Analysts’ Viewpoint

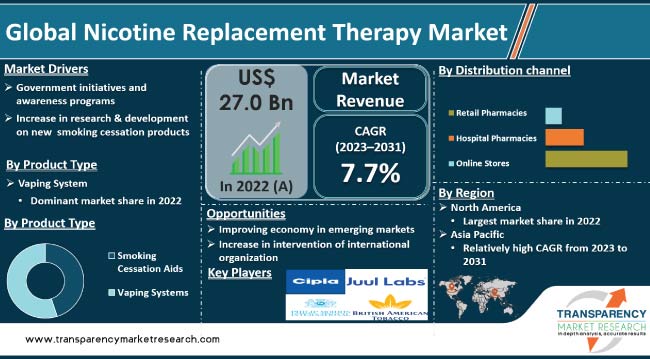

Rise in prevalence of smoking-related health issues, such as lung cancer, respiratory diseases, and cardiac diseases are driving the global market. Increase in awareness about the harmful effects of smoking on health has fueled demand for effective smoking cessation aids. Government initiatives and anti-smoking campaigns play a crucial role in promoting nicotine replacement therapy as a part of smoking cessation program. Nicotine replacement therapy offers safer replacement for tobacco addiction that also helps in managing the withdrawal symptoms, which is likely to propel global nicotine replacement therapy market size.

Surge in demand for nicotine replacement therapy in both emerging and developed markets offers lucrative opportunities to market players. Manufacturers are focusing on potential alternatives, such as e-cigarettes and heat-not-burn tobacco products, which are gaining acceptance among the youth.

Nicotine replacement therapy (NRT) is a treatment that helps people quit smoking by replacing the nicotine they would obtain from cigarettes or other tobacco products. The goal of NRT is to reduce withdrawal symptoms and cravings associated with nicotine addiction, thereby increasing the chances of successfully quitting smoking.

It is available in several forms, including gum, patches, lozenges, inhalers, and nasal sprays. NRT can be an essential tool in helping people overcome nicotine addiction and quit smoking.

According to an article published in the journal Frontiers Psychiatry, in November 2022, NRT is a widely recognized and effective intervention for smoking cessation, and considered the gold standard. NRT can significantly increase the rate of smoking cessation by 50% to 70%.

According to the Centers for Disease Control and Prevention (CDC), NRT products are much safer than smoking, as the hundreds of hazardous compounds in cigarette smoke are the primary cause of most of the health hazards and not nicotine.

Governments across the world are taking steps to promote smoking cessation and reduce the prevalence of smoking. These initiatives include public campaigns to raise awareness about the health risks of smoking. According to Times of India, in June 2023, India became the first country in the world to start anti-tobacco warnings on OTT platforms.

More than 8 million people die from the tobacco epidemic each year, including over 1.2 million deaths from exposure to secondhand smoke, making it one of the greatest public health hazards the world has ever faced. Consequently, demand for smoking cessation products, including NRT, has increased in the past few years.

Provision of affordable or free NRT products to smokers is one of the ways in which governments are promoting smoking cessation. For example, some governments provide NRT products at no cost through public health clinics or pharmacies. This makes it easier for individuals to access these products and quit smoking without the need for a prescription.

The U.S. Centers for Disease Control and Prevention (CDC) offers a free telephone-based support service called the Quitline, which provides counseling and support to help individuals quit smoking. The Quitline also offers free NRT products to eligible individuals.

Therefore, government initiatives and awareness programs for smoking cessation are expected to augment global nicotine replacement therapy market growth in the next few years.

In terms of product type, the vaping systems segment dominated the global nicotine replacement therapy industry in 2022. The e-cigarettes sub-segment is projected to grow at the fastest CAGR during the forecast period. Electronic cigarettes or vaping devices have gained popularity as alternatives to traditional cigarettes. Individuals use e-cigarettes as a way to quit smoking.

According to news published by University of Oxford in November 2022, e-cigarettes are more efficient for smoking cessation than NRT, and helps smokers to quit. In October 2022, a study published by USFDA and CDC stated that 2.55 million middle and high school students in the U.S. are using e-cigarettes. Consumption rate is 14.1% among high school students and 3.3% in middle school students.

The smoking cessation aids segment is likely to grow at a high CAGR during the forecast period. Nicotine gums is one of the leading sub-segments of the smoking cessation aids segment. Nicotine gums work by releasing nicotine into the bloodstream via the gums, which can help reduce withdrawal symptoms and cravings associated with quitting smoking. These are available in different strengths and flavors, and can be easily purchased over-the-counter. Users find it more effective and economic to combat nicotine smoking, as it is cheap and easily available.

Based on distribution channel, the retail pharmacies segment accounted for the largest global nicotine replacement therapy market share in 2022. The segment is expected to account for major share during the forecast period.

Several NRT products are available over-the-counter at retail pharmacies, without the need of prescription. Accessibility and availability of diverse NRT products, such as nicotine gums, patches, and inhalers sprays, makes it easier for individual to purchase NRT products that suit their preferences, habit, and promptly initiates their tobacco free journey.

According to nicotine replacement therapy market trends, North America accounted for significant share of global market in 2022. This is ascribed to high prevalence of smoking, which has led to large market for NRT products. Additionally, strong regulatory environment in North America supports usage of NRT products and encourages smoking cessation.

As per global nicotine replacement therapy market forecast, Asia Pacific is expected to exhibit significant industry expansion during the forecast period. The NRT market in the region is experiencing rapid growth due to increase in awareness about the harmful effects of smoking and the need for smoking cessation.

A growing middle class in several countries has led to increase in disposable income and greater ability to purchase NRT products. Asia Pacific has a large population, which presents significant opportunity to NRT manufacturers.

The nicotine replacement therapy market report concludes with the company profiles section that includes key information about the major players. Leading players are focusing on strategies such as new product launches, mergers, and partnerships & collaborations to compete in the marketplace.

Haleon Group of Companies, Perrigo Company plc, SAABI NZ PTY Limited, Pfizer, Inc., PL Developments, Philip Morris International, Inc., Cipla Limited, JUUL Labs, Inc., JT International SA, Imperial Brands plc, Pierre Fabre S.A., Sparsha Pharma International Pvt. Ltd., Rubicon Research Pvt. Ltd., Lucy Goods, McNeil AB (Johnson & Johnson), BAT plc., and Fontem Holdings 4 B.V. are the prominent players in the market.

Prominent players have been profiled in the nicotine replacement therapy market research report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 27.0 Bn |

|

Forecast (Value) in 2031 |

More than US$ 52.1Bn |

|

Growth Rate (CAGR) |

7.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 27.0 Bn in 2022.

It is projected to reach more than US$ 52.1 Bn by 2031.

It is anticipated to expand at a CAGR of 7.7% from 2023 to 2031.

Government initiatives & awareness programs, increase in research & development on new smoking cessation products, and rise in usage of smoking cessation aids.

The vaping system product type segment accounted for more than 80.0% share in 2022.

North America is expected to account for the largest share from 2023 to 2031.

Haleon Group of Companies, Perrigo Company plc, SAABI NZ PTY Limited, Pfizer, Inc., PL Developments, Philip Morris International, Inc., Cipla Limited, JUUL Labs, Inc., JT International SA, Imperial Brands plc, Pierre Fabre S.A., Sparsha Pharma International Pvt. Ltd., Rubicon Research Pvt. Ltd., Lucy Goods, McNeil AB (Johnson & Johnson), BAT plc., and Fontem Holdings 4 B.V.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Nicotine Replacement Therapy Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Nicotine Replacement Therapy Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Regulatory landscape analysis by key countries

5.2. Supply/Value chain analysis

5.3. Recent Developments/Latest product launches/Key strategies

5.4. Prevalence/Incidence of Smoking Addiction by key regions

5.5. Prevalence/Incidence of Individuals Undergoing NRT Therapy by Region

5.6. COVID-19 Pandemic Impact on Industry

6. Global Nicotine Replacement Therapy Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017-2031

6.3.1. Smoking Cessation Aids

6.3.1.1. Nicotine Inhalers

6.3.1.2. Nicotine Gums

6.3.1.3. Nicotine Lozenges

6.3.1.4. Nicotine Patches

6.3.1.5. Others

6.3.2. Vaping System

6.3.2.1. E-cigarettes

6.3.2.2. Heat-not-burn Tobacco Products

6.4. Market Attractiveness Analysis, by Product Type

7. Global Nicotine Replacement Therapy Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Distribution Channel, 2017-2031

7.3.1. Retail Pharmacies

7.3.2. Hospital Pharmacies

7.3.3. Online Stores

7.4. Market Attractiveness Analysis, by Distribution Channel

8. Global Nicotine Replacement Therapy Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Nicotine Replacement Therapy Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product Type, 2017-2031

9.2.1. Smoking Cessation Aids

9.2.1.1. Nicotine Inhalers

9.2.1.2. Nicotine Gums

9.2.1.3. Nicotine Lozenges

9.2.1.4. Nicotine Patches

9.2.1.5. Others

9.2.2. Vaping System

9.2.2.1. E-cigarettes

9.2.2.2. Heat-not-burn Tobacco Products

9.3. Market Value Forecast, by Distribution Channel, 2017-2031

9.3.1. Retail Pharmacies

9.3.2. Hospital Pharmacies

9.3.3. Online Stores

9.4. Market Value Forecast, by Country, 2017-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By Distribution Channel

9.5.3. By Country

10. Europe Nicotine Replacement Therapy Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017-2031

10.2.1. Smoking Cessation Aids

10.2.1.1. Nicotine Inhalers

10.2.1.2. Nicotine Gums

10.2.1.3. Nicotine Lozenges

10.2.1.4. Nicotine Patches

10.2.1.5. Others

10.2.2. Vaping System

10.2.2.1. E-cigarettes

10.2.2.2. Heat-not-burn Tobacco Products

10.3. Market Value Forecast, by Distribution Channel, 2017-2031

10.3.1. Retail Pharmacies

10.3.2. Hospital Pharmacies

10.3.3. Online Stores

10.4. Market Value Forecast, by Country/Sub-region, 2017-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By Distribution Channel

10.5.3. By Country/Sub-region

11. Asia Pacific Nicotine Replacement Therapy Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017-2031

11.2.1. Smoking Cessation Aids

11.2.1.1. Nicotine Inhalers

11.2.1.2. Nicotine Gums

11.2.1.3. Nicotine Lozenges

11.2.1.4. Nicotine Patches

11.2.1.5. Others

11.2.2. Vaping System

11.2.2.1. E-cigarettes

11.2.2.2. Heat-not-burn Tobacco Products

11.3. Market Value Forecast, by Distribution Channel, 2017-2031

11.3.1. Retail Pharmacies

11.3.2. Hospital Pharmacies

11.3.3. Online Stores

11.4. Market Value Forecast, by Country/Sub-region, 2017-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By Distribution Channel

11.5.3. By Country/Sub-region

12. Latin America Nicotine Replacement Therapy Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017-2031

12.2.1. Smoking Cessation Aids

12.2.1.1. Nicotine Inhalers

12.2.1.2. Nicotine Gums

12.2.1.3. Nicotine Lozenges

12.2.1.4. Nicotine Patches

12.2.1.5. Others

12.2.2. Vaping System

12.2.2.1. E-cigarettes

12.2.2.2. Heat-not-burn Tobacco Products

12.3. Market Value Forecast, by Distribution Channel, 2017-2031

12.3.1. Retail Pharmacies

12.3.2. Hospital Pharmacies

12.3.3. Online Stores

12.4. Market Value Forecast, by Country/Sub-region, 2017-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By Distribution Channel

12.5.3. By Country/Sub-region

13. Middle East & Africa Nicotine Replacement Therapy Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017-2031

13.2.1. Smoking Cessation Aids

13.2.1.1. Nicotine Inhalers

13.2.1.2. Nicotine Gums

13.2.1.3. Nicotine Lozenges

13.2.1.4. Nicotine Patches

13.2.1.5. Others

13.2.2. Vaping System

13.2.2.1. E-cigarettes

13.2.2.2. Heat-not-burn Tobacco Products

13.3. Market Value Forecast, by Distribution Channel, 2017-2031

13.3.1. Retail Pharmacies

13.3.2. Hospital Pharmacies

13.3.3. Online Stores

13.4. Market Value Forecast, by Country/Sub-region, 2017-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By Distribution Channel

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2022

14.3. Company Profiles

14.3.1. Haleon Group of Companies

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Pfizer, Inc.

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. McNeil AB (Johnson & Johnson)

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. SAABI NZ PTY Limited

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. PL Developments

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Cipla Limited

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. BAT plc

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. JT International SA

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Imperial Brands plc

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Sparsha Pharma International Pvt. Ltd.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. Pierre Fabre S.A.

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. Lucy Goods

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.2. Financial Overview

14.3.12.3. SWOT Analysis

14.3.12.4. Strategic Overview

14.3.13. Rubicon Research Pvt. Ltd.

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Product Portfolio

14.3.13.3. Financial Overview

14.3.13.4. SWOT Analysis

14.3.13.5. Strategic Overview

14.3.14. JUUL Labs, Inc.

14.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.14.2. Product Portfolio

14.3.14.3. Financial Overview

14.3.14.4. SWOT Analysis

14.3.14.5. Strategic Overview

14.3.15. Fontem Holdings 4 B.V.

14.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.15.2. Product Portfolio

14.3.15.3. Financial Overview

14.3.15.4. SWOT Analysis

14.3.15.5. Strategic Overview

14.3.16. Philip Morris International, Inc.

14.3.16.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.16.2. Product Portfolio

14.3.16.3. Financial Overview

14.3.16.4. SWOT Analysis

14.3.16.5. Strategic Overview

14.3.17. Perrigo Company plc

14.3.17.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.17.2. Product Portfolio

14.3.17.3. Financial Overview

14.3.17.4. SWOT Analysis

14.3.17.5. Strategic Overview

List of Tables

Table 01: Global Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 02: Global Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Smoking Cessation Aids, 2017-2032

Table 03: Global Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Vaping System, 2017-2033

Table 04: Global Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 05: Global Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 06: North America Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 07: North America Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Smoking Cessation Aids, 2017-2031

Table 08: North America Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Vaping System, 2017-2032

Table 09: North America Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 10: North America Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Country, 2017-2031

Table 11: Europe Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 12: Europe Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Smoking Cessation Aids, 2017-2031

Table 13: Europe Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Vaping System

Table 14: Europe Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 15: Europe Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 16: Asia Pacific Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 17: Asia Pacific Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Smoking Cessation Aids, 2017-2031

Table 18: Asia Pacific Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Vaping System

Table 19: Asia Pacific Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 20: Asia Pacific Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 21: Latin America Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 22: Latin America Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Smoking Cessation Aids, 2017-2031

Table 23: Latin America Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Vaping System

Table 24: Latin America Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 25: Latin America Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 26: Middle East & Africa Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 27: Middle East & Africa Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Smoking Cessation Aids, 2017-2031

Table 28: Middle East & Africa Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Vaping System

Table 29: Middle East & Africa Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 30: Middle East & Africa Nicotine Replacement Therapy Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01: Global Nicotine Replacement Therapy Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Nicotine Replacement Therapy Market Value Share, by Product Type, 2022

Figure 03: Global Nicotine Replacement Therapy Market Value Share, by Distribution Channel, 2022

Figure 04: Global Nicotine Replacement Therapy Market Value Share Analysis by Product Type, 2022 and 2031

Figure 05: Global Nicotine Replacement Therapy Market Revenue (US$ Mn), by Smoking Cessation Aids, 2017-2031

Figure 06: Global Nicotine Replacement Therapy Market Revenue (US$ Mn), by Vaping System, 2017-2031

Figure 07: Global Nicotine Replacement Therapy Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 08: Global Nicotine Replacement Therapy Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 09: Global Nicotine Replacement Therapy Market Revenue (US$ Mn), by Retail Pharmacies, 2017-2031

Figure 10: Global Nicotine Replacement Therapy Market Revenue (US$ Mn), by Hospital Pharmacies, 2017-2031

Figure 11: Global Nicotine Replacement Therapy Market Revenue (US$ Mn), by Online Stores, 2017-2031

Figure 12: Global Nicotine Replacement Therapy Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 13: Global Nicotine Replacement Therapy Market Value Share Analysis, by Region, 2022 and 2031

Figure 14: Global Nicotine Replacement Therapy Market Attractiveness Analysis, by Region, 2023-2031

Figure 15: North America Nicotine Replacement Therapy Market Value (US$ Mn) Forecast, 2017-2031

Figure 16: North America Nicotine Replacement Therapy Market Value Share Analysis, by Country, 2022 and 2031

Figure 17: North America Nicotine Replacement Therapy Market Attractiveness Analysis, by Country, 2023-2031

Figure 18: North America Nicotine Replacement Therapy Market Value Share Analysis by Product Type 2022 and 2031

Figure 19: North America Nicotine Replacement Therapy Market Attractiveness Analysis by Product Type 2023-2031

Figure 20: North America Nicotine Replacement Therapy Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 21: North America Nicotine Replacement Therapy Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 22: Europe Nicotine Replacement Therapy Market Value (US$ Mn) Forecast, 2017-2031

Figure 23: Europe Nicotine Replacement Therapy Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 24: Europe Nicotine Replacement Therapy Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 25: Europe Nicotine Replacement Therapy Market Value Share Analysis by Product Type, 2022 and 2031

Figure 26: Europe Nicotine Replacement Therapy Market Attractiveness Analysis by Product Type, 2023-2031

Figure 27: Europe Nicotine Replacement Therapy Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 28: Europe Nicotine Replacement Therapy Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 29: Asia Pacific Nicotine Replacement Therapy Market Value (US$ Mn) Forecast, 2017-2031

Figure 30: Asia Pacific Nicotine Replacement Therapy Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 31: Asia Pacific Nicotine Replacement Therapy Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 32: Asia Pacific Nicotine Replacement Therapy Market Value Share Analysis by Product Type, 2022 and 2031

Figure 33: Asia Pacific Nicotine Replacement Therapy Market Attractiveness Analysis by Product Type, 2023-2031

Figure 34: Asia Pacific Nicotine Replacement Therapy Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 35: Asia Pacific Nicotine Replacement Therapy Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 36: Latin America Nicotine Replacement Therapy Market Value (US$ Mn) Forecast, 2017-2031

Figure 37: Latin America Nicotine Replacement Therapy Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 38: Latin America Nicotine Replacement Therapy Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 39: Latin America Nicotine Replacement Therapy Market Value Share Analysis by Product Type, 2022 and 2031

Figure 40: Latin America Nicotine Replacement Therapy Market Attractiveness Analysis by Product Type, 2023-2031

Figure 41: Latin America Nicotine Replacement Therapy Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 42: Latin America Nicotine Replacement Therapy Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 43: Middle East and Africa Nicotine Replacement Therapy Market Value (US$ Mn), 2017-2031

Figure 44: Middle East and Africa Nicotine Replacement Therapy Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 45: Middle East and Africa Nicotine Replacement Therapy Market Attractiveness, by Country/Sub-region, 2023-2031

Figure 46: Middle East and Africa Nicotine Replacement Therapy Market Value Share Analysis by Product Type, 2022 and 2031

Figure 47: Middle East and Africa Nicotine Replacement Therapy Market Attractiveness by Product Type, 2023-2031

Figure 48: Middle East and Africa Nicotine Replacement Therapy Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 49: Middle East and Africa Nicotine Replacement Therapy Market Attractiveness, by Distribution Channel, 2023-2031

Figure 50: Company Share Analysis Nicotine Replacement Therapy, 2022