For several decades, veterinary vaccines have played a key role in improving food security and as a result, human health. The medicine sphere wherein veterinary medicines constitute a significant share continues to evolve at a consistent pace. At present, innovations in the veterinary therapeutics market are largely made possible through advancements in technology and research & development activities. Over the past decade, a considerable amount of promising breakthroughs in the veterinary therapeutic field have paved the way for a host of specialty medicine. The significant rise in the number of pet animals worldwide, progress in surgical and medical capabilities pertaining to the treatment of animals, growing focus on improving the overall wellness of animals, significant progress in the development of new vaccines for an array of diseases, and discovery of new medication to curb the occurrence of new diseases are some of the key factors expected to influence the expansion of the veterinary therapeutics market during the forecast period.

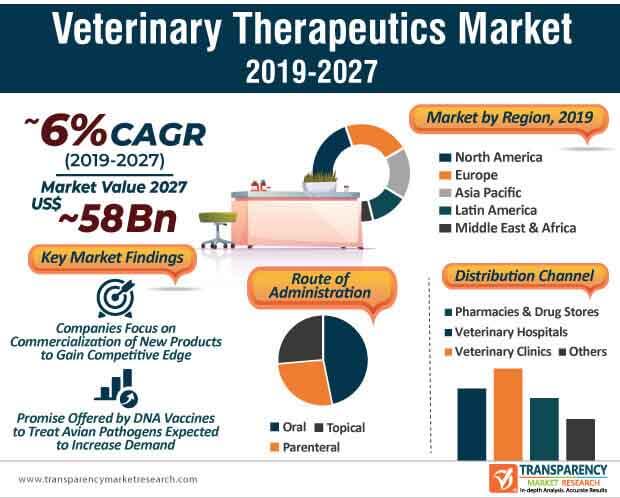

Companies involved in the current veterinary therapeutics market landscape are actively engaged in research and development activities that have offered considerable promise. However, one of the glaring challenges that market participants are required to negotiate their way through is the evolving regulatory framework. Product development is likely to remain the cornerstone of the growth of the global veterinary therapeutics market, which is expected to reach US$ 58.5 Bn mark by the end of 2027.

To know the scope of our report Get a Sample on Veterinary Therapeutics Market

Veterinary therapeutics have evolved at a considerable pace over the past decade, as drug developers continue to improve the overall efficacy of their products. Moreover, cost-efficiency, ease of administration, and suitability for mass vaccination are some of the other areas that have gained a great amount of consideration during the drug development phase. In recent times, DNA vaccines have offered significant promise as an ideal solution for different poultry diseases, as they have exhibited no reversion to virulence and infection. At present, DNA vaccines have started to gain a great amount of traction, as they can be deployed against an array of pathogens and are comparatively easier to develop, manufacture, and store. However, despite offering these advantages, the adoption of DNA vaccines could slow down, owing to lack of capacity to induce high immunity and lack of availability for large-scale vaccination in the current scenario.

Get a glimpse of the in-depth analysis through our Report Brochure

Vaccines and the development of new drugs will continue to progress at a consistent pace during the forecast period. Presently, in terms of product type, drugs are set to retain the majority of the share of the veterinary therapeutics market– a trend that is expected to continue during the forecast period. Although drugs will remain popular, the development of new vaccines will gain considerable momentum. DNA vaccines to address diseases in poultry are predominantly for combating bacterial, viral, and protozoan diseases. Although DNA vaccines to tackle poultry diseases have gained momentum since 1993, FDA approval for these vaccines has gathered pace only in the past decade. Clinical trials and added research and development activities will continue to boost the adoption of vaccines within the global veterinary therapeutics market in the coming years.

Companies operating in the current veterinary therapeutics market are expected to increase their market share by relying on inorganic growth strategies such as mergers & acquisitions. While expanding the product portfolio will continue to be an integral part of growth strategies for participants operating in the current market landscape, commercialization and development of new veterinary therapeutics are expected to gain momentum. For instance, in July 2019, Elanco Animal Health Incorporated announced that the company has completed the acquisition of Aratana Therapeutics. With the acquisition, Elanco could expand its product portfolio and gain the exclusive rights to manufacture, develop, and commercialize the ‘cash cow’ Galliprant. While drug development will continue to revolve around companion animals as well as livestock animals, market participants are anticipated to continue to improve the efficacy of their veterinary therapeutics during the forecast period.

Expanding operations in future? To get the perfect launch ask for a custom report

Analysts’ Viewpoint

The global veterinary therapeutics market is expected to grow at a CAGR of 5.6% during the forecast period. Some of the major factors that are likely to propel the market growth include growing demand for improved drugs, rise in the number of companion animals worldwide, improvements in surgical and medical capabilities of treatments for companion animals, development of products to combat new diseases, and growing emphasis on wellness and prevention of diseases in animals. Companies operating in the current market landscape should focus on expanding their product portfolio, investing in the development of DNA vaccines, and adopting inorganic growth strategies, including mergers & acquisitions to gain steady ground in the veterinary therapeutics market.

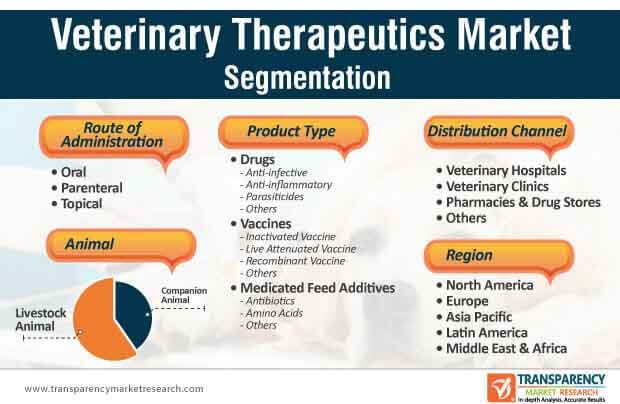

Veterinary Therapeutics Market - Segmentation

TMR’s study on the global veterinary therapeutics market includes information divided into four segments: product type, animal, route of administration, distribution channel, and region. Changing industry trends and other crucial market dynamics associated with these segments of the global veterinary therapeutics market are discussed in detail.

|

Product Type |

Drugs

Vaccines

Medicated Feed Additives

|

|

Animal |

Companion Animal Livestock Animal |

|

Route of Administration |

Oral Parenteral Topical |

|

Distribution Channel |

Veterinary Hospitals Veterinary Clinics Pharmacies & Drug Stores Others |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Veterinary therapeutics market is expected to reach US$ 58.5 Bn mark by the end of 2027

Veterinary therapeutics market is expected to grow at a CAGR of 5.6% during 2019 - 2027

Veterinary therapeutics market is driven by rise in demand for high quality protein

North America accounted for a major share of the global veterinary therapeutics market and the trend is anticipated to continue during the forecast period

Key players in the global veterinary therapeutics market include Zoetis, Inc., Merck Animal Health, Elanco Animal Health, and Boehringer Ingelheim GmbH, Ceva Santé Animale

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Research Methodology

3. Executive Summary

3.1. Global Veterinary Therapeutics Market Snapshot

4. Market Overview

4.1. Product Overview

4.2. Key Industry Events

4.3. Market Dynamics

4.3.1. Drivers and Restraints Snapshot Analysis

4.3.2. Drivers

4.3.3. Restraints

4.3.4. Opportunities

4.4. Porter’s Five Forces Analysis

4.5. Value Chain Analysis

4.6. Global Veterinary Therapeutics Market Outlook

5. Market Outlook

5.1. U.S. Pet Ownership Statistics, 2017

5.2. Cat and Dog Annual Expenditures, 2017

5.3. United States Pet Expenditures

6. Global Veterinary Therapeutics Market Analysis, by Product Type

6.1. Key Findings

6.2. Introduction

6.3. Global Veterinary Therapeutics Market Value Share Analysis, by Product Type

6.4. Global Veterinary Therapeutics Market Forecast, by Product Type

6.4.1. Drugs

6.4.2. Vaccines

6.4.3. Medicated Feed Additives

6.5. Global Veterinary Therapeutics Market Analysis, by Product Type

6.6. Global Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Drugs, 2017–2027

6.6.1. Anti-infective

6.6.2. Anti-inflammatory

6.6.3. Parasiticides

6.6.4. Others

6.7. Global Veterinary Therapeutics Market Analysis, by Drugs

6.8. Global Veterinary Therapeutics Market Forecast, by Vaccines, 2017–2027

6.8.1. Inactivated Vaccines

6.8.2. Live Attenuated Vaccines

6.8.3. Recombinant Vaccines

6.8.4. Others

6.9. Global Veterinary Therapeutics Market Analysis, by Vaccines

6.10. Global Veterinary Medicated Feed Additives Market Forecast, by Medicated Feed Additives

6.10.1. Antibiotics

6.10.2. Amino Acids

6.10.3. Others

6.11. Global Veterinary Medicated Feed Additives Market Analysis, by Medicated Feed Additives

6.12. Global Veterinary Therapeutics Market Attractiveness Analysis, by Product Type

6.13. Key Trends

7. Global Veterinary Therapeutics Market Analysis, by Animal

7.1. Key Findings

7.2. Introduction

7.3. Global Veterinary Therapeutics Market Value Share Analysis, by Animal

7.4. Global Veterinary Therapeutics Market Forecast, by Animal

7.4.1. Companion Animal

7.4.2. Livestock Animal

7.5. Veterinary Therapeutics Market Forecast, by Animal

7.6. Veterinary Therapeutics Market Attractiveness Analysis, by Animal

7.7. Key Trends

8. Veterinary Therapeutics Market Analysis, by Route of Administration

8.1. Key Findings

8.2. Introduction

8.3. Global Veterinary Therapeutics Market Value Share Analysis, by Route of Administration, 2018 and 2027

8.4. Global Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

8.4.1. Oral

8.4.2. Parenteral

8.4.3. Topical

8.5. Veterinary Therapeutics Market Forecast, by Route of Administration

8.6. Veterinary Therapeutics Market Attractiveness Analysis, by Route of Administration, 2019-2027

8.7. Key Trends

9. Global Veterinary Therapeutics Market Analysis, by Distribution Channel

9.1. Key Findings

9.2. Introduction

9.3. Global Veterinary Therapeutics Market Value Share Analysis, by Distribution Channel

9.4. Global Veterinary Therapeutics Market Forecast, by Distribution Channel

9.4.1. Veterinary Hospitals

9.4.2. Veterinary Clinics

9.4.3. Pharmacies & Drug stores

9.4.4. Others

9.5. Global Veterinary Therapeutics Market Forecast, by Distribution Channel

9.6. Global Veterinary Therapeutics Market Attractiveness Analysis, by Distribution Channel

9.7. Key Trends

10. Global Veterinary Therapeutics Market Analysis, by Region

10.1. Global Veterinary Therapeutics Market Snapshot, by Country

10.2. Global Veterinary Therapeutics Market Value Share Analysis, by Region

10.3. Global Veterinary Therapeutics Market Forecast, by Region

10.3.1. North America

10.3.2. Europe

10.3.3. Asia Pacific

10.3.4. Latin America

10.3.5. Middle East & Africa

10.4. Global Veterinary Therapeutics Market Attractiveness Analysis, by Region

11. North America Veterinary Therapeutics Market Analysis

11.1. Key Findings

11.2. North America Veterinary Therapeutics Market Overview

11.3. North America Veterinary Therapeutics Market Value Share Analysis, by Product Type

11.4. North America Veterinary Therapeutics Market Forecast, by Product Type

11.4.1. Drugs

11.4.1.1. Anti-infective

11.4.1.2. Anti-inflammatory

11.4.1.3. Parasiticides

11.4.1.4. Others

11.4.2. Vaccines

11.4.2.1. Inactivated Vaccines

11.4.2.2. Live Attenuated Vaccines

11.4.2.3. Recombinant Vaccines

11.4.2.4. Others

11.4.3. Medicated Feed Additives

11.4.3.1. Antibiotics

11.4.3.2. Amino Acids

11.4.3.3. Others

11.5. North America Veterinary Therapeutics Market Value Share Analysis, by Animal

11.6. North America Veterinary Therapeutics Market Forecast, by Animal

11.6.1. Companion Animal

11.6.2. Livestock Animal

11.7. North America Veterinary Therapeutics Market Value Share Analysis, by Route of Administration

11.8. North America Veterinary Therapeutics Market Forecast, by Route of Administration

11.8.1. Oral

11.8.2. Parenteral

11.8.3. Topical

11.9. North America Veterinary Therapeutics Market Value Share Analysis, by Distribution Channel

11.10. North America Veterinary Therapeutics Market Forecast, by Distribution Channel

11.10.1. Veterinary Hospitals

11.10.2. Veterinary Clinics

11.10.3. Pharmacies & Drug Stores

11.10.4. Others

11.11. North America Veterinary Therapeutics Market Value Share Analysis, by Country

11.11.1. U.S.

11.11.2. Canada

11.12. North America Veterinary Therapeutics Market Attractiveness Analysis

11.13. Market Trends

12. Europe Veterinary Therapeutics Market Analysis

12.1. Key Findings

12.2. Europe Veterinary Therapeutics Market Overview

12.3. Europe Veterinary Therapeutics Market Value Share Analysis, by Product Type

12.4. Europe Veterinary Therapeutics Market Forecast, by Product Type

12.4.1. Drugs

12.4.1.1. Anti-infective

12.4.1.2. Anti-inflammatory

12.4.1.3. Parasiticides

12.4.1.4. Others

12.4.2. Vaccines

12.4.2.1. Inactivated Vaccines

12.4.2.2. Live Attenuated Vaccines

12.4.2.3. Recombinant Vaccines

12.4.2.4. Others

12.4.3. Medicated Feed Additives

12.4.3.1. Antibiotics

12.4.3.2. Amino Acids

12.4.3.3. Others

12.5. Europe Veterinary Therapeutics Market Value Share Analysis, by Animal

12.6. Europe Veterinary Therapeutics Market Forecast, by Animal

12.6.1. Companion Animal

12.6.2. Livestock Animal

12.7. Europe Veterinary Therapeutics Market Value Share Analysis, by Route of Administration

12.8. Europe Veterinary Therapeutics Market Forecast, by Route of Administration

12.8.1. Oral

12.8.2. Parenteral

12.8.3. Topical

12.9. Europe Veterinary Therapeutics Market Value Share Analysis, by Distribution Channel

12.10. Europe Veterinary Therapeutics Market Forecast, by Distribution Channel

12.10.1. Veterinary Hospitals

12.10.2. Veterinary Clinics

12.10.3. Pharmacies & Drug Stores

12.10.4. Others

12.11. Europe Veterinary Therapeutics Market Value Share Analysis, by Country/Sub-region

12.11.1. U.K.

12.11.2. Germany

12.11.3. Italy

12.11.4. France

12.11.5. Spain

12.11.6. Rest of Europe

12.12. Europe Veterinary Therapeutics Market Attractiveness Analysis

12.13. Market Trends

13. Asia Pacific Veterinary Therapeutics Market Analysis

13.1. Key Findings

13.2. Asia Pacific Veterinary Therapeutics Market Overview

13.3. Asia Pacific Veterinary Therapeutics Market Value Share Analysis, by Product Type

13.4. Asia Pacific Veterinary Therapeutics Market Forecast, by Product Type

13.4.1. Drugs

13.4.1.1. Anti-infective

13.4.1.2. Anti-inflammatory

13.4.1.3. Parasiticides

13.4.1.4. Others

13.4.2. Vaccines

13.4.2.1. Inactivated Vaccines

13.4.2.2. Live Attenuated Vaccines

13.4.2.3. Recombinant Vaccines

13.4.2.4. Others

13.4.3. Medicated Feed Additives

13.4.3.1. Antibiotics

13.4.3.2. Amino Acids

13.4.3.3. Others

13.5. Asia Pacific Veterinary Therapeutics Market Value Share Analysis, by Animal

13.6. Asia Pacific Veterinary Therapeutics Market Forecast, by Animal

13.6.1. Companion Animal

13.6.2. Livestock Animal

13.7. Asia Pacific Veterinary Therapeutics Market Value Share Analysis, by Route of Administration

13.8. Asia Pacific Veterinary Therapeutics Market Forecast, by Route of Administration

13.8.1. Oral

13.8.2. Parenteral

13.8.3. Topical

13.9. Asia Pacific Veterinary Therapeutics Market Value Share Analysis, by Distribution Channel

13.10. Asia Pacific Veterinary Therapeutics Market Forecast, by Distribution Channel

13.10.1. Veterinary Hospitals

13.10.2. Veterinary Clinics

13.10.3. Pharmacies & Drug Stores

13.10.4. Others

13.11. Asia Pacific Veterinary Therapeutics Market Value Share Analysis, by Country/Sub-region

13.11.1. China

13.11.2. Japan

13.11.3. India

13.11.4. Australia & New Zealand

13.11.5. Rest of Asia Pacific

13.12. Asia Pacific Veterinary Therapeutics Market Attractiveness Analysis

13.13. Market Trends

14. Latin America Veterinary Therapeutics Market Analysis

14.1. Key Findings

14.2. Latin America Veterinary Therapeutics Market Overview

14.3. Latin America Veterinary Therapeutics Market Value Share Analysis, by Product Type

14.4. Latin America Veterinary Therapeutics Market Forecast, by Product Type

14.4.1. Drugs

14.4.1.1. Anti-infective

14.4.1.2. Anti-inflammatory

14.4.1.3. Parasiticides

14.4.1.4. Others

14.4.2. Vaccines

14.4.2.1. Inactivated Vaccines

14.4.2.2. Live Attenuated Vaccines

14.4.2.3. Recombinant Vaccines

14.4.2.4. Others

14.4.3. Medicated Feed Additives

14.4.3.1. Antibiotics

14.4.3.2. Amino Acids

14.4.3.3. Others

14.5. Latin America Veterinary Therapeutics Market Value Share Analysis, by Animal

14.6. Latin America Veterinary Therapeutics Market Forecast, by Animal

14.6.1. Companion Animal

14.6.2. Livestock Animal

14.7. Latin America Veterinary Therapeutics Market Value Share Analysis, by Route of Administration

14.8. Latin America Veterinary Therapeutics Market Forecast, by Route of Administration

14.8.1. Oral

14.8.2. Parenteral

14.8.3. Topical

14.9. Latin America Veterinary Therapeutics Market Value Share Analysis, by Distribution Channel

14.10. Latin America Veterinary Therapeutics Market Forecast, by Distribution Channel

14.10.1. Veterinary Hospitals

14.10.2. Veterinary Clinics

14.10.3. Pharmacies & Drug Stores

14.10.4. Others

14.11. Latin America Veterinary Therapeutics Market Value Share Analysis, by Country/Sub-region

14.11.1. Brazil

14.11.2. Mexico

14.11.3. Rest of Latin America

14.12. Latin America Veterinary Therapeutics Market Attractiveness Analysis

14.13. Market Trends

15. Middle East & Africa Veterinary Therapeutics Market Analysis

15.1. Key Findings

15.2. Middle East & Africa Veterinary Therapeutics Market Overview

15.3. Middle East & Africa Veterinary Therapeutics Market Value Share Analysis, by Product Type

15.4. Middle East & Africa Veterinary Therapeutics Market Forecast, by Product Type

15.4.1. Drugs

15.4.1.1. Anti-infective

15.4.1.2. Anti-inflammatory

15.4.1.3. Parasiticides

15.4.1.4. Others

15.4.2. Vaccines

15.4.2.1. Inactivated Vaccines

15.4.2.2. Live Attenuated Vaccines

15.4.2.3. Recombinant Vaccines

15.4.2.4. Others

15.4.3. Medicated Feed Additives

15.4.3.1. Antibiotics

15.4.3.2. Amino Acids

15.4.3.3. Others

15.5. Middle East & Africa Veterinary Therapeutics Market Value Share Analysis, by Animal

15.6. Middle East & Africa Veterinary Therapeutics Market Forecast, by Animal

15.6.1. Companion Animal

15.6.2. Livestock Animal

15.7. Middle East & Africa Veterinary Therapeutics Market Value Share Analysis, by Route of Administration

15.8. Middle East & Africa Veterinary Therapeutics Market Forecast, by Route of Administration

15.8.1. Oral

15.8.2. Parenteral

15.8.3. Topical

15.9. Middle East & Africa Veterinary Therapeutics Market Value Share Analysis, by Distribution Channel

15.10. Middle East & Africa Veterinary Therapeutics Market Forecast, by Distribution Channel

15.10.1. Veterinary Hospitals

15.10.2. Veterinary Clinics

15.10.3. Pharmacies & Drug Stores

15.10.4. Others

15.11. Middle East & Africa Veterinary Therapeutics Market Value Share Analysis, by Country/Sub-region

15.11.1. Brazil

15.11.2. Mexico

15.11.3. Rest of Middle East & Africa

15.12. Middle East & Africa Veterinary Therapeutics Market Attractiveness Analysis

15.13. Market Trends

16. Competition Analysis

16.1. Global Veterinary Therapeutics Market Share Analysis, by Company

16.2. Competition Matrix

16.3. Company Profile

16.3.1. Boehringer Ingelheim GmbH

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Financial Overview

16.3.1.3. Product Portfolio

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Merck Animal Health

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Financial Overview

16.3.2.3. Product Portfolio

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Zoetis Inc.

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Financial Overview

16.3.3.3. Product Portfolio

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Eli Lilly and Company (Elanco Animal Health)

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Financial Overview

16.3.4.3. Product Portfolio

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Ceva Santé Animale

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Financial Overview

16.3.5.3. Product Portfolio

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Virbac

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Financial Overview

16.3.6.3. Product Portfolio

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Vetoquinol S.A.

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Financial Overview

16.3.7.3. Product Portfolio

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Dechra Pharmaceuticals PLC

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Financial Overview

16.3.8.3. Product Portfolio

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Biovac

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Financial Overview

16.3.9.3. Product Portfolio

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. The Chanelle Group

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Financial Overview

16.3.10.3. Product Portfolio

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. ImmuCell Corporation

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Financial Overview

16.3.11.3. Product Portfolio

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

List of Tables

Table 01: U.S. Pet Ownership Statistics, 2017

Table 02: Cat and Dog Annual Expenditures, 2017

Table 03: United States Pet Expenditures (US$ Bn)

Table 04: Global Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 05: Global Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Drugs, 2017–2027

Table 06: Global Veterinary Therapeutics Market Forecast, by Vaccines, 2017–2027

Table 07: Global Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Medicated Feed Additives, 2017–2027

Table 08: Global Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Animal, 2017–2027

Table 09: Global Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 10: Global Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 11: Global Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 12: North America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 13: North America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Drugs, 2017–2027

Table 14: North America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Vaccines, 2017–2027

Table 15: North America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Medicated Feed Additives, 2017–2027

Table 16: North America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Animal, 2017–2027

Table 17: North America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 18: North America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 19: North America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 20: Europe Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Product Type, 2017–2027

Table 21: Europe Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Drugs, 2017–2027

Table 22: Europe Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Vaccines, 2017–2027

Table 23: Europe Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Medicated Feed Additives, 2017–2027

Table 24: Europe Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Animal, 2017–2027

Table 25: Europe Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 26: Europe Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 27: Europe Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 28: Asia Pacific Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Product Type, 2017–2027

Table 29: Asia Pacific Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Drugs, 2017–2027

Table 30: Asia Pacific Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Vaccines, 2017–2027

Table 31: Asia Pacific Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Medicated Feed Additives, 2017–2027

Table 32: Asia Pacific Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Animal, 2017–2027

Table 33: Asia Pacific Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 34: Asia Pacific Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 35: Asia Pacific Veterinary Therapeutics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 36: Latin America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 37: Latin America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Drugs, 2017–2027

Table 38: Latin America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Vaccines, 2017–2027

Table 39: Latin America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Medicated Feed Additives, 2017–2027

Table 40: Latin America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Animal, 2017–2027

Table 41: Latin America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 42: Latin America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 43: Latin America Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 44: Middle East & Africa Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 45: Middle East & Africa Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Drugs, 2017–2027

Table 46: Middle East & Africa Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Vaccines, 2017–2027

Table 47: Middle East & Africa Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Medicated Feed Additives, 2017–2027

Table 48: Middle East & Africa Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Animal, 2017–2027

Table 49: Middle East & Africa Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 50: Middle East & Africa Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 51: Middle East & Africa Veterinary Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Figure 01: Global Veterinary Therapeutics Market Value (US$ Mn) and Distribution (%), by Region, 2018 and 2027

Figure 02: Global Veterinary Therapeutics Market Value (US$ Mn) Forecast, 2017–2027

Figure 03: Global Veterinary Therapeutics Market Value Share, by Product Type (2018)

Figure 04: Global Veterinary Therapeutics Market Value Share, by Distribution Channel (2018)

Figure 05: Global Veterinary Therapeutics Market Value Share, by Animal (2018)

Figure 06: Global Veterinary Therapeutics Market Value Share, by Region (2018)

Figure 07: Global Veterinary Therapeutics Market Value Share, by Route of Administration (2018)

Figure 08: Global Veterinary Therapeutics Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 09: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Drugs, 2017–2027

Figure 10: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Vaccines, 2017–2027

Figure 11: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Medicated Feed Additives, 2017–2027

Figure 12: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Drugs, 2017–2027

Figure 13: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Vaccine, 2017–2027

Figure 14: Global Veterinary Therapeutics Market Revenue (US$ Mn), by Medicated Feed Additives, 2017–2027

Figure 15: Veterinary Therapeutics Market Attractiveness Analysis, by Product Type, 2019-2027

Figure 16: Global Veterinary Therapeutics Market Value Share Analysis, by Animal, 2018 and 2027

Figure 17: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Companion Animal, 2017–2027

Figure 18: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Livestock Animal, 2017–2027

Figure 19: Veterinary Therapeutics Market Attractiveness Analysis, by Animal, 2019-2027

Figure 20: Global Veterinary Therapeutics Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 21: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Oral, 2017–2027

Figure 22: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Parenteral, 2017–2027

Figure 23: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Topical, 2017–2027

Figure 24: Veterinary Therapeutics Market Attractiveness Analysis, by Route of Administration, 2019-2027

Figure 25: Global Veterinary Therapeutics Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 26: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Veterinary Hospitals, 2017–2027

Figure 27: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Veterinary Clinics, 2017–2027

Figure 28: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Pharmacies & Drug Stores, 2017–2027

Figure 29: Global Veterinary Therapeutics Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 30: Global Veterinary Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2019-2027

Figure 31: Global Veterinary Therapeutics Market Value Share Analysis, by Region, 2018 and 2027

Figure 32: Global Veterinary Therapeutics Market Attractiveness Analysis, by Region, 2019-2027

Figure 33: North America Veterinary Therapeutics Market Value (US$ Mn), 2017–2027

Figure 34: North America Veterinary Therapeutics Market Attractiveness Analysis, by Country, 2019–2027

Figure 35: North America Veterinary Therapeutics Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 36: North America Veterinary Therapeutics Market Value Share Analysis, by Animal, 2018 and 2027

Figure 37: North America Veterinary Therapeutics Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 38: North America Veterinary Therapeutics Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 39: North America Veterinary Therapeutics Market Value Share Analysis, by Country, 2018 and 2027

Figure 40: North America Veterinary Therapeutics Market Attractiveness Analysis, by Product, 2019–2027

Figure 41: North America Veterinary Therapeutics Market Attractiveness Analysis, by Animal, 2019–2027

Figure 42: North America Veterinary Therapeutics Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 43: North America Veterinary Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 44: Europe Veterinary Therapeutics Market Value (US$ Mn) Forecast, 2017–2027

Figure 45: Europe Market Attractiveness Analysis, by Country/Sub-region, 2019-2027

Figure 46: Europe Veterinary Therapeutics Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 47: Europe Veterinary Therapeutics Market Value Share Analysis, by Animal, 2018 and 2027

Figure 48: Europe Veterinary Therapeutics Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 49: Europe Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 50: Europe Veterinary Therapeutics Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 51: Europe Veterinary Therapeutics Market Attractiveness Analysis, by Product, 2019-2027

Figure 52: Europe Veterinary Therapeutics Market Attractiveness Analysis, by Animal, 2019-2027

Figure 53: Europe Veterinary Therapeutics Market Attractiveness Analysis, by Route of Administration, 2019-2027

Figure 54: Europe Veterinary Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2019-2027

Figure 55: Asia Pacific Veterinary Therapeutics Market Size (US$ Mn) Forecast, 2017–2027

Figure 56: Asia Pacific Market Attractiveness Analysis, by Country/Sub-region, 2019-2027

Figure 57: Asia Pacific Veterinary Therapeutics Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 58: Asia Pacific Veterinary Therapeutics Market Value Share Analysis, by Animal, 2018 and 2027

Figure 59: Asia Pacific Veterinary Therapeutics Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 60: Asia Pacific Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 61: Asia Pacific Veterinary Therapeutics Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 62: Asia Pacific Veterinary Therapeutics Market Attractiveness Analysis, by Product, 2019-2027

Figure 63: Asia Pacific Veterinary Therapeutics Market Attractiveness Analysis, by Animal, 2019-2027

Figure 64: Asia Pacific Veterinary Therapeutics Market Attractiveness Analysis, by Route of Administration, 2019-2027

Figure 65: Asia Pacific Veterinary Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2019-2027

Figure 66: Latin America Veterinary Therapeutics Market Value (US$ Mn) Forecast, 2017–2027

Figure 67: Latin America Veterinary Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 68: Latin America Veterinary Therapeutics Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 69: Latin America Veterinary Therapeutics Market Value Share Analysis, by Animal, 2018 and 2027

Figure 70: Latin America Veterinary Therapeutics Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 71: Latin America Veterinary Therapeutics Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 72: Latin America Veterinary Therapeutics Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 73: Latin America Veterinary Therapeutics Market Attractiveness Analysis, by Product, 2019–2027

Figure 74: Latin America Veterinary Therapeutics Market Attractiveness Analysis, by Animal, 2019–2027

Figure 75: Latin America Veterinary Therapeutics Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 76: Latin America Veterinary Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 77: Middle East & Africa Veterinary Therapeutics Market Value (US$ Mn) Forecast, 2017–2027

Figure 78: Middle East & Africa Veterinary Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 79: Middle East & Africa Veterinary Therapeutics Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 80: Middle East & Africa Veterinary Therapeutics Market Value Share Analysis, by Animal, 2018 and 2027

Figure 81: Middle East & Africa Veterinary Therapeutics Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 82: Middle East & Africa Veterinary Therapeutics Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 83: Middle East & Africa Veterinary Therapeutics Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 84: Middle East & Africa Veterinary Therapeutics Market Attractiveness Analysis, by Product Type, 2019-2027

Figure 85: Middle East & Africa Veterinary Therapeutics Market Attractiveness Analysis, by Animal, 2019-2027

Figure 86: Middle East & Africa Veterinary Therapeutics Market Attractiveness Analysis, by Route of Administration, 2019-2027

Figure 87: Middle East & Africa Veterinary Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2019-2027

Figure 88: Global Veterinary Therapeutics Market Share Analysis, by Company (2018)