Analysts’ Viewpoint on Market Scenario

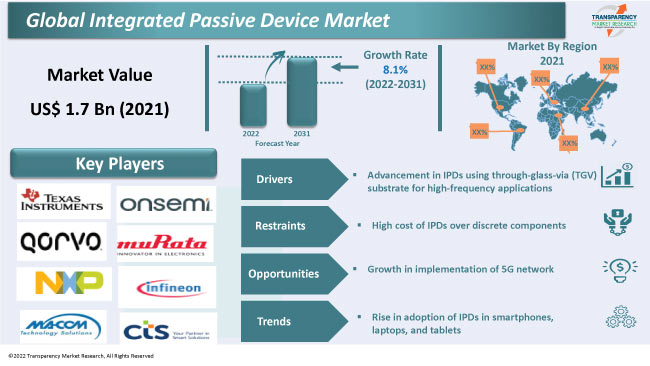

Surge in demand for high-powered compact electronic devices is driving the global integrated passive device market. Apart from consumer electronics, integrated passive devices (IPDs) are used in various end-use industries such as automotive, energy & utility, aerospace & defense, healthcare, and IT & telecommunication. Rise in penetration of the Internet of Things (IoT) and 5G technology is contributing to market growth.

Furthermore, increase in adoption of integrated passive components in LED, RF modules, WLAN, GPS systems, and Bluetooth is expected to fuel integrated passive device market development in the next few years. Rise in demand for electric vehicles and smartphones packed with 5G technologies is expected to boost integrated passive device market share during the forecast period. Integrated passive device manufacturers are likely to grab incremental opportunities by integrating IPDs in different wearable devices in the next few years.

Baluns, filters, couplers, diplexers, resonators, power splitters/combiners, attenuators, etc., are the various types of integrated passive devices. Integrated passive device market demand is expected to rise in the near future, due to increase in usage of filters and diplexers in wireless system applications. IoT applications of passive electronic components such as resistors, capacitors, and inductors are creating lucrative opportunities for manufacturers.

IPDs are being increasingly used in smart appliances, smart TVs, and wearable & hearable devices. They are also being utilized in consumer electronic products such as set-top boxes, wireless speakers, routers, drones, and gaming systems. Moreover, the integrated passive device market size is increasing due to the advancement in M2M communication technology.

Request a sample to get extensive insights into the Integrated Passive Device Market

Demand for high-speed mobile communication is rising consistently; however, the current ceramic filters have some constraints in thin modules and high-frequency applications. IPDs developed using glass thin films are increasingly being preferred over IPDs developed using through-silicon via (TSV) substrate.

Glass substrate became progressively popular in passive device fabrication due to its high thermal stability, low dielectric loss, high resistivity, and adjustable coefficient of thermal expansion. Therefore, advancement in IPDs using through-glass-via (TGV) substrate is anticipated to augment the integrated passive device business growth during the forecast period.

Key players in the market are focusing on the development of efficient and reliable passive devices for the adoption of 5G network. This is expected to contribute to market growth in the next few years. Integrated passive devices offer excellent stability in harsh environments. These devices are suitable for 5G telecom equipment, due to their high power. 5G telecom networks are expected to gain tremendous popularity in the near future as they deliver faster data and better connections for smartphones, industrial applications, self-driving cars, and smart cities. 5G phone networks are causing an exponential increase in global data traffic and mobile data, which must be supported by electronic hardware and infrastructure.

IPDs are used in several applications such as telecom base stations and other internet networking hardware due to their stability and reliability. Small dimensions, compact size, stable parameters in a broad range of temperatures, and long-term reliability are some of the major requirements of 5G components. Demand for passive components increased significantly in 2020 despite the pandemic's threat to overall economic growth. Demand is expected to increase during the forecast period.

According to IDC, global smartphone shipments are expected to reach 1.54 billion units in 2025 with a compound annual growth rate (CAGR) of 3.9% from 2020 to 2025. This growth is attributed primarily to emerging countries in South Asia and Middle East & Africa, where demand for smartphones is strong due to the lower penetration of smartphones. Therefore, rise in demand for smartphones across the globe is likely to have a positive impact on the adoption of integrated passive device technologies during the forecast period.

Request a custom report on Integrated Passive Device Market

According to the integrated passive device market research report, North America is expected to hold major share of the global market during the forecast period. This is due to the increase in penetration of the internet of things (IoT), rise in investment in 5G communication, and expansion of semiconductor sector in the region. Furthermore, rise in demand for IPDs in consumer durables is fueling integrated passive device industry growth in the near future.

Furthermore, region-wise analysis of the integrated passive device market forecast report also revealed that Asia Pacific and Europe accounted for a significant share of the global market in 2021. Growth in adoption of in-vehicle infotainment systems is driving the integrated passive devices market demand in the automotive sector in Europe. Ultra-miniaturized RF passive devices are largely installed in GPS, instrument clusters, and other electronic devices.

This business is consolidated with the presence of a few large-scale entities controlling majority of the global integrated passive device industry share. Key players operating in the global market are CTS Corporation, Global Communication Semiconductors, LLC, Infineion Technologies AG, Johanson Technology, Inc, MACOM, Murata Manufacturing Co., Ltd., NXP Semiconductors, ON Semiconductors, Qurvo, Inc., STMicroelectronics and Texas Instruments Incorporated. These players are engaged in implementing productive strategies to mark their presence in the global integrated passive device.

The global integrated passive device market report profiles these key players based on financial overview, product portfolio, company overview, business segments, business strategies, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.7 Bn |

|

Market Forecast Value in 2031 |

US$ 3.6 Bn |

|

Growth Rate (CAGR) |

8.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis and COVID-19 Impact Analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It stood at US$ 1.7 Bn in 2021.

It is expected to advance at a CAGR of 8.1% from 2022 to 2031.

It is likely to reach 3.6 Bn in 2031.

Advancement in IPDs using through-glass-via (TGV) substrate for high-frequency applications, growth in implementation of 5G network, and rise in adoption of IPDs in smartphones, laptops, and tablets.

Asia Pacific was a more lucrative region for vendors in 2021.

Murata Manufacturing Co., Ltd., NXP Semiconductors, ON Semiconductors, Qurvo, Inc., STMicroelectronics, and Texas Instruments Incorporated.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Integrated Passive Device Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Integrated Passive Device (IPD) Technology Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Integrated Passive Device Market Analysis, by Passive Devices

5.1. Integrated Passive Device Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Passive Devices, 2017–2031

5.1.1. Baluns

5.1.2. Filters

5.1.3. Couplers

5.1.4. Diplexers

5.1.5. Resonators

5.1.6. Others

5.2. Market Attractiveness Analysis, By Passive Devices

6. Global Integrated Passive Device Market Analysis, by Substrate

6.1. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Substrate, 2017–2031

6.1.1. Silicon

6.1.2. Glass Wafer

6.1.3. GaAs

6.1.4. Ceramic

6.2. Market Attractiveness Analysis, By Substrate

7. Global Integrated Passive Device Market Analysis, by Packaging

7.1. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Packaging, 2017–2031

7.1.1. Wire Bonding

7.1.2. SIL

7.1.3. QFN

7.1.4. Chip-scale Package

7.1.5. Wafer Level Package

7.1.6. Others

7.2. Market Attractiveness Analysis, By Packaging

8. Global Integrated Passive Device Market Analysis, by Application

8.1. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

8.1.1. LED

8.1.2. RF Module

8.1.3. Ultra-wideband

8.1.4. WLAN

8.1.5. GPS System

8.1.6. Others

8.2. Market Attractiveness Analysis, By Application

9. Global Integrated Passive Device Market Analysis, by End-use Industry

9.1. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

9.1.1. Automotive

9.1.2. Aerospace & Defense

9.1.3. Consumer Electronics

9.1.4. Healthcare

9.1.5. Others

9.2. Market Attractiveness Analysis, By End-use Industry

10. Global Integrated Passive Device Market Analysis and Forecast, By Region

10.1. Integrated Passive Device Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017–2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, By Region

11. North America Integrated Passive Device Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Integrated Passive Device Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Passive Devices, 2017–2031

11.3.1. Baluns

11.3.2. Filters

11.3.3. Couplers

11.3.4. Diplexers

11.3.5. Resonators

11.3.6. Others

11.4. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Substrate, 2017–2031

11.4.1. Silicon

11.4.2. Glass Wafer

11.4.3. GaAs

11.4.4. Ceramic

11.5. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Packaging, 2017–2031

11.5.1. Wire Bonding

11.5.2. SIL

11.5.3. QFN

11.5.4. Chip-scale Package

11.5.5. Wafer Level Package

11.5.6. Others

11.6. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

11.6.1. LED

11.6.2. RF Module

11.6.3. Ultra-wideband

11.6.4. WLAN

11.6.5. GPS System

11.6.6. Others

11.7. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

11.7.1. Automotive

11.7.2. Aerospace & Defense

11.7.3. Consumer Electronics

11.7.4. Healthcare

11.7.5. Others

11.8. Integrated Passive Device Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.8.1. U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Market Attractiveness Analysis

11.9.1. By Passive Devices

11.9.2. By Substrate

11.9.3. By Packaging

11.9.4. By Application

11.9.5. By End-use Industry

11.9.6. By Country/Sub-region

12. Europe Integrated Passive Device Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Integrated Passive Device Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Passive Devices, 2017–2031

12.3.1. Baluns

12.3.2. Filters

12.3.3. Couplers

12.3.4. Diplexers

12.3.5. Resonators

12.3.6. Others

12.4. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Substrate, 2017–2031

12.4.1. Silicon

12.4.2. Glass Wafer

12.4.3. GaAs

12.4.4. Ceramic

12.5. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Packaging, 2017–2031

12.5.1. Wire Bonding

12.5.2. SIL

12.5.3. QFN

12.5.4. Chip-scale Package

12.5.5. Wafer Level Package

12.5.6. Others

12.6. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

12.6.1. LED

12.6.2. RF Module

12.6.3. Ultra-wideband

12.6.4. WLAN

12.6.5. GPS System

12.6.6. Others

12.7. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

12.7.1. Automotive

12.7.2. Aerospace & Defense

12.7.3. Consumer Electronics

12.7.4. Healthcare

12.7.5. Others

12.8. Integrated Passive Device Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.8.1. The U.K.

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Market Attractiveness Analysis

12.9.1. By Passive Devices

12.9.2. By Substrate

12.9.3. By Packaging

12.9.4. By Application

12.9.5. By End-use Industry

12.9.6. By Country/Sub-region

13. Asia Pacific Integrated Passive Device Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Integrated Passive Device Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Passive Devices, 2017–2031

13.3.1. Baluns

13.3.2. Filters

13.3.3. Couplers

13.3.4. Diplexers

13.3.5. Resonators

13.3.6. Others

13.4. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Substrate, 2017–2031

13.4.1. Silicon

13.4.2. Glass Wafer

13.4.3. GaAs

13.4.4. Ceramic

13.5. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Packaging, 2017–2031

13.5.1. Wire Bonding

13.5.2. SIL

13.5.3. QFN

13.5.4. Chip-scale Package

13.5.5. Wafer Level Package

13.5.6. Others

13.6. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

13.6.1. LED

13.6.2. RF Module

13.6.3. Ultra-wideband

13.6.4. WLAN

13.6.5. GPS System

13.6.6. Others

13.7. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

13.7.1. Automotive

13.7.2. Aerospace & Defense

13.7.3. Consumer Electronics

13.7.4. Healthcare

13.7.5. Others

13.8. Integrated Passive Device Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.8.1. China

13.8.2. Japan

13.8.3. Taiwan

13.8.4. South Korea

13.8.5. Rest of Asia Pacific

13.9. Market Attractiveness Analysis

13.9.1. By Passive Devices

13.9.2. By Substrate

13.9.3. By Packaging

13.9.4. By Application

13.9.5. By End-use Industry

13.9.6. By Country/Sub-region

14. Middle East & Africa Integrated Passive Device Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Integrated Passive Device Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Passive Devices, 2017–2031

14.3.1. Baluns

14.3.2. Filters

14.3.3. Couplers

14.3.4. Diplexers

14.3.5. Resonators

14.3.6. Others

14.4. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Substrate, 2017–2031

14.4.1. Silicon

14.4.2. Glass Wafer

14.4.3. GaAs

14.4.4. Ceramic

14.5. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Packaging, 2017–2031

14.5.1. Wire Bonding

14.5.2. SIL

14.5.3. QFN

14.5.4. Chip-scale Package

14.5.5. Wafer Level Package

14.5.6. Others

14.6. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

14.6.1. LED

14.6.2. RF Module

14.6.3. Ultra-wideband

14.6.4. WLAN

14.6.5. GPS System

14.6.6. Others

14.7. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

14.7.1. Automotive

14.7.2. Aerospace & Defense

14.7.3. Consumer Electronics

14.7.4. Healthcare

14.7.5. Others

14.8. Integrated Passive Device Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Market Attractiveness Analysis

14.9.1. By Passive Devices

14.9.2. By Substrate

14.9.3. By Packaging

14.9.4. By Application

14.9.5. By End-use Industry

14.9.6. By Country/Sub-region

15. South America Integrated Passive Device Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Integrated Passive Device Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Passive Devices, 2017–2031

15.3.1. Baluns

15.3.2. Filters

15.3.3. Couplers

15.3.4. Diplexers

15.3.5. Resonators

15.3.6. Others

15.4. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Substrate, 2017–2031

15.4.1. Silicon

15.4.2. Glass Wafer

15.4.3. GaAs

15.4.4. Ceramic

15.5. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Packaging, 2017–2031

15.5.1. Wire Bonding

15.5.2. SIL

15.5.3. QFN

15.5.4. Chip-scale Package

15.5.5. Wafer Level Package

15.5.6. Others

15.6. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

15.6.1. LED

15.6.2. RF Module

15.6.3. Ultra-wideband

15.6.4. WLAN

15.6.5. GPS System

15.6.6. Others

15.7. Integrated Passive Device Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

15.7.1. Automotive

15.7.2. Aerospace & Defense

15.7.3. Consumer Electronics

15.7.4. Healthcare

15.7.5. Others

15.8. Integrated Passive Device Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Market Attractiveness Analysis

15.9.1. By Passive Devices

15.9.2. By Substrate

15.9.3. By Packaging

15.9.4. By Application

15.9.5. By End-use Industry

15.9.6. By Country/Sub-region

16. Competition Assessment

16.1. Global Integrated Passive Device Market Competition Matrix - a Dashboard View

16.1.1. Global Integrated Passive Device Market Company Share Analysis, by Value (2021)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. Broadcom

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. CTS Corporation

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. Global Communication Semiconductors, LLC

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. Infineon Technologies AG

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. Johanson Technology, Inc.

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. MACOM

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. Murata Manufacturing Co., Ltd.

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. NXP Semiconductors

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. ON Semiconductors

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. Qurvo, Inc.

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. STMicroelectronics

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

17.12. Texas Instruments Incorporated

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Key Financials

18. Recommendation

18.1. Opportunity Assessment

18.1.1. By Passive Devices

18.1.2. By Substrate

18.1.3. By Packaging

18.1.4. By Application

18.1.5. By End-use Industry

18.1.6. By Region

List of Tables

Table 01: Global Integrated Passive Device Market Size & Forecast, by Passive Devices, Value (US$ Mn), 2017–2031

Table 02: Global Integrated Passive Device Market Size & Forecast, by Passive Devices, Volume (Million Units), 2017–2031

Table 03: Global Integrated Passive Device Market Size & Forecast, by Substrate (US$ Mn), 2017–2031

Table 04: Global Integrated Passive Device Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 05: Global Integrated Passive Device Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 06: Global Integrated Passive Device Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 07: North America Integrated Passive Device Market Size & Forecast, by Passive Devices, Volume (Million Units), 2017–2031

Table 08: North America Integrated Passive Device Market Size & Forecast, by Substrate (US$ Mn), 2017–2031

Table 09: North America Integrated Passive Device Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 10: North America Integrated Passive Device Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 11: North America Integrated Passive Device Market Size & Forecast, by Country, Value (USD Million), 2017–2031

Table 12: Europe Integrated Passive Device Market Size & Forecast, by Passive Devices, Value (US$ Mn), 2017–2031

Table 13: Europe Integrated Passive Device Market Size & Forecast, by Passive Devices, Volume (Million Units), 2017–2031

Table 14: Europe Integrated Passive Device Market Size & Forecast, by Substrate (US$ Mn), 2017–2031

Table 15: Europe Integrated Passive Device Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 16: Europe Integrated Passive Device Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 17: Europe Integrated Passive Device Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017–2031

Table 18: Asia Pacific Integrated Passive Device Market Size & Forecast, by Passive Devices, Value (US$ Mn), 2017–2031

Table 19: Asia Pacific Integrated Passive Device Market Size & Forecast, by Passive Devices, Volume (Million Units), 2017–2031

Table 20: Asia Pacific Integrated Passive Device Market Size & Forecast, by Substrate (US$ Mn), 2017–2031

Table 21: Asia Pacific Integrated Passive Device Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 22: Asia Pacific Integrated Passive Device Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 23: Asia Pacific Integrated Passive Device Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017–2031

Table 24: Middle East & Africa Integrated Passive Device Market Size & Forecast, by Passive Devices, Value (US$ Mn), 2017–2031

Table 25: Middle East & Africa Integrated Passive Device Market Size & Forecast, by Passive Devices, Volume (Million Units), 2017–2031

Table 26: Middle East & Africa Integrated Passive Device Market Size & Forecast, by Substrate (US$ Mn), 2017–2031

Table 27: Middle East & Africa Integrated Passive Device Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 28: Middle East & Africa Integrated Passive Device Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 29: Middle East & Africa (MEA) Integrated Passive Device Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017–2031

Table 30: South America Integrated Passive Device Market Size & Forecast, by Passive Devices, Value (US$ Mn), 2017–2031

Table 31: South America Integrated Passive Device Market Size & Forecast, by Passive Devices, Volume (Million Units), 2017–2031

Table 32: South America Integrated Passive Device Market Size & Forecast, by Substrate (US$ Mn), 2017–2031

Table 33: South America Integrated Passive Device Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 34: South America Integrated Passive Device Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 35: South America Integrated Passive Device Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017–2031

List of Figures

Figure 01: Global Integrated Passive Device Price Trend Analysis (Average Price, US$)

Figure 02: Global Integrated Passive Device Market, Y-O-Y Growth 2017–2031

Figure 03: Global Integrated Passive Device Market, Value (US$ Mn), 2017–2031

Figure 04: Global Integrated Passive Device Market, Volume (Million Units), 2017–2031

Figure 05: Global Integrated Passive Device Market Projections, by Passive Devices, Value (US$ Mn), 2017–2031

Figure 06: Global Integrated Passive Device Market, Incremental Opportunity, by Passive Devices, Value (US$ Mn), 2022 – 2031

Figure 07: Global Integrated Passive Device Market Share, by Passive Devices, Value (US$ Mn), 2022 – 2031

Figure 08: Global Integrated Passive Device Market Projections, by Substrate, Value (US$ Mn), 2017–2031

Figure 09: Global Integrated Passive Device Market, Incremental Opportunity, by Substrate, Value (US$ Mn), 2022 – 2031

Figure 10: Global Integrated Passive Device Market Projections, by Packaging, Value (US$ Mn), 2017–2031

Figure 11: Global Integrated Passive Device Market, Incremental Opportunity, by Packaging, Value (US$ Mn), 2022 – 2031

Figure 12: Global Integrated Passive Device Market Share, by Packaging, Value (US$ Mn), 2022 – 2031

Figure 13: Global Integrated Passive Device Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 14: Global Integrated Passive Device Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 15: Global Integrated Passive Device Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 16: Global Integrated Passive Device Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 17: Global Integrated Passive Device Market Size & Forecast, by Region, Revenue (US$ Mn), 2017–2031

Figure 18: Global Integrated Passive Device Market Attractiveness, by Region, Value (US$ Mn), 2022 – 2031

Figure 19: Global Integrated Passive Device Market Size & Forecast, by Region, Value (US$ Mn), 2022 – 2031

Figure 20: North America Integrated Passive Device Market, Y-O-Y Growth, 2017–2031

Figure 21: North America Integrated Passive Device Market, Value (US$ Mn), 2017–2031

Figure 22: North America Integrated Passive Device Market, Volume (Million Units), 2017–2031

Figure 23: North America Integrated Passive Device Market, Price Trend, 2017–2031

Figure 24: North America Integrated Passive Device Market Projections, by Passive Devices, Value (US$ Mn), 2017–2031

Figure 25: North America Integrated Passive Device Market, Incremental Opportunity, by Passive Devices, Value (US$ Mn), 2022 – 2031

Figure 26: North America Integrated Passive Device Market Share, by Passive Devices, Value (US$ Mn), 2022 – 2031

Figure 27: North America Integrated Passive Device Market Projections, by Substrate, Value (US$ Mn), 2017–2031

Figure 28: North America Integrated Passive Device Market, Incremental Opportunity, by Substrate, Value (US$ Mn), 2022 – 2031

Figure 29: North America Integrated Passive Device Market Projections, by Packaging, Value (US$ Mn), 2017–2031

Figure 30: North America Integrated Passive Device Market, Incremental Opportunity, by Packaging,, Value (US$ Mn), 2022 – 2031

Figure 31: North America Integrated Passive Device Market Share, by Packaging,, Value (US$ Mn), 2022 – 2031

Figure 32: North America Integrated Passive Device Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 33: North America Integrated Passive Device Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 34: North America Integrated Passive Device Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 35: North America Integrated Passive Device Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 36: North America Integrated Passive Device Market Size & Forecast, by Country, Revenue (US$ Mn), 2017–2031

Figure 37: North America Integrated Passive Device Market Attractiveness, by Country, Value (US$ Mn), 2022 – 2031

Figure 38: North America Integrated Passive Device Market Size & Forecast, by Country, Value (US$ Mn), 2022 – 2031

Figure 39: Europe Integrated Passive Device Market, Y-O-Y Growth, 2017–2031

Figure 40: Europe Integrated Passive Device Market, Value (US$ Mn), 2017–2031

Figure 41: Europe Integrated Passive Device Market, Volume (Million Units), 2017–2031

Figure 42: Europe Integrated Passive Device Market, Price Trend

Figure 43: Europe Integrated Passive Device Market Projections, by Passive Devices, Value (US$ Mn), 2017–2031

Figure 44: Europe Integrated Passive Device Market, Incremental Opportunity, by Passive Devices, Value (US$ Mn), 2022 – 2031

Figure 45: Europe Integrated Passive Device Market Share, by Passive Devices, Value (US$ Mn), 2022 – 2031

Figure 46: Europe Integrated Passive Device Market Projections, by Substrate, Value (US$ Mn), 2017–2031

Figure 47: Europe Integrated Passive Device Market, Incremental Opportunity, by Substrate, Value (US$ Mn), 2022 – 2031

Figure 48: Europe Integrated Passive Device Market Projections, by Packaging, Value (US$ Mn), 2017–2031

Figure 49: Europe Integrated Passive Device Market, Incremental Opportunity, by Packaging, Value (US$ Mn), 2022 – 2031

Figure 50: Europe Integrated Passive Device Market Share, by Packaging, Value (US$ Mn), 2022 – 2031

Figure 51: Europe Integrated Passive Device Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 52: Europe Integrated Passive Device Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 53: Europe Integrated Passive Device Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 54: Europe Integrated Passive Device Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 55: Europe Integrated Passive Device Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017–2031

Figure 56: Europe Integrated Passive Device Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 57: Europe Integrated Passive Device Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 58: Asia Pacific Integrated Passive Device Market, Y-O-Y Growth, 2017–2031

Figure 59: Asia Pacific Integrated Passive Device Market, Value (US$ Mn), 2017–2031

Figure 60: Asia Pacific Integrated Passive Device Market, Volume (Million Units), 2017–2031

Figure 61: Asia Pacific Integrated Passive Device Market, Price Trend

Figure 62: Asia Pacific Integrated Passive Device Market Projections, by Passive Devices, Value (US$ Mn), 2017–2031

Figure 63: Asia Pacific Integrated Passive Device Market, Incremental Opportunity, by Passive Devices, Value (US$ Mn), 2022 – 2031

Figure 64: Asia Pacific Integrated Passive Device Market Share, by Passive Devices, Value (US$ Mn), 2022 – 2031

Figure 65: Asia Pacific Integrated Passive Device Market Projections, by Substrate, Value (US$ Mn), 2017–2031

Figure 66: Asia Pacific Integrated Passive Device Market, Incremental Opportunity, by Substrate, Value (US$ Mn), 2022 – 2031

Figure 67: Asia Pacific Integrated Passive Device Market Projections, by Packaging, Value (US$ Mn), 2017–2031

Figure 68: Asia Pacific Integrated Passive Device Market, Incremental Opportunity, by Packaging, Value (US$ Mn), 2022 – 2031

Figure 69: Asia Pacific Integrated Passive Device Market Share, by Packaging, Value (US$ Mn), 2022 – 2031

Figure 70: Asia Pacific Integrated Passive Device Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 71: Asia Pacific Integrated Passive Device Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 72: Asia Pacific Integrated Passive Device Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 73: Asia Pacific Integrated Passive Device Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 74: Asia Pacific Integrated Passive Device Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017–2031

Figure 75: Asia Pacific Integrated Passive Device Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 76: Asia Pacific Integrated Passive Device Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 77: Middle East & Africa Integrated Passive Device Market, Y-O-Y Growth, 2017–2031

Figure 78: Middle East & Africa Integrated Passive Device Market, Value (US$ Mn), 2017–2031

Figure 79: Middle East & Africa Integrated Passive Device Market, Volume (Million Units), 2017–2031

Figure 80: Middle East & Africa Integrated Passive Device Market, Price Trend

Figure 81: Middle East & Africa Integrated Passive Device Market Projections, by Passive Devices, Value (US$ Mn), 2017–2031

Figure 82: Middle East & Africa Integrated Passive Device Market, Incremental Opportunity, by Passive Devices, Value (US$ Mn), 2022 – 2031

Figure 83: Middle East & Africa Integrated Passive Device Market Share, by Passive Devices, Value (US$ Mn), 2022 – 2031

Figure 84: Middle East & Africa Integrated Passive Device Market Projections, by Substrate, Value (US$ Mn), 2017–2031

Figure 85: Middle East & Africa Integrated Passive Device Market, Incremental Opportunity, by Substrate, Value (US$ Mn), 2022 – 2031

Figure 86: Middle East & Africa Integrated Passive Device Market Projections, by Packaging, Value (US$ Mn), 2017–2031

Figure 87: Middle East & Africa Integrated Passive Device Market, Incremental Opportunity, by Packaging, Value (US$ Mn), 2022 – 2031

Figure 88: Middle East & Africa Integrated Passive Device Market Share, by Packaging, Value (US$ Mn), 2022 – 2031

Figure 89: Middle East & Africa Integrated Passive Device Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 90: Middle East & Africa Integrated Passive Device Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 91: Middle East & Africa Integrated Passive Device Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 92: Middle East & Africa Integrated Passive Device Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 93: Middle East & Africa (MEA) Integrated Passive Device Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017–2031

Figure 94: Middle East & Africa (MEA)Integrated Passive Device Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 95: Middle East & Africa (MEA) Integrated Passive Device Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 96: South America Integrated Passive Device Market, Y-O-Y Growth, 2017–2031

Figure 97: South America Integrated Passive Device Market, Value (US$ Mn), 2017–2031

Figure 98: South America Integrated Passive Device Market, Volume (Million Units), 2017–2031

Figure 99: South America Integrated Passive Device Market, Price Trend

Figure 100: South America Integrated Passive Device Market Projections, by Passive Devices, Value (US$ Mn), 2017–2031

Figure 101: South America Integrated Passive Device Market, Incremental Opportunity, by Passive Devices, Value (US$ Mn), 2022 – 2031

Figure 102: South America Integrated Passive Device Market Share, by Passive Devices, Value (US$ Mn), 2022 – 2031

Figure 103: South America Integrated Passive Device Market Projections, by Substrate, Value (US$ Mn), 2017–2031

Figure 104: South America Integrated Passive Device Market, Incremental Opportunity, by Substrate, Value (US$ Mn), 2022 – 2031

Figure 105: South America Integrated Passive Device Market Projections, by Packaging, Value (US$ Mn), 2017–2031

Figure 106: South America Integrated Passive Device Market, Incremental Opportunity, by Packaging, Value (US$ Mn), 2022 – 2031

Figure 107: South America Integrated Passive Device Market Share, by Packaging, Value (US$ Mn), 2022 – 2031

Figure 108: South America Integrated Passive Device Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 109: South America Integrated Passive Device Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 110: South America Integrated Passive Device Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 111: South America Integrated Passive Device Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 112: South America Integrated Passive Device Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017–2031

Figure 113: South America Integrated Passive Device Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 114: South America Integrated Passive Device Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022 – 2031