Global Next Generation Processor Market: Snapshot

The demand for next generation processors is primarily driven by their extensive use in smartphones, automated systems, intelligent buildings, intelligent cars, and other applications. Industries are seeking energy-efficient ways of mega-tasking without generating much heat. The aim being addressing the consumer demand for automation. While these factors will bolster the deployment of next generation processors, the market is also expected to gain from the proliferation of the Internet-of-things (IoT). Besides this, next generation processors are also deployed in heating, ventilating, and air conditioning (HVAC) systems.

In addition, the rising demand from the consumer electronics segment is expected to be a chief market driver. Therefore in response to the proliferation of smart televisions and smartphones, growth witnessed in the global next generation processor market will stimulate. On the downside, the high cost of raw materials will hinder its trajectory to an extent. Existing issues of software integration will also create troubles for the market. Nevertheless, with the increasing research and development activities, these concerns are soon likely to get mitigated thus bolstering growth opportunities.

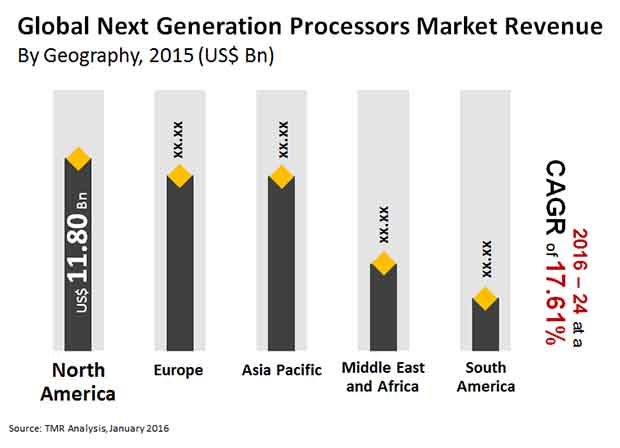

Transparency Market Research (TMR), forecasts the global next generation processor market to exhibit a CAGR of 17.6% between 2016 and 2024. At this pace, the market is expected to reach US$165.27 bn from a valuation of US$41.41 bn in 2015.

Despite North America’s Dominance, Market to Witness Lucrative Prospects in Asia Pacific

Regionally, Asia Pacific, Europe, North America, South America, and the Middle East and Africa constitute the key segments in the global next generation processor market. Among these regions, North America held the largest share in the overall market as it is considered a hub of intelligent building and automotive industries. While Europe will continue holding a considerable market share, it is in Asia Pacific that next generation processor vendors will witness impressive prospects. The rising demand witnessed in China and Japan will aid expansion of the next generation processor market in Asia Pacific. Additionally, the demand for automated cars is significantly high in these countries, which will bolster opportunities for the next generation processor market.

Demand for Automation in Consumer Electronics to Boost Growth

By end use, the global next generation processors market can be segmented into consumer electronics, information and communication technology, manufacturing, automotive, and others. Of these, the consumer electronics segment emerged dominant in the overall market. Due to the rising demand for smart technologies among consumers, the demand for next generation processors in the consumer electronics segment is forecast to increase. However, in terms of revenue, the manufacturing industry is expected to report growth at the highest rate during the forecast period. In a bid to reduce quality-related faults and encourage smart manufacturing the application of next generation processor is expected to increase in the industry.

In terms of volume, the automotive segment will hold significant market share owing to the increasing demand for intelligent cars rises that use sensors and automotive braking systems. Spurred by these factors, the global next generation processors market is likely to report robust growth.

Some of the leading players operating in the market are Intel Corporation (US), Advanced Micro Devices Inc. (U.S.), VIA Technologies Inc. (Taiwan), Fujitsu Ltd (Japan), and Acer Group (Taiwan) among others.

Next Generation Processors Market to Gain Impetus from High Sales of Consumer Electronics

The increasing use of consumer electronics such as smartphones, laptops, and others worldwide is a prime factor boosting the global next generation processors market. A few variables including the notoriety of PDAs, astute structures, and mechanized frameworks has prompted the development of the worldwide market for cutting edge processors. Besides this, the huge progressions in the area of web of things (IoT) have likewise added to the development of the worldwide cutting edge processors market. Other than this, the auto business has been unflinching in embracing keen hardware while fabricating vehicles and different vehicles. Another critical propeller of interest is the utilization of cutting edge processors in ventilation frameworks, air cooling frameworks, and radiators.

The interest for cutting edge processors is principally determined by their broad use in cell phones, robotized frameworks, wise structures, insightful vehicles, and different applications. Enterprises are looking for energy-proficient methods of super entrusting without creating a lot of warmth. While these components will reinforce the sending of cutting edge processors, the market is likewise expected to acquire from the expansion of the Internet-of-things (IoT). Other than this, cutting edge processors are additionally conveyed in warming, ventilating, and cooling (HVAC) frameworks.

The development of gaming applications and keen TVs combined with the endeavors of the gadgets business to advance cutting edge processors has additionally prompted the development of the worldwide market. Finally, the substantial dependence of the majority on gadgets in each circle of work shall end up being a launch cushion for market development in the years to come. Additionally, the rising interest from the purchaser gadgets section is required to be a main market driver. In this manner because of the expansion of shrewd TVs and cell phones, development saw in the worldwide cutting edge processor market will animate. On the drawback, the significant expense of crude materials will upset its direction to a degree. Existing issues of programming combination will likewise make inconveniences for the market. By the by, with the expanding innovative work exercises, these worries are soon prone to get alleviated consequently reinforcing development openings.

The global next generation processors device market has been segmented into:

|

by End Users |

|

|

by Machine Type |

|

|

by Region |

|

Section 1 Preface

1.1 Market Definition and Scope

1.2 Market Segmentation

1.3 Key Research Objectives

1.4 Research Highlights

Section 2 Assumptions and Research Methodology

Section 3 Executive Summary: Next Generation Processors Market

Section 4 Market Overview

4.1 Product Overview

4.2 Market Indicators

Section 5 Market Dynamics

5.1 Key Findings

5.2 Drivers and Restraints Snapshot Analysis

5.3 Drivers

5.4 Restraints

5.5 Opportunities

5.6 Next Generation Processors s Market Outlook

Section 6 Next Generation Processors s Market Analysis by End-Use

6.1 Introduction

6.2 Global Next Generation Processors Market Value Share Analysis, By End-Use

6.3 Global Next Generation Processors Market Volume Share Analysis, By End-Use

6.4 Next Generation Processors Market Analysis By End-Use

Section 7 Next Generation Processors Market Analysis By Machine Type

7.1 Introduction

7.2 Global Next Generation Processors Market Value Share Analysis, By Machine Type

7.3 Global Next Generation Processors Market Volume Share Analysis, By Machine Type

7.4 Next Generation Processors Market Analysis By By Machine Type

Section 8 Next Generation Processors Market Analysis By Region Type

8.1 Global Regulatory Scenario

8.2 Global Next Generation Processors Market Value Share Analysis, By Region Type

8.3 Global Next Generation Processors Market Volume Share Analysis, By Region Type

Section 9 North America next generation processors Market Analysis

9.1 North America Next Generation Processors Market Overview

9.2 North America Market Value Share Analysis, By End-User Type

9.3 North America Market Volume Share Analysis, By End-User Type

9.4 North America Market Value Share Analysis, By Machine Type

9.5 North America Market Volume Share Analysis, By Machine Type

9.6 North America Market Value Share Analysis, By Country

9.7 North America Market Volume Share Analysis, By Country

Section 10 Europe next generation processors Market Analysis

10.1 Europe Next Generation Processors Market Overview

10.2 Europe Market Value Share Analysis, By End-User Type

10.3 Europe Market Volume Share Analysis, By End-User Type

10.4 Europe Market Value Share Analysis, By Machine Type

10.5 Europe Market Volume Share Analysis, By Machine Type

10.6 Europe Market Value Share Analysis, By Country

10.7 Europe Market Volume Share Analysis, By Country

Section 11 Asia Pacific next generation processors Market Analysis

11.1 Asia Pacific Next Generation Processors Market Overview

11.2 Asia Pacific Market Value Share Analysis, By End-User Type

11.3 Asia Pacific Market Volume Share Analysis, By End-User Type

11.4 Asia Pacific Market Value Share Analysis, By Machine Type

11.5 Asia Pacific Market Volume Share Analysis, By Machine Type

11.6 Asia Pacific Market Value Share Analysis, By Country

11.7 Asia Pacific Market Volume Share Analysis, By Country

Section 12 Middle East and Africa next generation processors Market Analysis

12.1 Middle East and Africa Next Generation Processors Market Overview

12.2 Middle East and Africa Market Value Share Analysis, By End-User Type

12.3 Middle East and Africa Market Volume Share Analysis, By End-User Type

12.4 Middle East and Africa Market Value Share Analysis, By Machine Type

12.5 Middle East and Africa Market Volume Share Analysis, By Machine Type

12.6 Middle East and Africa Market Value Share Analysis, By Country

12.7 Middle East and Africa Market Volume Share Analysis, By Country

Section 13 South America Next Generation Processors Market Analysis

13.1 South America Next Generation Processors Market Overview

13.2 South America Market Value Share Analysis, By End-User Type

13.3 South America Market Volume Share Analysis, By End-User Type

13.4 South America Market Value Share Analysis, By Machine Type

13.5 South America Market Volume Share Analysis, By Machine Type

13.6 South America Market Value Share Analysis, By Country

13.7 South America Market Volume Share Analysis, By Country

Section 14 Company Profiles

14.1 Intel Corporation

14.1.1 Company Details (HQ, Foundation Year, Employee Strength)

14.1.2 Market Presence, by Segment and Geography

14.1.3 Key Developments

14.1.4 SWOT Analysis

14.1.5 Strategic Overview

14.1.6 Revenue and Year on Year Growth

14.2 Advanced Micro Devices, Inc.

14.2.1 Company Details (HQ, Foundation Year, Employee Strength)

14.2.2 Market Presence, by Segment and Geography

14.2.3 Key Developments

14.2.4 SWOT Analysis

14.2.5 Strategic Overview

14.2.6 Revenue and Year on Year Growth

14.3 VIA Technologies Inc.

14.3.1 Company Details (HQ, Foundation Year, Employee Strength)

14.3.2 Market Presence, by Segment and Geography

14.3.3 Key Developments

14.3.4 SWOT Analysis

14.3.5 Strategic Overview

14.3.6 Revenue and Year on Year Growth

14.4 Fujitsu Ltd

14.4.1 Company Details (HQ, Foundation Year, Employee Strength)

14.4.2 Market Presence, by Segment and Geography

14.4.3 Key Developments

14.4.4 SWOT Analysis

14.4.5 Strategic Overview

14.4.6 Revenue and Year on Year Growth

14.5 Acer Group

14.5.1 Company Details (HQ, Foundation Year, Employee Strength)

14.5.2 Market Presence, by Segment and Geography

14.5.3 Key Developments

14.5.4 SWOT Analysis

14.5.5 Strategic Overview

14.5.6 Revenue and Year on Year Growth

14.6 IBM Corporation

14.6.1 Company Details (HQ, Foundation Year, Employee Strength)

14.6.2 Market Presence, by Segment and Geography

14.6.3 Key Developments

14.6.4 SWOT Analysis

14.6.5 Strategic Overview

14.6.6 Revenue and Year on Year Growth

14.7 United Microelectronics Corporation

14.7.1 Company Details (HQ, Foundation Year, Employee Strength)

14.7.2 Market Presence, by Segment and Geography

14.7.3 Key Developments

14.7.4 SWOT Analysis

14.7.5 Strategic Overview

14.7.6 Revenue and Year on Year Growth

14.8 Nvidia Corporation

14.8.1 Company Details (HQ, Foundation Year, Employee Strength)

14.8.2 Market Presence, by Segment and Geography

14.8.3 Key Developments

14.8.4 SWOT Analysis

14.8.5 Strategic Overview

14.8.6 Revenue and Year on Year Growth

14.9 Qualcomm Incorporated

14.9.1 Company Details (HQ, Foundation Year, Employee Strength)

14.9.2 Market Presence, by Segment and Geography

14.9.3 Key Developments

14.9.4 SWOT Analysis

14.9.5 Strategic Overview

14.9.6 Revenue and Year on Year Growth

14.10 Atmel Corporation

14.10.1 Company Details (HQ, Foundation Year, Employee Strength)

14.10.2 Market Presence, by Segment and Geography

14.10.3 Key Developments

14.10.4 SWOT Analysis

14.10.5 Strategic Overview

14.10.6 Revenue and Year on Year Growth

List of Table

Table 1.Global Next Generation Processors Market Size (USD Bn) Forecast, By End-User Type, 2015–2024

Table 2:Global Next Generation Processors Market Volume (In Bn Units) Forecast, By End-User Type, 2015–2024

Table 3: Global Next Generation Processors Market Size (USD Bn) Forecast, By Machine Type, 2015–2024

Table 4: Global Next Generation Processors Market Volume (In Bn Units) Forecast, By End-User Type, 2015–2024

Table 5:Global Next Generation Processors Market Size (USD) Value Forecast, By Region Type, 2015–2024

Table 6:Global Next Generation Processors Market Size (in Bn Units) Volume Forecast, By Region Type, 2015–2024

Table 7: Next Generation Processors Market Size (USD) Value Forecast, By End-Use Type, 2015–2024

Table 8: Next Generation Processors Market Size (in Bn Units) Volume Forecast, By End-Use Type, 2015–2024

Table 9: Next Generation Processors Market Size (USD) Value Forecast, By End-Use Type, 2015–2024

Table 10:Next Generation Processors Market Size (in Bn Units) Volume Forecast, By End-Use Type, 2015–2024

Table 11: Next Generation Processors Market Value (USD Bn) Forecast, By Country, 2015–2024

Table 12: Next Generation Processors Market Volume (In Bn Units) Forecast, By Country, 2015–2024

Table 13:Next Generation Processors Market Size (USD) Value Forecast, By End-Use Type, 2015–2024

Table 14: Next Generation Processors Market Size (in Bn Units) Volume Forecast, By End-Use Type, 2015–2024

Table 15:Next Generation Processors Market Size (USD) Value Forecast, By Machine Type 2015–2024

Table 16:Next Generation Processors Market Size (in Bn Units) Volume Forecast, By End-Use Type, 2015–2024

Table 17:Next Generation Processors Market Value (In Bn Units) Forecast, By Country, 2015–2024

Table 18:Next Generation Processors Market Volume (In Bn Units) Forecast, By Country, 2015–2024

Table 19:Next Generation Processors Market Size (USD) Value Forecast, By End-Use Type, 2015–2024

Table 20:Next Generation Processors Market Size (in Bn Units) Volume Forecast, By End-Use Type, 2015–2024

Table 21:Next Generation Processors Market Size (USD) Value Forecast, By Machine Type 2015–2024

Table 22:Next Generation Processors Market Size (in Bn Units) Volume Forecast, By End-Use Type, 2015–2024

Table 23: Next Generation Processors Market Value (In Bn Units) Forecast, By Country, 2015–2024

Table 24: Next Generation Processors Market Volume (In Bn Units) Forecast, By Country, 2015–2024

Table 25: Next Generation Processors Market Size (USD) Value Forecast, By End-Use Type, 2015–2024

Table 26:Next Generation Processors Market Size (in Bn Units) Volume Forecast, By End-Use Type, 2015–2024

Table 27:Next Generation Processors Market Size (USD) Value Forecast, By Machine Type 2015–2024

Table 28:Next Generation Processors Market Size (in Bn Units) Volume Forecast, By End-Use Type, 2015–2024

Table 29:MEA Generation Processors Market Value (In Bn Units) Forecast, By Country, 2015–2024

Table 30:Next Generation Processors Market Volume (In Bn Units) Forecast, By Country, 2015–2024

Table 31:Next Generation Processors Market Size (USD) Value Forecast, By End-Use Type, 2015–2024

Table 32:Next Generation Processors Market Size (in Bn Units) Volume Forecast, By End-Use Type, 2015–2024

Table 33: Next Generation Processors Market Size (USD) Value Forecast, By Machine Type 2015–2024

Table 34:Next Generation Processors Market Size (in Bn Units) Volume Forecast, By End-Use Type, 2015–2024

Table 35:Next Generation Processors Market Value (In Bn Units) Forecast, By Country, 2015–2024

Table 36:Next Generation Processors Market Volume (In Bn Units) Forecast, By Country, 2015–2024

List of Figures

Fig 1:Global Next Generation Processors Market Size (USD Bn) and Market Volume (in Billion Units) Forecast, 2016–2024

Fig 2:Global Next Generation Processors Market Value Share Analysis By End-User Type, 2016 and 2024

Fig 3:Global Next Generation Processors Market Volume Share Analysis By End-User Type, 2016 and 2024

Fig 4:Next Generation Processors Market Analysis By End-User Type, 2015-2024

Fig 5:Next Generation Processors Systems Market Analysis By End-User Type, 2015-2024

Fig 6:Next Generation Processors Market Analysis By End-User Type, 2015-2024

Fig 7:Next Generation Processors Market Analysis By End-User Type, 2015-2024

Fig 8:Next Generation Processors Market Analysis By End-User Type, 2015-2024

Fig 9:Global Next Generation Processors Market Value Share Analysis By End-User Type, 2016 and 2024

Fig 10:Global Next Generation Processors Market Volume Share Analysis By Machine Type, 2016 and 2024

Fig 11:Next Generation Processors Market Analysis By End-User Type, 2015-2024

Fig 12:Next Generation Processors Systems Market Analysis By Application, 2015-2024

Fig 13:Next Generation Processors Market Analysis By Machine Type, 2015-2024

Fig 14:Global Next Generation Processors Market Value Share Analysis By Region Type, 2015 and 2024

Fig 15:Global Next Generation Processors Market Volume Share Analysis By Region Type, 2015 and 2024

Fig 16:North America Next Generation Processors Market Size (USD Bn and Bn Units) Forecast, 2015–2024

Fig 17:North America Market Value Share Analysis By End-User Type, 2015 and 2024

Fig 18:North America Market Volume Share Analysis By End-User Type, 2015 and 2024

Fig 19:North America Market Value Share Analysis By Machine Type, 2015 and 2024

Fig 20:North America Market Volume Share Analysis By Machine Type, 2015 and 2024

Fig 21:North America Market Value Share Analysis By Country, 2016 and 2024

Fig 22:North America Market Volume Share Analysis By Country, 2016 and 2024

Fig 23:Europe Next Generation Processors Market Size (USD Bn and Bn Units) Forecast, 2015–2024

Fig 24:Europe Market Value Share Analysis By End-User Type, 2015 and 2024

Fig 25:Europe Market Volume Share Analysis By End-User Type, 2015 and 2024

Fig 26:Europe Market Value Share Analysis By Machine Type, 2015 and 2024

Fig 27:Europe Market Volume Share Analysis By Machine Type, 2015 and 2024

Fig 28:Europe Market Value Share Analysis By Country, 2016 and 2024

Fig 29:Europe Market Volume Share Analysis By Country, 2016 and 2024

Fig 30:Asia Pacific Next Generation Processors Market Size (USD Bn and Bn Units) Forecast, 2015–2024

Fig 31:Asia Pacific Market Value Share Analysis By End-User Type, 2015 and 2024

Fig 32:APAC Market Volume Share Analysis By End-User Type, 2015 and 2024

Fig 33:APAC Market Value Share Analysis By Machine Type, 2015 and 2024

Fig 34:APAC Market Volume Share Analysis By Machine Type, 2015 and 2024

Fig 35:APAC Market Value Share Analysis By Country, 2016 and 2024

Fig 36:APAC Market Volume Share Analysis By Country, 2016 and 2024

Fig 37:MEA Next Generation Processors Market Size (USD Bn and Bn Units) Forecast, 2015–2024

Fig 38:MEA Market Value Share Analysis By End-User Type, 2015 and 2024

Fig 39:MEA Market Volume Share Analysis By End-User Type, 2015 and 2024

Fig 40:MEA Market Value Share Analysis By Machine Type, 2015 and 2024

Fig 41:MEA Market Volume Share Analysis By Machine Type, 2015 and 2024

Fig 42:MEA Market Value Share Analysis By Country, 2016 and 2024

Fig 43:MEA Market Volume Share Analysis By Country, 2016 and 2024

Fig 44:South America Next Generation Processors Market Size (USD Bn and Bn Units) Forecast, 2015–2024

Fig 45:South America Market Value Share Analysis By End-User Type, 2015 and 2024

Fig 46:South America Market Volume Share Analysis By End-User Type, 2015 and 2024

Fig 47:South America Market Value Share Analysis By Machine Type, 2015 and 2024

Fig 48:South America Market Volume Share Analysis By Machine Type, 2015 and 2024

Fig 49:South America Market Value Share Analysis By Country, 2016 and 2024

Fig 50:South America Market Volume Share Analysis By Country, 2016 and 2024