Analysts’ Viewpoint

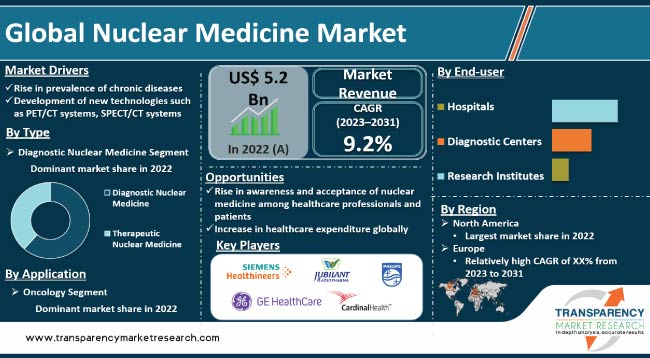

Rise in awareness and acceptance of nuclear medicine procedures are the key drivers of the global nuclear medicine market. Nuclear medicine provides accurate and early diagnosis of various medical conditions. Increase in adoption of advanced imaging technologies such as PET-CT and SPECT is expected to propel the global nuclear medicine industry growth during the forecast period. Furthermore, surge in usage of nuclear medicine procedures in the treatment of various medical conditions, such as cancer and cardiovascular diseases, is likely to bolster global nuclear medicine market size.

Increase in investment in research & development of new nuclear medicine procedures offers lucrative opportunities to market players. Companies are focusing on developing more efficient and cost-effective nuclear medicine procedures in order to increase market share.

Nuclear medicine refers to a specialized radiology field that utilizes small amounts of radioactive materials, known as radiopharmaceuticals, to examine the structure and function of organs. This imaging technique is an amalgamation of various disciplines such as chemistry, physics, mathematics, computer technology, and medicine. It is particularly useful in the early detection and treatment of diseases, such as thyroid cancer.

By analyzing the behavior of radionuclides in the body during a nuclear scan, healthcare professionals can diagnose a range of conditions, including infections, tumors, cysts, hematomas, and organ enlargement. Additionally, nuclear scans are helpful in assessing organ function and blood circulation.

Positron emission tomography (PET) is a type of nuclear medicine that uses a tracer to demonstrate the natural activity of cells, providing detailed information on organ functionality and cell damage. PET scans are often combined with three-dimensional imaging techniques, such as computed tomography (CT) or magnetic resonance imaging (MRI), to produce a more comprehensive picture of the organ.

Surge in incidence of cancer and cardiovascular diseases is one of the major drivers of the global nuclear medicine market growth. Nuclear medicine plays a critical role in the diagnosis, staging, and treatment of these diseases.

Cancer is a leading cause of death globally, and the number of new cases is expected to increase in the next few years. Nuclear medicine techniques, such as PET and SPECT, are widely used for cancer diagnosis, staging, and treatment planning. Radiopharmaceuticals are used to target cancer cells and deliver radiation therapy directly to the tumor site, reducing the risk of damage to healthy tissue.

Cardiovascular diseases, including heart disease and stroke, are also major global health concerns. Nuclear medicine techniques such as myocardial perfusion imaging (MPI) and positron emission tomography (PET) are commonly used for the diagnosis and management of cardiovascular diseases.

Aging population and increase in demand for personalized medicine are also driving the global nuclear medicine industry. Rise in the geriatric population increases the incidence of chronic diseases that require nuclear medicine interventions. Personalized medicine, which involves tailoring treatment to an individual's specific genetic and biological characteristics, relies primarily on nuclear medicine techniques for accurate diagnosis and treatment.

Overall, increase in incidence of cancer & cardiovascular diseases, aging population, and rise in demand for personalized medicine are expected to drive nuclear medicine market demand in the next few years.

Rise in awareness and acceptance of nuclear medicine procedures are the key drivers of global nuclear medicine market development. Demand for nuclear medicine procedures is expected to increase significantly, as more people become aware of the benefits of the procedures.

One of the key advantages of nuclear medicine procedures is the ability to provide accurate and early diagnosis of various medical conditions. Nuclear medicine procedures are non-invasive and use small amounts of radioactive materials to produce detailed images of the body's internal organs and tissues. These images can help healthcare professionals detect and diagnose diseases at an early stage, which can significantly improve patient outcomes.

Nuclear medicine procedures are increasingly being used in the treatment of various medical conditions, such as cancer and cardiovascular diseases. Nuclear medicine therapies use radioactive materials to target and destroy cancer cells or other abnormal cells in the body, without causing significant damage to healthy cells.

Increase in acceptance of nuclear medicine procedures as a standard part of healthcare is another key driver of the market. As healthcare professionals become more familiar with nuclear medicine procedures and their benefits, they are more likely to recommend them to patients.

In terms of type, the diagnostic nuclear medicine segment accounted for the largest global nuclear medicine market share in 2022. Diagnostic nuclear medicine involves usage of radiopharmaceuticals to diagnose various medical conditions, including cancer, heart disease, and neurological disorders. It is a non-invasive imaging technique that provides high-quality images of the body's internal organs, tissues, and bones.

The diagnostic nuclear medicine segment is driven by increase in demand for accurate and effective diagnostic procedures. Rise in prevalence of chronic diseases, such as cancer and cardiovascular diseases, and surge in demand for early disease detection and prevention are fueling the growth of the segment.

The diagnostic nuclear medicine segment is benefiting from the increasing adoption of advanced imaging technologies such as PET-CT and SPECT. These imaging technologies provide high-resolution images that aid in accurate diagnosis and treatment planning.

Based on application, the oncology segment dominated the global nuclear medicine market in 2022. Nuclear medicine plays a critical role in the diagnosis and treatment of various types of cancers, including breast cancer, lung cancer, prostate cancer, and lymphoma. Nuclear medicine is used primarily for diagnosis, staging, and treatment of cancer.

Rise in prevalence of cancer across the world and increase in demand for effective cancer treatments are driving the oncology segment. Usage of PET-CT and SPECT imaging technologies is increasing in the diagnosis and treatment of cancer. These imaging technologies are used to locate cancerous cells and monitor the effectiveness of cancer treatments.

In terms of end-user, the hospitals segment held the largest share of global nuclear medicine market value in 2022. Nuclear medicine is a medical specialty that uses radioactive substances to diagnose and treat various diseases. Hospitals are the primary end-users of nuclear medicine, where it is used for a range of diagnostic and therapeutic applications.

Hospitals have a significant demand for nuclear medicine products and services due to the large number of patients they serve. Nuclear medicine procedures are commonly used for the diagnosis and treatment of cancer, cardiovascular diseases, neurological disorders, and other medical conditions. Hospitals require a constant supply of radiopharmaceuticals, which are essential for nuclear medicine procedures.

Hospitals have the necessary infrastructure and trained personnel to perform complex nuclear medicine procedures. These have specialized departments that are dedicated to nuclear medicine, which are equipped with advanced imaging equipment such as PET-CT scanners and SPECT cameras.

Nuclear medicine is a global industry that is expected to experience significant growth in the next few years. North America is the largest market for nuclear medicine in 2022. This is ascribed to presence of advanced healthcare infrastructure, high healthcare spending, and large aging population.

Europe was the second largest market for nuclear medicine in 2022. The market in the region is driven by rise in prevalence of chronic diseases, increase in healthcare expenditure, and presence of a well-established pharmaceutical industry.

The market in Asia Pacific is expected to grow at a rapid pace during the forecast period. This is ascribed to increase in demand for advanced medical imaging technologies, rise in healthcare expenditure, and surge in prevalence of chronic diseases. Countries such as China, Japan, and India are expected to be the major markets in the region.

The market in Middle East & Africa is likely to witness moderate growth during the forecast period. This is ascribed to increase in investment in healthcare infrastructure, rise in healthcare expenditure, and surge in prevalence of chronic diseases.

Expansion of product portfolio and merger & acquisition are the key strategies adopted by prominent manufacturers to increase market share and presence. GE Healthcare, Siemens Healthineers, Philips Healthcare, Cardinal Health, Bracco Imaging S.p.A., Curium Pharma, Eckert & Ziegler, Jubilant Radiopharma, Lantheus Medical Imaging, Nordion, Inc., Advanced Accelerator Applications (AAA), IBA Radiopharma Solutions, NorthStar Medical Radioisotopes, Polatom, and Isotopia Molecular Imaging are the prominent players in the global market.

The nuclear medicine market report profiles key players based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 5.2 Bn |

| Forecast (Value) in 2031 | US$ 11.4 Bn |

| Growth Rate (CAGR) | 9.2% |

| Forecast Period | 2023-2031 |

| Historical Data | 2017-2021 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s five forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 5.2 Bn in 2022

It is projected to reach more than US$ 11.4 Bn by 2031

It is anticipated to grow at a CAGR of 9.2% from 2023 to 2031

Rise in prevalence of chronic diseases and development of new technologies such as PET/CT systems, SPECT/CT systems.

North America is projected to be an attractive market for companies.

GE Healthcare, Siemens Healthineers, Philips Healthcare, Cardinal Health, Bracco Imaging S.p.A., Curium Pharma, Eckert & Ziegler, Jubilant Radiopharma, Lantheus Medical Imaging, Nordion, Inc., Advanced Accelerator Applications (AAA), IBA Radiopharma Solutions, NorthStar Medical Radioisotopes, Polatom, and Isotopia Molecular Imaging.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Nuclear Medicine Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Nuclear Medicine Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Technological Advancements

5.2. List of FDA Approved Radioisotopes

5.3. No. of Nuclear Medicine Centers in Major Countries

5.4. COVID-19 Pandemic Impact on Industry

6. Global Nuclear Medicine Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2017-2031

6.3.1. Diagnostic Nuclear Medicine

6.3.1.1. PECT Radiopharmaceuticals

6.3.1.2. PET Radiopharmaceuticals

6.3.2. Therapeutic Nuclear Medicine

6.3.2.1. Alpha Emitters

6.3.2.2. Beta Emitters

6.3.2.3. Brachytherapy Isotopes

6.4. Market Attractiveness Analysis, by Type

7. Global Nuclear Medicine Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017-2031

7.3.1. Cardiology

7.3.2. Neurology

7.3.3. Oncology

7.3.4. Pulmonology

7.3.5. Gastroenterology

7.3.6. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Nuclear Medicine Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Hospitals

8.3.2. Diagnostic Centers

8.3.2.1. Individual Practice

8.3.2.2. Group Practice

8.3.3. Research Institutes

8.4. Market Attractiveness Analysis, by End-user

9. Global Nuclear Medicine Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Nuclear Medicine Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017-2031

10.2.1. Diagnostic Nuclear Medicine

10.2.1.1. PECT Radiopharmaceuticals

10.2.1.2. PET Radiopharmaceuticals

10.2.2. Therapeutic Nuclear Medicine

10.2.2.1. Alpha Emitters

10.2.2.2. Beta Emitters

10.2.2.3. Brachytherapy Isotopes

10.3. Market Value Forecast, by Application, 2017-2031

10.3.1. Cardiology

10.3.2. Neurology

10.3.3. Oncology

10.3.4. Pulmonology

10.3.5. Gastroenterology

10.3.6. Others

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. Hospitals

10.4.2. Diagnostic Centers

10.4.2.1. Individual Practice

10.4.2.2. Group Practice

10.4.3. Research Institutes

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Nuclear Medicine Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017-2031

11.2.1. Diagnostic Nuclear Medicine

11.2.1.1. PECT Radiopharmaceuticals

11.2.1.2. PET Radiopharmaceuticals

11.2.2. Therapeutic Nuclear Medicine

11.2.2.1. Alpha Emitters

11.2.2.2. Beta Emitters

11.2.2.3. Brachytherapy Isotopes

11.3. Market Value Forecast, by Application, 2017-2031

11.3.1. Cardiology

11.3.2. Neurology

11.3.3. Oncology

11.3.4. Pulmonology

11.3.5. Gastroenterology

11.3.6. Others

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. Hospitals

11.4.2. Diagnostic Centers

11.4.2.1. Individual Practice

11.4.2.2. Group Practice

11.4.3. Research Institutes

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Nuclear Medicine Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017-2031

12.2.1. Diagnostic Nuclear Medicine

12.2.1.1. PECT Radiopharmaceuticals

12.2.1.2. PET Radiopharmaceuticals

12.2.2. Therapeutic Nuclear Medicine

12.2.2.1. Alpha Emitters

12.2.2.2. Beta Emitters

12.2.2.3. Brachytherapy Isotopes

12.3. Market Value Forecast, by Application, 2017-2031

12.3.1. Cardiology

12.3.2. Neurology

12.3.3. Oncology

12.3.4. Pulmonology

12.3.5. Gastroenterology

12.3.6. Others

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. Hospitals

12.4.2. Diagnostic Centers

12.4.2.1. Individual Practice

12.4.2.2. Group Practice

12.4.3. Research Institutes

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Nuclear Medicine Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017-2031

13.2.1. Diagnostic Nuclear Medicine

13.2.1.1. PECT Radiopharmaceuticals

13.2.1.2. PET Radiopharmaceuticals

13.2.2. Therapeutic Nuclear Medicine

13.2.2.1. Alpha Emitters

13.2.2.2. Beta Emitters

13.2.2.3. Brachytherapy Isotopes

13.3. Market Value Forecast, by Application, 2017-2031

13.3.1. Cardiology

13.3.2. Neurology

13.3.3. Oncology

13.3.4. Pulmonology

13.3.5. Gastroenterology

13.3.6. Others

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. Hospitals

13.4.2. Diagnostic Centers

13.4.3. Research Institutes

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Nuclear Medicine Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017-2031

14.2.1. Diagnostic Nuclear Medicine

14.2.1.1. PECT Radiopharmaceuticals

14.2.1.2. PET Radiopharmaceuticals

14.2.2. Therapeutic Nuclear Medicine

14.2.2.1. Alpha Emitters

14.2.2.2. Beta Emitters

14.2.2.3. Brachytherapy Isotopes

14.3. Market Value Forecast, by Application, 2017-2031

14.3.1. Cardiology

14.3.2. Neurology

14.3.3. Oncology

14.3.4. Pulmonology

14.3.5. Gastroenterology

14.3.6. Others

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. Hospitals

14.4.2. Diagnostic Centers

14.4.2.1. Individual Practice

14.4.2.2. Group Practice

14.4.3. Research Institutes

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2022

15.3. Company Profiles

15.3.1. GE Healthcare

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Type Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Siemens Healthineers

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Type Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Philips Healthcare

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Type Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Cardinal Health

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Type Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Bracco Imaging S.p.A.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Type Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Curium Pharma

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Type Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Eckert & Ziegler

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Type Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Jubilant Radiopharma

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Type Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Lantheus Medical Imaging

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Type Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Nordion, Inc.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Type Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Advanced Accelerator Applications (AAA)

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Type Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. IBA Radiopharma Solutions

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Type Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

15.3.13. NorthStar Medical Radioisotopes

15.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.13.2. Type Portfolio

15.3.13.3. Financial Overview

15.3.13.4. SWOT Analysis

15.3.13.5. Strategic Overview

15.3.14. Polatom

15.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.14.2. Type Portfolio

15.3.14.3. Financial Overview

15.3.14.4. SWOT Analysis

15.3.14.5. Strategic Overview

15.3.15. Isotopia Molecular Imaging

15.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.15.2. Type Portfolio

15.3.15.3. Financial Overview

15.3.15.4. SWOT Analysis

15.3.15.5. Strategic Overview

List of Table

Table 01: Global Nuclear Medicine Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 02: Global Nuclear Medicine Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 03: Global Nuclear Medicine Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 04: Global Nuclear Medicine Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Nuclear Medicine Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 06: North America Nuclear Medicine Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 07: North America Nuclear Medicine Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 08: North America Nuclear Medicine Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 09: Europe Nuclear Medicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Europe Nuclear Medicine Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 11: Europe Nuclear Medicine Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 12: Europe Nuclear Medicine Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Asia Pacific Nuclear Medicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Asia Pacific Nuclear Medicine Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 15: Asia Pacific Nuclear Medicine Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 16: Asia Pacific Nuclear Medicine Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 17: Latin America Nuclear Medicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Nuclear Medicine Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 19: Latin America Nuclear Medicine Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 20: Latin America Nuclear Medicine Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 21: Middle East & Africa Nuclear Medicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Nuclear Medicine Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 23: Middle East & Africa Nuclear Medicine Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 24: Middle East & Africa Nuclear Medicine Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figure

Figure 01: Global Nuclear Medicine Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Nuclear Medicine Market Value Share, by Type, 2022

Figure 03: Global Nuclear Medicine Market Value Share, by Application, 2022

Figure 04: Global Nuclear Medicine Market Value Share, by End-user, 2022

Figure 05: Global Nuclear Medicine Market Value Share Analysis, by Type, 2022 and 2031

Figure 06: Global Nuclear Medicine Market Attractiveness Analysis, by Type, 2023-2031

Figure 07: Global Nuclear Medicine Market Value Share Analysis, by Application, 2022 and 2031

Figure 08: Global Nuclear Medicine Market Attractiveness Analysis, by Application 2023-2031

Figure 09: Global Nuclear Medicine Market Value Share Analysis, by End-user, 2022 and 2031

Figure 10: Global Nuclear Medicine Market Attractiveness Analysis, End-user, 2023-2031

Figure 13: Global Nuclear Medicine Market Value Share Analysis, by Region, 2022 and 2031

Figure 14: Global Nuclear Medicine Market Attractiveness Analysis, by Region, 2023-2031

Figure 15: North America Nuclear Medicine Market Value (US$ Mn) Forecast, 2017-2031

Figure 16: North America Nuclear Medicine Market Value Share Analysis, by Country, 2022 and 2031

Figure 17: North America Nuclear Medicine Market Attractiveness Analysis, by Country, 2023-2031

Figure 18: North America Nuclear Medicine Market Value Share Analysis, by Type, 2022 and 2031

Figure 19: North America Nuclear Medicine Market Attractiveness Analysis, by Type, 2023-2031

Figure 20: North America Nuclear Medicine Market Value Share Analysis, by Application, 2022 and 2031

Figure 21: North America Nuclear Medicine Market Attractiveness Analysis, by Application 2023-2031

Figure 22: North America Nuclear Medicine Market Value Share Analysis, by End-user, 2022 and 2031

Figure 23: North America Nuclear Medicine Market Attractiveness Analysis, End-user, 2023-2031

Figure 24: Europe Nuclear Medicine Market Value (US$ Mn) Forecast, 2017-2031

Figure 25: Europe Nuclear Medicine Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 26: Europe Nuclear Medicine Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 27: Europe Nuclear Medicine Market Value Share Analysis, by Type, 2022 and 2031

Figure 28: Europe Nuclear Medicine Market Attractiveness Analysis, by Type, 2023-2031

Figure 29: Europe Nuclear Medicine Market Value Share Analysis, by Application, 2022 and 2031

Figure 30: Europe Nuclear Medicine Market Attractiveness Analysis, by Application 2023-2031

Figure 29: Europe Nuclear Medicine Market Value Share Analysis, by End-user, 2022 and 2031

Figure 30: Europe Nuclear Medicine Market Attractiveness Analysis, End-user, 2023-2031

Figure 31: Asia Pacific Nuclear Medicine Market Value (US$ Mn) Forecast, 2017-2031

Figure 32: Asia Pacific Nuclear Medicine Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Asia Pacific Nuclear Medicine Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 34: Asia Pacific Nuclear Medicine Market Value Share Analysis, by Type, 2022 and 2031

Figure 35: Asia Pacific Nuclear Medicine Market Attractiveness Analysis, by Type, 2023-2031

Figure 36: Asia Pacific Nuclear Medicine Market Value Share Analysis, by Application, 2022 and 2031

Figure 37: Asia Pacific Nuclear Medicine Market Attractiveness Analysis, by Application 2023-2031

Figure 38: Asia Pacific Nuclear Medicine Market Value Share Analysis, by End-user, 2022 and 2031

Figure 39: Asia Pacific Nuclear Medicine Market Attractiveness Analysis, End-user, 2023-2031

Figure 40: Latin America Nuclear Medicine Market Value (US$ Mn) Forecast, 2017-2031

Figure 41: Latin America Nuclear Medicine Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Latin America Nuclear Medicine Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 43: Latin America Nuclear Medicine Market Value Share Analysis, by Type, 2022 and 2031

Figure 44: Latin America Nuclear Medicine Market Attractiveness Analysis, by Type, 2023-2031

Figure 45: Latin America Nuclear Medicine Market Value Share Analysis, by Application, 2022 and 2031

Figure 46: Latin America Nuclear Medicine Market Attractiveness Analysis, by Application, 2023-2031

Figure 47: Latin America Nuclear Medicine Market Value Share Analysis, by End-user, 2022 and 2031

Figure 48: Latin America Nuclear Medicine Market Attractiveness Analysis, End-user, 2023-2031

Figure 49: Middle East & Africa Nuclear Medicine Market Value (US$ Mn) Forecast, 2017-2031

Figure 50: Middle East & Africa Nuclear Medicine Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 51: Middle East & Africa Nuclear Medicine Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 52: Middle East & Africa Nuclear Medicine Market Value Share Analysis, by Type, 2022 and 2031

Figure 53: Middle East & Africa Nuclear Medicine Market Attractiveness Analysis, by Type, 2023-2031

Figure 54: Middle East & Africa Nuclear Medicine Market Value Share Analysis, by Application, 2022 and 2031

Figure 55: Middle East & Africa Nuclear Medicine Market Attractiveness Analysis, by Application 2023-2031

Figure 56: Middle East & Africa Nuclear Medicine Market Value Share Analysis, by End-user, 2022 and 2031

Figure 57: Middle East & Africa Nuclear Medicine Market Attractiveness Analysis, by End-user, 2023-2031

Figure 58: Global Nuclear Medicine Market Share Analysis By Company (2022)