Analysts’ Viewpoint on Market Scenario

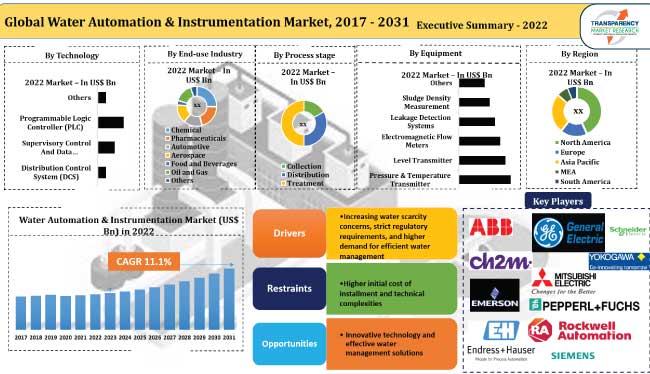

Increase in water scarcity concerns, strict regulatory requirements, high demand for efficient water management, and significant water loss in industries are the major factors driving the water automation & instrumentation market.

New growth avenues in the market are attributed to surge in demand from multiple end-use industries ranging from chemicals, manufacturing, metal, and water treatment plants. Quality concerns, technical upgrades, and instrument modernization support application of water automation. Water is a crucial but finite resource. Surge in demand from industries to efficiently manage water resources creates lucrative opportunities for water automation & instrumentation industry growth.

However, initial high cost of installment, technical complexities, and short term operational disruptions may hamper market growth. Nevertheless, manufacturers are striving to develop safe, innovative, and environment-friendly water automation & instrumentation processes.

Water automation and instrumentation systems are generally used to manage and control water flow inwards or outwards within a manufacturing plant. The key objective behind the deployment of water automation systems is to minimize and enhance the treatment of waste water flowing out of manufacturing plants. The real time operating systems and programming toolkits solve issues such as water shortage & poor quality, and enable process monitoring. Implementation of these systems are required for accuracy, speed, and ease of operations to regulate the water flow and ensure a safety and control mechanism. They also enable energy saving.

Water automation and instrumentation systems comprise various equipment such as pressure & temperature transmitters, liquid & gas analyzers, and leakage detection systems which are vital for end-use industries such as chemicals, pharma, metal fabrication, oil & gas, and food & beverages.

Regulatory compliance and quality adherence becomes easy due to instrument advancement, facilitating efficient processes. The global population is surging at a rapid pace; water supply and sanitation are facing pressure due to climate change and water scarcity issues. Instrument modernization plays a vital role in providing sustainable solutions. Rapid urbanization has increased the need for fresh water. Additionally, water automation & instrumentation market growth is fueled by the rise in number smart cities that propels the demand for intelligent water management systems.

Reliable automation systems are crucial for safety and economic reasons. For instance, apartment buildings in India have used WaterOn device, a smart metering and automated leakage prevention system, manufactured by SmarterHomes, which has helped to save an average of 35% water consumption across 40000 households. It saves around 71 million liters of water every month in Bengaluru, as per a report cited by World Bank, which denotes the efficiency of these instruments, thus boosting the use of water facility instrumentation.

Expansion of the global water automation & instrumentation market is facilitated by innovation and technology that plays a vital role in dealing with water scarcity issues, in water use efficiency, water treatment, and to simplify water quality control. Smart irrigation processes and new computing capacities to develop complex models for water management are the latest trends in water automation and instrumentation. Rise in concerns around availability of water across the globe and need for efficient water management processes due to the increasing population creates new opportunities for fluid management automation.

These systems helps in reducing operational cost and deal with the process challenges faced by manufacturers to improve performance and optimize resources, enhancing their rapid adoption and contributing to water automation & instrumentation market demand.

Water automation and instrumentation are used in various applications in multiple end-use industries. The chemical sector is one of the major end-use industries for water automation. Furthermore, food and beverages production and processing consumes massive amounts of water, both in products and as an essential material for cleaning, cooling, and many other utility purposes, bolstering the demand for water automation solutions, and highlighting the strong potential of water management solutions for efficient automation.

Water automation and instrumentation is the base of advanced control systems deployed in an industry. Water pumping and treatment processes are energy intensive. Water instrumentation allows optimization of processes and facilitates efficient water management practices, offering lucrative water automation & instrumentation market opportunities.

Investment in infrastructure and smart cities are soaring at a rapid pace where aquatic system control and monitoring is crucial, thus offering ample opportunities for hydro-automation and Instrumentation.

According to the latest water automation & instrumentation market forecast, North America is projected to be the dominant region and account for higher share. Favorable government initiatives, higher investment, technical advancement, and expanding end-use industries are some of the key factors boosting market statistics.

The water automation & instrumentation market share in Asia Pacific is expected to grow at a steady pace, ascribed to rise in adoption of water automation and instrumentation in various end-use sectors and its use in water treatment plants to facilitate efficient water management solutions.

As per the water automation & instrumentation market analysis, the industry is growing at a steady pace owing to surge in need for effective and sustainable water management solutions.

ABB Ltd., CH2M Hill Inc., Emerson, Electric Company, Endress + Hauser AG, General Electric Company, Mitsubishi Electric Corporation, Pepperl + Fuchs, Rockwell Automation Inc., Schneider Electric Corp., Siemens AG, and Yokogawa Electric Corporation are some of the key players. These companies are following the latest water automation & instrumentation market trends to avail lucrative revenue opportunities.

These players have been profiled in the water automation & instrumentation market report based on parameters such as financial overview, business segments, business strategies, latest developments, company overview, and product portfolio.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 18.8 Bn |

| Market Forecast Value in 2031 | US$ 48.5 Bn |

| Growth Rate (CAGR) | 11.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Includes cross-segment analysis at the global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 18.8 Bn in 2022

The CAGR is projected to be 11.1% from 2023 to 2031

It is expected to reach US$ 48.5 Bn by the end of 2031

Increase in water scarcity concerns, strict regulatory requirements, and higher demand for efficient water management solutions

ABB Ltd., CH2M Hill Inc., Emerson, Electric Company, Endress + Hauser AG, General Electric Company, Mitsubishi Electric Corporation, Pepperl + Fuchs, Rockwell Automation Inc., Schneider Electric Corp., Siemens AG, and Yokogawa Electric Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trend Analysis

5.2.1. Supplier Side

5.2.2. Demand Side

5.3. Key Market Indicator

5.3.1. Water & Wastewater Industry Overview

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Global Water Automation & Instrumentation Market Analysis and Forecast, 2017 - 2031

5.6.1. Market Value Projections (US$ Bn)

6. Global Water Automation & Instrumentation Market Analysis and Forecast, by Process Stage

6.1. Global Water Automation & Instrumentation Market Size (Value in US$ Bn), by Process Stage, 2017 - 2031

6.1.1. Collection

6.1.2. Distribution

6.1.3. Treatment

6.2. Incremental Opportunity, by Process Stage

7. Global Water Automation & Instrumentation Market Analysis and Forecast, by Equipment

7.1. Global Water Automation & Instrumentation Market Size (Value in US$ Bn), by Equipment, 2017 - 2031

7.1.1. Pressure And Temperature Transmitter

7.1.2. Level Transmitter

7.1.3. Electromagnetic Flow Meters

7.1.4. Leakage Detection Systems

7.1.5. Sludge Density Measurement

7.1.6. Others

7.2. Incremental Opportunity, by Equipment

8. Global Water Automation & Instrumentation Market Analysis and Forecast, by Technology

8.1. Global Water Automation & Instrumentation Market Size (Value in US$ Bn), by Technology, 2017 - 2031

8.1.1. Distribution Control System (DCS)

8.1.2. Supervisory Control And Data Acquisition (SCADA)

8.1.3. Programmable Logic Controller (PLC)

8.1.4. Others

8.2. Incremental Opportunity, by Technology

9. Global Water Automation & Instrumentation Market Analysis and Forecast, by End-use Industry

9.1. Global Water Automation & Instrumentation Market Size (Value in US$ Bn), by End-use Industry, 2017 - 2031

9.1.1. Chemical

9.1.2. Pharmaceuticals

9.1.3. Automotive

9.1.4. Aerospace

9.1.5. Food And Beverages

9.1.6. Oil And Gas

9.1.7. Others

9.2. Incremental Opportunity, by End-use Industry

10. Global Water Automation & Instrumentation Market Analysis and Forecast, by Region

10.1. Global Water Automation & Instrumentation Market Size (Value in US$ Bn), by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Water Automation & Instrumentation Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Process Stage, 2017 - 2031

11.3.1. Collection

11.3.2. Distribution

11.3.3. Treatment

11.4. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Equipment, 2017 - 2031

11.4.1. Pressure And Temperature Transmitter

11.4.2. Level Transmitter

11.4.3. Electromagnetic Flow Meters

11.4.4. Leakage Detection Systems

11.4.5. Sludge Density Measurement

11.4.6. Others

11.5. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Technology, 2017 - 2031

11.5.1. Distribution Control System (DCS)

11.5.2. Supervisory Control And Data Acquisition (SCADA)

11.5.3. Programmable Logic Controller (PLC)

11.5.4. Others

11.6. Water Automation & Instrumentation Market Size (Value in US$ Bn), by End-use Industry, 2017 - 2031

11.6.1. Chemical

11.6.2. Pharmaceuticals

11.6.3. Automotive

11.6.4. Aerospace

11.6.5. Food And Beverages

11.6.6. Oil And Gas

11.6.7. Others

11.7. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Country, 2017 - 2031

11.7.1. U.S.

11.7.2. Canada

11.7.3. Rest of North America

11.8. Incremental Opportunity Analysis

12. Europe Water Automation & Instrumentation Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Process Stage, 2017 - 2031

12.3.1. Collection

12.3.2. Distribution

12.3.3. Treatment

12.4. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Equipment, 2017 - 2031

12.4.1. Pressure And Temperature Transmitter

12.4.2. Level Transmitter

12.4.3. Electromagnetic Flow Meters

12.4.4. Leakage Detection Systems

12.4.5. Sludge Density Measurement

12.4.6. Others

12.5. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Technology, 2017 - 2031

12.5.1. Distribution Control System (DCS)

12.5.2. Supervisory Control And Data Acquisition (SCADA)

12.5.3. Programmable Logic Controller (PLC)

12.5.4. Others

12.6. Water Automation & Instrumentation Market Size (Value in US$ Bn), by End-use Industry, 2017 - 2031

12.6.1. Chemical

12.6.2. Pharmaceuticals

12.6.3. Automotive

12.6.4. Aerospace

12.6.5. Food And Beverages

12.6.6. Oil And Gas

12.6.7. Others

12.7. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Country, 2017 - 2031

12.7.1. U.K.

12.7.2. Germany

12.7.3. France

12.7.4. Rest of Europe

12.8. Incremental Opportunity Analysis

13. Asia Pacific Water Automation & Instrumentation Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Process Stage, 2017 - 2031

13.3.1. Collection

13.3.2. Distribution

13.3.3. Treatment

13.4. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Equipment, 2017 - 2031

13.4.1. Pressure And Temperature Transmitter

13.4.2. Level Transmitter

13.4.3. Electromagnetic Flow Meters

13.4.4. Leakage Detection Systems

13.4.5. Sludge Density Measurement

13.4.6. Others

13.5. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Technology, 2017 - 2031

13.5.1. Distribution Control System (DCS)

13.5.2. Supervisory Control And Data Acquisition (SCADA)

13.5.3. Programmable Logic Controller (PLC)

13.5.4. Others

13.6. Water Automation & Instrumentation Market Size (Value in US$ Bn), by End-use Industry, 2017 - 2031

13.6.1. Chemical

13.6.2. Pharmaceuticals

13.6.3. Automotive

13.6.4. Aerospace

13.6.5. Food And Beverages

13.6.6. Oil And Gas

13.6.7. Others

13.7. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Country, 2017 - 2031

13.7.1. China

13.7.2. India

13.7.3. Japan

13.7.4. Rest of Asia Pacific

13.8. Incremental Opportunity Analysis

14. Middle East & Africa Water Automation & Instrumentation Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Process Stage, 2017 - 2031

14.3.1. Collection

14.3.2. Distribution

14.3.3. Treatment

14.4. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Equipment, 2017 - 2031

14.4.1. Pressure And Temperature Transmitter

14.4.2. Level Transmitter

14.4.3. Electromagnetic Flow Meters

14.4.4. Leakage Detection Systems

14.4.5. Sludge Density Measurement

14.4.6. Others

14.5. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Technology, 2017 - 2031

14.5.1. Distribution Control System (DCS)

14.5.2. Supervisory Control And Data Acquisition (SCADA)

14.5.3. Programmable Logic Controller (PLC)

14.5.4. Others

14.6. Water Automation & Instrumentation Market Size (Value in US$ Bn), by End-use Industry, 2017 - 2031

14.6.1. Chemical

14.6.2. Pharmaceuticals

14.6.3. Automotive

14.6.4. Aerospace

14.6.5. Food And Beverages

14.6.6. Oil And Gas

14.6.7. Others

14.7. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Country, 2017 - 2031

14.7.1. GCC

14.7.2. South Africa

14.7.3. Rest of Middle East & Africa

14.8. Incremental Opportunity Analysis

15. South America Water Automation & Instrumentation Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Process Stage, 2017 - 2031

15.3.1. Collection

15.3.2. Distribution

15.3.3. Treatment

15.4. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Equipment, 2017 - 2031

15.4.1. Pressure and Temperature Transmitter

15.4.2. Level Transmitter

15.4.3. Electromagnetic Flow Meters

15.4.4. Leakage Detection Systems

15.4.5. Sludge Density Measurement

15.4.6. Others

15.5. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Technology, 2017 - 2031

15.5.1. Distribution Control System (DCS)

15.5.2. Supervisory Control And Data Acquisition (SCADA)

15.5.3. Programmable Logic Controller (PLC)

15.5.4. Others

15.6. Water Automation & Instrumentation Market Size (Value in US$ Bn), by End-use Industry, 2017 - 2031

15.6.1. Chemical

15.6.2. Pharmaceuticals

15.6.3. Automotive

15.6.4. Aerospace

15.6.5. Food And Beverages

15.6.6. Oil And Gas

15.6.7. Others

15.7. Water Automation & Instrumentation Market Size (Value in US$ Bn), by Country, 2017 - 2031

15.7.1. Brazil

15.7.2. Rest of South America

15.8. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Competition Dashboard

16.2. Market Share Analysis % (2022)

16.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

16.3.1. ABB Ltd.

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. Financial Information, (Subject to Data Availability)

16.3.1.4. Business Strategies / Recent Developments

16.3.2. CH2M Hill Inc.

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. Financial Information, (Subject to Data Availability)

16.3.2.4. Business Strategies / Recent Developments

16.3.3. Emerson Electric Company

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. Financial Information, (Subject to Data Availability)

16.3.3.4. Business Strategies / Recent Developments

16.3.4. Endress + Hauser AG

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. Financial Information, (Subject to Data Availability)

16.3.4.4. Business Strategies / Recent Developments

16.3.5. General Electric Company

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. Financial Information, (Subject to Data Availability)

16.3.5.4. Business Strategies / Recent Developments

16.3.6. Mitsubishi Electric Corporation

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. Financial Information, (Subject to Data Availability)

16.3.6.4. Business Strategies / Recent Developments

16.3.7. Pepperl + Fuchs

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. Financial Information, (Subject to Data Availability)

16.3.7.4. Business Strategies / Recent Developments

16.3.8. Rockwell Automation Inc.

16.3.8.1. Company Overview

16.3.8.2. Product Portfolio

16.3.8.3. Financial Information, (Subject to Data Availability)

16.3.8.4. Business Strategies / Recent Developments

16.3.9. Schneider Electric Corp.

16.3.9.1. Company Overview

16.3.9.2. Product Portfolio

16.3.9.3. Financial Information, (Subject to Data Availability)

16.3.9.4. Business Strategies / Recent Developments

16.3.10. Siemens AG

16.3.10.1. Company Overview

16.3.10.2. Product Portfolio

16.3.10.3. Financial Information, (Subject to Data Availability)

16.3.10.4. Business Strategies / Recent Developments

16.3.11. Yokogawa Electric Corporation

16.3.11.1. Company Overview

16.3.11.2. Product Portfolio

16.3.11.3. Financial Information, (Subject to Data Availability)

16.3.11.4. Business Strategies / Recent Developments

16.3.12. Other key players

16.3.12.1. Company Overview

16.3.12.2. Product Portfolio

16.3.12.3. Financial Information, (Subject to Data Availability)

16.3.12.4. Business Strategies / Recent Developments

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.1.1. By Process stage

17.1.2. By Equipment

17.1.3. By Technology

17.1.4. By End-use industry

17.1.5. By Region

17.2. Understanding the Procurement Process of End-users

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Water Automation & Instrumentation Market Value (US$ Bn) Projection By Process Stage 2017-2031

Table 2: Global Water Automation & Instrumentation Market Value (US$ Bn) Projection By Technology 2017-2031

Table 3: Global Water Automation & Instrumentation Market Value (US$ Bn) Projection By Equipment 2017-2031

Table 4: Global Water Automation & Instrumentation Market Value (US$ Bn) Projection By End-use Industry 2017-2031

Table 5: Global Water Automation & Instrumentation Market Value (US$ Bn) Projection By Region 2017-2031

Table 6: North America Water Automation & Instrumentation Market Value (US$ Bn) Projection By Process Stage 2017-2031

Table 7: North America Water Automation & Instrumentation Market Value (US$ Bn) Projection By Technology 2017-2031

Table 8: North America Water Automation & Instrumentation Market Value (US$ Bn) Projection By Equipment 2017-2031

Table 9: North America Water Automation & Instrumentation Market Value (US$ Bn) Projection By End-use Industry 2017-2031

Table 10: North America Water Automation & Instrumentation Market Value (US$ Bn) Projection By Country 2017-2031

Table 11: Europe Water Automation & Instrumentation Market Value (US$ Bn) Projection By Process Stage 2017-2031

Table 12: Europe Water Automation & Instrumentation Market Value (US$ Bn) Projection By Technology 2017-2031

Table 13: Europe Water Automation & Instrumentation Market Value (US$ Bn) Projection By Equipment 2017-2031

Table 14: Europe Water Automation & Instrumentation Market Value (US$ Bn) Projection By End-use Industry 2017-2031

Table 15: Europe Water Automation & Instrumentation Market Value (US$ Bn) Projection By Country 2017-2031

Table 16: Asia Pacific Water Automation & Instrumentation Market Value (US$ Bn) Projection By Process Stage 2017-2031

Table 17: Asia Pacific Water Automation & Instrumentation Market Value (US$ Bn) Projection By Technology 2017-2031

Table 18: Asia Pacific Water Automation & Instrumentation Market Value (US$ Bn) Projection By Equipment 2017-2031

Table 19: Asia Pacific Water Automation & Instrumentation Market Value (US$ Bn) Projection By End-use Industry 2017-2031

Table 20: Asia Pacific Water Automation & Instrumentation Market Value (US$ Bn) Projection By Country 2017-2031

Table 21: Middle East & Africa Water Automation & Instrumentation Market Value (US$ Bn) Projection By Process Stage 2017-2031

Table 22: Middle East & Africa Water Automation & Instrumentation Market Value (US$ Bn) Projection By Technology 2017-2031

Table 23: Middle East & Africa Water Automation & Instrumentation Market Value (US$ Bn) Projection By Equipment 2017-2031

Table 24: Middle East & Africa Water Automation & Instrumentation Market Value (US$ Bn) Projection By End-use Industry 2017-2031

Table 25: Middle East & Africa Water Automation & Instrumentation Market Value (US$ Bn) Projection By Country 2017-2031

Table 26: South America Water Automation & Instrumentation Market Value (US$ Bn) Projection By Process Stage 2017-2031

Table 27: South America Water Automation & Instrumentation Market Value (US$ Bn) Projection By Technology 2017-2031

Table 28: South America Water Automation & Instrumentation Market Value (US$ Bn) Projection By Equipment 2017-2031

Table 29: South America Water Automation & Instrumentation Market Value (US$ Bn) Projection By End-use Industry 2017-2031

Table 30: South America Water Automation & Instrumentation Market Value (US$ Bn) Projection By Country 2017-2031

List of Figures

Figure 1: Global Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Process Stage 2017-2031

Figure 2: Global Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Process Stage 2023-2031

Figure 3: Global Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Technology 2017-2031

Figure 4: Global Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Technology 2023-2031

Figure 5: Global Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Equipment 2017-2031

Figure 6: Global Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Equipment 2023-2031

Figure 7: Global Water Automation & Instrumentation Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 8: Global Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2023-2031

Figure 9: Global Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 10: Global Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2023-2031

Figure 11: North America Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Process Stage 2017-2031

Figure 12: North America Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Process Stage 2023-2031

Figure 13: North America Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Technology 2017-2031

Figure 14: North America Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Technology 2023-2031

Figure 15: North America Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Equipment 2017-2031

Figure 16: North America Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Equipment 2023-2031

Figure 17: North America Water Automation & Instrumentation Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 18: North America Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2023-2031

Figure 19: North America Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 20: North America Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 21: Europe Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Process Stage 2017-2031

Figure 22: Europe Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Process Stage 2023-2031

Figure 23: Europe Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Technology 2017-2031

Figure 24: Europe Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Technology 2023-2031

Figure 25: Europe Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Equipment 2017-2031

Figure 26: Europe Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Equipment 2023-2031

Figure 27: Europe Water Automation & Instrumentation Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 28: Europe Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2023-2031

Figure 29: Europe Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 30: Europe Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 31: Asia Pacific Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Process Stage 2017-2031

Figure 32: Asia Pacific Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Process Stage 2023-2031

Figure 33: Asia Pacific Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Technology 2017-2031

Figure 34: Asia Pacific Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Technology 2023-2031

Figure 35: Asia Pacific Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Equipment 2017-2031

Figure 36: Asia Pacific Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Equipment 2023-2031

Figure 37: Asia Pacific Water Automation & Instrumentation Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 38: Asia Pacific Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2023-2031

Figure 39: Asia Pacific Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 40: Asia Pacific Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 41: Middle East & Africa Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Process Stage 2017-2031

Figure 42: Middle East & Africa Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Process Stage 2023-2031

Figure 43: Middle East & Africa Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Technology 2017-2031

Figure 44: Middle East & Africa Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Technology 2023-2031

Figure 45: Middle East & Africa Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Equipment 2017-2031

Figure 46: Middle East & Africa Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Equipment 2023-2031

Figure 47: Middle East & Africa Water Automation & Instrumentation Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 48: Middle East & Africa Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2023-2031

Figure 49: Middle East & Africa Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 50: Middle East & Africa Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 51: South America Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Process Stage 2017-2031

Figure 52: South America Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Process Stage 2023-2031

Figure 53: South America Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Technology 2017-2031

Figure 54: South America Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Technology 2023-2031

Figure 55: South America Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Equipment 2017-2031

Figure 56: South America Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Equipment 2023-2031

Figure 57: South America Water Automation & Instrumentation Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 58: South America Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2023-2031

Figure 59: South America Water Automation & Instrumentation Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 60: South America Water Automation & Instrumentation Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031