Analysts’ Viewpoint

Ethyl acetate is widely utilized in the production of flexible packaging. It boosts the dispersion and dissolution of polymer resins, which helps in the manufacture of superlative packaging formulations. Growing demand for flexible packaging across the manufacturing sector is anticipated to propel the ethyl acetate market demand in the next few years.

Extensive usage of ethyl acetate in the production of paints & coatings, acrylics, urethanes, epoxies, and vinyl, due to its lower toxicity and pleasant odor, is also driving the ethyl acetate industry growth. Key ethyl acetate manufacturers are focusing on the development of ethyl acetate as a gelling agent in the production of essences and as an additive to polishes. This is projected to offer ethyl acetate market opportunities to manufacturers in the next few years.

Ethyl acetate is an ester of acetic acid and ethanol. Paints use ethyl acetate as activators or hardeners. It’s employed in adhesives, rayon, and coatings as industrial solvent, generally for dissolving the substance. It is a common component in varnishes, surface-coating lacquers, and thinners.

Ethyl acetates are used to manufacture cellulosics, acrylics, vinyl, and urethanes, among other coating compositions. Extended applications include cellulose varnishes, nitrocellulose, acetate lacquers, and shellacs for beautifying ceramic items, wood furniture, car restoration, automobiles, and architectural coatings for exteriors and interiors. Ethyl acetate qualifies as a least hazardous industrial organic solvent due to higher dilution ratios with aromatic and aliphatic diluents.

Ethyl acetate is extensively utilized to produce epoxy coatings, which are widely employed in the aerospace and food & beverage sectors. High-purity ethyl acetate is used to clean electric circuit boards in the electronics industry. Low-purity version is used in perfumes, pharmaceuticals, printing inks, and as carrier solvent for various herbicides. Marine and agricultural equipment also use ethyl acetate in coating formulations. Demand for ethyl acetate is high in the automotive sector, owing to the extensive use of coatings on external surfaces of various vehicle parts.

Growing concerns about the environment and stringent regulations are expected to hamper the ethyl acetate market progress, especially the demand for solvent-based coatings and paints. With the manufacturing vertical showing willingness toward spending more on flexible packaging for achieving differentiation, demand for ethyl acetate is expected to soar during the forecast period.

Ethyl acetate is used as solvent to produce high-resolution printing inks and laminated adhesives. These are employed in various flexible packaging material and plastic films. Flexible packaging has a better durability; it is cost-effective, can be recycled and is available in various sizes. Therefore, demand for flexible packaging is considerably high in diverse industries.

Ethyl acetate has the ability of dissolving and dispersing polymer resins that contribute toward formulating superior coating solutions. This enhances the barrier properties and durability of the packaging. Rising preference for flexible packaging in the manufacturing sector is projected to positively impact the ethyl acetate market development in the next few years.

Ethyl acetate is a highly preferred solvent in the manufacture of varnishes, paints, and coatings, especially in automotive, and building & construction sectors. Ethyl acetate acts as a solvent in several solvent-based inks that are used to package materials. The solvent-oriented features of ethyl acetate render it ideal during production of wool textiles as well. This helps achieve durable and vibrant printed designs on plastic, cardboard, and paper. It is being used as a denaturant in production of transparent and glazed paper. In soil injection technique, ethyl acetate is used in soil stabilization and alkali-sodium silicate stabilizer.

Other applications of ethyl acetate include extraction of natural flavors and aromas from the botanical sources such as spices, herbs, and fruits. These extracts are further absorbed into formulations of beverages and foodstuff in order to enhance sensory experience. Additionally, ethyl acetate imparts pleasant and fruity flavors to baked goods, chewing gum, candies, and beverages such as tea and coffee. These diverse applications of ethyl acetate are expected to significantly propel the ethyl acetate market revenue in the next few years.

Analysis of the regional ethyl acetate business reveals that Asia Pacific held more than 40% of the global ethyl acetate market share in 2022 due to considerable growth of automotive, pharmaceuticals, and food & beverages sectors in Japan, China, and India. The ethyl acetate market size in Vietnam and Thailand is expected to grow significantly in the next few years due to growing demand for printing inks, adhesives, and solvents for coatings.

Europe accounts for a notable share in global demand for ethyl acetate owing to the presence of a prominent number of manufacturers and suppliers of packaging solutions, chemical products, automobiles, and food and beverages in the U.K., Germany, and France.

One of the key ethyl acetate market trends witnessed in North America is the rise in demand for ethyl acetate in the manufacture of synthetic leather, varnishes, and printing inks in the region. Moreover, the U.S. is witnessing a substantial increase in demand for adaptable, simple packaging for foods and beverages, which in turn is expected to drive the ethyl acetate market statistics in the country in the next few years.

Demand for paints & coatings in automotive, furniture, and various other industries is rising in the UAE, Kuwait, and the Kingdom of Saudi Arabia, which is driving the ethyl acetate industry growth in Middle East & Africa.

The global ethyl acetate market is highly competitive with key players adopting an organic mode of development in order to expand their consumer base. Furthermore, they are employing strategic initiatives such as M&A, joint ventures, and partnerships to gain a competitive edge. Prominent ethyl acetate manufacturers are also focusing on the development of innovative bio-based solutions to comply with the global demand for eco-friendly products.

INEOS AG, Sekab Biofuels and Chemicals AG, Solventis Ltd., Sasol Ltd., Daicel Corporation, Ashok Alco-Chem Ltd., Celanese Corp., Eastman Chemical Co., Godavari Biorefineries Ltd., and Jiangsu Sopo (Group) C. Ltd. are some of the notable entities operating in the global market.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 5.5 Bn |

| Market Forecast Value in 2031 | US$ 8.8 Bn |

| Growth Rate (CAGR) | 5.9% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

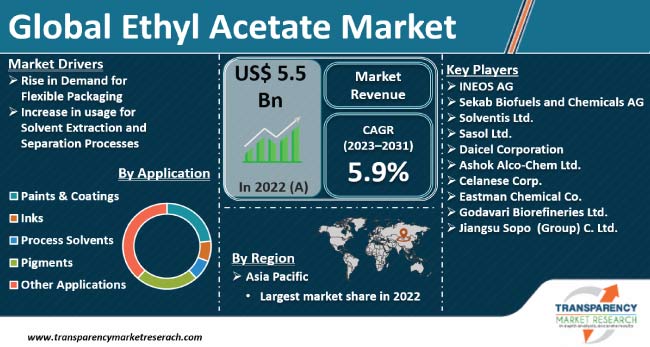

The global market was valued at US$ 5.5 Bn in 2022

It is projected to expand at a CAGR of 5.9% from 2023 to 2031

Demand for flexible packaging and growing usage in solvent extraction and separation processes

In terms of application, the paints & coatings segment held largest share in 2022

Asia Pacific is estimated to dominate the global business in the next few years

INEOS AG, Sekab Biofuels and Chemicals AG, Solventis Ltd., Sasol Ltd., Daicel Corporation, Ashok Alco-Chem Ltd., Celanese Corp., Eastman Chemical Co., Godavari Biorefineries Ltd., and Jiangsu Sopo (Group) C. Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Ethyl Acetate Market Analysis and Forecast, 2023-2031

2.6.1. Global Ethyl Acetate Market Volume (Tons)

2.6.2. Global Ethyl Acetate Market Value (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Ethyl Acetate

3.2. Impact on the Demand of Ethyl Acetate – Pre & Post Crisis

4. Production Output Analysis(Tons), 2023

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East and Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis, by Application

6.2. Price Trend Analysis by Region

7. Ethyl Acetate Market Analysis and Forecast, by Application, 2023–2031

7.1. Introduction and Definitions

7.2. Global Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

7.2.1. Printing Inks

7.2.2. Adhesives

7.2.3. Cosmetics

7.2.4. Paints & Coatings

7.2.5. Pharmaceuticals

7.2.6. Food & Beverages

7.2.7. Others

7.3. Global Ethyl Acetate Market Attractiveness, by Application

8. Global Ethyl Acetate Market Analysis and Forecast, by Region, 2023–2031

8.1. Key Findings

8.2. Global Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2023–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Ethyl Acetate Market Attractiveness, by Region

9. North America Ethyl Acetate Market Analysis and Forecast, 2023–2031

9.1. Key Findings

9.2. North America Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.3. North America Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2023–2031

9.3.1. U.S. Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.3.2. Canada Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.4. North America Ethyl Acetate Market Attractiveness Analysis

10. Europe Ethyl Acetate Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. Europe Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3. Europe Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

10.3.1. Germany Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

10.3.2. France Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.3. U.K. Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.4. Italy Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.5. Russia & CIS Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.6. Rest of Europe Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.4. Europe Ethyl Acetate Market Attractiveness Analysis

11. Asia Pacific Ethyl Acetate Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Asia Pacific Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application

11.3. Asia Pacific Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

11.3.1. China Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.2. Japan Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.3. India Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.4. ASEAN Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.5. Rest of Asia Pacific Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.4. Asia Pacific Ethyl Acetate Market Attractiveness Analysis

12. Latin America Ethyl Acetate Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Latin America Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.3. Latin America Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

12.3.1. Brazil Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.3.2. Mexico Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.3.3. Rest of Latin America Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.4. Latin America Ethyl Acetate Market Attractiveness Analysis

13. Middle East & Africa Ethyl Acetate Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Middle East & Africa Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.3. Middle East & Africa Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

13.3.1. GCC Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.3.2. South Africa Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.3.3. Rest of Middle East & Africa Ethyl Acetate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.4. Middle East & Africa Ethyl Acetate Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Green Cement Company Market Share Analysis, 2023

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.2.1. INEOS AG

14.2.1.1. Company Revenue

14.2.1.2. Business Overview

14.2.1.3. Product Segments

14.2.1.4. Geographic Footprint

14.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.2. Sekab Biofuels and Chemicals AG

14.2.2.1. Company Revenue

14.2.2.2. Business Overview

14.2.2.3. Product Segments

14.2.2.4. Geographic Footprint

14.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.3. Solventis Ltd.

14.2.3.1. Company Revenue

14.2.3.2. Business Overview

14.2.3.3. Product Segments

14.2.3.4. Geographic Footprint

14.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.4. Sasol Ltd.

14.2.4.1. Company Revenue

14.2.4.2. Business Overview

14.2.4.3. Product Segments

14.2.4.4. Geographic Footprint

14.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.5. Daicel Corporation

14.2.5.1. Company Revenue

14.2.5.2. Business Overview

14.2.5.3. Product Segments

14.2.5.4. Geographic Footprint

14.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.6. Ashok Alco-Chem Ltd.

14.2.6.1. Company Revenue

14.2.6.2. Business Overview

14.2.6.3. Product Segments

14.2.6.4. Geographic Footprint

14.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.7. Celanese Corp.

14.2.7.1. Company Revenue

14.2.7.2. Business Overview

14.2.7.3. Product Segments

14.2.7.4. Geographic Footprint

14.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.8. Eastman Chemical Co.

14.2.8.1. Company Revenue

14.2.8.2. Business Overview

14.2.8.3. Product Segments

14.2.8.4. Geographic Footprint

14.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.9. Godavari Biorefineries Ltd.

14.2.9.1. Company Revenue

14.2.9.2. Business Overview

14.2.9.3. Product Segments

14.2.9.4. Geographic Footprint

14.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.10. Jiangsu Sopo (Group) C. Ltd.

14.2.10.1. Company Revenue

14.2.10.2. Business Overview

14.2.10.3. Product Segments

14.2.10.4. Geographic Footprint

14.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 2: Global Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 3: Global Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Region, 2023–2031

Table 4: Global Ethyl Acetate Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 5: North America Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 6: North America Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 7: North America Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Country, 2023–2031

Table 8: North America Ethyl Acetate Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 9: U.S. Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 10: U.S. Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 11: Canada Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 12: Canada Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 13: Europe Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 14: Europe Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 15: Europe Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 16: Europe Ethyl Acetate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 17: Germany Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 18: Germany Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 19: France Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 20: France Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 21: U.K. Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 22: U.K. Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 23: Italy Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 24: Italy Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 25: Spain Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 26: Spain Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 27: Russia & CIS Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 28: Russia & CIS Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 29: Rest of Europe Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 30: Rest of Europe Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 31: Asia Pacific Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 32: Asia Pacific Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 33: Asia Pacific Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 34: Asia Pacific Ethyl Acetate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 35: China Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 36: China Ethyl Acetate Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 37: Japan Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 38: Japan Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 39: India Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 40: India Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 41: ASEAN Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 42: ASEAN Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 43: Rest of Asia Pacific Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 44: Rest of Asia Pacific Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 45: Latin America Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 46: Latin America Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 47: Latin America Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 48: Latin America Ethyl Acetate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 49: Brazil Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 50: Brazil Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 51: Mexico Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 52: Mexico Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 53: Rest of Latin America Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 54: Rest of Latin America Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 55: Middle East & Africa Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 56: Middle East & Africa Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 57: Middle East & Africa Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 58: Middle East & Africa Ethyl Acetate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 59: GCC Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 60: GCC Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 61: South Africa Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 62: South Africa Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 63: Rest of Middle East & Africa Ethyl Acetate Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 64: Rest of Middle East & Africa Ethyl Acetate Market Value (US$ Mn) Forecast, by Application, 2023–2031

List of Figures

Figure 1: Global Ethyl Acetate Market Volume Share Analysis, by Application, 2023, 2027, and 2031

Figure 2: Global Ethyl Acetate Market Attractiveness, by Application

Figure 3: Global Ethyl Acetate Market Volume Share Analysis, by Region, 2023, 2027, and 2031

Figure 4: Global Ethyl Acetate Market Attractiveness, by Region

Figure 5: North America Ethyl Acetate Market Volume Share Analysis, by Application, 2023, 2027, and 2031

Figure 6: North America Ethyl Acetate Market Attractiveness, by Application

Figure 7: North America Ethyl Acetate Market Attractiveness, by Application

Figure 8: North America Ethyl Acetate Market Attractiveness, by Country and Sub-region

Figure 9: Europe Ethyl Acetate Market Volume Share Analysis, by Application, 2023, 2027, and 2031

Figure 10: Europe Ethyl Acetate Market Attractiveness, by Application

Figure 11: Europe Ethyl Acetate Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2031

Figure 12: Europe Ethyl Acetate Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Ethyl Acetate Market Volume Share Analysis, by Application, 2023, 2027, and 2031

Figure 14: Asia Pacific Ethyl Acetate Market Attractiveness, by Application

Figure 15: Asia Pacific Ethyl Acetate Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2031

Figure 16: Asia Pacific Ethyl Acetate Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Ethyl Acetate Market Volume Share Analysis, by Application, 2023, 2027, and 2031

Figure 18: Latin America Ethyl Acetate Market Attractiveness, by Application

Figure 19: Latin America Ethyl Acetate Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2031

Figure 20: Latin America Ethyl Acetate Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Ethyl Acetate Market Volume Share Analysis, by Application, 2023, 2027, and 2031

Figure 22: Middle East & Africa Ethyl Acetate Market Attractiveness, by Application

Figure 23: Middle East & Africa Ethyl Acetate Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2031

Figure 24: Middle East & Africa Ethyl Acetate Market Attractiveness, by Country and Sub-region