channel, US$ Bn 2017-2031

Table 23: North America Knitwear Market, by Region, Million Units, 2017-2031

Table 24: North America Knitwear Market, by Region, US$ Bn 2017-2031

Table 25: Europe Knitwear Market, by Product type, Million Units, 2017-2031

Table 26: Europe Knitwear Market, by Product type, US$ Bn , 2017-2031

Table 27: Europe Knitwear Market, By Material Type, Million Units 2017-2031

Table 28: Europe Knitwear Market, By Material Type, US$ Bn 2017-2031

Table 29: Europe Knitwear Market, by Price Category, Million Units, 2017-2031

Table 30: Europe Knitwear Market, by Price Category, US$ Bn 2017-2031

Table 31: Europe Knitwear Market, by End-user, Million Units, 2017-2031

Table 32: Europe Knitwear Market, by End-user, US$ Bn 2017-2031

Table 33: Europe Knitwear Market, by Distribution Channel, Million Units, 2017-2031

Table 34: Europe Knitwear Market, by Distribution Channel, US$ Bn 2017-2031

Table 35: Europe Knitwear Market, by Region, Million Units, 2017-2031

Table 36: Europe Knitwear Market, by Region, US$ Bn 2017-2031

Table 37: Asia Pacific Knitwear Market, by Product type, Million Units, 2017-2031

Table 38: Asia Pacific Knitwear Market, by Product type, US$ Bn , 2017-2031

Table 39: Asia Pacific Knitwear Market, By Material Type, Million Units 2017-2031

Table 40: Asia Pacific Knitwear Market, By Material Type, US$ Bn 2017-2031

Table 41: Asia Pacific Knitwear Market, by Price Category, Million Units, 2017-2031

Table 42: Asia Pacific Knitwear Market, by Price Category, US$ Bn 2017-2031

Table 43: Asia Pacific Knitwear Market, by End-user, Million Units, 2017-2031

Table 44: Asia Pacific Knitwear Market, by End-user, US$ Bn 2017-2031

Table 45: Asia Pacific Knitwear Market, by Distribution Channel, Million Units, 2017-2031

Table 46: Asia Pacific Knitwear Market, by Distribution Channel, US$ Bn 2017-2031

Table 47: Asia Pacific Knitwear Market, by Region, Million Units, 2017-2031

Table 48: Asia Pacific Knitwear Market, by Region, US$ Bn 2017-2031

Table 49: Middle East & Africa Knitwear Market, by Product type, Million Units, 2017-2031

Table 50: Middle East & Africa Knitwear Market, by Product type, US$ Bn , 2017-2031

Table 51: Middle East & Africa Knitwear Market, By Material Type, Million Units 2017-2031

Table 52: Middle East & Africa Knitwear Market, By Material Type, US$ Bn 2017-2031

Table 53: Middle East & Africa Knitwear Market, by Price Category, Million Units, 2017-2031

Table 54: Middle East & Africa Knitwear Market, by Price Category, US$ Bn 2017-2031

Table 55: Middle East & Africa Knitwear Market, by End-user, Million Units, 2017-2031

Table 56: Middle East & Africa Knitwear Market, by End-user, US$ Bn 2017-2031

Table 57: Middle East & Africa Knitwear Market, by Distribution Channel, Million Units, 2017-2031

Table 58: Middle East & Africa Knitwear Market, by Distribution Channel, US$ Bn 2017-2031

Table 59: Middle East & Africa Knitwear Market, by Region, Million Units, 2017-2031

Table 60: Middle East & Africa Knitwear Market, by Region, US$ Bn 2017-2031

Table 61: South America Knitwear Market, by Product type, Million Units, 2017-2031

Table 62: South America Knitwear Market, by Product type, US$ Bn , 2017-2031

Table 63: South America Knitwear Market, By Material Type, Million Units 2017-2031

Table 64: South America Knitwear Market, By Material Type, US$ Bn 2017-2031

Table 65: South America Knitwear Market, by Price Category, Million Units, 2017-2031

Table 66: South America Knitwear Market, by Price Category, US$ Bn 2017-2031

Table 67: South America Knitwear Market, by End-user, Million Units, 2017-2031

Table 68: South America Knitwear Market, by End-user, US$ Bn 2017-2031

Table 69: South America Knitwear Market, by Distribution Channel, Million Units, 2017-2031

Table 70: South America Knitwear Market, by Distribution Channel, US$ Bn 2017-2031

Table 71: South America Knitwear Market, by Region, Million Units, 2017-2031

Table 72: South America Knitwear Market, by Region, US$ Bn 2017-2031

List of Figures

Figure 1: Global Knitwear Projections, by Product Type, Million Units 2017-2031

Figure 2: Global Knitwear Projections, by Product Type, US$ Bn 2017-2031

Figure 3: Global Knitwear, Incremental Opportunity, by Product Type, US$ Bn 2021 -2031

Figure 4: Global Knitwear Projections, By Material Type, Million Units, 2017-2031

Figure 5: Global Knitwear Projections, By Material Type, US$ Bn 2017-2031

Figure 6: Global Knitwear, Incremental Opportunity, By Material Type, US$ Bn 2021 -2031

Figure 7: Global Knitwear Projections, by Price Category, Million Units, 2017-2031

Figure 8: Global Knitwear Projections, by Price Category, US$ Bn 2017-2031

Figure 9: Global Knitwear, Incremental Opportunity, by Price Category, US$ Bn 2021 -2031

Figure 10: Global Knitwear Projections, by End-user, Million Units, 2017-2031

Figure 11: Global Knitwear Projections, by End-user, US$ Bn 2017-2031

Figure 12: Global Knitwear, Incremental Opportunity, by End-user, US$ Bn 2021 -2031

Figure 13: Global Knitwear Projections, by Distribution Channel, Million Units, 2017-2031

Figure 14: Global Knitwear Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 15: Global Knitwear, Incremental Opportunity, by Distribution Channel, US$ Bn 2021 -2031

Figure 16: Global Knitwear Projections, by Region, Million Units, 2017-2031

Figure 17: Global Knitwear Projections, by Region, US$ Bn 2017-2031

Figure 18: Global Knitwear, Incremental Opportunity, by Region, US$ Bn 2021 -2031

Figure 19: North America Knitwear Projections, by Product type, Million Units, 2017-2031

Figure 20: North America Knitwear Projections, by Product type, US$ Bn 2017-2031

Figure 21: North America Knitwear, Incremental Opportunity, by Product type, US$ Bn 2021 -2031

Figure 22: North America Knitwear Projections, By Material Type, Million Units, 2017-2031

Figure 23: North America Knitwear Projections, By Material Type, US$ Bn 2017-2031

Figure 24: North America Knitwear, Incremental Opportunity, By Material Type, US$ Bn 2021 -2031

Figure 25: North America Knitwear Projections, by Price Category, Million Units, 2017-2031

Figure 26: North America Knitwear Projections, by Price Category, US$ Bn 2017-2031

Figure 27: North America Knitwear, Incremental Opportunity, by Price Category, US$ Bn 2021 -2031

Figure 28: North America Knitwear Projections, by End-user, Million Units, 2017-2031

Figure 29: North America Knitwear Projections, by End-user, US$ Bn 2017-2031

Figure 30: North America Knitwear, Incremental Opportunity, by End-user, US$ Bn 2021 -2031

Figure 31: North America Knitwear Projections, by Distribution Channel, Million Units, 2017-2031

Figure 32: North America Knitwear Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 33: North America Knitwear, Incremental Opportunity, by Distribution Channel, US$ Bn 2021 -2031

Figure 34: North America Knitwear Projections, by Region, Million Units, 2017-2031

Figure 35: North America Knitwear Projections, by Region, US$ Bn 2017-2031

Figure 36: North America Knitwear, Incremental Opportunity, by Region, US$ Bn 2021 -2031

Figure 37: Europe Knitwear Projections, by Product type, Million Units, 2017-2031

Figure 38: Europe Knitwear Projections, by Product type, US$ Bn 2017-2031

Figure 39: Europe Knitwear, Incremental Opportunity, by Product type, US$ Bn 2021 -2031

Figure 40: Europe Knitwear Projections, By Material Type, Million Units, 2017-2031

Figure 41: Europe Knitwear Projections, By Material Type, US$ Bn 2017-2031

Figure 42: Europe Knitwear, Incremental Opportunity, By Material Type, US$ Bn 2021 -2031

Figure 43: Europe Knitwear Projections, by Price Category, Million Units, 2017-2031

Figure 44: Europe Knitwear Projections, by Price Category, US$ Bn 2017-2031

Figure 45: Europe Knitwear, Incremental Opportunity, by Price Category, US$ Bn 2021 -2031

Figure 46: Europe Knitwear Projections, by End-user, Million Units, 2017-2031

Figure 47: Europe Knitwear Projections, by End-user, US$ Bn 2017-2031

Figure 48: Europe Knitwear, Incremental Opportunity, by End-user, US$ Bn 2021 -2031

Figure 49: Europe Knitwear Projections, by Distribution Channel, Million Units, 2017-2031

Figure 50: Europe Knitwear Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 51: Europe Knitwear, Incremental Opportunity, by Distribution Channel, US$ Bn 2021 -2031

Figure 52: Europe Knitwear Projections, by Region, Million Units, 2017-2031

Figure 53: Europe Knitwear Projections, by Region, US$ Bn 2017-2031

Figure 54: Europe Knitwear, Incremental Opportunity, by Region, US$ Bn 2021 -2031

Figure 55: Asia Pacific Knitwear Projections, by Product type, Million Units, 2017-2031

Figure 56: Asia Pacific Knitwear Projections, by Product type, US$ Bn 2017-2031

Figure 57: Asia Pacific Knitwear, Incremental Opportunity, by Product type, US$ Bn 2021 -2031

Figure 58: Asia Pacific Knitwear Projections, By Material Type, Million Units, 2017-2031

Figure 59: Asia Pacific Knitwear Projections, By Material Type, US$ Bn 2017-2031

Figure 60: Asia Pacific Knitwear, Incremental Opportunity, By Material Type US$ Bn 2021 -2031

Figure 61: Asia Pacific Knitwear Projections, by Price Category, Million Units, 2017-2031

Figure 62: Asia Pacific Knitwear Projections, by Price Category, US$ Bn 2017-2031

Figure 63: Asia Pacific Knitwear, Incremental Opportunity, by Price Category, US$ Bn 2021 -2031

Figure 64: Asia Pacific Knitwear Projections, by End-user, Million Units, 2017-2031

Figure 65: Asia Pacific Knitwear Projections, by End-user, US$ Bn 2017-2031

Figure 66: Asia Pacific Knitwear, Incremental Opportunity, by End-user, US$ Bn 2021 -2031

Figure 67: Asia Pacific Knitwear Projections, by Distribution Channel, Million Units, 2017-2031

Figure 68: Asia Pacific Knitwear Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 69: Asia Pacific Knitwear, Incremental Opportunity, by Distribution Channel, US$ Bn 2021 -2031

Figure 70: Asia Pacific Knitwear Projections, by Region, Million Units, 2017-2031

Figure 71: Asia Pacific Knitwear Projections, by Region, US$ Bn 2017-2031

Figure 72: Asia Pacific Knitwear, Incremental Opportunity, by Region, US$ Bn 2021 -2031

Figure 73: Middle East & Africa Knitwear Projections, by Product type, Million Units, 2017-2031

Figure 74: Middle East & Africa Knitwear Projections, by Product type, US$ Bn 2017-2031

Figure 75: Middle East & Africa Knitwear, Incremental Opportunity, by Product type, US$ Bn 2021 -2031

Figure 76: Middle East & Africa Knitwear Projections, By Material Type, Million Units, 2017-2031

Figure 77: Middle East & Africa Knitwear Projections, By Material Type, US$ Bn 2017-2031

Figure 78: Middle East & Africa Knitwear, Incremental Opportunity, By Material Type, US$ Bn 2021 -2031

Figure 79: Middle East & Africa Knitwear Projections, by Price Category, Million Units, 2017-2031

Figure 80: Middle East & Africa Knitwear Projections, by Price Category, US$ Bn 2017-2031

Figure 81: Middle East & Africa Knitwear, Incremental Opportunity, by Price Category, US$ Bn 2021 -2031

Figure 82: Middle East & Africa Knitwear Projections, by End-user, Million Units, 2017-2031

Figure 83: Middle East & Africa Knitwear Projections, by End-user, US$ Bn 2017-2031

Figure 84: Middle East & Africa Knitwear, Incremental Opportunity, by End-user, US$ Bn 2021 -2031

Figure 85: Middle East & Africa Knitwear Projections, by Distribution Channel, Million Units, 2017-2031

Figure 86: Middle East & Africa Knitwear Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 87: Middle East & Africa Knitwear, Incremental Opportunity, by Distribution Channel, US$ Bn 2021 -2031

Figure 88: Middle East & Africa Knitwear Projections, by Region, Million Units, 2017-2031

Figure 89: Middle East & Africa Knitwear Projections, by Region, US$ Bn 2017-2031

Figure 90: Middle East & Africa Knitwear, Incremental Opportunity, by Region, US$ Bn 2021 -2031

Figure 91: South America Knitwear Projections, by Product type, Million Units, 2017-2031

Figure 92: South America Knitwear Projections, by Product type, US$ Bn 2017-2031

Figure 93: South America Knitwear, Incremental Opportunity, by Product type, US$ Bn 2021 -2031

Figure 94: South America Knitwear Projections, By Material Type, Million Units, 2017-2031

Figure 95: South America Knitwear Projections, By Material Type, US$ Bn 2017-2031

Figure 96: South America Knitwear, Incremental Opportunity, By Material Type, US$ Bn 2021 -2031

Figure 97: South America Knitwear Projections, by Price Category, Million Units, 2017-2031

Figure 98: South America Knitwear Projections, by Price Category, US$ Bn 2017-2031

Figure 99: South America Knitwear, Incremental Opportunity, by Price Category, US$ Bn 2021 -2031

Figure 100: South America Knitwear Projections, by End-user, Million Units, 2017-2031

Figure 101: South America Knitwear Projections, by End-user, US$ Bn, 2017-2031

Figure 102: South America Knitwear, Incremental Opportunity, by End-user, US$ Bn, 2021 -2031

Figure 103: South America Knitwear Projections, by Distribution Channel, Million Units, 2017-2031

Figure 104: South America Knitwear Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 105: South America Knitwear, Incremental Opportunity, by Distribution Channel, US$ Bn, 2021 -2031

Figure 106: South America Knitwear Projections, by Region, Million Units, 2017-2031

Figure 107: South America Knitwear Projections, by Region, US$ Bn 2017-2031

Figure 108: South America Knitwear, Incremental Opportunity, by Region, US$ Bn 2021 -2031