Analysts’ Viewpoint

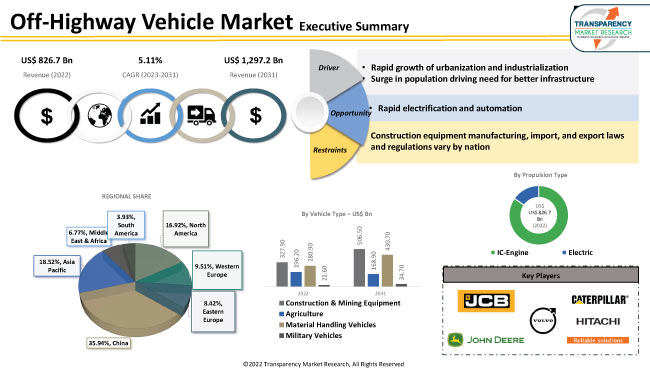

Increase in urbanization and rapid growth in mining activities are driving the global off-highway vehicle market. Utilization of off-road vehicles is rising in various industries such as agriculture, building, mining, and infrastructure. Surge in adoption of agricultural tractors & equipment is propelling the global off-highway vehicle market demand. Furthermore, government initiatives and investments in infrastructural development, especially in developing countries, are expected to bolster the global off-highway vehicle market size during the forecast period.

Improvements in carbon emissions of off-highway vehicles offers lucrative opportunities to market players. Manufacturers are focusing on investing in development of electric off-highway vehicles in order to increase market share and revenue.

However, high price and maintenance requirements are projected hamper the growth of the global off-highway vehicle market in the next few years.

Off-highway vehicle, also known as off-road vehicle or overland or adventure vehicle, is any vehicle that can go both on and off paved or gravel surfaces. Off-highway vehicles refer to vehicles, such as excavators, tractors, forklifts, cranes, backhoes, bulldozers, and golf carts, that are used off of public roads or highways. These vehicles are commonly used for mining and construction activities, agricultural activities, material handling, military, and other off-road applications.

Off-highway vehicles are identified with large tires with open and deep treads, a flexible suspension, or even caterpillar tracks, providing them higher ground clearance and higher power. These features enable these vehicles to access trails and roads that have rough and low-traction surfaces and maintenance of their wheels or tracks on the ground to maintain traction.

Wheeled vehicles achieve this by having an appropriate balance of extra or larger tires along with a high and flexible suspension. Additionally, these vehicles require specially designed engines for high power and high load carrying capacities.

Rapid growth in construction and mining activities, high demand in agriculture and forestry sector and developing port & material handling industry across the globe are projected to bolster the global off-highway vehicle market development during the forecast period.

Rise in both private & public sector investments in infrastructure development projects and growing urbanization are driving the global off-highway vehicle industry. According to United Nations, around 50% of the population lives in towns or cities, and the urban population is expected to rise to 5 billion by the end of 2030.

Growth in the urban population is increasing demand for new construction projects, including commercial buildings & infrastructure and housing. Moreover, rise in disposable income among the general public and increased preference for premium housing & infrastructure in a safe environment are boosting market growth.

The housing and building industry's continual innovations, trend of nuclear family, and shift of population from rural to urban areas in the emerging economies are fueling the growth of the construction industry. This is anticipated to bolster demand in the global off-highway vehicle market.

Demand for critical minerals is rising across the globe as a result of increase in electric vehicles, wind turbines, solar panels, and other technologies that are key to clean energy transition.

According to IEA, clean energy technologies are propelling the demand for critical minerals such as lithium, cobalt, nickel, and copper. Demand for lithium has increased three fold, 70% jump in demand for cobalt, and 50% jump in demand for copper and nickel. Hence, investment in mining activities of the critical minerals rose by 30% in 2022 as compared to 20% increase in 2021. Several mining companies are investing significantly in mineral supplies and equipment.

Therefore, significant growth in the mining activities is likely to bolster the global off-highway vehicle business growth during the forecast period.

In terms of vehicle type, the construction & mining equipment segment accounted for the largest global off-highway vehicle market share in 2022. Increase in construction and infrastructure activities across the world owing to rise in industrialization and urbanization is propelling the demand for construction and mining equipment. Heavy mining and construction equipment play a significant role in lowering overall project costs by boosting output and ensuring on-time project completion, particularly for large contracts.

Government initiatives for infrastructural development in emerging economies, such as India, China, and African countries, have increased in the past few years. For instance, the Government of India has planned an investment of US$ 122 Bn in FY23-24 for the construction of roadways, railway projects, airports, and other infrastructures.

Therefore, the growing construction & mining industry is anticipated to boost the demand for off-highway vehicles during the forecast period.

Based on propulsion, the IC-engine segment dominated the global market in 2022. The trend is expected to continue during the forecast period. High power requirement in OHVs and inadequacy of electric off-highway vehicles to fulfill the power requirements are likely to propel the IC-engine segment.

Electric off-highway vehicles are in early development phase. However, the electrification rate has been increasing in off-highway vehicles, including those used in the mining and construction sector. This is due to the necessary technologies becoming more mature and affordable, aided by their development and utilization in on-road vehicles.

Several major OEMs are already producing electric vehicles for construction, mining, and agriculture. For instance, in November 2022, Caterpillar, Inc. successfully demonstrated its electric 793 large mining truck, developed with the help of key mining customers such as BHP, Freeport-McMoRan, Newmont Corporation, Rio Tinto, and Teck Resources limited participating in Caterpillar’s Early Learner Program.

As per off-highway vehicle market trends, Asia Pacific accounted for the largest share in 2022. Ongoing mega infrastructure projects, robust industrialization, and strong business policies are the major factors driving the market in China. Moreover, surge in mining, construction, and infrastructure projects in India, Japan, Australia, North Korea, ASEAN, and other countries are expected to propel the market in Asia Pacific in the next few years.

The market in North America is likely to be propelled by robust growth in port infrastructure due to large import-export trade. According to Port Economics, Management and Policy report, the share of the total U.S. container traffic doubled every decade as a result of the rapid growth of international trade and the diffusion of containerization as a privileged mode of transportation. Additionally, significant growth in the mining activities in Canada and the U.S. for critical minerals, aluminum, gold, and others is expected to bolster the off-highway market in North America.

The global off-highway vehicle market is consolidated, with the presence of a large number of manufacturers controlling the significant market share. Major manufacturers are focusing on increasing market presence by investing in R&D activities for the development of electric off-highway vehicles to be future ready. Expansion of product portfolio and new product launches are the major strategies adopted by key players to increase market revenue.

AB Volvo, AGCO Corporation, Caterpillar, Inc., CRRC Corporation Limited, Cummins, Inc., Daimler AG, Deere & Company, Deutz AG, Doosan Corporation, Epiroc AB, Hitachi Construction Machinery Co. Ltd., Husqvarna, J. C. Bamford Excavators Ltd., Komatsu Ltd., Kubota Corp., Liebherr, Mahindra & Mahindra Limited, Massey Ferguson Ltd., Sandvik AB, Sany Heavy Industries, Scania AB, Weichai Power Co. Ltd., and Yanmar Co. Ltd. are the prominent players in the market.

Each of these players has been profiled in the off-highway vehicle market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 826.7 Bn |

| Forecast (Value) in 2031 | US$ 1,297.2 Bn |

| Growth Rate (CAGR) | 5.11% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross-segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profile |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 826.7 Bn in 2022

It is projected to expand at a CAGR of 5.11% by 2031.

It is expected to reach US$ 1,297.2 Bn in 2031.

Rise in infrastructure development and increase in construction & mining activities.

The construction & mining equipment segment accounted for the largest share in 2022.

Asia Pacific is anticipated to be highly lucrative region.

AB Volvo, AGCO Corporation, Caterpillar, Inc., CRRC Corporation Limited, Cummins, Inc., Daimler AG, Deere & Company, Deutz AG, Doosan Corporation, Epiroc AB, Hitachi Construction Machinery Co. Ltd., Husqvarna, J. C. Bamford Excavators Ltd., Komatsu Ltd., Kubota Corp, Liebherr, Mahindra & Mahindra Limited (Mahindra Powertrain), Massey Ferguson Ltd., Sandvik AB, Sany Heavy Industries, Scania AB, Weichai Power Co. Ltd., and Yanmar Co. Ltd.

1. Executive Summary

1.1. Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Demand & Supply Side Trends

1.3. TMR Analysis and Recommendations

1.3.1. Investment Opportunities and Recommendations

1.4. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunity

2.3. Market Factor Analysis

2.3.1. Porter’s Five Force Analysis

2.3.2. SWOT Analysis

2.4. Regulatory Scenario

2.5. Key Trend Analysis

2.6. Technology Milestones

2.7. Technical Standards by key players

2.7.1. Regional

3. Electrification Strategies by key OEMs

3.1. Growth Strategy Adopted

3.2. Tie-up with technology/ tier-1 suppliers

3.3. Service Providers for OEMs

4. Who Supplies Whom

4.1. List of Propulsion Suppliers

4.1.1. OEM customers of components

4.1.2. Electric Propulsion System Propulsion Suppliers

5. Key Player Analysis

5.1. Heat map of Key Players

5.2. Strategic Overview by Key Players

5.3. R&D Expenditure by OEMs for electric vehicles

5.4. Top models by key OEMs for Commercial & off-highway vehicles

5.5. Testing Partners - component level, system level, vehicle level

6. Industry Ecosystem Analysis

6.1. Value Chain Analysis

6.1.1. Propulsion Manufacturer

6.1.2. Tier 1 Players

6.1.3. 0.5 Tier Players/ Technology Providers

6.2. Vendor Matrix

6.3. Gross Margin Analysis

7. Pricing Analysis

7.1. Cost Structure Analysis

7.2. Profit Margin Analysis

8. Impact Analysis – Off-Highway Vehicle Market

8.1. Smart City Development Projects

8.2. Road & Infrastructure Development

8.3. Urbanization & Demand for Construction & Mining

8.4. Global Increase in Population Outlook

9. COVID-19 Impact Analysis – Off-Highway Vehicle Market

10. Off-Highway Vehicle Market – Production Statistics

11. Off-Highway Vehicle Market – Primary Insights

12. Global Off-highway Vehicle Market, By Vehicle Type

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

12.2.1. Construction & Mining Equipment

12.2.1.1. Excavators

12.2.1.2. Backhoe loaders

12.2.1.3. Skid steer loaders

12.2.1.4. Dumpers

12.2.1.5. Bulldozers

12.2.1.6. Motor graders

12.2.1.7. Road rollers

12.2.1.8. Pavers

12.2.1.9. Cold planers

12.2.1.10. Drilling equipment

12.2.1.11. Piling equipment

12.2.1.12. Tunnel boring machines and equipment

12.2.1.13. Demolition equipment

12.2.1.14. Mixer trucks

12.2.1.15. Formwork equipment

12.2.1.16. Scaffolding equipment

12.2.1.17. Dump trucks

12.2.1.18. Underground mining equipment

12.2.1.19. Forestry Equipment

12.2.1.20. Trailers

12.2.1.21. Other construction & mining equipment material

12.2.2. Agriculture

12.2.2.1. Agriculture Equipment

12.2.2.2. Tractor

12.2.3. Material Handling Vehicles

12.2.4. Military Vehicles

13. Global Off-highway Vehicle Market, By Propulsion

13.1. Market Snapshot

13.1.1. Introduction, Definition, and Key Findings

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. Global Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Propulsion

13.2.1. IC-Engine

13.2.1.1. Gasoline

13.2.1.2. Diesel

13.2.2. Electric

13.2.2.1. Battery Electric Vehicle

13.2.2.2. Hybrid Electric Vehicle

14. Global Off-highway Vehicle Market, By Engine Capacity

14.1. Market Snapshot

14.1.1. Introduction, Definition, and Key Findings

14.1.2. Market Growth & Y-o-Y Projections

14.1.3. Base Point Share Analysis

14.2. Global Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Engine Capacity

14.2.1. Less than 5L

14.2.2. 5L to 10L

14.2.3. More than 10L

15. Global Off-highway Vehicle Market, By Power Output

15.1. Market Snapshot

15.1.1. Introduction, Definition, and Key Findings

15.1.2. Market Growth & Y-o-Y Projections

15.1.3. Base Point Share Analysis

15.2. Global Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Power Output

15.2.1. Agricultural Equipment

15.2.1.1. Up to 25 KW

15.2.1.2. 26 KW – 50 KW

15.2.1.3. 51 KW –75 KW

15.2.1.4. More than 76 KW

15.2.2. Construction & Mining Equipment

15.2.2.1. Up to 75 KW

15.2.2.2. 76 KW – 150 KW

15.2.2.3. 151 KW – 300 KW

15.2.2.4. 301 KW – 400 KW

15.2.2.5. More than 400 KW

15.2.3. Others

16. Global Off-highway Vehicle Market, By Country/Region

16.1. Market Snapshot

16.1.1. Introduction, Definition, and Key Findings

16.1.2. Market Growth & Y-o-Y Projections

16.1.3. Base Point Share Analysis

16.2. Global Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Country

16.2.1. North America

16.2.2. Western Europe

16.2.3. Eastern Europe

16.2.4. China

16.2.5. Asia Pacific (except China)

16.2.6. Middle East & Africa

16.2.7. Latin America

17. North America Off-highway Vehicle Market

17.1. Market Snapshot

17.2. North America COVID-19 Impact Analysis & Government Countermeasures

17.3. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

17.3.1. Construction & Mining Equipment

17.3.1.1. Excavators

17.3.1.2. Backhoe loaders

17.3.1.3. Skid steer loaders

17.3.1.4. Dumpers

17.3.1.5. Bulldozers

17.3.1.6. Motor graders

17.3.1.7. Road rollers

17.3.1.8. Pavers

17.3.1.9. Cold planers

17.3.1.10. Drilling equipment

17.3.1.11. Piling equipment

17.3.1.12. Tunnel boring machines and equipment

17.3.1.13. Demolition equipment

17.3.1.14. Mixer trucks

17.3.1.15. Formwork equipment

17.3.1.16. Scaffolding equipment

17.3.1.17. Dump trucks

17.3.1.18. Underground mining equipment

17.3.1.19. Forestry Equipment

17.3.1.20. Trailers

17.3.1.21. Other construction & mining equipment material

17.3.2. Agriculture

17.3.2.1. Agriculture Equipment

17.3.2.2. Tractor

17.3.3. Material Handling Vehicles

17.3.4. Military Vehicles

17.4. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Propulsion

17.4.1. IC-Engine

17.4.1.1. Gasoline

17.4.1.2. Diesel

17.4.2. Electric

17.4.2.1. Battery Electric Vehicle

17.4.2.2. Hybrid Electric Vehicle

17.5. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Engine Capacity

17.5.1. Less than 5L

17.5.2. 5L to 10L

17.5.3. More than 10L

17.6. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Power Output

17.6.1. Agricultural Equipment

17.6.1.1. Up to 25 KW

17.6.1.2. 26 KW –50 KW

17.6.1.3. 51 KW – 75 KW

17.6.1.4. More than 76 KW

17.6.2. Construction & Mining Equipment

17.6.2.1. Up to 75 KW

17.6.2.2. 76 KW – 150 KW

17.6.2.3. 151 KW – 300 KW

17.6.2.4. 301 KW – 400 KW

17.6.2.5. More than 400 KW

17.6.3. Others

17.7. Key Country Analysis – North America Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031

17.7.1. U.S.

17.7.2. Canada

18. Western Europe Off-highway Vehicle Market

18.1. Market Snapshot

18.2. Europe COVID-19 Impact Analysis & Government Countermeasures

18.3. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

18.3.1. Construction & Mining Equipment

18.3.1.1. Excavators

18.3.1.2. Backhoe loaders

18.3.1.3. Skid steer loaders

18.3.1.4. Dumpers

18.3.1.5. Bulldozers

18.3.1.6. Motor graders

18.3.1.7. Road rollers

18.3.1.8. Pavers

18.3.1.9. Cold planers

18.3.1.10. Drilling equipment

18.3.1.11. Piling equipment

18.3.1.12. Tunnel boring machines and equipment

18.3.1.13. Demolition equipment

18.3.1.14. Mixer trucks

18.3.1.15. Formwork equipment

18.3.1.16. Scaffolding equipment

18.3.1.17. Dump trucks

18.3.1.18. Underground mining equipment

18.3.1.19. Forestry Equipment

18.3.1.20. Trailers

18.3.1.21. Other construction & mining equipment material

18.3.2. Agriculture

18.3.2.1. Agriculture Equipment

18.3.2.2. Tractor

18.3.3. Material Handling Vehicles

18.3.4. Military Vehicles

18.4. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Propulsion

18.4.1. IC-Engine

18.4.1.1. Gasoline

18.4.1.2. Diesel

18.4.2. Electric

18.4.2.1. Battery Electric Vehicle

18.4.2.2. Hybrid Electric Vehicle

18.5. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Engine Capacity

18.5.1. Less than 5L

18.5.2. 5L to 10L

18.5.3. More than 10L

18.6. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Power Output

18.6.1. Agricultural Equipment

18.6.1.1. Up to 25 KW

18.6.1.2. 26 KW –50 KW

18.6.1.3. 51 KW –75 KW

18.6.1.4. More than 76 KW

18.6.2. Construction & Mining Equipment

18.6.2.1. Up to 75 KW

18.6.2.2. 76 KW –150 KW

18.6.2.3. 151 KW – 300 KW

18.6.2.4. 301 KW – 400 KW

18.6.2.5. More than 400 KW

18.6.3. Others

18.7. Key Country Analysis – Western Europe Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031

18.7.1. Germany

18.7.2. U.K.

18.7.3. France

18.7.4. Italy

18.7.5. Spain

18.7.6. Nordic Countries

18.7.7. Rest of Europe

19. Eastern Europe Off-highway Vehicle Market

19.1. Market Snapshot

19.2. Europe COVID-19 Impact Analysis & Government Countermeasures

19.3. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

19.3.1. Construction & Mining Equipment

19.3.1.1. Excavators

19.3.1.2. Backhoe loaders

19.3.1.3. Skid steer loaders

19.3.1.4. Dumpers

19.3.1.5. Bulldozers

19.3.1.6. Motor graders

19.3.1.7. Road rollers

19.3.1.8. Pavers

19.3.1.9. Cold planers

19.3.1.10. Drilling equipment

19.3.1.11. Piling equipment

19.3.1.12. Tunnel boring machines and equipment

19.3.1.13. Demolition equipment

19.3.1.14. Mixer trucks

19.3.1.15. Formwork equipment

19.3.1.16. Scaffolding equipment

19.3.1.17. Dump trucks

19.3.1.18. Underground mining equipment

19.3.1.19. Forestry Equipment

19.3.1.20. Trailers

19.3.1.21. Other construction & mining equipment material

19.3.2. Agriculture

19.3.2.1. Agriculture Equipment

19.3.2.2. Tractor

19.3.3. Material Handling Vehicles

19.3.4. Military Vehicles

19.4. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Propulsion

19.4.1. IC-Engine

19.4.1.1. Gasoline

19.4.1.2. Diesel

19.4.2. Electric

19.4.2.1. Battery Electric Vehicle

19.4.2.2. Hybrid Electric Vehicle

19.5. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Engine Capacity

19.5.1. Less than 5L

19.5.2. 5L to 10L

19.5.3. More than 10L

19.6. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Power Output

19.6.1. Agricultural Equipment

19.6.1.1. Up to 25 KW

19.6.1.2. 26 KW – 50 KW

19.6.1.3. 51 KW – 75 KW

19.6.1.4. More than 76 KW

19.6.2. Construction & Mining Equipment

19.6.2.1. Up to 75 KW

19.6.2.2. 76 KW – 150 KW

19.6.2.3. 151 KW – 300 KW

19.6.2.4. 301 KW – 400 KW

19.6.2.5. More than 400 KW

19.6.3. Others

19.7. Key Country Analysis – Eastern Europe Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031

19.7.1. Russia

19.7.2. Turkey

19.7.3. Poland

19.7.4. Rest of Eastern Europe

20. China Off-highway Vehicle Market

20.1. Market Snapshot

20.2. Asia Pacific COVID-19 Impact Analysis & Government Countermeasures

20.3. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

20.3.1. Construction & Mining Equipment

20.3.1.1. Excavators

20.3.1.2. Backhoe loaders

20.3.1.3. Skid steer loaders

20.3.1.4. Dumpers

20.3.1.5. Bulldozers

20.3.1.6. Motor graders

20.3.1.7. Road rollers

20.3.1.8. Pavers

20.3.1.9. Cold planers

20.3.1.10. Drilling equipment

20.3.1.11. Piling equipment

20.3.1.12. Tunnel boring machines and equipment

20.3.1.13. Demolition equipment

20.3.1.14. Mixer trucks

20.3.1.15. Formwork equipment

20.3.1.16. Scaffolding equipment

20.3.1.17. Dump trucks

20.3.1.18. Underground mining equipment

20.3.1.19. Forestry Equipment

20.3.1.20. Trailers

20.3.1.21. Other construction & mining equipment material

20.3.2. Agriculture

20.3.2.1. Agriculture Equipment

20.3.2.2. Tractor

20.3.3. Material Handling Vehicles

20.3.4. Military Vehicles

20.4. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Propulsion

20.4.1. IC-Engine

20.4.1.1. Gasoline

20.4.1.2. Diesel

20.4.2. Electric

20.4.2.1. Battery Electric Vehicle

20.4.2.2. Hybrid Electric Vehicle

20.5. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Engine Capacity

20.5.1. Less than 5L

20.5.2. 5L to 10L

20.5.3. More than 10L

20.6. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Power Output

20.6.1. Agricultural Equipment

20.6.1.1. Up to 25 KW

20.6.1.2. 26 KW – 50 KW

20.6.1.3. 51 KW – 75 KW

20.6.1.4. More than 76 KW

20.6.2. Construction & Mining Equipment

20.6.2.1. Up to 75 KW

20.6.2.2. 76 KW – 150 KW

20.6.2.3. 151 KW – 300 KW

20.6.2.4. 301 KW – 400 KW

20.6.2.5. More than 400 KW

20.6.3. Others

21. Asia Pacific (Except China) Off-highway Vehicle Market

21.1. Market Snapshot

21.2. Europe COVID-19 Impact Analysis & Government Countermeasures

21.3. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

21.3.1. Construction & Mining Equipment

21.3.1.1. Excavators

21.3.1.2. Backhoe loaders

21.3.1.3. Skid steer loaders

21.3.1.4. Dumpers

21.3.1.5. Bulldozers

21.3.1.6. Motor graders

21.3.1.7. Road rollers

21.3.1.8. Pavers

21.3.1.9. Cold planers

21.3.1.10. Drilling equipment

21.3.1.11. Piling equipment

21.3.1.12. Tunnel boring machines and equipment

21.3.1.13. Demolition equipment

21.3.1.14. Mixer trucks

21.3.1.15. Formwork equipment

21.3.1.16. Scaffolding equipment

21.3.1.17. Dump trucks

21.3.1.18. Underground mining equipment

21.3.1.19. Forestry Equipment

21.3.1.20. Trailers

21.3.1.21. Other construction & mining equipment material

21.3.2. Agriculture

21.3.2.1. Agriculture Equipment

21.3.2.2. Tractor

21.3.3. Material Handling Vehicles

21.3.4. Military Vehicles

21.4. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Propulsion

21.4.1. IC-Engine

21.4.1.1. Gasoline

21.4.1.2. Diesel

21.4.2. Electric

21.4.2.1. Battery Electric Vehicle

21.4.2.2. Hybrid Electric Vehicle

21.5. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Engine Capacity

21.5.1. Less than 5L

21.5.2. 5L to 10L

21.5.3. More than 10L

21.6. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Power Output

21.6.1. Agricultural Equipment

21.6.1.1. Up to 25 KW

21.6.1.2. 26 KW – 50 KW

21.6.1.3. 51 KW – 75 KW

21.6.1.4. More than 76 KW

21.6.2. Construction & Mining Equipment

21.6.2.1. Up to 75 KW

21.6.2.2. 76 KW – 150 KW

21.6.2.3. 151 KW – 300 KW

21.6.2.4. 301 KW – 400 KW

21.6.2.5. More than 400 KW

21.6.3. Others

21.7. Key Country Analysis – Asia Pacific Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031

21.7.1. India

21.7.2. Japan

21.7.3. ASEAN Countries

21.7.4. ANZ

21.7.5. South Korea

21.7.6. Rest of Asia Pacific

22. Middle East & Africa Off-highway Vehicle Market

22.1. Market Snapshot

22.2. Europe COVID-19 Impact Analysis & Government Countermeasures

22.3. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

22.3.1. Construction & Mining Equipment

22.3.1.1. Excavators

22.3.1.2. Backhoe loaders

22.3.1.3. Skid steer loaders

22.3.1.4. Dumpers

22.3.1.5. Bulldozers

22.3.1.6. Motor graders

22.3.1.7. Road rollers

22.3.1.8. Pavers

22.3.1.9. Cold planers

22.3.1.10. Drilling equipment

22.3.1.11. Piling equipment

22.3.1.12. Tunnel boring machines and equipment

22.3.1.13. Demolition equipment

22.3.1.14. Mixer trucks

22.3.1.15. Formwork equipment

22.3.1.16. Scaffolding equipment

22.3.1.17. Dump trucks

22.3.1.18. Underground mining equipment

22.3.1.19. Forestry Equipment

22.3.1.20. Trailers

22.3.1.21. Other construction & mining equipment material

22.3.2. Agriculture

22.3.2.1. Agriculture Equipment

22.3.2.2. Tractor

22.3.3. Material Handling Vehicles

22.3.4. Military Vehicles

22.4. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Propulsion

22.4.1. IC-Engine

22.4.1.1. Gasoline

22.4.1.2. Diesel

22.4.2. Electric

22.4.2.1. Battery Electric Vehicle

22.4.2.2. Hybrid Electric Vehicle

22.5. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Engine Capacity

22.5.1. Less than 5L

22.5.2. 5L to 10L

22.5.3. More than 10L

22.6. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Power Output

22.6.1. Agricultural Equipment

22.6.1.1. Up to 25 KW

22.6.1.2. 26 KW – 50 KW

22.6.1.3. 51 KW – 75 KW

22.6.1.4. More than 76 KW

22.6.2. Construction & Mining Equipment

22.6.2.1. Up to 75 KW

22.6.2.2. 76 KW – 150 KW

22.6.2.3. 151 KW – 300 KW

22.6.2.4. 301 KW – 400 KW

22.6.2.5. More than 400 KW

22.6.3. Others

22.7. Key Country Analysis – Middle East & Africa Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031

22.7.1. GCC

22.7.2. Egypt

22.7.3. Nigeria

22.7.4. South Africa

22.7.5. Rest of Middle East & Africa

23. Latin America Off-highway Vehicle Market

23.1. Market Snapshot

23.2. Europe COVID-19 Impact Analysis & Government Countermeasures

23.3. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

23.3.1. Construction & Mining Equipment

23.3.1.1. Excavators

23.3.1.2. Backhoe loaders

23.3.1.3. Skid steer loaders

23.3.1.4. Dumpers

23.3.1.5. Bulldozers

23.3.1.6. Motor graders

23.3.1.7. Road rollers

23.3.1.8. Pavers

23.3.1.9. Cold planers

23.3.1.10. Drilling equipment

23.3.1.11. Piling equipment

23.3.1.12. Tunnel boring machines and equipment

23.3.1.13. Demolition equipment

23.3.1.14. Mixer trucks

23.3.1.15. Formwork equipment

23.3.1.16. Scaffolding equipment

23.3.1.17. Dump trucks

23.3.1.18. Underground mining equipment

23.3.1.19. Forestry Equipment

23.3.1.20. Trailers

23.3.1.21. Other construction & mining equipment material

23.3.2. Agriculture

23.3.2.1. Agriculture Equipment

23.3.2.2. Tractor

23.3.3. Material Handling Vehicles

23.3.4. Military Vehicles

23.4. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Propulsion

23.4.1. IC-Engine

23.4.1.1. Gasoline

23.4.1.2. Diesel

23.4.2. Electric

23.4.2.1. Battery Electric Vehicle

23.4.2.2. Hybrid Electric Vehicle

23.5. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Engine Capacity

23.5.1. Less than 5L

23.5.2. 5L to 10L

23.5.3. More than 10L

23.6. Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, By Power Output

23.6.1. Agricultural Equipment

23.6.1.1. Up to 25 KW

23.6.1.2. 26 KW – 50 KW

23.6.1.3. 51 KW – 75 KW

23.6.1.4. More than 76 KW

23.6.2. Construction & Mining Equipment

23.6.2.1. Up to 75 KW

23.6.2.2. 76 KW – 150 KW

23.6.2.3. 151 KW – 300 KW

23.6.2.4. 301 KW – 400 KW

23.6.2.5. More than 400 KW

23.6.3. Others

23.7. Key Country Analysis – Latin America Off-highway Vehicle Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031

23.7.1. Brazil

23.7.2. Mexico

23.7.3. Rest of Latin America

24. Competitive Landscape

24.1. Company Share Analysis/ Brand Share Analysis, 2022

24.2. Key Strategy Analysis

24.2.1. Strategic Overview - Expansion, M&A, Partnership

24.3. Pricing Trend/ Comparison Analysis for Key Players

24.3.1. By Propulsion

24.3.2. By Engine Capacity

24.3.3. By Power Output

24.4. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

24.5. Company Profile/ Key Players

24.5.1. AB Volvo

24.5.1.1. Company Overview

24.5.1.2. Company Footprints

24.5.1.3. Production Locations

24.5.1.4. Product Portfolio

24.5.1.5. Competitors & Customers

24.5.1.6. Subsidiaries & Parent Organization

24.5.1.7. Recent Developments

24.5.1.8. Financial Analysis

24.5.1.9. Profitability

24.5.1.10. Revenue Share

24.5.2. AGCO Corporation

24.5.2.1. Company Overview

24.5.2.2. Company Footprints

24.5.2.3. Production Locations

24.5.2.4. Product Portfolio

24.5.2.5. Competitors & Customers

24.5.2.6. Subsidiaries & Parent Organization

24.5.2.7. Recent Developments

24.5.2.8. Financial Analysis

24.5.2.9. Profitability

24.5.2.10. Revenue Share

24.5.3. Caterpillar, Inc.

24.5.3.1. Company Overview

24.5.3.2. Company Footprints

24.5.3.3. Production Locations

24.5.3.4. Product Portfolio

24.5.3.5. Competitors & Customers

24.5.3.6. Subsidiaries & Parent Organization

24.5.3.7. Recent Developments

24.5.3.8. Financial Analysis

24.5.3.9. Profitability

24.5.3.10. Revenue Share

24.5.4. CRRC Corporation Limited

24.5.4.1. Company Overview

24.5.4.2. Company Footprints

24.5.4.3. Production Locations

24.5.4.4. Product Portfolio

24.5.4.5. Competitors & Customers

24.5.4.6. Subsidiaries & Parent Organization

24.5.4.7. Recent Developments

24.5.4.8. Financial Analysis

24.5.4.9. Profitability

24.5.4.10. Revenue Share

24.5.5. Cummins, Inc.

24.5.5.1. Company Overview

24.5.5.2. Company Footprints

24.5.5.3. Production Locations

24.5.5.4. Product Portfolio

24.5.5.5. Competitors & Customers

24.5.5.6. Subsidiaries & Parent Organization

24.5.5.7. Recent Developments

24.5.5.8. Financial Analysis

24.5.5.9. Profitability

24.5.5.10. Revenue Share

24.5.6. Daimler AG

24.5.6.1. Company Overview

24.5.6.2. Company Footprints

24.5.6.3. Production Locations

24.5.6.4. Product Portfolio

24.5.6.5. Competitors & Customers

24.5.6.6. Subsidiaries & Parent Organization

24.5.6.7. Recent Developments

24.5.6.8. Financial Analysis

24.5.6.9. Profitability

24.5.6.10. Revenue Share

24.5.7. Deere & Company

24.5.7.1. Company Overview

24.5.7.2. Company Footprints

24.5.7.3. Production Locations

24.5.7.4. Product Portfolio

24.5.7.5. Competitors & Customers

24.5.7.6. Subsidiaries & Parent Organization

24.5.7.7. Recent Developments

24.5.7.8. Financial Analysis

24.5.7.9. Profitability

24.5.7.10. Revenue Share

24.5.8. Deutz AG

24.5.8.1. Company Overview

24.5.8.2. Company Footprints

24.5.8.3. Production Locations

24.5.8.4. Product Portfolio

24.5.8.5. Competitors & Customers

24.5.8.6. Subsidiaries & Parent Organization

24.5.8.7. Recent Developments

24.5.8.8. Financial Analysis

24.5.8.9. Profitability

24.5.8.10. Revenue Share

24.5.9. Doosan Corporation

24.5.9.1. Company Overview

24.5.9.2. Company Footprints

24.5.9.3. Production Locations

24.5.9.4. Product Portfolio

24.5.9.5. Competitors & Customers

24.5.9.6. Subsidiaries & Parent Organization

24.5.9.7. Recent Developments

24.5.9.8. Financial Analysis

24.5.9.9. Profitability

24.5.9.10. Revenue Share

24.5.10. Epiroc AB

24.5.10.1. Company Overview

24.5.10.2. Company Footprints

24.5.10.3. Production Locations

24.5.10.4. Product Portfolio

24.5.10.5. Competitors & Customers

24.5.10.6. Subsidiaries & Parent Organization

24.5.10.7. Recent Developments

24.5.10.8. Financial Analysis

24.5.10.9. Profitability

24.5.10.10. Revenue Share

24.5.11. Hitachi Construction Machinery Co. Ltd.

24.5.11.1. Company Overview

24.5.11.2. Company Footprints

24.5.11.3. Production Locations

24.5.11.4. Product Portfolio

24.5.11.5. Competitors & Customers

24.5.11.6. Subsidiaries & Parent Organization

24.5.11.7. Recent Developments

24.5.11.8. Financial Analysis

24.5.11.9. Profitability

24.5.11.10. Revenue Share

24.5.12. Husqvarna

24.5.12.1. Company Overview

24.5.12.2. Company Footprints

24.5.12.3. Production Locations

24.5.12.4. Product Portfolio

24.5.12.5. Competitors & Customers

24.5.12.6. Subsidiaries & Parent Organization

24.5.12.7. Recent Developments

24.5.12.8. Financial Analysis

24.5.12.9. Profitability

24.5.12.10. Revenue Share

24.5.13. J. C. Bamford Excavators Ltd.

24.5.13.1. Company Overview

24.5.13.2. Company Footprints

24.5.13.3. Production Locations

24.5.13.4. Product Portfolio

24.5.13.5. Competitors & Customers

24.5.13.6. Subsidiaries & Parent Organization

24.5.13.7. Recent Developments

24.5.13.8. Financial Analysis

24.5.13.9. Profitability

24.5.13.10. Revenue Share

24.5.14. Komatsu Ltd.

24.5.14.1. Company Overview

24.5.14.2. Company Footprints

24.5.14.3. Production Locations

24.5.14.4. Product Portfolio

24.5.14.5. Competitors & Customers

24.5.14.6. Subsidiaries & Parent Organization

24.5.14.7. Recent Developments

24.5.14.8. Financial Analysis

24.5.14.9. Profitability

24.5.14.10. Revenue Share

24.5.15. Kubota Corp

24.5.15.1. Company Overview

24.5.15.2. Company Footprints

24.5.15.3. Production Locations

24.5.15.4. Product Portfolio

24.5.15.5. Competitors & Customers

24.5.15.6. Subsidiaries & Parent Organization

24.5.15.7. Recent Developments

24.5.15.8. Financial Analysis

24.5.15.9. Profitability

24.5.15.10. Revenue Share

24.5.16. Liebherr

24.5.16.1. Company Overview

24.5.16.2. Company Footprints

24.5.16.3. Production Locations

24.5.16.4. Product Portfolio

24.5.16.5. Competitors & Customers

24.5.16.6. Subsidiaries & Parent Organization

24.5.16.7. Recent Developments

24.5.16.8. Financial Analysis

24.5.16.9. Profitability

24.5.16.10. Revenue Share

24.5.17. Mahindra & Mahindra Limited (Mahindra Powertrain)

24.5.17.1. Company Overview

24.5.17.2. Company Footprints

24.5.17.3. Production Locations

24.5.17.4. Product Portfolio

24.5.17.5. Competitors & Customers

24.5.17.6. Subsidiaries & Parent Organization

24.5.17.7. Recent Developments

24.5.17.8. Financial Analysis

24.5.17.9. Profitability

24.5.17.10. Revenue Share

24.5.18. Massey Ferguson Ltd.

24.5.18.1. Company Overview

24.5.18.2. Company Footprints

24.5.18.3. Production Locations

24.5.18.4. Product Portfolio

24.5.18.5. Competitors & Customers

24.5.18.6. Subsidiaries & Parent Organization

24.5.18.7. Recent Developments

24.5.18.8. Financial Analysis

24.5.18.9. Profitability

24.5.18.10. Revenue Share

24.5.19. Nidec Corp

24.5.19.1. Company Overview

24.5.19.2. Company Footprints

24.5.19.3. Production Locations

24.5.19.4. Product Portfolio

24.5.19.5. Competitors & Customers

24.5.19.6. Subsidiaries & Parent Organization

24.5.19.7. Recent Developments

24.5.19.8. Financial Analysis

24.5.19.9. Profitability

24.5.19.10. Revenue Share

24.5.20. Sandvik AB

24.5.20.1. Company Overview

24.5.20.2. Company Footprints

24.5.20.3. Production Locations

24.5.20.4. Product Portfolio

24.5.20.5. Competitors & Customers

24.5.20.6. Subsidiaries & Parent Organization

24.5.20.7. Recent Developments

24.5.20.8. Financial Analysis

24.5.20.9. Profitability

24.5.20.10. Revenue Share

24.5.21. Sany Heavy Industries

24.5.21.1. Company Overview

24.5.21.2. Company Footprints

24.5.21.3. Production Locations

24.5.21.4. Product Portfolio

24.5.21.5. Competitors & Customers

24.5.21.6. Subsidiaries & Parent Organization

24.5.21.7. Recent Developments

24.5.21.8. Financial Analysis

24.5.21.9. Profitability

24.5.21.10. Revenue Share

24.5.22. Scania AB

24.5.22.1. Company Overview

24.5.22.2. Company Footprints

24.5.22.3. Production Locations

24.5.22.4. Product Portfolio

24.5.22.5. Competitors & Customers

24.5.22.6. Subsidiaries & Parent Organization

24.5.22.7. Recent Developments

24.5.22.8. Financial Analysis

24.5.22.9. Profitability

24.5.22.10. Revenue Share

24.5.23. Weichai Power Co. Ltd.

24.5.23.1. Company Overview

24.5.23.2. Company Footprints

24.5.23.3. Production Locations

24.5.23.4. Product Portfolio

24.5.23.5. Competitors & Customers

24.5.23.6. Subsidiaries & Parent Organization

24.5.23.7. Recent Developments

24.5.23.8. Financial Analysis

24.5.23.9. Profitability

24.5.23.10. Revenue Share

24.5.24. Yanmar Co. Ltd.

24.5.24.1. Company Overview

24.5.24.2. Company Footprints

24.5.24.3. Production Locations

24.5.24.4. Product Portfolio

24.5.24.5. Competitors & Customers

24.5.24.6. Subsidiaries & Parent Organization

24.5.24.7. Recent Developments

24.5.24.8. Financial Analysis

24.5.24.9. Profitability

24.5.24.10. Revenue Share

List of Tables

Table 1: Global Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 2: Global Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 3: Global Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 4: Global Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 5: Global Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 6: Global Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Table 7: Global Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Table 8: Global Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Table 9: Global Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 10: Global Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Region, 2017-2031

Table 11: North America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 12: North America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 13: North America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 14: North America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 15: North America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 16: North America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Table 17: North America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Table 18: North America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Table 19: North America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 20: North America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 21: Western Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 22: Western Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 23: Western Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 24: Western Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 25: Western Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 26: Western Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Table 27: Western Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Table 28: Western Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Table 29: Western Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 30: Western Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 31: China Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 32: China Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 33: China Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 34: China Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 35: China Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 36: China Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Table 37: China Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Table 38: China Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Table 39: Eastern Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 40: Eastern Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 41: Eastern Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 42: Eastern Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 43: Eastern Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 44: Eastern Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Table 45: Eastern Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Table 46: Eastern Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Table 47: Eastern Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Eastern Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 49: Asia Pacific Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 50: Asia Pacific Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 51: Asia Pacific Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 52: Asia Pacific Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 53: Asia Pacific Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 54: Asia Pacific Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Table 55: Asia Pacific Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Table 56: Asia Pacific Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Table 57: Asia Pacific Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 58: Asia Pacific Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 59: Middle East & Africa Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 60: Middle East & Africa Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 61: Middle East & Africa Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 62: Middle East & Africa Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 63: Middle East & Africa Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 64: Middle East & Africa Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Table 65: Middle East & Africa Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Table 66: Middle East & Africa Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Table 67: Middle East & Africa Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 68: Middle East & Africa Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 69: Latin America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 70: Latin America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 71: Latin America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 72: Latin America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 73: Latin America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 74: Latin America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Table 75: Latin America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Table 76: Latin America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Table 77: Latin America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 78: Latin America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 2: Global Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 3: Global Off-highway Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 4: Global Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 5: Global Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 6: Global Off-highway Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 7: Global Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 8: Global Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Figure 9: Global Off-highway Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Mn), 2023-2031

Figure 10: Global Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Figure 11: Global Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Figure 12: Global Off-highway Vehicle Market, Incremental Opportunity, by Power Output (KW), Value (US$ Mn), 2023-2031

Figure 13: Global Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 14: Global Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Region, 2017-2031

Figure 15: Global Off-highway Vehicle Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023-2031

Figure 16: North America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 17: North America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 18: North America Off-highway Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 19: North America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 20: North America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 21: North America Off-highway Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 22: North America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 23: North America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Figure 24: North America Off-highway Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Mn), 2023-2031

Figure 25: North America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Figure 26: North America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Figure 27: North America Off-highway Vehicle Market, Incremental Opportunity, by Power Output (KW), Value (US$ Mn), 2023-2031

Figure 28: North America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 29: North America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 30: North America Off-highway Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 31: Western Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 32: Western Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 33: Western Europe Off-highway Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 34: Western Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 35: Western Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 36: Western Europe Off-highway Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 37: Western Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 38: Western Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Figure 39: Western Europe Off-highway Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Mn), 2023-2031

Figure 40: Western Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Figure 41: Western Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Figure 42: Western Europe Off-highway Vehicle Market, Incremental Opportunity, by Power Output (KW), Value (US$ Mn), 2023-2031

Figure 43: Western Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 44: Western Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 45: Western Europe Off-highway Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 46: China Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 47: China Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 48: China Off-highway Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 49: China Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 50: China Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 51: China Off-highway Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 52: China Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 53: China Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Figure 54: China Off-highway Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Mn), 2023-2031

Figure 55: China Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Figure 56: China Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Figure 57: China Off-highway Vehicle Market, Incremental Opportunity, by Power Output (KW), Value (US$ Mn), 2023-2031

Figure 58: Eastern Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 59: Eastern Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 60: Eastern Europe Off-highway Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 61: Eastern Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 62: Eastern Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 63: Eastern Europe Off-highway Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 64: Eastern Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 65: Eastern Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Figure 66: Eastern Europe Off-highway Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Mn), 2023-2031

Figure 67: Eastern Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Figure 68: Eastern Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Figure 69: Eastern Europe Off-highway Vehicle Market, Incremental Opportunity, by Power Output (KW), Value (US$ Mn), 2023-2031

Figure 70: Eastern Europe Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Eastern Europe Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 72: Eastern Europe Off-highway Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 73: Asia Pacific Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 74: Asia Pacific Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 75: Asia Pacific Off-highway Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 76: Asia Pacific Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 77: Asia Pacific Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 78: Asia Pacific Off-highway Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 79: Asia Pacific Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 80: Asia Pacific Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Figure 81: Asia Pacific Off-highway Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Mn), 2023-2031

Figure 82: Asia Pacific Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Figure 83: Asia Pacific Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Figure 84: Asia Pacific Off-highway Vehicle Market, Incremental Opportunity, by Power Output (KW), Value (US$ Mn), 2023-2031

Figure 85: Asia Pacific Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 86: Asia Pacific Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 87: Asia Pacific Off-highway Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 88: Middle East & Africa Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 89: Middle East & Africa Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 90: Middle East & Africa Off-highway Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 91: Middle East & Africa Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 92: Middle East & Africa Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 93: Middle East & Africa Off-highway Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 94: Middle East & Africa Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 95: Middle East & Africa Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Figure 96: Middle East & Africa Off-highway Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Mn), 2023-2031

Figure 97: Middle East & Africa Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Figure 98: Middle East & Africa Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Figure 99: Middle East & Africa Off-highway Vehicle Market, Incremental Opportunity, by Power Output (KW), Value (US$ Mn), 2023-2031

Figure 100: Middle East & Africa Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 101: Middle East & Africa Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 102: Middle East & Africa Off-highway Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 103: Latin America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 104: Latin America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 105: Latin America Off-highway Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 106: Latin America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 107: Latin America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 108: Latin America Off-highway Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 109: Latin America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 110: Latin America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Engine Capacity, 2017-2031

Figure 111: Latin America Off-highway Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Mn), 2023-2031

Figure 112: Latin America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Power Output (KW), 2017-2031

Figure 113: Latin America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Power Output (KW), 2017-2031

Figure 114: Latin America Off-highway Vehicle Market, Incremental Opportunity, by Power Output (KW), Value (US$ Mn), 2023-2031

Figure 115: Latin America Off-highway Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 116: Latin America Off-highway Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 117: Latin America Off-highway Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031