Analysts’ Viewpoint

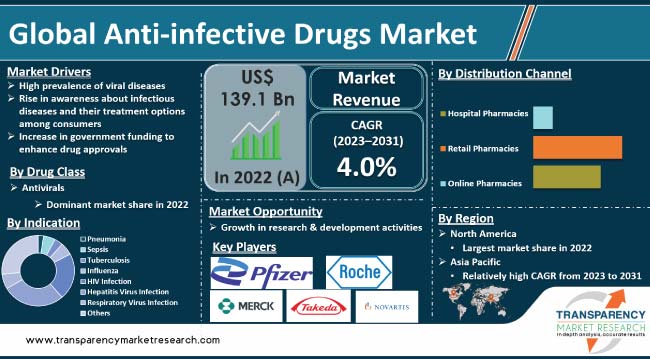

High prevalence of viral diseases and rise in awareness about infectious diseases and their treatment options among consumers are key factors driving the global market. Growth in government funding to enhance drug approvals is also boosting the anti-infective drugs market revenue. Furthermore, increase in R&D and technological advancements are augmenting the market.

Manufacturers are concentrating on new product launches, approvals, and collaborations to gain value-grab anti-infective drugs market opportunities. Anti-infective drug companies are focusing on expanding their production capacity post the peak of the COVID-19 pandemic. Government organizations such as the WHO and UNICEF are also increasing funding to enhance product approvals. However, side-effects associated with anti-infective drugs and shortage of resources in certain low- and middle-income countries (LMIC) are likely to restrain market growth in the near future.

Anti-infective drugs are medications used to treat or prevent infections caused by bacteria, viruses, fungi, or parasites. These drugs can work in various ways, such as by killing the infectious organism or by inhibiting its growth and replication.

Common examples of anti-infective drugs include antibiotics, antivirals, antifungals, and antiparasitics. Antibiotics are used to treat bacterial infections in patients, while antivirals are used to treat viral infections. Antifungals help treat fungal infections, whereas antiparasitics are used to treat parasitic infections.

Tuberculosis (TB) is the world’s second-largest infectious disease after COVID-19. In 2020, TB accounted for an estimated 1.5 million deaths (including people with HIV). After South Africa, India is the leading country with high prevalence of HIV/AIDS worldwide.

New infectious diseases such as avian flu and swine flu are also emerging at a higher rate and spreading more rapidly than ever in communities. Thus, the global demand for anti-infective drugs is expected to increase during the forecast period.

Growth in government initiatives to create awareness about infectious diseases and their treatment options is a key factor fueling the anti-infective drugs market expansion. Governments of several countries are increasingly investing in laboratory infrastructure and diagnostic capacities.

As per an article published by the Centers for Disease Control and Prevention (CDC), in September 2021, the Biden-Harris administration invested US$ 2.1 Bn to improve infection prevention and control activities across the U.S. public health and healthcare sector.

Rise in investment in R&D activities of anti-infective drugs due to surge in various new infectious diseases, such as COVID-19, is driving the global market. In 2019, the pharmaceutical sector invested US$ 83.0 Bn in R&D of anti-infective drugs.

The COVID-19 pandemic has had a significant impact on the global market for anti-infective drugs. Several industries, lives, communities, and businesses were negatively affected owing to the restrictions imposed by various countries during the pandemic. Anti-infective drugs helped prevent the spread of the SARS-CoV-2 virus.

Besides the increase in R&D spending in the private sector, the federal government has provided support to the private sector to develop vaccines in order to address the pandemic. In June 2022, the Frontiers in Immunology recommended the usage of antimicrobial peptides and antibodies as anti-infective agents against the SARS-CoV-2 virus. Wide use of anti-infective drugs to arrest the spread of COVID-19 among the population significantly contributed to anti-infective drugs market growth.

In terms of drug class, the global anti-infective drugs market has been segmented into antibacterials, antivirals, antifungals, and others. The antivirals drug class segment is anticipated to dominate the global market during the forecast period, owing to the rise in prevalence of new infectious diseases.

Several market players and government organizations have been focusing on production and manufacture of antiviral drugs. In January 2022, the UNICEF signed several LTA (long-term agreements) with suppliers for the procurement of Molnupiravir, a new antiviral medicine.

In October 2021, Merck & Co., Inc. signed a voluntary licensing agreement with Medicines Patent Pool (MPP), a United Nations-backed public health organization. The agreement facilitates affordable global access to Molnupiravir, which is an investigational oral COVID-19 antiviral medicine for the treatment of mild-to-moderate COVID-19 in adults. These initiatives are likely to boost the antiviral drugs segment growth during the forecast period.

According to the latest anti-infective drugs market forecast, the retail pharmacies distribution channel segment is anticipated to lead the global industry during the forecast period.

Retail pharmacies sell over-the-counter drugs such as common cold medicines, antipyretics, and analgesics. The number of retail pharmacies is increasing rapidly across the globe. Thus, presence of large number of knowledgeable pharmacists who review prescriptions for infectious diseases is contributing to the segment growth.

North America accounted for the largest share of the global market in 2022. The region is anticipated to lead the global landscape in the next few years, owing to the improved healthcare infrastructure and presence of well-established distribution channels in the U.S. and Canada.

Growth in the pharmaceutical sector and favorable reimbursement policies are key factors boosting market statistics in North America. Antivirals are recommended for the treatment of several infectious disorders by the Centers for Disease Control and Prevention (CDC) in the U.S. Rise in government efforts to promote the usage of antivirals is also augmenting market progress in the region.

The anti-infective drugs market size in Asia Pacific is projected to increase at a rapid pace, owing to the presence of large number of generic companies, rise in economic stability, and increase in disposable income of consumers in the region. Furthermore, surge in geriatric population that is prone to infections is projected to fuel anti-infective drugs market growth in Asia Pacific in the near future.

The global landscape is consolidated, with the presence of several key players that control majority of the market share. According to the anti-infective drugs market research, leading companies are focusing on mergers & acquisitions, new product development, and product portfolio expansion to gain incremental opportunities.

Pfizer Inc., Gland Pharma Ltd., Teva Pharmaceutical Industries Ltd., F. Hoffmann-La Roche Ltd., Novartis AG, Gilead Sciences, Inc., GlaxoSmithKline plc, Merck & Co., Inc., Abbott, Astellas Pharma Inc., Alkem Laboratories, AstraZeneca, Eli Lilly and Company, Johnson & Johnson Services, Inc., Takeda Pharmaceutical Company Limited, and Sanofi are key players operating in the global market. These players are following the anti-infective drugs market trends to avail lucrative revenue opportunities.

Prominent players have been profiled in the anti-infective drugs market report based on parameters such as financial overview, product portfolio, latest developments, business strategies, business segments, and company overview.

| Attribute | Details |

|---|---|

|

Market Value in 2022 |

US$ 139.1 Bn |

|

Market Forecast Value in 2031 |

More than US$ 177.9 Bn |

|

Growth Rate (CAGR) |

4.0% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 139.1 Bn in 2022

It is projected to reach more than US$ 177.9 Bn by 2031

The CAGR is anticipated to be 4.0% from 2023 to 2031

Increase in prevalence of viral diseases and rise in government funding and initiatives to enhance drug approvals

The antiviral drug class segment accounted for major share in 2022

North America is likely to account for major share from 2023 to 2031

Pfizer Inc., Gland Pharma Ltd., Teva Pharmaceutical Industries Ltd., F. Hoffmann-La Roche Ltd., Novartis AG, Gilead Sciences, Inc., GlaxoSmithKline plc, Merck & Co., Inc., Abbott, Astellas Pharma Inc., Alkem Laboratories, AstraZeneca, Eli Lilly and Company, Johnson & Johnson Services, Inc., Takeda Pharmaceutical Company Limited, and Sanofi

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Anti-infective Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Anti-infective Drugs Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Disease Prevalence & Incidence Rate Globally With Key Countries

5.2. Regulatory Scenario, by Region

5.3. Reimbursement Scenario by Region/Globally

5.4. Pipeline Analysis

5.5. Key Product/Brand Analysis

5.6. Key Mergers & Acquisitions

5.7. COVID-19 Pandemic Impact on Industry (Value Chain and Short/Mid/Long Term Impact)

6. Global Anti-infective Drugs Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Drug Class, 2017-2031

6.3.1. Antibacterials

6.3.1.1. B-lactams

6.3.1.2. Quinolones

6.3.1.3. Macrolides

6.3.1.4. Tetracycline

6.3.1.5. Aminoglycoside

6.3.1.6. Others

6.3.2. Antivirals

6.3.2.1. Miscellaneous Antivirals

6.3.2.2. Adamantane Antivirals

6.3.2.3. Antiviral Boosters

6.3.2.4. Others

6.3.3. Antifungals

6.3.3.1. Azoles

6.3.3.2. Echinocandins

6.3.3.3. Polyenes

6.3.3.4. Others

6.3.4. Others

6.4. Market Attractiveness Analysis, by Drug Class

7. Global Anti-infective Drugs Market Analysis and Forecast, by Route of Administration

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Route of Administration, 2017-2031

7.3.1. Oral

7.3.2. Parenteral

7.3.3. Others

7.4. Market Attractiveness Analysis, by Route of Administration

8. Global Anti-infective Drugs Market Analysis and Forecast, by Indication

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Indication, 2017-2031

8.3.1. Pneumonia

8.3.2. Sepsis

8.3.3. Tuberculosis

8.3.4. Influenza

8.3.5. HIV Infection

8.3.6. Hepatitis Virus Infection

8.3.7. Respiratory Virus Infection

8.3.8. Others

8.4. Market Attractiveness Analysis, by Indication

9. Global Anti-infective Drugs Market Analysis and Forecast, by Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Distribution Channel, 2017-2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. Market Attractiveness Analysis, by Distribution Channel

10. Global Anti-infective Drugs Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017-2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Country/Region

11. North America Anti-infective Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017-2031

11.2.1. Antibacterials

11.2.1.1. B-lactams

11.2.1.2. Quinolones

11.2.1.3. Macrolides

11.2.1.4. Tetracycline

11.2.1.5. Aminoglycoside

11.2.1.6. Others

11.2.2. Antivirals

11.2.2.1. Miscellaneous Antivirals

11.2.2.2. Adamantane Antivirals

11.2.2.3. Antiviral Boosters

11.2.2.4. Others

11.2.3. Antifungals

11.2.3.1. Azoles

11.2.3.2. Echinocandins

11.2.3.3. Polyenes

11.2.3.4. Others

11.2.4. Others

11.3. Market Value Forecast, by Route of Administration, 2017-2031

11.3.1. Oral

11.3.2. Parenteral

11.3.3. Others

11.4. Market Value Forecast, by Indication, 2017-2031

11.4.1. Pneumonia

11.4.2. Sepsis

11.4.3. Tuberculosis

11.4.4. Influenza

11.4.5. HIV Infection

11.4.6. Hepatitis Virus Infection

11.4.7. Respiratory Virus Infection

11.4.8. Others

11.5. Market Value Forecast, by Distribution Channel, 2017-2031

11.5.1. Hospital Pharmacies

11.5.2. Retail Pharmacies

11.5.3. Online Pharmacies

11.6. Market Value Forecast, by Country/Sub-region, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Drug Class

11.7.2. By Route of Administration

11.7.3. By Indication

11.7.4. By Distribution Channel

11.7.5. By Country/Sub-region

12. Europe Anti-infective Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017-2031

12.2.1. Antibacterials

12.2.1.1. B-lactams

12.2.1.2. Quinolones

12.2.1.3. Macrolides

12.2.1.4. Tetracycline

12.2.1.5. Aminoglycoside

12.2.1.6. Others

12.2.2. Antivirals

12.2.2.1. Miscellaneous Antivirals

12.2.2.2. Adamantane Antivirals

12.2.2.3. Antiviral Boosters

12.2.2.4. Others

12.2.3. Antifungals

12.2.3.1. Azoles

12.2.3.2. Echinocandins

12.2.3.3. Polyenes

12.2.3.4. Others

12.2.4. Others

12.3. Market Value Forecast, by Route of Administration, 2017-2031

12.3.1. Oral

12.3.2. Parenteral

12.3.3. Others

12.4. Market Value Forecast, by Indication, 2017-2031

12.4.1. Pneumonia

12.4.2. Sepsis

12.4.3. Tuberculosis

12.4.4. Influenza

12.4.5. HIV Infection

12.4.6. Hepatitis Virus Infection

12.4.7. Respiratory Virus Infection

12.4.8. Others

12.5. Market Value Forecast, by Distribution Channel, 2017-2031

12.5.1. Hospital Pharmacies

12.5.2. Retail Pharmacies

12.5.3. Online Pharmacies

12.6. Market Value Forecast, by Country/Sub-region, 2017-2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Drug Class

12.7.2. By Route of Administration

12.7.3. By Indication

12.7.4. By Distribution Channel

12.7.5. By Country/Sub-region

13. Asia Pacific Anti-infective Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017-2031

13.2.1. Antibacterials

13.2.1.1. B-lactams

13.2.1.2. Quinolones

13.2.1.3. Macrolides

13.2.1.4. Tetracycline

13.2.1.5. Aminoglycoside

13.2.1.6. Others

13.2.2. Antivirals

13.2.2.1. Miscellaneous Antivirals

13.2.2.2. Adamantane Antivirals

13.2.2.3. Antiviral Boosters

13.2.2.4. Others

13.2.3. Antifungals

13.2.3.1. Azoles

13.2.3.2. Echinocandins

13.2.3.3. Polyenes

13.2.3.4. Others

13.2.4. Others

13.3. Market Value Forecast, by Route of Administration, 2017-2031

13.3.1. Oral

13.3.2. Parenteral

13.3.3. Others

13.4. Market Value Forecast, by Indication, 2017-2031

13.4.1. Pneumonia

13.4.2. Sepsis

13.4.3. Tuberculosis

13.4.4. Influenza

13.4.5. HIV Infection

13.4.6. Hepatitis Virus Infection

13.4.7. Respiratory Virus Infection

13.4.8. Others

13.5. Market Value Forecast, by Distribution Channel, 2017-2031

13.5.1. Hospital Pharmacies

13.5.2. Retail Pharmacies

13.5.3. Online Pharmacies

13.6. Market Value Forecast, by Country/Sub-region, 2017-2031

13.6.1. China

13.6.2. India

13.6.3. Japan

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Drug Class

13.7.2. By Route of Administration

13.7.3. By Indication

13.7.4. By Distribution Channel

13.7.5. By Country/Sub-region

14. Latin America Anti-infective Drugs Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Class, 2017-2031

14.2.1. Antibacterials

14.2.1.1. B-lactams

14.2.1.2. Quinolones

14.2.1.3. Macrolides

14.2.1.4. Tetracycline

14.2.1.5. Aminoglycoside

14.2.1.6. Others

14.2.2. Antivirals

14.2.2.1. Miscellaneous Antivirals

14.2.2.2. Adamantane Antivirals

14.2.2.3. Antiviral Boosters

14.2.2.4. Others

14.2.3. Antifungals

14.2.3.1. Azoles

14.2.3.2. Echinocandins

14.2.3.3. Polyenes

14.2.3.4. Others

14.2.4. Others

14.3. Market Value Forecast, by Route of Administration, 2017-2031

14.3.1. Oral

14.3.2. Parenteral

14.3.3. Others

14.4. Market Value Forecast, by Indication, 2017-2031

14.4.1. Pneumonia

14.4.2. Sepsis

14.4.3. Tuberculosis

14.4.4. Influenza

14.4.5. HIV Infection

14.4.6. Hepatitis Virus Infection

14.4.7. Respiratory Virus Infection

14.4.8. Others

14.5. Market Value Forecast, by Distribution Channel, 2017-2031

14.5.1. Hospital Pharmacies

14.5.2. Retail Pharmacies

14.5.3. Online Pharmacies

14.6. Market Value Forecast, by Country/Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Drug Class

14.7.2. By Route of Administration

14.7.3. By Indication

14.7.4. By Distribution Channel

14.7.5. By Country/Sub-region

15. Middle East & Africa Anti-infective Drugs Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Drug Class, 2017-2031

15.2.1. Antibacterials

15.2.1.1. B-lactams

15.2.1.2. Quinolones

15.2.1.3. Macrolides

15.2.1.4. Tetracycline

15.2.1.5. Aminoglycoside

15.2.1.6. Others

15.2.2. Antivirals

15.2.2.1. Miscellaneous Antivirals

15.2.2.2. Adamantane Antivirals

15.2.2.3. Antiviral Boosters

15.2.2.4. Others

15.2.3. Antifungals

15.2.3.1. Azoles

15.2.3.2. Echinocandins

15.2.3.3. Polyenes

15.2.3.4. Others

15.2.4. Others

15.3. Market Value Forecast, by Route of Administration, 2017-2031

15.3.1. Oral

15.3.2. Parenteral

15.3.3. Others

15.4. Market Value Forecast, by Indication, 2017-2031

15.4.1. Pneumonia

15.4.2. Sepsis

15.4.3. Tuberculosis

15.4.4. Influenza

15.4.5. HIV Infection

15.4.6. Hepatitis Virus Infection

15.4.7. Respiratory Virus Infection

15.4.8. Others

15.5. Market Value Forecast, by Distribution Channel, 2017-2031

15.5.1. Hospital Pharmacies

15.5.2. Retail Pharmacies

15.5.3. Online Pharmacies

15.6. Market Value Forecast, by Country/Sub-region, 2017-2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Drug Class

15.7.2. By Route of Administration

15.7.3. By Indication

15.7.4. By Distribution Channel

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by Tier and Size of Companies)

16.2. Market Share Analysis, by Company, 2022

16.3. Company Profiles

16.3.1. Pfizer Inc.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Gland Pharma Ltd.

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Teva Pharmaceutical Industries Ltd.

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. F. Hoffmann-La Roche Ltd.

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Novartis AG

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. GlaxoSmithKline plc

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Gilead Sciences, Inc.

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Merck & Co., Inc.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Abbott

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Astellas Pharma Inc.

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. Alkem Laboratories

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Portfolio

16.3.11.3. Financial Overview

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

16.3.12. AstraZeneca

16.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.12.2. Product Portfolio

16.3.12.3. Financial Overview

16.3.12.4. SWOT Analysis

16.3.12.5. Strategic Overview

16.3.13. Eli Lilly and Company

16.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.13.2. Product Portfolio

16.3.13.3. Financial Overview

16.3.13.4. SWOT Analysis

16.3.13.5. Strategic Overview

16.3.14. Johnson & Johnson Services, Inc.

16.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.14.2. Product Portfolio

16.3.14.3. Financial Overview

16.3.14.4. SWOT Analysis

16.3.14.5. Strategic Overview

16.3.15. Takeda Pharmaceutical Company Limited

16.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.15.2. Product Portfolio

16.3.15.3. Financial Overview

16.3.15.4. SWOT Analysis

16.3.15.5. Strategic Overview

16.3.16. Sanofi

16.3.16.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.16.2. Product Portfolio

16.3.16.3. Financial Overview

16.3.16.4. SWOT Analysis

16.3.16.5. Strategic Overview

List of Tables

Table 01: Global Anti-infective Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 02: Global Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antibacterials, 2017-2031

Table 03: Global Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antivirals, 2017-2031

Table 04: Global Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antifungals, 2017-2031

Table 05: Global Anti-infective Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 06: Global Anti-infective Drugs Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 07: Global Anti-infective Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 08: Global Anti-infective Drugs Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 09: North America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 10: North America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antibacterials, 2017-2031

Table 11: North America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antivirals, 2017-2031

Table 12: North America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antifungals, 2017-2031

Table 13: North America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 14: North America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 15: North America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 16: North America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 17: Europe Anti-infective Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 18: Europe Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antibacterials, 2017-2031

Table 19: Europe Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antivirals, 2017-2031

Table 20: Europe Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antifungals, 2017-2031

Table 21: Europe Anti-infective Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 22: Europe Anti-infective Drugs Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 23: Europe Anti-infective Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 24: Europe Anti-infective Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 25: Asia Pacific Anti-infective Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 26: Asia Pacific Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antibacterials, 2017-2031

Table 27: Asia Pacific Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antivirals, 2017-2031

Table 28: Asia Pacific Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antifungals, 2017-2031

Table 29: Asia Pacific Anti-infective Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 30: Asia Pacific Anti-infective Drugs Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 31: Asia Pacific Anti-infective Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 32: Asia Pacific Anti-infective Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 33: Latin America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 34: Latin America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antibacterials, 2017-2031

Table 35: Latin America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antivirals, 2017-2031

Table 36: Latin America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antifungals, 2017-2031

Table 37: Latin America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 38: Latin America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 39: Latin America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 40: Latin America Anti-infective Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 41: Middle East & Africa Anti-infective Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 42: Middle East & Africa Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antibacterials, 2017-2031

Table 43: Middle East & Africa Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antivirals, 2017-2031

Table 44: Middle East & Africa Anti-infective Drugs Market Value (US$ Mn) Forecast, by Antifungals, 2017-2031

Table 45: Middle East & Africa Anti-infective Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 46: Middle East & Africa Anti-infective Drugs Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 47: Middle East & Africa Anti-infective Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 48: Middle East & Africa Anti-infective Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01: Global Anti-infective Drugs Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Anti-infective Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 03: Global Anti-infective Drugs Market Attractiveness Analysis, by Drug Class, 2022-2031

Figure 04: Global Anti-infective Drugs Market Revenue (US$ Mn), by Antibacterials, 2017-2031

Figure 05: Global Anti-infective Drugs Market Revenue (US$ Mn), by Antivirals, 2017-2031

Figure 06: Global Anti-infective Drugs Market Revenue (US$ Mn), by Antifungals, 2017-2031

Figure 07: Global Anti-infective Drugs Market Revenue (US$ Mn), by Others, 2017-2031

Figure 08: Global Anti-infective Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 09: Global Anti-infective Drugs Market Attractiveness Analysis, by Route of Administration, 2022-2031

Figure 10: Global Anti-infective Drugs Market Revenue (US$ Mn), by Oral, 2017-2031

Figure 11: Global Anti-infective Drugs Market Revenue (US$ Mn), by Parenteral, 2017-2031

Figure 12: Global Anti-infective Drugs Market Revenue (US$ Mn), by Others, 2017-2031

Figure 13: Global Anti-infective Drugs Market Attractiveness Analysis, by Indication, 2022-2031

Figure 14: Global Anti-infective Drugs Market Revenue (US$ Mn), by Pneumonia, 2017-2031

Figure 15: Global Anti-infective Drugs Market Revenue (US$ Mn), by Sepsis, 2017-2031

Figure 16: Global Anti-infective Drugs Market Revenue (US$ Mn), by Tuberculosis, 2017-2031

Figure 17: Global Anti-infective Drugs Market Revenue (US$ Mn), by Influenza, 2017-2031

Figure 18: Global Anti-infective Drugs Market Revenue (US$ Mn), by HIV Infection, 2017-2031

Figure 19: Global Anti-infective Drugs Market Revenue (US$ Mn), by Hepatitis Virus Infection, 2017-2031

Figure 20: Global Anti-infective Drugs Market Revenue (US$ Mn), by Others, 2017-2031

Figure 21: Global Anti-infective Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 22: Global Anti-infective Drugs Market Revenue (US$ Mn), by Hospital Pharmacies, 2017-2031

Figure 23: Global Anti-infective Drugs Market Revenue (US$ Mn), by Retail Pharmacies, 2017-2031

Figure 24: Global Anti-infective Drugs Market Revenue (US$ Mn), by Online Pharmacies, 2017-2031

Figure 25: Global Anti-infective Drugs Market Value Share Analysis, by Region, 2022 and 2031

Figure 26: Global Anti-infective Drugs Market Attractiveness Analysis, by Region, 2022-2031

Figure 27: North America Anti-infective Drugs Market Value (US$ Mn) Forecast, 2017-2031

Figure 28: North America Anti-infective Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 29: North America Anti-infective Drugs Market Attractiveness Analysis, by Drug Class, 2022-2031

Figure 30: North America Anti-infective Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 31: North America Anti-infective Drugs Market Attractiveness Analysis, by Route of Administration, 2022-2031

Figure 32: North America Anti-infective Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 33: North America Anti-infective Drugs Market Attractiveness Analysis, by Indication, 2022-2031

Figure 34: North America Anti-infective Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 35: North America Anti-infective Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 36: North America Anti-infective Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 37: North America Anti-infective Drugs Market Attractiveness Analysis, by Country, 2022-2031

Figure 38: North America Anti-infective Drugs Market Value (US$ Mn) Forecast, 2017-2031

Figure 39: Europe Anti-infective Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 40: Europe Anti-infective Drugs Market Attractiveness Analysis, by Drug Class, 2022-2031

Figure 41: Europe Anti-infective Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 42: Europe Anti-infective Drugs Market Attractiveness Analysis, by Route of Administration, 2022-2031

Figure 43: Europe Anti-infective Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 44: Europe Anti-infective Drugs Market Attractiveness Analysis, by Indication, 2022-2031

Figure 45: Europe Anti-infective Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 46: Europe Anti-infective Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 47: Europe Anti-infective Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 48: Europe Anti-infective Drugs Market Attractiveness Analysis, by Country, 2022-2031

Figure 49: Europe Anti-infective Drugs Market Value (US$ Mn) Forecast, 2017-2031

Figure 50: Asia Pacific Anti-infective Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 51: Asia Pacific Anti-infective Drugs Market Attractiveness Analysis, by Drug Class, 2022-2031

Figure 52: Asia Pacific Anti-infective Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 53: Asia Pacific Anti-infective Drugs Market Attractiveness Analysis, by Route of Administration, 2022-2031

Figure 54: Asia Pacific Anti-infective Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 55: Asia Pacific Anti-infective Drugs Market Attractiveness Analysis, by Indication, 2022-2031

Figure 56: Asia Pacific Anti-infective Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 57: Asia Pacific Anti-infective Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 58: Asia Pacific Anti-infective Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 59: Asia Pacific Anti-infective Drugs Market Attractiveness Analysis, by Country, 2022-2031

Figure 60: Asia Pacific Anti-infective Drugs Market Value (US$ Mn) Forecast, 2017-2031

Figure 61: Latin America Anti-infective Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 62: Latin America Anti-infective Drugs Market Attractiveness Analysis, by Drug Class, 2022-2031

Figure 63: Latin America Anti-infective Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 64: Latin America Anti-infective Drugs Market Attractiveness Analysis, by Route of Administration, 2022-2031

Figure 65: Latin America Anti-infective Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 66: Latin America Anti-infective Drugs Market Attractiveness Analysis, by Indication, 2022-2031

Figure 67: Latin America Anti-infective Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 68: Latin America Anti-infective Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 69: Latin America Anti-infective Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 70: Latin America Anti-infective Drugs Market Attractiveness Analysis, by Country, 2022-2031

Figure 71: Latin America Anti-infective Drugs Market Value (US$ Mn) Forecast, 2017-2031

Figure 72: Middle East & Africa Anti-infective Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 73: Middle East & Africa Anti-infective Drugs Market Attractiveness Analysis, by Drug Class, 2022-2031

Figure 74: Middle East & Africa Anti-infective Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 75: Middle East & Africa Anti-infective Drugs Market Attractiveness Analysis, by Route of Administration, 2022-2031

Figure 76: Middle East & Africa Anti-infective Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 77: Middle East & Africa Anti-infective Drugs Market Attractiveness Analysis, by Indication, 2022-2031

Figure 78: Middle East & Africa Anti-infective Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 79: Middle East & Africa Anti-infective Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 80: Middle East & Africa Anti-infective Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 81: Middle East & Africa Anti-infective Drugs Market Attractiveness Analysis, by Country, 2022-2031

Figure 82: Middle East & Africa Anti-infective Drugs Market Value (US$ Mn) Forecast, 2017-2031