Global chemical supply chains have been undergoing stress during 2020 and 2021 due to the ongoing trade wars, coronavirus crisis, and global protectionism. This trend has been prominent in China, which dictates a significant share of the world’s supply for active pharmaceutical ingredients (APIs) and their chemical raw materials. As a result, it caused ripple effects in the succinic acid market, since this chemical is used for the production of antibiotics and other curative agents.

Companies in the succinic acid market are witnessing an oversupply of chemicals since the demand is still low in key sectors such as automotive, consumer products, and transport. Nevertheless, manufacturers are focusing on mission-critical applications in pharmaceuticals, food & beverage, and personal care products to keep economies running.

To gauge the scope of customization in our reports Ask for a Sample

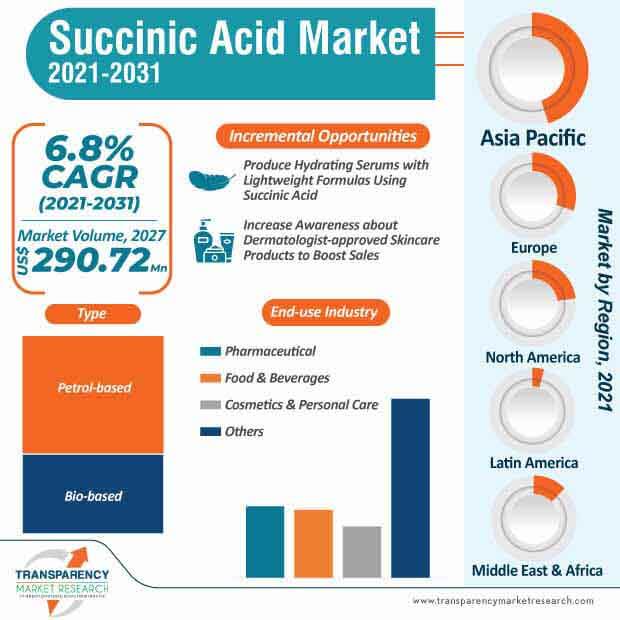

The succinic acid market is expected to reach the revenue of US$ 290.72 Mn by 2031. Succinic acid, also known as butanedioic acid is a naturally occurring dicarboxylic acid that can be used as an acidulant and flavoring agent in food with the European food additive number E363. However, possible side effects of succinic acid involve genotoxicity, oral toxicity, and carcinogenicity. Hence, manufacturers such as BioAmber Inc. - a Delaware registered Canadian sustainable chemicals company, is investing in R&D to increase the availability of food grade and FDA-approved succinic acid that causes little to no side effects and is safe under intended uses.

The growing trend of veganism is bolstering the demand for chemical derived and bio-based succinic acid.

Get an idea about the offerings of our report from Report Brochure

Antimicrobial and anti-inflammatory properties of succinic acid are being preferred in cosmetics & personal care products. Its powerful acne-fighting capabilities with few chances of skin irritation is grabbing the attention of stakeholders in the succinic acid market. This explains why the market is slated to clock a favorable CAGR of 6.8% during the forecast period.

Succinic acid is emerging as the hot new ingredient in skincare products. Companies in the succinic acid market are boosting their production capabilities to offer dermatologist-approved skincare products. They are producing hydrating serums with lightweight formulas that allows the succinic acid to better penetrate and combine with hyaluronic acid to amp-up the hydrating effects.

Apart from pharmaceuticals and cosmetics, companies in the succinic acid market are tapping revenue opportunities in biodegradable plastics. Bio-based succinic acid is being known as an alternative for several chemicals such as adipic acid for the production of biodegradable plastics. Prominent strategies for the development of bio-based succinic acid involves the use of bacterial strains isolated from rumen. These strains are excellent natural succinic acid producers and their yields can be improved through metabolic engineering.

Companies in the succinic acid market are increasing research in the use of well-known industrial microorganisms such as Escherichia coli or Saccharomyces cervisiae for development of bio-based chemicals.

Looking for Regional Analysis or Competitive Landscape in Succinic Acid Market for Performance OEM , ask for a customized report

Analysts’ Viewpoint

The coronavirus outbreak is prompting stakeholders in the succinic acid market to rethink their global supply chains for situations where Europe is trying to reduce dependency on third countries i.e. those outside the European Union for critical raw materials. Succinic acid’s little to no side effects in cosmetics products is proving beneficial for market stakeholders. Skincare brands are increasing awareness about dermatologist approved products and conducting a patch test on the inner forearm to prevent any adverse events among consumers after using succinic acid-induced skincare products. Bio-based succinic acid is being preferred for the production of biodegradable plastics. Succinic acid can be produced through fermentation of sugars from different biomass such as starch or sugar crops.

|

Attribute |

Detail |

|

Market Size Value in 2020 |

US$ 143.19 Mn |

|

Market Forecast Value in 2031 |

US$ 290.72 Mn |

|

Growth Rate (CAGR) |

6.8% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value & Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, value chain analysis, key trend analysis, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

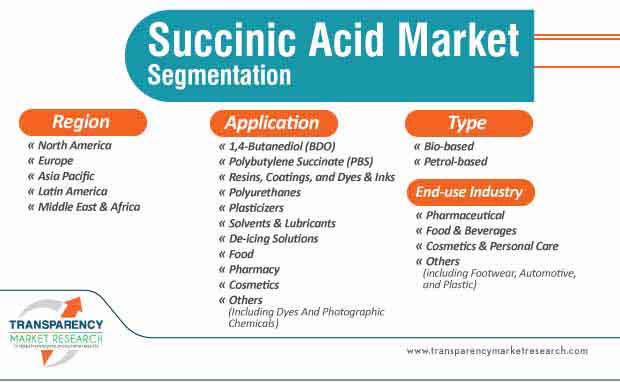

Succinic Acid Market – Segmentation

TMR’s research study assesses the global succinic acid market on the basis of type, application, end-use industry, and region. This report presents extensive market dynamics and growth trends associated with different segments and how they are influencing growth prospects for the global succinic acid market.

| Type |

|

| Application |

|

| End-use Industry |

|

| Region |

|

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Definitions

2.3. Market Indicators

3. Market Dynamics

3.1. Drivers and Restraints Snapshot Analysis

3.1.1. Drivers

3.1.2. Restraints

3.1.3. Opportunities

3.2. Porter’s Five Forces Analysis

3.2.1. Threat of Substitutes

3.2.2. Bargaining Power of Buyers

3.2.3. Bargaining Power of Suppliers

3.2.4. Threat of New Entrants

3.2.5. Degree of Competition

3.3. Regulatory Scenario

3.4. Value Chain Analysis

3.4.1. List of Manufacturers

3.4.2. List of Potential Customers

4. Production Output Analysis

5. Price Trend Analysis

6. COVID-19 Impact Analysis

6.1. Assessing the Impact of COVID-19 on Succinic Acid Market

7. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis, by Type

7.1. Key Findings and Introduction

7.2. Global Succinic Acid Market Value Share Analysis, by Type, 2020–2031

7.2.1. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Bio-based, 2020–2031

7.2.2. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Petrol-based, 2020–2031

7.2.3. Global Succinic Acid Market Attractiveness Analysis, by Type

8. Global Succinic Acid Market Analysis, by Application

8.1. Key Findings and Introduction

8.2. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Application, 2020–2031

8.2.1. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by 1,4-Butanediol (BDO), 2020–2031

8.2.2. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Polybutylene Succinate (PBS), 2020–2031

8.2.3. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Resins, Coatings, and Dyes & Inks, 2020–2031

8.2.4. Global Succinic Acid Market V Volume (Tons) and value (US$ Mn) Forecast, by Polyurethanes, 2020–2031

8.2.5. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Plasticizers, 2020–2031

8.2.6. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Solvents & Lubricants, 2020–2031

8.2.7. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by De-icing Solutions, 2020–2031

8.2.8. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Food, 2020–2031

8.2.9. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Pharmacy, 2020–2031

8.2.10. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Cosmetics, 2020–2031

8.2.11. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Others, 2020–2031

8.3. Global Succinic Acid Market Attractiveness Analysis, by Application

9. Global Succinic Acid Market Analysis, by End-use Industry

9.1. Key Findings and Introduction

9.2. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2020–2031

9.2.1. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Pharmaceutical, 2020–2031

9.2.2. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Food & Beverages, 2020–2031

9.2.3. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Cosmetics & Personal Care, 2020–2031

9.2.4. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Others, 2020–2031

9.3. Global Succinic Acid Market Attractiveness Analysis, by End-use Industry

10. Global Succinic Acid Market Analysis, by Region, 2020–2031

10.1. Key Findings

10.2. Global Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Region, 2020–2031

10.3. Global Succinic Acid Market Attractiveness Analysis, by Region

11. North America Succinic Acid Market Analysis, 2020–2031

11.1. Key Findings

11.2. North America Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Type, 2020–2031

11.3. North America Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Application, 2020–2031

11.4. North America Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2020–2031

11.5. North America Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Country, 2020–2031

11.5.1. U.S. Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.2. U.S. Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.3. U.S. Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.5.4. Canada Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.5. Canada Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.6. Canada Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.6. North America Succinic Acid Market Attractiveness Analysis, by Type

11.7. North America Succinic Acid Market Attractiveness Analysis, by Application

11.8. North America Succinic Acid Market Attractiveness Analysis, by End-use Industry

11.9. North America Succinic Acid Market Attractiveness Analysis, by Country

12. Europe Succinic Acid Market Analysis, 2020–2031

12.1. Key Findings

12.2. Europe Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Type, 2020–2031

12.3. Europe Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Application, 2020–2031

12.4. Europe Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2020–2031

12.5. Europe Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2020–2031

12.5.1. Germany Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.2. Germany Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.3. Germany Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.5.4. U.K. Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.5. U.K. Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.6. U.K. Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.5.7. France Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.8. France Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.9. France Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.5.10. Italy Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.11. Italy Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.12. Italy Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.5.13. Spain Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.14. Spain Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.15. Spain Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.5.16. Russia & CIS Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.17. Russia & CIS Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.18. Russia & CIS Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.5.19. Rest of Europe Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.20. Rest of Europe Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.21. Rest of Europe Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.6. Europe Succinic Acid Market Attractiveness Analysis, by Type

12.7. Europe Succinic Acid Market Attractiveness Analysis, by Application

12.8. Europe Succinic Acid Market Attractiveness Analysis, by End-use Industry

12.9. Europe Succinic Acid Market Attractiveness Analysis, by Country and Sub-region

13. Asia Pacific Succinic Acid Market Analysis, 2020–2031

13.1. Key Findings

13.2. Asia Pacific Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Type, 2020–2031

13.3. Asia Pacific Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Application, 2020–2031

13.4. Asia Pacific Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2020–2031

13.5. Asia Pacific Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2020–2031

13.5.1. China Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.5.2. China Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.3. China Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.5.4. India Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.5.5. India Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.6. India Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.5.7. Japan Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.5.8. Japan Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.9. Japan Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.5.10. ASEAN Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.5.11. ASEAN Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.12. ASEAN Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.5.13. Rest of Asia Pacific Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.5.14. Rest of Asia Pacific Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.15. Rest of Asia Pacific Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.6. Asia Pacific Succinic Acid Market Attractiveness Analysis, by Type

13.7. Asia Pacific Succinic Acid Market Attractiveness Analysis, by Application

13.8. Asia Pacific Succinic Acid Market Attractiveness Analysis, by End-use Industry

13.9. Asia Pacific Succinic Acid Market Attractiveness Analysis, by Country and Sub-region

14. Latin America Succinic Acid Market Analysis, 2020–2031

14.1. Key Findings

14.2. Latin America Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Type, 2020–2031

14.3. Latin America Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Application, 2020–2031

14.4. Latin America Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2020–2031

14.5. Latin America Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2020–2031

14.5.1. Brazil Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

14.5.2. Brazil Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.5.3. Brazil Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

14.5.4. Mexico Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

14.5.5. Mexico Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.5.6. Mexico Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

14.5.7. Rest of Latin America Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

14.5.8. Rest of Latin America Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.5.9. Rest of Latin America Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

14.6. Latin America Succinic Acid Market Attractiveness Analysis, by Type

14.7. Latin America Succinic Acid Market Attractiveness Analysis, by Application

14.8. Latin America Succinic Acid Market Attractiveness Analysis, by End-use Industry

14.9. Latin America Succinic Acid Market Attractiveness Analysis, by Country and Sub-region

15. Middle East & Africa Succinic Acid Market Analysis, 2020–2031

15.1. Key Findings

15.2. Middle East & Africa Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Type, 2020–2031

15.3. Middle East & Africa Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Application, 2020–2031

15.4. Middle East & Africa Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2020–2031

15.5. Middle East & Africa Succinic Acid Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2020–2031

15.5.1. GCC Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

15.5.2. GCC Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

15.5.3. GCC Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

15.5.4. South Africa Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

15.5.5. South Africa Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

15.5.6. South Africa Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

15.5.7. Rest of Middle East & Africa Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

15.5.8. Rest of Middle East & Africa Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

15.5.9. Rest of Middle East & Africa Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

15.6. Middle East & Africa Succinic Acid Market Attractiveness Analysis, by Type

15.7. Middle East & Africa Succinic Acid Market Attractiveness Analysis, by Application

15.8. Middle East & Africa Succinic Acid Market Attractiveness Analysis, by End-use Industry

15.9. Middle East & Africa Succinic Acid Market Attractiveness Analysis, by Country and Sub-region

16. Competition Landscape

16.1. Global Succinic Acid Market Share Analysis, by Company (2020)

16.2. Company Profiles

16.2.1. thyssenkrupp AG

16.2.1.1. Company Details

16.2.1.2. Company Description

16.2.1.3. Business Overview

16.2.1.4. Financial Overview

16.2.1.5. Strategic Overview

16.2.2. BASF SE

16.2.2.1. Company Details

16.2.2.2. Company Description

16.2.2.3. Business Overview

16.2.2.4. Financial Overview

16.2.2.5. Strategic Overview

16.2.3. Roquette Frères

16.2.3.1. Company Details

16.2.3.2. Company Description

16.2.3.3. Business Overview

16.2.4. Kawasaki Kasei Chemicals

16.2.4.1. Company Details

16.2.4.2. Company Description

16.2.4.3. Business Overview

16.2.5. NIPPON SHOKUBAI CO., LTD

16.2.5.1. Company Details

16.2.5.2. Company Description

16.2.5.3. Business Overview

16.2.5.4. Financial Overview

16.2.5.5. Strategic Overview

16.2.6. Ernesto Ventós, S.A.

16.2.6.1. Company Details

16.2.6.2. Company Description

16.2.6.3. Business Overview

16.2.7. FUSO CHEMICAL CO., LTD.

16.2.7.1. Company Details

16.2.7.2. Company Description

16.2.7.3. Business Overview

16.2.8. R-Biopharm AG

16.2.8.1. Company Details

16.2.8.2. Company Description

16.2.8.3. Business Overview

16.2.9. ESIM Chemicals

16.2.9.1. Company Details

16.2.9.2. Company Description

16.2.9.3. Business Overview

16.2.10. Novomer Inc.

16.2.10.1. Company Details

16.2.10.2. Company Description

16.2.10.3. Business Overview

17. Primary Research – Key Insights

18. Appendix

18.1. Research Methodology and Assumptions

List of Tables

Table 1: Global Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 2: Global Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 3: Global Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 4: Global Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 5: Global Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 6: Global Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 7: Global Succinic Acid Market Volume (Tons) Forecast, by Region, 2020–2031

Table 8: Global Succinic Acid Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 9: North America Succinic Acid Market Volume (Tons) Forecast, by Country, 2020–2031

Table 10: North America Succinic Acid Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 11: North America Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 12: North America Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 13: North America Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 14: North America Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 15: North America Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 16: North America Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 17: U.S. Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 18: U.S. Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 19: U.S. Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 20: U.S. Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 21: U.S. Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 22: U.S. Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 23: Canada Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 24: Canada Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 25: Canada Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 26: Canada Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 27: Canada Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 28: Canada Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 29: Europe Succinic Acid Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 30: Europe Succinic Acid Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 31: Europe Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 32: Europe Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 33: Europe Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 34: Europe Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 35: Europe Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 36: Europe Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 37: Germany Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 38: Germany Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 39: Germany Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 40: Germany Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 41: Germany Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 42: Germany Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 43: U.K. Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 44: U.K. Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 45: U.K. Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 46: U.K. Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 47: U.K. Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 48: U.K. Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 49: France Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 50: France Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 51: France Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 52: France Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 53: France Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 54: France Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 55: Italy Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 56: Italy Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 57: Italy Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 58: Italy Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 59: Italy Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 60: Italy Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 61: Spain Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 62: Spain Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 63: Spain Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 64: Spain Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 65: Spain Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 66: Spain Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 67: Russia & CIS Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 68: Russia & CIS Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 69: Russia & CIS Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 70: Russia & CIS Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 71: Russia & CIS Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 72: Russia & CIS Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 73: Rest of Europe Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 74: Rest of Europe Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 75: Rest of Europe Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 76: Rest of Europe Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 77: Rest of Europe Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 78: Rest of Europe Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 79: Asia Pacific Succinic Acid Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 80: Asia Pacific Succinic Acid Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 81: Asia Pacific Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 82: Asia Pacific Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 83: Asia Pacific Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 84: Asia Pacific Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 85: Asia Pacific Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 86: Asia Pacific Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 87: China Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 88: China Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 89: China Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 90: China Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 91: China Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 92: China Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 93: India Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 94: India Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 95: India Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 96: India Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 97: India Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 98: India Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 99: Japan Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 100: Japan Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 101: Japan Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 102: Japan Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 103: Japan Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 104: Japan Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 105: ASEAN Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 106: ASEAN Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 107: ASEAN Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 108: ASEAN Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 109: ASEAN Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 110: ASEAN Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 111: Rest of Asia Pacific Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 112: Rest of Asia Pacific Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 113: Rest of Asia Pacific Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 114: Rest of Asia Pacific Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 115: Rest of Asia Pacific Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 116: Rest of Asia Pacific Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 117: Latin America Succinic Acid Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 118: Latin America Succinic Acid Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 119: Latin America Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 120: Latin America Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 121: Latin America Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 122: Latin America Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 123: Latin America Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 124: Latin America Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 125: Brazil Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 126: Brazil Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 127: Brazil Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 128: Brazil Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 129: Brazil Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 130: Brazil Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 131: Mexico Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 132: Mexico Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 133: Mexico Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 134: Mexico Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 135: Mexico Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 136: Mexico Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 137: Rest of Latin America Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 138: Rest of Latin America Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 139: Rest of Latin America Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 140: Rest of Latin America Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 141: Rest of Latin America Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 142: Rest of Latin America Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 143: Middle East & Africa Succinic Acid Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 144: Middle East & Africa Succinic Acid Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 145: Middle East & Africa Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 146: Middle East & Africa Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 147: Middle East & Africa Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 148: Middle East & Africa Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 149: Middle East & Africa Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 150: Middle East & Africa Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 151: GCC Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 152: GCC Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 153: GCC Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 154: GCC Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 155: GCC Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 156: GCC Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 157: South Africa Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 158: South Africa Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 159: South Africa Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 160: South Africa Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 161: South Africa Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 162: South Africa Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 163: Rest of Middle East & Africa Succinic Acid Market Volume (Tons) Forecast, by Type, 2020–2031

Table 164: Rest of Middle East & Africa Succinic Acid Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 165: Rest of Middle East & Africa Succinic Acid Market Volume (Tons) Forecast, by Application, 2020–2031

Table 166: Rest of Middle East & Africa Succinic Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 167: Rest of Middle East & Africa Succinic Acid Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 168: Rest of Middle East & Africa Succinic Acid Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

List of Figures

Figure 01: Global Succinic Acid Market Value Share Analysis, by Type

Figure 02: Global Succinic Acid Market Attractiveness Analysis, by Type

Figure 03: Global Succinic Acid Market Value Share Analysis, by Application

Figure 04: Global Succinic Acid Market Attractiveness Analysis, by Application

Figure 05: Global Succinic Acid Market Value Share Analysis, by End-use Industry

Figure 06: Global Succinic Acid Market Attractiveness Analysis, by End-use Industry

Figure 07: Global Succinic Acid Market Value Share Analysis, by Region

Figure 08: Global Succinic Acid Market Attractiveness Analysis, by Region

Figure 09: North America Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, 2020–2031

Figure 10: North America Succinic Acid Market Value Share Analysis, by Country, 2020, 2025, and 2031

Figure 11: North America Succinic Acid Market Attractiveness Analysis, by Country

Figure 12: North America Succinic Acid Market Value Share Analysis, by Type

Figure 13: North America Succinic Acid Market Value Share Analysis, by Application

Figure 14: North America Succinic Acid Market Value Share Analysis, by End-use Industry

Figure 15: North America Succinic Acid Market Attractiveness Analysis, by Type

Figure 16: North America Succinic Acid Market Attractiveness Analysis, by Application

Figure 17: North America Succinic Acid Market Attractiveness Analysis, by End-use Industry

Figure 18: Europe Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, 2020–2031

Figure 19: Europe Succinic Acid Market Value Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 20: Europe Succinic Acid Market Attractiveness Analysis, by Country and Sub-region

Figure 21: Europe Succinic Acid Market Value Share Analysis, by Type

Figure 22: Europe Succinic Acid Market Value Share Analysis, by Application

Figure 23: Europe Succinic Acid Market Value Share Analysis, by End-use Industry

Figure 24: Europe Succinic Acid Market Attractiveness Analysis, by Type

Figure 25: Europe Succinic Acid Market Attractiveness Analysis, by Application

Figure 26: Europe Succinic Acid Market Attractiveness Analysis, by End-use Industry

Figure 27: Asia Pacific Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, 2020–2031

Figure 28: Asia Pacific Succinic Acid Market Value Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 29: Asia Pacific Succinic Acid Market Attractiveness Analysis, by Country and Sub-region

Figure 30: Asia Pacific Succinic Acid Market Value Share Analysis, by Type

Figure 31: Asia Pacific Succinic Acid Market Value Share Analysis, by Application

Figure 32: Asia Pacific Succinic Acid Market Value Share Analysis, by End-use Industry

Figure 33: Asia Pacific Succinic Acid Market Attractiveness Analysis, by Type

Figure 34: Asia Pacific Succinic Acid Market Attractiveness Analysis, by Application

Figure 35: Asia Pacific Succinic Acid Market Attractiveness Analysis, by End-use Industry

Figure 36: Latin America Succinic Acid Market Value Volume (Tons) and (US$ Mn) Forecast, 2020–2031

Figure 37: Latin America Succinic Acid Market Value Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 38: Latin America Succinic Acid Market Attractiveness Analysis, by Country and Sub-region

Figure 39: Latin America Succinic Acid Market Value Share Analysis, by Type

Figure 40: Latin America Succinic Acid Market Value Share Analysis, by Application

Figure 41: Latin America Succinic Acid Market Value Share Analysis, by End-use Industry

Figure 42: Latin America Succinic Acid Market Attractiveness Analysis, by Type

Figure 43: Latin America Succinic Acid Market Attractiveness Analysis, by Application

Figure 44: Latin America Succinic Acid Market Attractiveness Analysis, by End-use Industry

Figure 45: Middle East & Africa Succinic Acid Market Volume (Tons) and Value (US$ Mn) Forecast, 2020–2031

Figure 46: Middle East & Africa Succinic Acid Market Value Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 47: Middle East Succinic Acid Market Attractiveness Analysis, by Country and Sub-region

Figure 48: Middle East & Africa Succinic Acid Market Value Share Analysis, by Type

Figure 49: Middle East & Africa Succinic Acid Market Value Share Analysis, by Application

Figure 50: Middle East & Africa Succinic Acid Market Value Share Analysis, by End-use Industry