Industrial gears find vast usage across a number of industries owing to the reduction in mechanical work they bring about in a variety of industrial processes and operations. Industrial gears have equally expansive applications in heavy industries as well as in different manufacturing industries. Forming the core of most machinery used extensively in a vast array of industrial processes, the market for industrial gears in the highly industrialized European countries is expected to expand at a healthy pace in the next few years.

The Europe industrial gear market is mostly privatized and the features both international and local companies. Considering the new technologies introduced in the industrial gear market in the recent years, the market has vast potential opportunities for the manufacturers of industrial gears in the near future. As a result, the market is experiencing a high level of competition. Moreover, the entry of international players from North America and Asia Pacific into the region also facilitates the exchange of enhanced gear technologies. Growing competition is expected to ensure steady market growth rate over the forecast period

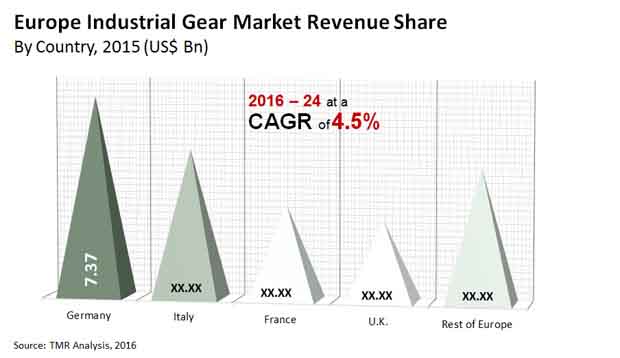

Transparency Market Research estimates that the market will exhibit a 4.5% CAGR over the period between 2016 and 2024. At this pace, the market is expected to rise from a valuation of US$24.21 bn in 2015 to US$35.23 bn by 2024.

On the basis of gear types the market is bifurcated into helical gears, bevel gears, worm gears, spur gears, herringbone gears, hypoid gears, crown gears, skew gears, spiral gears, non-circular gears, epicyclic gears, harmonic gears, and magnetic gears. Of these, the segment of helical gears held the dominant 12.4% of the overall market in 2015, in terms of revenue. The segment, however, is expected to witness a sizeable decline in its share in the Europe industrial gears market by 2024 owing to issues such as the production of more heat, less efficiency, and higher maintenance cost as compared to other gears.

Gear varieties such as worm gear, herringbone gear, and magnetic gear are expected to gain more focus and witness increased adoption across a number of industries over the period between 2016 and 2024. The segment of magnetic gears is expected to exhibit the most promising growth over the said period, an estimated 6.6% CAGR from 2016 through 2024; light weight, compact designs, and low costs of these gears are expected to work in their favor.

In terms of geography, the Europe industrial gears market is examined for U.K., Germany, Italy, France and Rest of Europe. Of these, the market in Germany dominated in terms of revenue contribution to the overall market in 2015. The presence of a large number of industries and a steadily expanding manufacturing sector in the country is fuelling the demand of industrial gears.

Over the forecast period, however, the market for industrial gears in Germany will lose prominence to other regional markets such as France, Italy, and countries in the Rest of the Europe segment, including Spain, Belgium, and the Netherlands. The Rest of the Europe segment will exhibit the most promising pace of growth, an estimated 5.5% CAGR from 2016 to 2024. The market in this region will primarily benefit from the flourishing manufacturing industries like construction, steel, and iron.

Some of the key players in the industrial gear market are Siemens AG (Germany), Klingelnberg GmbH (Switzerland), Precipart Corporation (U.S.), RenoldPlc (U.K.), BonfiglioliRiduttori S.P.A. (Italy), BMT International S.A. (Luxembourg), Rossi SpA (Italy), Getriebebau NORD GmbH &Co. KG (Germany), NGC (China), and Sumitomo Heavy Industries Ltd. (Japan).

Industrial gears are utilized in a wide range of industries because they reduce mechanical activity in a variety of industrial operations and processes. Industrial gears are equally expansive in heavy industry and in various processing sectors. Industrial gears are at the heart of most equipment utilized in a wide range of industrial applications, and the demand for them in highly developed European countries is expected to grow at a healthy rate in the coming years. This factor is likely to foster development of the Europe industrial gear market in the years to come.

The mostly privatized Europe industrial gear market has both local and foreign firms. In view of the introduction of advanced technology in the industrial gear market in recent years, market participants are likely to have huge growth opportunities in the years to come. As a consequence, the competition in the Europe industrial gear market is strong. Furthermore, it facilitates the exchange of improved gear technology with international players from North America and Asia-Pacific into the region. Growing competition is expected to ensure consistent demand growth in the forthcoming years.

Thanks to the ease of installation and consistency of this equipment, spur gear is one of the key forces in the development of the Europe industrial gear market. Another significant benefit of these gears is that they maintain a steady velocity ratio. Most of the automotive gear market in Europe is privatized and both foreign and local industries are part of this sector. In view of the modern innovations applied to the said industry, the market is estimated to offer industrial gear producers lucrative prospects. This leads to a significant degree of competition among existing market players.

Industrial gears contribute to the reduction of mechanical labor in industries by lowering the workload. It operates seamlessly for different equipment and does the hard work. In heavy industries, these gears are utilized to determine the course of rotational force from one axis to the other. The huge cost of repairs is stifling the Europe industrial gear market. The repair of the gears is one of the most important concerns for the manufacturing industry. Furthermore, the cost of spare parts is also high, resulting in a huge financial outlay.

Modern pinion wheels discover huge utilization across various businesses inferable from the decrease in mechanical work they achieve in an assortment of modern cycles and activities. Modern pinion wheels have similarly sweeping applications in hefty businesses just as in various manufacturing ventures. Framing the center of most hardware utilized widely in a huge swath of modern cycles, the market for mechanical cog wheels in the exceptionally industrialized European nations is required to grow at a sound speed in the following not many years.

Interests in discrete assembling areas like bundling, plastics, auto, and material taking care of are required to set out deals open doors for industrial gear. The assembling of mass-delivered vehicles and handling of food, pharm, biotech, and so forth commonly depends on transports and gear to carry the parts and gatherings to an area where robots or laborers are entrusted with a particular capacity. These electric engines are regularly associated straightforwardly to gearboxes with the assistance of gear as these are utilized for driving transports, lifts, robot arms, and so forth.

Machines utilized in the packaging business should convey elite in regularly requesting conditions. High velocity and precise and repeatable developments are essential in conditions where temperature, pressing factor, and loads can put a strain on electromechanical parts, including bundling gear. This grandstands a chance for the development of the industrial gear market.

The Europe industrial gear market is for the most part privatized and the highlights both global and nearby organizations. Considering the new advancements presented in the industrial gear market in the new years, the market has immense expected freedoms for the makers of industrial gears soon. Therefore, the market is encountering a significant degree of rivalry. Besides, the passage of global players from North America and Asia Pacific into the area additionally works with the trading of improved gear innovations. Developing rivalry is required to guarantee consistent market development rate in the coming years.

Industrial Gear Market – Segmentation

TMR’s study on the global industrial gear market includes information categorized into four sections ? product type, application, distribution channel, and region. Changing industry trends and other crucial market dynamics associated with these sections of the industrial gear market have been discussed in detail.

|

Product Type |

|

|

Application |

|

|

Distribution Channel |

|

|

Region |

|

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Premium Grade Industrial Gear

5.4.2. Increasing Crude Steel Production

5.4.3. Industrial Gear Manufacturers

5.5. Porter’s Five Forces Analysis

5.6. Technology Overview

5.7. Value Chain Analysis

5.7.1. Managing Supply Chain Risk and Disruption – Considering Impact of COVID-19

5.8. Industry SWOT Analysis

5.9. Global Industrial Gear Market Analysis and Forecast, 2018 - 2030

5.9.1. Market Revenue Projections (US$ Mn)

5.9.2. Market Revenue Projections (Million Units)

6. Global Industrial Gear Market Analysis and Forecast, By Product Type

6.1. Global Industrial Gear Market Size (US$ Mn, Million Units) Forecast, By Product Type, 2018 - 2030

6.1.1. Spur Gear

6.1.2. Planetary Gear

6.1.3. Helical Gear

6.1.4. Rack and Pinion Gear

6.1.5. Worm Gear

6.1.6. Bevel Gear

6.1.7. Others

6.2. Incremental Opportunity, By Product Type

7. Global Industrial Gear Market Analysis and Forecast, by Application

7.1. Global Industrial Gear Market Size (US$ Mn, Million Units), by Application, 2018 - 2030

7.1.1. Oilfield Equipment

7.1.2. Mining Equipment

7.1.3. Industrial Machinery

7.1.4. Power Plants

7.1.5. Construction Machinery

7.1.6. Others

7.2. Global Incremental Opportunity, by Application

8. Global Industrial Gear Market Analysis and Forecast, by Distribution Channel

8.1. Global Industrial Gear Market Size (US$ Mn, Million Units), by Distribution Channel, 2018 - 2030

8.1.1. Online

8.1.2. Offline

8.2. Global Incremental Opportunity, by Distribution Channel

9. Global Industrial Gear Market Analysis and Forecast, by Region

9.1. Industrial Gear Market Size (US$ Mn & Million Units), by Region, 2018 - 2030

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Global Incremental Opportunity, by Region

10. North America Industrial Gear Market Analysis and Forecast

10.1. Regional Snapshot

10.1.1. By Product Type

10.1.2. By Application

10.1.3. By Distribution Channel

10.1.4. By Country

10.2. Key Trend Analysis

10.2.1. Demand Side

10.2.2. Supply Side

10.3. Price Trend Analysis

10.3.1. Weighted Average Price

10.3.2. Price Impact-COVID-19

10.4. Impact Analysis of COVID- 19

10.5. Industrial Gear Market Size (US$ Mn, Million Units) Forecast, By Product Type, 2018 - 2030

10.5.1. Spur Gear

10.5.2. Planetary Gear

10.5.3. Helical Gear

10.5.4. Rack and Pinion Gear

10.5.5. Worm Gear

10.5.6. Bevel Gear

10.5.7. Others

10.6. Industrial Gear Market Size (US$ Mn, Million Units), by Application, 2018 - 2030

10.6.1. Oilfield Equipment

10.6.2. Mining Equipment

10.6.3. Industrial Machinery

10.6.4. Power Plants

10.6.5. Construction Machinery

10.6.6. Others

10.7. Industrial Gear Market Size (US$ Mn, Million Units), by Distribution Channel, 2018 - 2030

10.7.1. Online

10.7.2. Offline

10.8. Industrial Gear Market Size (US$ Mn & Million Units) Forecast, by Country & Sub-region, 2018 - 2030

10.8.1. The U.S.

10.8.2. Canada

10.8.3. Rest of North America

10.9. Incremental Opportunity Analysis

11. Europe Industrial Gear Market Analysis and Forecast

11.1. Regional Snapshot

11.1.1. By Product Type

11.1.2. By Application

11.1.3. By Distribution Channel

11.1.4. By Country

11.2. Key Trend Analysis

11.2.1. Demand Side

11.2.2. Supply Side

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.3.2. Price Impact-COVID-19

11.4. Impact Analysis of COVID- 19

11.5. Industrial Gear Market Size (US$ Mn, Million Units) Forecast, By Product Type, 2018 - 2030

11.5.1. Spur Gear

11.5.2. Planetary Gear

11.5.3. Helical Gear

11.5.4. Rack and Pinion Gear

11.5.5. Worm Gear

11.5.6. Bevel Gear

11.5.7. Others

11.6. Industrial Gear Market Size (US$ Mn, Million Units), by Application, 2018 - 2030

11.6.1. Oilfield Equipment

11.6.2. Mining Equipment

11.6.3. Industrial Machinery

11.6.4. Power Plants

11.6.5. Construction Machinery

11.6.6. Others

11.7. Industrial Gear Market Size (US$ Mn, Million Units), by Distribution Channel, 2018 - 2030

11.7.1. Online

11.7.2. Offline

11.8. Industrial Gear Market Size (US$ Mn & Million Units) Forecast, by Country & Sub-region, 2018 - 2030

11.8.1. Germany

11.8.2. U.K.

11.8.3. France

11.8.4. Rest of Europe

11.9. Incremental Opportunity Analysis

12. Asia Pacific Industrial Gear Market Analysis and Forecast

12.1. Regional Snapshot

12.1.1. By Product Type

12.1.2. By Application

12.1.3. By Distribution Channel

12.1.4. By Country

12.2. Key Trend Analysis

12.2.1. Demand Side

12.2.2. Supply Side

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.3.2. Price Impact-COVID-19

12.4. Impact Analysis of COVID- 19

12.5. Industrial Gear Market Size (US$ Mn, Million Units) Forecast, By Product Type, 2018 - 2030

12.5.1. Spur Gear

12.5.2. Planetary Gear

12.5.3. Helical Gear

12.5.4. Rack and Pinion Gear

12.5.5. Worm Gear

12.5.6. Bevel Gear

12.5.7. Others

12.6. Industrial Gear Market Size (US$ Mn, Million Units), by Application, 2018 - 2030

12.6.1. Oilfield Equipment

12.6.2. Mining Equipment

12.6.3. Industrial Machinery

12.6.4. Power Plants

12.6.5. Construction Machinery

12.6.6. Others

12.7. Industrial Gear Market Size (US$ Mn, Million Units), by Distribution Channel, 2018 - 2030

12.7.1. Online

12.7.2. Offline

12.8. Industrial Gear Market Size (US$ Mn & Million Units) Forecast, by Country & Sub-region, 2018 - 2030

12.8.1. China

12.8.2. India

12.8.3. Japan

12.8.4. South Korea

12.8.5. Rest of Asia Pacific

13. Middle East & Africa Industrial Gear Market Analysis and Forecast

13.1. Regional Snapshot

13.1.1. By Product Type

13.1.2. By Application

13.1.3. By Distribution Channel

13.1.4. By Country

13.2. Key Trend Analysis

13.2.1. Demand Side

13.2.2. Supply Side

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.3.2. Price Impact-COVID-19

13.4. Impact Analysis of COVID- 19

13.5. Industrial Gear Market Size (US$ Mn, Million Units) Forecast, By Product Type, 2018 - 2030

13.5.1. Spur Gear

13.5.2. Planetary Gear

13.5.3. Helical Gear

13.5.4. Rack and Pinion Gear

13.5.5. Worm Gear

13.5.6. Bevel Gear

13.5.7. Others

13.6. Industrial Gear Market Size (US$ Mn, Million Units), by Application, 2018 - 2030

13.6.1. Oilfield Equipment

13.6.2. Mining Equipment

13.6.3. Industrial Machinery

13.6.4. Power Plants

13.6.5. Construction Machinery

13.6.6. Others

13.7. Industrial Gear Market Size (US$ Mn, Million Units), by Distribution Channel, 2018 - 2030

13.7.1. Online

13.7.2. Offline

13.8. Industrial Gear Market Size (US$ Mn & Million Units) Forecast, by Country & Sub-region, 2018 - 2030

13.8.1. GCC

13.8.2. South Africa

13.8.3. Rest of Middle East & Africa

13.9. Incremental Opportunity Analysis

14. South America Industrial Gear Market Analysis and Forecast

14.1. Regional Snapshot

14.1.1. By Product Type

14.1.2. By Application

14.1.3. By Distribution Channel

14.1.4. By Country

14.2. Key Trend Analysis

14.2.1. Demand Side

14.2.2. Supply Side

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.3.2. Price Impact-COVID-19

14.4. Impact Analysis of COVID- 19

14.5. Industrial Gear Market Size (US$ Mn, Million Units) Forecast, By Product Type, 2018 - 2030

14.5.1. Spur Gear

14.5.2. Planetary Gear

14.5.3. Helical Gear

14.5.4. Rack and Pinion Gear

14.5.5. Worm Gear

14.5.6. Bevel Gear

14.5.7. Others

14.6. Industrial Gear Market Size (US$ Mn, Million Units), by Application, 2018 - 2030

14.6.1. Oilfield Equipment

14.6.2. Mining Equipment

14.6.3. Industrial Machinery

14.6.4. Power Plants

14.6.5. Construction Machinery

14.6.6. Others

14.7. Industrial Gear Market Size (US$ Mn, Million Units), by Distribution Channel, 2018 - 2030

14.7.1. Online

14.7.2. Offline

14.8. Industrial Gear Market Size (US$ Mn & Million Units) Forecast, by Country & Sub-region, 2018 - 2030

14.8.1. Brazil

14.8.2. Rest of South America

14.9. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, COVID – 19 Response, Strategy & Business Overview)

15.2.1. ABB Ltd

15.2.1.1. Company Overview

15.2.1.2. Sales Area/Geographical Presence

15.2.1.3. Revenue

15.2.1.4. COVID – 19 Response

15.2.1.5. Strategy & Business Overview

15.2.2. Siemens AG

15.2.2.1. Company Overview

15.2.2.2. Sales Area/Geographical Presence

15.2.2.3. Revenue

15.2.2.4. COVID – 19 Response

15.2.2.5. Strategy & Business Overview

15.2.3. Martin Sprocket & Gear, Inc.

15.2.3.1. Company Overview

15.2.3.2. Sales Area/Geographical Presence

15.2.3.3. Revenue

15.2.3.4. COVID – 19 Response

15.2.3.5. Strategy & Business Overview

15.2.4. Hota Industrial Manufacturing Co., Ltd.

15.2.4.1. Company Overview

15.2.4.2. Sales Area/Geographical Presence

15.2.4.3. Revenue

15.2.4.4. COVID – 19 Response

15.2.4.5. Strategy & Business Overview

15.2.5. OKUBO GEAR Co., Ltd.

15.2.5.1. Company Overview

15.2.5.2. Sales Area/Geographical Presence

15.2.5.3. Revenue

15.2.5.4. COVID – 19 Response

15.2.5.5. Strategy & Business Overview

15.2.6. Bharat Gears Ltd.

15.2.6.1. Company Overview

15.2.6.2. Sales Area/Geographical Presence

15.2.6.3. Revenue

15.2.6.4. COVID – 19 Response

15.2.6.5. Strategy & Business Overview

15.2.7. Elecon Engineering Company Limited

15.2.7.1. Company Overview

15.2.7.2. Sales Area/Geographical Presence

15.2.7.3. Revenue

15.2.7.4. COVID – 19 Response

15.2.7.5. Strategy & Business Overview

15.2.8. Precipart Corporation

15.2.8.1. Company Overview

15.2.8.2. Sales Area/Geographical Presence

15.2.8.3. Revenue

15.2.8.4. COVID – 19 Response

15.2.8.5. Strategy & Business Overview

15.2.9. Kohara Gear Industry Co., Ltd.

15.2.9.1. Company Overview

15.2.9.2. Sales Area/Geographical Presence

15.2.9.3. Revenue

15.2.9.4. COVID – 19 Response

15.2.9.5. Strategy & Business Overview

15.2.10. Aero Gear Incorporated

15.2.10.1. Company Overview

15.2.10.2. Sales Area/Geographical Presence

15.2.10.3. Revenue

15.2.10.4. COVID – 19 Response

15.2.10.5. Strategy & Business Overview

15.2.11. Shanthi Gears Limited

15.2.11.1. Company Overview

15.2.11.2. Sales Area/Geographical Presence

15.2.11.3. Revenue

15.2.11.4. COVID – 19 Response

15.2.11.5. Strategy & Business Overview

15.2.12. Ashoka Machine Tools Corporation

15.2.12.1. Company Overview

15.2.12.2. Sales Area/Geographical Presence

15.2.12.3. Revenue

15.2.12.4. COVID – 19 Response

15.2.12.5. Strategy & Business Overview

15.2.13. Cleveland Gear Company Inc.

15.2.13.1. Company Overview

15.2.13.2. Sales Area/Geographical Presence

15.2.13.3. Revenue

15.2.13.4. COVID – 19 Response

15.2.13.5. Strategy & Business Overview

15.2.14. Meritech Group

15.2.14.1. Company Overview

15.2.14.2. Sales Area/Geographical Presence

15.2.14.3. Revenue

15.2.14.4. COVID – 19 Response

15.2.14.5. Strategy & Business Overview

15.2.15. Bevel Gears India Pvt. Ltd.

15.2.15.1. Company Overview

15.2.15.2. Sales Area/Geographical Presence

15.2.15.3. Revenue

15.2.15.4. COVID – 19 Response

15.2.15.5. Strategy & Business Overview

16. Key Takeaways

16.1. Solution to Overcome the Current Situation (COVID-19 Impact)

16.2. Identification of Potential Market Spaces

16.2.1. Product Type

16.2.2. Application

16.2.3. Distribution Channel

16.2.4. Region

List of Tables

Table 1: Global Industrial Gear Market, Volume Size and Forecast, By Product Type, Million Units, 2018 - 2030

Table 2: Global Industrial Gear Market, Value Size and Forecast, By Product Type, US$ Mn, 2018 - 2030

Table 3: Global Industrial Gear Market, Volume Size and Forecast, By Application, Million Units, 2018 - 2030

Table 4: Global Industrial Gear Market, Value Size and Forecast, By Application, US$ Mn, 2018 - 2030

Table 5: Global Industrial Gear Market, Volume Size and Forecast, By Distribution Channel, Million Units, 2018 - 2030

Table 6: Global Industrial Gear Market, Value Size and Forecast, By Distribution Channel, US$ Mn, 2018 - 2030

Table 7: Global Industrial Gear Market, Volume Size and Forecast, By Region, Million Units, 2018 - 2030

Table 8: Global Industrial Gear Market, Value Size and Forecast, By Region, US$ Mn, 2018 - 2030

Table 9: North America Industrial Gear Market, Volume Size and Forecast, By Product Type, Million Units, 2018 - 2030

Table 10: North America Industrial Gear Market, Value Size and Forecast, By Product Type, US$ Mn, 2018 - 2030

Table 11: North America Industrial Gear Market, Volume Size and Forecast, By Application, Million Units, 2018 - 2030

Table 12: North America Industrial Gear Market, Value Size and Forecast, By Application, US$ Mn, 2018 - 2030

Table 13: North America Industrial Gear Market, Volume Size and Forecast, By Distribution Channel, Million Units, 2018 - 2030

Table 14: North America Industrial Gear Market, Value Size and Forecast, By Distribution Channel, US$ Mn, 2018 - 2030

Table 15: North America Industrial Gear Market, Volume Size and Forecast, By Country, Million Units, 2018 - 2030

Table 16: North America Industrial Gear Market, Value Size and Forecast, By Country, US$ Mn, 2018 - 2030

Table 17: Europe Industrial Gear Market, Volume Size and Forecast, By Product Type, Million Units, 2018 - 2030

Table 18: Europe Industrial Gear Market, Value Size and Forecast, By Product Type, US$ Mn, 2018 - 2030

Table 19: Europe Industrial Gear Market, Volume Size and Forecast, By Application, Million Units, 2018 - 2030

Table 20: Europe Industrial Gear Market, Value Size and Forecast, By Application, US$ Mn, 2018 - 2030

Table 21: Europe Industrial Gear Market, Volume Size and Forecast, By Distribution Channel, Million Units, 2018 - 2030

Table 22: Europe Industrial Gear Market, Value Size and Forecast, By Distribution Channel, US$ Mn, 2018 - 2030

Table 23: Europe Industrial Gear Market, Volume Size and Forecast, By Country, Million Units, 2018 - 2030

Table 24: Europe Industrial Gear Market, Value Size and Forecast, By Country, US$ Mn, 2018 - 2030

Table 25: Asia Pacific Industrial Gear Market, Volume Size and Forecast, By Product Type, Million Units, 2018 - 2030

Table 26: Asia Pacific Industrial Gear Market, Value Size and Forecast, By Product Type, US$ Mn, 2018 - 2030

Table 27: Asia Pacific Industrial Gear Market, Volume Size and Forecast, By Application, Million Units, 2018 - 2030

Table 28: Asia Pacific Industrial Gear Market, Value Size and Forecast, By Application, US$ Mn, 2018 - 2030

Table 29: Asia Pacific Industrial Gear Market, Volume Size and Forecast, By Distribution Channel, Million Units, 2018 - 2030

Table 30: Asia Pacific Industrial Gear Market, Value Size and Forecast, By Distribution Channel, US$ Mn, 2018 - 2030

Table 31: Asia Pacific Industrial Gear Market, Volume Size and Forecast, By Country, Million Units, 2018 - 2030

Table 32: Asia Pacific Industrial Gear Market, Value Size and Forecast, By Country, US$ Mn, 2018 - 2030

Table 33: Middle East & Africa Industrial Gear Market, Volume Size and Forecast, By Product Type, Million Units, 2018 - 2030

Table 34: Middle East & Africa Industrial Gear Market, Value Size and Forecast, By Product Type, US$ Mn, 2018 - 2030

Table 35: Middle East & Africa Industrial Gear Market, Volume Size and Forecast, By Application, Million Units, 2018 - 2030

Table 36: Middle East & Africa Industrial Gear Market, Value Size and Forecast, By Application, US$ Mn, 2018 - 2030

Table 37: Middle East & Africa Industrial Gear Market, Volume Size and Forecast, By Distribution Channel, Million Units, 2018 - 2030

Table 38: Middle East & Africa Industrial Gear Market, Value Size and Forecast, By Distribution Channel, US$ Mn, 2018 - 2030

Table 39: Middle East & Africa Industrial Gear Market, Volume Size and Forecast, By Country, Million Units, 2018 - 2030

Table 40: Middle East & Africa Industrial Gear Market, Value Size and Forecast, By Country, US$ Mn, 2018 - 2030

Table 41: South America Industrial Gear Market, Volume Size and Forecast, By Product Type, Million Units, 2018 - 2030

Table 42: South America Industrial Gear Market, Value Size and Forecast, By Product Type, US$ Mn, 2018 - 2030

Table 43: South America Industrial Gear Market, Volume Size and Forecast, By Application, Million Units, 2018 - 2030

Table 44: South America Industrial Gear Market, Value Size and Forecast, By Application, US$ Mn, 2018 - 2030

Table 45: South America Industrial Gear Market, Volume Size and Forecast, By Distribution Channel, Million Units, 2018 - 2030

Table 46: South America Industrial Gear Market, Value Size and Forecast, By Distribution Channel, US$ Mn, 2018 - 2030

Table 47: South America Industrial Gear Market, Volume Size and Forecast, By Country, Million Units, 2018 - 2030

Table 48: South America Industrial Gear Market, Value Size and Forecast, By Country, US$ Mn, 2018 - 2030

List of Figures

Figure 1: Global Industrial Gear Market, Volume Size and Forecast, By Product Type, Million Units, 2018 - 2030

Figure 2: Global Industrial Gear Market, Value Size and Forecast, By Product Type, US$ Mn, 2018 - 2030

Figure 3: Global Industrial Gear Market, Incremental Opportunity, By Product Type, US$ Mn, 2020 - 2030

Figure 4: Global Industrial Gear Market, Volume Size and Forecast, By Application, Million Units, 2018 - 2030

Figure 5: Global Industrial Gear Market, Value Size and Forecast, By Application, US$ Mn, 2018 - 2030

Figure 6: Global Industrial Gear Market, Incremental Opportunity, By Application, US$ Mn, 2020 - 2030

Figure 7: Global Industrial Gear Market, Volume Size and Forecast, By Distribution Channel, Million Units, 2018 - 2030

Figure 8: Global Industrial Gear Market, Value Size and Forecast, By Distribution Channel, US$ Mn, 2018 - 2030

Figure 9: Global Industrial Gear Market, Incremental Opportunity, By Distribution Channel, US$ Mn, 2020 - 2030

Figure 10: Global Industrial Gear Market, Volume Size and Forecast, By Region, Million Units, 2018 - 2030

Figure 11: Global Industrial Gear Market, Value Size and Forecast, By Region, US$ Mn, 2018 - 2030

Figure 12: Global Industrial Gear Market, Incremental Opportunity, By Region, US$ Mn, 2020 - 2030

Figure 13: North America Industrial Gear Market, Volume Size and Forecast, By Product Type, Million Units, 2018 - 2030

Figure 14: North America Industrial Gear Market, Value Size and Forecast, By Product Type, US$ Mn, 2018 - 2030

Figure 15: North America Industrial Gear Market, Incremental Opportunity, By Product Type, US$ Mn, 2020 - 2030

Figure 16: North America Industrial Gear Market, Volume Size and Forecast, By Application, Million Units, 2018 - 2030

Figure 17: North America Industrial Gear Market, Value Size and Forecast, By Application, US$ Mn, 2018 - 2030

Figure 18: North America Industrial Gear Market, Incremental Opportunity, By Application, US$ Mn, 2020 - 2030

Figure 19: North America Industrial Gear Market, Volume Size and Forecast, By Distribution Channel, Million Units, 2018 - 2030

Figure 20: North America Industrial Gear Market, Value Size and Forecast, By Distribution Channel, US$ Mn, 2018 - 2030

Figure 21: North America Industrial Gear Market, Incremental Opportunity, By Distribution Channel, US$ Mn, 2020 - 2030

Figure 22: North America Industrial Gear Market, Volume Size and Forecast, By Country, Million Units, 2018 - 2030

Figure 23: North America Industrial Gear Market, Value Size and Forecast, By Country, US$ Mn, 2018 - 2030

Figure 24: North America Industrial Gear Market, Incremental Opportunity, By Country, US$ Mn, 2020 - 2030

Figure 25: Europe Industrial Gear Market, Volume Size and Forecast, By Product Type, Million Units, 2018 - 2030

Figure 26: Europe Industrial Gear Market, Value Size and Forecast, By Product Type, US$ Mn, 2018 - 2030

Figure 27: Europe Industrial Gear Market, Incremental Opportunity, By Product Type, US$ Mn, 2020 - 2030

Figure 28: Europe Industrial Gear Market, Volume Size and Forecast, By Application, Million Units, 2018 - 2030

Figure 29: Europe Industrial Gear Market, Value Size and Forecast, By Application, US$ Mn, 2018 - 2030

Figure 30: Europe Industrial Gear Market, Incremental Opportunity, By Application, US$ Mn, 2020 - 2030

Figure 31: Europe Industrial Gear Market, Volume Size and Forecast, By Distribution Channel, Million Units, 2018 - 2030

Figure 32: Europe Industrial Gear Market, Value Size and Forecast, By Distribution Channel, US$ Mn, 2018 - 2030

Figure 33: Europe Industrial Gear Market, Incremental Opportunity, By Distribution Channel, US$ Mn, 2020 - 2030

Figure 34: Europe Industrial Gear Market, Volume Size and Forecast, By Country, Million Units, 2018 - 2030

Figure 35: Europe Industrial Gear Market, Value Size and Forecast, By Country, US$ Mn, 2018 - 2030

Figure 36: Europe Industrial Gear Market, Incremental Opportunity, By Country, US$ Mn, 2020 - 2030

Figure 37: Asia Pacific Industrial Gear Market, Volume Size and Forecast, By Product Type, Million Units, 2018 - 2030

Figure 38: Asia Pacific Industrial Gear Market, Value Size and Forecast, By Product Type, US$ Mn, 2018 - 2030

Figure 39: Asia Pacific Industrial Gear Market, Incremental Opportunity, By Product Type, US$ Mn, 2020 - 2030

Figure 40: Asia Pacific Industrial Gear Market, Volume Size and Forecast, By Application, Million Units, 2018 - 2030

Figure 41: Asia Pacific Industrial Gear Market, Value Size and Forecast, By Application, US$ Mn, 2018 - 2030

Figure 42: Asia Pacific Industrial Gear Market, Incremental Opportunity, By Application, US$ Mn, 2020 - 2030

Figure 43: Asia Pacific Industrial Gear Market, Volume Size and Forecast, By Distribution Channel, Million Units, 2018 - 2030

Figure 44: Asia Pacific Industrial Gear Market, Value Size and Forecast, By Distribution Channel, US$ Mn, 2018 - 2030

Figure 45: Asia Pacific Industrial Gear Market, Incremental Opportunity, By Distribution Channel, US$ Mn, 2020 - 2030

Figure 46: Asia Pacific Industrial Gear Market, Volume Size and Forecast, By Country, Million Units, 2018 - 2030

Figure 47: Asia Pacific Industrial Gear Market, Value Size and Forecast, By Country, US$ Mn, 2018 - 2030

Figure 48: Asia Pacific Industrial Gear Market, Incremental Opportunity, By Country, US$ Mn, 2020 - 2030

Figure 49: Middle East & Africa Industrial Gear Market, Volume Size and Forecast, By Product Type, Million Units, 2018 - 2030

Figure 50: Middle East & Africa Industrial Gear Market, Value Size and Forecast, By Product Type, US$ Mn, 2018 - 2030

Figure 51: Middle East & Africa Industrial Gear Market, Incremental Opportunity, By Product Type, US$ Mn, 2020 - 2030

Figure 52: Middle East & Africa Industrial Gear Market, Volume Size and Forecast, By Application, Million Units, 2018 - 2030

Figure 53: Middle East & Africa Industrial Gear Market, Value Size and Forecast, By Application, US$ Mn, 2018 - 2030

Figure 54: Middle East & Africa Industrial Gear Market, Incremental Opportunity, By Application, US$ Mn, 2020 - 2030

Figure 55: Middle East & Africa Industrial Gear Market, Volume Size and Forecast, By Distribution Channel, Million Units, 2018 - 2030

Figure 56: Middle East & Africa Industrial Gear Market, Value Size and Forecast, By Distribution Channel, US$ Mn, 2018 - 2030

Figure 57: Middle East & Africa Industrial Gear Market, Incremental Opportunity, By Distribution Channel, US$ Mn, 2020 - 2030

Figure 58: Middle East & Africa Industrial Gear Market, Volume Size and Forecast, By Country, Million Units, 2018 - 2030

Figure 59: Middle East & Africa Industrial Gear Market, Value Size and Forecast, By Country, US$ Mn, 2018 - 2030

Figure 60: Middle East & Africa Industrial Gear Market, Incremental Opportunity, By Country, US$ Mn, 2020 - 2030

Figure 61: South America Industrial Gear Market, Volume Size and Forecast, By Product Type, Million Units, 2018 - 2030

Figure 62: South America Industrial Gear Market, Value Size and Forecast, By Product Type, US$ Mn, 2018 - 2030

Figure 63: South America Industrial Gear Market, Incremental Opportunity, By Product Type, US$ Mn, 2020 - 2030

Figure 64: South America Industrial Gear Market, Volume Size and Forecast, By Application, Million Units, 2018 - 2030

Figure 65: South America Industrial Gear Market, Value Size and Forecast, By Application, US$ Mn, 2018 - 2030

Figure 66: South America Industrial Gear Market, Incremental Opportunity, By Application, US$ Mn, 2020 - 2030

Figure 67: South America Industrial Gear Market, Volume Size and Forecast, By Distribution Channel, Million Units, 2018 - 2030

Figure 68: South America Industrial Gear Market, Value Size and Forecast, By Distribution Channel, US$ Mn, 2018 - 2030

Figure 69: South America Industrial Gear Market, Incremental Opportunity, By Distribution Channel, US$ Mn, 2020 - 2030

Figure 70: South America Industrial Gear Market, Volume Size and Forecast, By Country, Million Units, 2018 - 2030

Figure 71: South America Industrial Gear Market, Value Size and Forecast, By Country, US$ Mn, 2018 - 2030

Figure 72: South America Industrial Gear Market, Incremental Opportunity, By Country, US$ Mn, 2020 - 2030