Healthcare informatics makes use of information technology in order to improve the role of healthcare by enhancing its overall quality as well as efficiency. Healthcare informatics is also called as clinical informatics, nursing informatics, medical informatics, or biomedical informatics. It allows improved health information management with the help of computerized systems between quality monitors, payers, providers, and customers. Patient monitoring devices aids the practitioners in deciding suitable treatment regimen and monitor the prognosis of disease during the time of treatment in post accurate care.

Rise in prevalence of chronic disorders and increasing adoption of state of the art technologies in the healthcare systems are some of the key factors driving the growth of the global healthcare informatics and patient monitoring market. In addition to this, flourishing urbanization, development of high end and new age technologies in the healthcare informatics, growing applications of these healthcare informatics and patient monitoring devices, and increase in the number of home care centers and hospitals are expected to help in driving the growth of the global market in the coming years of the forecast period.

However, there are some factors that might impede the growth of the healthcare informatics and patient monitoring market and stop it from reaching its full potential. One of the key restraining factor for the market growth has been the high cost associated with the installation of these healthcare informatics and patient monitoring systems. In addition to this, the cost of maintenance and the subsequent security concerns with respect to data storage is also expected to slow down the growth of the global healthcare informatics and patient monitoring market. Furthermore, there is a serious lack of awareness among consumers about the benefits of using these systems in underdeveloped regions. This too is expected to restraint the growth of the global market in coming years.

India Healthcare Informatics and Patient Monitoring Market: Snapshot

In a fragmented healthcare informatics and patient monitoring market in India, numerous local and international players are competing with one another. In order to steal a march over their rivals, they are said to be expending a lot of money on developing cutting-edge products. This is majorly fuelling growth in the market along with the dearth of nursing staff and mushrooming hospitals and homecare centers.

Besides, the alarming increase in chronic diseases in the nation due to the burgeoning geriatric population and changes in lifestyle brought about by urbanization and increasing income of people has also stoked growth in the market for healthcare informatics and patient monitoring in India.

Posing a roadblock to the market, on the other hand, is the price sensitivity of the consumer and frequent recall of patient monitors.

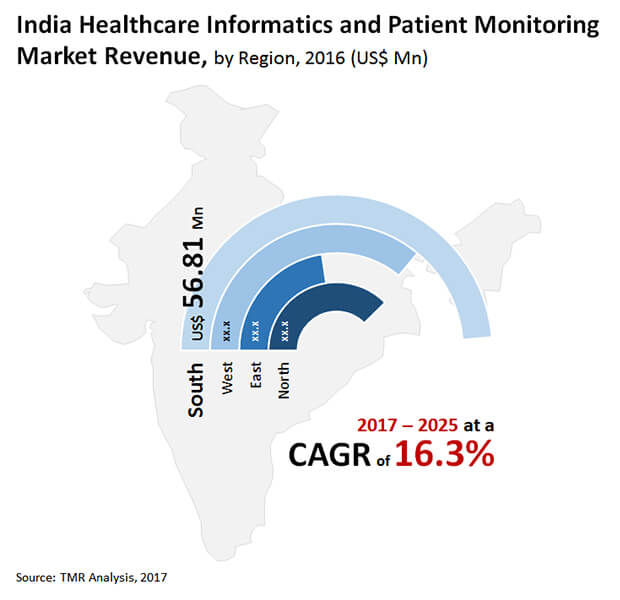

A report by Transparency Market Research predicts the India market for healthcare informatics and patient monitoring to rise at a robust 16.3% CAGR from 2017 to 2025 to attain a value of US$560.9 mn by 2025 from US$124.7 mn in 2015.

Metropolitan and Urban Hospitals and Healthcare Facilities Segment Boosted by Increasing Cardiovascular Diseases

Based on demography, the market for healthcare informatics and patient monitoring in India can be broadly split into metropolitan and urban hospitals and healthcare facilities and rural hospitals and healthcare facilities. Of the two, the metropolitan and urban hospitals and healthcare facilities segment leads the market with a mammoth share. In 2014, the figure stood at a whopping 88.0%. One of the primary reasons for the segment’s dominant position is the growing occurrence of cardiovascular and respiratory diseases. Besides, the rising instances of fatal conditions and rising number of beds in tier 1 and tier 2 cities have also helped the segment garner a leading share in the market.

The other segment of rural hospitals and healthcare facilities is predicted to progress at a healthy clip in the foreseeable future on account of the rising demand for multispecialty hospitals in rural pockets of the country.

Depending upon types, the segment of hospitals accounts for a dominant share in the India market for healthcare informatics and patient monitoring. This is mainly because of the rising number of critically ill patients in India and increasing number of hospital beds.

South India Market Shines due to Availability of Technologically Superior Patient Monitors

Region-wise, the key segments of the India market for healthcare informatics and patient monitoring are North, South, West, and East. Of them, the South India market has progressed the most to account for a dominant position. This is primarily due to the quick adoption of latest medical technologies, better availability of technologically superior patient monitors, and solid support from the government. In 2015, South India accounted for 39.0% share in the overall India market. Currently, the market in South India is worth US$56.81 mn.

Going forward, the Eastern part of India is also likely to contribute significantly to the market for healthcare informatics and patient monitoring, powered by the highly populated city of Kolkata where a large number of people are said to be ailing from respiratory and cardiovascular diseases.

Some of the key players operating in the India market for healthcare informatics and patient monitoring are Mindray Medical India Pvt. Ltd., Philips India Ltd., Wipro GE Healthcare, Nihon Kohden India Pvt. Ltd., BPL Medical Technologies Pvt. Ltd., Schiller Healthcare India Pvt. Ltd., Dräger India Pvt. Ltd., and India Medtronic Pvt. Ltd.

The Indian market for Healthcare Informatics and Patient Monitoring has been segmented as follows:

|

by Demography |

|

|

by Type |

|

|

by Region |

|

Healthcare informatics and patient monitoring market is expected to reach a valuation of US$560.9 mn by the end of 2025

Healthcare informatics and patient monitoring market is anticipated to garner an astounding CAGR of 16.3% during the forecast period which is 2017 to 2025

Healthcare informatics and patient monitoring market is driven by rise in prevalence of chronic disorders and increasing adoption of state of the art technologies in the healthcare systems

The metropolitan and urban hospitals and healthcare facilities segment dominates the healthcare informatics and patient monitoring market owing to a rising prevalence of cardiovascular diseases

Key players in the healthcare informatics and patient monitoring market include Mindray Medical India Pvt. Ltd, Wipro GE Healthcare, Philips India Ltd, Schiller Healthcare India Pvt. Ltd., India Medtronic Pvt. Ltd., and PL Medical Technologies Pvt. Ltd

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : India Healthcare Informatics and Patient Monitoring Market

4. Market Overview

4.1. Introduction

4.2. Key Market Indicators

4.3. Key Industry Developments

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.5. India Healthcare Informatics and Patient Monitoring Market Analysis and Forecasts, 2015 – 2025

4.5.1. Market Revenue Projections (US$ Mn)

4.6. Market Outlook

5. India Healthcare Informatics and Patient Monitoring Market Analysis and Forecasts, By Demography

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Market Size (US$ Mn) Forecast By Demography

5.3.1. Metropolitan and Urban Hospitals and Healthcare Facilities

5.3.2. Rural Hospitals and Healthcare Facilities

5.4. Comparison Matrix By Demography

5.5. Market Attractiveness By Demography

6. India Healthcare Informatics and Patient Monitoring Market Analysis and Forecasts, By Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Size (US$ Mn) Forecast By Type

6.3.1. Ambulatory Care Centers

6.3.2. Home Healthcare

6.3.3. Hospitals

6.4. Comparison Matrix By Type

6.5. Market Attractiveness By Type

7. India Healthcare Informatics and Patient Monitoring Market Analysis and Forecasts, By Region

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Size (US$ Mn) Forecast By Region

7.3.1. North

7.3.1.1. Delhi

7.3.1.2. Punjab

7.3.1.3. Others

7.3.2. East

7.3.2.1. West Bengal

7.3.2.2. Others

7.3.3. West

7.3.3.1. Maharashtra

7.3.3.2. Gujarat

7.3.3.3. Others

7.3.4. South

7.3.4.1. Karnataka

7.3.4.2. Tamil Nadu

7.3.4.3. Kerala

7.3.4.4. Telangana

7.3.4.5. Others

7.4. Market Attractiveness By Region

8. Strategic Analysis

8.1. Pricing Strategy

8.1.1. Value Proposition and Price Sensitivity Analysis

8.1.2. Competitors’ Price Analysis

8.2. Marketing Strategy

8.2.1. Marketing Medium Selection

8.2.2. Target Market Positioning

8.2.3. Geographic Focus

8.2.4. Partnerships/Tie-ups

8.2.5. Market Attractiveness By Hospital Type and Specialty

9. Existing Competition Landscape

9.1. Market Player – Competition Matrix (By Tier and Size of companies)

9.2. Market Share Analysis By Company (2016)

9.3. Company Profiles

9.3.1. Philips India Ltd.

9.3.2. Wipro GE Healthcare Pvt. Ltd.

9.3.3. Mindray Medical India Pvt. Ltd.

9.3.4. Nihon Kohden India Pvt. Ltd.

9.3.5. Schiller Healthcare India Pvt. Ltd.

9.3.6. Dräger India Pvt. Ltd.

9.3.7. BPL Medical Technologies Pvt. Ltd.

9.3.8. India Medtronic Pvt. Ltd.

10. Key Takeaways

List of Tables

Table 1: India Healthcare Informatics and Patient Monitoring Market Size (US$ Mn) Forecast, By Demography, 2015–2025

Table 2: India Healthcare Informatics and Patient Monitoring Market Size (US$ Mn) Forecast, By Type, 2015–2025

Table 3: India Healthcare Informatics and Patient Monitoring Market Size (US$ Mn) Forecast, By Region, 2015–2025

Table 4: India Healthcare Informatics and Patient Monitoring Market Size (US$ Mn) Forecast, By North Region, 2015–2025

Table 5: India Healthcare Informatics and Patient Monitoring Market Size (US$ Mn) Forecast, By East Region, 2015–2025

Table 6: India Healthcare Informatics and Patient Monitoring Market Size (US$ Mn) Forecast, By West Region, 2015–2025

Table 7: India Healthcare Informatics and Patient Monitoring Market Size (US$ Mn) Forecast, By South Region, 2015–2025

Table 8: Price Range for Basic Parameter

Table 9: Price Range for Need-based Parameter

List of Figures

Figure 1: India Healthcare Informatics and Patient Monitoring Market - Share Analysis

Figure 2: India Healthcare Informatics and Patient Monitoring Market Value Share, By Region, 2025

Figure 3: India Medical Equipment Market (In US$ Mn)

Figure 4: India Healthcare Informatics and Patient Monitoring Market Size (US$ Mn) Forecast, 2015 – 2025

Figure 5: India Healthcare Informatics and Patient Monitoring Market Y-o-Y Growth (%), 2016 – 2025

Figure 6: Healthcare Informatics and Patient Monitoring Market Value Share By Demography (2016)

Figure 7: Healthcare Informatics and Patient Monitoring Market Value Share By Type (2016)

Figure 8: Healthcare Informatics and Patient Monitoring Market CAGR (2017-2025) By Demography (2016)

Figure 9: Healthcare Informatics and Patient Monitoring Market CAGR (2017-2025) By Type (2016)

Figure 10: Healthcare Informatics and Patient Monitoring Market Value Share By Region (2016)

Figure 11: Healthcare Informatics and Patient Monitoring Market CAGR (2017-2025) By Region

Figure 12: Healthcare Informatics and Patient Monitoring Market Revenue (US$ Mn) By Major States (2016)

Figure 13: India Healthcare Informatics and Patient Monitoring Market Value Share Analysis, By Demography, 2017 and 2025

Figure 14: Metropolitan and Urban Hospitals and Healthcare Facilities - Market Size (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 15: Rural Hospitals and Healthcare Facilities - Market Size (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 16: Comparison Matrix: India Healthcare Informatics and Patient Monitoring Market, By Demography

Figure 17: India Healthcare Informatics and Patient Monitoring Market Attractiveness Analysis, By Demography

Figure 18: India Healthcare Informatics and Patient Monitoring Market Value Share Analysis, By Type, 2017 and 2025

Figure 19: Ambulatory Care Centers - Market Size (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 20: Home Healthcare - Market Size (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 21: Hospitals- Market Size (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 22: Comparison Matrix: India Healthcare Informatics and Patient Monitoring Market, By Type

Figure 23: India Healthcare Informatics and Patient Monitoring Market Attractiveness Analysis, By Type

Figure 24: Healthcare Informatics and Patient Monitoring Market CAGR (2017 – 2025) Analysis, By Indian States

Figure 25: Healthcare Informatics and Patient Monitoring Market Attractiveness Analysis, By Region

Figure 26: Comparison Matrix: India Healthcare Informatics and Patient Monitoring Market, By Region

Figure 27: Value Proposition and Price Sensitivity Analysis

Figure 28: Healthcare Informatics and Patient Monitoring Market Attractiveness Analysis, By Hospital Type

Figure 29: Healthcare Informatics and Patient Monitoring Market Attractiveness Analysis, By Specialty

Figure 30: India Healthcare Informatics and Patient Monitoring Market Share Analysis (2016)